How to invest money

How to invest money

The Safest Way to Invest Money & Tips on How to Do So

Have you been sitting on your savings for too long? If so, you might be exploring different ways to invest your money.

Instead of letting your funds depreciate in the bank, consider allocating it in asset classes that can help you grow your wealth. This is by far the best way to use your money in a market full of opportunities.

In this article, we will show you the safest ways to invest money and give some useful tips on building investment portfolio. So keep on reading.

Topics we’ll cover

What’s considered a safe investment?

Everyone thinks there is a secret to investing. They keep looking for a risk-free, high yielding opportunity. It’s very difficult to point out investments of that sort. The economy is unpredictable, and so are all markets.

That being said, there are several options that are seen as low-risk investments. These include several different categories, from high-yielding saving accounts to real estate. We will analyze each category further in the following chapters.

But first things first. In order to discover safe investment opportunities, you will need to ensure that they have the following characteristics:

What is the golden rule of investing

Now that you have a better idea of the background, it’s time to talk about the actual investment process.

In this chapter, we will be pointing out our favorite tips on building an investment portfolio. You will see these “unspoken rules” being mentioned by most successful investors, whether in interviews or in books.

Take a moment to read through them and let them guide you at the beginning of your investment journey.

Invest as early as possible

This one is obviously very hard to do, especially for those with no skin in the game. It can also be seen as recklessness unless you are well-versed in a given industry. Investing in a company at a very early stage can be a rewarding opportunity if you know what you’re doing.

While these returns are uncommon they are not rare. The plethora of examples has made startup investing a career path, with many successful entrepreneurs turning to it after successfully selling their companies.

Early-stage investing is a pretty smart move to consider, especially for those that have a genuine interest in a particular industry and its outlook in the future. Some of the options you can use to invest new companies include the following platforms:

Take calculated risks based on logic – not emotions

What makes a particular asset worth investing in? If your answer is branding, marketing, and future promises, then you are thinking with your emotions. In this case, it might be better to hold onto your money for a little longer.

Every time you look into new investment options, start by checking (historical) data. How has this option performed in the past? How is the current outlook of the market? What does the market tell us about future demand? All these are good questions to ask yourself when you find an investment that seems interesting.

But logic-based investing doesn’t stop there. You will need to base all your investment decisions on logic and avoid falling into emotional reactions. To do this, you can start observing your feelings and understand what causes particular patterns of behavior.

Don’t invest money you can’t afford to lose

This is very important and ties perfectly with the previous two rules. In order to remain emotionally detached from your investments, you will need to invest an amount that you would feel comfortable losing.

Invest more and you will probably start worrying a little too much. And worry may lead to impulsive decisions. While there are many safe investment options, there will always be risks.

Research before investing

Understanding what you are getting yourself into is very important. This is true for all investment options. In most cases, you don’t want to trust your overly confident friend or a lucky family member. The markets are dynamic, which means that what works today may not necessarily work tomorrow.

To start with, you should select and research a particular asset class. Explore its past performance and see how it reacted to financial downturns. Keep an objective viewpoint and don’t become selective with your research. The more you know, the more confident you will feel with your final decision.

Diversify your portfolio

It is no surprise that most successful investors have a high degree of luck. The majority built their wealth in one industry – maybe even through a single investment.

But that’s not how their wealth is preserved. This happens by spreading your funds in different asset classes.

The safest way to invest money and protect your wealth is through diversification. Explore all the different options available and, based on your risk tolerance, asses the structure you want to follow.

Ideally, you’d want to invest the majority of your funds in low-risk, low-return investments, such as high-yielding savings accounts or real estate.

Then, use only a small amount of your money to invest in high-risk, high-return assets. If the latest end up performing well, they will grow into a significant % of your portfolio.

We have previously written on the importance of diversification and gave several examples of the types of investments you can make.

Building an investment portfolio from scratch

So, how do you build an investment portfolio? There are several steps you need to follow in order to understand what kind of structure works best for you and start investing.

Step 1: Planning your investment strategy

The first thing you need to do in order to build your portfolio is to assess the amount you are able to invest and your long-term goals.

Other basic considerations include how long you plan to allocate your money and how tolerant you are to risk. Are you able to remove your emotions from the decision making process? Are you prepared to be patient for several years? If not, you might reconsider your choice to invest.

Step 2: Determine which asset classes you want to invest in

There are several ways to divide your capital between different investment options. Once again, these will be determined to your risk tolerance and knowledge of the industry.

