How do you calculate cost of equity

How do you calculate cost of equity

How Do I Use the CAPM to Determine Cost of Equity?

What Is the Capital Asset Pricing Model (CAPM)?

In capital budgeting, corporate accountants and financial analysts often use the capital asset pricing model (CAPM) to estimate the cost of shareholder equity. Described as the relationship between systematic risk and expected return for assets, CAPM is widely used for the pricing of risky securities, generating expected returns for assets given the associated risk, and calculating costs of capital.

Key Takeaways

Cost of Equity CAPM Formula

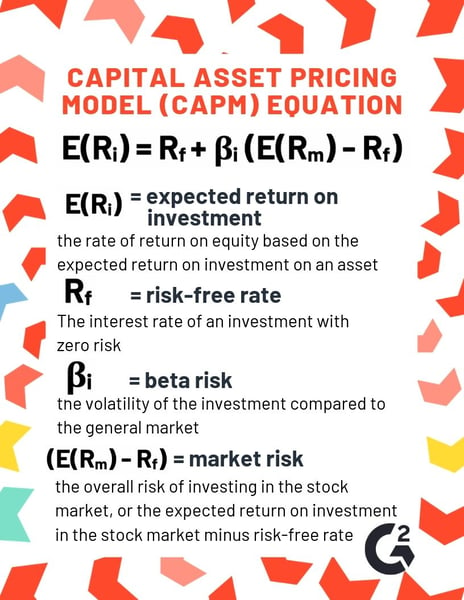

The CAPM formula requires only the following three pieces of information: the rate of return for the general market, the beta value of the stock in question, and the risk-free rate.

CAPM Formula

The no risk-free rate of return is the theoretical return of an investment with z

What the CAPM Can Tell You

The cost of equity is an integral part of the weighted average cost of capital (WACC). WACC is widely used to determine the total anticipated cost of all capital under different financing plans. WACC is often used in an effort to find the most cost-effective mix of debt and equity financing.

Assume Company ABC trades on the S&P 500 with a rate of return of 10%. The company’s stock is slightly more volatile than the market with a beta of 1.2. The risk-free rate based on the three-month T-bill is 4.5%.

Based on this information, the cost of the company’s equity financing is 11%:

Numerous online calculators can determine the CAPM cost of equity, but calculating the formula by hand or by using Microsoft Excel is a relatively simple exercise.

The Difference Between CAPM and WACC

The CAPM is a formula for calculating cost of equity. The cost of equity is part of the equation used for calculating the WACC. The WACC is the firm’s cost of capital which includes the cost of the cost of equity and cost of debt.

WACC Formula

WACC can be used as a hurdle rate against which to evaluate future funding sources. WACC can be used to discount cash flows with capital projects to determine net present value. A company’s WACC will be higher if its stock is volatile or seen as riskier as investors will demand greater returns to compensate for additional risk.

Limitations of Using CAPM

There are some limitations to the CAPM, such as agreeing on the rate of return and which one to use. Beyond that, there’s also the market return, which assumes positive returns, while also using historical data. This includes the beta, which is only available for publicly traded companies. The beta also only calculates systematic risk, which doesn’t account for the risk companies face in various markets.

There are also various assumptions that must be made including that investors can borrow money without limitations at the risk-free rate. The CAPM also assumes that no transaction fees occur, investors own a portfolio of assets, and investors are only interested in the rate of return for a single period—all of which are not always true.

Is CAPM the Same As Cost of Equity?

CAPM is a formula used to calculate the cost of equity—the rate of return a company pays to equity investors. For companies that pay dividends, the dividend capitalization model can be used to calculate the cost of equity.

How Do You Calculate Cost of Equity Using CAPM?

The CAPM formula can be used to calculate the cost of equity, where the formula used is:

What Are Some Potential Problems When Estimating the Cost of Equity?

The biggest issues when estimating the cost of equity include measuring the market risk premium, finding appropriate beta information, and using short- or long-term rates for the risk-free rate.

How Are CAPM and WACC Related?

