How can an individual attract investment

How can an individual attract investment

The Best Ways to Attract Business Investors for Your Start-Up

At each stage of its life cycle, a startup needs funding. No matter how great the idea is, its implementation requires certain resources, both financial and material. Thus, each startup gets to thinking how and where they can attract such resources. So, let’s see what startups need and what they can do to get it.

To begin with, each startup should decide what do they need more to get their business off the ground – money or assistance and support? Or both?

Where to Get Financing for Your Startup?

It may happen that at the initial stage the so-called seed capital is provided by the startuppers themselves with a bit of crowdfunding. The seed capital is needed to finance the initial market research, preparation of the business plan and creation of the MVP or product prototype. At this stage, it is the most difficult to find investors for business, as seed investments are considered very high-risk. For this reason, startup founders try to get the first investment with own resources and start looking for investors when their business has taken a certain shape and there is already something «to show».

However, if your own resources are insufficient and your business needs financing to get off the ground, you should be looking for ways to get investors for your startup.

Angel Investors vs Venture Capitalists: What’s the Difference?

Most startups obtain their financing from two major types of investors – angel investors and venture capitalists. They have a different approach to startup funding which can define both your choice of investor type and your strategy of attracting them. So, what’s the difference between the two?

Angel investors are mostly individuals who contribute their personal money to support startups they find promising. Their primary interest is not only in receiving the return on their investments but also in wanting to keep the pace with the current trends and to share their expertise with younger entrepreneurs. Some angel investors are just passionate about the industry you are working in and want to be part of it. They are more willing to support startups at the very initial stages of their growth.

Venture capitalists, on the contrary, are companies and funds whose financial assets belong to other corporations or funds. In other words, they are responsible to their partners for the money they are prepared to invest into an idea, and this fact influences the approach they take to startup financing. Venture capitalists are more prone to invest in businesses which have already shown certain progress.

With that in mind, we can identify the following important differences between angel investors and venture capitalists which should be taken into account while looking for investors for your startup business:

How to Attract Investors for a Startup

This is a key question, because looking for investors is an investment in itself, as you should not come to them empty-handed. So, what does it take to convince other people that investing in your startup is worth their while?

Assistance and Support

However, at the initial stage startup may need another type of resources – those in the form of support. The young business may want some office space, technical devices, access to high-speed Internet, and there are solutions for that, too.

Coworking

Coworking spaces, which have rightfully earned the unofficial name of «space-as-a-service» are a great solution for startups to get the ball rolling. Although providing no financing and, on the contrary, charging a fee for their services, coworking spaces help to significantly reduce the initial startup costs.

Coworking spaces will save you the headache of renting an office space, selecting office hardware, contracting an Internet provider, arranging meeting spaces for negotiations with prospective customers and investors. Such facilities already have it all in sufficient amounts.

WeWork, a global coworking network which heads most coworking ratings, describes their service in the following way: «You focus on your to-do’s, we take care of the rest». Indeed, you will find convenient space for your office with the necessary equipment and services, together with conference rooms, cafeterias, and recreational areas.

And the beauty of coworking spaces is that they are charging a monthly fee, so there is no need for long-term investments.

Business Incubators

Unlike coworking spaces, business incubators offer not only facilities and tools for running a business, but also a whole set of research, consulting and training services. There you can get a consultation on various aspects of business management – financial, legal, intellectual property, human resources, and much more. Incubators can bring you together with marketing experts who assist you in preparing a market study, trainers on management who help you set up your startup team, professional coaches who instruct you on the best practices of modern business.

Another great advantage of business incubators is that they can connect you with potential investors for your startup or arrange a bank loan if that is your preferred strategy. Some business incubators operate online only, providing no coworking services and focusing on consulting and facilitating instead.

Basically, the purpose of business incubators can be seen directly from the name – their goal is to help the emerging companies «incubate» their business ideas, nurture them into a prototype to attract investors, and, in general, to support an aspiring business until it spreads its wings. Business incubators can sometimes be part of government programs with government funding, while others are sponsored by venture capitals or large corporations.

An example of a business incubator is Idealab that searches for promising ideas and helps them become successful businesses.

