How do you get a mortgage

How do you get a mortgage

Mortgages 101: A Guide to Getting Your Mortgage

This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services.

You’re probably already familiar with the fundamental concept of obtaining a loan to become a homeowner. But in reality a mortgage is a rather complex marathon of financial calculations, comparing offers, and various approval stages.

In this article we’ll explore mortgages in depth, and in simple, comprehensible terms. We’ll go over the mortgage process from start to finish, where to look for the best rates, and the vocabulary you’ll need along the way.

In This Article:

What Is a Mortgage?

A mortgage is a loan that can be used to purchase property, which in turn acts as security for the loan. A mortgage tends to be for a large sum and is usually paid off over 25 or 30 years.

When you sign up for a mortgage, you’re agreeing to make regular payments. These mortgage payments are comprised of both principal and interest. When a payment is made, it’s first used to cover the interest, then the principal. A mortgage lets the mortgage lender take possession of the property should you fail to make the agreed-upon payments on time.

The Mortgage Process

Once you’ve decided you’d like to buy a home, the next step is to figure out how to pay for it. Unfortunately, most of us don’t have the cash saved up to buy a home outright. That’s where a mortgage comes in handy.

Before searching for a property, it’s a good idea to get pre-approved for a mortgage. When you’re pre-approved, you’ll know exactly how much you can afford to spend on a home. You also reduce your risk since you’re a lot less likely to make an offer on a home you can’t afford. (I’ll talk about the pre-approval process in greater detail later on.)

Once you’re pre-approved, you can go shopping for a home. It’s helpful to make a list of needs and wants. That way you can objectively look at each home when deciding if it’s right for you.

Once you find a home you like, you’ll put in an offer. Once your offer is accepted, you’ll work with your banker or mortgage broker (read our brokers vs. banks article if you’re not sure which to go with) to get the mortgage approval. You’ll need to provide documents and information. The lender will then sign off on everything if they’re good and you can remove condition of financing from your offer (if applicable).

How Do You Know It’s Time?

When is a good time to buy a home and take out a mortgage? A good time is when you’re personally and financially ready. That means you have a steady job, you’re settled in your personal life, and you’re committed to staying put in the same place for the next five or 10 years.

When applying for a mortgage, the lender wants to make sure you can afford it on a monthly basis. The lender does this with two debt ratios: the Gross Debt Service (GDS) Ratio and the Total Debt Service (TDS) Ratio.

The GDS Ratio looks at the percentage of your gross monthly income needed to cover expenses related to the home: your mortgage payments, property taxes, heating and maintenance fees (if applicable). Most lenders are looking for a GDS Ratio below 39%.

The TDS Ratio is similar to the GDS Ratio. It looks at all the same things as the GDS Ratio, however, it also factors in any other debt that you might have. If it’s revolving debt, such as credit card debt or a line of credit, 3% of the outstanding balance is usually used for debt servicing purposes. If it’s an installment loan with a fixed payment (i.e., a car loan, car lease, or personal loan), the payment is used for debt servicing purposes. Most lenders are looking for a TDS Ratio below 44%.

It should be noted that the mortgage payments used in these calculations are higher than you’re actually paying. That’s because the payments are calculated using the inflated stress test rate (currently at 4.79%).

While the GDS and TDS Ratios include some important homeownership expenses, it’s important to also factor in any other big expenses you may have, such as childcare expenses.

Where Can I Get a Mortgage?

There are several routes you can take when hunting for a mortgage, including going to a bank or credit union, or working with a mortgage broker.

As you shop for a mortgage, your gut instinct is probably to go to your local bank branch where you have your chequing account. Banks offer a suite of products and it might be convenient for you to hold all your important finances in the same place. And some banks will offer you extra perks for bundling your mortgage with another product.

That said, if you simply get a mortgage with the existing bank you use for chequing and savings, you might miss out on a more competitive rate that’s offered elsewhere. The mortgage market is very dynamic and it’s always a good idea to shop around. I recommend also checking out the mortgage rates offered by virtual banks (sometimes referred to as ‘direct banks’), like Tangerine Mortgage. Virtual banks don’t have physical branches, and their substantially lower overhead costs typically allow them to offer more competitive mortgage deals than traditional banks, particularly for long-term, fixed-rate mortgages.

Mortgage Broker

Another way to shop around is through a mortgage broker. An independent mortgage broker has access to dozens of lenders and can provide you with unbiased advice. Even if you end up choosing your local bank branch in the end, at least you’ll have peace of mind knowing you got a good deal.