Another point to keep in mind is the different portfolio structures you can choose to adopt. The more aggressive you choose to go, the higher your potential rewards will be. Here are some basic structures you can choose to follow:

As you can see, the more aggressive your portfolio becomes, the higher the risk of putting your funds in danger.

Step 3: Analyze and rebalance periodically

A review of your investments is always a good thing to do. However, it doesn’t stop there – you will most likely need to make adjustments on an occasional basis. Once you create a portfolio, you might be following a split that looks like this:

Now, imagine what happens if your high-risk investment ends up performing extremely well under good market conditions. The amount you invested multiplies and the split now looks as follows:

This is where rebalancing comes in. At this point, you might want to take profits from your high-risk investments and reinvest this amount into safer options. Doing so will help you return to the prior portfolio split you chose to follow.

How to Build an Investment Portfolio

Building an investment portfolio is an excellent way to reduce the risks involved with holding cash and get higher returns than you would if you simply store your savings in the bank.

There are several factors you need to keep in mind when building an effective, low-risk portfolio. This chapter will walk you through each step to help you create a strategy that works for you.

1. Determine how long you plan to hold onto your investments

The first step in any investment portfolio strategy is goal assessment. What do you want to get out of this and how long are you willing to be patient to achieve this?

2. Research the assets you plan to invest in

At this point, you might want to search for high-quality resources to help you better understand the investment journey you are about to undertake. Great options to start your research include:

Keep in mind that the safest way to invest money includes spreading it over a large number of options. So even if you find one asset class to be superior to others, never use all your capital to buy into it. In the following chapters, we will share our favorite asset classes.

3. Invest on your own or ask for professional help

Nowadays, investing is as easy as downloading an app. You no longer need to be an industry insider or extremely wealthy. The following apps are a great starting point for basic investment decisions:

However, if you are uncertain about your choices, you can always choose to trust a stockbroker or seek investment advice. These services may come at a cost but ensure that you are using the safest way to invest money.

At this point, you (or your broker) will need to spread your money across the different company shares you want to invest in.

4. Followup and research

The companies you invested in will most likely be affected by economic trends, market sentiment, and other variables.

In the previous chapter, we explain how rebalancing your portfolio can hedge risk even more. Don’t simply invest and forget. The market is dynamic. Make sure you stay up to date by reading the news on popular blogs, forums, and Social media.

Then, make logical choices while keeping your emotions in check.

The safest ways to invest money

Let’s make something clear. The safest way to invest money is not the most rewarding one. The return rates will usually be lower than, for example, the stock market, or cryptocurrencies.

That being said, the options we will list below will help you see definitive returns, without taking any further action.

High-Yield Savings Account

These types of accounts are more rewarding than your typical savings account. Y

Certificates of Deposit (CoD)

Certificated of deposit are very similar to high-yield savings accounts. The main difference is that they come with a predetermined “lockup” period.

Money Market Accounts

These accounts provide higher returns than high-yield savings accounts, similar to Certificates of Deposit.

Growth Stock Funds

These funds will spread your money across many different growth stocks. Growth stocks, in this case, are companies that have performed very well long-term. They include FANG stocks and other well-known companies.

S&P500 Index fund

The S&P 500 Index Fund is comprised of the 500 largest American companies.

Wrap-up

If you made it this far you probably understand that the safest way to invest money will not make you rich overnight.

In this article, we explored the following topics:

We hope you have a better idea of what it takes to be a successful investor and invite you to research each asset class more. Having a good understanding of what you’re getting yourself into is very important.

Frequently Asked Questions

Let’s take a look at the most common questions related to safe investing.

1. How much money do you need to start an investment portfolio?

The best way to start investing is to allocate a part of your savings for your portfolio. For example, you could start with as little as 5%-10% of your salary and gradually grow the value of your portfolio over time.

Keep in mind that this number is highly related to the amount of risk you are willing to undertake and the amount of money you have available.

2. What makes a good investment portfolio?

A good investment portfolio is one that has maximized the opportunity for profit in the safest possible way. And to do this, you will need to consider diversification.

This means that you will have to invest in several asset classes, including blue-chip stocks, bonds, index funds, and real estate.

Assuming the amount should be obtained through passive investing while minimizing risk, there are several options to answer this question.

4. What does an investment portfolio look like?

A portfolio is a collection of different investments that have a high potential of preserving and growing one’s wealth. It can contain stocks, bonds, cryptocurrency, real estate, cash, and more.

