Biz2credit how to check status

Biz2credit how to check status

Help Us Protect Glassdoor

Please wait while we verify that you’re a real person. Your content will appear shortly. If you continue to see this message, please email to let us know you’re having trouble.

Aidez-nous à protéger Glassdoor

Veuillez patienter pendant que nous vérifions que vous êtes une personne réelle. Votre contenu s’affichera bientôt. Si vous continuez à voir ce message, contactez-nous à l’adresse pour nous faire part du problème.

Helfen Sie mit, Glassdoor zu schützen

Help ons Glassdoor te beschermen

Even geduld a.u.b. terwijl we verifiëren of u een persoon bent. Uw content wordt binnenkort weergegeven. Als u dit bericht blijft zien, stuur dan een e-mail naar om ons te informeren over uw problemen.

Ayúdanos a proteger Glassdoor

Ayúdanos a proteger Glassdoor

Espera mientras verificamos que eres una persona real. Tu contenido aparecerá en breve. Si continúas viendo este mensaje, envía un correo electrónico a para informarnos que tienes problemas.

Ajude-nos a proteger o Glassdoor

Aguarde enquanto confirmamos que você é uma pessoa de verdade. Seu conteúdo será exibido em breve. Caso continue recebendo esta mensagem, envie um e-mail para para nos informar sobre o problema.

Aiutaci a proteggere Glassdoor

Attendi mentre verifichiamo che sei una persona reale. Il tuo contenuto verrà visualizzato a breve. Se continui a visualizzare questo messaggio, invia un’email all’indirizzo per informarci del problema.

Biz2Credit Reviews

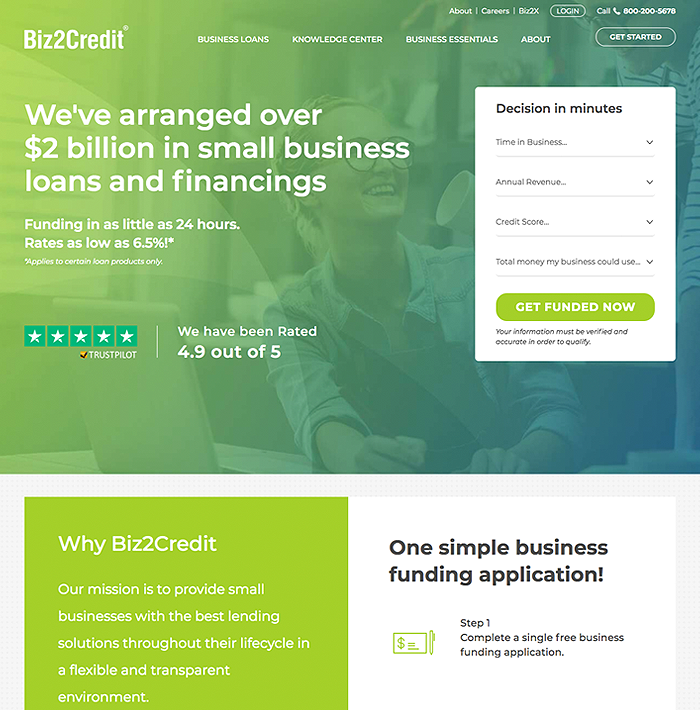

Biz2Credit is a loan matching service that describes themselves as the leading online credit resource for startup and small business loans, lines of credit, equipment loans, working capital and other funding options.

How Does Biz2Credit Work?

According to their website, the lending solutions offered by traditional banks can often be slow and cumbersome, and don’t always meet the needs of small businesses, which can sometimes need money quickly and without all the obstacles created by large scale financial institutions.

To help small and medium sized businesses meet all their needs, Biz2Credit.com partners with more than 1,300 different lenders to provide their clients with Commercial, Small Business and Startup Loans, as well as Real Estate Financing and other types of unsecured loans.

Regardless of what kind of loan you are looking for, this company states they use the latest technology to create a unique profile for your business – in just minutes – which will then be used to match you with appropriate lenders who can meet your needs.

Cost & Price Plans

As with any lending company, there is no way to quote in currency what the loan will cost you, since it depends on the personal circumstances of your business, the amount of the loan you wish to borrow, and the length of the loan repayment schedule.

But the website does offer users a loan calculator, which will take into account the loan amount, estimated interest rate, and the loan term in months to see the estimated costs of this loan.

Refund Policy

As a loan matching service, this company does not actually take fees from their customers, nor do they distribute the loans themselves.

They simply provide a loan matching service, which will take the needs and circumstances of your business into account, and then match you with a lender that can help meet your loan needs.