Online Mortgage Broker

The benefit of an online mortgage broker is that they likely have access to many more lenders than your local broker would. The more options you have, the more flexibility you get. With multiple lender options, you’re also likely to find a better rate. Not only that, but if you’ve been denied a mortgage from your bank in the past, you can still search for one through online mortgage brokers.

Homewise is a digital mortgage solution that helps you find the best mortgage options from over 30 banks and lenders. You’ll get support from a personal advisor at every step of the way, including understanding the fine print of your offers. The service is free and the process is done online, 24/7, in all of five minutes.

Breezeful is an online mortgage broker that makes it quick and painless to shop around for different lenders. With an online database of over 30 lenders, Breezeful works to match you with one that best suits your particular needs. You’ll get some of the lowest rates possible, all from the comfort of your own home and faster than your normal, brick-and-mortar banks.

Important Terms to Know

Pre-Qualification: This is ideal when you’re only thinking about buying a home. A lender will collect basic information about your finances and then give you an approximate figure for how much they’d potentially be willing to lend you to buy a property.

Pre-Approval: Getting pre-approved for a mortgage is more formal than pre-qualifying. In this stage a lender will verify the financial information you provide them and run a credit check. If you’re pre-approved it indicates that the lender is committed to providing you with a loan, though the final amount they’re willing to lend you and the terms of the mortgage are subject to change based on an actual property valuation as well as market fluctuations.

The Mortgage Stress Test: This is a calculation of whether you can still afford to pay your mortgage in the event that rates increase. The results of this stress test will determine your qualifications for the mortgage you’re looking to take and applies to all home buyers, including those who make a 20% down payment on their home.

Mortgage Rate: This is the interest rate you’ll pay on your mortgage. This will determine how much you pay in interest over the life of your mortgage. Your mortgage rate may change depending on if it’s fixed or variable (more on that below).

Closing Costs: These are expenses that you’re required to pay out of pocket leading up to your closing date. Examples of closing costs include real estate lawyer fees, land transfer taxes, a home inspection, and movers. It’s a good idea to budget between 1.5% and 4% of a home’s purchase price towards closing costs.

Different Types of Mortgages

Insured, Insurable, and Uninsurable

There are three main types of mortgages: insured, insurable, and uninsurable.

An insured or high-ratio mortgage is when you’re required to pay mortgage default insurance that protects the lender. Because of that, most lenders offer their lowest mortgage rates on these products (although this is offset by the mortgage default insurance you’ll pay).

An insurable or conventional mortgage is when you make at least a 20% down payment on a home. In this case, you aren’t required to pay mortgage insurance. This saves you money, but because it’s slightly riskier for lenders you’ll most often pay a higher mortgage rate than an insured mortgage.

Term vs. Amortization

A mortgage term is the length of time the terms and conditions of your mortgage are guaranteed. If you have a fixed-rate mortgage, your mortgage rate will remain the same for the duration of the time.

The mortgage amortization is how long it will take you to pay off your mortgage in full. The standard length in Canada is 25 years, although there’s nothing stopping you from choosing a shorter or longer term (as long as you can pass the stress test).

Open vs. Closed

An open mortgage lets you repay the mortgage in full at any point during your mortgage term. Because of this, it tends to come with a higher mortgage rate. Open mortgages only tend to make sense if you expect a huge cash windfall or intend to sell your home in the near future.

A closed mortgage has limitations on how much extra money you can put towards your mortgage beyond your regular mortgage payments. Because of that it tends to come with a lower mortgage rate than an open mortgage.

Fixed vs. Variable

With a fixed-rate mortgage, your mortgage rate and payment amount remain the same during your mortgage term. With a variable rate mortgage, your mortgage rate and payment may change during your mortgage term depending on changes in a lender’s prime rate.

Fixed mortgages tend to come with a higher mortgage rate than variable mortgages since you’re paying for the stability of knowing exactly what your mortgage rate and payment will be.

What Do Lenders Look at When Approving You for a Mortgage?

Lenders consider several factors when deciding whether to approve your mortgage application. They look at your income, down payment, assets, debts, credit, and the property itself.

Income

Lenders are looking for borrowers with a stable source of income. You’ll need to be able to prove that your income is sufficient to regularly make mortgage payments. If you’re a full-time salaried employee, you’ll be golden in the eyes of most lenders. If you’re an hourly employee whose hours are guaranteed, lenders like that as well. If you’re a full-time or part-time hourly employee whose hours are not guaranteed or you’re working on contract, you’ll typically need two years of income in order for a lender to consider your income (lenders will do a two-year average). For proof of income, you’ll usually need to provide a letter of employment, recent paystub, T4s, and notices of assessment for the last two years.