Accelerators

They are one step up from business incubators, as this is where a startup can already secure certain initial investment. At the same time, business accelerators have some entry barriers and conditions which a startup must fulfill to qualify for the seed investment from the accelerator:

Techstars is an US-headquartered global accelerator network with operating programs in Israel, Germany, South Africa, Australia, and others. In 2017 DA-14 CEO and Co-Founder, Dmitriy Sushko, took part in Techstars Boston as a Technical Associate to help startups build prototypes and automate business operations, assisted by remote JavaScript developers from the DA-14 team. Techstars has laid down some simple recommendations for startups hoping to be accepted for their programs:

On a final note, looking for investors is a difficult path where nobody is safe from failure. However, if you are well-prepared and determined, you will succeed in finding a person or company to finance your project. Then your startup success will be in your hands.

How to Make Your Project Attractive to Investors

In an era where almost anyone can build revolutionary projects with nothing but a computer and determination, everyone wants to create the next Facebook or Google. Unfortunately entrepreneurs are probably more likely to be struck by lightning than they are to secure a venture capital round. In general it’s possible to build out a decent minimal viable product without a large budget, but you’ll often reach a point where you’ll need some investment to grow your business. Let’s look at how you can put yourself in the best position to attract investment for your project.

Keep in mind that if you’re soliciting outside investment, whether through crowdfunding or seeking venture capital, you should be seeking to take your project to the next level. If you’re in a position where your company is going under, that’s a topic for another article.

Learning from Investors

If you’re planning to pitch for investment, learning from investors themselves is a great way to increase the odds of securing capital to improve your business. At a recent Angel Education Day hosted by The Soho Loft, accredited investors from multiple states gathered to learn from seasoned professionals on best practices to improve early stage investment opportunities.

Although the conference was specifically for Angel investors, many of the concepts from the conference are applicable to software development projects.

What Investors Want You to Know

In a presentation titled What Every Angel Investor Wants You to Know, Brian Cohen outlined multiple tips to help ensure that investors make the right decisions when putting money into companies. One of the more notable points from the talk revolved around the ideal team structure of a startup. For a company to successfully attract venture capital, they will need multiple founders with complementary skill sets.

According to Cohen, to be one of the smartest people in the room, you don’t need to know everything. Rather, you need to know what you don’t know, and have the ability to admit it. Aside from this, the next thing that investors consider is the ability of an entrepreneur to think on their feet. When it comes to coding, it can take hours to resolve issues, however if you’re planning to pitch to an investor, you’ll have to be able to think on your feet.

Even if you land the chance to pitch to an investor and they like your idea, you’ll also need to hold up against a stringent background check. While every investor is different in how they approach this stage, one rule always holds true: honesty is always the best policy. Whether your investor asks if you’ve always paid your taxes on time, or if they want to know if you’ve ever done anything in the past which could jeopardize the company down the road — when in doubt, it’s always best to disclose. Venture capitalists typically participate in tight knit communities so damaging your relationship with one can harm you for years to come.

The Rise of the Inventrepreneur

As mentioned at the beginning of this article, software has revolutionized the world by allowing almost anyone to bring his or her ideas to life with little more than a computer. Many developers work on projects without considering a critical question: “How is this product going to make money?” It sounds like a simple question, but if you can’t provide investors with a solid answer that’s backed by data, they’re never going to consider working with you.

Financial projections are never going to be one hundred per cent accurate, and investors know that. When they’re reviewing your company, they want to see that your figures are realistic. As you might expect, investors generally only consider projects with large growth prospects, ideally delivering a 300 – 500% return. They are well aware that without proper execution, their investment will go down the drain.

Intellectual Property Isn’t Everything

Although intellectual property can be a valuable tool for boosting the value of your software project, it’s not the be-all and end-all. If you are developing something complex such as mobile payments or a speech recognition project, you should avoid pursuing a patent just because you feel that it will make or break your pitch. In fact, over relying on intellectual property can backfire because it can give the impression that you don’t fully understand how a business should be valued.

If you’re strapped for cash, you might be tempted to pursue a provisional patent for your venture. If you do head down this route, remember that you can’t raise funds around a provisional patent, and everything within the provisional patent becomes public knowledge upon filing. In the US, a provisional patent simply indicates you intend to file a patent, and provides you with a yearlong runway to file the formal paperwork. In other countries, the terms can differ so be sure to consult with an attorney familiar with your country’s laws before making a decision.

Execution Is the Key

The most important lesson to keep in mind as an entrepreneur is that when it comes to private equity and landing an investment for your company, execution is everything. An investor is more likely to work with a great entrepreneur with a less than stellar idea, as opposed to a sub-par entrepreneur with a great idea.

