How can protectionism policy help countries to regulate their import and export

How can protectionism policy help countries to regulate their import and export

Fair trade and its implications for developing and developed countries.

Trade

G1obalization and free trade. Pros and cons.

Globalization is the tendency for the world economy to work as one unit. It’s led by large international corporations operating all over the world. As any process globalization has advantages and disadvantages.

On the one hand it increase competition among producers and others consumers have a big range of products and services. Globalization rises peoples living standards. Also expansion of production provides the new jobs for people.

On the other hand globalization can damage local industries, if they are not competitive enough. If the companies want to survive in the period of globalization they need to take part in the competition. Also globalization can creates some cross-cultural problems or even ruins national customs.

Free trade is a situation in which goods come into and out of a country without any controls or taxes. Free trade is beneficial to countries. Countries, which open their markets, usually have a policy of deregulation. They free their markets without government’s control. Customers in free trade areas are offered a wider range of high-quality products at lower prices.

But the negative aspect of free trade is that a lot of foreign competitors can destroy local industries.

How can countries regulate their imports and exports. Protectionism.

Many countries try to protect their industries from foreign competitors and do not allow free markets. Also countries control and regulate their imports and exports. It is a policy of protectionism.

Some nations compete unfairly. For example dumping. It is common in international trade. Nations sell goods at very low prices, less than it costs the company to produce the goods. Companies are heavily subsidized by their governments. Infant industries need to be protected until they are strong enough to compete in the world markets.

There are two main barriers of free trade: tariffs and subsidies. Tariffs are taxes on imported goods, so that the imports cannot compete so well against domestic products. Subsidies are money paid to domestic producers so that they can sell their goods more cheaply than foreign competitors.

Less important barriers are quotas, licences and documents. Quotas limit the quantity of a product, which can be imported. Expensive licences for importers add greatly to costs.

All these tools help to r In conclusion I’d like to say that the choice of policy will depend on the level of social and economic development of the country. Developing countries prefer to protect infant and strategic industries. The developed and successful ones choose free trade and open markets. egulate imports and exports of different countries.

Fair trade and its implications for developing and developed countries.

Fair trade is a trading partnership, based on interaction of openness and respect. Fair trade seeks to achieve equality in international trade.

Fair trade exists for the development of business, offers better conditions of trade, ensure the safety of the rights of private producers and their employees.

Fair trade organizations consider that the main principle of their business is trade justice.

The main principles of fair trade are: creating opportunities for producers, financial transparency and responsibility, fair price, payment, working conditions and so on.

In conclusion, fair trade is more just a trade. This is evidence that a fair approach in the world trade is possible.

Fair trade shows that charity is not needed to lift people out of poverty and that social and environmental standards can be put into trade. It may not be the answer to developing countries, which need fairer rules, not ways of circumventing unfair ones, but for the moment it is the only option for western consumers who want to add some human rights to a manifestly unjust global trading system.

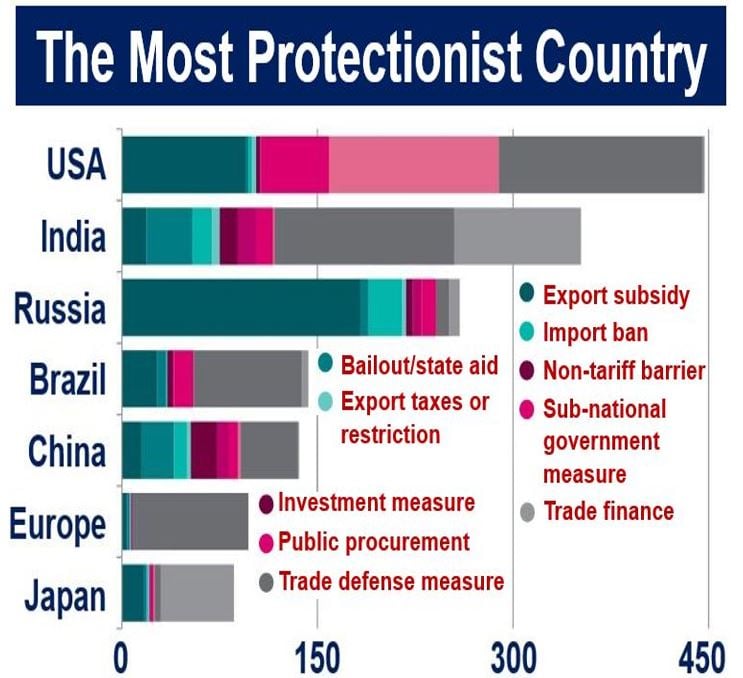

What is protectionism? Definition and meaning

Protectionism is an attempt by a country’s leaders to restrict imports or promote exports. They do this by imposing tariffs, quotas, and introducing other barriers to trade. Protectionism is the opposite of free trade. Free trade is international trade which follows its natural course without quotas, tariffs, or other restrictions.