WACC is the total cost cost of all capital. CAPM is used to determine the estimated cost of the shareholder equity. The cost of equity calculated from the CAPM can be added to the cost of debt to calculate the WACC.

The Bottom Line

For accountants and analysts, CAPM is a tried-and-true methodology for estimating the cost of shareholder equity. The model quantifies the relationship between systematic risk and expected return for assets and is applicable to a multitude of accounting and financial contexts.

Cost of Equity

What Is the Cost of Equity?

The cost of equity is the return that a company requires to decide if an investment meets capital return requirements. Firms often use it as a capital budgeting threshold for the required rate of return. A firm’s cost of equity represents the compensation that the market demands in exchange for owning the asset and bearing the risk of ownership. The traditional formula for the cost of equity is the dividend capitalization model and the capital asset pricing model (CAPM).

Key Takeaways

Cost of Equity

Cost of Equity Formula

Using the dividend capitalization model, the cost of equity is:

What the Cost of Equity Can Tell You

The cost of equity refers to two separate concepts, depending on the party involved. If you are the investor, the cost of equity is the rate of return required on an investment in equity. If you are the company, the cost of equity determines the required rate of return on a particular project or investment.

There are two ways that a company can raise capital: debt or equity. Debt is cheaper, but the company must pay it back. Equity does not need to be repaid, but it generally costs more than debt capital due to the tax advantages of interest payments. Since the cost of equity is higher than debt, it generally provides a higher rate of return.

Special Considerations

The dividend capitalization model can be used to calculate the cost of equity, but it requires that a company pays dividends. The calculation is based on future dividends. The theory behind the equation is that the company’s obligation to pay dividends is the cost of paying shareholders and therefore the cost of equity. This is a limited model in its interpretation of costs.

The capital asset pricing model, however, can be used on any stock, even if the company does not pay dividends. That said, the theory behind CAPM is more complicated. The theory suggests that the cost of equity is based on the stock’s volatility and level of risk compared to the general market.

The CAPM Formula is:

In this equation, the risk-free rate is the rate of return paid on risk-free investments such as Treasuries. Beta is a measure of risk calculated as a regression on the company’s stock price. The higher the volatility, the higher the beta and relative risk compared to the general market.

The market rate of return is the average market rate. In general, a company with a high beta—that is, a company with a high degree of risk—will have a higher cost of equity.

The cost of equity can mean two different things, depending on who’s using it. Investors use it as a benchmark for an equity investment, while companies use it for projects or related investments.

Cost of Equity vs. Cost of Capital

The cost of capital is the total cost of raising capital, taking into account both the cost of equity and the cost of debt. A stable, well-performing company generally will have a lower cost of capital. To calculate the cost of capital, the cost of equity and the cost of debt must be weighted and then added together. The cost of capital is generally calculated using the weighted average cost of capital.

What Is the Cost of Equity?

The cost of equity is the return that a company must realize in exchange for a given investment or project. When a company decides whether it takes on new financing, for instance, the cost of equity determines the return that the company must achieve to warrant the new initiative. Companies typically undergo two ways to raise funds: through debt or equity. Each has differing costs and rates of return.

How Do You Calculate the Cost of Equity?