HOW TO ATTRACT INVESTORS TO YOUR BUSINESS [Mastery Guide]: 15+ Best Tips

Table of Contents Hide

It is very important to save money throughout the business development process. Running your business right from startup from your purse will take longer than anticipated. It is highly recommended you know how to attract investors to your business and as well have a well-thought-out plan in place to reduce the time, effort, cost, and energy necessary to be successful.

It is no news that with financial support your business can experience exponential growth and reach its success potential. No man is an island, and no business is one either, so don’t shy away from reaching out to investors to inject the needed cash to boost your business.

The process of searching for an investor is an investment in its own right, but if you rightly apply your efforts in the usage of time, money and energy during your pursuit, you will have a higher chance of reaching your set goals.

Proven Tips to Attract Investors to your Business

Here are various proven ways to attract investors to your business. Try to peruse with keen interest, comprehend, and apply the knowledge in attracting the investors your business need.

#1. Create a Solid Business Plan

Your business plan is a critical document that shows investors that your business is worth their time and money. Your strategy should clearly explain your business’s aims and goals, as well as demonstrate the knowledge of your team in your sector. Demonstrate a thorough understanding of your clients (your target market) and provide a detailed description of the products or services you supply.

Your marketing plan is an important part of your business plan. It identifies your market’s size and growth prospects, as well as trends and sales possibilities. Pricing, promotion, and distribution tactics all play a role here. Discuss entrance barriers as well, including how you intend to keep competition at bay. Finally, make your business strategy accessible for everyone by presenting it in an appealing way. This not only makes you stand out, but your audience may even thank you for it.

It’s worth noting that investors that are already familiar with your sector and market are more likely to invest in your firm due to their knowledge and comfort. Take note that their knowledge may imply more specific inquiries for you, so be prepared to demonstrate your experience.

#2. Create a Forecast Model

It is critical to have a transparent, replicable business model that is scalable and as thorough as feasible. Demonstrate to investors that you have not only projected but also planned for growth. Prepare to demonstrate how your business strategy will assist your organization in becoming more lucrative. Financial and market issues should be prioritized because they are critical for investors.

A plausible forecast model is a technique that investors can use to judge how well you know your market and your likelihood of success in it. Your model should be reasonable, but it should also show enough income and growth to pique the curiosity of investors. Just be prepared to explain how you intend to meet your targets. Consider presenting conservative and aggressive estimates to demonstrate alternative assumptions ranging from cautious to enthusiastic. Remember that forecasting is a continual process that necessitates constant reevaluation. The more current your projections, the more equipped you will be to make informed strategic decisions for your business.

#3. Request Customer References

Investors want to speak with customers who have firsthand knowledge of your product or service. A customer discussion provides a unique viewpoint on your company that cannot be obtained from a meeting with you or by reading your firm’s marketing materials or website.

Investors want to know the value your business provides to customers, the process your customers went through when deciding to buy, what your customers’ user experience is like, and what sets you apart from competitors. Prepare consumers to conduct interviews with possible investors when the time comes.

#4. IP address (if applicable)

Intellectual property, or IP, is more crucial than ever for organizations today, especially for technological start-ups and manufacturing firms because information acts as a sustainable and defensible differentiation. Patents, trademarks, and copyrights are the three categories of intellectual property. Investors want to see that you understand what intellectual property your company needs to protect and how to preserve it.

According to the Startup Genome Project, intellectual property (IP) has been highlighted as a vital factor for companies around the world to acquire a competitive advantage in the market.

#5 Prepare to Explain Your Cap Table

A capitalization table (cap table) lists the various investors’ or lenders’ equity and debt ownership and liquidation ranks in a business. A cap table is useful to investors since it indicates how much of the company’s founders hold.

Investors want to know that their interests are aligned with the founders’, and that there is enough stock left over to attract investors in subsequent rounds. Be aware that “founder dilution”—cash handed to founders on onerous terms—can raise a red signal.

#6 Describe Your Financial Statements

The financial statements of your firm reveal a lot about how you run your business. Investors are particularly interested in your cash flow, debt commitments, and equity. Having cash in the bank demonstrates that you are prepared for unanticipated issues and that you can seize fresh possibilities.

Good cash flow (and a strong cash flow prediction) is a sign of sustainable operations, which reassures investors; they believe you can stay out of the “red.” Debt commitments, on the other hand, translate into cash being consumed in debt payments. Slow months may result in your failure to satisfy payroll and other obligations. What about fairness? Investors are interested in purchasing stock in your firm, so they will utilize your financial statements to determine the business of your company to shareholders.

