The failure of risk management why it s broken and how to fix it

The failure of risk management why it s broken and how to fix it

Библиотека

An essential guide to the calibrated risk analysis approach

The Failure of Risk Management takes a close look at misused and misapplied basic analysis methods and shows how some of the most popular «risk management» methods are no better than astrology! Using examples from the 2008 credit crisis, natural disasters, outsourcing to China, engineering disasters, and more, Hubbard reveals critical flaws in risk management methods–and shows how all of these problems can be fixed. The solutions involve combinations of scientifically proven and frequently used methods from nuclear power, exploratory oil, and other areas of business and government. Finally, Hubbard explains how new forms of collaboration across all industries and government can improve risk management in every field.

Douglas W. Hubbard (Glen Ellyn, IL) is the inventor of Applied Information Economics (AIE) and the author of Wiley’s How to Measure Anything: Finding the Value of Intangibles in Business (978-0-470-11012-6), the #1 bestseller in business math on Amazon. He has applied innovative risk assessment and risk management methods in government and corporations since 1994.

«Doug Hubbard, a recognized expert among experts in the field of risk management, covers the entire spectrum of risk management in this invaluable guide. There are specific value-added take aways in each chapter that are sure to enrich all readers including IT, business management, students, and academics alike»

—Peter Julian, former chief-information officer of the New York Metro Transit Authority. President of Alliance Group consulting

«In his trademark style, Doug asks the tough questions on risk management. A must-read not only for analysts, but also for the executive who is making critical business decisions.»

—Jim Franklin, VP Enterprise Performance Management and General Manager, Crystal Ball Global Business Unit, Oracle Corporation.

The Failure of Risk Management. Why It’s Broken and How to Fix It

Скачать книгу

О книге «The Failure of Risk Management. Why It’s Broken and How to Fix It»

An essential guide to the calibrated risk analysis approach The Failure of Risk Management takes a close look at misused and misapplied basic analysis methods and shows how some of the most popular «risk management» methods are no better than astrology! Using examples from the 2008 credit crisis, natural disasters, outsourcing to China, engineering disasters, and more, Hubbard reveals critical flaws in risk management methods–and shows how all of these problems can be fixed. The solutions involve combinations of scientifically proven and frequently used methods from nuclear power, exploratory oil, and other areas of business and government. Finally, Hubbard explains how new forms of collaboration across all industries and government can improve risk management in every field. Douglas W. Hubbard (Glen Ellyn, IL) is the inventor of Applied Information Economics (AIE) and the author of Wiley’s How to Measure Anything: Finding the Value of Intangibles in Business (978-0-470-11012-6), the #1 bestseller in business math on Amazon. He has applied innovative risk assessment and risk management methods in government and corporations since 1994. «Doug Hubbard, a recognized expert among experts in the field of risk management, covers the entire spectrum of risk management in this invaluable guide. There are specific value-added take aways in each chapter that are sure to enrich all readers including IT, business management, students, and academics alike» —Peter Julian, former chief-information officer of the New York Metro Transit Authority. President of Alliance Group consulting «In his trademark style, Doug asks the tough questions on risk management. A must-read not only for analysts, but also for the executive who is making critical business decisions.» —Jim Franklin, VP Enterprise Performance Management and General Manager, Crystal Ball Global Business Unit, Oracle Corporation.

На нашем сайте можно скачать книгу «The Failure of Risk Management. Why It’s Broken and How to Fix It» в формате pdf или читать онлайн. Здесь так же можно перед прочтением обратиться к отзывам читателей, уже знакомых с книгой, и узнать их мнение. В интернет-магазине нашего партнера вы можете купить и прочитать книгу в бумажном варианте.

An Evening with Doug Hubbard: The Failure of Risk Management: Why it’s *Still* Broken and How to Fix It

There seems to be two different types of risk managers in the world: those who are perfectly satisfied with the status quo, and those who think current techniques are vague and do more harm than good. Doug Hubbard is firmly in the latter camp. His highly influential and groundbreaking 2009 book titled The Failure of Risk Management: Why it’s Broken and How to Fix It takes readers on a journey through the history of risk, why some methods fail to enable better decision making and – most importantly – how to improve. Since 2009, however, much has happened in the world of forecasting and risk management: the Fukushima Daiichi Nuclear Disaster in 2011, the Deepwater Horizon Offshore Oil Spill in 2019, multiple large data breaches (Equifax, Anthem, Target), and many more. It makes one wonder; in the last 10 years, have we “fixed” risk?