If you’re self-employed usually you can still get a mortgage, however, you’ll need to provide more documentation. Since the income from your own business is less stable than a full-time salaried position in the eyes of lenders, typically you’ll need to be in business for a minimum of two years and provide Personal T1 Generals, Notices of Assessment and Corporate Financial Statements (if applicable) for the two most recent years.

Down Payment

If the down payment funds are from a bank account, the lender will usually want to see a 90-day transaction history. If the funds are from investments or RRSPs, you’ll usually need to provide three monthly statements. If it’s from the sale of another property, you’ll usually need to provide a copy of the signed purchase agreement and a recent mortgage statement (if the property you’ve sold already has a mortgage). If you’re receiving gifted funds, the lender will usually request a signed gift letter and want to see proof that the funds have been transferred to your bank account.

Assets

Debts and Credit

Debts and credit are related to each other. A lender looks at the types of credit you have, considers the outstanding balances and the payment status and also considers your credit score and credit history when evaluating you as a borrower. This information is found on a borrower’s credit report, which a lender must obtain your written permission to access.

A lender is generally looking for a borrower with a credit score above 670 or 680 with no late or delinquent payments. However, if you have late payments, or, in some cases, if you’ve filed for bankruptcy or a consumer proposal, you may still be able to get a mortgage. A lender will usually want to know the reason why you have a credit blemish. If it’s due to life circumstances outside your control (e.g. you got sick or were laid off from work and fell behind on bills) and you can prove you’re a responsible borrower otherwise, you may still be able to get a mortgage.

The Property

The last thing lenders consider is the property itself. This is done by way of an appraisal. Depending on the property and where it’s located, some lenders may use an automated valuation model (AVM) to determine the value of your property. (This is when a lender doesn’t need to visit your property to determine its value.) Other lenders may request a full appraisal. The property appraisal confirms the property is worth what you paid for it. It also lets the lender know the condition of the property.

What to Consider When Shopping for a Mortgage

While the mortgage rate certainly matters when shopping for a mortgage, it shouldn’t be the only factor you consider.

Are You Going to Break Your Mortgage?

When you sign up for a mortgage, breaking it is probably the last thing on your mind. But a lot can happen during the standard, five-year mortgage term. If you think there’s a chance you might need to break your mortgage during your mortgage term, it’s a good idea to go with a lender and mortgage type with a lower mortgage penalty. Variable rate mortgages tend to have lower penalties than fixed rate.

How Will You Be Penalized if You Break Your Mortgage?

If you end up breaking your mortgage during your mortgage term to buy a new home, you may be able to avoid mortgage penalties by porting your mortgage. Porting your mortgage means moving your mortgage with you to the new property. Some lenders have more flexible portability policies than others. One lender may only give you 30 days to port your mortgage, whereas another gives you 90 days. You’ll want to ask a lender about the specifics of its portability policy if that’s important to you.

What About Prepayments?

If you want to aggressively pay down your mortgage, prepayments are a must. Prepayments generally come in three forms: regular payment increases, doubling up, and lump-sum payments. Not all lenders offer the same prepayments. For example, one lender might only let you make 10% lump-sum payments and increase your mortgage payment by 10% per year, while another may let you make 15% lump-sum payments and increase your payment by 15% per year. By choosing the lender with the right prepayments for you, you can pay down your mortgage at the pace you want without incurring a penalty for making too many extra payments.

Final Word

As you can see, there are a lot more things to consider when shopping for a mortgage than just the mortgage rate.

The mortgage process can be stressful, but it doesn’t have to be. After reading this article you should be better prepared the next time you apply for a mortgage. By knowing exactly what mortgage lenders will be looking at, where you should look and what you should expect, the process will go a lot smoother.

How to Get a Mortgage in 5 Steps

Gain insight into the mortgage process.

Talk to a local Redfin Agent

We’re here to help seven days a week.

Tips on how to prepare

Unless you can afford to buy a home in cash, you’ll need to get a mortgage. When you’re serious about buying a home, it’s important to understand the mortgage process and see how much mortgage you can qualify for.

Step 1: Know your numbers

The first step in preparing to apply for a mortgage is to document your monthly debt and income. Lenders look at your debt-to-income ratio to determine how much you can afford to borrow. Typically your total debt, including a new home payment, should not exceed 43% of your income. Use our Mortgage Calculator with PMI.

