How the economic machine works

How the economic machine works

10 Daily Observations

Today: Ray Dalio and how the economic machine works, how do we teach our kids about money, and Warren Buffet’s productivity tips.

QUOTE OF THE DAY

From very early on, whenever I took a position in the markets, I wrote down the criteria I used to make my decisions. Then, when I closed out a trade, I could reflect on how well these criteria had worked.

─ Ray Dalio

I have been applying this tactic for years and can attest to its effectiveness. For one, if you can’t clearly write down why you did something, you probably don’t have a good grasp of it.

Every investor I have studied had a writing habit. They said it helped them improve their thought process.

Second, if you take a trade for a certain reason and have 10 losses in a row, something could be wrong. If you have not written down why you took those trades, you will have no idea if it the randomness of your system or if your system is flawed.

Speaking of Ray Dalio, I re-watched his video on “How the Economic Machine Works”. If you want a better understanding of how the economy works, I highly recommend watching this now. (30 min)

In Ray’s opinion, much of what drives our economy is credit. In fact, the amount of credit in our economy is

$63 trillion dollars(2015) and the amount of actual money is around

$3 trillion dollars.

So keeping an eye on credit growth can offer a small window into future consumption because my spending is your income and your spending is someone else’s income. Sooner or later, those debts have to be settled.

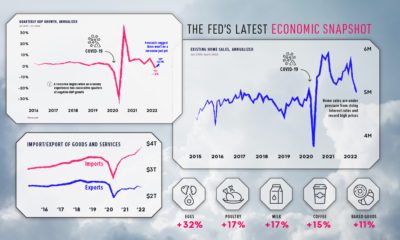

The chart below is bank loan growth YoY.

WORRIED ABOUT MONEY?

Click here for the full story.

Some data from the article:

After analyzing data from high schools representing over 85% of all students, the main conclusions of the study were as follows:

•Only 16.4% of U.S. students are required to take a personal finance course to graduate high school.

•Five states do have a personal finance requirement: Alabama, Missouri, Tennessee, Utah and Virginia.

•But outside of these states, the proportion of students with a personal finance requirement drops to 8.6%.

•Meanwhile, only 5.5% of low-income schools (outside of mandate states) have personal finance as a requirement.

Why this is important.

From the article:

We can’t count on the educational system to educate our kids about money. As parents, my wife and I will start educating our kids early on.

For help getting started,

The Guardian lists 7 ways to teach your kids about money. I encourage you to check it out. If you have had success with any of them, let me know and I will share your story. For more, read the story below.

Speaking of teaching our kids about money.

Stockpile is a new company that lets you buy fractional shares in certain companies and give them to people as gift cards. The WSJ has an article about the company(paywall).

From the article:

Max Shriver, a 10-year-old from Westchester County, New York, said he created a Stockpile account last year after receiving some gift cards for Christmas.

Max said he is invested in Microsoft, Tesla Inc., and Walt Disney Co., among other firms, although his favorite publicly traded company at the moment, he said, is probably Take-Two Interactive Software Inc. — the distributor of video games including “NBA 2K18,” “ Sid Meier’s Civilization VI” and “BioShock.” After expressing an interest in stock investing, Max started receiving fractional shares purchased online from Stockpile in return for helping his parents out with chores around the house.

I am rooting for this company. I love the idea of giving gift cards of stocks as gifts. 👏👏👏

PRODUCTIVITY

Warren Buffett’s 3 step strategy on how to maximize your focus and master your priorities

From the article:

STEP 1: Buffett started by asking Flint to write down his top 25 career goals. So, Flint took some time and wrote them down. (Note: you could also complete this exercise with goals for a shorter timeline. For example, write down the top 25 things you want to accomplish this week.)

STEP 2: Then, Buffett asked Flint to review his list and circle his top 5 goals. Again, Flint took some time, made his way through the list, and eventually decided on his 5 most important goals.

Note: If you’re following along at home, pause right now and do these first two steps before moving on to Step 3.

STEP 3: At this point, Flint had two lists. The 5 items he had circled were List A and the 20 items he had not circled were List B.

Flint confirmed that he would start working on his top 5 goals right away. And that’s when Buffett asked him about the second list, “And what about the ones you didn’t circle?”