As international trade continues to expand, economists across the world warn about the dangers of protectionism.

20th-century leaders had hoped that protectionism would protect their economies. However, their policies had the opposite effect, i.e., they undermined GDP growth. GDP stands for Gross Domestic Product.

Free trade policies were more successful in promoting GDP growth than protectionism during the 20th century.

This was not the case, however, during the 18th and 19th centuries. During the 18th and 19th centuries, Europe benefited enormously from protectionism.

The most popular methods of protectionism include quotas and tariffs on imports. Tax cuts or subsidies for domestic companies are also protectionist measures.

Reasons for Protectionism

Some leaders may favor protectionism for the following reasons:

– They want to reduce the trade deficit. If a country imports more than it exports it has a trade deficit. In other words, they want to intervene to either reduce a trade deficit or turn it into a surplus.

– The government wishes to protect or recover job numbers in certain sectors.

– To promote the growth of specific domestic industries.

Over the past decade, protectionism has become a common theme for the anti-globalization movement.

The anti-globalization movement is against large, multinational corporations having unregulated economic and political power. Multinationals have become powerful as a result of financial market deregulation and trade agreements.

Protectionism measures

Governments have a wide array of economic, financial and administrative weapons at their disposal to achieve their protectionist goals:

Tariffs

These are taxes and duties governments levy on imports. Rates vary, depending on the import. For example, tobacco and alcoholic drinks typically have high tariffs. Educational books and infant milk powder, on the other hand, usually have no import taxes.

Import tariffs push up the cost to importers and raise the price of their goods in local markets. This subsequently favors domestic suppliers.

Preferential Government Spending

All government departments may have orders to purchase goods and services only from domestic suppliers.

Quotas

The quota’s aim is to reduce the total number of imports or their monetary value by imposing a limit.

Political Campaigns

The government could finance a propaganda program to try to persuade consumers to buy domestic goods and services.

However, unless domestic companies produce excellent quality goods, this measure does not usually work.

Administrative Barriers

The protectionist country can drown the importer in an ocean of red tape, rules, and regulations.

Anti-dumping regulations

The importer may accuse the foreign supplier of dumping. Dumping means exporting something at cost or below cost prices. Dumping is a strategy to destroy competitors abroad or gain market share internationally. It may also be a strategy to protect jobs.

Exchange Rate Controls

The government or its central bank may artificially reduce the value of its currency. Subsequently, exports become cheaper and imports more expensive.

This policy only works over the short-term, because a cheaper currency usually precedes higher inflation.

Export subsidies

The government gives money to exporters to reduce the price of exports.

Direct Subsidies

The government gives money to the domestic suppliers. Specifically, the government targets domestic suppliers that are struggling in the global market.

Protectionism in the United States

The United States appears to be closing a 2-centuries-old circle which started with the Tariff of 1816 and ended in 1945. It now appears to be starting again with President Trump. From 1816 to the end of World War II (1945), America had a de facto protectionist policy.

In 1945, when World War II wiped out its major competitors, the US opened up to a free trade policy.

Since becoming President, Donald Trump appears to be raising that protectionist wall again.

Economic commentators say that President Trump will not be able to raise the walls of protectionism for several reasons:

Retaliation

If he did, other countries would retaliate. It would soon become clear that the US would suffer enormously in an international trade war. Especially if that trade war were with the rest of the world.

Consequently, President Trump would change his mind and back off.

The Republican Party

President Trump represents a party that believes strongly in the market economy. The market economy includes free trade. Therefore, many lawmakers in his own party will try to stop him from going ahead with a protectionist policy.

Automation

President Trump made a promise during his election campaign that he will be unable to keep. Many of his voters were blue-collar workers from America’s Rust Belt. He told them that their jobs had gone abroad.

