How to send money from credit card to credit card

How to send money from credit card to credit card

Send money with credit card: all you need to know

Gabriela Peratello

Wondering how to transfer money from credit card to a bank? Or maybe you want to know how to send money with a credit card to a friend or family member?

This guide covers everything about how to send money with a credit card, including apps to send money with a credit card and more.

And if the payment you need to make is heading overseas, we’ll also introduce Wise as a good way to save on fees when you need to transfer money from a credit card to a bank account abroad.

Can you send money with a credit card?

First, the obvious question: can you send money with a credit card?

The good news is that there are a few different ways you’ll be able to pay using your credit card when you send money to a friend, business or to pay a bill. This guide runs through the key options looking at cost, convenience and speed.

How to transfer money from a credit card to a bank account?

Depending on exactly what you need to do, you may find you have a few different ways to send money with your credit card. Features and fees do vary based on the method you choose, though, so it’s worth shopping around before you decide.

Through cash advance

Most credit cards allow cash advances, which may incur an extra percentage fee and immediate interest charges. This can be a costly but often convenient option.

Depending on the card provider you’re with you’ll usually be able to use your credit card to make a withdrawal from an ATM, or you could be able to get a check issued, or have your card provider deposit an agreed amount right into your bank account.

Using a P2P payment

If you’re looking to send money to a friend you might be interested in P2P (person to person, or peer to peer) payment providers. Popular names include Western Union or MoneyGram for example, but there are quite a few providers depending on where you want to send money to.

You’ll need to create an online account with the provider you pick, and pay for your transfer using your card. Fees will apply from the provider, and your card may also still charge a cash advance fee.

With a money transfer provider

Money transfer providers, which include online and mobile specialist services, can be a good option to send money to a bank account directly within the US or internationally.

Different providers have different target markets, which means their services, features and fees vary widely. Check out the apps highlighted below as great options to explore as you find your perfect match.

Apps to send money with credit card

If you need to send money from a credit card, or want to transfer money from credit card to a bank, using a mobile app is often the easiest, fastest option. Here are a few providers to consider.

Many money apps to send money with credit cards don’t allow international services — or impose high fees where they do. Wise is different.

Send money overseas with the real mid-market exchange rate, using just your recipient’s email address. Fees are low and transparent, and payments are often instant.

Venmo¹

Venmo is a super convenient way to send money fast, to family and friends. It’s popular for mobile payments with a social element, as you can add emojis and notes to money as you transfer it.

Using Venmo you can send money by credit or debit card, as well as by linking your bank account. You can only use this service in the US.

PayPal²

You’re likely already familiar with PayPal. PayPal payments can be sent with a credit card, and are likely to be deposited into your recipient’s PayPal account almost instantly.

However, it’ll probably take a day or two for your recipient to withdraw the money to their bank account, and if you’re paying by credit card you’ll pay 2.9% + fixed fee for most domestic payments, and a 5% fee for international transfers.

Zelle³

Zelle is a convenient option for sending money from one bank account to another. However, if you’re thinking along the lines of “can you send money through Zelle with a credit card?” The answer is, unfortunately, no. You can’t link your credit card to Zelle, so it’s no use if you want to send money to a bank account from a credit card.

Western Union⁴

Western Union is one of the most recognizable money transfer services around — and you can usually make your transfer online with a credit card if you’d like to.

Simply set up a WU account, and select the option to pay with your chosen credit card. It’s worth knowing that the fees for sending with your credit card are usually higher compared to other methods, and an exchange rate markup applies if you’re sending across currencies.

Cash App⁵

Things to consider when sending money with a credit card

Sending money using your credit card may not be the cheapest option — and there are a few other things to consider too. Here are some pointers to get your thinking.

How it’ll impact your credit

Using a credit card wisely, and repaying your bill every period can help you build a good credit score. However, if you overextend yourself or end up missing repayments, you could accidentally damage your credit — not good news for any of us.

The fees you’re paying

Make sure you’re crystal clear on all the fees that may come up when sending money from your credit card. Your own card provider might charge a cash advance fee if you withdraw cash or send money with a third party provider. And a money transfer service will also have their own fees, which can include an exchange rate markup if the person you’re sending to is overseas.

How much interest your bank will charge you

If your credit card payment is treated as a cash advance it’ll likely incur instant interest from your card network. Make sure you’re clear on your own card’s policy to avoid any surprises.

Try Wise, an easy way to send money abroad with credit card

If you’re sending money overseas with your credit card don’t pay more than you need to. Get Wise for low cost international transfers which use the mid-market exchange rate with no hidden fees.

Just set up your payment in the Wise app or desktop site to see instantly the exchange rate and fee options available, pay with your credit card, and the money will be moved right away to your recipient’s bank account. No hidden costs, no sneaky exchange rate markups and no hassle.