Flint replied, “Well, the top 5 are my primary focus, but the other 20 come in a close second. They are still important so I’ll work on those intermittently as I see fit. They are not as urgent, but I still plan to give them a dedicated effort.”

To which Buffett replied, “No. You’ve got it wrong, Mike. Everything you didn’t circle just became your Avoid-At-All-Cost list. No matter what, these things get no attention from you until you’ve succeeded with your top 5.”

BELOW THE FOLD

💰 Average monthly trade deficit since 2001.

How the economic machine works

“A serious contribution and an urgent warning.”

“Essential reading to understand our times.”

“After reading this book, you probably won’t see the world the same again.”

“Important lessons for the US and China today.”

“An astounding, inspiring, and thought-provoking look at the rises and declines of empires.”

“This may well be the most important book of the year, if not the decade.”

“Ray shows how to learn from history to not repeat the mistakes that lead to the downfall of nations.”

“An excellent, deeply thoughtful study of what drives the rise and demise of economic cycles and empires”

“A provocative read. Dalio has identified metrics from history that can be applied to today.”

Andrew Ross Sorkin

“Ray Dalio’s latest book should be required reading for everyone. It would be irresponsible not to understand what Ray has laid out, steeped in history, serving as a roadmap for the future.”

How does the economy really work?

This simple but not simplistic video by Ray Dalio, Founder of Bridgewater Associates, shows the basic driving forces behind the economy, and explains why economic cycles occur by breaking down concepts such as credit, interest rates, leveraging and deleveraging.

Principles for Dealing with The Changing World Order

This new 40-minute animated video shares the key ideas found in Ray’s best-selling book of the same title.

Andrew Ross Sorkin

Sign up to Receive Updates

You’re almost finished

You will receive an email confirmation shortly.

conversations

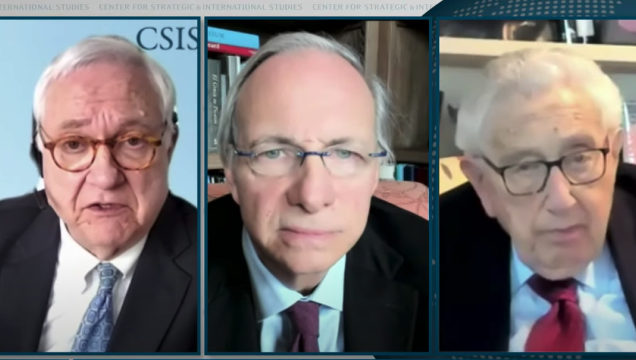

Conversations on the Changing World Order

Listen to recent interviews between Ray and Henry Kissinger, Fareed Zakaria, David Rubenstein, and others

Henry Kissinger at Center for Strategic and International Studies

CSIS Trustee and Counselor Henry A. Kissinger and Ray bring together their unique strategic perspectives on statecraft and economies to discuss the state of the world and what lies ahead.

Fareed Zakaria at the Council on Foreign Relations

Fareed and Ray discuss the changing world order, including the international economic environment’s trajectory, the economic and security implications of the current global geopolitical tensions, and lessons from analogous historical periods.

David Rubenstein at the 92nd Street Y

Ray discusses the cycle of economic history in Changing World Order on “The David Rubenstein Show: Peer-to-Peer Conversations.” They cover the rise of China, challenges in cryptocurrency, how meditation enables better decision making, and advice to new investors in light of current events.

Hank Paulson’s Straight Talk Podcast

Ray and the former US Treasury Secretary discuss the current economic situation, US-China relations, and the most important principles for our world leaders.

Michael Moritz at the Commonwealth Club of CA

Ray joins Michael Moritz to discuss five centuries of economic history to better understand current events. They cover the historical role of banking institutions in dealing with debt, rising internal and external conflicts, and the role of knowledge and technology.

CNN Quest Means Business

On CNN “Quest Means Business,” Ray explores the six identifiable stages of a nation’s economic status and why the progression of these stages is predictable but not inevitable. Ray offers practical optimism for the US, if the country is able to do what’s required to remain strong.

Andy Serwer at Yahoo Finance

Ray joins Andy Serwer on Yahoo Finance “Influencers” to discusses the forces behind inflation, how the Us-China standoff will unfold, and how it will affect the global economy.

