How to become debt free

How to become debt free

Choose to Be Debt Free

Colin Anderson / Getty Images

Miriam Caldwell has been writing about budgeting and personal finance basics since 2005. She teaches writing as an online instructor with Brigham Young University-Idaho, and is also a teacher for public school students in Cary, North Carolina.

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R&D, programmer analyst, and senior copy editor.

Many people do not know what it is like to be debt-free. Many young adults start out their independence by attending college and taking out student loans to finance their education. They may, additionally, take advantage of the numerous credit cards offered to college students and may graduate with thousands of dollars in credit card debt. Once they graduate, they may move on to car loans and then mortgages, never stopping to think about becoming debt-free. Payments are just a way of life.

Think About What You Could Do Without Debt Payments

Consider Your Freedom from Debt

Being debt-free also means freedom. You may be more likely to be able to quit your job if you are not happy, without the worry about whether you will be able to keep your home or be able to make your payments. Debt is a big worry that is always there in the back of your mind, even if you are pretty good at ignoring it. Paying it off means that you can make your money work for you, and that you can begin to build wealth.

Change the Way You Think About Debt

People often mistakenly look at credit as an easy way to get the things that they want now. They fail to look at the long-term consequences and costs that debt brings. Living debt-free allows people to live the kind of life that they want to live. It means that they do not have to worry quite as much about payments or what would happen if they were to lose their job suddenly.

It can be revolutionary to think about living debt-free. A life without payments is very different from one with payments. Debt-free living means the possibility of saving up for things. It means making sacrifices and resisting impulse purchases. It means limiting the amount of money you waste each month. It means planning for the bigger purchases and making sure that you are using your money for the things that matter most to you.

Put a Plan in Place

To become debt-free, you need to create a debt payment plan. First, you should list your debts according to their interest rates. Then you need to find the money to apply to your debt each month. It may mean cutting back on your expenses or taking on a second job. Then you apply all of the extra money to the first debt on your list. Once you have paid it off, you move on to the next debt, applying the allocated money as well as the payment amount from the first debt. You continue to do that until you have paid off all of your debts.

This system is also called a «snowball plan,» because as the payments become bigger as each debt is paid off, you can pay off the remaining debts much more quickly. Depending on the amount of debt that you have, you may need to focus for a year or two to pay off what you owe. If you have a large amount of debt, it helps to break down the plan so that you will have milestones that you can meet along the way.

Commit to Staying Debt-Free

Once you have become debt-free, you will need to commit to not going into debt again. It means planning and saving money for bigger purchases. It also means sticking to a budget, but all of these things are worth being debt-free. It is important to remember the freedom that comes with living debt-free. Do not let all of the work that it took to get there go to waste by taking on additional debt. An emergency fund can help you stay out of debt, but your budget is your best tool to stay out of debt.

How to become debt free

37 Best Tips on How to Become Debt Free

Hi there! You new here? We love that you found our little corner of the web. Here at Debt Free Guys, we’re all about helping people experience the freedom of becoming debt free! Would you love to feel that relief? After reading our article below, see how we can help you more here.

How to become debt free?

Becoming debt free is more than a list

Becoming debt free is more than a laundry list of dos and don’ts, which is what Google will find for you when you search “how to become debt free.” Yes, doing and not doing things such as:

are all great ways to save money and put more money toward your debt to become debt free. But all these practical and tactical steps don’t tackle the real reason most – not all – people get into credit card debt.

1. Adopting the mindset to become debt free

Designer clothes. Grand vacations. Homes in the choicest of neighborhoods. Happy hours that were all longer than an hour. Sound familiar?

Some say it’s the “gay lifestyle.” A while back, a young gay man asked in an FB group, “Why’s it so expensive to be gay?” We know what he’s talking about because we felt the same. Maybe you do, too?

Keeping up with gay money was making us two unhappy homos. We were the gay-cliché of looking fabulous but being fabulously broke – like those shacking up four boys in a two-bedroom apartment in L.A. but driving Beemers and Audis.

Sound familiar? Yeah. Us, too.

One night sitting on the dining room floor of our basement apartment, we said “Enough!” We were depressed and pissed because our debt was keeping us from the life we wanted – the life we pretended we had. We tried to fix it before but the fixing never worked. We couldn’t live that way anymore and knew something had to change.

We had to change. Maybe you want something different, too?

That’s why starting with changing our thinking was key.

2. Creating the vision to become debt free

Many of us can’t imagine a life without debt. Whether it’s student loan debt, credit cards or medical bills. Debt is a constant, but it doesn’t have to be.

It was FUN daydreaming. We talked about taking real vacations, ones that didn’t cause a credit card hangover. We talked about moving out of our basement apartment and buying a condo.

What would your debt free life look like? There’s freedom when you become debt free; you have more money and less stress. Can you visualize being debt free yourself?

3. Being friendly with the Benjis

Knowing where you are and where you want to be, gives you a roadmap for making it happen. When we chose to become debt free we needed that roadmap, otherwise, Sunday Funday, poppin’ bottles at happy hour and that Amazon addiction would remain the path of least resistance – especially with Visa and Master Card never saying “No.”

Another great thing about the Benjis is that we now spend with a purpose. What brings you true joy, not temporary happiness? Not a slight buzz from a couple of cocktails-happy?

4. Having the audacity to do it

Think about your last amazing, first date. How did it happen? I’m not talking about logistics. Some of those are too personal to share, except maybe on Grindr or Scruff.