5. What is a good portfolio return?

The portfolio return, more commonly known as ROI, is dependent on the risk tolerance of the investor. Generally speaking, the higher the risk, the higher the potential rewards.

No risk options such as high-yielding savings accounts can yield anywhere between 2%-2.5% per year. This amount may be small but there is no involvement of the investor for whatsoever.

An annual return of 5.5%-6% per annum is the average for individuals with long-term, low-risk portfolios. These include the structures we described earlier, where a small portion of the investment may be invested in high-risk options.

Experienced investors may raise this number to 8%-10%, while those with tolerance to risk and lots of experience could aim for even higher numbers. For example, cryptocurrency investors often multiply their initial investment multifold by timing the market correctly.

How to Invest Money

First of all, congratulations! Investing your money is the most reliable way to build wealth over time. If you’re a first-time investor, we’re here to help you get started. It’s time to make your money work for you.

Before you put your hard-earned cash into an investment vehicle, you’ll need a basic understanding of how to invest your money the right way. However, there’s no one-size-fits-all answer here. The best way to invest your money is whichever way works best for you. To figure that out, you’ll want to consider your investing style, your budget, and your risk tolerance.

1. Your style

How much time do you want to put into investing your money?

The investing world has two major camps when it comes to the ways to invest money: active investing and passive investing. We believe both styles have merit, as long as you focus on the long term and aren’t just looking for short-term gains. But your lifestyle, budget, risk tolerance, and interests might give you a preference for one type.

Active investing means taking time to research investments yourself and constructing and maintaining your portfolio on your own. If you plan to buy and sell individual stocks through an online broker, you’re planning to be an active investor. To successfully be an active investor, you’ll need three things:

Passive investing

More simplicity, more stability, more predictability

Active investing

More work, more risk, more potential reward

2. Your budget

How much money do you have to invest?

One important step to take before investing is to establish an emergency fund. This is cash set aside in a form that makes it available for quick withdrawal. All investments, whether stocks, mutual funds, or real estate, have some level of risk, and you never want to find yourself forced to divest (or sell) these investments in a time of need. The emergency fund is your safety net to avoid this.

3. Your risk tolerance

How much financial risk are you willing to take?

One good solution for beginners is using a robo-advisor to formulate an investment plan that meets your risk tolerance and financial goals. In a nutshell, a robo-advisor is a service offered by a brokerage that will construct and maintain a portfolio of stock- and bond-based index funds designed to maximize your return potential while keeping your risk level appropriate for your needs.

What should you invest your money in?

Here’s the tough question, and unfortunately there isn’t a perfect answer. The best type of investment depends on your investment goals. But based on the guidelines discussed above, you should be in a far better position to decide what you should invest in.

For example, if you have a relatively high risk tolerance, as well as the time and desire to research individual stocks (and to learn how to do it right), that could be the best way to go. If you have a low risk tolerance but want higher returns than you’d get from a savings account, bond investments (or bond funds) might be more appropriate.

If you’re like most Americans and don’t want to spend hours of your time on your portfolio, putting your money in passive investments like index funds or mutual funds can be the smart choice. And if you really want to take a hands-off approach, a robo-advisor could be right for you.

Related investing topics

How to Invest in Stocks: A Beginner’s Guide for Getting Started

Are you ready to jump into the stock market? We’ve got you.

19 Simple Ways to Invest and Make Money Daily + Fast (2022 Guide)

When it comes to the world of investing, you’re probably looking to make money quickly or save for your future. Sometimes within the same day.

While it can be difficult to find these investments, there are some other options if you want to make money daily.

Whenever investing your money, it’s important to consider the risks involved, especially for some of the more speculative investing strategies. You’ll also want to consider the length of your investments. It’s much more likely that you’ll make money by holding your investments for longer than one day.

In this post, I’ll explore how to invest and make money daily, some of the top compound interest investments, investments to make money fast, and much more. Let’s get started!

What You’ll Learn

How to to Invest and Make Money Daily in 2022

Let’s start by defining what it means to make money every day. To me, this means your investments will either increase in value or provide you with a cash return. But for you, it might mean something slightly different.

Below are some of the best ways to generate daily returns from your investments. There’s sure to be an investment for everyone.

Invest in Crowdfunded Real Estate to Grow Your Money

Investing in real estate can be an excellent way to grow your wealth. But there’s one problem. Many new investors aren’t sure where to get started. It can be overwhelming to purchase a rental property and try to manage it yourself.

That’s why I recommend Fundrise. With this real estate investing platform you can easily start investing in a variety of offerings stress-free.