Lex Fridman Podcast

Ray chats with Lex Fridman about the trajectory of the US’s Big Cycle, rising US-China conflict, Ray’s friendship with Henry Kissinger, and the vulnerabilities of investing in Bitcoin.

Investors Podcast

Ray joins William Green on “The Investor’s Podcast” to talk about Changing World Order and the economic crossroads the US faces. They cover China’s rapid rise, the investing trade-offs with Bitcoin, what it means to be “radically truthful,” and how meditation builds resilience.

An examination of how the economic machine works

A thought-provoking interview between Ray Dalio and Larry Summers, President Emeritus of Harvard University and former US Treasury Secretary.

How Does The Economy Really Work by Ray Dalio (Transcript)

Ray Dalio, Founder of Bridgewater Associates, discusses how the economy machine really works. Note: this is the transcript only for educational and ‘ideas worth spreading’ purposes.

How the economic machine works, in 30 minutes.

The economy works like a simple machine. But many people don’t understand it — or they don’t agree on how it works. And this has led to a lot of needless economic suffering. I feel a deep sense of responsibility to share my simple but practical economic template. Though it’s unconventional, it has helped me to anticipate and sidestep the global financial crisis, and has worked well for me for over 30 years.

Though the economy might seem complex, it works in a simple, mechanical way. It’s made up of a few simple parts and a lot of simple transactions that are repeated over and over again a zillion times. These transactions are above all else driven by human nature, and they create 3 main forces that drive the economy.

Number 1: Productivity growth

Number 2: The Short term debt cycle

And Number 3: The Long term debt cycle

We’ll look at these three forces and how laying them on top of each other creates a good template for tracking economic movements and figuring out what’s happening now.

Let’s start with the simplest part of the economy: Transactions.

An economy is simply the sum of the transactions that make it up and a transaction is a very simple thing. You make transactions all the time. Every time you buy something you create a transaction. Each transaction consists of a buyer exchanging money or credit with a seller for goods, services or financial assets. Credit spends just like money, so adding together the money spent and the amount of credit spent, you can know the total spending.

The total amount of spending drives the economy. If you divide the amount spent by the quantity sold, you get the price. And that’s it. That’s a transaction. It is the building block of the economic machine. All cycles and all forces in an economy are driven by transactions.

So, if we can understand transactions, we can understand the whole economy. A market consists of all the buyers and all the sellers making transactions for the same thing. For example, there is a wheat market, a car market, a stock market and markets for millions of things. An economy consists of all of the transactions in all of its markets.

If you add up the total spending and the total quantity sold in all of the markets, you have everything you need to know to understand the economy. It’s just that simple. People, businesses, banks and governments all engage in transactions the way I just described: exchanging money and credit for goods, services and financial assets.

The biggest buyer and seller is the government, which consists of two important parts: a Central Government that collects taxes and spends money…and a Central Bank, which is different from other buyers and sellers because it controls the amount of money and credit in the economy. It does this by influencing interest rates and printing new money.

For these reasons, as we’ll see, the Central Bank is an important player in the flow of Credit. I want you to pay attention to credit. Credit is the most important part of the economy, and probably the least understood. It is the most important part because it is the biggest and most volatile part. Just like buyers and sellers go to the market to make transactions, so do lenders and borrowers.

Lenders usually want to make their money into more money and borrowers usually want to buy something they can’t afford, like a house or car or they want to invest in something like starting a business. Credit can help both lenders and borrowers get what they want.

Borrowers promise to repay the amount they borrow, called the principal, plus an additional amount, called interest. When interest rates are high, there is less borrowing because it’s expensive. When interest rates are low, borrowing increases because it’s cheaper. When borrowers promise to repay and lenders believe them, credit is created.

Any two people can agree to create credit out of thin air! That seems simple enough but credit is tricky because it has different names. As soon as credit is created, it immediately turns into debt. Debt is both an asset to the lender, and a liability to the borrower.

In the future, when the borrower repays the loan, plus interest, the asset and liability disappear and the transaction is settled.

So, why is credit so important? Because when a borrower receives credit, he is able to increase his spending. And remember, spending drives the economy. This is because one person’s spending is another person’s income.