Sending money from a credit card can be a convenient option — but it’s not always the cheapest. That’s why it’s important you look out for all the possible fees involved in your payment to get the best deal.

And if you’re sending money from your credit card to someone overseas, check out Wise to get a better exchange rate and pay less overall.

Sources:

Sources checked on 04.21.2022

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

Sending Money With a Credit Card: Benefits, Risks, and How to Do It

Wiring Money With a Credit Card Should Be a Last Resort

Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. She is the founder of Wealth Women Daily and an author.

Need to wire funds but you don’t have cash in the bank? Sooner or later, somebody will suggest that you send money with a credit card.

It’s easy to do, and you can move money around the world. But before you provide those digits, see what you’re getting yourself into and evaluate the alternatives.

Types of Transfers

Before determining whether you should send money from a credit card, it’s important to first define what we mean when we talk about different types of transfers.

Bank Wire Transfer

Wire transfers traditionally go through banks. These are same-day transfers from one account to another, and they’re popular for transactions like home purchases. To complete a wire, you’ll need to provide the recipient’s bank information, and you may need to submit a paper form (although small transfer requests might be available online).

Money Transfer

This can mean several things, but the basic idea is that you send funds electronically, whether it’s a traditional “wire transfer” or not. The funds might even be available to the recipient on the same day—even within a few minutes, like with Venmo. Western Union, MoneyGram, and others offer this type of service, and you can set up transfers online or over the phone (the recipient can be identified by an email address, phone number, or name). Sometimes these transfers take two to three business days, as they move through the ACH network.

Downsides of Cash Advances, Transfers

No matter which method you use, you’ll need a cash advance if you plan to fund the transfer with your credit card. An advance provides “free and clear” money available for sending out immediately. But there are a few considerations that should come into play before you pull the trigger on either the advance or the transfer itself.

Interest Charges

Cash advances on your credit card are expensive. The interest rate charged on advances is typically higher than the interest rate on balances that come from purchases (expect a rate of at least 25%). Plus, there’s no grace period on cash advances, so you’ll pay interest charges even if you pay off your card before the end of your statement cycle.

To get an idea of how much interest you might pay because of cash advance, plug your card’s numbers into our loan calculator:

Risk of Damaged Credit

When you borrow against your credit card, you risk damaging your credit—at least temporarily. Large cash advances can use up the majority of your available credit limit, signaling that you may be in financial trouble. If you’re planning to make a large purchase in the near future (home or vehicle, for example), a lower credit score may make it harder to borrow. Avoid maxing out your credit card and pay the debt off immediately.

Irreversible

Unlike purchases on your card, you may not be able to have cash advances reversed, which reduces the risk for your bank or money transfer service. They may be only willing to make an irreversible transfer if they have the money more or less in hand. The recipient will be able to take the funds immediately (in cash, or by moving the money elsewhere), and there’s no way to recover the money.

Only send money if you know where it’s going, and if you trust the recipient. Several scams make use of wire transfers (or money transfer services), and con artists take advantage of misunderstandings about how these payments work. Most people think that their bank or Western Union can help if there’s a problem, but the money is usually gone for good.

How to Get a Cash Advance

If you’re planning to wire money using a bank, you’ll need to get funds into your bank account. You can do this by visiting a teller in your bank’s branch and requesting a cash advance (moving the proceeds into your checking account), or you can just withdraw cash at an ATM and deposit the funds into your account. If you’re using a money transfer service, the cash advance happens automatically as you go through the steps to complete a transfer.

Remember, if you use a credit card to fund a wire transfer, you’re borrowing money to make the transfer. As a result, you’ll pay a high interest rate on the money you borrow, and the fees will be added to your loan balance, increasing the total amount of interest you pay.

Credit Card Transfer Alternatives

Because of the risks and costs, you should consider other ways to send money. Depending on the situation and whether or not you need to borrow money, some of the options below might be a better fit.

Wire From Your Bank Account

If you don’t need to borrow and you’re confident about the recipient (you know it’s not a scam), just send funds from your checking account. There are several ways to do this, including using a standard wire transfer.

Pay With a Debit Card

Online sites usually ask for a “credit card” number, but you can use a debit card in most cases. Debit cards pull money from your checking account instead of creating a loan, so you’ll avoid cash advance and interest charges. Just be sure you know who you’re giving your card number to.

Money Order or Cashier’s Check

There are several ways to send “guaranteed” funds. In addition to wire transfers, cashier’s checks are considered to be extremely safe (as long as the check isn’t a fake). The issuing bank guarantees cashier’s checks, so they can’t bounce. Money orders are also an option in some situations.