Any problems or concerns you have once you have accepted the loan terms of a provider must be addressed directly with the provider themselves, and not with Biz2Credit.com.

Customer Service Contact Info

Customers who would like to speak to their Customer Service team about their questions, concerns, or complaints can do so by phone at 800-200-5678, by email at [email protected], or by submitting them directly to their website through their Contact Us link.

Reputation

Biz2Credit.com is part of a new group of alternative lenders that specialize in providing small businesses with access to a wide variety of lenders through their network of lending partners.

These websites can provide benefits not only to borrowers, but also to lenders, who can use this service to bring them clients without any need for them to do any of the work seeking out new clients, or get and process their initial information which indicates whether or not they can move forward with the loan process at all.

Because of the mutual benefits to both borrowers and lenders, Bloomberg Business reports that these type of business loan matching websites can be a good place for small and medium businesses to look for their loan needs.

Biz2Credit Review

Expert Analyst & Reviewer

Biz2Credit

Biz2Credit Overview

Biz2Credit is a New York-based alternative lending platform that offers multiple types of financing to small businesses. This company is a direct funder, but if its products don’t work for you, Biz2Credit can also match you up with a financing product from its network of partner lenders. Through Biz2Credit, you might be eligible for a variety of funding options, such as working capital funding, short-term loans, and commercial real estate-secured loans. This company also offers a free financial assistant called BizAnalyzer and multiple funding calculators to help you understand your business financials.

To qualify for financing with Biz2Credit, you’ll need to have at least six months in business and solid revenue. While startups will have to look elsewhere for financing, Biz2Credit is a viable option for many young businesses. That said, as always, you’ll want to comparison shop before committing to any kind of alternative loan. Our short-term funding comparison chart can give you a head start.

If you’re not scared away by fees or short on time, and have a business that’s at least six months old with solid revenue, you may find Biz2Credit to be a useful service. However, readers with somewhat established businesses should know that you might be able to find better rates and fees elsewhere.

Table of Contents

Services Offered By Biz2Credit

Biz2Credit offers several types of financing:

Biz2Credit also offers lines of credit and SBA loans via its network of partners. Biz2Credit offered Paycheck Protection Program loans as well, but they are now closed to new applications.

In addition to offering business financing for all merchants, Biz2Credit offers programs specifically to help women and minorities receive funding.

Biz2Credit Borrower Qualifications

To qualify for financing through Biz2Credit or one of its partners, you’ll generally need to have at least six months in business, solid revenue, and fair personal credit. However, a poor credit score will not necessarily disqualify you from funding.

According to Biz2Credit, most qualifying applicants will meet the following minimum requirements:

Working Capital Funding

| Credit Score | 575 |

| Annual Revenue | $250K |

| Time In Business | 6 months |

Term Loans

| Credit Score | 660 |

| Annual Revenue | $250K |

| Time In Business | 18 months |

Commercial Real Estate-Secured Loans

| Credit Score | 660 |

| Annual Revenue | $250K |

| Time In Business | 18 months |

| Other | Already own commercial property |

Biz2Credit Terms & Fees

Because Biz2Credit offers several types of financing products, some in-house and some from lending partners, your rates and fees will vary, depending on the financial products you qualify for. Overall, fees are higher than what you’d be charged by a bank, but then again, a Biz2Credit loan is a lot faster and easier to qualify for than a bank loan.

In addition to interest or a factor rate, you might also have to pay an underwriting fee, closing fee, or origination fee, depending on the type of financing you are accepting. Biz2Credit does not charge application or submission fees — you won’t have to pay anything unless you accept financing. Check out our list of common fees for a more detailed breakdown of fees you might encounter.

When it comes to repaying your loan, Biz2Credit might be able to set you up with daily, weekly, bi-weekly, or monthly repayments (depending on the financial product and the needs of the business). Repayments might be automatically deducted from your bank account or credit card sales.

Working Capital Funding

Here’s what you can expect from Biz2Credit’s Working Capital Funding MCAs:

| Borrowing Amount: | $25K-$2M |

| Interest/Factor Rate: | Unknown |

| Term Length: | Variable |

| Other Fees: | $250-$400 |

| Effective APR: | Learn more |

| Collateral: | Unknown |

Each business day, a percentage of your card-based sales will be held back and collected by the funder. Since your sales probably fluctuate from day to day, the amount of time it takes to satisfy the terms of your advance may vary. Most last for less than a year, however. Note that for its Working Capital Funding product (which is essentially an MCA), Biz2Credit also allows biweekly repayment.