What credit score do you need to buy a house?

Another important factor is your credit score. Your lender will run a credit check when you apply for pre-approval, but it’s a good idea to get your own credit report to see if there’s anything you need to work on before applying.

Not missing payments and paying off as much debt as you can will help increase your credit score while lowering your debt-to-income ratio.

Be careful not to change jobs, take out new debt, or do anything that could negatively affect your credit score before or after applying for a mortgage.

Step 2: Find a lender

The most common types of lenders are banks, credit unions, and online financial institutions. Not all lenders offer the same rates or loan types, so it’s important to shop around. Talk to at least four different lenders and try to compare loan rates, fees, and product attributes.

It’s nice to get the lowest interest rate, but remember it’s also important to select a mortgage lender that is fast, trustworthy, and communicates well since they will be very involved in the closing process.

For recommendations on mortgage lenders, see who Redfin clients recommend here or ask a Redfin Agent who she or he trusts in your area.

Pre-qualification

Unlike a pre-approval, pre-qualification is a quick, informal process that allows you to compare loan details from different lenders before getting pre-approved.

Typically during a phone call or meeting with a lender, you’ll go over your income, assets, and debt. While it’s important to be honest, for a pre-qualification your financial information will not be verified by the lender. Based on that information, the lender will provide a rough estimate—not a guarantee—of how much money and what types of loans they can offer you.

Step 3: Get pre-approved

Once you select a lender, you should apply for mortgage pre-approval. Sellers are typically more willing to accept offers from pre-approved buyers because pre-approval shows that the buyer has the financial resources available to make good on their offer.

When you apply for pre-approval, your lender will check your credit and ask for all financial documents to accurately assess your financial situation.

In addition to two forms of government identification, you’ll also need:

Work history

Total debt

Names, balances, and account numbers for all of the following:

Down payment

Investment and other assets

Residence history

There are special types of loans for military veterans, first-time homebuyers with good credit, etc. Ask your mortgage lender if you qualify for any of these.

Once you’re approved, you’ll receive a pre-approval letter. When you find a home you want to buy, your real estate agent will give the seller a copy of your pre-approval letter along with your offer.

Step 4: Set your own budget

Keep in mind that just because you’re pre-approved for a certain amount doesn’t mean you can actually afford that amount. Prepare your own monthly budget to be sure.

Typically, your total house payment (including fees, taxes, and insurance) should not exceed 35% of your gross (pre-tax) income, but it’s recommended to stay closer to 25%.

When calculating your budget, your total housing payment is important, but also consider closing costs, monthly homeowner’s association (HOA) dues, utilities, and general home upkeep.

How much house can you afford?

The Redfin Home Affordability Calculator takes into account your annual household income, down payment, monthly spending, the loan type you want, and current interest rates to give you an estimate of how much you can realistically spend on a home.

Step 5: Finalize your mortgage and close

Once you make an offer that is accepted, let your lender know right away so she or he can get the loan process started. This takes 30 days on average. Your lender will be in close contact with you, your agent, and the escrow agency throughout the closing process.

Secure your mortgage

If you haven’t done so already, submit a formal loan application to your lender. Then your lender will send you an official Loan Estimate with your estimated closing costs. Review these documents closely, ask any questions you have. When everything looks good, send your lender an intent to proceed.

Home appraisal

Your bank will need to see an official home appraisal to make sure the home you’re purchasing is worth what they’ve committed to lending you. You can either pay for your appraisal upfront or have it added to your closing costs. Performing the appraisal is often the longest step in the approval process, so it is important to deliver your sales contract and order the appraisal with your lender as quickly as possible.

Underwriting

Your lender will create a loan file and send it to an underwriter. The underwriter will review the entire loan package and make sure all requirements are met. Sometimes the underwriter may request additional documentation from you. If this is the case, it’s important that you submit the documents as quickly as possible. Once underwriting is complete, your loan is considered approved and your closing date will be scheduled.

Closing

Once your loan is approved and final closing costs are established, you’ll have to:

If your closing is executed smoothly, all of the money and documents associated with the transaction will be distributed to the proper parties, and you’ll get the keys to your new home!

How to get a mortgage

Written by Dan Base, Financial Content Writer

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.

It can be daunting applying for a mortgage: there are a lot of forms to fill in and a lot of information to provide. Add in the anticipation and urgency of buying your first property and applying for your first mortgage can seem overwhelming. But with some simple planning and a bit of organisation it need not be stressful.