Think back to how it began, though. Who asked who? Which one of you had the courage to ask the other out? After that date, weren’t you happy? (insert mischievous grin)

5. Doing it smart to become debt free fast

Most people who Google ways to become debt free often land on something written by one of Dave Ramsey’s staff writers. Ramsey’s a superfan of the Debt Snowball Method to pay off debt. The Snowball Method says to focus on paying off your credit card with the smallest balance first (with extra money, bonuses, gift money, tax refunds, etc) while making minimum monthly payments to all your other cards. Once you’ve paid off that card with the smallest balance, work on paying off the card with the next smallest balance.

The Snowball Method will give you initial, quick wins. It’ll also cost you more money in the long run, as it’s the least fiscally responsible method. Listening to Dave Ramsey’s show or buying Financial Peace University also brings with it a bunch of religious baggage that lots of folks don’t want – but, hey, “don’t cram your lifestyle down my throat and all!”

The next most popular method, the more fiscally responsible of the two, is the Avalanche Method. It says to focus on paying off your credit card with the highest interest rate first while making minimum monthly payments to the rest of your cards. Of the two, the Avalanche Method will save you more money over time. It’s just that it takes forever to pay off all your debt.

So, we looked at what was making becoming debt free take so long. Can you guess?

It was the high credit card interest rates. Some credit cards charge over 22% in interest. So, we created our Debt Lasso Method.

6. Lassoing your debt to become debt free

The Debt Lasso Method says to rein in your debt to as few locations as possible with the lowest interest rate as possible, ideally 0%. This is most easily achieved with 0% interest rate credit card balance transfer offers. Low-interest personal loans or loans from friends and family are other options, though we’re not super fans of the latter two.

There are 5 total steps to the Debt Lasso Method to make it super-effective:

More tools for becoming debt free:

A Debt Story And 21 Things You Can Do To Become Debt Free

A Debt Story Repeated.

I recently re-connected with an old friend from 20 years ago. She was bad with money then and she’s bad with money now.

Her life has been difficult from an early age and she has not had good role models in her life to steer her in the right direction.

When I met her 20 years ago she was a young single mum just getting back to work and doing it all without any family help.

In those days she didn’t have the financial commitments that can really screw your finances up.

She had no mortgage, no car and her utilities were on pre-paid meters.

She didn’t have real debt and thank goodness she didn’t go down the route of door step creditors.

Unfortunately her poor decision making led to instances such as time off work because she didn’t have transportable food for her son to take to nursery.

4 days she was off work that time – aargh!

She was waiting for her child benefit payment so she could re-stock her cupboards.

It’s A Complicated Life

Fast forward 20 years and her finances are much more complicated.

She has a mortgage, credit cards, utility bills, car payment.

All the things that are normal when you are in your late 30’s and been working for 20 years.

Problem is her finances are in a complete mess.

When I say mess I mean non-payment of her water bill has been outsourced to a debt collector.

I mean a mortgage which tracks the Libor rate as it’s not from a mainstream lender.

I mean a credit card with an interest rate of 40%+.

I mean not even knowing what bills are in arrears, whether bills are still on direct debit or they have bounced.

That kind of mess.

Looking At How To Become Debt Free In 5 Years

So I am stepping up and trying to help her get her finances back on track.

If we work hard and her focus is on how to become debt free in 5 years, I reckon she can do it.

It will take some hard work as she does need help in getting out of debt.

My plan is to get her focused on paying off her debt and creating a future debt free lifestyle that is sustainable long term.

We started this conversation because she wants to move to a bigger house and she had a mortgage broker round her house the other day talking about getting a new larger mortgage.

The broker thought she should be OK to get another mortgage!

Really Mr Broker? Really?

Let’s just think about this for a minute. She has:

And you think she can or should get another, larger mortgage? Jeez.

The Outline Debt Management Plan

So far we have only got her paperwork in order i.e. it’s now in order in separate plastic files for each bill/institution.

Her homework last time we met was to create a list of all her income and outgoings and print her bank statements for past 3 months.

She also agreed to contact 2 creditors to re-engage in a dialogue with them.

Next time we meet we can compare her income to her outgoings and draft a budget.

And hopefully a debt management plan to help her become debt free, in time.

Debt Stories

I know people get themselves into financial pickles but I was shocked and disappointed my friend was in this place.

She works in credit control and knows about debt chasing yet had managed to bury her head in the sand as regards to her own finances.

There is obviously much more to this story than just poor financial management.

I can’t help her with some of her other difficulties but hopefully I can help her get her finances in better shape.

As long as she commits to the work this will involve.

I’ve had my eyes opened to just how messy things can get when from the outside you would think she was doing ok.

Own flat, nice car, good job, 2 kids.

Helping my friend start the process of tackling her financial mess got me thinking about what she needed to do to become debt free.

Ideally long term I’d like to see her re-mortgage with a mainstream lender.

This will take some time and she’s going to need to put in some hard graft before that happens but it is possible.

So what can you do if you need help getting out of debt? What steps must you take in order to achieve that coveted debt free status?

Follow me on Pinterest for more money saving hacks and financial tips!

How To Become Debt Free On A Low Income

1. Stop Your Borrowing

This may be obvious but sometimes we can fool ourselves.

We rob Peter to pay Paul.

You will never learn how to get rid of debt if you are increasingly using your overdraft each month.

Paying off a personal loan whilst increasing your credit card balance is not reducing your debt.

You are just shifting it.

You have to commit to no more borrowing as part of your new, soon to be debt free lifestyle.

2. Clearly Defined Goals

Having a goal of learning how to become debt free on a low income and getting rid of debt is not enough.