Term Loans

Here’s what you can expect from Biz2Credit’s unsecured business term loans:

| Borrowing Amount: | $25K-$250K |

| Interest/Factor Rate: | 8.99%+ |

| Term Length: | 12-36 months |

| Other Fees: | 1%-6% origination fee |

| Effective APR: | Learn more |

| Collateral: | Personal guarantee |

An unsecured business loan simply means it does not require collateral in the traditional sense. You will, however, be asked to sign a personal guarantee, which is a promise that you’ll be personally responsible for any debts that your business is unable to pay. So keep that in mind when you’re dealing with unsecured loans.

Otherwise, Biz2Credit offers what amounts to a pretty traditional short-term loan. You’ll receive a lump sum, minus the origination fee, Loan repayments are expected weekly or biweekly.

Commercial Real Estate-Secured Loans

| Borrowing Amount: | $250K-$6M |

| Interest/Factor Rate: | 10%+ |

| Term Length: | 12-36 months |

| Other Fees: | Unknown |

| Effective APR: | Unknown |

| Collateral: | Commercial real estate property |

Biz2Credit commercial real estate (CRE) loans are large, short-term loans that you can secure with an existing piece of commercial real estate property. Interest rates are on the high side, starting at 10%, but these loans are relatively easy to qualify for if you have business property to use as collateral. You might use this type of loan to acquire a new business, refinance existing debt, fund a renovation project, or expand your business. These loans have monthly repayments.

Note that CRE Loans have longer closing cycles compared to Biz2Credit’s other short-term lending products, so closing times may vary.

Extended Network Products

Here’s a quick rundown of other financing products Biz2Credit might be able to set you up with through their partner lenders:

Application Process

The major convenience offered by Biz2Credit is its quick and easy application process. You can find out how much you can borrow by submitting information about the amount you’re seeking, your time in business, your annual revenue, and your credit score. The application generally takes about four minutes.

If you’d like some help, you can also begin the process through the site’s chat feature. Spend more than a few moments there, and you’ll be pinged by a representative who can answer your questions and take your information.

Biz2Credit will then match you to one of its funding products. If you’re given multiple options, you can choose the product that best suits your needs. After that, your experience will differ, depending on the financing product you choose. Biz2Credit may ask you to submit additional documentation at that time.

Sales & Advertising Transparency

Biz2Credit does a fairly decent job of disclosing the fees and terms of its service, especially through its FAQ and knowledge center. Just keep in mind that you won’t know too much about the financing product you’ll receive until much further down the line. The company also maintains accounts on Facebook, Twitter, LinkedIn, and YouTube.

Customer Service & Technical Support

Biz2Credit provides several different methods of contact, including by phone, email, contact form, or through the site’s integrated LiveChat. The LiveChat can be a little aggressive, but it’s an easy way to ask questions.

Biz2Credit Reviews, Complaints, & Testimonials

Although Biz2Credit reviews have been mostly positive throughout the years, the company racked up a lot of complaints regarding its rollout of Paycheck Protection Program loans.

Negative Reviews & Complaints

Biz2Credit isn’t formally accredited with the BBB and there are a whopping 1,461 complaints on record from the last 12 months, most of which concern PPP loans. Negative factors associated with the company include:

Positive Reviews & Testimonials

Despite its numerous complaints on the BBB website. Biz2Credit reviews are overwhelmingly positive on Trustpilot (though there are also a good amount of negative reviews about Biz2Credit’s PPP loans on Trustpilot). Biz2Credit’s TrustPilot score currently stands at 4.2/5. Positive user reviews praised:

Final Verdict

If you’re 1) not scared away by the fees or bad reviews, 2) short on time, and 3) have a business that’s at least six months old with solid revenue, you may find Biz2Credit to be a useful service. Some borrowers might receive somewhat high terms and fees (in comparison to low-cost financing options, such as a bank loan), depending on what financial products they qualify for. However, if you don’t qualify for lower-cost financing or you need a loan fast, Biz2Credit offers an easy-to-use service and most businesses will find something that suits their financial needs.

Personally, I would not be too deterred by the complaints regarding PPP loans, as online lenders have been overwhelmed by the volume of program participants and I don’t think Biz2Credit’s issues with PPP loans are representative of the company as a whole. Still, many alternative lenders executed their PPP loans without too many hiccups, so I can understand why Biz2Credit’s botched PPP rollout could give one pause.

If you’re looking for alternatives to Biz2Credit, take a look at our comparison charts for merchant cash advances and small business loans.

Biz2Credit

At TheCreditReview, we value your trust.

TheCreditReview.com is a free online resource that provides valuable content and comparison features to visitors. To keep our resources 100% free, TheCreditReview.com attempts to partner with some of the companies listed on this page, and may receive marketing compensation in exchange for clicks and calls from our site. Compensation can impact the location and order in which such companies appear on this page. All such location, order and company ratings are subject to change based on editorial decisions.