How to get your first mortgage

You’ve found a home you want to buy. If you’ve never applied for a mortgage before, you can apply for a first time buyer mortgage. But there are some things you will need to do before you start the mortgage application process:

Look into the schemes that help first buyers, explained below, to see if any suit you

Find a property

Really easy to get your head around it. I’m a first-time buyer and I was ignorant on the subject of mortgages, fixed and variable rates, etc. After spending an hour or so and doing a few figures I was able to determine what was the ideal mortgage for me, and what was the best interest rate the banks or building societies were offering. I am able to calculate and budget for my up-and-coming first house. If I can do it, you can!

John McCartan, from Trustpilot

How much do you need for a first mortgage deposit?

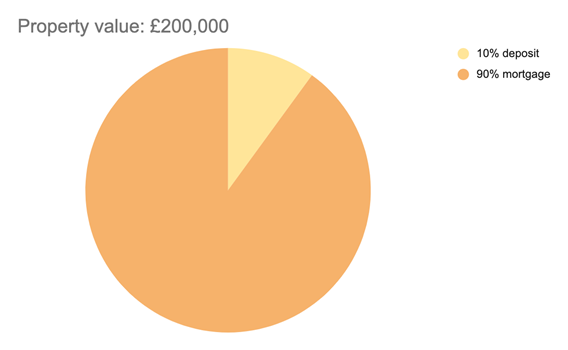

The higher your deposit, the easier you will find getting a mortgage as a first time buyer. A smaller deposit means your mortgage provider will have to cover more of the property’s total price – which makes you a riskier bet. Mortgage companies use something called a loan to value ( LTV ) calculation, which helps them decide whether to lend and at what rate.

For example, if you saved £20,000 for a deposit on a £200,000 home, this would cover 10% of the cost. You would need a mortgage for the remaining £180,000, meaning its LTV is 90% of the purchase price. If you’d saved just £10,000 your LTV would be 95%.

You can get first time buyer mortgages with an LTV of up to 95%. There are even some 100% mortgage deals available with no deposit, including guarantor mortgages that require a family member or friend to guarantee your mortgage and step in if you miss repayments.

There are fewer mortgages available for high LTVs, and the deals you can get usually have more expensive interest rates and upfront fees. The bigger your deposit, the more choice you’ll have and the less interest you’ll pay.

Can I get a mortgage on my own?

Yes, but you will need to earn enough money to cover the cost of your monthly mortgage payments. Mortgage lenders will determine your affordability based on your income and expenses.

It may also be harder to save up for a deposit alone, and you may not be able to borrow as much as you would if you applied for a joint mortgage with a partner, friend or family member.

What mortgages can I apply for?

You can apply for most types of mortgages, but some are designed specifically for first-time buyers, for instance, those that allow you to buy with a small deposit.

Here are some of the main options to explore:

First-time buyer mortgages

Some mortgages are only available for first-time buyers and allow for high LTVs, meaning you would only need a deposit of 5% or 10%. Often, these are a more expensive way to borrow, because the lender is shouldering a bigger proportion of the risk and therefore charges a higher rate of interest.

Guarantor mortgages

These allow you to buy a property with a small deposit, and some are available with an LTV of 100%, meaning you do not need a deposit at all.

A family member or friend must agree to be named on the mortgage and to cover your repayments if you miss them. They will have to guarantee the mortgage payments with either:

Their own property, which could be repossessed if you get too far behind on your repayments

Their savings, which the lender will hold in a savings account until you have paid off a percentage of your mortgage

Help to Buy mortgages

The Help to Buy equity loan is a government scheme that can help you get onto the property ladder with limited savings. The government lends you money that you can use towards your deposit and repay later.

The loan is interest-free for five years and can cover 20% of the purchase price (40% in London). You still need to save a 5% deposit yourself.

Right to Buy

Right to Buy mortgages let you buy your council house at a discounted price. The maximum discount is £87,200 across England, except in London boroughs where it is £116,200. The discount you get depends on whether you live in a house or flat. You can find out more on the gov.uk website.

Shared Ownership mortgages

You can use a Shared Ownership mortgage to buy between 25% and 75% of a property. You can buy further shares in your property until you own all of it.

These mortgages can come with much smaller repayments and deposits than if you buy 100% of a property. However, you will also pay rent to your local authority or a housing developer who owns the rest of your home on top of your mortgage payments. The rent is discounted, so it’s more affordable and you’re also building equity at the same time.

Should you get a mortgage?

