How to trade forex for beginners

How to trade forex for beginners

How to start Forex trading?

What are the financial markets?

Financial markets are global trading platforms where some market instruments are exchanged for others. A striking example of a financial market is Forex, where currency units of different countries are traded for each other.

How do traders earn money?

The trader’s earnings are differences between the asset’s buy and sell prices. It sounds pretty simple but for implementing this scheme one must know how to predict growth or decline of the price of some financial instrument and have trading experience.

What is necessary to start trading?

To start trading on financial markets, you need to register a trader’s Members Area and, after deciding on a trading terminal, an account base currency, and a leverage value, open a corresponding trading account.

Where can a trading terminal be downloaded?

RoboForex clients can choose one of the most popular trading platforms in the industry and install it on their PCs or mobile devices. Moreover, those who are “always on the go” can use web versions of the platforms, which can be run at any moment in familiar browsers.

One of the most popular platforms that earned the trust of the trader community.

An updated version of the classic terminal with unique innovative tools and features.

A platform for professionals that provides STP access to the Forex market.

A multi-asset web platform that provides access to more than 12,000 assets and the most advanced instruments.

A web terminal designed by RoboForex for fast and comfortable trading on MT4-based accounts.

What instrument to invest in?

RoboForex clients are offered a wide range of popular assets: Forex, Stocks – in total more than 12,000 trading instruments. Every trader decides for themselves whether to choose one asset or diversify their portfolio by investing money in several different ones.

How much money do I need to start trading?

To start trading at RoboForex, the minimum amount of 10 USD will be enough, but if you want to get access to a wider range of services, it’s better to deposit at least 100 USD.

To learn how to start working on international financial markets through R StocksTrader, watch a video from RoboForex.

How to buy or sell on financial markets?

Through the example of the Forex currency market.

Types of orders

Buy (long position)

When this type of order is opened, the traded asset rate is expected to rise.

Sell (short position)

When opening this order, a trader believes that the financial instrument price is going to fall.

How to open an order?

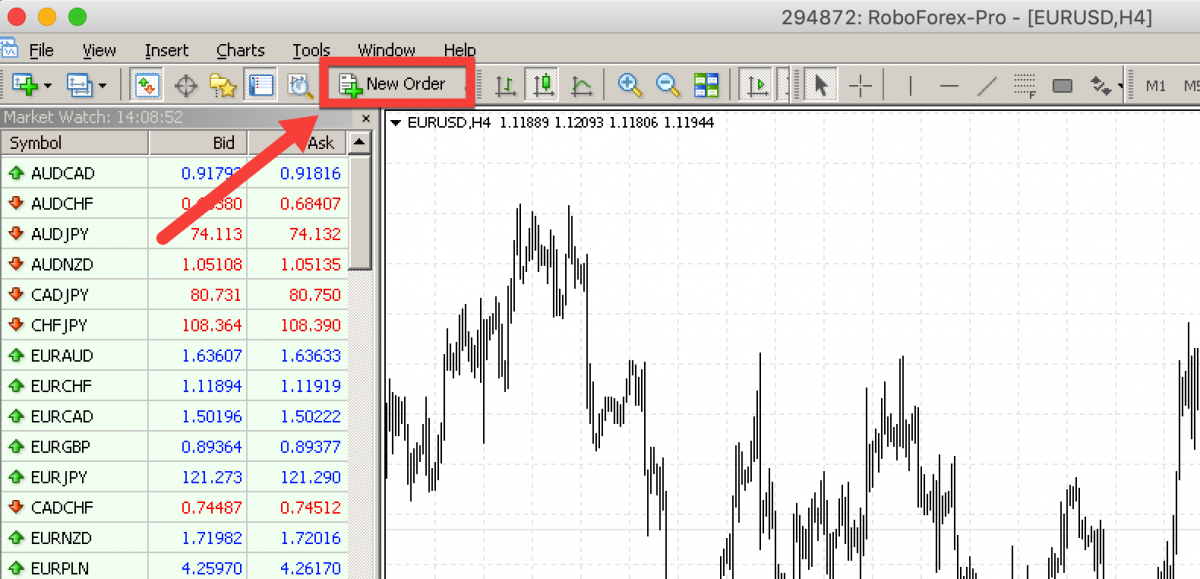

Choose a currency pair you’re interested in.

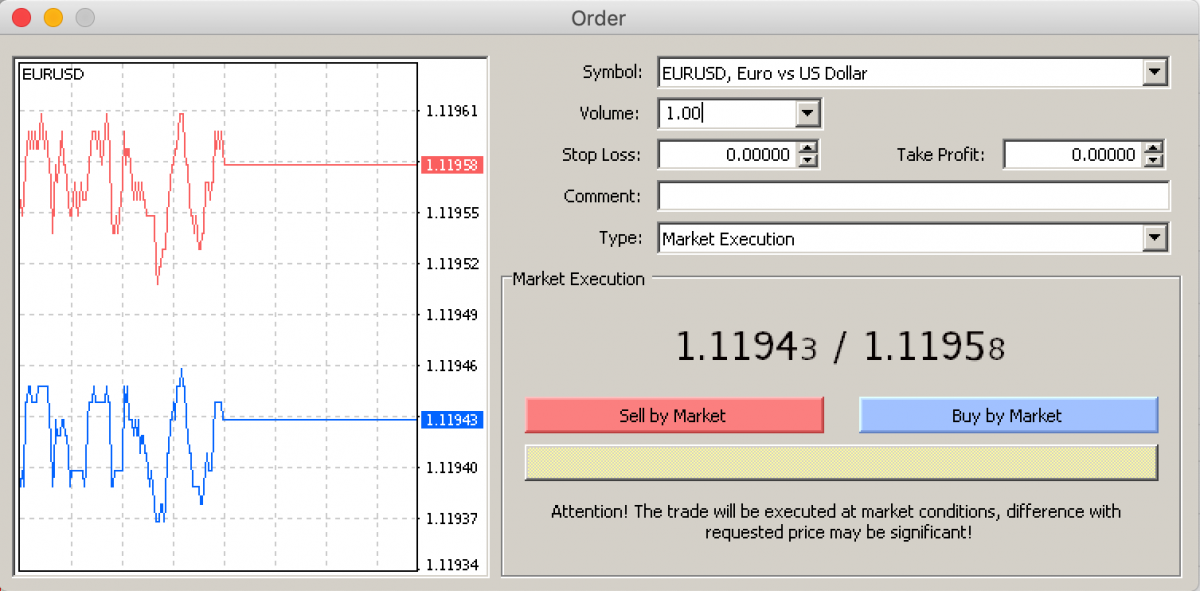

Click “New order” on the trading terminal panel, specify the order volume, as well as Take Profit and Stop Loss levels.

Click “Buy” or ”Sell” depending on the chosen order direction.

Congratulations! Your order has been placed!

Now you will have to monitor changes in the traded instrument rate in order to close the order in the future according to your trading strategy.

What is a trading strategy?

A trading strategy is a set of rules used by a trader in their trading operations. Every investor creates their own tactics, by choosing a method of analysis (fundamental or technical), duration of orders (short-, mid-, or long-term), and additional tools (trading signals and automated strategies).

A unique trading style can be developed only by practicing, learning the behavior of attractive assets, and adopting the experience of professional traders.

What may be helpful in learning how to invest?

To understand how to start trading correctly, use the tools offered by RoboForex. Use them to make your start in forex trading and the first trading transactions the most successful:

A set of analytical tools for successful trading on Forex.

A course on the different aspects of trading on the currency market.

“Easy-to-read” materials about topical events on financial markets.

Official sponsor of «Starikovich-Heskes» team at

Experienced racers with more than 60,000 off road kilometers in Europe, Africa, and Australia under their belt.

RoboForex Ltd is an Official sponsor of Andrei Kulebin

RoboForex Ltd is an international broker regulated by the FSC, license No. 000138/333, reg. number 128.572. Address: 2118 Guava Street, Belama Phase 1, Belize City, Belize.

Risk Warning: There is a high level of risk involved when trading leveraged products such as Forex/CFDs. 58.42% of retail investor accounts lose money when trading CFDs with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. RoboForex Ltd and its affiliates do not target EU/EEA/UK clients. RoboForex Ltd and it affiliates don’t work on the territory of the USA, Canada, Japan, Australia, Bonaire, Curaçao, East Timor, Iran, Liberia, Saipan, Russia, Sint Eustatius, Tahiti, Turkey, Guinea-Bissau, Micronesia, Northern Mariana Islands, Svalbard and Jan Mayen, South Sudan, and other restricted countries.

At RoboForex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a Civil Liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© RoboForex, 2009-2022.

All rights reserved.

What is Forex trading?

Learn how to become a forex trader with our comprehensive guide.

Your starting point as a beginner to forex trading

The foreign exchange market, also known as the forex market, is the world’s most traded financial market. We’re committed to ensuring our clients have the best education, tools, platforms, and accounts to navigate this market and trade forex.

If you’re not sure where to start when it comes to forex, you’re in the right place.