Our Business Loans Partners

Biz2Credit, BlueVine, Fundera

User

Rating

I have been working with Biz2credit in the last three years. Recently, I need an additional fund(s) to renovate my dryclean shop. Ron and his Team offered to assist me immediately after one phone call. I was able to get the approval and funding to my account within 48 hours. I strongly recommend to work with Ron, Chad and his Team. In business, trust and efficient are important. Ron, Chad and his team members earn both trust and efficient. Thank you to Biz2Credit for you help.

I was very lucky to have Sarah Rivera for applying PPP loan. I had several technical mistakes in filing the application but Sarah helped me through to correct those issues step by step, going out her way so that I was able to file and got the loan approved. Sarah was very kind and patient with me spending time without making me feel dumb. I would like to recommend Sarah Rivera over anybody and will look for her in any future need.

Biz2Credit 2022 Review

Thanks to top alternative lenders such as Biz2Credit, more small businesses are able to have access to the financing they need to meet their business goals.

Each business is different, which means your cash flow is unique, which means a one size product doesn’t work. With Biz2Credit’s flexible terms, you determine your repayment schedule (daily, weekly, monthly, etc.) and you can mix and match products. For example, you could take a cash advance for running payroll while also applying for a long-term funding to open a new location at the same time.

Whether you select a more traditional funding method or go for quick cash, Biz2Credit’s more flexible lending requirements and lower minimum credit scores give wider access to crucial funding to those businesses that otherwise may not be able to find it.

Biz2Credit additionally offers risk-based pricing, meaning that you can gain better loan rates if you have collateral or a stronger business profile (even regardless of your personal credit profile).

Biz2Credit Business Loans: What You Need to Know

Your business must be operational for at least six months and have solid cash flow ($100,000+ of annual business revenue recommended) in order to qualify for funding through Biz2Credit.

They also offer BizAnalyzer Virtual CFO, a free financing tool, to help you better understand your business’s financials so you can plan for your future.

How Do Biz2Credit Business Loans Work?

When you fill out an application for funding through Biz2Credit, your information goes directly to Biz2Credit’s underwriting team, who will then advise you on the best financial options available for your business.

Unlike business loans marketplaces who shop and sell your data to numerous other companies, your information stays safe and secure with Biz2Credit.

Some types of loans directly available through Biz2Credit:

Loans are available to businesses servicing a wide variety of industries.

Where Is Biz2Credit Available?

Biz2Credit is available to businesses in all 50 states, though some types of loans may only be available in certain states.

How Much Does Biz2Credit Cost?

It doesn’t cost anything to apply for loans from Biz2Credit, but you will pay interest rates and possibly some other fees if you qualify for a loan.

How much you will pay for financing through Biz2Credit will vary based on the type of funding you choose, how much you borrow, and your individual qualifications when applying for the loan.

Biz2Credit provides tailored loan offerings and potentially lower rates depending on borrowers’ ability to repay and on business performance.

While Biz2Credit’s interest rates and fees may be higher than you typically find from a traditional bank lender, they’re about on par or lower than those you’d find in selecting another alternative small business lender.

What Does Biz2Credit Offer?

Biz2Credit directly offers a wide variety of small business financing options.

Some of the financing options available with Biz2Credit include:

Working Capital Loans

Sometimes, your business comes up short on the money you need to maintain day-to-day operations such as purchasing supplies and stock, paying your workers, or paying rent. For those times, a working capital loan can give you the cash you need to keep your business running.

These loans are usually short-term, meaning you have to pay them back over less time than a traditional loan, and are designed to give you funding to get over a financial hump.

Merchant Cash Advances

Rather than getting a loan to cover the daily expenses you need, a merchant cash advance allows you to receive funding based on your future credit card processing projections.

If you take credit cards as payment, you can receive funding based on your expected future receipts, and pay the financing back out of your daily credit card processing.

Merchant cash advances are usually paid back on a much more frequent schedule than other loans, often daily or weekly, and can come with higher fees if your credit card processing is lower than anticipated.

SBA Loans

The Small Business Administration offers long-term loans at lower interest rates to businesses looking to grow their operations. These loans are among the most coveted in the industry, as they are usually less expensive and offer longer repayment terms.

However, there usually is a lot of paperwork that needs to be completed and SBA loans can take longer to receive a decision on than many other types of financing. This makes them an undesirable choice for those small businesses that need their funding quickly to cover an unexpected expense or a sudden opportunity.