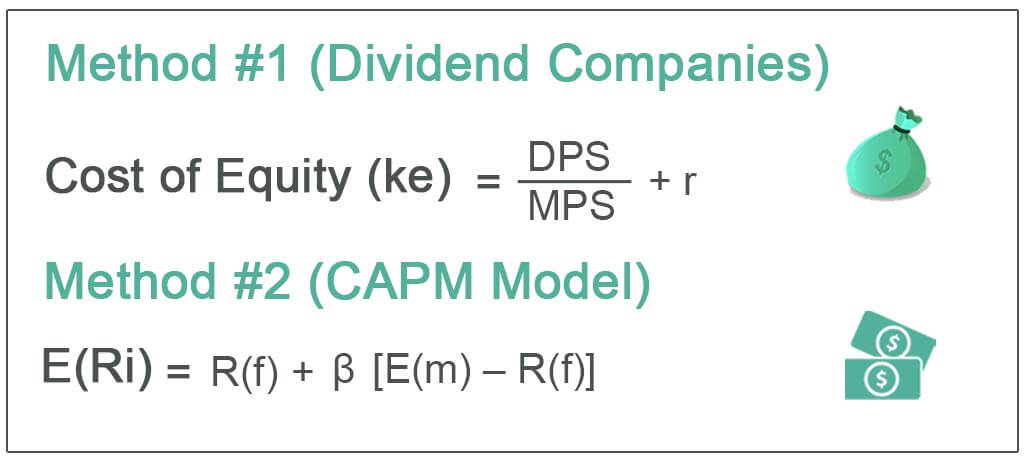

There are two primary ways to calculate the cost of equity. The dividend capitalization model takes dividends per share (DPS) for the next year divided by the current market value (CMV) of the stock, and adds this number to the growth rate of dividends (GRD), where Cost of Equity = DPS ÷ CMV + GRD. Conversely, the capital asset pricing model (CAPM) evaluates if an investment is fairly valued, given its risk and time value of money in relation to its anticipated return. Under this model, Cost of Equity = Risk-Free Rate of Return + Beta × (Market Rate of Return – Risk-Free Rate of Return).

What Is an Example of Cost of Equity?

Consider company A trades on the S&P 500 at a 10% rate of return. Meanwhile, it has a beta of 1.1, expressing marginally more volatility than the market. Presently, the T-bill (risk-free rate) is 1%. Using the capital asset pricing model (CAPM) to determine its cost of equity financing, you would apply Cost of Equity = Risk-Free Rate of Return + Beta × (Market Rate of Return – Risk-Free Rate of Return) to reach 1 + 1.1 × (10-1) = 10.9%.

Cost of Equity Formula

What is Cost of Equity Capital Formula?

We will discuss each of the methods in detail.

Table of contents

Method #1 – Cost of Equity Formula for Dividend Companies

The dividend growth model Dividend Growth Model The Dividend Discount Model (DDM) is a method of calculating the stock price based on the likely dividends that will be paid and discounting them at the expected yearly rate. In other words, it is used to value stocks based on the future dividends’ net present value. read more requires that a company pays dividends. Therefore, it is based on upcoming dividends. The logic behind the equation is that the company’s obligation to pay dividends is the cost of producing its shareholders. Therefore, the Ke, i.e., cost of equity. It is a limited model in its interpretation of costs.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Cost of Equity Formula (wallstreetmojo.com)

Cost of Equity Calculations

You can consider the following example for a better understanding of the Cost of Equity Formula:

Example #1

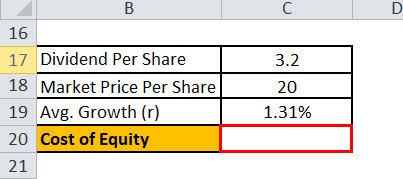

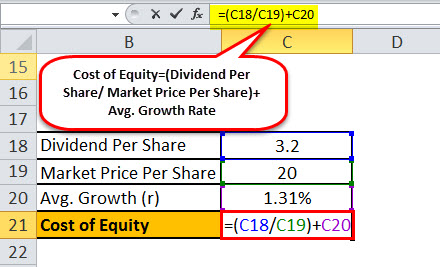

Let us try the cost of equity formula calculation with a first formula where we assume a company is paying regular dividends.

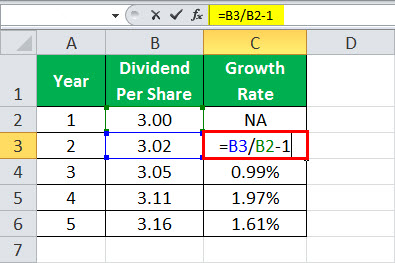

Suppose XYZ Co. is a regularly paying dividend company. Its stock price is currently trading at 20, and it expects to pay a dividend of 3.20 next year. The following is the dividend payment history. So, now, let us calculate the company’s cost of equity.

| Year | Dividend Per Share |

|---|---|

| 1 | 3.00 |

| 2 | 3.02 |

| 3 | 3.05 |

| 4 | 3.11 |

| 5 | 3.16 |

Let us first calculate the average growth rate of dividends. Then, continuing the same formula as per below will yield yearly growth rates.