Think about it, every dollar you spend, someone else earns. And every dollar you earn, someone else has spent. So when you spend more, someone else earns more. When someone’s income rises it makes lenders more willing to lend him money because now he’s more worthy of credit.

A creditworthy borrower has two things: the ability to repay and collateral. Having a lot of income in relation to his debt gives him the ability to repay. In the event that he can’t repay, he has valuable assets to use as collateral that can be sold. This makes lenders feel comfortable lending him money.

So increased income allows increased borrowing which allows increased spending. And since one person’s spending is another person’s income, this leads to more increased borrowing and so on. This self-reinforcing pattern leads to economic growth and is why we have Cycles.

In a transaction, you have to give something in order to get something and how much you get depends on how much you produce. Over time we learn and that accumulated knowledge raises our living standards, we call this productivity growth.

Those who were inventive and hard-working raise their productivity and their living standards faster than those who are complacent and lazy, but that isn’t necessarily true over the short run. Productivity matters most in the long run, but credit matters most in the short run. This is because productivity growth doesn’t fluctuate much, so it’s not a big driver of economic swings. Debt is — because it allows us to consume more than we produce when we acquire it and it forces us to consume less than we produce when we have to pay it back.

Debt swings occur in two big cycles. One takes about 5 to 8 years and the other takes about 75 to 100 years. While most people feel the swings, they typically don’t see them as cycles because they see them too up close — day by day, week by week.

In this chapter we are going to step back and look at these three big forces and how they interact to make up our experiences.

As mentioned, swings around the line are not due to how much innovation or hard work there is, they’re primarily due to how much credit there is. Let’s for a second imagine an economy without credit.

In this economy, the only way I can increase my spending is to increase my income, which requires me to be more productive and do more work. Increased productivity is the only way for growth. Since my spending is another person’s income, the economy grows every time I or anyone else is more productive. If we follow the transactions and play this out, we see a progression like the productivity growth line.

But because we borrow, we have cycles. This isn’t due to any laws or regulation, it’s due to human nature and the way that credit works. Think of borrowing as simply a way of pulling spending forward. In order to buy something you can’t afford, you need to spend more than you make. To do this, you essentially need to borrow from your future self.

In doing so you create a time in the future that you need to spend less than you make in order to pay it back. It very quickly resembles a cycle. Basically, anytime you borrow you create a cycle. This is as true for an individual as it is for the economy. This is why understanding credit is so important because it sets into motion a mechanical, predictable series of events that will happen in the future. This makes credit different from money.

Video: How the Economic Machine Works, According to Ray Dalio

January 15, 2018

Ray Dalio has reached the part of his life where he is giving back.

However, since 2011, the billionaire has passed the baton for the role of CEO at Bridgewater – and he’s also been focused on passing on his knowledge as well.

The Knowledge Baton

Most recently, Ray Dalio has been praised for releasing his book entitled Principles: Life and Work, where he outlines the principles that have guided his impressive success with Bridgewater.

Just as timeless, however, is this 30 minute animated video that he and Bridgewater released a few years ago, which gives their unique template for how the global economy works. It’s possible that you may have seen this before – but if not, it can be a useful tool to understand how the pieces fit together.

Dalio starts at the micro level, showing how individual transactions are part of the overall economic machine.

Then, using human nature and history as a guide, Dalio reduces the complex global economy down to just three major forces that must be understood.

Three Major Forces

Dalio says this model has guided Bridgewater for over 30 years, and that there are three major forces that shape the economy:

1. Productivity Growth

Productivity growth, which is measured as a percentage of GDP, grows over time as knowledge, technology, and innovations help to raise our productivity and living standards.

2. Short-Term Debt Cycle

Usually lasting 5-8 years, the short-term debt cycle is a repeating pattern that occurs as credit expands and contracts.

3. Long-Term Debt Cycle

Usually lasting 75-100 years, the long-term debt cycle usually ends in a period of extreme deleveraging, where global debt is unsustainable and asset prices fall.

Based on Dalio’s model and his concerns about the abuse of money printing by central banks, it’s clear why he routinely holds gold for about 5-10% of his personal portfolio, as well.

Rules of Thumb

The video ends with Dalio giving three rules of thumb – takeaways that make sense for individuals, companies, and policymakers.

Rule #1. Don’t have debt rise faster than income

Your debt burdens will eventually crush you.