You’ll find everything you need to know about forex trading, what it is, how it works and how to start trading.

Jump to your chapter of interest

What is forex?

Forex is short for foreign exchange – the transaction of changing one currency into another currency. This process can be performed for a variety of reasons including commercial, tourism and to enable international trade.

Forex is traded on the forex market, which is open to buy and sell currencies 24 hours a day, five days a week and is used by banks, businesses, investment firms, hedge funds and retail traders.

What is the forex market?

One critical feature of the forex market is that there is no central marketplace or exchange in a central location, as all trading is done electronically via computer networks. This is known as an over the counter (OTC) market.

What is FX?

The foreign exchange (also known as forex or FX) market refers to the global marketplace where banks, institutions and investors trade and speculate on national currencies.

Summarizing the basics of forex trading

What is forex trading?

Forex trading is the process of speculating on currency prices to potentially make a profit. Currencies are traded in pairs, so by exchanging one currency for another, a trader is speculating on whether one currency will rise or fall in value against the other.

The value of a currency pair is influenced by trade flows, economic, political and geopolitical events which affect the supply and demand of forex. This creates daily volatility that may offer a forex trader new opportunities. Online trading platforms provided by global brokers like FXTM mean you can buy and sell currencies from your phone, laptop, tablet or PC.

What is an online forex broker?

An online forex broker acts as an intermediary, enabling retail traders to access online trading platforms to speculate on currencies and their price movements.

Most online brokers will offer leverage to individual traders, which allows them to control a large forex position with a small deposit. It is important to remember that profits and losses are magnified when trading with leverage.

FXTM offers a number of different trading accounts, each providing services and features tailored to a clients’ individual trading objectives.

Discover the account that’s right for you by visiting our account page. If you’re new to forex, you can begin exploring the markets by trading on our demo account, risk-free.

Why trade forex?

Forex offers many benefits to retail traders.

You can trade around the clock in different sessions across the globe, as the forex market is not traded through a central exchange like a stock market. This means you can jump on volatility, wherever it happens. High liquidity also enables you to execute your orders quickly and effortlessly.

Trading forex using leverage allows you to open a position by putting up only a portion of the full trade value. You can also go long (buy) or short (sell) depending on whether you think a forex pair’s value will rise or fall.

Forex trading offers constant opportunities across a wide range of FX pairs. FXTM’s comprehensive range of educational resources are a perfect way to get started and improve your trading knowledge.

Understanding Currency Pairs

All transactions made on the forex market involve the simultaneous buying and selling of two currencies.

This ‘currency pair’ is made up of a base currency and a quote currency, whereby you sell one to purchase another. The price for a pair is how much of the quote currency it costs to buy one unit of the base currency. You can make a profit by correctly forecasting the price move of a currency pair.

FXTM offers hundreds of combinations of currency pairs to trade including the majors which are the most popular traded pairs in the forex market. These include the Euro against the US Dollar, the US Dollar against the Japanese Yen and the British Pound against the US Dollar.

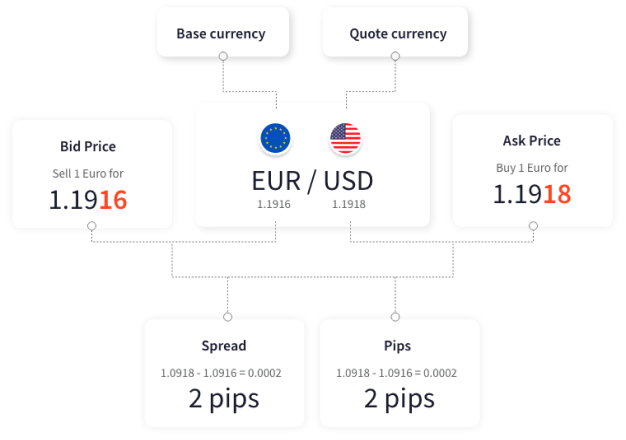

The diagram on the left looks at the most traded currency pair (EUR/USD) in the forex market and breaks down its essential components

For most currency pairs, a pip is the fourth decimal place, the main exception being the Japanese Yen where a pip is the second decimal place.

On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit. Of course, such large trading volumes mean a small spread can also equate to significant losses.

Trading forex is risky, so always trade carefully and implement risk management tools and techniques.

Essential components of currency pair trading

Base currency

The base currency is the first currency that appears in a forex pair and is always quoted on the left. This currency is bought or sold in exchange for the quote currency and is always worth 1.

Based on the example above, it will cost a trader 1.1918 USD to buy 1 EUR.

Alternatively, a trader could sell 1 EUR for 1.1916 USD.

Bid price

The bid price is the value at which a trader is prepared to sell a currency. This price is usually to the left of the quote and often in red.

The bid price is given in real time and is constantly updating as it is a live market.

Quote currency

The second currency of a currency pair is called the quote currency and is always on the right.

In EUR/USD for example, USD is the quote currency and shows how much of the quote currency you’ll exchange for 1 unit of the base currency.

Ask price

The ask price is the value at which a trader accepts to buy a currency or is the lowest price a seller is willing to accept. This is usually to the right and in blue.

The ask price is given in real time and is constantly changing as it is a live market.

Understanding spreads and pip in forex

Spread

As a forex trader, you’ll notice that the bid price is always higher than the ask price. The difference between these two prices is the spread. In other words, it is the cost of trading. The narrower the spread, the cheaper it costs. The wider the spread, the more expensive it is.

For example, if EUR/USD is trading with an ask price of 1.1918 and a bid price of 1.1916, then the spread will be the ask price minus the bid price. In this case, 0.0002.

In order to make a profit in foreign exchange trading, you’ll want the market price to rise above the bid price if you are long, or fall below the ask price if you are short.

Pip

A point in percentage – or pip for short – is a measure of the change in value of a currency pair in the forex market.

It is the smallest possible move that a currency price can change which is the equivalent of a ‘point’ of movement.

What is a forex trader?

A forex trader will hold a ‘position’ in a currency pair. This is the term used to describe a trade in progress and one that will have a profit or a loss, as the open position indicates the trader has some market exposure

Difference between long and short positions

A long position means a trader has bought a currency expecting its value to rise. Once the trader sells that currency back to the market (ideally for a higher price than he or she paid for it), their long position is said to be ‘closed’ and the trade is complete.

If you wanted to open a long position on the Euro, you would purchase 1 Euro for USD 1.1918. You will then hold your position in the hope that it will appreciate, selling it back to the market at a profit once the price has increased.

A short position refers to a trader who sells a currency expecting its value to fall and plans to buy it back at a lower price. A short position is ‘closed’ once the trader buys back the asset (ideally for less than he or she sold it for).

In this case, if you think the Euro will weaken against the Dollar, you will sell 1 Euro for USD 1.1916 and hold a short position. You expect the Euro to depreciate and plan to buy it back at a lower rate.

What are the most traded currency pairs on the forex market?

There are seven major currency pairs traded in the forex market, all of which include the US Dollar in the pair.

You can also trade crosses, which do not involve the USD, and exotic currency pairs which are historically less commonly traded (and relatively illiquid).

This means they often come with wider spreads, meaning they’re more expensive than crosses or majors.

Different Groups of Currency Pairs

Major currency pairs

Major currency pairs are generally thought to drive the forex market. They are the most commonly traded and account for over 80% of daily forex trade volume.

There are four traditional majors – EURUSD, GBPUSD, USDJPY and USDCHF – and three known as the commodity pairs – AUDUSD, USDCAD and NZDUSD.

These currency pairs typically have high liquidity, which means they tend to have lower spreads. They are associated with stable, well managed economies and are less prone to slippage, where the expected price of a trade differs from the price the trade was executed at.

Cross currency pairs

The most commonly traded are derived from minor currency pairs and can be less liquid than major currency pairs. Examples of the most commonly traded crosses include EURGBP, EURCHF, and EURJPY.

Exotic currency pairs

Exotics are currencies from emerging or developing economies, paired with one major currency.

Compared to crosses and majors, exotics are traditionally riskier to trade because they are more volatile and less liquid. This is because these countries’ economies can be more susceptible to intervention and sudden shifts in political and financial developments.

Overview of different currency pairs across forex trading, as well as their nicknames used in the market

Majors

EUR/USD «fiber”

USD/JPY «gopher»

GBP/USD «cable»

USD/CHF «swissie»

AUD/USD «aussie»

USD/CAD «loonie»

NZD/USD «kiwi”

Minors

EUR/GBP «chunnel»

EUR/JPY «yuppy»

GBP/JPY «guppy»

NZD/JPY «kiwi yen»

CAD/CHF «loonie swissy»

AUD/JPY

Exotics

USD/MXN

GBP/NOK

GBP/DKK

CHF/NOK

CHF/NOK

EUR/TRY

USD/TRY

How to trade forex for beginners

There are two main types of analysis that traders use to predict market movements and enter live positions in forex markets – fundamental analysis and technical analysis.

A forex trader will tend to use one or a combination of these to determine their trading style which fits their personality.