So the growth rate for all the years will be-

Now take a simple average growth rate, which will come to 1.31%.

Now we have all the inputs i.e.

DPS for next year = 3.20, MPS = 20 and r = 1.31%

Example #2 – Infosys

| Announcement Date | Effective Date | Dividend Type | Dividend (%) | Remarks | Dividend Per Share |

|---|---|---|---|---|---|

| 12/04/2018 | 14/06/2018 | Final | 410 | Rs. 20.5000 per share (410%) Final Dividend | 20.50 |

| 13/04/2017 | 01/06/2017 | Final | 295 | Rs. 14.7500 per share (295%) Final Dividend | 14.75 |

| 15/04/2016 | 09/06/2016 | Final | 285 | Rs. 14.2500 per share (285%) Final Dividend | 14.25 |

| 24/04/2015 | 15/06/2015 | Final | 590 | Rs. 29.5000 per share (590%) Final Dividend (equivalent to Rs 14.75/- per share after 1.1 bonus issue) | 29.50 |

| 15/04/2014 | 29/05/2014 | Final | 860 | Rs. 43.0000 per share (860%) Final Dividend | 43.00 |

| 12/04/2013 | 30/05/2013 | Final | 540 | Rs. 27.0000 per share (540%) Final Dividend | 27.00 |

| 13/04/2012 | 24/05/2012 | Final | 640 | Rs. 22.00 per share (440%) Final Dividend & Rs.10.00 per share (200%) Special Dividend | 22.00 |

Method #2 – Cost of Equity Formula using CAPM Model

However, the Capital Asset Pricing Model (CAPM) can be used on several stocks, even if they are not paying dividends. With that said, the logic behind CAPM is rather complicated, which suggests the cost of equity (Ke) is based on the stock’s volatility, which is computed by beta and level of risk compared to the general market, i.e., the equity market risk premium Market Risk Premium The market risk premium is the supplementary return on the portfolio because of the additional risk involved in the portfolio; essentially, the market risk premium is the premium return investors should have to make sure to invest in stock instead of risk-free securities. read more which is nothing but a differential of Market Return and Risk-Free Rate.

In the CAPM equation, the risk-free rate (Rf) The Risk-free Rate (Rf) A risk-free rate is the minimum rate of return expected on investment with zero risks by the investor. It is the government bonds of well-developed countries, either US treasury bonds or German government bonds. Although, it does not exist because every investment has a certain amount of risk. read more is the rate of return paid on risk-free investments like government bonds or treasuries. Beta, a measure of risk, can be calculated as a regression on the company’s market price. The higher the volatility goes, the higher the beta will come and its relative risk compared to the general stock market. The market rate of return Em(r) is the average market rate, which has generally been assumed to be 11% to12 % over the past eighty years. A company with a high beta will have a high risk and pay more for equity.

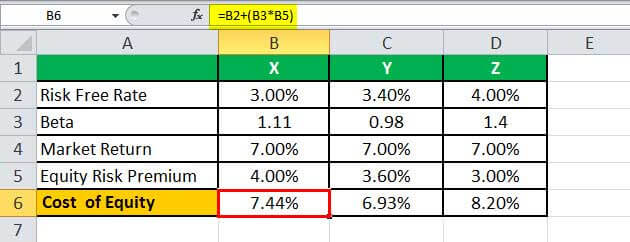

Example #1

Below, the three companies’ inputs have arrived. Now we have to calculate their cost of equity.

| Particulars | X | Y | Z |

|---|---|---|---|

| Risk Free Beta | 3.00% | 3.40% | 4.00% |

| Beta | 1.11 | 0.98 | 1.4 |

| Market Return | 7.00% | 7.00% | 7.00% |

Then, we will calculate the cost of equity using CAPM, i.e.,

Rf + β [E(m) – R(f)] i.e., Risk-free rate + Beta(Equity Risk Premium)

Continuing the same formula as above for all the companies, we will get the cost of equity.