#7. Explain How Proceeds Will Be Used (Use of Funds)

Investors want to know how your company intends to use the funds. Will you use their funds for capital expenditures? What about research and development? What about legal and accounting fees? What about the costs and compensation of recruiting? Establishing capital efficiency early in the process can assist your company in developing perceptive leadership and, as a result, make you more appealing to investors. Prepare to communicate to investors what milestones you hope to attain and the expected outcomes.

Investors evaluating your company’s investment potential will scrutinize your financial performance from every angle. Tell them how you expect to expand your business swiftly while using the least amount of their money. Spending prudently should be your goal regardless of economic conditions, so establish a track record of solid financial management.

#8. Recognize the Total Address Market and the Go-To-Market Strategy

TAM, or total addressable market, informs investors about the potential size of your market. What is the maximum number of clients that can be reached? How long does it take to become the market leader? Understanding market sizing not only helps you steer your business, but it also helps you determine your go-to-market strategy. Understanding your TAM will allow you to make forecasts about the genuine size of your market, the number of prospects you can expect, the length of time your sales pipeline will be satisfied, and potential income for a given time frame.

Investors want to know how you intend to use your resources to reach out to and provide value to customers in order to acquire a competitive advantage. The importance of fluidity cannot be overstated—as your market, industry, and business change, so must your strategy. Keep in mind that investors like companies that can expand swiftly and manage that expansion. You must be able to articulate your TAM and discuss your approach for achieving it to investors.

#9: Demonstrate a Strong Sales Pipeline

There is no such thing as a business without sales. Investors must be satisfied that your product or service is in high demand. Your product or service must distinguish itself from what is already on the market. When explaining the sales process to investors, your differentiators should be simply defined.

Perhaps your competitive edge is based on your intellectual property, or perhaps you’re tackling an issue in a novel way. Prepare to demonstrate to investors, using real proof, that your market potential is substantial enough to justify an investment. Provide a track record of previous sales (including the number of prospects at each level of the buying process) and demonstrate how you intend to continue to increase your pipeline in order to grow the business and generate money.

#10: Conduct Legal Due Diligence

Investors who are interested in investing in your firm will undoubtedly have an attorney conduct a thorough legal analysis. While unpleasant, the legal due diligence procedure is effectively the final check on all legal aspects of your business and team. Investors not only obtain a better understanding of your firm and operations before making a purchase, but they also utilize the information to assist them estimate the buying price.

It’s important for their legal team and yours to get along well in order for the process to move as smoothly as possible.

#11. Knowledge of your investors

It is generally believed that what you know, you stand a better chance of attracting. In most cases, you don’t sit down at a place and expect investors to troop to you. Just like the same way you look for your product’s target market, look for your investors. You can take some time researching about the investors. Pay proper attention to the kind of investors you did want. This will help give you ideas for what they’re looking for, which in turn helps you save time and energy.

Knowing them on a personal level is a big up to you. Find investors with beliefs and interests similar to yours. It did be a whole lot easier to connect with them.

Read More: How to Penetrate your market with ease[6 ways]

#12. Meet Budget Milestones

Investors want to be guaranteed that your business can give them the returns they want. And one of the ways of convincing them is to show what you are capable of. They consider the best businesses to be those with proven customer discovery. You will need a budget to get your first customers and make sure that a match exists between your business and the market. Once you succeed in reaching some milestones, you can move to pitch to investors.

Investors are sure to be attracted to your business because you have shown that you have a track record of delivering. You also need to factor in the cost in terms of expenses and travel as you seek out investors. This is because pitching investors can run into months.

Read More: How to win price way

#13. Lean Towards Crowdfunding

In answering the question of how to attract investors to your business in recent times, the term crowdfunding is sure to come up. Crowdfunding is a recent form of attracting investors to business and raising capital. Crowdfunding is mainly done online. It involves posting your business idea on a crowdfunding site and letting your potential investors find it on the site. It is a way of announcing what you do to the world.

Crowdfunding can benefit all kinds of entrepreneurs, irrespective of the stage they find themselves. This is due to the fact that it has a global reach to people once there is an internet connection. Depending on how it goes, you might either get all or some of the cash you need. So when next you think of how to attract investors to your business, think crowdfunding.