Rule #2. Don’t have income rise faster than productivity

You’ll eventually become uncompetitive.

Rule #3. Do all that you can to raise productivity

In the long run, that’s what matters the most.

Over the Next Year, Germany Will Hit a Scary Demographic Milestone

The 10 Companies That Dominate the Global Arms Trade

You may also like

Countries with the Highest Default Risk in 2022

3 Insights From the FED’s Latest Economic Snapshot

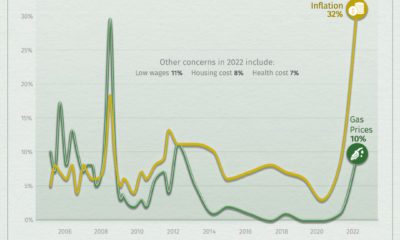

Poll: Inflation is the Top Financial Concern for Americans

Who Are the Russian Oligarchs?

Technology

Thematic Investing: 3 Key Trends in Cybersecurity

Cyberattacks are becoming more frequent and sophisticated. Here’s what investors need to know about the future of cybersecurity.

Written By

Graphics & Design

Thematic Investing: 3 Key Trends in Cybersecurity

In 2020, the global cost of cybercrime was estimated to be around $945 billion, according to McAfee.

It’s likely even higher today, as multiple sources have recorded an increase in the frequency and sophistication of cyberattacks during the pandemic.

In this infographic from Global X ETFs, we highlight three major trends that are shaping the future of the cybersecurity industry that investors need to know.

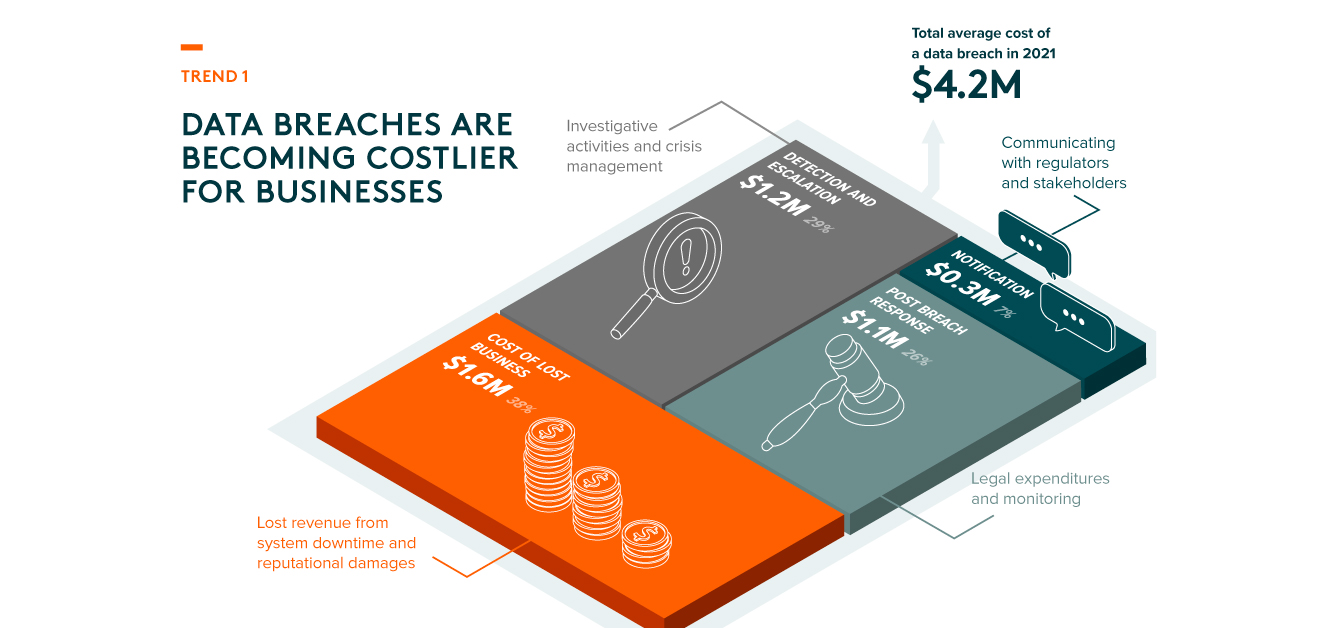

Trend 1: Increasing Costs

| Cost Component | Value ($) |

|---|---|

| Cost of lost business | $1.6M |

| Detection and escalation | $1.2M |

| Post breach response | $1.1M |

| Notification | $0.3M |

| Total | $4.2M |

The greatest cost of a data breach is lost business, which results from system downtimes, reputational losses, and lost customers. Second is detection and escalation, including investigative activities, audit services, and communications to stakeholders.