You need to define it so you know exactly what steps you need to take.

And it needs to be realistic!

If you have only £3000 spare each year to throw at your debt then there is no point having a financial goal to pay off £5000 each year.

It may be defined but it’s not realistic.

Your goal needs to be SMART (specific, measurable, achievable, realistic, time bound). Create your goal so that you know:

3. Emergency Fund

Real life always gets in the way of a good goal.

You think you have every eventuality covered and then life throws you a curve ball.

Having an emergency fund is key to keeping your goals on track. Ideally you would want around £1000 in your emergency fund.

That should be enough to fix your car, cover an extra bill.

All without your plans falling by the wayside.

It may seem counter intuitive to have your savings in an emergency fund when you are in debt but how else are you going to fix your car or pay that unexpected bill?

Your emergency fund allows you to stop worrying about money, knowing you can cover an emergency.

And yes this is an emergency fund.

It is not a dip into fund when you’re feeling the pinch.

It’s a do not touch fund unless it really is an emergency.

Your new debt free lifestyle depends on you having enough money to cover emergencies.

4. Know Your Why

To be successful in any long term financial plan you need to understand why you are doing it.

It may seem a bit obvious, like doh!

Of course you want to know how to get rid of debt! Doesn’t everyone?

But actually why?

Why do you want to?

Why do you want to become debt free?

Other people have debt and survive.

The Joneses have plenty of debt and ride around in nice cars and have nice holidays.

So you need to dig deep and understand why you want to do this.

When the going gets tough it is your why that will keep you going.

5. Never Give Up

Sticking to a long term plan to get out of debt is hard!

Knowing your why helps but day to day, week to week it’s still hard to pay down your debt.

It’s hard to watch other people seemingly have more money and enjoy themselves.

Thing is, you’ve probably already done that. And this is why you have debt.

Fast forward to becoming debt free and you’ll have more money and be able to make better choices on what to spend it on.

You won’t get into debt again after all your hard work.

You will want to keep your debt free lifestyle and the peace of mind it brings you.

In the mean time, don’t give up.

You may also like:

6. There’s Always An Alternative

We see so much around us through the media, social media and people watching that you can be forgiven for thinking there are many things that are essential and that you are entitled to.

Your essentials are a roof over your head and food in your belly.

Understanding that there are alternatives to most things helps you to focus on your debt.

Kids can make their own entertainment, have play dates. Free to view TV can be good enough.

I know you won’t be able to watch Game of Thrones but what did you do before GoT became a thing?

7. Visual Reassurance

When you have debt that’s going to take time to pay off, having a way of actually seeing it go down can be really motivating.

Looking at numbers on your credit card statement or a spreadsheet doesn’t always make it feel real.

Try creating a debt pay off chart, maybe in the shape of a thermometer and color it in each week/month to show your progress.

Initially it will be a little bare but it will soon get colorful.

8. Celebrate Your Wins

Do not think that you cannot have any celebratory events whilst you are pursuing debt free status.

It’s really important to celebrate small wins as they happen.

Paid off your 1 st debt in full? Celebrate it.

Paid off your 1 st £1000? Celebrate it.

What I don’t mean by celebrating is to splash the cash.

Your celebration may be having a cuppa with your other half and congratulating each other.

It could be spending a fiver on a bottle of wine, all within your budget of course.

Celebrating your achievements keeps you motivated and on track with your goals.

9. Get Cash For Your Stuff

I think it’s probably rare that a true minimalist seeks out debt help. Many people’s debt comes from buying stuff.

If that is you then why not sell some of your stuff to make a little extra money? That money can be thrown at your debt to pay it off faster.

You can sell stuff online, at a garage sale or via Facebook. Every penny helps!

For more inspiration on how to declutter have a read of these posts:

10. Snowball Or Avalanche?

There are two popular methods to paying off your debt. Both work but for slightly different reasons.

They are similar in that you pay the minimum payments on all your debt except one which you focus on until it’s cleared.

Debt Snowball Method

This method was made popular by Dave Ramsey.

You focus your payments on the smallest balance first, regardless of the interest rate.

The idea behind it is that actually paying off in full one or more of your debts will keep you motivated and keep you on track to become debt free.

Once you have paid off one debt you thrown all your extra cash at the next smallest.

You only pay the minimum payments on all other debts regardless of size and interest rate.

Avalanche Method

With this method you pay your debts in the priority of highest interest rate first.

This makes mathematical sense as you should pay less interest overall.

However, overall it would seem there is little difference in which method you choose.

Both methods will get your debt paid off and there isn’t much difference in the cost and timing. See this great explanation

The most important thing is you plan how to get out of debt.

Use the snowball method, the avalanche method or another and stick to that plan throughout.

In the UK and no doubt the US and Canada, there are government debt help schemes available to support you if you need help getting out of debt.

Debt Camel is a good starting place for information on government debt help schemes in the UK and other fee free organisations that will provide you with debt help. For free.

You may also like:

11. Revisit Your Student Loans

In America you can end up with huge loans. These obviously can take years to pay off.

However there are various ways to re-finance them, get the interest rate reduced or even get loan forgiveness if you are in the right vocation.

In the UK your student loan is more like a graduate tax. The more you earn the more your repay.

Unless you earn a very decent wage and this is going to rapidly increase in the next few years it doesn’t make sense to pay off your student loan early.

The Institute of Fiscal Studies estimates that 83% of graduates with English loans will not pay off this debt within the 30 year period.