Luckily, we get an answer. A second edition of the book will be released in July 2019, titled The Failure of Risk Management: Why it’s *Still* Broken and How to Fix It. On September 10th, 2018, Hubbard treated San Francisco to a preview of the new edition, which includes updated content and his unique analysis on the events of the last decade. Fans of quantitative risk techniques and measurement (yes, we’re out there) also got to play a game that Hubbard calls “The Measurement Challenge,” in which participants attempt to stump him with questions they think are immeasurable.

It was a packed event, with over 200 people from diverse fields and technical backgrounds in attendance in downtown San Francisco. Richard Seiersen, Hubbard’s How to Measure Anything in Cybersecurity Risk co-author, kicked off the evening with a few tales of risk measurement challenges he’s overcome during his many years in the cybersecurity field.

Is it Still Broken?

The first edition of the book used historical examples of failed risk management, including the 2008 credit crisis, the Challenger disaster and natural disasters to demonstrate that the most popular form of risk analysis today (scoring using ordinal scales) is flawed and does not effectively help manage risk. In the 10 years since Hubbard’s first edition was released, quantitative methods, while still not widely adopted, have made inroads in consulting firms and companies around the world. Factor Analysis of Information Risk (FAIR) is an operational risk analysis methodology that shares many of the same approaches and philosophies that Hubbard advocates for and has made signification traction in risk departments in the last decade. One has to ask – is it still broken?

It is. Hubbard pointed to several events since the first edition:

Fukushima Daiichi Nuclear Disaster (2011)

Deepwater Horizon Offshore Oil Spill (2010)

Flint Michigan Water System (2012 to present)

Samsung Galaxy Note 7 (2016)

Amtrak Derailments/collisions (2018)

Multiple large data breaches (Equifax, Anthem, Target)

Risk managers are fighting the good fight in trying to drive better management decisions with risk analysis, but by and large, we are not managing our single greatest risk: how we measure risk.

Hubbard further drove the point home and explained that the most popular method of risk analysis, the risk matrix, is fatally flawed. Research by Cox, Bickel and many others discovered that the risk matrix adds errors, rather than reduces errors, in decision making.

Fig 1: Typical risk matrix

How do we fix it? Hubbard elaborated on the solution at length, but the short answer is: math with probabilities. There are tangible examples in the first edition of the book, and will be expanded upon in the second edition.

The Measurement Challenge!