Post breach response includes costs such as legal expenditures, issuing new accounts or credit cards (in the case of financial institutions), and other monitoring services. Lastly, notification refers to the cost of notifying regulators, stakeholders, and other third parties.

Trend 2: Remote Work Opens New Vulnerabilities

A major reason for this gap is that work-from-home setups are typically less secure. Phishing attacks surged in 2021, taking advantage of the fact that many employees access corporate systems through their personal devices.

| Type of Attack | Number of attacks in 2020 | Number of attacks in 2021 | Growth (%) |

|---|---|---|---|

| Spam phishing | 1.5M | 10.1M | +573% |

| Credential phishing | 5.5M | 6.2M | +13% |

As detected by Trend Micro’s Cloud App Security.

Spam phishing refers to “fake” emails that trick users by impersonating company management. They can include malicious links that download ransomware onto the users device. Credential phishing is similar in concept, though the goal is to steal a person’s account credentials.

A tactic you may have seen before is the Amazon scam, where senders impersonate Amazon and convince users to update their payment methods. This strategy could also be used to gain access to a company’s internal systems.

Trend 3: AI Can Reduce the Cost of a Data Breach

AI-based cybersecurity can detect and respond to cyberattacks without any human intervention. When fully deployed, IBM measured a 20% reduction in the time it takes to identify and contain a breach. It also resulted in cost savings upwards of 60%.

A prominent user of AI-based cybersecurity is Google, which uses machine learning to detect phishing attacks within Gmail.

Machine learning helps Gmail block spam and phishing messages from showing up in your inbox with over 99.9% accuracy. This is huge, given that 50-70% of messages that Gmail receives are spam.

– Andy Wen, Google

Introducing the Global X Cybersecurity ETF

The Global X Cybersecurity ETF (Ticker: BUG) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Cybersecurity Index. See below for industry and country-level breakdowns, as of June 2022.

| Sector (By security type) | Weight |

|---|---|

| Cloud | 28.0% |

| Network | 25.1% |

| Identity | 17.7% |

| Internet | 15.0% |

| Endpoint | 12.8% |

| Country | Weight |

|---|---|

| 🇺🇸 U.S. | 71.6% |

| 🇮🇱 Israel | 13.2% |

| 🇬🇧 UK | 8.2% |

| 🇯🇵 Japan | 5.5% |

| 🇰🇷 South Korea | 0.9% |

| 🇨🇦 Canada | 0.6% |

Totals may not equal 100% due to rounding.

Investors can use this passively managed solution to gain exposure to the rising adoption of cybersecurity technologies.

How the Economic Machine Works by Ray Dalio

Ray Dalio released his unconventional template on how the economy works in 2013 which it is still relevant today. We can study this template to understand where we are today in relation to where we have been.

Dalio recently has explained we are right now (as of September 2018) towards the end of the short term debt cycle (business cycle) after having enjoyed a beautiful deleveraging and expansion after the debt crisis of 2008 (long term debt cycle.

Below is a written summary of his template, but you can watch the entire video here:

Though the economy might seem complex, it works in a simple mechanical way, it’s made up of a few simple parts and a lot of simple transactions that are repeated over and over again a zillion times. These transactions above all else are driven by human nature and they create three main forces that drive the economy.

Number one, productivity growth.

Number two, the short term debt cycle.

And number three the long term debt cycle.

An economy is simply the sum of the transactions that make it up and a transaction is a very simple thing. You make transactions all the time. Every time you buy something, you create a transaction. Each transaction consists of a buyer exchanging money or credit with a seller for goods, services, or financial assets.

Credit spends just like money, so adding together the money spent and the amount of credit spent, you could know the total spending. The total amount of spending drives the economy. If you divide the amounts spent by the quantity sold, you get the price and that’s it, that’s a transaction. It’s the building block of the economic machine.