Commercial Real Estate (CRE) Loans

If you’re looking to build, purchase, or update your commercial space, Biz2Credit can help you secure a commercial real estate loan to cover this expense.

In addition, commercial real estate (CRE) loans can often be converted to SBA loans after an initial term (interest-only in most cases), and Biz2Credit will handle all of the paperwork and help shepherd the loan conversion on behalf of the client. This is a huge time/effort savings and a big advantage of working with Biz2Credit.

Term Loans

Depending on your individual needs and qualifications, Biz2Credit offers both short-term and long-term loans.

Short-term loans are typically repaid over a shorter period of time, usually under three years. Because of the short-term nature of these loans, the interest rates are higher than for a longer-term loan since they’re seen as more of a risk for lenders.

Equipment Financing

If you need a piece of equipment to run your business, such as a tractor, forklift, truck, or even computer, Biz2Credit can help you finance that purchase. Some equipment financing is available up to 100 percent of the purchase price of the equipment.

Equipment financing works in a similar manner to consumer vehicle loans: Your lender pays the person selling the equipment the purchase price (less any down payment you may have), and you then pay the lender for that loan amount plus interest.

Franchise Loans

For business owners looking to open up a new franchise or to make a new franchise acquisition, funding is available to help you purchase the franchise.

You borrow the money necessary to buy the franchise on a term, then pay the loan back to the lender. This allows business owners to expand their business opportunities or open up new potential revenue streams without having to pay the entire franchise fee out-of-pocket.

Disaster Recovery Loans

Sometimes, weather emergencies, fires, or other disasters can cost a small business big. For these times, Biz2Credit offers disaster recovery loans.

These loans are designed specifically for businesses that have experienced some kind of disaster and need to replace equipment, rebuild or remodel facilities, or replenish lost stock.

Unsecured Loans

When getting a loan from a traditional lender, many borrowers are required to secure that loan with collateral. This can be real estate, expensive equipment, or other personal or business assets that the lender can repossess in the event that the borrower defaults on the loan.

Biz2Credit offers funding options for those business owners who may not have high-dollar assets to use as collateral by providing unsecured loans. These loans don’t require any collateral when you take out the loan. However, because they’re seen as a higher risk to lenders, they often come with higher interest rates than many other types of loans.

Loans for Women, Minorities, and Veterans

Biz2Credit and its partner lenders offer a variety of special lending programs available to women business owners, businesses owned by minorities, and veteran-owned businesses.

The exact types of loans available through these programs vary depending on the individual lender, but many of these special loans are term loans that come with lower interest rates in an effort to support women, minority, and veteran business owners.

Biz2Credit Business Loan Features

Pros and Cons of Biz2Credit Business Loans

Here are some of the pros and cons of choosing Biz2Credit for your small business loan:

Biz2Credit Business Loan Customer Reviews

In its more than a decade in operation, Biz2Credit has accumulated a fair number of positive customer reviews, with many pointing to the easy online application process and great customer service as their favorite parts.

Biz2Credit has more than 1,500 reviews on TrustPilot, with an average star rating of 4.9 out of 5.

Here’s what some of Biz2Credit’s customers are saying about them:

How to Apply for Biz2Credit Business Loans

Applying for a small business loan through Biz2Credit or its partner lenders is fast and easy online.

How to Contact Biz2Credit

Address: 1 Penn Plaza 45th Floor, New York, NY 10119

Customer Service: (888) 959-0580

Email Support: [email protected]

Facebook: https://www.facebook.com/biz2credit

Twitter: @Biz2Credit

LinkedIn: https://www.linkedin.com/company/biz2credit-inc/

Does Biz2Credit Offer Other Loans?

Biz2Credit only offers loans to small business owners.

Summary

Finding financing as a small business owner can be difficult. Traditional lenders don’t want to work with you because you haven’t been in business long enough, you don’t make enough money, or you have a spotty credit history.

With the advent of alternative lenders such as Biz2Credit, getting financing as a small business owner has gotten easier than ever before.

Biz2Credit offers a wide variety of quality business financing options, and its lending requirements are more flexible than traditional banks and lenders. Whether you need quick cash to repair your business roof or you want to take advantage of an expansion opportunity, Biz2Credit and their direct funding options can help match you with the best solution.

Although the fees and interest rates charged for borrowing from Biz2Credit may be higher than those of traditional lenders, their fees and interest rates are similar to those you’ll find at other alternative small business lenders.

If you’re looking for a variety of lending options with flexible requirements, Biz2Credit may be a great fit.

Speak To A Biz2Credit Representative Now

Frequently Asked Questions

Does it cost anything to check funding offers from Biz2Credit?