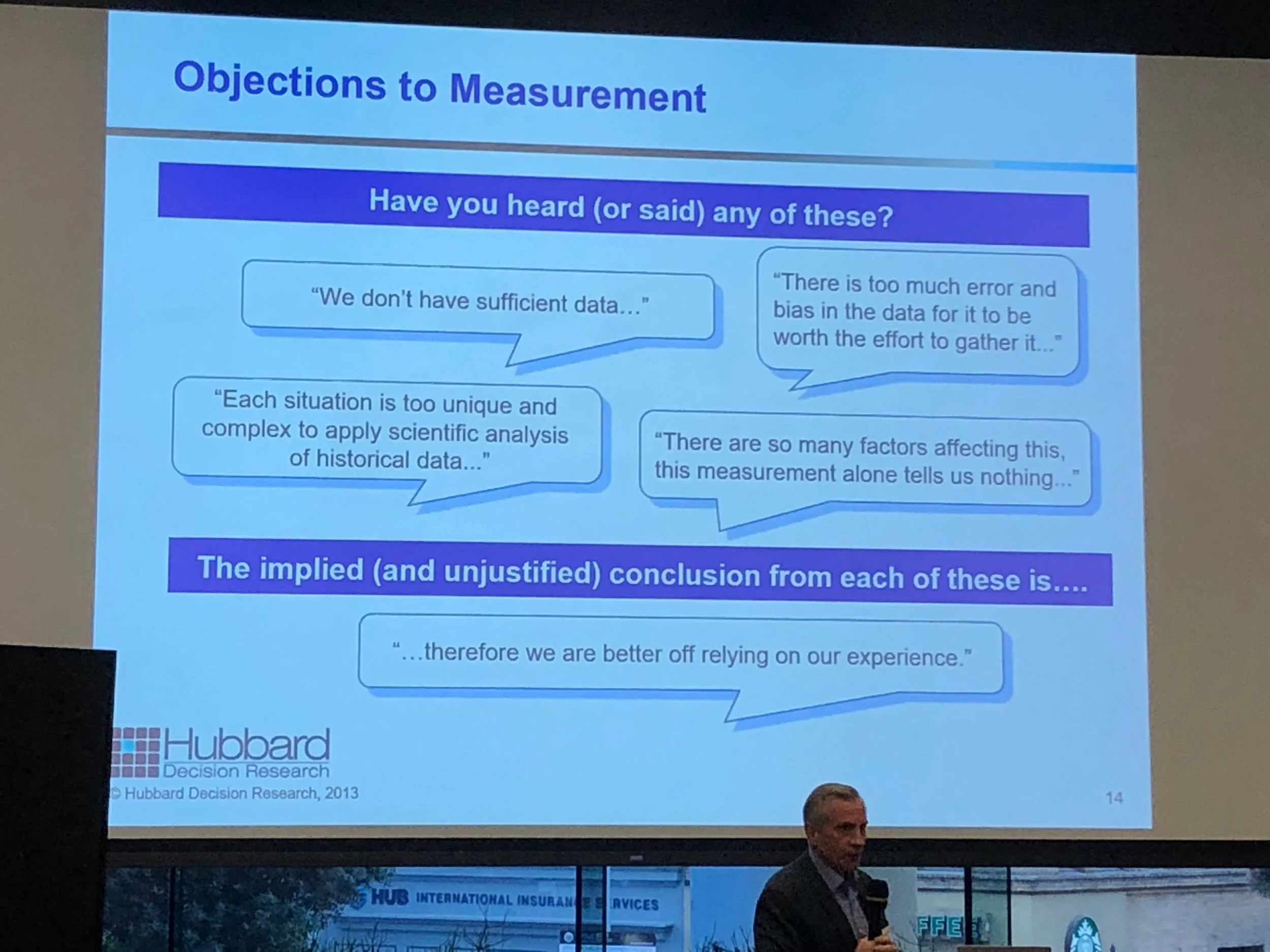

A pervasive problem in business is the belief that some things, especially those that are intangible, cannot be measured. Doug Hubbard has proven, however, that anything can be measured. The technique lies in understanding exactly what measurement is and framing the object under measurement in a way that facilitates measurement. Based on this idea, Hubbard created a game that he likes to do on his website, books and occasionally when he speaks at an event, called The Measurement Challenge. The Measurement Challenge is a simple concept: Hubbard will take questions, concepts, items, or ideas that people perceive to be immeasurable, and he will demonstrate how to measure them. The Measurement Challenge is based on another one of Hubbard’s books, How to Measure Anything: Finding the Value of Intangibles in Business in which simple statistical techniques are described to demonstrate how to measure (literally!) anything.

When all the participants checked into the event that evening, The Measurement Challenge was briefly explained to them, and they were given paper to write down one item they thought was hard or impossible to measure. Some entries actually have been measured before, such as measuring the number of jelly beans in a jar, the number of alien civilizations in the universe and decomposition problems, similar to the number of piano tuners in Chicago. The most interesting ones were things that are intangible, and which is of course, is Hubbard’s specialty.

Measuring intangibles requires a clear definition of what it is you’re trying to measure.

It’s useful to keep in mind the clarification chain, described in Hubbard’s book How to Measure Anything: Finding the Value of Intangibles in Business. The clarification chain is summed up as three axioms:

If it matters at all, it is detectable/observable.

If it is detectable, it can be detected as an amount (or range of possible amounts.)

If it can be detected as a range of possible amounts, it can be measured.

All entries were collected, duplicates were combined and tallied up for final voting. The finalist questions were put up on an online voting system for all participants to vote on from their smartphones. There were a diverse number of excellent questions, but two were picked to give plenty of time to delve into the concepts of measurement and how to decompose the problems.