Ultimately, if you can afford your mortgage, it makes far better financial sense than renting. Do your sums carefully, and shop around to get the best deal.

Make sure that you’ve factored in the following costs:

the monthly repayment on the mortgage

fees that come with getting a mortgage

homeowner bills like energy, broadband and council tax

emergency savings – ideally you should have at least three months’ worth of basic household expenses and mortgage repayments

If you’re a first time buyer or looking to move house or remortgage, we can help you find the best mortgage deal to suit your needs.

How to Get a Mortgage: From Start to Finish

Mortgage Q&A: “How to get a mortgage?”

If you already know what a mortgage is, you may be wondering how to obtain one. To refresh your memory, a mortgage is just another way of saying a home loan.

Of course, mortgages serve different purposes – some are used to purchase a home and others are used to refinance an existing mortgage.

You may even open a second mortgage behind an existing first mortgage to tap into the equity of your home (home equity line of credit).

It’s important to have a basic understanding of mortgages before you set out to get one, just like anything else you might shop for.

If you’re more knowledgeable on the subject, chances are you’ll secure a lower rate and choose a more suitable loan product that fits your needs.

Let’s discuss what the process might look it.

First Educate Yourself on Mortgages

I’ve made this plea countless times because I feel like not enough time is devoted to education on personal finance.

If you’re putting in hours to research a new big screen TV, don’t you think a mortgage decision deserves days, if not weeks of research?

The interest rate you receive on your home loan will affect your pocketbook month after month, potentially for decades to come. So a little extra time is absolutely warranted.

Research will also help guide you to the right loan product based on your unique situation.

Also determine if homeownership is right for you before making the move from renting. It’s not as wonderful as it appears, and it requires a lot of work.

Tip: Conduct this discovery process before speaking to interested parties like lenders and real estate agents who may dictate your behavior.

Then Determine If You’re Able to Get a Mortgage

Regardless of loan type, the next step to successfully getting a mortgage is figuring out how much mortgage you can afford, or if you even qualify.

Mortgages are a privilege, not a right. So before you begin to shop around, you need to determine if you’re actually eligible.

This way you won’t waste your time, or anyone else’s. For example, it’s probably best not to attend open houses and/or hire a real estate agent if you’re not even sure you can get a mortgage.

The best way to accomplish this is by figuring out a rough idea of your debt to income ratio, or going a step further and running the actual numbers through a mortgage affordability calculator.

At the same time, you’ll want to organize all your assets to ensure you have money for a down payment and closing costs, and take a hard look at your credit score to make sure it’s in good shape.

Employment history is also key so make sure you’ve got a couple years under your belt in the same position or line of work before attempting to fill out a mortgage application.

Once you’ve done all your homework, you can start looking for a a bank, mortgage lender, credit union, or mortgage broker to work with.

They can take a look at all those numbers and get you pre-qualified to help determine how much you can borrow and at what interest rate, at least a ballpark figure.

If the mortgage is for a purchase, you’ll also need to get pre-approved to show the home seller (and their real estate agent) that you’re a serious candidate (pre-qualification vs pre-approval). They surely won’t want to waste their time with ineligible borrowers.

Where to Get Your Mortgage (10 Options to Consider)

There are a lot of options here, and no one-size-fits-all solution. Which route you choose will depend on a number of factors, including your own preferences.

One important thing to note is that you don’t have to use the same bank, broker, or lender who provided you with the pre-approval. You are free to change your mind after the fact and go with someone else.

For example, you may have been pre-approved with your real estate agent’s contact, but later decided to use your own bank to get the mortgage instead. That’s perfectly acceptable, regardless of what they may tell you.

These days, there are lenders that cater to all types of people. If you’re not the social type, you might be able to go through much of the process online, or via email and text.

Those who are tech-savvy might find working with a fintech mortgage lender, like SoFi or Clara, to be more convenient.

If you’re the type who likes to meet face-to-face, there’s an option for that as well. Search around to find the right fit based on your needs and your personality. There’s something for everyone.

Using Your Existing Bank to Get a Mortgage

I’d guess that most prospective and current homeowners seeking a mortgage would go to their bank or credit union first.

After all, if you keep your money with them, there must be a certain level of trust and some kind of relationship.

That relationship could equate to savings and special deals on a mortgage, and perhaps a streamlined process.

If they already have information about you, they may be able to assess your borrowing profile more easily, and get you an answer sooner.

However, a bank or credit union is only as good as the loan programs it offers. In other words, you’re stuck with whatever they’re selling.