Fundamental Analysis

This analysis is interested in the ‘why’ – why is a forex market reacting the way it does? Forex and currencies are affected by many reasons, including a country’s economic strength, political and social factors, and market sentiment.

The biggest fundamental analysis indicators

News and Economic Data

Investors and banks look for strong economies to place their funds, in the expectation that their capital will appreciate.This is because the currency of that country will be in demand as the outlook for the economy encourages more investment. Any news and economic reports which back this up will in turn see traders want to buy that country’s currency.

Central Bank and Government Policy

Central banks determine monetary policy, which means they control things like money supply and interest rates. The tools and policy types used will ultimately affect the supply and demand of their currencies. A government’s use of fiscal policy through spending or taxes to grow or slow the economy may also affect exchange rates.

Technical Analysis

Forex traders who use technical analysis study price action and trends on the price charts. These movements can help the trader to identify clues about levels of supply and demand.

The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market.

The three most popular charts in trading

Candlestick Chart

The chart displays the high-to-low range with a vertical line and opening and closing prices. The difference to the bar charts is in the ‘body’ which covers the opening and closing prices, while the candle ‘wicks’ show the high and low.

If the candlestick is filled, then the currency pair closed lower than it opened. If the candlestick is hollow, then the closing price is higher than the opening price.

Bar chart

A bar chart shows the opening and closing prices, as well as the high and low for that period. he top of the bar shows the highest price paid, and the bottom indicates the lowest traded price.

The whole bar represents the currency pair’s whole trading range and the horizontal marks on the sides indicate the opening (left) and the closing prices (right).

Line chart

While a bar chart is commonly used to identify the contraction and expansion of price ranges, a line chart is the simplest of all charts and mostly used by beginners. It simply shows a line drawn from one closing price to the next.

When connected, it is simple to identify a price movement of a currency pair through a specific time period and determine currency patterns.

How to start trading with a forex broker

FXTM gives you access to trading forex as you can execute your buy and sell orders on their trading platforms.

You should always choose a licensed, regulated broker that has at least five years of proven experience. These brokers will offer you peace of mind as they will always prioritise the protection of your funds. Once you open an active account, you can start trading forex — and you will be required to make a deposit to cover the costs of your trades. This is called a margin account which uses financial derivatives like CFDs to buy and sell currencies.

It is important to remember that trading for beginners isn’t an overnight process. It takes time to become familiar with the markets and there’s a whole new vocabulary to learn. For this reason, FXTM offer a wealth of resources to learn to trade forex. For example, our Demo account is a great way to experiment with different trading strategies – but with virtual money which means with no risk attached!

Once you’re ready to move on to live trading, we’ve also got a great range of trading accounts and online trading platforms to suit you.

Online trading platforms

Forex trading platforms have transformed how people interact with financial markets. They enable investors to easily access hundreds of different markets across the globe.

MetaTrader and FXTM

As a leading global broker, we’re committed to providing flexible services tailored to the needs of our clients. As such, we are proud to offer the most popular trading platforms in the world – MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They are both available on a PC, Mac, mobile or tablet. Our traders can also use the WebTrader version, which means no download is required, while the MT apps for iOS and Android allow you to trade the markets on the go, anytime and anywhere.

All these platforms can be used to open, close and manage trades from the device of your choice.

Combine tools with MetaTrader

The platforms contain a huge variety of tools, indicators and charts designed to allow you to monitor and analyse the markets in real-time. You can even build strategies to execute your trades using algorithms. Together with innovative services such as FXTM’s Pivot Point tool, Dow Jones insights, and our award-winning Customer Support team, our clients have the resources they need to trade with confidence on the platform of their choice. You can read more and download the trading platforms from our trading platforms page.

Explore trading platforms in more depth

Get all the details you need on MT4 and MT5 by visiting their respective pages.

Learn forex trading

FXTM firmly believes that developing a sound understanding of the markets is your best chance at success as a forex trader. That’s why we offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and more experienced traders.

These include Ebooks, daily market analysis, a variety of videos, and more long read guides just like this one!

There are also many forex tools available to traders such as margin calculators, pip calculators, profit calculators, foreign exchange currency converters, economic data calendars and trading signals.

Forex widgets can help to enhance your trading experience. Some of the most popular widgets include Live Rates Feed, Live Commodities Quotes, Live Indices Quotes, and Market Update widgets.

FREQUENTLY ASKED QUESTIONS

What is trading?

How do I learn forex trading?

How do I start forex trading?

Is forex trading profitable?

Ready to trade with a world-leading broker?

Open you account in minutes, or log in to continue your trading journey.

Any questions? Get in touch – we’re here to help.

Join our community

Exinity Limited, 5th Floor, 355 NEX Tower,

Rue du Savoir, Cybercity, Ebene 72201, Mauritius

West End Towers, Waiyaki Way, 6th Floor,

P.O. Box 1896-00606, Nairobi, Republic of Kenya

FXTM in Nigeria

Sponsorships and ESG

FXTM brand is authorized and regulated in various jurisdictions.

ForexTime Ltd (www.forextime.com/eu) with registration number HE 310361 and registration address at 35, Lamprou Konstantara, FXTM Tower, 4156, Kato Polemidia, Limassol, Cyprus is regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614.

Exinity UK Limited (www.forextime.com/uk) with registration number 10599136 and registration address at 1 st. Katharine’s Way London, England, E1W 1UN, UK is authorised and regulated by the Financial Conduct Authority with license number 777911.

Exinity Limited (www.forextime.com) with registration number C119470 C1/GBL and registration address at 5th Floor, NEX Tower, Rue du Savoir, Cybercity, 72201 Ebene, Republic of Mauritius is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License with license number C113012295.

Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market.

Risk Warning: Trading Forex and Leveraged Financial Instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Trading non-leveraged products such as stocks also involves risk as the value of a stock can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of the FXTM brand based on the legal requirements in his/her country of residence. Please read FXTM’s full Risk Disclosure.

Regional restrictions FXTM brand does not provide services to residents of the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic People’s Republic of Korea, Puerto Rico, Brazil, the Occupied Area of Cyprus, Quebec, Iraq, Hong Kong, Syria and Cuba. Find out more in the Regulations section of our FAQs.

Step by Step Plan for Forex Trading for Beginners

This Forex Trading for Beginner’s Guide will give you all the information you need so you can start trading Forex. You’ll learn what forex trading is, how to trade forex, how to make your first trade, plus our best forex trading strategies. We’ll also help provide you with the forex trading strategies you need to find the best currency pairs and improve your daily ROI.

By the end of this forex trading guide, you’ll be equipped with the right knowledge to tackle the world’s largest capital market. Currently, the forex market accounts for more than 6 trillion USD in trading activity every day. Learning how to find underpriced currencies can help you earn money as a forex trader. As a bonus, we’re also going to reveal the best forex trading platforms.

If this is your first time on our website, Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, to get your Free Trading Strategy sent directly to your inbox every week.

There are many reasons why you should learn to trade. The best forex trading strategies will empower you to earn a considerable amount of money over time. This doesn’t mean there aren’t disadvantages to Forex trading. There are pros and cons of trading forex that you need to factor in. If you want to have a good starting experience, you need to have a 360-degree view of the FX market.

You need the best forex training for beginners that is currently available. Once you are trained, you can learn how the Forex 24-hour trading market can give you access to trading, through the four major trading sessions (London, New York, Tokyo, and Sydney) regardless of your time zone.

Let’s get started and learn the inner workings of forex trading and how it works.

What is Forex Trading? A Basic Overview

Unlike stocks, which are traded on a stock exchange like the NYSE, the global Forex market is a decentralized market. Most Forex transactions are carried out over-the-counter or off-exchange. Stocks are listed on physical public exchanges, but Forex currencies have no physical location.

The biggest players that operate in the FX market are the big banks, governments, major corporations, and hedge funds. These organizations have the capacity to cause notable forex price swings. These are also referred to as being the institutional market players. However, there are also quite a few individual traders involved in the market as well. These individuals are referred to as the retail crowd

How Does Forex Trading Work?

Forex Trading is the process of converting one currency into another. Usually, you exchange money for a good or service. In stock trading, you exchange money for shares in a company. In the Forex market, when we trade we exchange one currency unit for another currency unit. The American Dollar (USD), Euro (EUR), and British Pound (GBP) are all among the most commonly traded currencies. Other major currencies include the Japanese Yen (JPY), Canadian Dollar (CAD), and the Australian Dollar (AUD).

Forex traders trade with one another through a structured group of dealers and computer networks that act as market makers for their own customers. They place orders of currency pairs (or pairs of currency that you plan to swap). These currency pairs have different exchange rates associated with them, which is where the arbitrage comes in.

For example, if the price of the EUR/USD exchange rate is 1.1150 it suggests that we can get 1 Euro for every 1.1150 USD.

How to Make Money Trading Forex Currencies

Like in any business, you make money by buying something at one price and selling it at a higher price. The same principles work in FX trading. The difference is that you’re not buying physical products, but buying and selling currencies.