So, the cost of equity for companies X, Y, and Z comes to 7.44%, 6.93%, and 8.20%, respectively.

Example #2 – TCS Cost of Equity using the CAPM Model

Let us try calculating the cost of equity for TCS through the CAPM model.

For the time being, we will take the 10-year government bond yield as a risk-free rate of 7.46%.

Secondly, we need to come up to Equity Risk Premium,

For India, Equity Risk Premium is 7.27%.

We need a beta for TCS, which we have taken from Yahoo finance India.

So the cost of equity (Ke) for TCS will be-

Cost of Equity Calculations

You can use the following Cost of Equity Formula Calculator.

| Dividend per Share |

| Market price per Share |

| Growth Rate of Dividends |

| Cost of Equity Formula = |

Relevance and Use

Cost of Equity Formula in Excel (with excel template)

Let us take the case mentioned in the above cost of equity formula example no.1 to illustrate the same in the excel template below.

Suppose XYZ Co. is a regularly paying dividend company. Its stock price is currently trading at 20, and it expects to pay a dividend of 3.20 next year. The following is the dividend payment history.

In the below-given table is the data for calculating the cost of equity.

In the below given excel template, we have used the cost of equity equation calculation to find the cost of equity.

So the calculation of the Cost of equity will be-

Cost of Equity Formula Video

Recommended Articles:

This article is a guide to the Cost of Equity Formula. Here, we learn the two methods to calculate the cost of equity 1) for dividend-paying companies and 2) using the CAPM model and practical examples and concepts. You may learn more about valuations from the following articles: –

Cost of Equity

The rate of return a shareholder requires for investing equity

What is Cost of Equity?

Cost of Equity is the rate of return a company pays out to equity investors. A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities. Companies typically use a combination of equity and debt financing, with equity capital being more expensive.

How to Calculate Cost of Equity

The cost of equity can be calculated by using the CAPM (Capital Asset Pricing Model) or Dividend Capitalization Model (for companies that pay out dividends).

CAPM (Capital Asset Pricing Model)

CAPM takes into account the riskiness of an investment relative to the market. The model is less exact due to the estimates made in the calculation (because it uses historical information).

E(Ri) = Rf + βi * [E(Rm) – Rf]

E(Ri) = Expected return on asset i

Rf = Risk-free rate of return

βi = Beta of asset i

E(Rm) = Expected market return

Risk-Free Rate of Return

The return expected from a risk-free investment (if computing the expected return for a US company, the 10-year Treasury note could be used).

The measure of systematic risk (the volatility) of the asset relative to the market. Beta can be found online or calculated by using regression: dividing the covariance of the asset and market’s returns by the variance of the market.

βi 1: Asset i is more volatile (relative to the market)

Expected Market Return

This value is typically the average return of the market (which the underlying security is a part of) over a specified period of time (five to ten years is an appropriate range).

Dividend Capitalization Model

The Dividend Capitalization Model only applies to companies that pay dividends, and it also assumes that the dividends will grow at a constant rate. The model does not account for investment risk to the extent that CAPM does (since CAPM requires beta).

