Value investing made easy pdf

Value investing made easy pdf

Value Investing For Dummies

Скачать книгу

О книге «Value Investing For Dummies»

Want to follow in Warren Buffett’s investing footprints? Value Investing For Dummies, 2nd Edition, explains what value investing is and how to incorporate it into your overall investment strategy. It presents a simple, straightforward way to apply proven investment principles, spot good deals, and produce extraordinary returns. This plain-English guide reveals the secrets of how to value stocks, decide when the price is right, and make your move. You’ll find out why a good deal is a good deal, no matter what the bulls and bears say, get tips in investing during jittery times, and understand how to detect hidden agendas in financial reports. And, you’ll uncover the keys to identifying the truly good businesses with enduring and growing value that continually outperform both their competition and the market as a whole. Discover how to: Understand financial investments View markets like a value investor Assess a company’s value Make use of value investing resources Incorporate fundamentals and intangibles Make the most of funds, REITs, and ETFs Develop your own investing style Figure out what a financial statement is really telling you Decipher earnings and cash-flow statements Detect irrational exuberance in company publications Make a value judgment and decide when to buy Complete with helpful lists of the telltale signs of value and “unvalue,” as well as the habits of highly successful value investors, Value Investing For Dummies, 2nd Edition, could be the smartest investment you’ll ever make!

На нашем сайте можно скачать книгу «Value Investing For Dummies» в формате pdf или читать онлайн. Здесь так же можно перед прочтением обратиться к отзывам читателей, уже знакомых с книгой, и узнать их мнение. В интернет-магазине нашего партнера вы можете купить и прочитать книгу в бумажном варианте.

Value investing made easy – Part 1

Tuesday, September 4, 2018

This webinar by Mr Shailesh Saraf on 4th Sep, will focus on the true value of your stocks. Know the true value of the stocks in relation to their price. Mr Saraf will guide you in understanding and identifying those stocks which are available below their true value. Learn the parameters required to do the above.

Key Topics

Mr. Saraf will cover the below Topics in his webinar. The objective is to guide investors on the parameters required to know the true value of stocks and invest accordingly. The topics covered are:

1. What is Value Investing

2. Guidance on the Four Important parameters for taking out the true value of any stock

3. Identify the right stocks to invest in after knowing their true value

The webinar is interactive and includes a Q&A session

Target Audience

The Audience for these topics will be Financial Companies, Investors, Traders and Brokers either from Trading firms, Financial Institutions or Freelancers, who want to stay informed and up to date. Also for investors who are looking for a basic guide to understanding the process of value investing.

The Learning Outcome of This Webinar

The aim is to enrich the audience with the knowledge of value investing to identify the right stocks to invest in. The learning is with respect to ROC, ROCE, Earnings Growth & Discounted Cash Flow for knowing the real value of stocks.

Know how great Investors like Warren Buffet identify stocks with great growth potential and also know the right time to do value investing in these stocks.

Shailesh Saraf

Mr Shailesh Saraf has an experience of nearly 20 years in the financial market, especially in areas related to capital & derivatives market operations, trading, research and management. Mr Shailesh Saraf has learnt international best practices and continues to strive for nothing but the best in terms of both moral and material growth. Passionate about Research, Mr Saraf spearheads the Research team, constantly striving to give maximum value to our clients. www.dynamiclevels.com, a research website and an initiative of Mr Saraf, aims at providing comprehensive updated research and knowledge on all the NSE Stocks and Nifty, to empower traders to trade independently.

Mr. Shailesh Saraf has also applied for Patent in US, Euro zone and India on Dec 21, 2011 for his innovation of the Technical Levels Ladder.

A Great Value Investing PDF for All You Freeloaders

Hey you – hey you, FREELOADER! Stop right there! I got something for you…it’s an awesome, comprehensive value investing PDF that you can have…and did I say that it was free?

Well, good news – it is!

If you’re reading this blog, then you likely know Andrew Sather and have read some of his blogs, listened to his podcast, or maybe even used his Value Trap Indicator to help you find companies that are undervalued vs. their intrinsic value. But if you haven’t downloaded the free PDF at stockmarketpdf.com, then what are you doing?

I mean, come on – it’s free! That has to be the first thing that you do, right?

The PDF is thorough, and I mean thorough. It’s 40 pages of straight knowledge straight from Andrew to us as investors. At first, it might seem too intense to digest but I promise it’s not. He did a great job of laying it out in easy chapters to understand, and a very easy to read way, that makes it a great tool to not only the new investor but those that have been investing for years.

So, what exactly is included in the PDF?

Below is the table of contents included in the PDF:

As you can see, it really is 7 simple steps to understanding the stock market. Something that I love about the PDF is that Andrew really takes some time to focus on the ‘why’ of investing.

He does this by talking about compound interest and how it’s really the thing that makes investing worth it. He ends the section by talking about the Rule of 72, which is essentially a rule that tells you how long it takes to double your money and gets you your first introduction to compound interest and how amazing it is.