You can make money trading Forex currencies if one of the two things happens:

There are several key factors that drive the exchange rate. The central bank monetary policy, economic data, political events, and geopolitical risk events, but ultimately it all comes down to the price action. If you are a visual person, you can learn how to read a price chart to forecast future market trends.

How to Trade Forex for Beginners?

The basic foundation of trading in the foreign exchange market consists of understanding how currencies are quoted and what the exchange rates represent. In the Forex market, all currencies are quoted in pairs. This is why the act of Forex trading involves simultaneously buying one currency against another currency, which is sold.

Let’s now examine how many types of currency pairs you can encounter in the FX market.

Features of Foreign Exchange Market

The main features of the Foreign Exchange Market are that it’s open 24 hours a day, five days a week from Monday morning till Friday night, excluding weekends. Trading around the clock gives you the ability to trade from anywhere without having the time constraint. This means you can trade even after your 9-to-5 job.

Forex Basic Terms

Learning a new foreign language starts with learning the alphabet. The same goes for the Forex market which has its own alphabet and language. It’s important to learn this new language to understand the market.

Understanding the Forex jargon is essential if you want to learn Forex trading. In TSG’s Forex glossary you will be able to find the basic Forex terminology.

Forex Term #1: Currency Pair

Forex is quoted in currency pairs, one currency unit against another currency unit. And each currency has a 3-letter abbreviation.

For example, if we put together the euro and the US dollar we have the currency pair EUR/USD.

The first currency of the quotation system is called the base currency – the euro.

The second currency of the quotation system is the quote currency or counter currency – the US Dollar.

Forex Term #2: Exchange Rate – The Quote

The exchange rate is the price at which you can buy or sell one currency for another. The price quote shows you how much you need to buy one unit of the base currency using the quote currency.

Since currencies are quoted in pairs, it means that the value of one currency is always stated relative to another currency.

The currency exchange rate is determined by the supply and demand law.

Forex Term #3: Pip

A pip stands for Price Interest Point (or Percentage in Point) and is the smallest price change that a currency exchange rate can make. It’s the last decimal of a Forex quote.

For example, if the EUR/USD exchange rate is currently at 1.1500, and by tomorrow is at 1.1580, we can say the EUR/USD exchange rate has increased by 80 pips.

Forex Term #4: Ask Price

Currency pairs use a two-price quotation system. That is the reason why when you pull up the order window you’ll have two prices. On the right side, you have the Ask price, which is the price at which you buy a currency pair.

For example, if the EUR/USD quote displays the following rates 1.1520/1.1521 you can buy at the 1.1521 price.

Forex Term #5: Bid Price

On the left side of the two-price quote system is the Bid price or the price you need to pay if you want to sell a currency pair.

For example, if the EUR/USD quote displays the following rates 1.1520/1.1521 you can sell at the 1.1520 price.

Forex Term #6: Spread

The spread is the difference between the price at which you buy (Ask) and the price at which you sell (Bid). Usually, the size of the Forex spread depends on market liquidity and volatility.

Forex Term #7: Margin

In the Forex market, you don’t need to have the whole amount of what you’re trading. You only need to deposit a small percent of your trading size to cover possible losses. This deposit that you’re required to set aside is called margin. Your preferred Forex broker will let you trade a certain multiple of that margin. Margin works in conjunction with leverage.

Type of Currency Pairs

Depending on how much trading volume a currency is carrying out, we can split currencies into three major categories:

As you can see, the American Dollar plays a major role in the forex market.

Next, we need to clarify how to read currency pairs and why we use a three-letter quotation system.

How to Read and Understand Forex Quotes

The standard quotation system uses a three-letter abbreviation system and will always involve two currencies where the first currency listed on the left is the Base currency while on the right is the quote currency. The quoted price indicates how much of Quote currency is required to buy/sell one unit of Base currency.

The next thing to understand is that currency pairs always have two prices: the Bid price and the Ask price. This is the two-way quote system used for buying and selling currencies. In simple terms, the Bid price is the price at which you can buy while the Ask price is the price at which you can sell.

How to Use Forex Orders

Generally speaking, a Forex Order is a command given to your broker that shows:

Direction wise, a Forex Order can be used to do two things:

There are five common order types that anyone can use to enter and exit a position in the Forex market:

This is the process to learn how to trade Forex for beginners. Once you are more familiar with the forex market, you will be able to use the London Breakout Strategy and various other forex trading strategies.

How to Open Your First Forex Trade

The first step you need to undertake is to open a practice account with your favorite Forex broker. This will give you a trading platform from where you can access the Forex market.

If you don’t want to wait for a particular exchange rate to be reached to open your first trade you can instruct your trading platform to open the trade at the current price level. This is called entering at the current market price.

You can instruct your trading platform where your stop loss, take profit and how much quantity you want to trade aka the position size. Your trading platform will do the rest.

In order for you to make a profit the market needs to go up after you bought. The same is true in reverse if you shorted the market; the price needs to go down to make a profit.

Leverage, Volume, and Margin Requirements.

To invest and trade in the Forex market, you need to understand how margin trading works. Basically, whenever you open a trade you only need to put up as collateral a certain amount of your balance. This deposit is referred to as the margin requirement.

This means that you don’t have to cover the full position size, but only deposit a fraction of it to cover the possible losses. As long as your trade is active, your FX broker will lock up the required margin and only free it back to you once the position is closed. This enables traders to execute much larger trades than they could otherwise afford.

The margin requirement depends on three things:

The forex instrument, position size, and leverage you choose will depend on your working capital and your forex trading objectives.

How to Calculate Forex Margin

The margin requirement can be calculated using the following formula:

Margin Requirement = (Contract Size * Lot Size * Price) / Leverage.

Again, if you haven’t checked it out already, we highly encourage using a forex position calculator while trading.

Let’s now study some of the market catalysts that can drive a currency pair.

What Drives the Forex Exchange Rate

The value of the currency pair can be driven by several factors including:

These are a few of the factors that can influence the value of a currency.

Best Forex Trading Platform for Beginners

The best forex trading platform for beginners is the MetaTrader4 platform developed by MetaQuotes Software. The MT4 platform is one of the most popular Forex trading platforms utilized by millions of retail Forex traders around the world. Its features can be used by both experienced and beginner forex traders alike.

The MetaTrader 4 is free and it comes with many built-in features. There are countless technical indicators that can help you analyze a Forex price chart. Additionally, you can use the MT4 to build your own automated trading strategy and backtest any kind of trading ideas you might have.

Alternatively, you can use the web-based trading platform TradingView, which is another free Forex trading platform that has the same features as the MT4 platform and much more.

Without a forex trading strategy to advance your trading skills, a trading platform is useless. This is why we want to also explore the wide range of forex trading strategies

Below you’ll discover what are the different types of forex trading strategies that work.

Forex Trading Strategies for Beginners

Forex traders employ different trading styles that mostly fit their own personalities. We can break down Forex market trading strategies into four distinctive trading edges that can be used in different market environments:

While these are the most popular active FX trading strategies, Forex traders can use these concepts to innovate and develop well-versed Forex systems through the use of fundamental analysis and/or technical analysis. There are many tools a Forex trader can use to gain an edge in the FX market like Forex chart patterns, technical indicators, statistics and much more.

Check out a top-down approach to fundamental analysis of stocks: Fundamental Analysis of Stocks – 5 Financial Ratios to Follow.

In order to time the Forex market, you can apply a Forex strategy that is designed to improve your trading:

As a novice Forex trader, you have a wide variety of Forex trading strategies so you can take advantage of the currency price fluctuations. Since the market conditions are constantly changing, make sure you get familiarized with different types of Forex trading strategies.

Forex Trading For Beginners FAQ

Is Forex Trading good for Beginners?

Forex trading can be challenging because of several factors such as risk management and also extreme competition in the forex market. The forex market is large, fast-moving, and affects by many different variables. However, If you focus on risk management first and find a solid forex trading strategy, then it can be a great place for beginners to learn to trade.

Is Forex Trading Easy to Learn?

Forex trading is similar to other kinds of trading and if you learn the basics first and focus on the fundamentals it is something that anyone with basic market information can learn and master over time. You have to start somewhere.

What is the best way to Learn Forex?

The best way to learn to be proficient with Forex is to get a demo account where you can practice without having to worry about losing money. When you trade successfully on demo for a period of time say 6 months then you can move over to a small live account. Only after being successful on a demo first.

Is there a Trading Forex for Beginners PDF guide available to download?

We have many trading guides available here on this site which you can download and print out to help you learn to become successful at forex trading.

Is Forex Harder than Stocks?

Final Words – Forex Trading for Beginners

The basic mechanics of trading the forex market are similar to any other market. Buy low and sell high in the hope to generate a profit. Due to its unique characteristics, the forex market provides a wide range of trading opportunities that no other market does. The forex market, therefore, is very suitable for the novice trader that is looking to either make an extra income or a full-time trading career.

Forex trading for beginners can be extremely competitive. So, make sure you learn how to trade forex for beginners before you risk your hard-earned money. Learn as much as you can about the ins and outs of FX trading so, you’ll always be prepared to safely navigate the Forex market.