This might mean you can only get a fixed-rate mortgage, or the loan-to-value may be capped at 80 percent.

Same goes for their interest rates. They might not be that competitive in the mortgage space, or simply charge more than the other guys.

Look Beyond Your Bank for More Options and Possibly Better Pricing

If you want more options, consider a mortgage broker. They work as middlemen between banks and borrowers, and can offer loan programs from an infinite number of lenders.

For example, a mortgage broker may be able to get you mortgage rate quotes from Bank of America, Wells Fargo, Chase, and many others, all at the same time. Then you can compare them side by side.

To ensure you don’t miss out on anything, you can speak with both your local bank/credit union and a mortgage broker (or two).

And grab a quote or two online while you’re at it. That way you can compare mortgage rates, programs, closing costs, and more to determine which is best for you.

If you’re buying a home, chances are your real estate agent will “know someone.” Just take their recommendation with a grain of salt, because it’s likely referral business, and not necessarily in your best interest.

However, their recommendations tend to carry a lot of weight. Something like half of home buyers go with the lender their real estate agent recommends, for better or worse.

As a courtesy, you can call their bank or lender just to get pricing and avoid ruffling any feathers. But I wouldn’t stop there. It should be one of many quotes and opinions you receive.

Ultimately, you can speak to a variety of different lenders and then make your decision after that point.

If you’re a first-time home buyer, you can also visit a local housing counselor to discuss your options and ideally get some education on the home-buying process while you’re at it.

There is data that says those who receive some level of pre-purchase counseling tend to be better borrowers, so it might come in handy over the long-term as well.

The Process of Obtaining a Mortgage Loan

[Check out my in-depth step-by-step refinance guide for more on the process and what to expect.]

Once you’re actually ready to apply for a loan, the bank or mortgage broker will pull your credit and ask you to provide documentation for the loan.

This can also happen during the pre-approval stage if it’s a robust process.

In return, they are required to provide you with a Loan Estimate (LE) disclosure within three days of loan application.

This is essentially a loan summary and an estimate of the charges you’ll incur upon settlement of your loan.

You can use this Loan Estimate to compare offers from different banks, as the terms of the deal, such as mortgage rate, APR, and closing costs, will be spelled out fairly clearly.

After everything is submitted, it will take anywhere from a few days to a couple weeks to get an underwriting decision on your home loan.

Generally, it doesn’t take too long, but ever since the mortgage crisis things have gotten a little backed up.

Assuming you get approved, you’ll be issued a conditional loan approval with a list of items that must be provided before loan documents are released.

While this is happening, an appraisal will be ordered on your behalf to determine the value of the subject property.

You will also need to lock your mortgage rate before docs are drawn to ensure your desired rate doesn’t change once you’re happy with a certain price.

After you satisfy these conditions and receive your loan documents, they must be signed and a list of funding conditions must also be met, if applicable.

Once those are satisfied, your mortgage will fund. Yes, it sounds like a lot, and it is, but mortgages aren’t a trivial matter. They typically involve hundreds of thousands of dollars or more.

If for some reason your home loan application is declined, you can make an appeal with the bank that denied you or simply apply elsewhere.

In some cases, you may need to restructure the loan or wait until your credit/asset/employment outlook improves.

Unfortunately, not everyone is eligible for a mortgage…but if you put in the time and research upfront, you can avoid most surprises and set yourself up for success.

2 thoughts on “How to Get a Mortgage: From Start to Finish”

This is great information for new buyers. As a realtor, I am constantly amazed that I’m the first people call when they are ready to buy a home. The first step is to get approved for a loan buy a lender. That is the key to looking for a home.

If we already have a mortgage but are looking to move out of state, how do we get a pre-qualification? We can’t afford two mortgages and will be selling our home, but the market where we are looking is moving VERY fast and contingency offers aren’t considered.

How to get a mortgage

Advertiser Disclosure

How We Make Money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Share this page

Share

Why you can trust Bankrate

Why you can trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner.

Editorial Integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Insurance Disclosure

Coverage.com, LLC is a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed. Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

Open page navigation

ON THIS PAGE

Close page navigation

With rates on the rise, you might be looking to fast track your home purchase. Locking in a rate now protects you from rate increases in the future, but getting a mortgage can take some time and effort.

Whether you know a little about the mortgage process or have no idea how to get a home loan, don’t fret. This guide to getting a mortgage breaks down every step of the process so you’ll know what to expect.

What documents do you need to get a mortgage?