All cycles and all forces in an economy are driven by transactions. So, if we can understand transactions, we can understand the whole economy. A market consists of all the buyers and all the sellers making all transactions for the same thing. For example, there is a (wheat) market, a farm market, a stock market and markets from millions of things. An economy consists of all of the transactions and all of its markets. If you add up the total spending and the total quantity sold in all of the markets, you have everything you need to know to understand the economy.

The biggest buyer and seller is the government which consists of two important parts. A central government that collects taxes and spends money and a central bank, which is different from other buyers and sellers because it controls the amount of money and credit in the economy, it does this by influencing interest rates and printing new money.

Credit is the most important part of the economy and probably the least understood. It’s the most important part because it’s the biggest and most volatile part. Just like buyers and sellers go to the market to make transactions, so the lenders and borrowers. Lenders usually want to make their money into more money and borrowers usually want to buy something they can afford, like a house or a car, or they want to invest in something like starting a business. Credit can help both lenders and borrowers get what they want. Borrowers promise to pay the amount they borrow called principal, plus an additional amount called interest.

When interest rates are low, borrowing increases because it’s cheaper. When borrowers promise to repay and lenders believe them, credit is created. Any two people can agree to create credit out of thin air, that seems simple enough but credit is tricky because it has different names, as soon as credit is created, it immediately turns into debt. Debt is both an asset to the lender and a liability to the borrower. In the future, when the borrower repays the loan plus interest, the asset and the liability disappear and the transaction is settled. So why is credit so important? Because when a borrower receives credit, he is able to increase his spending, and remember, spending drives the economy.

This is because one persons spending is another person’s income. Think about it, every dollar you spend, someone else earns and every dollar you earn, someone else’s spend. So when you spend more, someone else earns more. When someone’s income rises, it makes lenders more willing to lend them more money because now he’s more worthy of credit. A credit worthy borrower has two things, the ability to repay and collateral.

Having a lot of income in relation to his debt, gives him the ability to repay. In the event that he can’t repay, he has valuable assets to use as collateral that can be sold. This makes lenders feel comfortable lending him money. So increased income, allows increase borrowing, which allows increase spending and since one person’s spending is another person’s income, this leads to more increase borrowing and so on. This self free enforcing pattern leads to economic growth and it’s why we have cycles.

Debt swings occur in two big cycles. One takes about five to eight years and the other takes about 75 to a hundred years, while most people feel the swings, they typically don’t see them as cycles because they see them too up close, day by day, week by week.

The reality is, that most of what people call money is actually credit.

In an economy without credit the only way to increase your spending is to produce more, but with an economy with credit, you can also increase your spending by borrowing. As a result, an economy with credit has more spending and allows incomes to rise faster than productivity over the short run but not over the long run.

Credit isn’t necessarily something bad but just causes cycles. It’s bad when it finances over a consumption that can’t be paid back, however it’s good when it efficiently allocates resources and produces income, so you can pay back the debt.

When the amount of spending and income grow faster than the production of goods, prices rise, when prices rise, we call this inflation.

Seeing prices rise, the central bank raises interest rates. With higher interest rates, fewer people can afford to borrow money and the cost of existing debts rises.

Because people borrow less and a higher debt repayments, they have less money left over to spend, so spending slows. And since one person’s spending is another person’s income, incomes drop and so on and so forth. When people spend less, prices go down, we call this deflation. Economic activity decreases and we have a recession. If the recession becomes too severe and inflation is no longer a problem, the central bank will lower interest rates to cause everything to pick up again.

As you can see, the economy works like a machine. In the short term debt cycles, spending is constrained only by the willingness of lenders and borrowers to provide and receive credit.

When credit is easily available, there is an economic expansion. When credit isn’t easily available, there is a recession and note that this cycle is controlled primarily by the central bank.

Over decades, debt burdens slowly increase creating larger and larger debt repayments. At some point, debt repayments start growing faster than incomes, forcing people to cut back on their spending. And since one person’s spending is another person’s income, incomes begin to go down, which makes people less credit worthy, causing borrowing to go down. Debt repayments continue to rise, which makes spending drop even further and the cycle reverses itself. This is the long term debt peak, debt burden have simply become too big.