Payment Apps

If you know the person you’re sending money to (a friend or family member, for example), try a free or inexpensive payment service. Square’s Cash App moves funds from your checking account directly to the recipient’s checking account—using your debit cards—for free. PayPal is available for international payments, and there are several other options that may meet your needs.

Loans

Your credit card isn’t the only way to borrow. Assuming that you truly need to borrow, ask your bank about a personal loan (or any other options available) for drumming up the money. Online lenders and peer-to-peer loans may also be an inexpensive option, especially if you have a few days to work with. Credit cards are probably the fastest option, but you’ll pay a premium for that speed.

Convenience Checks

Getting a cash advance from a teller or an ATM is expensive. You might be able to pay less if you keep your eye out for special offers from your credit card company. With convenience checks or balance transfer offers, you can write a check to yourself and use the money in any way you like. Although you still might pay fees, there’s a good chance that the fees will be lower, and as a bonus, you could get a lower interest rate (for a limited time. )

Standard Credit Card Payment

Another option is to simply pay with a credit card (assuming cards are accepted). Credit cards can be used internationally, and you’ll get consumer protection benefits if you use your card to make a purchase directly. PayPal is a similar option, and it’s free to make purchases with PayPal. For some purchases, PayPal will even lend you money (through PayPal Credit.)

If none of the options above will work, it may make sense to use your credit card and wire money, but only in emergencies.

Save Instead of Spend

Borrowing money on credit cards is not sustainable. Eventually, high interest rates and steep fees can drag you into a debt spiral. You’ll spend more on maintaining the debt every month than you put toward the debt itself.

To avoid borrowing money, budget for necessary expenses and build up an emergency fund. Ideally, you’ll have enough to cover three to six months’ worth of living expenses (or more, if you prefer to be conservative). Emergency funds should be kept somewhere safe and accessible, such as a savings or money market account. Avoid raiding the fund, and when surprises come up, you won’t need to pay hefty costs.

Sometimes borrowing is inevitable. If you like having a backup plan, you might benefit from keeping a line of credit open. A line of credit is a pool of money that is available for borrowing, but you don’t actually borrow until you need to. The line of credit should be inexpensive to maintain since you’ll only pay interest when you borrow money (if ever).

How to Wire Money from a Credit Card

This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow’s legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 22,965 times.

A traditional wire transfer is done from one bank account to another. However, you can also use your credit card to wire money to someone. Using a money transfer website or mobile app is typically the easiest way to do this. However, many money transfer apps only allow relatively small transfers and may have a weekly or monthly maximum total you can send. To avoid these limits, use a bank or wire transfer service if you need to send a substantial amount of money. However, many banks don’t do wire transfers from a credit card. Additionally, the fees to wire money from a credit card are often higher than wiring cash or money from a bank account. [1] X Research source

\u00a9 2022 wikiHow, Inc. All rights reserved. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. This image may not be used by other entities without the express written consent of wikiHow, Inc.

\n

\u00a9 2022 wikiHow, Inc. All rights reserved. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. This image may not be used by other entities without the express written consent of wikiHow, Inc.

\n

\u00a9 2022 wikiHow, Inc. All rights reserved. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. This image may not be used by other entities without the express written consent of wikiHow, Inc.

\n

Tip: Some apps do a micro-transaction to verify your credit card. Before you can use your card, you’ll need to check your credit card activity and provide the money transfer app with information about the micro-transaction, including the amount and the date it went through.

\u00a9 2022 wikiHow, Inc. All rights reserved. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. This image may not be used by other entities without the express written consent of wikiHow, Inc.

\n

Tip: Review your transfer request carefully before you submit. Any typos or mistakes could keep the person from getting the money, and you may have difficulty reversing the transaction.

Send money online with credit card

Join over 3 million people who left their banks to send their money faster, cheaper, and easier than ever. At the real exchange rate. Every time.

Sir Richard Branson invested in Wise. Learn why.

42,000+ reviews on Trustpilot

Customers love Wise

From the same people

that built Skype

Fully authorised by the UK Financial Conduct Authority (FCA)

How to send money internationally with credit card?

1. Create your free account.

Click ‘Sign up’, then create your free account. It takes seconds. You can do it on our website or with our app.

All you need is an email address, or a Google or Facebook account.

2. Set up your first transfer.

Use our calculator to tell us how much money you want to send, and where you want to send it. You’ll see our fees upfront.

We’ll tell you when your money should get there, too.

3. Tell us who you’re sending to.

Yourself? Someone else? A business or charity? Pick your answer.

Then we’ll ask you for some basic information about your recipient, including their bank details. They need a bank account, but they don’t need a Wise account. (Though we hope they’ll want one soon.)