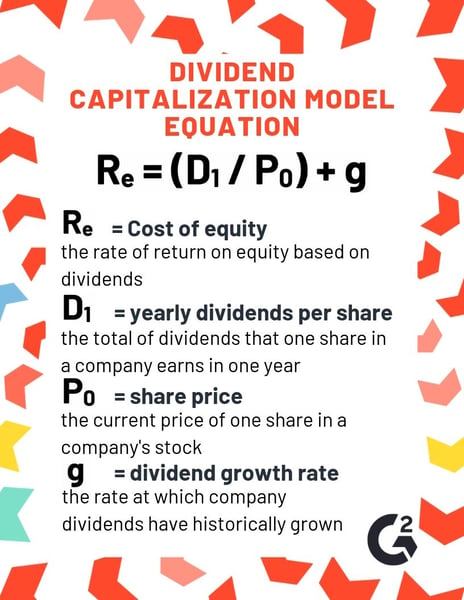

Dividend Capitalization Formula:

Re = Cost of Equity

D1 = Dividends/share next year

P0 = Current share price

g = Dividend growth rate

Dividends/Share Next Year

Companies usually announce dividends far in advance of the distribution. The information can be found in company filings (annual and quarterly reports or through press releases). If the information cannot be located, an assumption can be made (using historical information to dictate whether the next year’s dividend will be similar).

Current Share Price

The share price of a company can be found by searching the ticker or company name on the exchange that the stock is being traded on, or by simply using a credible search engine.

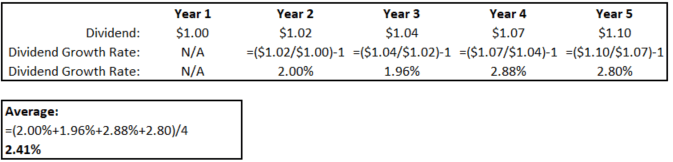

Dividend Growth Rate

The Dividend Growth Rate can be obtained by calculating the growth (each year) of the company’s past dividends and then taking the average of the values.

The growth rate for each year can be found by using the following equation:

Dividend Growth = (Dt/Dt-1) – 1

Dt = Dividend payment of year t

Dt-1 = Dividend payment of year t-1 (one year before year t)

Example

Below are the dividend amounts paid every year by a company that has been operating for five years.

The average of the growth rates is 2.41%.

Dividend Capitalization Model Example

The cost of equity for XYZ Co. is 12%.

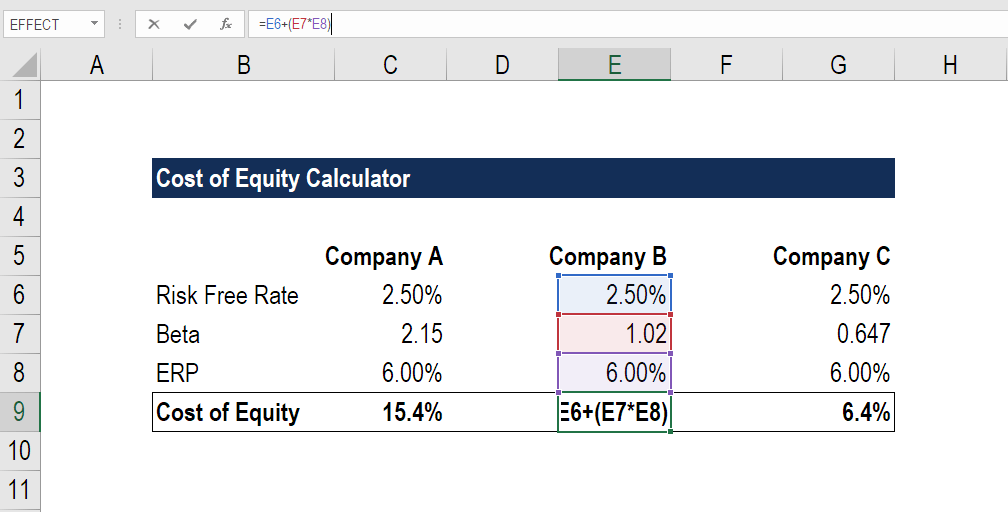

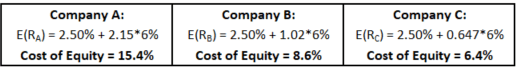

Cost of Equity Example in Excel (CAPM Approach)

Step 1: Find the RFR (risk-free rate) of the market

Step 2: Compute or locate the beta of each company

Step 3: Calculate the ERP (Equity Risk Premium)

E(Rm) = Expected market return

Rf = Risk-free rate of return

Step 4: Use the CAPM formula to calculate the cost of equity.