#14. Familiarize with your pitch

Your ability to attract a certain investor to your business might boil down to your pitch, and you sure have to get it right to attract such investors. At this point, no slip up is expected of you, and you have to take measures so as not to slip up.

You have got to rehearse your pitch to know it very well, know your facts like you know your name, though you don’t have to be robotic. In preparation, you have to anticipate their questions and have answers ready for them.

Be articulate, show some level of calmness, don’t be defensive or aggressive. And be sure to know your numbers so as to make the right decisions on the spot.

#15.Knowledge of your Market

As earlier established, most of your efforts should be geared towards convincing investors that your business is worthy of their investment. And you can prove that by showing how well you know your market.

Before pitching, make a thorough research about your target market. Have the numbers right and available to the investors. Let them know how in-demand your product or service is, how well you know your consumers, as well as how to get to them.

Show your potential investors how different you are from the competition if there are any. They are also better convinced when they know the growth potential of your business and the marketing strategy you intend to adopt. When next you are thinking of how to attract investors to your business, you did have a better answer nestled in your head.

#16. Provide Bios and References for the Management Team

Investors are interested in both you (as CEO) and the management team, from their industry background to their business experience. They must be convinced that you and your team can lead the company to success while also providing a return on their investment. Your experience as a “top banana” is extremely important to investors. They want to discover if you have a track record of exceptional achievement, knowledge, and leadership in your field or previous enterprise. Make sure you project confidence and passion, and show your readiness and ability to change course if your firm needs to.

Other favorable characteristics that investors seek in CEOs include the capacity to make decisions with input from your leadership team (there is no place for indecision), excellent interpersonal and networking abilities, and the ability to develop a firm around key competencies and execute on them.

To attract investors can be quite a tedious task as are other facets of running a business. With proper drive and dedication, business targets are sure to be met. But if as a business owner you have asked the question, how do I attract investors to my business, I am sure you now know better ways of going about it.

How to Attract Investors FAQ’s

How do I find investors?

Attending startup events—industry conferences, pitch competitions, meetups, and so on—is a terrific way to meet possible investors and VCs. These events provide you with the opportunity to network with other businesses, learn from successful entrepreneurs, and meet investors in person.

How do investors get paid back?

More frequently, investors will be paid back in relation to their equity in the company, or the amount of the business that they hold based on their investment. This can be repaid solely on the basis of the amount they possess, or it can be done through preferred payments.

Is an investor an owner?

You are not an owner as a lending investor. When you purchase stock in a firm, you are making an ownership investment. Your reward will be proportional to your part of the company’s profits. The initial investment amount will be included in the final worth of the company.

How to Attract Investors and Get Funding for Your Startup Business

You poured your heart and soul into your business, and now it’s time to determine how to attract investors and secure funding to continue growing.

But how would you fare if investors – like VCs, angel investors, and bankers – were to evaluate your company?

What components will drive their decision to invest or not?

When you know what to expect, pitching your idea to investors may feel less intimidating and more like, “Let’s see if we’re the right fit.”

The process of getting startup funding for your business may put you on edge just a bit— not because you don’t know your company inside and out, but because you’re uncertain what will be asked of you when you meet with potential investors.

We’ve worked with all kinds of entrepreneurs from many industries.

Here are 11 steps that will help you attract investors and get funding for your startup business:

1. Develop a Strong Business Plan

2. Develop a Forecast Model

3. Obtain Customer References

4. Address IP

5. Be Ready to Explain Your Cap Table

6. Explain Your Financial Statements

7. Justify Use of Proceeds / Funds

8. Acknowledge Total Address Market and Go-To-Market Strategy

9. Present a Strong Sales Pipeline

10. Perform Legal Due Diligence

11. Provide Management Team Bios & References

Want to read this later? Download the PDF:

#1. Develop a Strong Business Plan

Your business plan is an all-important document that proves one thing to investors: that your business is worth their risk. Your plan should clearly outline your business objectives and goals and demonstrate your team’s expertise in your field.

Show that you have a deep understanding of your customers (your target market) and provide a complete description of the product or services you offer.

An essential section of the business plan is your marketing plan. It defines your market size and growth prospects and should show trend influences and sales potential. Here is where pricing, promotion, and distribution strategies come into play. Talk about barriers to entry as well, addressing how you plan to keep competitors at bay.

Finally, make things digestible for everyone by presenting your business plan in an engaging format. Not only does this make you stand out, but your audience may also actually thank you for it.