For more trading tips and tricks make sure you follow our Top 10 Forex Blogs list. The more you can learn about forex trading strategies, the more likely you’ll be able to become a successful trader.

Thank you for reading!

Feel free to leave any comments below, we do read them all and will respond.

Please Share this Trading Strategy Below and keep it for your own personal use! Thanks, Traders!

How to Trade on Forex? Ultimate Guide for Beginners

Contents

What are financial markets – exchange and Forex?

When an uninitiated reader encounters the collocation «financial market», they discern no difference between such terms as «stock market», «exchange», «Forex», «equity market», «bond market», «currency market», «derivative market», etc. So, I think there should be an explanation what the financial market really is. First of all, understand and remember that the financial market is not just a place for trading, but the entire system of the economic relations, which appeared in the process of exchanging different goods and recourses.

The financial market is an environment for mobilization and aggregation of capital, for loaning, exchanging currencies, and investing in the industrial sector. Balance of supply/demand for borrowed funds forms the global financial market. The global financial market can be classified according to types of goods that are traded. There are following types of financial markets:

Another classification that may be used for financial markets is the trade procedure:

Trading procedures on Forex

Since the Forex market is an OTC market, it doesn’t imply actually buying or selling currencies like they do in exchange offices.

A lot of people ask themselves a question: «How do I become a trader and start trading on financial markets?» Let’s try to track the career path of a future «big boy from Wall Street» step by step. Early stages in trading on Forex and other financial markets are pretty similar. Let’s take a closer look at this process by the example of the currency market.

First of all, a trader-to-be chooses a broker and decides on the trading platform they are going to use for trading. A variety of trading terminals available on the market allows to choose one that meets all their requirements and preferences. After choosing the platform, they have to decide on a trading account type. As a first step, it’s better to go for a standard demo account, which helps to learn how to open and close positions, place Stop Loss and Take Profit levels, and use charts and indicators.

Stop Loss is a protective order placed by a trader to limit possible losses in case of negative market situation. The order level is defined on basis of the current market situation, risks that a trader can afford, and their trading strategy.

Take Profit is an order to close a position when the instrument quotes reaches some specific price level. The order parameters are set by a trader based on their forecasts or according to their trading strategies. Take Profit orders can be placed not lonely at the position opening, but later as well. Also, there are methods of trading without Stop Loss and Take Profit levels, when a trader closes each deal manually after evaluating the current market situation.

Point (pip, tick) is the minimum distance covered by the currency pair quotes in case of the price change.

As a rule, there are no restrictions on the duration of open positions on the Forex market.

How to trade on demo account?

Let’s assume that a trader chooses MetaTrader 4 terminal, opens a demo account with 10,000 virtual USD, and decides to trade EUR/USD positions of 1 lot. In this case, a trader opens positions using virtual money and if they lose it, no real financial losses will be incurred. Any trader has an opportunity to open several demo account with the same broker and trade any amount of virtual funds.

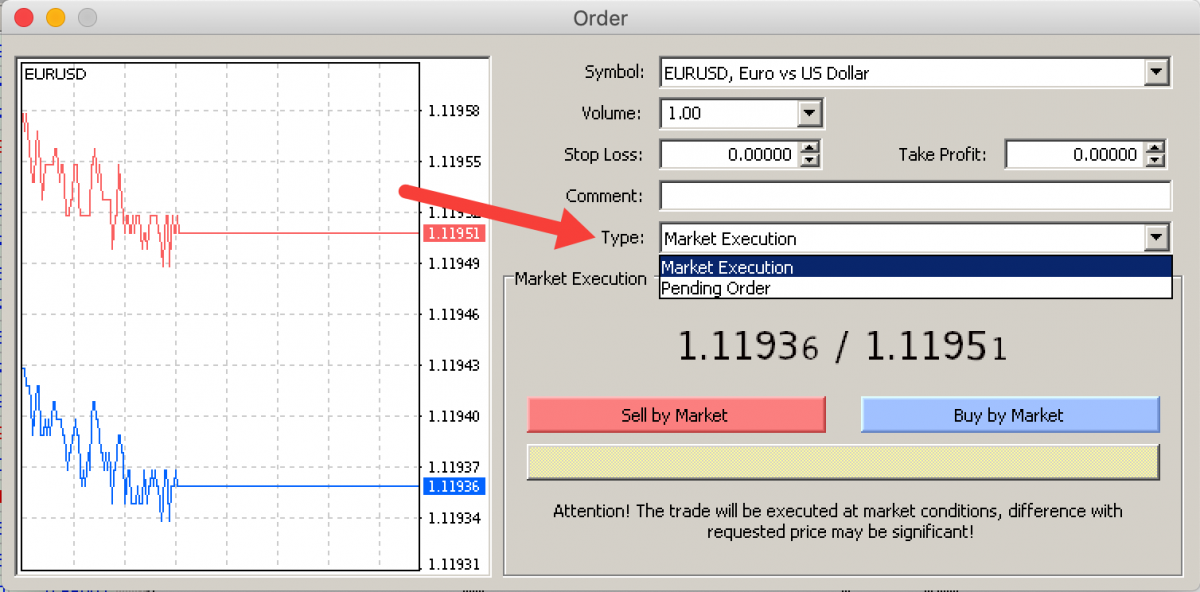

After that, it’s time to learn how to open positions. After opening the EUR/USD chart, a trader sees that the price may rise in the future (we’ll later discuss what reasons this conclusion is based upon). To open an order, we choose «New order» tab, specify the volume (by default, 1 lot), set Stop Loss and Take Profit levels, and add comment to the order if necessary.

Then we click «Buy by Market», that is sending an order to open a position at the current market price. As a rule, one doesn’t have to constantly monitor their open positions in case there are protective orders – the position will close automatically when the instrument price reaches one of the values set by a trader. If a traders doesn’t set Stop Loss and Take Profit level for one reason or another, the can close their positions manually at any moment. Long positions are opened in the same way, by clicking «Sell by Market».

Let’s calculate the [profit received by a trader by the example of EUR/USD. A trader opened an order and bought 1 lot (100,000 units of the base currency, EUR in this case) at 1.1250. Some time later, the price went up by 20 pips and reached 1.1270. With 1 pip being worth 10 USD, a trader gets the profit of 200 USD.

How transactions are performed?

The market always features a lot of both buyers and sellers, and each of them has their own perception of what is currently happening on the market. Traders and investors open and close a lot of positions every minute. To perform a transaction on the financial market, one has to send an order to a broker to open a position.

How to open a position on Forex

As a rule, such orders are sent through trading platforms and imply buying or selling a financial instrument (for instance, EUR/USD) at the current market price. To do this, you need to choose «New order» in your MetaTrader 4 trading terminal.

By clicking «New Order», you will open a new window with different parameters for the order you want to open. After choosing the required ticker from «Symbol» dropdown list box, you will see current Ask and Bid prices. In our case, EUR/USD can be bought at 1.12641 or sell at 1.12627. The difference between Ask and Bid price is called Spread.

In the same window, we can choose the volume of our position, which will influence the future profit, and set levels for Stop Loss (the position will be automatically closed at a loss when the price reaches this level) and Take Profit (the position will be automatically closed at a profit when the price reaches this level). In «Comment», you can describe your order, but in most cases, this field is empty. After specifying all parameters of your order, click either «Sell by Market» (if you expected the instrument to fall) or «Buy by Market» (when the instrument is predicted to rise). «By Market» execution mode will open a position at the current market price in both cases.

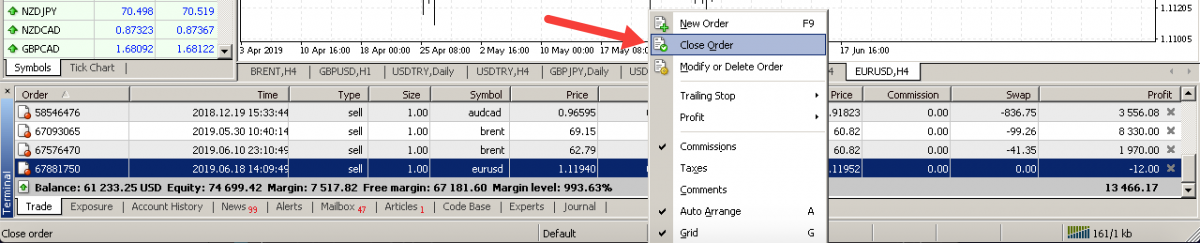

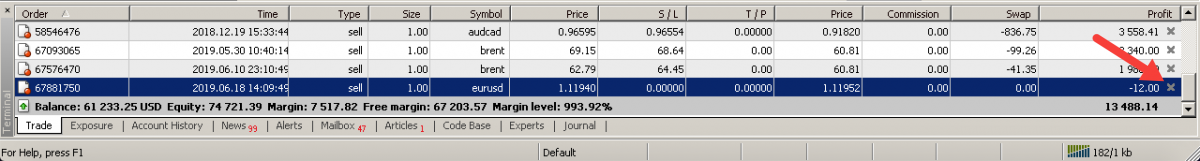

After your order is opened, it will be displayed on the chart. In our example, it was a sell order in EUR/USD of 1 lot with Stop Loss at 1.1295 and Take Profit at 1.1175. Stop Loss is an order sent to a broker to close the current position when the price reaches the specified value. As a rule, this type of order is used to minimize possible losses. Take Profit, in its turn, is another order sent to a broker, but to close the current position at an expected profit.