E(Ri) = Rf + βi*ERP

E(Ri) = Expected return on asset i

Rf = Risk free rate of return

βi = Beta of asset i

ERP (Equity Risk Premium) = E(Rm) – Rf

The company with the highest beta sees the highest cost of equity and vice versa. It makes sense because investors must be compensated with a higher return for the risk of more volatility (a higher beta).

Download the Free Template

Enter your name and email in the form below and download the free template now!

Cost of Equity Calculator

Cost of Equity vs Cost of Debt

The cost of equity is often higher than the cost of debt. Equity investors are compensated more generously because equity is riskier than debt, given that:

Cost of Equity vs WACC

The cost of equity applies only to equity investments, whereas the Weighted Average Cost of Capital (WACC) accounts for both equity and debt investments.

Cost of equity can be used to determine the relative cost of an investment if the firm doesn’t possess debt (i.e., the firm only raises money through issuing stock).

The WACC is used instead for a firm with debt. The value will always be cheaper because it takes a weighted average of the equity and debt rates (and debt financing is cheaper).

Cost of Equity in Financial Modeling

WACC is typically used as a discount rate for unlevered free cash flow (FCFF). Since WACC accounts for the cost of equity and cost of debt, the value can be used to discount the FCFF, which is the entire free cash flow available to the firm. It is important to discount it at the rate it costs to finance (WACC).

Cost of equity can be used as a discount rate if you use levered free cash flow (FCFE). The cost of equity represents the cost to raise capital from equity investors, and since FCFE is the cash available to equity investors, it is the appropriate rate to discount FCFE by.

Related Reading

CFI is a global provider of financial modeling certification programs for aspiring financial analysts working in investment banking, equity research, corporate development, and FP&A. To continue advancing your career, these additional CFI resources will be helpful:

What is Cost of Equity? Formula to calculate it

by Maddie Rehayem

by Maddie Rehayem

Share

Share

If you could have any superpower, what would it be?

Invisibility? Mind reading? Flight?

Stock market investors would probably choose the power to see into the future. Since they can’t exactly do that, their best bet is using equations to make predictions determining the cost of equity of their investments. Read on to learn how to predict the future for yourself using the cost of equity calculations.

What is cost of equity?

Cost of equity is the return that an investor requires for investing in a company, or the required rate of return that a company must receive on an investment or project. It answers the question of whether investing in equity is worth the risk. It is also used, along with cost of debt, as part of the calculation of a company’s weighted average cost of capital, or WACC.

There are two ways to calculate cost of equity: using the dividend capitalization model or the capital asset pricing model (CAPM). Neither method is completely accurate because the return on investment is a calculation based on predictions about the stock market, but they can both help you make educated investments.

Take note of the formulas below:

Cost of equity formula

Dividend capitalization model: Re = (D1 / P0) + g

Don’t be afraid if the symbols seem complicated—we’ll break down everything that goes into these calculations in this article.

How do you calculate cost of equity?

The method you choose to calculate cost of equity depends on the type of investment you are analyzing and the level of accuracy you need. Remember, neither method is completely accurate (we can’t predict the future like we can when we calculate cost of debt), but both are still helpful estimates.

The dividend capitalization model requires that the stock you are analyzing earns dividends. If the investment in question does not earn dividends, you must use the CAPM formula, which is based on estimates about the company and stock market. Read on to learn what information goes into each.

Dividend capitalization model

You already know that this model is used to determine the cost of equity of dividend stocks, so you can surmise that dividends play a part in using this equation. But what other information do you need?

Using this model, find the cost of equity of a dividend stock by dividing yearly dividends per share by the current price of one share, then adding the dividend growth rate.

Keep in mind that this model does not account for stock appreciation or risk. It also presumes that the dividend payment will go up rather than stay the same or go down.

Capital asset pricing model (CAPM)

While the CAPM for finding cost of equity is a little more complicated, it is a little bit more accurate because it accounts for the risk associated with the particular stock you are analyzing.