If you are in that 83% it therefore doesn’t make financial sense to throw more money at a debt you won’t finish repaying.

12. Utilize 0% Credit Cards

If your credit worthiness is not shot to pieces then using a 0% credit card can really make a difference to paying down your debt.

Transfer your high interest balance credit card to a 0% and you can have up to 24 or more months to pay that debt off interest free.

But you absolutely must not spend on that card. You are aiming to become debt free so no credit card spending.

13. Get Rid Of Mobile Phone High Price Plan

Mobile phone plans vary enormously in cost. In the UK you can get sim only deals from as little as £8 a month.

Keep your old phone, don’t upgrade and switch to a sim only deal.

There are so many places these days with free WiFi that you don’t need a huge amount of data included in your plan.

Just make sure you don’t use public WiFi when accessing your bank apps and the like.

14. Car Insurance

I am always surprised at the number of people who auto renew their car insurance.

The difference in insurance quotes can be hundreds of pounds.

Always shop around each year and get yourself the best deal.

Once you have your debt plan under control and working, make sure you pay for your car insurance annually.

Almost all insurers these days charge you interest if you pay monthly.

15. Become A Coupon King/Queen

Coupons can be great to reduce the cost of your grocery and household shopping.

In America it’s big business and there are still good savings to be made here in the UK.

Coupon clipping, searching out good deals and learning to stack them does take time.

But if you are in debt then you are likely to have more time than money.

16. Sweat The Small Stuff

My Grandma always said “Look after the pennies and the pounds look after themselves”.

Your Granny probably did too.

Every penny counts so track all your spending and concentrate on saving every penny.

I recently had a money focus month to get back to sweating the small stuff. It’s very easy to stop doing this

Check the price per kg. Sometimes a big box of cereal can work out more expensive than 2 small boxes.

Choose a smaller supermarket or a cheaper one to shop in.

I switched to Lidl for this reason. There is enough choice but not too much and the prices are cheaper. Aldi is similar.

17. Stop Using Credit Cards

Credit cards can make your spending money seem invisible.

You don’t know how much you’ve spent until the monthly statement lands in your inbox or on your doormat.

I know you can use cashback credit cards or those that have rewards. But guess what?

You are in debt and have not been managing your money that great recently.

Stop using the credit cards full stop. Use only your debit card and cash. Make sure all your spending is highly visible.

18. Plan Your Expenses

You need to know what your expenses are each month and plan these.

You need to plan how much you intend to spend on lunches for work (don’t! – take a packed lunch instead).

You need to plan how much money you intend to spend on clothes for the family and stick to this plan.

Knowing what your expenses are and your plans will help you keep to your debt goals.

19. Track Where Your Money Goes

Having a plan for all your money is great. But how do you know whether you have stuck to your plan?

If you planned to spend £300 on groceries, how do you know if you did or didn’t? You need to track all your spending.

Knowing what you are actually spending versus what you planned to spend is key to understanding your money habits.

Your plans may have been too generous or not realistic enough.

If you want to use an App to track your debt and help you pay it off quickly then MoneyBliss’ post Best Debt Apps To Payoff Debt is just the thing for you.

20. Stop Following The Joneses – They’re In Debt Too!

The Joneses are in debt. They are living beyond their means. Don’t try and keep up with the Joneses.

Don’t look at what other people have got and what they are spending their money on.

In the UK we are very bad at having money discussions.

Heck, we don’t always get to know what our colleagues at work earn as you aren’t allowed to discuss salaries in some companies.

Other people may earn more than you, they may have debt, they may be a coupon king.

You don’t know their money life so don’t look on the outside and presume all is well on the inside.

21. Be Happy With What You’ve Already Got

Marketing companies have a lot to answer for.

We are constantly bombarded with the next best thing, which replaces the last best thing that only came out last year.

Be happy with what you have already bought. You obviously liked it so keep it.

Don’t watch adverts if you get new thing envy.

If your TV works, you don’t need a new one.

Your neighbor might have just got a 60” plasma screen TV but you don’t need one!

There might be a new exercise tracker out on the market, you don’t need it.

Be happy with what you have, enjoy them and save your money.

22. (BONUS) Best Things In Life Are Free

It may be a little corny but it’s true. A cuddle with a loved one is the best thing in life when you are feeling tired.

Your friends and relationships are priceless and free. Make the most of them.

Enjoy spending time with your friends.

Crunching your way through the leaves in your local wood on an lovely autumn day gives you a sense of peace and tranquility.

Sitting outside with a cuppa and listening to the birds sing whilst you breathe in fresh air is priceless.

Search out the free things that make your heart sing.

How To Become Debt Free

Some of these are quick to do and one off’s. Some are about changing habits and the way you view your finances and life in general.

You may find some really easy and others not so.

When setting your goal to get out of debt you need to recognize that you can control a huge amount of what happens and how it happens.

You may have to make difficult choices in order to become debt free.

But you can do it as long as you take control and see it through to the end.

Wish me luck in getting my friend signed up to all of these!

Follow me on Pinterest for more money saving hacks and financial tips!

Last Updated on 14th July 2020 by Emma

About Emma

I’m here to help you become confident in making the best money decisions for you and your family. Frugal living has changed my life, let me help you change yours.

20 thoughts on “A Debt Story And 21 Things You Can Do To Become Debt Free”

Nice post. 20 is the best. “Stop following the Joneses – they’re in debt too!”. I don’t agree with 17 though. I can’t remember the last time I held cash, all I use is my credit card. Attached to an automatic budgeting software that updates me on how my expenses for each category is going. I find cash more invisible, because I lose track of where it has gone.