All open positions will be displayed in «Trade» tab of «Terminal» section. Here you can see numbers of orders, the time of opening, types (Sell means a short position, Buy – a long one) and volumes (numbers of lots). SL is short for «Stop Loss», TP – for «Take Profit». «Price» shows the current asset price, while «Profit» indicates a financial outcome.

When placing Stop Loss levels, remember that it should be above the current market price in case of selling and below it in case of buying.

Take Profit orders also have their nuances: if a trader sells, the level should be placed below the current price. Otherwise, the order should be above it.

To close your order, you have to right-click the required positions and choose «Close Order». After that, your position will be closed and moved to «Account history» tab. Another way to close your position is to click the cross next to the number in «Profit» tab.

How to set a pending order

However, there are situations on the market when you can’t open a new position at the current price. For such cases, terminals offer a special type of orders called «Pending order». They are orders to buy or sell an instrument above or below the current market price.

To place a pending order, you have to choose «Pending Order» from «Type» dropdown list. After that, 4 types of pending orders will be available to you.

Buy Limit is a pending order to buy below the current market price. For example, a trader wants to buy EUR/USD at 1.1100, but the current price is 1.1275. To buy the pair at 1.1100, a trader has an opportunity place a Buy Limit without waiting until EUR/SUD moves downwards. After being placed, this order will be automatically activated as soon as the Ask price reaches 1.1100.

Sell Limit is a pending order to sell above the current market price. For example, a trader wants to sell EUR/USD at 1.1400, but the current price is 1.1275. To sell the pair at 1.1400, a trader has an opportunity place a Sell Limit order without waiting until EUR/SUD moves upwards. After being placed, this order will be automatically activated as soon as the Bid price reaches 1.1400.

Buy Stop is a pending order to buy above the current market price. For example, a trader wants to buy EUR/USD at 1.1355, but the current price is 1.1275. To buy the pair at 1.1355, a trader has an opportunity place a Buy Stop order without waiting until EUR/USD moves upwards. After being placed, this order will be automatically activated as soon as the Bid price reaches 1.1355.

Sell Stop is a pending order to sell below the current market price. For example, a trader wants to sell EUR/USD at 1.1155, but the current price is 1.1275. To sell the pair at 1.1155, a trader has an opportunity place a Sell Stop order without waiting until EUR/USD moves downwards. After being placed, this order will be automatically activated as soon as the Ask price reaches 1.1155.

Basic types of forex trading strategies

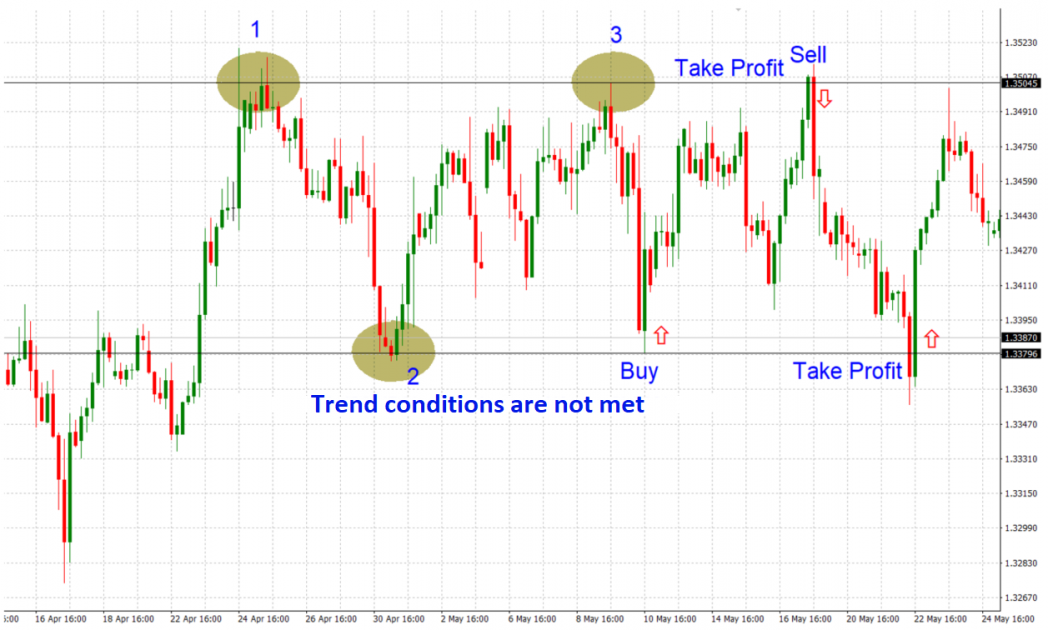

Prices on the Forex market may go either up or down – as the say, «there is no third option here». However, sometimes the price starts moving in some specific range with support and resistance levels formed before.

Thus, we can distinguish 3 basic types of trading systems:

So, trend systems can be of two types:

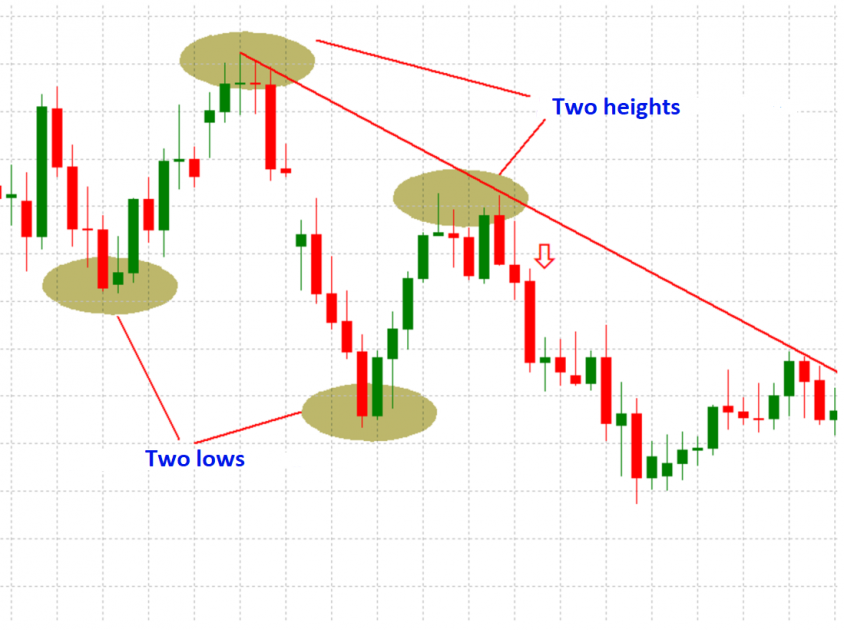

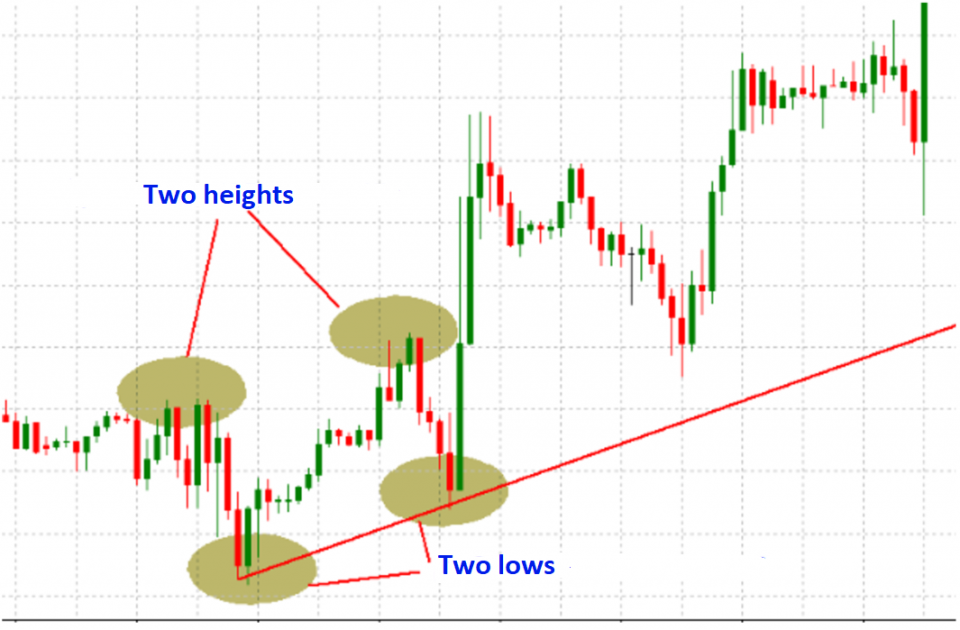

Trend lines trading

First off, let’s talk about trading systems that are based on chart analysis, specifically – formation of trend lines. However, in order to trade using trend systems, one should understand what a trend is.