It’s worth noting that investors already familiar with your industry and market may be more likely to invest in your company because of their expertise and comfort. Note their knowledge may also mean more targeted questions for you, so be prepared to showcase your experience.

#2. Develop a Forecast Model

A transparent, replicable business model that is scalable and as detailed as possible is essential. Show investors that you not only forecasted growth, but you’ve planned for it.

Be ready to prove how your business model will help your company become more profitable. Emphasize financial and market issues, as these are vital areas for investors.

A reasonable forecast model is a tool for investors to determine how well you know your market and your presumptive success concerning your market.

Your model should be realistic but also show enough revenue and growth to keep investors interested. Just be ready to explain how you’ll achieve your numbers.

Consider providing conservative and aggressive forecasts to show alternate assumptions— from more cautious to more optimistic.

Remember that forecasting is an ongoing process that requires constant reassessment.

The more up-to-date your projections, the better prepared you’ll be to make informed strategic decisions for your business.

#3. Obtain Customer References

Investors want to speak directly with customers who have first-hand experience with your product or services.

A conversation with a customer brings a unique perspective about your company that simply cannot be gained through a meeting with you or by reading your company’s marketing materials or website.

Investors are looking to understand the value your business brings to customers, the process your customers went through when deciding to buy, what your customers’ user experience is like, and what differentiates you from competitors. Have customers ready to offer interviews to potential investors when the time comes.

#4. Address IP (if applicable)

Intellectual property, or IP, is more important today for businesses than ever, particularly for technology start-ups and manufacturing firms whose knowledge serves as a sustainable and defensible differentiator for the company.

The three types of intellectual property are patents, trademarks, and copyrights. Investors want to see that you know what IP your company needs to protect and how to protect it.

According to the Startup Genome Project, IP has been identified as the critical ingredient for startups worldwide to gain a competitive advantage in the market.

#5. Be Ready to Explain Your Cap Table

A capitalization table (cap table) lays out all the equity and debt ownership and liquidation rankings of the various investors or lenders invested in a business. For investors, a cap table is valuable because it reveals precisely how much the company’s founders may own.

Investors want to ensure their interests are aligned with the founders, and there is enough equity left over to bring in investors at later rounds. Be forewarned that “founder dilution” can raise a red flag—where cash provided to founders can come on onerous terms.

#6. Explain Your Financial Statements

Your company’s financial statements tell a lot about how you operate your business. In particular, investors care about your cash flow, your debt obligations, and your equity. Having cash in the bank proves you’re prepared for unanticipated problems and that you can capitalize on new opportunities.

Good cash flow (and providing a strong cash flow projection) is a sign of sustainable operations that comforts investors; they trust you can stay outside the “red.” Alternately, debt obligations translate into cash being eaten up in debt payments. Slow months can mean your inability to meet payroll and other expenses. What about equity? Investors are interested in buying stock in your business, so they’ll use your financial statements to calculate your company’s worth to shareholders.

#7. Justify Use of Proceeds (Use of Funds)

Investors want to know precisely how your company plans to use its proceeds. Will you allocate their money to capital expenses? Research and development? Legal and accounting fees? What about recruiting costs and salaries?

Establishing capital efficiency early in the process can help your company develop insightful leadership and ultimately make you more attractive to investors. Be prepared to explain to investors what milestones you’re aiming to achieve and the anticipated results.

Investors analyzing your company’s potential for investment will examine your financial performance from every angle. Let them know how you intend to grow your business quickly using the least amount of their invested cash.

Spending wisely should be your objective regardless of economic conditions, so set a track record for sound money management.

#8. Acknowledge Total Address Market and Go-To-Market Strategy

Total addressable market, or TAM, informs investors as to the potential size of your market. How many customers can be reached?

How long might it take to become a market leader? Understanding market sizing not only helps in steering your business but also aids in determining your go-to-market strategy.

Understanding your TAM will help you make predictions about your market’s true size, how many prospects you can expect, how long your sales pipeline will remain satisfied, and potential revenue for a specified time frame.

Investors want to know how you plan to utilize your resources to reach and deliver value to customers to gain a competitive edge.

Fluidity is key—as your market, industry, and business change, so must your strategy. Keep in mind that investors want companies that can grow quickly and manage that growth. You must be able to articulate your TAM to investors and discuss your strategy to achieve it.

#9. Present a Strong Sales Pipeline

There is no business without sales. Investors must be convinced that people are willing to buy your product or services.