I use my credit card exclusively too but you and I probably have a good handle on our finances. I know too many people who don’t manage their money well and their credit cards are always part of their downfall. Logically credit cards are great, get cashback, don’t fritter/lose the cash, but in reality those who struggle with their money often lose the sense of what has been spent via a credit card.

I know what you mean about cash! We went on holiday recently and I cannot account for £50! Because I didn’t track it there and then nor get receipts. That’s why I track the cash withdrawn rather than spent.

Her life has been difficult from an early age and she has not had good role models in her life to steer her in the right direction. Reply

Hi MERJ, you’re less a cautionary tale more just look how big student loans can get! I obviously have a UK perspective so we currently think £50k is huge but in the US I know loans can be so much more even if you aren’t a big spender.

My friend initiated the call for help in that as we were reconnecting we were bringing each other up to date with lives and kids. The fact that her elder child is working full time AND NOT PAYING ANY KEEP kinda jumped out at me. Because of my background I asked a few pertinent questions which snowballed with answers and she then reached out and said – can you help me? I’m not an expert but I am at least fairly organised so figured I can’t make things worse and 2 heads are better than one. She does at least have family around her now who can support her and do which is great to see.

Crunching on ice on a hot daily sounds fab, something you can do wherever you are. On holiday last week and it was HOT, dipping my toes into various lakes and streams was heaven!

It’s great that you are in a position to help her and she is lucky to have you on board. It sounds like you are really good at organising and directing – have you thought about doing more of this when you are FIRE’d?

I’m on the fence with the student loans. I know that in the UK MSE has also been outspoken about not paying these off early because you may never earn enough to have to. But something in me thinks that is really demotivating and graduates should be motivated to get to be amongst the top earners. Maybe that sounds really shallow – I don’t mean it to be. But what’s the point of saddling yourself with all that debt if you are never going to rise above average salaries? Thirty years is a long time to having an additional “tax” – even if ultimately some of it gets written off.

I agree with your simple life philosophy and that the best things are free. I think that’s something that’s easier to appreciate with age. I did have a fair few years of being spendy but I get far more satisfaction now from being simple.

I can see myself doing some form of voluntary work once I have taken time out and moved to the Lake District. I was a trustee up until last year but got frustrated at not having enough time to devote to the charity as it really needed an overhaul with some seriously antiquated ways of working. Started to stress me out so made the hard decision to walk away.

I’ve always been worried about student loans and don’t like the idea of that debt hanging around. However DD2 is hoping to move into the performing arts industry and she is very articulate about unlikely to ever earn £21k never mind £25k in that field. Can’t get a job without at least a degree as it’s the level of training required to move into the professional roles she’s aiming for. So listening to her and her friends has made me re-evaluate somewhat. Their generation just do not see debt in the same way those of over 40 do. Is that a good thing or bad?

It’s always eye-opening to find out that people who seem to be doing ok from the outside are actually struggling massively. It’s good that you’re helping your friend work through this – it seems mainstream advice hasn’t been doing her any favours. My only debt is my student loan – I agree most students should treat it as a tax, but it depends on when they started uni. My loan will only get written off at 65, so the thought of having it hang over me for that long, and knowing I’ll likely have to pay all of it off anyway got me fired up to get rid of it as fast as possible.

Isn’t it frustrating how the government keep changing the student loan rules? I don’t blame you for wanting it gone before 65. I think DD1 is in same position as you so she is aiming to get rid at some point as well. You’ve done really well to only have the as your debt – although living abroad for 8 years will have helped I expect! Are you required to still pay when abroad or are your payments voluntary?

Yes I’ve still got to pay monthly, and for some reason my monthly contribution is much higher than if I was earning the equivalent salary in the UK! They have different calculations for different countries, the logic of which I have no clue…

Gosh that’s a bit harsh on one level. Given you are intent on paying it off and saving money being in a low cost country it works well for you. Wouldn’t want you to be in Norway or similar trying to pay back the higher loan payments!

Your friend is very fortunate to have you to help her but it’s good that she recognised that she needed help – all too often, people in that situation just do nothing until the bailiffs come calling or the bank to repossess the house.

I’m with @FIREthe9to5 regarding student loans – I think it’s kind of ‘defeatist’ just to say that it will be written off because as she says, that likely to mean you’re never going to aim to get a salary where you will start paying it off. I only had a small student loan when I graduated – the Student Loans Company even back then were incompetent and started deducting from my salary even though I was earning well below the threshold. They didn’t sort it out, I didn’t chase them up and eventually just overpaid to get rid of it as I didn’t want to deal with them any more!

“She works in credit control and knows about debt chasing yet had managed to bury her head in the sand as regards to her own finances.”

Err, that would be me in my late 20s/early 30s, haha!

And finally, I know you say you need to improve the ‘financial relationship’ with DD2 but I’m afraid “hoping to move into the performing arts industry” just sounds to me that you will be her ‘bank of mum and dad’ for quite a while!

Now I never would have thought that was you 10/20 years ago. Just shows you how far you have come. Kudos for overpaying your student loan even if it was initiated by not chasing down the SLC. Not sure how far you would have got even if you had chased them down.

I’ll be honest, what DD2 says and subsequently does can be 2 different things. She can be very quick to dismiss things (not going to pay off her loan) but I think it’s more a defense mechanism so she doesn’t add it to her mental baggage. Time will tell. And yeah, performing arts industry smacks of low pay and intermittent work doesn’t it? FIREing early on a leanFIRE budget will reduce that significantly if only because I won’t have the safety net of my salary. Once I finish work I fully intend to be very open about our finances as part of her education I plan to provide her. Whether she likes it or not!