It does not cost you anything to receive multiple no-obligation funding quotes from Biz2Credit. You will pay interest rates and other fees directly to Biz2Credit if you receive funding.

How much funding could I get approved for from Biz2Credit?

Biz2Credit considers a wide range of factors, but typically you will receive 75% to 125% of your business’s monthly deposits (as seen in bank statements).

How long does it take to get funding through Biz2Credit?

Getting financing can take as little as 24 hours or up to four weeks, according to Biz2Credit. The length of time depends on the type of funding you’ve applied for and whether any additional documentation is required to complete the approval process.

How does Biz2Credit calculate their interest rates for funding?

The 4 biggest determining factors are credit, industry, time in business, and cash flow.

Is Biz2Credit a broker or marketplace?

No, Biz2Credit is a direct lender.

Biz2Credit provides funding at affordable/attractive rates (all under a single roof), thanks to strong financial backing and world-class technology that gives Biz2Credit the ability to fund promising businesses that are deserving of extra capital.

By working with a trusted direct lender like Biz2Credit, you avoid getting your information and data sold to other companies (and then potentially bombarded with phone calls).

Is Biz2Credit a stable business to work with?

Reviews for Biz2Credit

Why leave a review about the service here?

Your reviews are a valuable source of insight for us to improve our service as well as improve the offerings. All pros and cons submitted here are evaluated and are responded. We also share these insights with our partners so that they could improve their offerings as well.

Biz2Credit Review

Find a customized quote easily

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands (and/or their products) are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Biz2Credit summary

Get approved in 24 hours

Financing for new businesses available

Excellent customer support

High revenue requirements

Origination and factor fees

Online experience

Has learning resources, access to rates, mobile app

Customer services and support

Multiple ways of reaching lender, wide range of hours

Variety of loan types

Offers most loan types

Loan amount range

Eligibility

Doesn’t cover bad credit, low revenue, new businesses

Overview

Biz2Credit is a direct funding provider for small businesses where you can find term loans, business cash advances, and commercial real estate loans. Biz2Credit uses a simple application to find multiple pre-approved loan offers for your business. Plus, the company has loan advisors at the ready to help you pick the right type of loan for your business.

Why Biz2Credit Is Good For Your Business

Biz2Credit is designed to connect growing businesses with the money needed for expansion. What makes this funding provider unique is that it caters to a wide variety of businesses. For example, established businesses can choose traditional term loans, while startups can get financing that is repaid with a percentage of future profits. Biz2Credit’s partners typically approve loans within 24 hours and you can receive funds within 3 business days.

Loan Features

Biz2Credit coordinates several different types of loans. Small business term loans feature low interest rates, weekly or biweekly payments, and flexible term options. Startup financing is designed for young businesses that have been around for less than 18 months and can be repaid based on future profits rather than through fixed payments. Commercial real estate loans offer lower interest rates and more funding for businesses that own their own property.

Application Process

Biz2Credit offers an online application that takes less than 5 minutes to complete. Just enter details about yourself and your business, and Biz2Credit will instantly display loan options for which you’re already pre-approved.

Once you decide on a loan offer, the lender will run a hard credit check and ask for supporting documentation. Most Biz2Credit partners offer final approval in less than 24 hours and can get funds to you within 72 hours.

How Much Can You Borrow?

Repayment Terms

Biz2Credit term loans and commercial real estate loans have a repayment term from 12 to 36 months. Your interest rate will vary depending on your credit history and lender, but Biz2Credit advertises rates as low as 8.99% APR. Payments are weekly or biweekly for term loans and monthly for commercial real estate loans.

If you choose startup financing, your lender takes a percentage of your profits on a daily, weekly, or biweekly basis to pay off your debt. The amount of time it takes to repay your loan will depend on how big the percentage is and how much profit your business makes.

Privacy and Security

Biz2Credit’s website and application is secured with SSL encryption through Entrust. The company has a very comprehensive privacy policy, although it does share details about your business with partners.

Help & Support

Biz2Credit offers support by phone, email, and live chat 5 days a week. The company also offers a business toolkit so you can track your business’s finances and find out how much a loan will cost.

Phone: (212) 644-4555

Physical Address

1 Penn Plaza, 45th Floor,

New York, NY 10119

Summary

Biz2Credit makes it easy to find the perfect loan or financing offer for your business. This funding provider connects you with lenders who cater to a wide range of businesses who approve loans in as little as 24 hours. Biz2Credit offers a simple application, excellent customer support, and high borrowing limits.

Our editorial staff consists of writers who are knowledgeable about financial services. We specialize in simplifying the process of choosing the right provider for your needs.