Using this model, find the cost of equity (or expected return of investment) by adding the risk-free rate to the beta risk of the investment multiplied by the market risk premium (found by subtracting the risk-free rate from the expected return on investment). It’s easier than it sounds—see the graphic below for an explanation of these variables.

Keep in mind that this model does not account for the dividends earned by a particular stock.

Cost of equity example

Let’s say you want to invest in a dividend stock—McDonalds, for example. Here’s how you would find the cost of equity and determine whether or not to invest.

Dividend capitalization model example

| Tip: for a more accurate calculation, use the average of several years of dividend growth. Repeat the step above for multiple years, then average your results. |

Plug those numbers into the dividend capitalization model equation from above, and you’ll find the cost of equity of McDonald’s stock:

| Re = 4.64/205.27 + 0.15 = 0.17 or 17% |

The cost of equity, or rate of return of McDonald’s stock (using the dividend capitalization model) is 0.17 or 17%. Think that’s pretty good dividend earnings for your investing needs? Go ahead and buy McDonald’s stock! Still unsure? Worried about appreciation and risk factor? Read on, we’ll analyze the cost of equity of McDonald’s stock using CAPM next.

Capital asset pricing model (CAPM) example

Using the CAPM, you can find the expected rate of return on any kind of asset, not just stock, but for the sake of comparison, let’s use the same McDonald’s stock we used in the example above. We will, however, need some more information about it before we calculate its cost of equity using this model.

Nasdaq tells us the beta of McDonald’s stock is 0.72. This number represents how risky investing in McDonald’s is compared to the general market.

| Tip: A beta less than one means an asset is less volatile relative to the market, and a beta greater than one means an asset is more volatile relative to the market. Of course, a beta of exactly one would mean the asset’s risk is the same as the market risk. |

Think of the risk-free rate as the interest your money would earn if you just left it in the bank. You’re risking losing money by investing in stock, but your potential return will, barring disaster either to McDonald’s or the stock market/economy, be greater than just letting your money sit in the bank. According to U.S. Department of the Treasury, the risk-free rate at the time of writing is 2.17%.

The expected return on investment is the percentage of return you could expect, in general, from any investment in the stock market. The most accurate estimation of this return is provided by the S&P 500 index—it is an average rate of return of 500 of the largest publicly traded stocks in America, accounting for dividends as well as appreciation. As of writing, the average stock market return is 10%.

Now that we have all the information we need, let’s calculate the cost of equity of McDonald’s stock using the CAPM.

The cost of equity, or rate of return of McDonald’s stock (using the CAPM) is 0.078 or 7.8%. That’s pretty far off from our dividend capitalization model calculation of 17%. That’s because instead of analyzing the yearly dividends and dividend growth, we analyzed beta and market risk.

It makes sense that our CAPM result is lower than the dividend capitalization model result because while McDonald’s stock earns high dividends compared to the rest of the market, it has a beta of less than one, meaning it is a low-risk (and therefore low-reward) investment.

Can we trust this calculation?

We can trust our results to an extent, but if you’ve been following along, you can see that our results from using each method are quite different. Evaluating your assets based on this calculation will not always be completely accurate, but can help point you in the right direction when it comes to investing.

On the other hand, you could also use investment portfolio management software to help you decide which stocks to invest in and how to manage your portfolio, or if you have a crystal ball that allows you to see into the future of the stock market, use that instead.

:max_bytes(150000):strip_icc()/andrew_bloomenthal_bio_photo-5bfc262ec9e77c005199a327.png)

:max_bytes(150000):strip_icc()/smith20abi-AndySmith-f114f5e4171944bc8f7adb1a957d9cf0.jpg)

:max_bytes(150000):strip_icc()/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

:max_bytes(150000):strip_icc()/JBJHeadshot-JanetBerry-Johnson-238498f91a144bf082ed759d0b1c86a8.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)

by Maddie Rehayem

by Maddie Rehayem