Then he goes into some of the stock market basics, such as investing on analysis vs. media noise, dollar cost averaging and making sure that you don’t time the market. I can tell you that ignoring any of these three important lessons can be a fatal flaw and I can also tell you that I have made each one of these mistakes when I first started investing.

If you’re currently investing then you’re likely familiar with these terms but if not, they’re truly building blocks that are so important to building a great foundation for your investing journey.

If you don’t understand these terms and how to apply them, then your risk is going to intensify. Specifically for me, dollar cost averaging was a major lesson that I had to learn and it has helped me avoid my instinct of trying to time the market and helps smooth out any risk that I have when I am either entering or exiting a position because it’s spread amongst many days of buying and selling.

Ok – you have the fundamentals down now, so what next? Time to buy your first stock! Andrew talks next about making that first purchase and getting your feet wet.

He talks about the entire process of setting up an account, finding the stock and then physically purchasing it, which is a bottleneck that I see with a lot of aspiring investors.

It seems like many people want to invest but have an issue taking that ‘first step’ and getting into the market. Once you buy your first stock, then the wheels will slowly start to gain traction and things will start to make much more sense to you.

Fortunately for us, many brokerages don’t charge fees anymore and I think a lot of that has to do with Robinhood starting this free commission trading. To me, that was the one advantage that Robinhood had, and now that many firms offer transactions without fees, I think you’d be silly to consider Robinhood as your investing platform.

Congratulations! You officially are now an investor and you are officially an owner of a company. Even if it’s one share of Apple, you are a partial owner of Apple and that’s the mindset that you should have.

So, what’s next? How do you continue to shape your investing knowledge and strategic plan?

Well, Andrew will tell you!

Andrew focuses next on some of the most important ratios for identifying successful stocks in the past, such as P/B and P/S and shows why they’re so impactful. He talks about the value of dividends and how if you implement DRIP (Dividend Reinvestment Plan) then it’s an extremely effective way to maximize compound interest.

Remember the term compound interest? That’s why we’re going through all of this in the first place!

You’ll learn about earnings in the PDF and how you should be viewing them, as they are a very important part of the business but shouldn’t be viewed in isolation as a buy/sell reasoning. At the end of it all, earnings are why a company is actually in business, but it is just one of many different pieces of financial information that you need to be cognizant of when evaluating a company.

And that’s it! Believe it or not, 40 pages is very concise considering how much information that you are given (for completely free I might add). And my favorite thing is that it’s laid out in such an easy to comprehend way that you can read it as you go through the process.

It’s not imperative to understand the P/B ratio if you’re trying to learn about how the stock market works. It’s laid out stage-by-stage so you can digest it as you go along the process.

And again, it’s free – just download the PDF! Your future, early-retired self will thank you for it!

Время стоимостного инвестирования (Value investing)

«Давайте возьмём очень простой пример, — это хлебозавод. Печёт себе хлеб и всё хорошо. Собственники решили построить ещё один в соседнем районе. Вышли на IPO разместили 1 мио акций по 10$ (справедливая оценочная цена) и на перспективах открытия нового хлебозавода акции стоят 14$.

Мы не будем углубляться в тонкости фундаментальных мультипликаторов, а только предположим завод построен и грянул финансовый кризис и акции просели до 7$.

Простые вопросы:

1. Сильно изменится ниша потребителей? — нет.

2. Хлеб, как покупали, так и будут покупать, возможно какая-то элитная выпечка пострадает.

3. Количество потенциальных клиентов снизиться? Если и да, то очень не значительно (возможно кто-то перейдёт на сухари за махинации повлёкшие кризис ))) ).

Что-то это как не прекрасная возможность купить привлекательный актив с дисконтом, за которым кстати ещё стоит ликвидное оборудование и помещения.»

Сейчас именно то время когда стоит присмотреться к «земным» бумагам. К продукции тех компаний, которыми мы пользуемся ежедневно и даже в условиях кризиса не сильно снизим свои затраты.

Критерии очень просты:

1. Компания из сектора «Потребительские товары» или ему подобного.

2. Желательно крупной или входить в определённый фондовый индекс.

3. После нынешней коррекции не выглядит перекупленной, можно использовать различные мультипликаторы фундаментального анализа например: P/E, P/BV и т.д. так и технического.

Для примера возьмём:

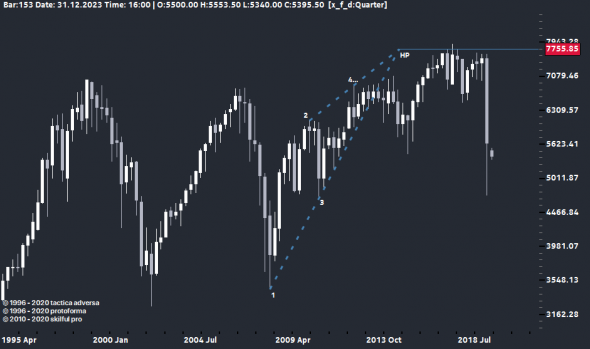

FTSE 100 Index (англ. Financial Times Stock Exchange Index, рус. Футси 100) — ведущий индекс Британской фондовой биржи (лондонский биржевой индекс).