Some interesting questions that weren’t picked:

Measure the capacity for hate

The effectiveness of various company training programs

The value of being a better calibrated estimator

How much does my daughter love me?

The winning questions were:

How much does my dog love me?, and

What is the probable reputation damage to my company resulting from a cyber incident?

Challenge #1: How much does my dog love me?

How much does my dog love me? This is a challenging question, and it combined many other questions that people had asked of a similar theme. There were many questions on love, hate and other emotions, such as: How do I know my daughter loves me? How much does my spouse love me? How can I measure the love between a married couple? How much does my boss hate me? If you can figure out how to measure love, you would also know how to measure hate. Taking that general theme, “How much does my dog love me?” is a good first measurement challenge.

Hubbard read the question, looked up somewhat quizzically and told the person who had asked the question to raise their hand. He asked a counter question: “What do you mean by love?” Most people in the audience, including the person who’d asked the question, were unsure how to answer. Pausing to let the point be made, Hubbard then started to explain how to solve this problem.

He explained that the concept of “love” has many different definitions based on who you are, your cultural differences, age, gender, and many other factors. The definition of love also varies by the object of which you are forming the question around. For example, the definition of love from an animal is very different from the definition of love from a child, which is also very different from the love from a spouse. After explaining, Hubbard asked again: “What do you mean by love from your dog? What does this mean?”

People started throwing out ideas of what it means for a dog to love an individual, naturally using the clarification chain as a mental framework. Observable, detectable behaviors were shouted out, such as:

When I come home from work and my dog is happy to see me. She jumps up on me. This is how I know she loves me.

I observe love from my dog when he cuddles in bed after a long day at work.

Some dogs are service animals and are trained to save lives or assist throughout your day. That could also be a form of love.

Hubbard asked a follow-up question, “Why do you care if your dog loves you?” This is where the idea of measuring “love” started to come into focus for many of the people in the audience. If one is able to clearly define what love is, able to articulate why one personally cares, and frame the measurement as what can be observed, meaningful measurements can be made.

The last question Hubbard asked was, “What do you already know about this measurement problem?” If one’s idea of love from a dog is welcome greetings, one can measure how many times the dog jumps up, or some other activity that is directly observable. In the service animal example, what would we observe that would tell us that the dog is doing its job? Is it a number of activities per day that that the dog is able to complete successfully? Would it be passing certain training milestones so that you would know that the dog can save your life when it’s needed? If your definition of love falls within those parameters, it should be fairly easy to build measurements around what you can observe.

Challenge #2: What is the probable reputation damage to my company resulting from a cyber incident?

The next question was by far one of the most popular questions that was asked. This is a very interesting problem, because some people would consider this to be an open and shut case. Reputation damage has been measured many times by many people and the techniques are fairly common knowledge. However, many risk managers proudly exclaim that reputation damage simply cannot be measured for various reasons: the tools don’t exist, it’s too intangible, or that it’s not possible to inventory all the various areas a business has reputation, as an asset to lose.

Just like the first question, he asked the person that posed this problem to raise their hand and he asked a series of counter questions, designed to probe exactly what they mean by “reputation,” what could you observe that would tell you that have good reputation, and as a counter question, what could you observe that would tell you that you have a bad reputation?

Framing it in the form of observables started an avalanche of responses from audience. One person chimed in saying that if a company had a good reputation, it would lead to customers’ trust and sales might increase. Another person added that an indicator of a bad reputation could be a sharp decrease in sales. The audience got the point quickly. Many other ideas were brought up:

A drop in stock price, which would be a measurement of shareholder trust/satisfaction.

A bad reputation may lead to high interest rates when borrowing money.

Inability to retain and recruit talent.

Increase in public relations costs.

Many more examples, and even more sector specific examples, were given by the audience. By the end of this exercise, the audience was convinced that reputation could indeed be measured, as well as many other intangibles.

Further Reading

Hubbard previewed his new book at the event and everyone in the audience had a great time trying to stump him with measurement challenges, even if it proved to be futile. These are all skills that can be learned. Check out the links below for further reading.