Your product or service must stand out from what’s already being offered in the market. Your differentiators should be easily definable when explaining the sales process to investors.

Perhaps your competitive advantage lies within your intellectual property, or maybe you’re solving a problem in a new way. Be prepared to prove to investors, using concrete evidence, that your market potential is large enough to warrant an investment.

Provide a track record of sales you’ve already made (breaking down the number of prospects at each stage in the buying process) and show how you plan to continue to expand your pipeline to grow the business and make money.

G-Squared Tip: Explain how you’ll “build a moat” around your business, such as using patents or other intellectual property to protect your unique position. Address the intangible elements you’ll use to protect your brand, making it as impenetrable as possible.

#10. Perform Legal Due Diligence

Investors interested in investing in your company will unquestionably have an attorney conduct a complete legal review.

The legal due diligence process, while stressful, is essentially the final check on all legal aspects of your business and team.

Investors not only gain deeper insight into your company and operations before purchasing, but they also use the information gleaned to help them determine their purchase price.

It’s wise for their legal team and yours to establish a good rapport for the process to run as smoothly as possible. For more on legal due diligence and proper planning, take a look at the article: «What Every Business Owner Needs To Know About Legal Liability».

#11. Provide Management Team Bios & References

Investors have a keen interest in both you (as the CEO) and the management team—from understanding their industry background to their business experience. They need to feel confident that you and your team can lead the company to grow and make a return on their investment.

As a “top banana,” your experience matters profoundly to investors. They want to know you have a proven track record for superior performance and expertise and leadership in your industry or previous venture.

Ensure you exude confidence and passion and demonstrate your willingness and ability to change course should your company need to shift direction.

Other positive traits investors look for in CEOs are the ability to make decisions with input from your leadership team (there’s no room for indecisiveness), excellent relationship and networking skills, and the ability to build a company around core competencies and deliver on them.

G-Squared Tip: References will likely be contacted to vouch for your team members, as such “outsiders” can provide perspective regarding your team’s talent, track record, and potential for success.

Final thoughts

Investors assume risk whenever they invest. An exit opportunity provides them a “reward” for their risky move. It’s therefore imperative to integrate an exit strategy into your business plan. Let investors know how you plan to return their investment (and then some!). Will you pursue an acquisition? Merge with another company?

Choose an exit strategy that aligns with your business and personal goals. Your time frame may vary, so think about when you may want to implement your exit strategy as well. The objective is for all parties to exit profitably.

Once your meeting is over, let us know how you did! We’re seasoned in helping entrepreneurs like you lay the rock-solid financial groundwork that investors are looking for when pinpointing businesses for funding.

As exhilarating as it is, the fundraising process can be intimidating. But when you’re prepared, you can go in strong and confident—moving you one step closer to achieving your goal. Need help getting your financials in order? Learn more about our CFO and bookkeeping services or schedule a consultation.

Do you have further questions about how to attract investors to your business? Drop us a line by filling out the contact form below. G-Squared provides strategic financial, accounting, and operational expertise to CEOs and entrepreneurs.

How To Attract Investors To Your Business

For many startups looking to grow their business, attracting potential investors is crucial. Early in my professional career, I realized there was no proven route to securing investors. Just like every other aspect of running a business, it requires a bit of patience and a lot of hard work. Networking absolutely helps when attempting to secure an early investment, but you can’t meet everybody in one day. That’s where the patience comes in. In most cases with investors, they want to see a proof of concept before diving in.

Building up a core customer base and establishing a solid foundation is vital. Think of it like a garden. You need to plant the seed in the soil and get the plant to start sprouting a bit before an investor joins, that’s where the hard work comes in.

Tips For Businesses Trying To Attract Investors

Throughout my professional career, I’ve been able to hone in on five key tips for attracting investors that I love sharing with other entrepreneurs. The first and arguably most important tip is focusing on the customer. Make an effort to speak with every customer in the store and ask them about their experience. Make sure they walk-out believing that every effort was made to provide them with a pleasant and memorable experience. Customers are often fantastic early investors as they’ve already had a chance to build a level of trust and belief in not only your products and process – but also in the people who make up your organization – you, your partners and staff members.

The second tip is thinking like an investor. Take the time to consider what questions you would ask a potential business owner if the roles were reversed. When I was getting ready to meet with investors, I stood in front of the mirror and asked myself a ton of questions about my business. I tried to think of different questions about my business plan, products, shipping operations, and anything else I could come up with. I wanted to be sure I could answer any question that may come my way.