The way it works is by pooling money together from a large number of investors so the entire fund can purchase a large real estate asset that you wouldn’t normally have access to.

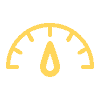

Fundrise has a proven track record of delivering results with an average return greater than 9% annually. For 2021, the returns closed in on a whopping 23%. Talk about a great investment!

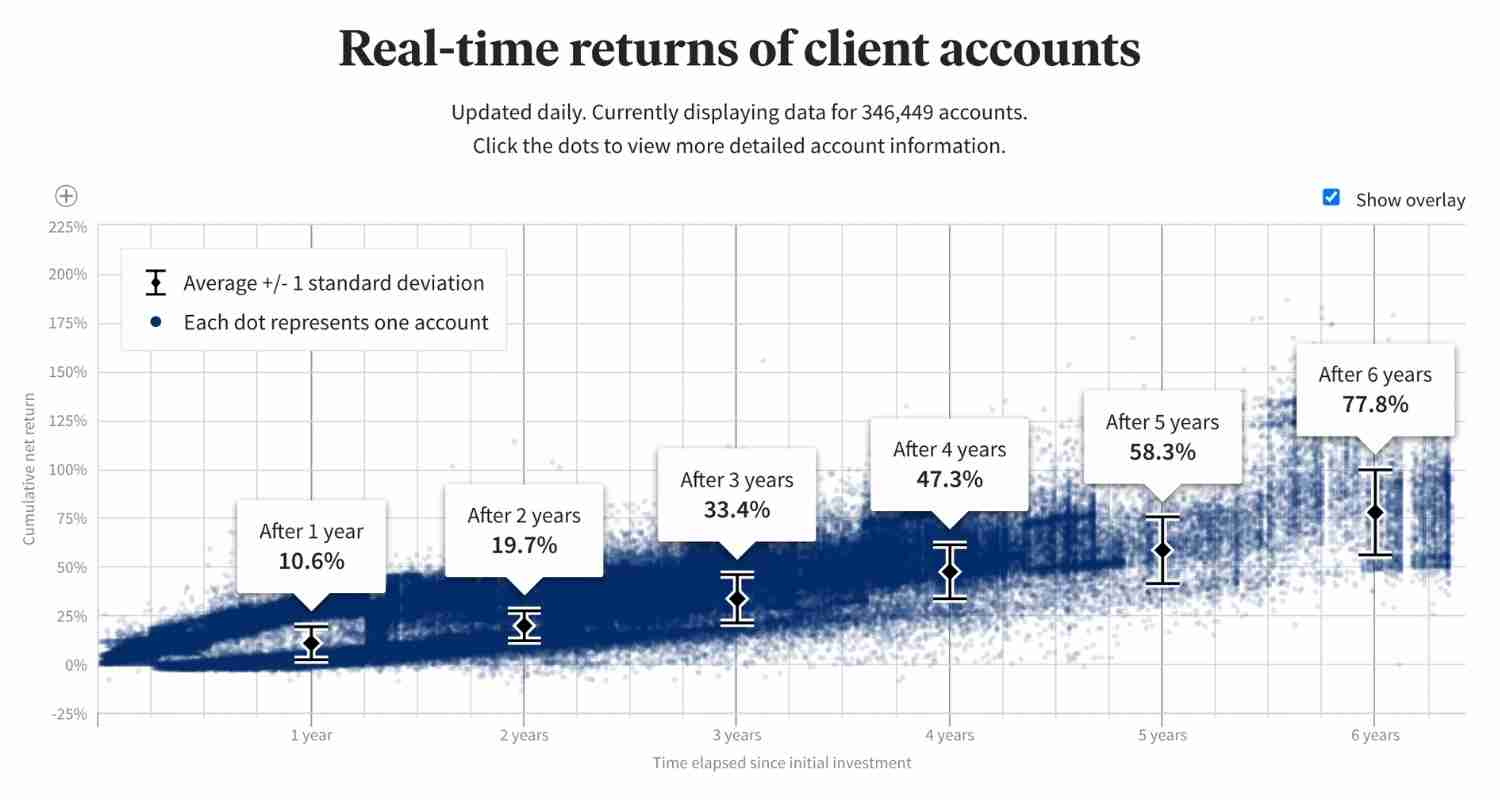

Invest in Real Estate Debts

There are many different ways you can invest in real estate to build wealth, but one of the most overlooked methods is investing in short term real estate debts.

Here’s how it works.