He said that he would bring them back with import tariffs and other protectionist measures.

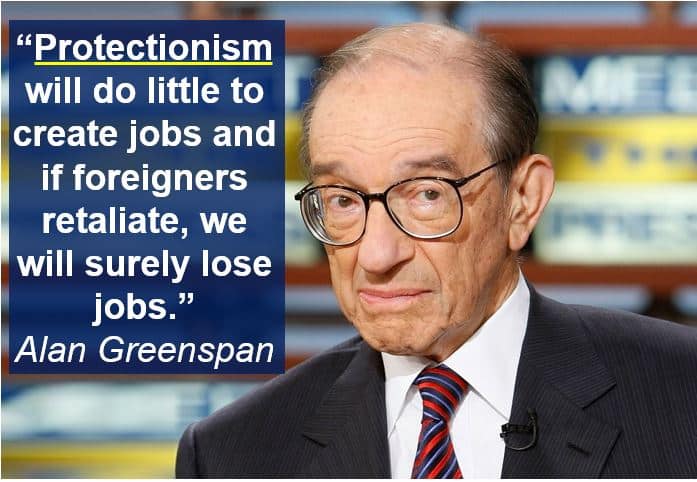

Alan Greenspan is an American economist who was Chairman of the Federal Reserve of the United States from 1987 to 2006. He has the second-longest Fed tenure in US history, behind William McChesney Martin (1906-1998). In February 2007, he forecast a possible recession in the US either before or in early 2008. Within a day of making that comment, the Dow Jones Industrial Average lost 3.3% of its value – falling 416 points. (Image: thefamouspeople.com)

What Trump did not tell them was that most manufacturing jobs in America have been disappearing because of automation. Some jobs have gone abroad, but that was a problem a couple of decades ago.

Automation is advancing at breakneck speed, and there is nothing he can do about that. The Rust Belt is not only an American problem – it is a global one.

No matter how much he embraces protectionism, President Trump will not be able to bring back those jobs.

Even in Germany, Japan, and China, blue-collar manufacturing jobs are disappearing because of automation (robots).

Import Substitution Industrialization

During the 20th century, many developing and emerging economies pursued Import Substitution Industrialization or ISI.

ISI advocated replacing imports with domestic production. It was a protectionist policy which mainly died out during the 1980s and 1990s.

Video – Why enact protectionism?

If most economists say free trade is better for a country’s economy, why are there nations erecting barriers and embracing protectionism?

This Mindlever Education Center video explains why certain governments have decided to restrict imports.

Understanding the Pros and Cons of Protectionism

Protectionism is a type of trade policy by which governments attempt to prevent or limit competition from other countries. While it may provide some short-term benefit, particularly in poor or developing nations, unlimited protectionism eventually harms the country’s ability to compete in international trade. This article examines the tools of protectionism, how they are applied in the real world, and the advantages and disadvantages of limiting free trade.

Key Takeaways: Protectionism

Protectionism Definition

Protectionism is a defensive, often politically-motivated, policy intended to shield a country’s businesses, industries, and workers from foreign competition through the imposition of trade barriers such as tariffs and quotas on imported goods and services, along with other government regulations. Protectionism is considered to be the opposite of free trade, which is the total absence of government restrictions on trade.

Historically, strict protectionism has been used mainly by newly developing countries as they build the industries necessary to compete internationally. While this so-called “infant industry” argument may promise brief, limited protection to the businesses and workers involved, it ultimately harms consumers by increasing the costs of imported essential goods, and workers by reducing trade overall.

Protectionism Methods

Traditionally, governments employ four main methods of implementing protectionist policies: import tariffs, import quotas, product standards, and subsidies.

Tariffs

The most commonly applied protectionist practices, tariffs, also called “duties,” are taxes charged on specific imported goods. Since tariffs are paid by the importers, the price of imported goods in local markets is increased. The idea of tariffs is to make the imported product less attractive to consumers than the same locally produced product, thus protecting the local business and its workers.

One of the most famous tariffs is the Smoot-Hawley Tariff of 1930. Initially intended to protect American farmers from the post-World War II influx of European agricultural imports, the bill eventually approved by Congress added high tariffs on many other imports. When European countries retaliated, the resulting trade war restricted global trade, harming the economies of all countries involved. In the United States, the Smoot-Hawley Tariff was considered an overly-protectionist measure that worsened the severity of the Great Depression.