Getting a mortgage involves a lengthy underwriting process. Your lender is likely providing hundreds of thousands of dollars to purchase a home, so it wants to make sure that you’ll be able to repay that loan.

Expect to need the following documents to complete the lending process.

Your lender will request the specific documents it wants to see.

How to get a mortgage, step by step:

Step 1: Strengthen your credit

A strong credit score demonstrates to mortgage lenders that you can responsibly manage your debt. So, you’re likely to get approved for a mortgage with a competitive interest rate if you have good or excellent credit. If your credit score is on the lower side, you could still get a loan, but you’ll likely pay more in interest.

“Having a strong credit history and credit score is important because it means you can qualify for favorable rates and terms when applying for a loan,” says Rod Griffin, senior director of Public Education and Advocacy for Experian, one of the three major credit reporting agencies.

To improve your credit before applying for your mortgage, Griffin recommends these tips:

Step 2: Know what you can afford

It’s fun to fantasize about a dream home with every imaginable bell and whistle, but it’s much more practical to only purchase what you can reasonably afford. With rates rising, monthly payments will be higher, so you might have to lower your budget to find an affordable home.

“Most analysts believe you should not spend more than 30 percent of your gross monthly income on home-related costs,” says Katsiaryna Bardos, associate professor of finance at Fairfield University in Fairfield, Connecticut. This includes home maintenance and utilities.

Bardos says one way to determine how much you can afford is to calculate your debt-to-income ratio (DTI). This is calculated by summing up all of your monthly debt payments and dividing that figure by your gross monthly income.

“Fannie Mae and Freddie Mac loans accept a maximum DTI ratio of 45 percent. If your ratio is higher than that, you might want to wait to buy a house until you reduce your debt,” Bardos suggests.

Even with the 45 percent threshold, the lower your DTI ratio, the more room you’ll have in your budget for expenses not related to your home. That’s why many financial advisors recommend keeping the ratio closer to 36 percent, if feasible.

Andrea Woroch, a Bakersfield, California-based finance expert, says it’s essential to take into account all your monthly expenses — including food, healthcare and medical costs, childcare, transportation, vacation and entertainment expenses — and other savings goals.

“The last thing you want to do is get locked into a mortgage payment that limits your lifestyle flexibility and keeps you from accomplishing your goals,” Woroch says.

You can determine what you can afford by using Bankrate’s calculator, which factors in your income, monthly obligations, estimated down payment and other details of your mortgage, including the interest rate and homeowners insurance and property taxes.

Step 3: Build your savings

Your first savings goal should be your down payment.

“Saving for a down payment is crucial so that you can put the most money down — preferably 20 percent to reduce your mortgage loan, qualify for a better interest rate and avoid having to pay private mortgage insurance,” Woroch explains.

It’s equally important to build up your reserves. One general rule of thumb is to have the equivalent of roughly six months’ worth of mortgage payments in a savings account, even after you fork over the down payment. This can help safeguard you if you lose your job, for example, or something else unexpected happens.

Also, don’t forget closing costs, which are the fees you’ll pay to finalize the mortgage. They typically run between 2 percent to 5 percent of the loan’s principal. They don’t include escrow payments, either, which are a separate expense. Generally, you’ll also need around 3 percent of the home’s price for annual maintenance and repair costs.

Overall, aim to save as much as possible until you reach your desired down payment and reserve savings objectives.

“Start small if necessary but remain committed. Try to prioritize your savings before spending on any discretionary items,” Bardos recommends. “Open a separate account for down payment savings that you don’t use for any other expenses. This will help you stick to your savings goals.”

Step 4: Choose the right mortgage

Once your credit score and savings are in an adequate place, start searching for the right kind of mortgage for your situation. You’ll also want to have an idea of how mortgages work before moving forward.

A first-time homebuyer, for instance, might consider an FHA loan, which requires a minimum credit score of 500 with a 10 percent down payment or a minimum score of 580 with as little as 3.5 percent down. A conventional loan could be a better fit for a homebuyer with a higher credit score and more down payment savings.

Mortgages can have a fixed or adjustable rate, meaning the interest rate stays the same for the duration of the loan term or changes over time, respectively. Most home loans have 15- or 30-year terms, although there are 10-year, 20-year, 25-year and even 40-year mortgages available.

Adjustable-rate loans might come with a lower monthly payment initially, but can become more expensive over time if rates rise. Given today’s rising rates, there’s a good chance that your payment will rise once your rate-lock period ends. If you can’t afford that risk, the fixed-rate is the way to go.