The Forex market defines a trend as a stable price movement is some particular direction. Trends can be ascending (uptrend) and descending (downtrend).

As a result, to identify the current trend, one requires 4 key points, 2 of which are the minimum price values on the current timeframe, while other 2 are the maximum price values on the same timeframe.

The chart shows it in the following way.

These 4 points help us to form the trend line and decide on its direction. To find an entry point, we must form the trend line based on lows in case of the uptrend and on highs in case of the downtrend.

The third contact of the price and the trend line may be considered the simplest and most efficient entry point in the direction of the trend. Consequently, it’s quite easy to find an entry point. The most serious problem on the market is to find an exit point, i.e the price to take the profit. In this trading system, an exit point to close a position is the channel’s line parallel to the trend line on highest and lowest price values (depending on the current trend).

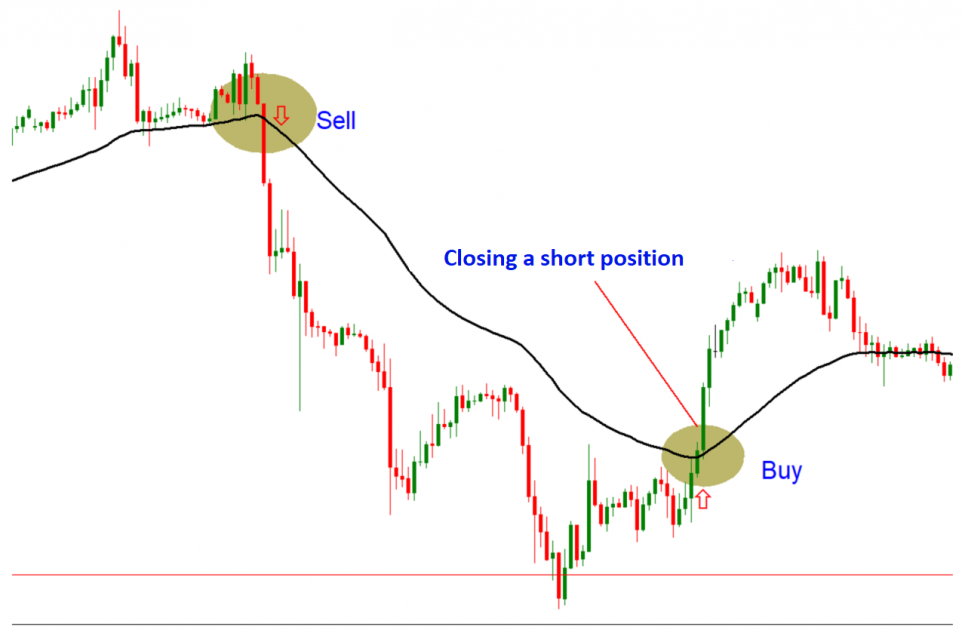

We’ve just discussed a trend trading system based on chart analysis. Now, let’s turn to an indicator trading strategy.

Indicator trading strategy

The most popular trend indicator is Moving Average. This function is the basis for almost 60% of all indicators used on the market. This particular trading system is very simple. First of all, you should lay one Moving Average on the chart. When choosing its period, remember that the shorter the period, the more false signals the indicator may give. However, in case of longer periods, the indicator will be significantly lagging in defining entry points, which may result in higher risks and loss of some part of your profit. The period of Moving Average should be defined individually for every currency pair by analyzing available historic data.

To define an entry point using Moving Average, you should wait until the price breaks this indicator’s level. Breaking it to the upside will indicate a long position, otherwise it will signal a short one. A signal to close a position will be a reverse breakout of Moving Averages.

We’ve discussed simple, but quite efficient trend systems. Now, let’s talk about flat trading systems.

Flat trading systems

To identify a flat on the market, we should define key levels, between which a currency pair is moving. In other words, find the resistance and the support. As a rule, there should be at least three key points, which may help to understand that the price is currently trading sideways. And, of course, it’s important to see that there are no signs of an uptrend or a downtrend on the market at that moment.

After finding the resistance and the support, all we have to do is to wait until the price reaches them and rebounds. At the same time, a signal to close a long position will be the price’s reaching the resistance, while a Take Profit order for a short position should be placed at the support.

When working with a flat, you should understand that the price can’t move in this range all the time, that’s why the most secure deals are the ones with the first rebounds from the channel’s borders after it was defined as a flat. With each next rebound, risks of loss significantly increases.

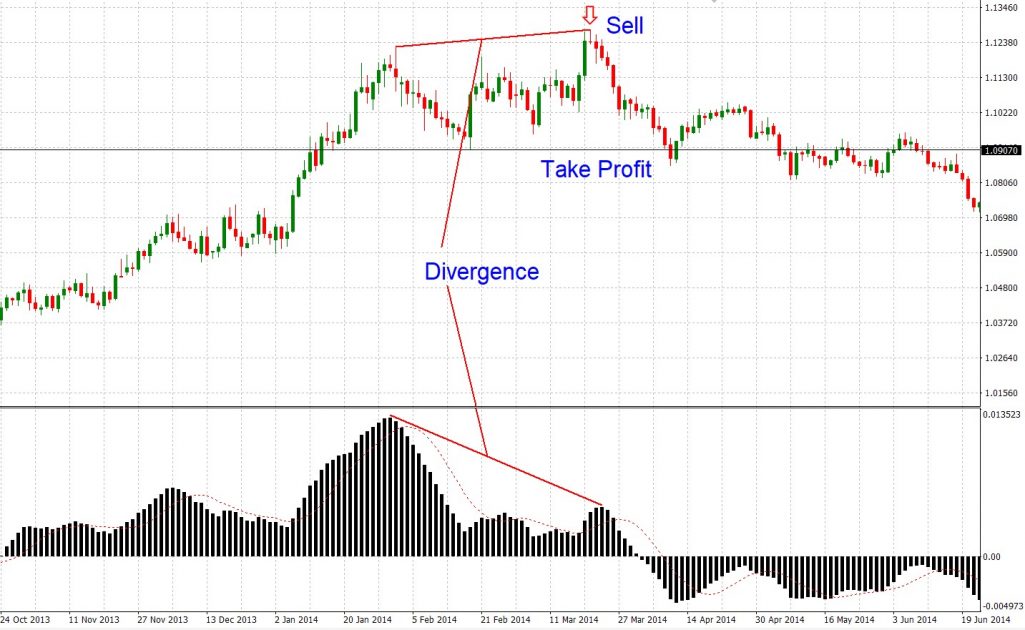

Countertrend trading system

And now let’s talk about the most risky strategy, which shows entry points against the current trend. The strategy uses MACD (Moving Average Convergence/Divergence) indicator, which is a version of Moving Averages, and all it does is measuring the distance between two of them with 12- and 26-day periods. This distance indicates the strength of the current trend and when the distance is getting smaller, it is considered as the first signal that the trend is weakening and may reverse. It is not very convenient to perceive this visually on Moving Average indicator, that’s’ why MACD indicators is considered more useful for such purposes.

So, a signal to open a position against the current trend is a movement of MACD lines in the direction that is opposite to the price. In other words, if the highs are getting lower on MACD, but are getting higher on a usual price chart, it’s a sign of a divergence and a signal to sell.

If the lows are getting higher on MACD, but are getting lower on a usual price chart, it’s a sign of a convergence and a signal to buy.

In this system, closest supports and resistances may be used as exit points.

Tips for beginners

Trading is a job, which requires years of getting knowledge and working hard. As a rule, engineering sciences take from 3 to 5 years at universities, medical profession – 5-6 years plus at least 3 years of medical residency. In process of training, future specialists get knowledge, master their skills, and gain experience. The same happens in trading – to receive efficient trading skills, you must read a great amount of books written by different acknowledged authorities of the financial world and spend a lot of time on learning fundamental and technical aspects of event that are happening in the industry.

At the same time, there are a lot of strategies, which may be used «manually». In addition to that, you have an opportunity to gain experience by trading on demo accounts or by implementing trading robots to make profit.

But why are there so much different strategies, if we need the only strategy, but a profitable one? Explanations are very simple, «so many men, so many minds» or «one man’s meat is another man’s poison.»

Conclusions

Material is prepared by

Dmitriy Gurkovskiy

He used to be the head o the laboratory of technical and fundamental analysis of financial markets in the Research Institute of Applied System Analysis. Now works as the head of RoboForex analytical department and gives daily Fibonacci analyses for the company’s clients.

Forex Trading: A Beginner’s Guide

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Trading currencies can be risky and complex. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Retail investors should spend time learning about the forex market and then researching which forex broker to sign up with, and find out whether it is regulated in the United States or the United Kingdom (U.S. and U.K. dealers have more oversight) or in a country with more lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Read on to learn about the forex markets, what it’s used for, and how you can get started trading.