Whenever an investor needs money to complete a project, they might utilize a short term loan.

This is where a platform like Groundfloor comes in.

Groundfloor allows investors to “loan” money for short term real estate projects that typically last for less than 6 months.

The returns are solid, averaging around 10% annually and this can be an excellent option to diversify your investments.

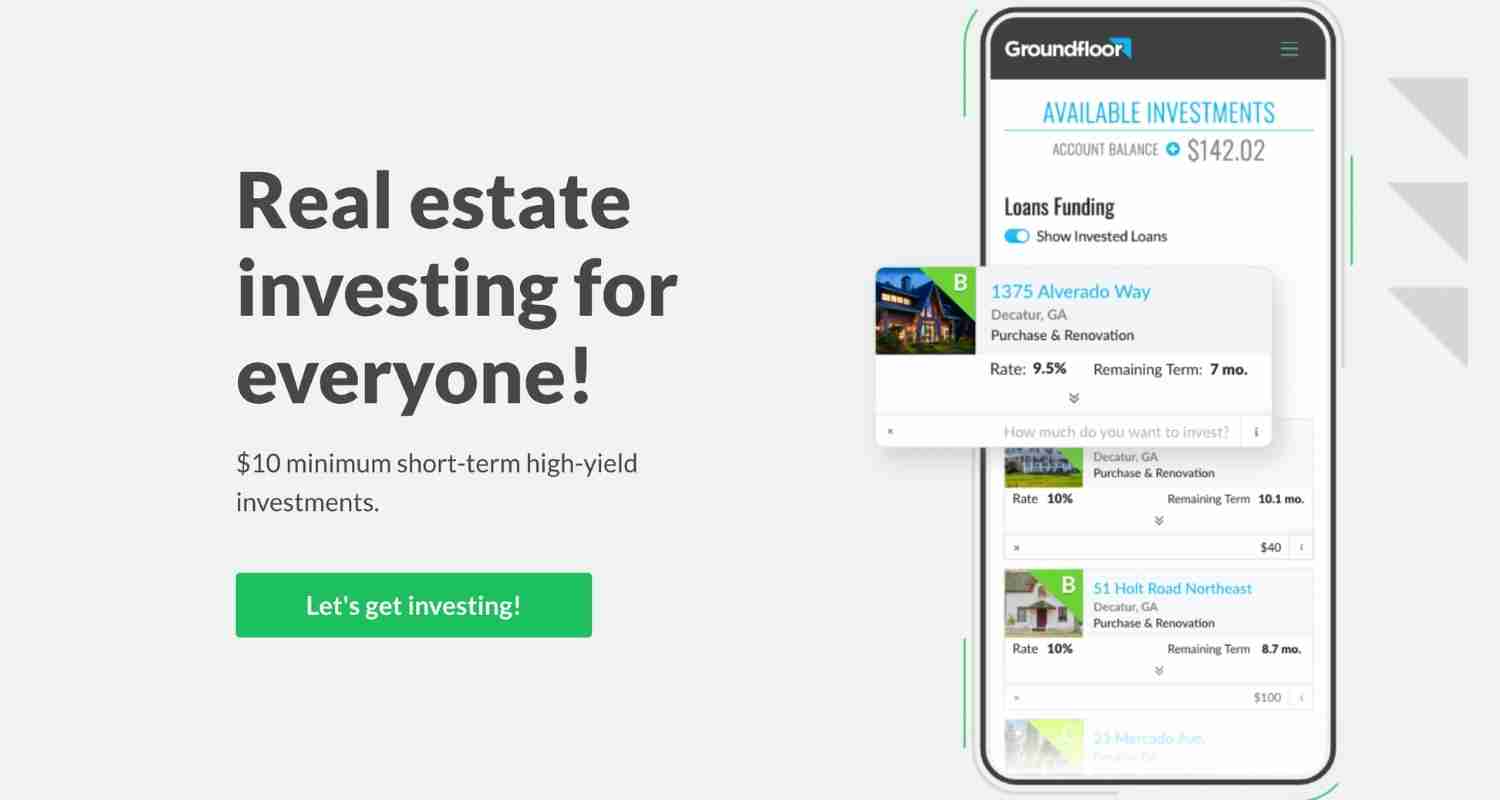

Invest in Commercial Real Estate

Commercial real estate can be another great investing option you can use to reach your financial goals.

By using a platform like Streitwise, you can start investing in commercial properties with just a couple thousand dollars.

One of the big advantages of commercial properties are that they can be more stable than other investments and they can be used to keep your portfolio diversified.