Now the economy begins deleveraging. In a deleveraging, people cuts spending, incomes fall, credit disappears, asset prices drop, banks gets squeezed, the stock market crashes, social tensions rise and the whole thing starts to feed on itself the other way.

Scrambling to fill this hole, borrowers are forced to sell assets. The rush to sell assets floods the market at the same time as spending falls. This is when the stock market collapses, the real estate market tanks and banks get into trouble. As asset prices drop, the value of the collateral borrowers can put up drops, this makes borrowers even less credit worthy, people feel poor, credit rapidly disappears. Less spending, less income, less wealth, less credit, less borrowing, and so on, it’s a vicious cycle.

This appears similar to a recession but the difference here is that interest rates can’t be lowered to save the day. In a recession, lowering interest rates works to stimulate borrowing, however in deleveraging, lowering interest rates doesn’t work because interest rates are already low and soon hits zero percent, so the stimulation ends. Interest rates in the United States hits zero percent during deleveraging of the 1930’s and again, in 2008. The difference between a recession and a deleveraging is that in the deleveraging, borrowers debt burdens have simply gotten too big and can’t be relieved by lowering interest rates.

This severe economic contraction is a depression, a big part of a depression is people discovering much of what they’ve thought was their wealth isn’t really there.

This situation can lead to political change that can sometimes be extreme. In the 1930’s, this led to Hitler come into power, war in Europe and depression in the United States, pressure to do something to end the depression increases. Remember, most of what people thought was money was actually credit.

So when credit disappears, people don’t have enough money. People are desperate for money and you remember who can print money, the central bank can. Having already lowered already its interest rates to nearly zero, it’s forced to print money. Unlike cut in spending, debt reduction and wealth redistribution, printing money is inflationary and stimulative. Inevitably, the central bank prints new money out of thin air and uses it to buy financial assets and government bonds.

It happened in the United States during the great depression and again in 2008, when the United States central bank, the federal reserve printed over two trillion dollars. Other central banks around the world that could, printed a lot of money too.

This is a very risky time. Policy makers need to balance the four ways that debt burdens come down. The deflationary ways need to balance with the inflationary ways in order to maintain stability. If balanced correctly, there can be a beautiful deleveraging. You see, a deleveraging could be ugly or it can be beautiful. How can be a deleveraging be beautiful? Even though a deleveraging is a difficult situation, handling a difficult situation in the best possible way is beautiful.

In a beautiful deleveraging, debts decline relative to income, real economic growth is positive and inflation isn’t a problem. It is achieved by having the right balance, the right balance requires a certain mix of cut in spending, reducing debt, transferring wealth and printing money, so that economic and social stability can be maintained. People ask if printing money will raise inflation, it won’t if it offsets falling credit. Remember, spending is what matters. A dollar of spending paid for with money has the same effect on price as a dollar spending paid for with credit. By printing money, the central bank can make up for the disappearance of credit with an increase in the amount of money.

You need to print enough money to get the rate of income growth above the rate of interest. However, printing money could easily be abused because it’s so easy to do and people prefer to the alternatives. The key is to avoid printing too much money and causing unacceptably high inflation the way Germany did during it’s deleveraging in the 1920’s. If policy makers achieve the right balance, a deleveraging isn’t so dramatic, growth is slow but debt burdens go down, that’s a beautiful deleveraging.

When incomes begin to rise, borrowers begin to appear more credit worthy, and when borrowers appear more credit worthy, lenders begin to lend money again. Debt burdens finally begin to fall, able to borrow money, people can spend more, eventually the economy begins to grow again, leading to the reflation phase of the long term debt cycle though the deleveraging process can be horrible if handled badly. If handled well, it will eventually fix the problem. It takes roughly a decade or more to debt burdens to fall and economic activity to get back to normal, hence the term lost decade enclosing.

So, in summary there are three rules of thumb that I’d like you to take away from this.

First, don’t have debt rise faster than income because your debt burdens will eventually crush you.

Second, don’t have income rise faster than productivity because you’ll eventually become uncompetitive.

And third, do all that you can to raise your productivity because in the long run, that’s what matters most.

This is simple advice for you and its simple advice for policy makers. You might be surprised, but most people including most policy makers don’t enough attention to this.