Key Takeaways

Forex Trading: A Beginner’s Guide

What Is the Forex Market?

The foreign exchange market is where currencies are traded. Currencies are important because they allow us to purchase goods and services locally and across borders. International currencies need to be exchanged to conduct foreign trade and business.

If you are living in the United States and want to buy cheese from France, then either you or the company from which you buy the cheese has to pay the French for the cheese in euros (EUR). This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars (USD) for euros.

The same goes for traveling. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. The tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over the counter (OTC), which means that all transactions occur via computer networks among traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich—across almost every time zone. This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active anytime, with price quotes changing constantly.

Note that you’ll often see the terms FX, forex, foreign exchange market, and currency market. These terms are synonymous and all refer to the forex market.

A Brief History of Forex

In its most basic sense, the forex market has been around for centuries. People have always exchanged or bartered goods and currencies to purchase goods and services. However, the forex market, as we understand it today, is a relatively modern invention.

After the Bretton Woods accord began to collapse in 1971, more currencies were allowed to float freely against one another. The values of individual currencies vary based on demand and circulation and are monitored by foreign exchange trading services.

Commercial and investment banks conduct most of the trading in forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

There are two distinct features of currencies as an asset class:

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the Japanese yen (JPY) and buy British pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a carry trade.

Currency trading was very difficult for individual investors prior to the Internet. Most currency traders were large multinational corporations, hedge funds, or high-net-worth individuals (HNWIs) because forex trading required a lot of capital. With help from the Internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets through either the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

An Overview of Forex Markets

The FX market is where currencies are traded. It is the only truly continuous and nonstop trading market in the world. In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has become more retail-oriented in recent years, and traders and investors of many holding sizes have begun participating in it.

An interesting aspect of world forex markets is that there are no physical buildings that function as trading venues for the markets. Instead, it is a series of connections made through trading terminals and computer networks. Participants in this market are institutions, investment banks, commercial banks, and retail investors.

The foreign exchange market is considered more opaque than other financial markets. Currencies are traded in OTC markets, where disclosures are not mandatory. Large liquidity pools from institutional firms are a prevalent feature of the market. One would presume that a country’s economic parameters should be the most important criterion to determine its price. But that’s not the case. A 2019 survey found that the motives of large financial institutions played the most important role in determining currency prices.

Forex is traded primarily via three venues: spot markets, forwards markets, and futures markets. The spot market is the largest of all three markets because it is the “underlying” asset on which forwards and futures markets are based. When people refer to the forex market, they are thus usually referring to the spot market. The forwards and futures markets tend to be more popular with companies or financial firms that need to hedge their foreign exchange risks out to a specific date in the future.

Spot Market

Forex trading in the spot market has always been the largest because it trades in the biggest underlying real asset for the forwards and futures markets. Previously, volumes in the forwards and futures markets surpassed those of the spot markets. However, the trading volumes for forex spot markets received a boost with the advent of electronic trading and the proliferation of forex brokers.

The spot market is where currencies are bought and sold based on their trading price. That price is determined by supply and demand and is calculated based on several factors, including current interest rates, economic performance, sentiment toward ongoing political situations (both locally and internationally), and the perception of the future performance of one currency against another. A finalized deal is known as a spot deal. It is a bilateral transaction in which one party delivers an agreed-upon currency amount to the counterparty and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than in the future), these trades actually take two days for settlement.

Forwards and Futures Markets

A forward contract is a private agreement between two parties to buy a currency at a future date and at a predetermined price in the OTC markets. A futures contract is a standardized agreement between two parties to take delivery of a currency at a future date and at a predetermined price. Futures trade on exchanges and not OTC.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves. In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange (CME).

In the United States, the National Futures Association (NFA) regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterparty to the trader, providing clearance and settlement services.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

In addition to forwards and futures, options contracts are also traded on certain currency pairs. Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date and for a pre-set exchange rate, before the option expires.

Unlike the spot market, the forwards, futures, and options markets do not trade actual currencies. Instead, they deal in contracts that represent claims to a certain currency type, a specific price per unit, and a future date for settlement. This is why they are known as derivatives markets.

Uses of the Forex Markets

Forex for Hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

The blender company could have reduced this risk by short selling the euro and buying the U.S. dollar when they were at parity. That way, if the U.S. dollar rose in value, then the profits from the trade would offset the reduced profit from the sale of blenders. If the U.S. dollar fell in value, then the more favorable exchange rate would increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world.

Forex for Speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect the supply and demand for currencies, creating daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

How to Start Trading Forex

Trading forex is similar to equity trading. Here are some steps to get yourself started on the forex trading journey.

1. Learn about forex: While it is not complicated, forex trading is a project of its own and requires specialized knowledge. For example, the leverage ratio for forex trades is higher than for equities, and the drivers for currency price movement are different from those for equity markets. There are several online courses available for beginners that teach the ins and outs of forex trading.

2. Set up a brokerage account: You will need a forex trading account at a brokerage to get started with forex trading. Forex brokers do not charge commissions. Instead, they make money through spreads (also known as pips) between the buying and selling prices.

For beginner traders, it is a good idea to set up a micro forex trading account with low capital requirements. Such accounts have variable trading limits and allow brokers to limit their trades to amounts as low as 1,000 units of a currency. For context, a standard account lot is equal to 100,000 currency units. A micro forex account will help you become more comfortable with forex trading and determine your trading style.

3. Develop a trading strategy: While it is not always possible to predict and time market movement, having a trading strategy will help you set broad guidelines and a road map for trading. A good trading strategy is based on the reality of your situation and finances. It takes into account the amount of cash that you are willing to put up for trading and, correspondingly, the amount of risk that you can tolerate without getting burned out of your position. Remember, forex trading is mostly a high-leverage environment. But it also offers more rewards to those who are willing to take the risk.

4. Always be on top of your numbers: Once you begin trading, always check your positions at the end of the day. Most trading software already provides a daily accounting of trades. Make sure that you do not have any pending positions to be filled out and that you have sufficient cash in your account to make future trades.

5. Cultivate emotional equilibrium: Beginner forex trading is fraught with emotional roller coasters and unanswered questions. Should you have held onto your position a bit longer for more profits? How did you miss that report about low gross domestic product (GDP) numbers that led to a decline in overall value of your portfolio? Obsessing over such unanswered questions can lead you down a path of confusion. That is why it is important to not get carried away by your trading positions and cultivate emotional equilibrium across profits and losses. Be disciplined about closing out your positions when necessary.

Forex Terminology

The best way to get started on the forex journey is to learn its language. Here are a few terms to get you started:

Basic Forex Trading Strategies

The most basic forms of forex trades are a long trade and a short trade. In a long trade, the trader is betting that the currency price will increase in the future and they can profit from it. A short trade consists of a bet that the currency pair’s price will decrease in the future. Traders can also use trading strategies based on technical analysis, such as breakout and moving average, to fine-tune their approach to trading.

Depending on the duration and numbers for trading, trading strategies can be categorized into four further types:

Charts Used in Forex Trading

Three types of charts are used in forex trading. They are:

Line Charts

Line charts are used to identify big-picture trends for a currency. They are the most basic and common type of chart used by forex traders. They display the closing trading price for the currency for the time periods specified by the user. The trend lines identified in a line chart can be used to devise trading strategies. For example, you can use the information contained in a trend line to identify breakouts or a change in trend for rising or declining prices.

While it can be useful, a line chart is generally used as a starting point for further trading analysis.

Bar Charts

Much like other instances in which they are used, bar charts are used to represent specific time periods for trading. They provide more price information than line charts. Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price (OHLC) for a trade. A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined.

Bar charts for currency trading help traders identify whether it is a buyer’s market or a seller’s market.

Candlestick Charts

Candlestick charts were first used by Japanese rice traders in the 18th century. They are visually more appealing and easier to read than the chart types described above. The upper portion of a candle is used for the opening price and highest price point used by a currency, and the lower portion of a candle is used to indicate the closing price and lowest price point. A down candle represents a period of declining prices and is shaded red or black, while an up candle is a period of increasing prices and is shaded green or white.

The formations and shapes in candlestick charts are used to identify market direction and movement. Some of the more common formations for candlestick charts are hanging man and shooting star.

Pros and Cons of Trading Forex

Pros and Cons of Trading Forex

Forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. This makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

The forex market is traded 24 hours a day, five and a half days a week—starting each day in Australia and ending in New York. The broad time horizon and coverage offer traders several opportunities to make profits or cover losses. The major forex market centers are Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich.

The extensive use of leverage in forex trading means that you can start with little capital and multiply your profits.

Automation of forex markets lends itself well to rapid execution of trading strategies.

Forex trading generally follows the same rules as regular trading and requires much less initial capital; therefore, it is easier to start trading forex compared to stocks.

The forex market is more decentralized than traditional stock or bond markets. There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower.

Even though they are the most liquid markets in the world, forex trades are much more volatile than regular markets.

Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account.

Trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their interconnectedness to grasp the fundamentals that drive currency values.