Streitwise has a history of delivering strong returns. They have averaged over 9% annually – which is much stronger than many other investments.

Register below to get started or check out my Fundrise vs Streitwise comparison!

Invest in ETFs, Mutual Funds, and Index Funds

The stock market can be a great way turn your money into more money and generate passive income.

Index funds, or a fund that is meant to follow a broad market like that S&P 500 or Dow Jones Industrial Average, can be a great option to easily invest and keep your portfolio diversified. While your daily returns might not be very large, they will add up over time helping you to make money daily.

How much can you make investing in ETFs, mutual funds, or index funds?

7% return annually on your investment for a well-diversified portfolio. The stock market can be extremely volatile, so you’ll want to ensure you can handle the ups and downs that come along. By holding your investments for longer than 1 year, you’ll have a large chance of accruing positive returns on your money while simultaneously lowering your tax bill if you plan on selling your investments.

Check out the chart below showing the returns of a popular index fund, VOO. You’ll notice some years have returns greater than 30% while others have seen negative returns. This is why it’s important to invest for the long term and avoid trying to time the market.

So what are the differences between the three options?

The main difference between index funds and ETFs are the time in which you can purchase them.

Index funds are always purchased at market close, where ETFs can be purchased live throughout the day. Index funds and ETFs are passively managed and they feature extremely low fees, making them a great way to invest and make money daily.

A mutual fund is different than both ETFs and index funds in that they tend to be more actively managed and have higher fees. Sometimes you can find mutual funds that perform slightly better than an index fund or ETF but in most cases, this is offset by the higher fees.

There are many different investment platforms you can use to open a brokerage account and invest no matter the amount of money you have. If you’re looking to save for the long term, some investors will instead opt to fund their retirement accounts like an IRA or 401k to invest. These accounts will limit the amount of taxes you’ll pay on any profits from your investments.

If you want to invest in the stock market and grow your money, I always recommend Acorns. Here’s why:

What to Invest In

Building wealth underpins the American dream. Whether it’s paying for a kid’s education, securing a comfortable retirement, or attaining life-changing financial independence, what you invest in plays a huge role in your success. It’s not just about picking winning stocks, or stocks vs. bonds, either. It’s truly making appropriate investment decisions based on your goals. Or more specifically, when you will be relying on the proceeds from your investments.

Let’s take a closer look at some of the most popular investment vehicles. They may not all be appropriate for you today, but over time, the best investments for your needs can change. Let’s dig in.

Why stocks are good investments for almost everyone

Almost everyone should own stocks. That’s because stocks have consistently proven the best way for the average person to build wealth over the long term. U.S. stocks have delivered better returns than bonds, savings yields, and gold over the past four decades. Stocks have outperformed most investment classes over almost every 10-year period in the past century.

Why have U.S. stocks proven such great investments? Because as a stockholder, you own a business; as that business gets bigger and more profitable, and as the global economy grows, you own a business that becomes more valuable. In many cases, shareholders also earn a dividend.

We can use the past dozen years as an example. Even across two of the most brutal recessions in history, the SPDR S&P 500 ETF (NYSEMKT:SPY), an excellent proxy for the stock market as a whole, has delivered better returns than gold or bonds:

This is why stocks should make up the foundation for most people’s portfolios. What varies from one person to the next is how much stock makes sense.

For example, someone in their 30s saving for retirement can ride out many decades of market volatility and should own almost entirely stocks. Someone in their 70s should own some stocks for growth; the average 70-something American will live into their 80s, but they should protect assets they’ll need in the next five years by investing bonds and holding cash.

There are two main risks with stocks:

You can limit your risk to the two things above by understanding what your financial goals are.

Managing volatility

If your goals are still years and years in the future, you can hedge against volatility by doing nothing. Even through two of the worst market crashes in history, stocks delivered incredible returns for investors who bought and held.

Avoiding permanent losses

The best way to avoid permanent losses is to own a diversified portfolio, without too much of your wealth concentrated in any one company, industry, or end market. This diversification will help limit your losses to a few bad stock picks, while your best winners will more than make up for their losses.

Think about it this way: If you invest the same amount in 20 stocks and one goes bankrupt, the most you can lose is 5% of your capital. Now let’s say one of those stocks goes up 2,000% in value, it makes up for not just that one loser, but would double the value of your entire portfolio. Diversification can protect you from permanent losses and give you exposure to more wealth-building stocks.