And my friend have numerous baliff letters in among her paperwork. They just hadn’t got as far as knocking on her door! Am seeing her next week. Fingers crossed she’s done her homework.

Yeah, I have come a long way since those days! I used a combination of the avalanche method (not that I knew there was any other method!) and 0% credit cards – juggled this (and a strict budget) for around 4 years – there were no PF blogs back then to help me with hints on how to save and get out of debt quickly. Still I got there in the end!

Fantastic stuff! And 4 years is a long, hard slog. Especially without recourse to PF blogs that these days I hope provide some support and inspiration to others facing up to their debts. 0% cards really can help as long as you are disciplined enough to use them only to hold your debt and pay it down aggressively. Congrats on being debt free for so long and now part way to FIRE!

great to hear you are making sure you pay as little interest as possible. Keep the money in your pocket. Paying yourself first is really important, for your peace of mind and your stress levels.

Great post. I used to be just like your friend but I didn’t have a tuppenny to bail me out. she’s very lucky!

We are now debt free and are embarking on our “mortgage free in five years” plan. It’s ambitious but..we can do it.

Hi Anna! I love your ambitious mortgage free plan. Getting yourselves debt free will have been the hardest thing to do so I have every faith that you will achieve that goal – go for it! Thanks for stopping by.

We’re really trying to get out of debt and and sort out all our finances.

Hi Diane. I feel for you, getting out of debt is difficult as not only do you have debts to pay, you need to change your spending habits as well. Hopefully you’ve picked up some tips from this post. If you haven’t already then these two posts might also help? https://tuppennysfireplace.com/stop-living-paycheck-to-paycheck/ and https://tuppennysfireplace.com/how-to-love-living-within-your-means/ Thanks for stopping by!

Leave a comment Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Hey there!

I’m Emma and I’m a frugal loving, money saving girl at heart. I’ve spent my life saving tuppence (cents) at a time. It’s my mission to help you win at saving money and love the freedom that being frugal gives you.

How To Become Debt Free

Here’s the easiest quiz you’ll ever take: Would you like to sleep better, have a happy marriage, improve your health, have more confidence and be able to help your family and friends?

If you answered no, please see the nearest psychiatrist. The obvious answer is yes, though it leads directly to the biggest question of all: How do you get all that? Get out of credit card debt.

This is where a lot of people roll their eyes and go, “Sure, easy for you to say.” Nobody is saying it’s easy, but instead of rolling their eyes, millions of people have rolled up their sleeves and escaped the financial prison that is debt.

Their reward was a better, easier, more satisfying life. No, money can’t buy happiness, but lack of money often causes the opposite of all the desirable things listed in our opening quiz.

Call it Debt Depression. You turn blue worrying that your paycheck won’t be deposited in time to cover your electricity bill payment, or your car is making funny and expensive-sounding noises, but you’re afraid to take it in because you can’t handle any more bills.

A study by the American Psychological Association found that 72% of adults feel stressed about money, and 22% said they experience extreme stress.

Money problems cause 22% of divorces, according to a study by the Institute for Divorce Financial Analysts. In real terms, that means about 180,000 couples split up every year over money woes.

Majority of Americans Live In Debt

The personal savings rate in the U.S. is a paltry 5.1%, and 31% of Americans aren’t putting anything away for retirement.

But never mind all those depressing numbers. The main takeaway is high debt and low saving is a recipe for unhappiness, unless the thought of spending your Golden Years bagging groceries puts a smile on your face.

Hopefully you’re motivated by other things, like stability, marital bliss and giving your kids a good education. And we haven’t even mentioned having the ability to do what you want with your life.

Who hasn’t dreamed of pulling a Johnny Paycheck and telling their boss, “Take this job and shove it!”? We don’t necessarily recommend that as a vocational strategy, but how nice would it be not suffer a panic attack over the prospect of losing your job?

Want vs Need

Sometimes it can be difficult to tell the difference between a want and a need brought to you by Money Minute.

The Secret To Getting Out Of Debt

The secret to getting out of debt is no big secret – make more than you spend.

It sounds simple, yet you might as well be speaking Swahili to some people. Fortunately, millions of people have learned the language of debt eradication. The traits they generally share can act as a blueprint for the rest of us.

They’re not materialistic. They won’t buy a new BMW when a good used Honda is sitting next to it on the sales lot.

They’re detail oriented. They work off a budget so it’s easy to track their income and bills and know where every dime goes.

They’re secure and self-reliant. Their self-worth isn’t based on impressing people with their possessions or the size of the mortgage.

They have common sense and foresight. You don’t need an Ivy League diploma to get out of debt, but you need to appreciate how money works. For example, compound interest is your enemy when you owe money. It’s your friend when you’re saving money.

They have patience, perseverance and a plan. It might take a few years to dig out of debt, but they are willing to stick to the program. The problem is simply getting a program.

There are plenty of debt management companies that will assess your financial situation and help devise a budget. They provide credit counseling that educates you about the root causes of debt and will show you a way to dig yourself out.

Again, nobody’s saying it will be easy, but go back to our opening quiz and think of the payoff. That should be enough to make you sing, “Take this debt and shove it.”