» commonSiteWysiwyg=»[object Object]» commonUserGeoLocation=»[object Object]» commonUseragent=»[object Object]» commonCaptcha=»[object Object]» data-testid=»logo-icon»/>

Must Reads

Trustpilot reviews

Wonderful experience will recommend to my other business partners. Thank you so much for your help

I was very skeptical at first from seeing some of the bad reviews but from the moment I started working with Neil Johnson to get funds for my Business I have had very good communication with him. I have no complains at all. He made sure to answer all my questions in a very timely manner. Once I gave all required paperwork I recevied the funds in my business account the very next day. I am so thankful for the all the help which was much needed.

Great experience and so straight forward to have the loan forgiveness. Thanks Biz2credit for facilitating it.

The process was straightforward and efficient. We received approval of our loan forgiveness application quickly. No issues were raised.

I truly want to thank Biz2Credit and all your representatives that worked with me to secure my SBA loan as well as the Forgiveness process. You guys shown such professionalism, answering all my questions and offering all your definitely needed advice as I went to the process in securing my loan. And most importantly to the SBA in providing the desperate loan that I needed to continue with my business and helping me to maintain my employees. Mere words truly can’t express my heartfelt feelings for Biz2Credit and the SBA for working with me thru this disaster time. With all my heart, I truly thank you and you guys were GOD sent…. Thank You All 🙏🏾

Too much paperwork and no work.

It was amazing experience. Roger worked hard for us the whole time. We hit a few snags from my end. I’ve done two loans with this company and every time its gone smooth. I would do another one.

I went out of state with wife and daughter a series of events caused us to deplete our entire funds from every account along with borrowing 1200 to get home. This lead to me requesting a loan for capital through Bizz2credit. I was approved for 20k all have been processed and underwriting has been completed even had authorization call to wire in funds.My buisness has been on hault for 2 days now as I have yet to receive any funds. Checks that were issued prior have hit accounts and nearly 4k total negative accross all accounts. Every time I call they tell me everything is done on their end but nothing is wired. Today is Wednesday evening and this process started last Friday still no funds. I have started trying to reach out to other lenders but due to negative account status no one is able to help. So all this time wasted on Bizz2Credit. I feel scammed. Maybe they will eventually send and ill update comment but this has still been a nightmare experience! Update Thursday 7 pm cst still no funds Matthew won’t answer my calls or return them. I have the notarized approval and wire transfer authorization yet still heard nothing. Extremely unprofessional and has cost me 3 jobs so far!

I must say that Mr. Roger Dolson, is a person of great character, he took the time to explain and give clarity to all that the loan entails. Thank you sir, you have represented Biz 2 Credit well and with integrity.

This is my third time doing loans with Biz2credit and I could not be any happier. Moh Danish and his team are always attentive and help me always to guide through the process with patience and professionalism. I even consider Mohamad like a brother because he is so nice and cares about his clients. I will only deal with him at Bizz2credit.

Fast and awesome! Love it! Great customer service!

Arun and david gave me the best service to process the loan in timely frame.. it’s was really nice working with both of them.. Biz2credit need employees like them.

This was our second time receiving financing with Alan. They came through for us again when we were a bit short with funds while expanding!

The best people you can work.

Really great service for funding

Thank you Paul and Alan Thank you For helped me and I’m happy and satisfied with the company and I will send some of my friends to contact your team

It was great experience working with Daniel and Matthew I am so happy working with thanks all your help I really appreciate

I had a phenomenal experience with Biz2credit working with Ashish Kumar Mishra and Morgan Smith. They went above and beyond to answer ALL of my questions. They each also were so attentive and worked a loan that benefitted my business. I was so impressed and will always seek out Biz2credit for my business financing. I am a minority, female entrepreneur and to have this funding means so much to the growth of my business. Without a doubt. 5 stars! Thank you Biz2credit!

I am a new start up … just 20 months. Had sales that are growing … but no bank would touch me … I contacted Diwesh at Biz2Credit and he helped get me through a tough hurdle and was able to bridge a gap. Look forward to using them again in the future as I continue to grow. CM @ ATS

I cannot say how much we really enjoyed our experience and process of getting our business the funding we needed. Sumit was amazing in giving us all the information and guiding us through the process. Everyone we spoke to genuinely seem concerned to help us and not pushing funding on us. I would recommend anyone who is in need of quick funding to reach out to Biz2Credit.

good service by chirag

Nitish Patel was very helpful and quick in processing our loan. He is very knowledgeable and friendly. I will definitely refer my friends and family to Nitish. Very very happy with his prompt replies. Please call Nitish at 646-330-4758 and you will be helped right away.