Why you should invest in bonds

Over the long term, growing wealth is the most important step. But once you’ve built that wealth and get closer to your financial goal, bonds, which are loans to a company or government, can help you keep it.

There are three main kinds of bonds:

Here is a recent example of how bonds can be useful investments, using the Vanguard Total Bond Market ETF (NASDAQ:BND), which owns short- and long-term bonds, and the iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY), which owns the most stable treasury bonds, compared to the SPDR S&P 500 ETF Trust:

As you get closer to your financial goals, owning bonds that match up with your timeline will protect assets you’ll be counting on in the short term.

Why and how to invest in real estate

Real estate investing might seem out of reach for most people. And if you mean buying an entire commercial property, that’s true. However, there are ways for people at almost every financial level to invest in and make money from real estate.

Moreover, just like owning great companies, owning high-quality, productive real estate can be a wonderful way to build wealth, and in most recessionary periods throughout history, commercial real estate is counter-cyclical to recessions. It’s often viewed as a safer, more stable investment than stocks.

Publicly traded REITs, or real estate investment trusts, are the most accessible way to invest in real estate. REITs trade on stock market exchanges just like other public companies. Here are some examples:

REITs are excellent investments for income, since they don’t pay corporate taxes, as long as they pay out at least 90% of net income in dividends.

It’s actually easier to invest in commercial real estate development projects now than ever. In recent years, legislation made it legal for real estate developers to crowdfund capital for real estate projects. As a result, billions of dollars of capital has been raised from individual investors looking to participate in real estate development.

It takes more capital to invest in crowdfunded real estate, and unlike public REITs where you can easily buy or sell shares, once you make your investment you may not be able to touch your capital until the project is completed. Moreover, there’s risk that the developer doesn’t execute, and you can lose money. But the potential returns and income from real estate are compelling, and have been inaccessible to most people until recently. Crowdfunding is changing that.

How to Start Investing in Stocks: A Beginner’s Guide

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

Investing is a way to set aside money while you are busy with life and have that money work for you so that you can fully reap the rewards of your labor in the future. Legendary investor Warren Buffett defines investing as “the process of laying out money now in the expectation of receiving more money in the future.” The goal of investing is to put your money to work in one or more types of investment vehicles in the hopes of growing your money over time.

Key Takeaways

Click Play to Learn How to Start Investing in Stocks

What Kind of Investor Are You?

Before you commit your money, you need to answer this question: What kind of investor am I? When opening a brokerage account, an online broker such as Charles Schwab or Fidelity will ask you about your investment goals and what level of risk you’re willing to take.

Some investors want to take an active hand in managing their money’s growth, while others prefer to “set it and forget it.” More traditional online brokers, like the two mentioned above, allow you to invest in stocks, bonds, exchange-traded funds (ETFs), index funds, and mutual funds.

Online Brokers

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Discount brokers used to be the exception but are now the norm. Discount online brokers give you tools to select and place your own transactions, and many of them also offer a set-it-and-forget-it robo-advisory service. As the space of financial services has progressed in the 21st century, online brokers have added more features, including educational materials on their sites and mobile apps.

In addition, although there are a number of discount brokers with no (or very low) minimum deposit restrictions, you may be faced with other restrictions, and certain fees are charged to accounts that don’t have a minimum deposit. This is something that an investor should take into account if they want to invest in stocks.

Robo-Advisors

After the 2008 financial crisis, a new breed of investment advisor was born: the roboadvisor. Jon Stein and Eli Broverman of Betterment are often credited as the first in the space. Their mission was to use technology to lower costs for investors and streamline investment advice.

Since Betterment launched, other robo-first companies have been founded, and even established online brokers like Charles Schwab have added robo-like advisory services. According to a report by Charles Schwab, 58% of Americans say they will use some sort of robo advice by 2025. If you want an algorithm to make investment decisions for you, including tax-loss harvesting and rebalancing, then a roboadvisor may be for you. Also, as the success of index investing has shown, you might do better with a roboadvisor if your goal is long-term wealth building.

Investing Through Your Employer

If you’re on a tight budget, try to invest just 1% of your salary into the retirement plan available to you at work. The truth is you probably won’t even miss a contribution that small.

Work-based retirement plans deduct your contributions from your paycheck before taxes are calculated, which will make the contribution even less painful. When you’re comfortable with a 1% contribution, maybe you can increase it as you get annual raises. You’re unlikely to miss the additional contributions. If you have a 401(k) retirement account at work, then you may be investing in your future already with allocations to mutual funds and even your own company’s stock.