Import Quotas

Trade quotas are “non-tariff” trade barriers that limit the number of a specific product that can be imported over a set period of time. Limiting the supply of a certain imported product, while increasing prices paid by consumers, allows local producers a chance to improve their position in the market by filling the unmet demand. Historically, industries like autos, steel, and consumer electronics have used trade quotas to protect domestic producers from foreign competition.

For example, since the early 1980s, the United States has imposed a quota on imported raw sugar and sugar-containing products. Since then, the world price of sugar has averaged from 5 to 13 cents per pound, while the price within the U.S. has ranged from 20 to 24 cents.

In contrast to import quotas, “production quotas” occur when governments limit the supply of a certain product in order to maintain a certain price point for that product. For example, the nations of the Organization of Petroleum Exporting Countries (OPEC) imposes a production quota on crude oil in order to maintain a favorable price for oil in the world market. When the OPEC nations reduce production, U.S. consumers see higher gasoline prices.

The most drastic and potentially inflammatory form of import quota, the “embargo” is a total prohibition against importing a certain product into a country. Historically, embargoes have had drastic impacts on consumers. For example, when OPEC proclaimed an oil embargo against nations it perceived as supporting Israel, the resulting 1973 oil crisis saw the average price of gasoline in the U.S. jump from 38.5 cents per gallon in May 1973 to 55.1 cents in June 1974. Some lawmakers called for nationwide gas rationing and President Richard Nixon asked gasoline stations not to sell gas on Saturday nights or Sundays.

Product Standards

Product standards limit imports by imposing minimum safety and quality requirements for certain products. Product standards are typically based on concerns over product safety, material quality, environmental dangers, or improper labeling. For example, French cheese products made with raw, non-pasteurized milk, cannot be imported into the United States until they have been aged at least 60 days. While based on a concern for public health, the delay prevents some specialty French cheeses from being imported, thus providing local producers a better market for their own pasteurized versions.

Some product standards apply to both imported and domestically-produced products. For example, the U.S. Food and Drug Administration (FDA) limits the content of mercury in imported and domestically harvested fish sold for human consumption to one part per million.

Government Subsidies

Subsidies are direct payments or low-interest loans given by governments to local producers to help them compete in the global market. In general, subsidies lower production costs enabling producers to make a profit at lower price levels. For example, U.S. agricultural subsidies help American farmers supplement their income, while helping the government manage the supply of agricultural commodities, and control the cost of American farm products internationally. Additionally, carefully applied subsidies can protect local jobs and help local companies adjust to global market demands and pricing.

Protectionism vs. Free Trade

Free trade—the opposite of protectionism—is a policy of completely unrestricted trade between countries. Devoid of protectionist restrictions like tariffs or quotas, free trade allows goods to move freely across borders.

While both total protectionism and free trade have been tried in the past, the results were usually harmful. As a result, multilateral “free trade agreements,” or FTAs, such as the North American Free Trade Agreement (NAFTA) and the 160-nation World Trade Organization (WTO) have become common. In FTAs, the participating nations mutually agree on limited protectionist practices tariffs and quotas. Today, economists agree that FTAs has averted many potentially disastrous trade wars.

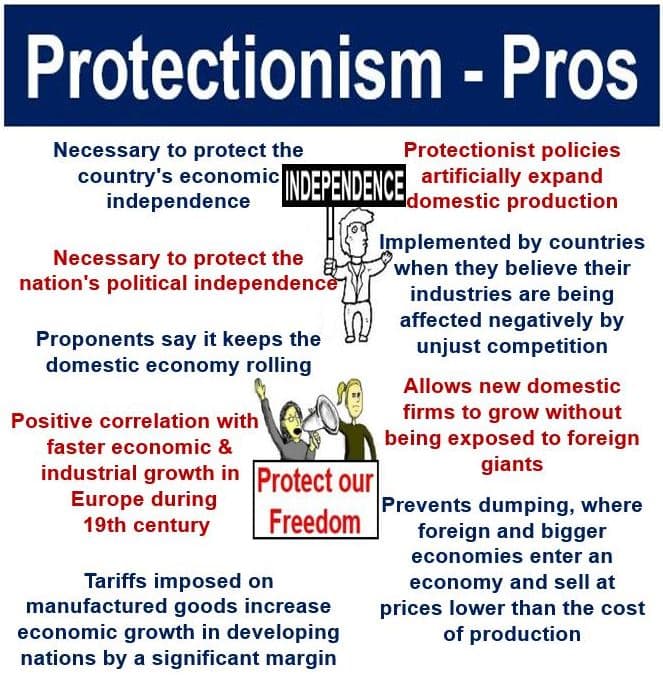

Protectionism Pros and Cons

In poor or emerging countries, strict protectionist policies like high tariffs and embargoes on imports can help their new industries grow by protecting them from foreign competition.