Douglas Hubbard

The Failure of Risk Management, by Douglas Hubbard

How to Measure Anything, by Douglas Hubbard

More Information of Risk Matrices

Bickel et al. “The Risk of Using Risk Matrices”, Society of Petroleum Engineers, 2014

The Failure of Risk Management: Why It’s Broken and How to Fix It

An essential guide to the calibrated risk analysis approach The Failure of Risk Management takes a close look at misused and misapplied basic analysis methods and shows how some of the most popular «risk management» methods are no better than astrology! Using examples from the 2008 credit crisis, natural disasters, outsourcing to China, engineering disasters, and more, An essential guide to the calibrated risk analysis approach The Failure of Risk Management takes a close look at misused and misapplied basic analysis methods and shows how some of the most popular «risk management» methods are no better than astrology! Using examples from the 2008 credit crisis, natural disasters, outsourcing to China, engineering disasters, and more, Hubbard reveals critical flaws in risk management methods-and shows how all of these problems can be fixed. The solutions involve combinations of scientifically proven and frequently used methods from nuclear power, exploratory oil, and other areas of business and government. Finally, Hubbard explains how new forms of collaboration across all industries and government can improve risk management in every field.

Douglas W. Hubbard (Glen Ellyn, IL) is the inventor of Applied Information Economics (AIE) and the author of Wiley’s How to Measure Anything: Finding the Value of Intangibles in Business (978-0-470-11012-6), the #1 bestseller in business math on Amazon. He has applied innovative risk assessment and risk management methods in government and corporations since 1994.

«Doug Hubbard, a recognized expert among experts in the field of risk management, covers the entire spectrum of risk management in this invaluable guide. There are specific value-added take aways in each chapter that are sure to enrich all readers including IT, business management, students, and academics alike»

—Peter Julian, former chief-information officer of the New York Metro Transit Authority. President of Alliance Group consulting

Get A Copy

Friend Reviews

Reader Q&A

Be the first to ask a question about The Failure of Risk Management

Lists with This Book

Community Reviews

I had high expectations for this book after reading «How to Measure Anything», and unfortunately none of them were met. My very short review would state: were it not for those high expectations, I would have stopped reading the book about 1/3 of the way in, but based on past performance, I stuck it through to the end. That was a mistake.

The defects in Hubbard’s second book are many. First and foremost, it is simply not pleasant to read. While «How to Measure» adopted a posture of helpful tutoria I had high expectations for this book after reading «How to Measure Anything», and unfortunately none of them were met. My very short review would state: were it not for those high expectations, I would have stopped reading the book about 1/3 of the way in, but based on past performance, I stuck it through to the end. That was a mistake.

This is one of the best business books I’ve read, and I’d recommend it to anyone working for an organization that uses a «risk matrix» (those grids that show frequency on one axis, consequence on another, and are usually brightly-coloured in red, yellow, and green).

Hubbard argues many approaches to risk management are «equivalent to astrology» (p.xv, preface) and that at worse, risk management systems can expose an organization to more risk than they mitigate. Risk matrices have spread from com This is one of the best business books I’ve read, and I’d recommend it to anyone working for an organization that uses a «risk matrix» (those grids that show frequency on one axis, consequence on another, and are usually brightly-coloured in red, yellow, and green).

Hubbard argues many approaches to risk management are «equivalent to astrology» (p.xv, preface) and that at worse, risk management systems can expose an organization to more risk than they mitigate. Risk matrices have spread from company to company «live a dangerous virus with a long incubation period» (p5) and have even been codified into some laws, and now we’re all trapped using these faulty tools.

I used 3 stacks of page tabs on this one. some of the most interesting ideas and best quotes:

p66, on some people’s objections to incorporating expert subjective probability estimates in qualitative methods to estimate risk: «Some analysts who had no problem saying a likelihood was a 4 on a scale of 1 to 5 or a medium on a verbal scale will argue there are requirements for quantitative probabilities that make quantification somehow infeasible. Somehow, the problems that were not an issue when using more ambiguous methods are major roadblocks when attempting to state meaningful probabilities.» (this is such a great risk management zinger)

p68-72: Senior leadership of organizations should establish a Risk Tolerance Curve (chance on the y axis, loss/risk on the x axis) to unambiguously quantify what losses (at what probabilities) they are willing to accept. By analyzing all risks in the organization, a Loss Exceedance Curve (LEC) can also be generated that visualize the current (well-quantified) risks. If LEC > RTC, there’s a problem. Capital can be deployed to mitigate risks to bring the LEC under the RTC. Easier to prioritize and visualize than a list of things in the «red corner» of the risk matrix.