Minimums to Open an Account

It pays to shop around some and check out our broker reviews before deciding where you want to open an account. We list minimum deposits at the top of each review. Some firms do not require minimum deposits. Others may often reduce costs, such as trading fees and account management fees if you have a balance above a certain threshold. Still others may offer a certain number of commission-free trades for opening an account.

Commissions and Fees

As economists like to say, there ain’t no such thing as a free lunch. Though many brokers have been racing recently to lower or eliminate commissions on trades, and ETFs offer index investing to everyone who can trade with a bare-bones brokerage account, all brokers have to make money from their customers one way or another.

Depending on how often you trade, these fees can add up and affect your profitability. Investing in stocks can be very costly if you hop into and out of positions frequently, especially with a small amount of money available to invest.

Remember, a trade is an order to purchase or sell shares in one company. If you want to purchase five different stocks at the same time, this is seen as five separate trades, and you will be charged for each one.

If you plan to trade frequently, check out our list of brokers for cost-conscious traders.

Mutual Fund Loads

Besides the trading fee to purchase a mutual fund, there are other costs associated with this type of investment. Mutual funds are professionally managed pools of investor funds that invest in a focused manner, such as large-cap U.S. stocks.

An investor will incur many fees when investing in mutual funds. One of the most important fees to consider is the management expense ratio (MER), which is charged by the management team each year based on the number of assets in the fund. The MER ranges from 0.05% to 0.7% annually and varies depending on the type of fund. But the higher the MER, the more it affects the fund’s overall returns.

You may see a number of sales charges called loads when you buy mutual funds. Some are front-end loads, but you will also see no-load and back-end load funds. Be sure that you understand whether a fund that you are considering carries a sales load prior to buying it. Check out your broker’s list of no-load funds and no-transaction-fee funds if you want to avoid these extra charges.

Diversify and Reduce Risks

Diversification is considered to be the only free lunch in investing. In a nutshell, by investing in a range of assets, you reduce the risk of one investment’s performance severely hurting the return of your overall investment. You could think of it as financial jargon for “Don’t put all of your eggs in one basket.”

This is where the major benefit of mutual funds or ETFs comes into focus. Both types of securities tend to have a large number of stocks and other investments within their funds, which makes them more diversified than a single stock.

Stock Market Simulators

People new to investing who wish to gain experience trading without risking their money in the process may find that a stock market simulator is a valuable tool. There are a wide variety of trading simulators available, including those with and without fees. Investopedia’s simulator is entirely free to use.

Stock market simulators offer users imaginary, virtual money to «invest» in a portfolio of stocks, options, ETFs, or other securities. These simulators typically track price movements of investments and, depending on the simulator, other notable considerations such as trading fees or dividend payouts. Investors make virtual «trades» as if they were investing real money. Through this process, simulator users have the opportunity to learn about the ins and outs of investing—and to experience the consequences of their virtual investment decisions—without running the risk of putting their own money on the line. Some simulators even allow users to compete against other participants, providing an additional incentive to invest thoughtfully.

What is the Difference Between a Full-Service and a Discount Broker?

Full-service brokers provide a broad array of financial services, including offering financial advice for retirement, healthcare, and a host of investment products. They have traditionally catered to high-net-worth individuals and often require significant investments. Discount brokers have much lower thresholds for access, but also tend to offer a more streamlined set of services. Discount brokers allow users to place individual trades and also increasingly offer educational tools and other resources.

What Are the Risks of Investing?

Investing is a commitment of resources now toward a future financial goal. There are many levels of risk, with certain asset classes and investment products inherently much riskier than others. However, essentially all investing comes with at least some degree of risk: it is always possible that the value of your investment will not increase over time. For this reason, a key consideration for investors is how to manage their risk in order to achieve their financial goals, whether they are short- or long-term.

How Do Commissions and Fees Work?

The Bottom Line

It is possible to invest if you are just starting out with a small amount of money. It’s more complicated than just selecting the right investment (a feat that is difficult enough in itself), and you have to be aware of the restrictions that you face as a new investor.

You’ll have to do your homework to find the minimum deposit requirements and then compare the commissions to those of other brokers. Chances are that you won’t be able to cost-effectively buy individual stocks and still diversify with a small amount of money. You will also need to choose the broker with which you would like to open an account.

:max_bytes(150000):strip_icc()/mansaPicture_08T-Copy-JuliusMansa-127908fd255745b5886a16fced0cdb7b.jpg)

:max_bytes(150000):strip_icc()/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)