Thank you Neil Johnson! Neil was super supportive in helping us secure a loan through Biz2Credit for our coffee shop. It was a seamless process, and he assisted us every step of the way. We appreciate the transparency, and the loan helped our business. We will consider Biz2Credit for future funding. Thanks again, Neil!

My rep Mr Ankit was excellent 👍 Thanks biz2credit

Roger was very helpful.

I have been a customer in the past and just like then this new process was very easy and improved by technology. The funds came quickly and easily and the staff was very helpful and had great follow through.

In the end they came through for my business just in time. Jack Williams is going to be my loan guy moving forward. Thanks!

Best company to get funds for business. Their employees are well trained to answer related questions. Special thanks to Ashish, he went extra mile to help us.

Quick and easy loan process.. thank you to Danny Simon from biz2credit team and make my loan fast..

Super easy to work with. Ravi Kumar was very helpful in getting us through the process and getting the loan approved.

This is first time we got into funding program and my case managers educated me every single thing during the process. We are happy.

I had an excellent treatment and a fast financing, I recommend your services, thanks to Jack William for his work, he made me feel safe and he was very kind.

At first, I was very hesitant because once I was told that I had been approved, I thought this must be a scam. After more research, I found it was true, and the transition was smooth, fast, and easy.

excellent services with great follow up

Brad and Dominique’s customer service is exceptional and they went above and beyond in helping our business grow. They move very quickly in assisting us with our needs. Will definitely contact them again in the near future as we grow. Thanks guys!!

I could secure the funds because of my best funding specialist Mr. Roshan and kevin.

I was working with harsh singh to secure funds. He was so polite and responsive so i will use his services again.

Shashi was a great help during the application process, he made the process smooth as possible and had our approval to us in a timely manner. I would recommend Shashi and biz 2 credit to my fellow entrepreneurs.

I had a great assistance Thank you Brad Wilson

We love James Jay at Biz2Credit!! ALWAYS very very helpful & professional!! LOVE LOVE!!

I had good experience with biz2credit for getting me funded on time. Thank you Roshan for making it fast.

I have worked with Mark Harris and he helped me what exactly I need he is very nice and the company itself is great great people to work with if you would like to boost your business call them

From my first time with Mark Harris to my second time with Erick Brown / Aryan the process has been absolutely smooth/clear and all have been an absolute pleasure to speak to, their customer service is by far beyond and above any other company of this kind.

Thank you so much Ashish Rodolf for always kind explanations and quick turnaround.

Easy process, fast funding.

The whole process was quick and easy.

Very fast and quickly approved.

Thanks Matthew for your expedient service and special attention to our accounts kind regards Summit estate sales

I shopped my Business to many lenders And Biz2Credit Gave me the best terms. Looking forward to working with them in the future.

I am very happy with all your service thank you

I am a CPA. I had some problems with my clients Forgiveness Applications. I was working through Biz2credit to get the client applications filed. Kendra Brown and Marissa Vega were the best customer satisfaction team I have ever experienced, and Jessica Clemons the Senior Customer Success Manager with CPA.com (an AICPA company). Being a member of the AICPA for 42 years I was glad to see that we had high quality people like Jessica working for us. I give them all an “A” for their outstanding performance. I also had an excellent experience with the Biz2credit Technical Support Engineer assigned to my case, ASHISH TYAGI. However, I am doing a separate review of my excellent experience with him. ADDED: I cannot figure out how to write a separate review so I have to add to this one. ASHISH TYAGI is the Technical Support Engineer assigned to my account. He did an excellent job of handling my problems in a quick and efficient manner. He resolved everything for me and I am sure he was putting out other fires at the same time. This was enough for him to rate a superior rating in my view. However, there is more. I have lived in the south all my life and people from other parts of the U.S. have trouble with how we say certain words, and our accent. I assume English is Ashigh’s second language. Anytime I get a customer service rep from India, I get immediate anxiety but not for the reason you think. It is because I feel empathy for them if I say I don’t understand them. In addition, I am afraid they won’t understand me because of my dialect and I hate the thought of them feeling inadequate because of me. There are plenty of people in the U.S. who wouldn’t understand me. Ashish and I understood each other. That’s not to say there weren’t discussions where we had to explain things differently to each other but Ashish (and I hopefully) handled it with great patience and worked through it. Everyone should handle things like Ashish. He also gets a solid A in my opinion.

Easy, friendly, helpful

Biz2Credit is top notch. Their customer service reps and agents were so good at being respectful and providing clear instructions all what’s needed for the process from beginning to end. The online portal was good and very user friendly. The Biz2Credit family really in a whole genuinely wanted to help to their fullest capabilities and I really appreciate that. You can’t go wrong with Biz2Credit.