4. Tell us a little about yourself.

We’ll ask you if you’re sending money as an individual or business. We’ll also need your full name, birthday, phone number, and address. You know, the standard stuff.

5. Make sure everything looks good.

We’ll show you a summary of your transfer. If everything looks good, click Confirm.

You can also make any changes you need to.

6. Pay for your transfer.

Would you like to pay by credit card? Debit card or bank debit? Wire transfer?

Make your choice, and we’ll tell you how to do it. Each payment method has its own steps, but they’re all straightforward and should only take a few minutes.

7. That’s it.

Once you complete that last step, the wheels are in motion. The money’s on its way.

And since you used us, instead of a bank or traditional service, you saved a bunch of it.

Better way to send money internationally

Safe and speedy

We’re regulated by authorities all over the world. That’s a lot of standards to live up to – so we have to be safe. And our smart tech moves your money faster than banks.

Transparent Fees

No hidden fees. No sneaky surprises. For one low, upfront fee, you get the real, mid-market exchange rate.

Send money online with credit card

Send money online on our website, or on the move, with our app. Wherever you are, and wherever they are, you’re good to go.

What you’ll need for your online money transfer

Wise makes international money transfers simple

All you need is your recipient’s:

For example, you need an IBAN for Euro transfers, a SORT code and account number for the UK, a routing and account number for the US, and an IFSC code for India.

International money transfer fees: How much do they cost?

No big fees, hidden or otherwise. So it’s cheaper than what you’re used to.

Where can you transfer money internationally with Wise?

Where can you transfer money internationally with Wise?

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-667606659-5a4e7ded98020700371f3052.jpg)

:max_bytes(150000):strip_icc()/PritchardJustinJacketSized-5b7485a846e0fb0050436534.jpg)

:max_bytes(150000):strip_icc()/CharleneRhinehartHeadshot-CharleneRhinehart-95d680d01e524f3e97ea85984fbbcac5.jpg)

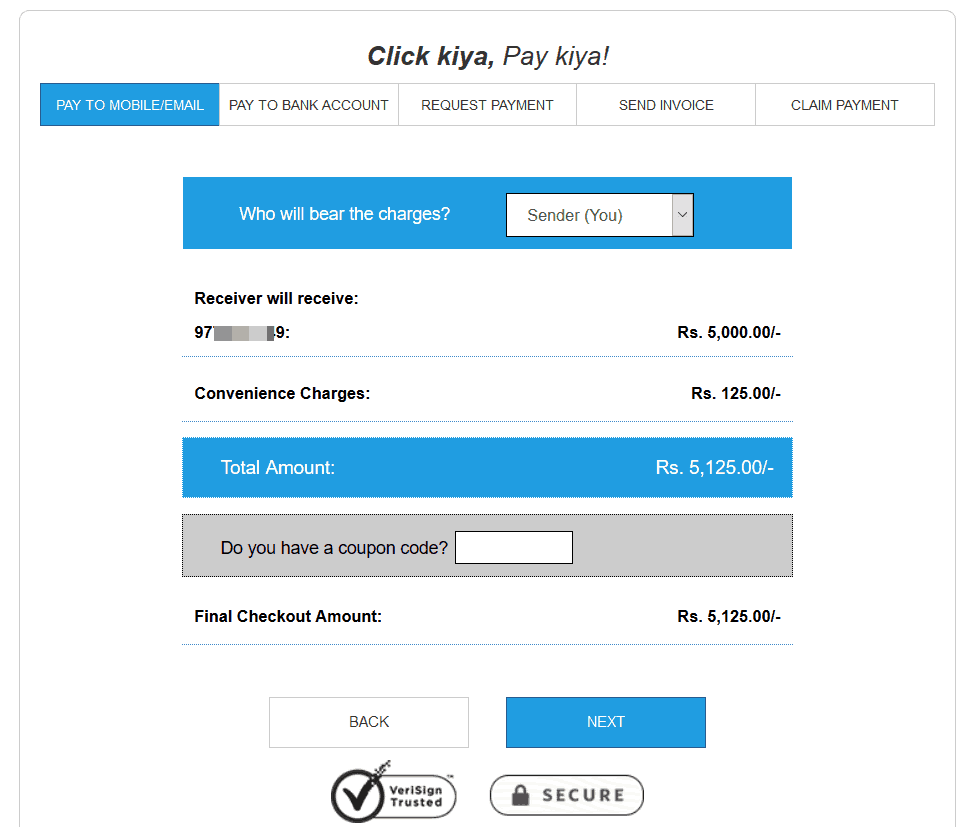

Charges for using PayDeck

Charges for using PayDeck PayDeck signup form

PayDeck signup form