How to Become Debt-Free in 5 Simple Steps

Becoming debt-free is an important goal and a significant financial milestone. To some, it might feel out of reach, and to others it might be just around the corner. In some cases, becoming free of credit card debt is the primary goal, and in other cases it’s medical bills, a car payment, or a mortgage. At Clearpoint, we want you to rid yourself of bad debt (like credit cards) and also pay off your mortgage, vehicles, and any other debts in your name. That would really be a debt-free lifestyle, and it’s our hope for everyone. Let’s take a look at how to become debt-free in five simple steps.

Step One: Evaluate your Debt

You may have heard of the terms “good” debt and “bad” debt. This idea is a little controversial, and some conservative financial planners and commentators suggest that no debt is “good.” But in reality, some debt is much less dangerous than others and some is nearly impossible to avoid in the short-term.

When we think of bad debt, we think of high-interest rates. These can wreck a budget quickly because they take original purchases and make them much more expensive over time. Credit card debt is known for brutal interest rates, and right now the average APR is about 15 percent. Of course, payday loans are probably one of the worst with APRs of over 300 percent. Just as a quick refresher, here’s a look at how lower interest rates cost much less than their high-interest counterparts:

| Account | Balance | Interest Rate | Interest Paid after One Year |

|---|---|---|---|

| Credit Card | $15,000 | 15% | $1,723 |

| Personal Loan | $15,000 | 7% | $1,016 |

When we speak of good debt, we are talking about low interest debt that serves a real purpose and need. Often, credit cards debt only serves one purpose—to fulfill a “want.” For instance, when you go on a shopping spree with credit, you are getting things you want, not things you need. Of course, there are some exceptions to this. Sometimes, people run into credit card debt to pay for medical bills, or other important expenses, and credit feels like the only option.

On the other hand, good debt fulfills needs and does so in a safe manner. A mortgage, for example, provides a home (shelter is a “need”) and often does so at reasonable interest rates. In many cases, taking on this debt can be cheaper in the long-run than other “debt-free” options, such as renting.

A car payment is similar in the sense that it provides something useful, such as a form of transportation to work every day. And if you have good credit, the rates on auto loans can be pretty good. But most financial experts wouldn’t really classify a car payment as “good” debt, because the price is low enough to the point that you are probably better off saving your money and purchasing vehicles with cash. It’s much less feasible to buy a home with cash.

Repaying good debt doesn’t always have to be rushed. There are several cases where it makes more sense to save for retirement or meet other financial obligations instead of paying off “good” low-interest debt in advance.

Either way, the first step to becoming debt-free is simply to determine how much good debt and how much bad debt you have. Once you figure this out, you will have a better sense of how to prioritize. And, of course, bad debt will be your focus. After you figure out how much debt you have, you need to calculate how much of your income is being devoted to these debt obligations. This will help you assess how dire your situation really is, and can help determine if your level of debt is really manageable.

*Note: Really, a debt-to-income ratio should be based on monthly income and debt payment figures. Learn more about monthly-debt-to-income ratios.

To do this, you need to know your debt-to-income ratio. A debt-to-income ratio or dti is a tool used by lenders to determine the level of risk a borrower presents, but it’s useful for all of us. To calculate it, you simply divide your debt by your income and then convert the decimal into a percentage. You can use this calculator to figure your dti conveniently.

At a minimum, we recommend that your debt-to-income ratio stay below twenty percent for non-mortgage debt. Really, though, it’s ideal to stay at 15 percent and below. Once you incorporate a mortgage into the figure, financial advisors recommend keeping your total debt-to-income ratio at or below 43 percent. Sometimes, you will hear this referred to as the back-end ratio.

Step Two: Select a Repayment Approach

The next step to becoming debt-free is to select a repayment method. Your choice will be based on the type of debt you have, along with the status of your debt-to-income ratio. If your dti is over twenty percent, we recommend that you seek credit counseling as your initial repayment strategy. During a credit counseling session, your counselor will do a thorough review of your situation and help identify strategies to spend less.

If you and your counselor are able to come up with sufficient ways to cut spending and build a monthly cushion, you might be okay to select a self-pay method for your debt. If not, and your situation continues to be difficult due to high interest credit cards, a debt management program might be the better option. This repayment method is structured, and often comes with unique benefits such as lowered interest rates, which can save you thousands during your repayment.

If your debt level is more manageable but you are still dealing with multiple, non-mortgage debts, you will want to choose a self-pay method. The two methods we recommend are the ladder method and the debt snowball. The ladder method prioritizes the high-interest accounts and saves you the most money over time, while the snowball focuses on the smallest balances and creates the most immediate reward as you close accounts. We encourage you to check out our guides on the ladder method and debt snowball, as they can be extremely helpful in your debt-free journey.

Step Three: Get Organized

When you set up your repayment plan, you need to stay organized in various ways.

First comes the physical organization. You will need to create a space to keep your mail, bills, and other financial documents. To prevent headache and frustration, you will want to organize these in files and folders for various categories, such as insurance, utility bills, bills from creditors, and so on. You will want to keep a calculator handy too and develop a routine filing system. Doing this can also help ensure that you don’t overlook bills or forget about some of your past financial obligations. And, believe it or not, this doesn’t have to be boring. Check out two of our favorite designs we found on Pinterest.

We love how neat and tidy this home office space is. Something like this could work well even in an apartment or other small space. For the record, it’s totally cool if you just have one trashcan.

This area makes great use of wall space and the folders are great for holding bills of different types. The fact that they are see-through also makes them a little more approachable and could cut down on some of the frustration when you need to go looking and digging for something in particular.