Protectionist policies also help create new jobs for local workers. Protected by tariffs and quotas, and bolstered by government subsidies, domestic industries are able to hire locally. However, the effect is typically temporary, actually reducing employment as other countries retaliate by imposing their own protectionist trade barriers.

On the negative side, the reality that protectionism hurts the economies of countries that employ it dates back to Adam Smith’s The Wealth of Nations, published in 1776. Eventually, protectionism weakens domestic industries. With no foreign competition, industries see no need for innovation. Their products soon decline in quality, while becoming more expensive than higher quality foreign alternatives.

In order to succeed, strict protectionism demands the unrealistic expectation that the protectionist country will be able to produce everything its people need or want. In this sense, protectionism is in direct opposition to the reality that a country’s economy will prosper only when its workers are free to specialize at what they do best rather than trying to make the country self-sufficient.

What Is Trade Protectionism?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Trade protectionism is a policy that protects domestic industries from unfair foreign competition. The four primary tools used in trade protectionism are tariffs, subsidies, quotas, and currency manipulation.

Definition and Examples of Trade Protectionism

Trade protectionism is a measured and purposeful policy by a nation to control imports while promoting exports. It is done in an effort to promote the economy of the nation above all other economies.

For example, if a U.S. manufacturer produced goods domestically that were more expensive than foreign imports, the government might enact tariffs, or import taxes, that boost the price of the foreign-made products. The effect would be make the U.S.-made goods more competitive on price.

How Trade Protectionism Works

The most common protectionist strategy is to enact tariffs that tax imports. That immediately raises the price of imported goods. They become less competitive when compared to locally-produced goods. This method works best for countries with a lot of imports, such as the U.S.

The chart below shows the share of tariffs collected on U.S. imports since 1790. Tariffs hit a record 57.3% in 1830 due to the Tariff of Abominations. They hit a record low in 2008 at 1.2%.

Protectionism fell out of favor after the Smoot-Hawley Tariff of 1930. It was designed to protect farmers from agricultural imports from Europe. U.S. farmers were already suffering from the Dust Bowl and European farmers were ramping up production after the destruction of World War I. But Congress added many other tariffs. Other countries retaliated. The resultant trade war restricted global trade. It was one reason for the extended severity of the Great Depression.

The Use of Subsidies

Governments also frequently subsidize local industries to help them compete in the global market. Subsidies come in the form of tax credits or direct payments. Some of the most commonly used subsidies are granted to farms, which allows farmers to lower the price of the food they produce. In turn, these subsidies make the products affordable for the consumer while still allowing the producer to turn a profit.

There are instances when subsidies can cause problems. For instance, the Agricultural Adjustment Act of 1933 allowed the government to pay farmers not to grow crops or livestock. The government wanted to control supply and increase prices. The act also enabled farmers the chance to let their fields rest and regain nutrients due to overproduction. In this case, the subsidies helped the agriculture industry but raised food costs during the Depression and hurt consumers.

Using Import Quotas and Currency Manipulation

A third method is to impose quotas on imported goods. This method is more effective than the first two. No matter how low a foreign country sets the price through subsidies, it can’t ship more goods.

Currency manipulation is a deliberate attempt by a country to lower the value of its currency. While it can make exports cheaper and more competitive in the short term, currency manipulation can also result in retaliation by other countries and start a currency war. One way countries can lower their currency’s value is through a fixed exchange rate.

Another way to manipulate currency is by creating so much national debt that the currency becomes less valuable.

Advantages and Disadvantages of Trade Protectionism

Protects a country’s new industries from foreign competition

Temporarily creates jobs

Companies without competition decline in quality

Protectionism

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

What Is Protectionism?

Protectionism refers to government policies that restrict international trade to help domestic industries. Protectionist policies are usually implemented with the goal to improve economic activity within a domestic economy but can also be implemented for safety or quality concerns.