Number three, be prepared to eloquently explain your story. What drove you to start your company? What motivates you to put in the hard work necessary to grow a business? What problem are you attempting to solve? Every organization has an origin story so be prepared to tell yours.

The fourth tip is understanding why you need the investment and a detailed plan outlining what you’ll do with it. Every potential investor will want to know exactly where their money is going and how it will help your company. Investors want to feel secure that you have a clear vision for the growth of your company. The final tip is being a reliable partner. Like every relationship in life, trust is key. Investors want to know that you are someone that follows through with their promises. Stick to your word and prove that no matter what, you’re a trustworthy and honorable person.

Numbers that Matter Most To Early Investors

One of the most important aspects of running a business is knowing your numbers! The numbers that matter most to an investor who is looking at your business will vary based on whether you’re a startup or an existing business. Early investors are not as focused on how much revenue is being generated at the start. More importantly, they want to see that you understand how those numbers correlate to your business. What’s your presentation of the numbers? Why are your numbers the way they are? How can those numbers change over time? How can their investment enhance those numbers and the profitability of your business? These are the numbers that early investors will focus on. So, be prepared to provide a detailed analysis, showcasing your knowledge on all phases of your organization.

Do Not Get Offended By Investors

Most investors will want to take a look at your books before investing. Frankly, who can blame them? Before I write a check, I want to be sure that the information I’m getting is accurate. Try not to take it personally when investors start doing their own research. They may ask to see financial statements, speak with employees, speak with your accountant or financial advisor to review tax and bank statements, etc. It’s a natural feeling to slightly pause when asked by investors for this information, but remember it’s not for a lack of trust. Investors have every right to do their due-diligence and analyze the numbers before committing their money.

There’s a very good chance that investors will take a look at your numbers and come back with more questions. In some cases, a question may be posed simply to gauge your passion and conviction toward the business. A good old-fashioned debate can lead to healthy discussions about operations and further highlight your confidence in the future of your organization. Investors love confidence – but they hate arrogance. So keep that in mind when answering questions about your business. As an investor, I would want to know that the person I was investing in was willing to take feedback, constructive criticism, and be open to new ideas. Even if you don’t entirely agree with an investor’s suggestion, they want to know that you’ll be open and willing to listen.

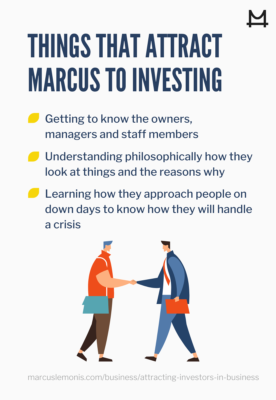

Things That Attract Me To Investing In A Business

One of the biggest things that attracts me to a business is the people – the owners and managers as well as the staff members. I like to get to know them, find out what makes them tick and why they started the business in the first place. Sometimes, I’ll ask questions that are more clinical and academic in nature to check certain boxes. Other times, I like to ask more personal questions about their upbringing or home life. Sometimes I’ll ask a question that probably shouldn’t be asked. But I want to understand philosophically how they look at things and the reasons why. Understanding their philosophical approach gives me a better idea of how someone processes information and what drives their decision-making. Every business has some down days. Understanding how they approach people on those down days will give me a clearer picture of how they will handle a bigger crisis, if and when it arises. I want to know exactly what kind of leader I have philosophically and not just financially.

What To Look Out For When Looking For Investors

There are a few things I look at when I’m considering investing in a business. Is this person passionate about their business? What’s the quality of their character? Do they have a thorough understanding of the numbers? All of these things matter. Right off the bat, I want to see if we share an alignment of goals, strategies, and incentives. I need to be sure that the partnership isn’t lopsided because that can lead to mistrust on both sides down the road. Finding a business partner is a lot like dating. It can’t be a one-way street. This means that when I invest, I want to know that I’m truly bringing something to the table and I’m being valued. Do you have a plan for what you will do with my investment? Nobody wants to sign a check and walk away and forget about it. I want to invest because the other person is looking for a mentor, uses me as a resource for problem solving or connecting with others, and has a clear path for how my investment will further grow their company. These are just a few examples of the things that excite me as an investor, aside from generating a profit. It also makes an investor feel like a bigger part of the company, resulting in a greater sense of pride in the organization and partnership.

-png.png)