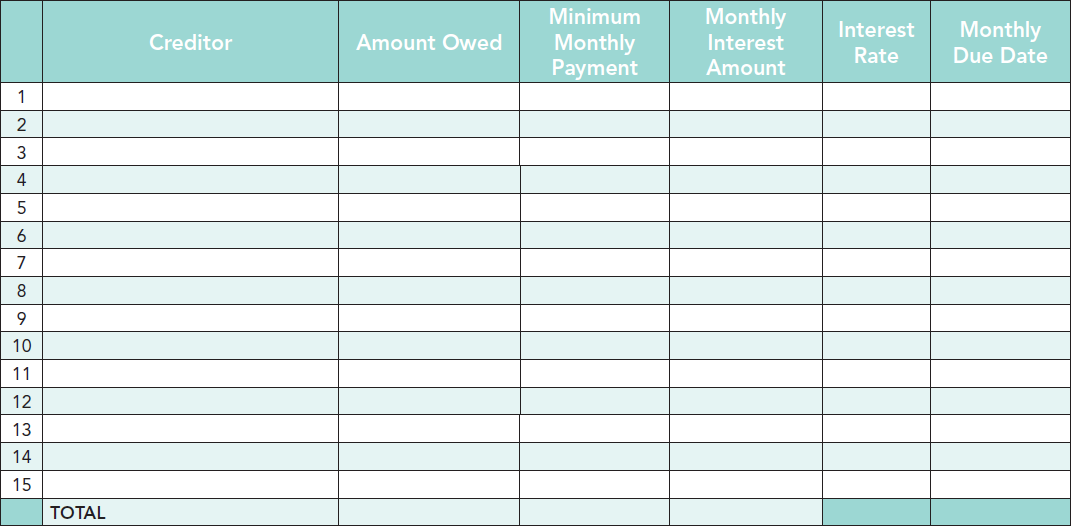

Secondly, you will want to organize your debts into some sort of visual representation that shows your strategy. We recommend this debt payoff table, and if you really want to stay organized use the Excel version:

This is important for two reasons. First, it allows you to put all of your important information in one place. Having interest rates, minimum payments, and total balances altogether will be an important first step in setting up either the ladder or snowball repayment plans. As you adjust the numbers each month, it will also help you see your progress.

The second reason why this is important is actually rather simple—it will give you a visual representation of where you stand. We all look at things differently and find motivation from different sources. For some, having a constant visual reminder could be an extremely important part of your repayment. You can monitor your progress each month, print out the table and put it on your refrigerator, etc. You want to soak up as much encouragement and positive energy as possible on your path to becoming debt-free.

Step Four: Communicate

Communication sounds “abstract” but it’s actually one of the most important steps on the road to becoming debt-free. If you have a family or partner, you need to realize that your journey to becoming debt-free will involve them too. While they will probably benefit in the end, they might not be ready for the changes coming to your lifestyle.

For instance, maybe your kids are used to going out to eat multiple times each week, but you have decided to cut that cost as part of your strategy. You will need to communicate the new expectations.

Also, dealing with a spouse or partner is its own unique challenge. You will need to work together to determine each other’s financial strengths and weaknesses. You will also want to avoid conflict and disagreement, so make the debt-free goal and journey something you can share.

It’s not only your family that needs your communication. You also will want to stay in close contact with your creditors during this time. If you experience any drastic change to your financial situation, such as a job loss, reduced income, relocation, serious injury, etc. you need to explain this to your creditor immediately. Doing so could allow you to modify your repayment terms temporarily, so that your credit doesn’t take a hit. There are hardship programs, workout options, and other such possibilities for consumers facing these types of situations. The key is to communicate, because unless you speak up you will be expected to pay in full and on time. And, failure to do so will put you in risk of being reported to the credit bureaus.

Step Five: Form New Habits

You don’t want “debt-free” to be a temporary label. Instead, you want it to be a new lifestyle that you carry into the future. For this to work, you need to make sure that the principles you use to pay off your debt aren’t just quick fixes. It’s a lot like studying for a test in school. If you just cram, you might get an A on the quiz, but when you need to answer questions about the topic in a few weeks, you will be clueless.

As you are repaying your debt, you will want to really involve yourself in the spirit behind what you are doing. Take a close look and spend a lot of time thinking about the way your money flows in and out each month, and look for consistent ways to save. You need to create a routine and habits that you can implement on a daily basis. You will also need to reward yourself for your hard work along the way to the point that even rewards can become routine. By taking this approach, you will form lasting habits that you enjoy and you will become even more involved in living a life of financial stability. This is not just the key to becoming debt-free. It’s the key to staying debt-free.

Whether you have significant credit card debt or just a house payment, we hope you can put these simple strategies to work for you. Every day, we help clients create plans for their debt, and we are proud to say that many of them go on to live successful, debt-free lives. We know you can do it too. Best of luck, and please don’t hesitate to get started with credit counseling, if you are struggling with your current level of debt.

Thomas Bright is a longstanding Clearpoint blogger and student loan repayment aficionado who hopes that his writing can simplify complex subjects. When he’s not writing, you’ll find him hiking, running or reading philosophy. You can follow him on Twitter.

Ready to become debt-free?

Our program can help. We offer expert counselors and unique benefits.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-519517731-58e990d73df78c516254d8ce.jpg)

:max_bytes(150000):strip_icc()/_MG_7718a-AnthonyBattle-d80902bb5d3f42cbbdb6c6d07dc5da3e.jpg)

:max_bytes(150000):strip_icc()/DavidRubinBio-08b0dfb58313406bb83c4415015f41b3.jpeg)