Key Takeaways

Protectionism

Understanding Protectionism

Protectionist policies are typically focused on imports but may also involve other aspects of international trade such as product standards and government subsidies. The merits of protectionism are the subject of fierce debate.

Critics argue that over the long term, protectionism often hurts the people and entities it is intended to protect by slowing economic growth and increasing price inflation, making free trade a better alternative. Proponents of protectionism argue that the policies can help to create domestic jobs, increase gross domestic product (GDP), and make a domestic economy more competitive globally.

Types of Protectionist Tools

Tariffs

Import tariffs are one of the top tools a government uses when seeking to enact protectionist policies. There are three main import tariff concepts that can be theorized for protective measures. In general, all forms of import tariffs are charged to the importing country and documented at government customs. Import tariffs raise the price of imports for a country.

Scientific tariffs are import tariffs imposed on an item-by-item basis, raising the price of goods for the importer and passing on higher prices to the end buyer. Peril point import tariffs are focused on a specific industry.

These tariffs involve the calculation of the levels at which point tariff decreases or increases would cause significant harm to an industry overall, potentially leading to the jeopardy of closure due to an inability to compete. Retaliatory tariffs are tariffs enacted primarily as a response to excessive duties being charged by trading partners.

Import Quotas

Import quotas are nontariff barriers that are put in place to limit the number of products that can be imported over a set period of time. The purpose of quotas is to limit the supply of specified products provided by an exporter to an importer. This is typically a less drastic action that has a marginal effect on prices and leads to higher demand for domestic businesses to cover the shortfall.

Quotas may also be put in place to prevent dumping, which occurs when foreign producers export products at prices lower than production costs. An embargo, in which the importation of designated products is completely prohibited, is the most severe type of quota.

Product Standards

Product safety and low-quality products or materials are typically top concerns when enacting product standards. Product standard protectionism can be a barrier that limits imports based on a country’s internal controls.

Some countries may have lower regulatory standards in the areas of food preparation, intellectual property enforcement, or materials production. This can lead to a product standard requirement or a blockage of certain imports due to regulatory enforcement. Overall, restricting imports through the implementation of product standards can often lead to a higher volume of production domestically.

For one example, consider French cheeses made with raw instead of pasteurized milk, which must be aged at least 60 days prior to being imported to the U.S. Because the process for producing many French kinds of cheese often involves aging of 50 days or fewer, some of the most popular French cheeses are banned from the U.S., providing an advantage for U.S. producers.

Government Subsidies

Government subsidies can come in various forms. Generally, they may be direct or indirect. Direct subsidies provide businesses with cash payments. Indirect subsidies come in the form of special savings such as interest-free loans and tax breaks.

When exploring subsidies, government officials may choose to provide direct or indirect subsidies in the areas of production, employment, tax, property, and more.

When seeking to boost a country’s balance of trade, a country might also choose to offer subsidies to businesses for exports. Export subsidies provide an incentive for domestic businesses to expand globally by increasing their exports internationally.

What Are Examples of Protectionism?

Common examples of protectionism, or tools that are used to implement a policy of protectionism include tariffs, quotas, and subsidies. All of these tools are meant to promote domestic companies by making foreign goods more expensive or scarce.

Is Protectionism Left-Wing or Right-Wing Politics?

Traditionally, protectionism is a left-wing policy. Right-wing politics generally support free trade, which is the opposite of a protectionist stance. Left-wing politics support economic populism, of which protectionism is a part.

What Are the Arguments for Protectionism?

Lawmakers that favor protectionist trade policies believe that they protect jobs at home, help support and grow small companies and industries, and provide a layer of security to the nation.

:max_bytes(150000):strip_icc()/anti-free-trade-postcard-526930930-5c054e4f46e0fb000123437b.jpg)

:max_bytes(150000):strip_icc()/Amadeo-Closeup-582619cd3df78c6f6acca4e6.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

:max_bytes(150000):strip_icc()/Balance-Lars_Peterson_Headshot-11-ee8a849bd04f428c857815dc22ac78a2.jpg)

:strip_icc()/what-is-trade-protectionism-3305896-v6-3f85cde89bce41fd89f4f31ca713b241.png)

:max_bytes(150000):strip_icc()/Group1805-3b9f749674f0434184ef75020339bd35.jpg)