p102: Some very well-established organizations have fallen into the risk matrix trap. ISACA in the IT space, PMI in the project management space (everyone with a PMP designation), and NIST in the States.

p135: Chapter 7 is all about «the limits of expert knowledge and how humans are bad at estimating probabilities. Fortunately, enough research has been done to be able to mitigate these effects. Calibration training can dramatically improve people’s abilities to estimate a range of possibilities. I love this quote on p136 to justify calibrating people: «Technicians, scientists, or engineers [. ] wouldn’t want to use an instrument if they didn’t know it was calibrated [. ] For managers and analysts, too, we should apply a measure of their past performance at estimating risks. We should know whether those instruments consistently overestimate or underestimate risk.»

p164: The concept of ordinal scales: a scale that indicates a relative order of what is being assessed, not actual units of measure. Movie star ratings, for example. Chapter 8, «Worse Than Useless» is all about how arbitrary values set in risk matrix templates can totally skew risk analysis outcomes when you start multiplying frequency into consequence.

p203: Hubbard has an interesting 6-page call-out of Nassim Taleb. As I said above I think Hubbard and Taleb are mostly on the same page with each other, and Hubbard has fallen into the trap of having to refute some common misconceptions about risk based on how the «black swan» has entered the wider vernacular. I think Hubbard misrepresents some of Taleb’s points though, the «turkey problem» (p40 of Black Swan 2e) is misrepresented as a historical analysis, whereas Taleb’s point is that «a black swan is relative (to your point of view». (again on p279 Hubbard won’t let the turkey go!)

p217: Hubbard refutes «not-invented-here» syndrome and talks about how yes, risk management can be done at any organization.

p228: The Risk Paradox. «The most sophisticated risk analysis methods are often applied to low-level operational risks, whereas the biggest risks use softer methods or none at all.»

p271: How to calibrate people (for accurate probability estimates). Repetition and feedback, equivalent bet test, consider that you’re wrong (premortem), avoid anchoring.

The Failure of Risk Management

Посоветуйте книгу друзьям! Друзьям – скидка 10%, вам – рубли

Эта и ещё 2 книги за 399 ₽

A practical guide to adopting an accurate risk analysis methodology

The Failure of Risk Management provides effective solutionstosignificantfaults in current risk analysis methods. Conventional approaches to managing risk lack accurate quantitative analysis methods, yielding strategies that can actually make things worse. Many widely used methods have no systems to measure performance, resulting in inaccurate selection and ineffective application of risk management strategies. These fundamental flaws propagate unrealistic perceptions of risk in business, government, and the general public. This book provides expert examination of essential areas of risk management, including risk assessment and evaluation methods, risk mitigation strategies, common errors in quantitative models, and more. Guidance on topics such as probability modelling and empirical inputs emphasizes the efficacy of appropriate risk methodology in practical applications.

Recognized as a leader in the field of risk management, author Douglas W. Hubbard combines science-based analysis with real-world examples to present a detailed investigation of risk management practices. This revised and updated second edition includes updated data sets and checklists, expanded coverage of innovative statistical methods, and new cases of current risk management issues such as data breaches and natural disasters.

Identify deficiencies in your current risk management strategy and take appropriate corrective measures Adopt a calibrated approach to risk analysis using up-to-date statistical tools Employ accurate quantitative risk analysis and modelling methods Keep pace with new developments in the rapidly expanding risk analysis industry Risk analysis is a vital component of government policy, public safety, banking and finance, and many other public and private institutions. The Failure of Risk Management: Why It’s Broken and How to Fix It is a valuable resource for business leaders, policy makers, managers, consultants, and practitioners across industries.

Источники информации:

- http://avidreaders.ru/book/the-failure-of-risk-management-why.html

- http://www.tonym-v.com/blog/2019/5/6/an-evening-with-doug-hubbard-the-failure-of-risk-management-why-its-still-broken-and-how-to-fix-it

- http://www.goodreads.com/book/show/6516407-the-failure-of-risk-management

- http://www.litres.ru/douglas-w-hubbard-25740140/the-failure-of-risk-management/