в него входят несколько компаний из сектора «Потребительские товары»:

Посмотрим на исторические данные по индексу FTSE 100 с 1996 года, квартальный план:

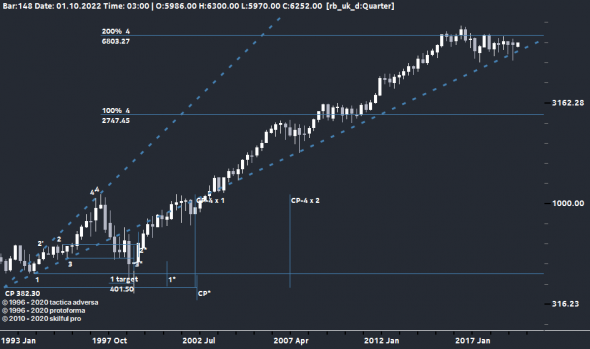

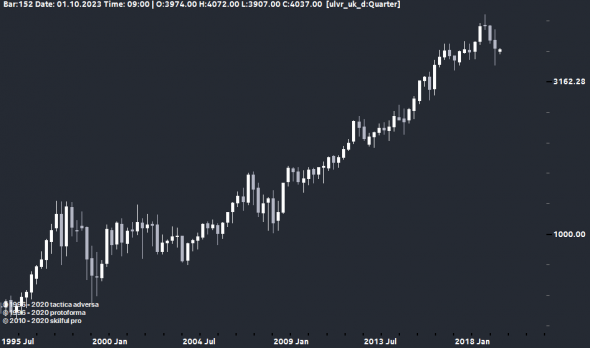

Reckitt Benckiser:

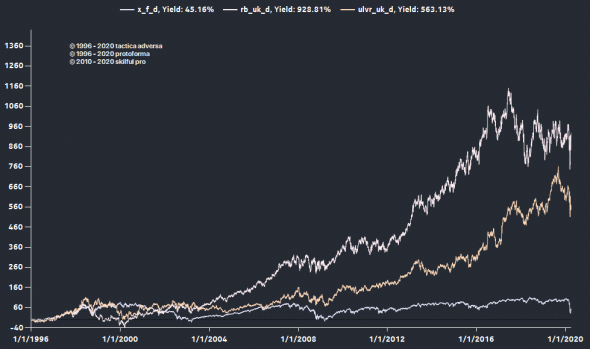

доходность индекса и этих двух бумаг:

Портфель из этих двух компаний дал прирост +745,5%, по отдельности:

— Reckitt Benckiser +928%;

— Unilever +563%

Что не мудрено, кто покупатели группы «Потребительские товары»?, — мы:

У крепкой компании могут быть провалы/перекупленность акций(коррекции)/форс мажоры, вот только «коронавирусы приходят и уходят, а кушать хочется всегда.»

На дневном плане стоимость акций компании Reckitt Benckiser практически отыграла провал:

Book Summary — The Little Book of Value Investing

This book fit-in perfectly as I started thinking about investing in stock myself.

T he Book describes the theory of value investing — investing in undervalued companies and holding them for a long time, even though / especially if they are not party-hot companies, but genuinely undervalued.

You need to invest but you don’t need to be a genius to do it smartly.

Value Investing is long-term investing in undervalued stock. The author also recommends investing in index’ to diversify the portfolio.

What is it worth?

Think like a banker → assess what the stock is worth.

This is what rational investors do. They sit back and wait for the market to offer stocks for less than they are worth and to buy the same stocks back for more than they are worth.

Intrinsic Value

Buy Stocks like Steaks… On Sale

The time to buy stock is when it’s low in price.

Buy stocks at a low multitude of their earnings.

Debt → company should own 2x of what it owes

Cycles → industries / companies are more/less dependent on the economy (ie food is not dependent)

Competition → only if there is a clear advantage

Fraud → if you don’t understand their financial statement, don’t buy

Currencies → don’t speculate on currencies, hedge them

Stay within your own circle of competence.

Examination

Balance Sheet — shows the companies’ stamina

current ratio = current assets / current liabilities → should be 2x

quick ratio = as above just excludes inventory

Income Statement — what can the business earn?

Questions to Consider

Margin of Safety

First rule of investing: Don’t lose money.

Second rule of investing: Refer to rule number one.

Leave yourself a cushion in case you made a mistake

Companies with debt → less appealing with less debt as they can survive tough times better

Diversification → both in terms of stock you own and industry they are in (ie invest globally)

How to Find the Right Company

Stock

You can even check who else owns the stock.

Funds

When to Buy

Buy when insiders buy — they have many reasons to sell their stock, but only one reason to buy it → in the US insiders have to announce that they are buying 2 days in advance

It’s time in the market, not market timing, that counts.

Don’t check prices every day → you’re investing in the long term.