How fintech is shaping the future of banking henri arslanian текст

How fintech is shaping the future of banking henri arslanian текст

How Fintech is Shaping the Future of Banking

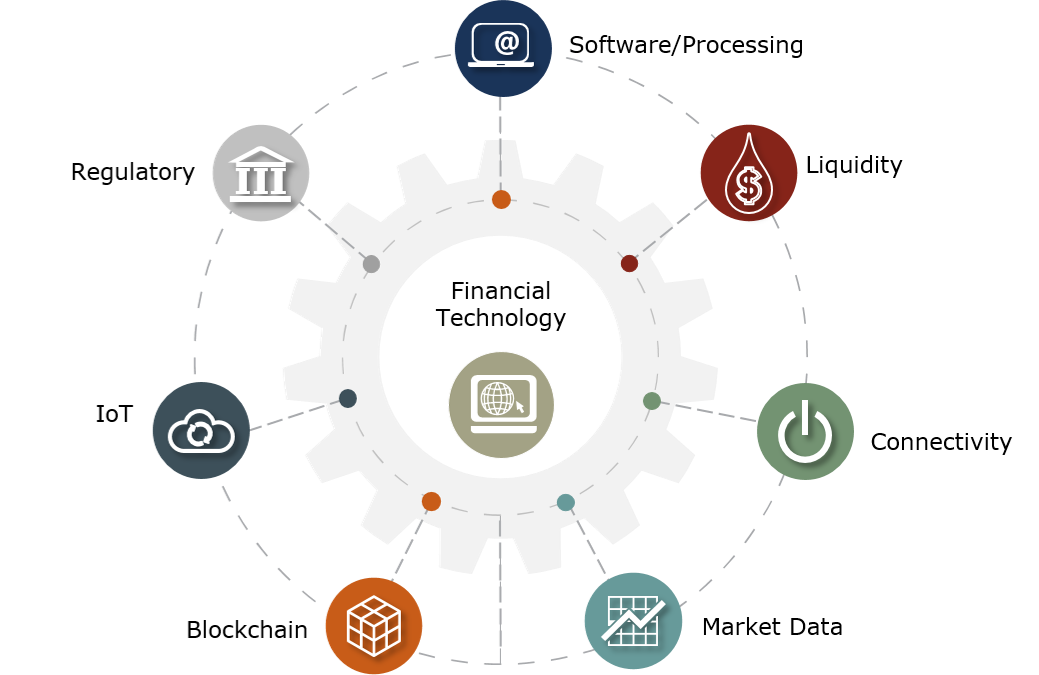

The financial technology, or Fintech, industry works to create the innovative technologies that are used to offer improved financial services that are compatible with the modern consumer.

There is no doubt that growth in financial technology has accelerated over the years. It continues to disrupt the economy, from retail and banking to financial services. The financial technology, or Fintech, industry works to create the innovative technologies that are used to offer improved financial services that are compatible with the modern consumer.

This comes as technology becomes more popular to enhance mutual trust, increase cooperation between multiple parties globally, and take a more active role in shaping green behavior to address the issue of climate change.

In the past few years, the business world has seen how technologies are integrated into the fintech industry. Cloud computing and artificial intelligence is now widely integrated by engineering teams and adopted in financial management and risk control. Overall, this helps to create a more productive, efficient, and stable operating environment.

An Overview of the Fintech Revolution

The Fintech revolution has been gaining interest as technologies are dramatically changing the business of financial services. As a result, financial technology is playing a more significant role in producing relative performance growth for businesses.

People are constantly looking for easier and more effective ways to access essential financial services in a digital way. From ordering a new product to managing finances and receiving advice, consumers are looking for a way to meet their needs as quickly and conveniently as possible.

Some credit marketplaces have already offered pre-approved loans that can be accessed in just a few short minutes. This is possible because lenders have made innovative choices in how they utilize technology.

On the contrary, many finance businesses still work with data and processes that rely on legacy technologies. These businesses will stay behind and may even lose customers over time.

How Fintech Is Transforming the Future of the Banking Industry

The products and services under the Fintech umbrella have caused a notable disruption of the financial services industry, including the banking sector. A major part of this disturbance is FinTech’s ability to make financial transactions easier and more accessible.

Fintech has also created a channel for small startup businesses to challenge an industry that has always been dominated by big banks. Of the new entrants that threaten big banks, ‘fintechs’ that initially focus on a single financial product are the most dominant. These startups have three key characteristics:

Recently, there has also been a rise in neo-banks, otherwise known as challenger banks. These types of fintechs can be seen as mobile-only banks that only offer an account with a credit or debit card. All other products are typically offered through partnerships with other fintechs.

Compared to banks, fintech offers the following benefits that make it increasingly more popular:

In short, all financial services can be accessed online with fintech. And this is just getting started. As these technologies gain popularity in the future, more people will get access to better facilities.

Will this lead to the disappearance of big banks? The industry and the current situation is too complex to make a concrete statement about this. However, it looks like more people will be moving away from banks to easier, more affordable and more accessible fintech platforms.

Fintech Development

Any business that wants to transform and adopt new technology to meet the increasing needs of customers must look at the best ways to develop and implement the correct structures and processes. This can be a complex method, as many businesses do not have internal access to the right resources, such as a fintech developer team.

IT professionals such as a build release engineer can help businesses to transform. This type of engineer is a computer software developer who is largely focused on developing a line from a program’s source code to launch a product.

Release engineers typically deal with existing source codes that can be used for integration and the effective work of software. They are responsible for the timely and productive delivery of software products as well as their efficient functionality and implementation.

Build release developer experts usually have the primary goal to make the development process easier for programmers and ensure that everything is working correctly from the start of the project through to the final release.

This type of engineer can help to develop custom fintech software solutions for both web and mobile platforms to enhance user experience and stay ahead of the curve. Other benefits of hiring a build and release engineer include:

With the increasing popularity of fintech, the number of fintech solutions is also growing. Increasingly more businesses focus on time to market, and turn to software development professionals. Often the best way for businesses to hire these professionals is through outsourcing. Remote build and release engineer teams and freelance DevOps often have enhanced skills and experience to help businesses implement the best possible solutions. Outsourcing is also an affordable option for businesses, as they can grow and decrease teams only when required.

The Bottom Line

The Fintech revolution has allowed businesses to offer new products, innovative business processes and better business models. Such innovation has been welcomed by the financial sector, including the banking industry, as companies are constantly exploring opportunities to set themselves apart from competitors and increase their value relative to their competitors. To do this, many businesses are using build and release developers and DevOps engineers. These professionals have the skills and knowledge to help businesses achieve success in the financial sector.

Save faster.

Way faster. Save faster. Way faster.

A super high-yield interest account created for renters and landlords.

How Fintech is Shaping the Future Of Banking?

The future of banking lies within Fintech. Financial Technology is helping a lot of banks in offering better service to their customer.

Is Fintech shaping the future of banking? Of course, Fintech is the main responsible for all the ease of banking we have now. It has made a lot of work easier and faster. People can now send money to any person directly with few clicks. They don’t even need to turn on their laptops, they can do it directly from the mobile phone. This shows the progress of Fintech.

What is Fintech?

Before we get more in-depth, let’s understand the meaning of Fintech. Fintech consists of two words, fin, and tech. Fin stands for Financial and Tech is for the technology.

When financial things are served using digital technology, it is known as Fintech. This is the easiest meaning of Fintech.

Usually, it is SaaS (Software as a Service). SaaS means a place where software is provided to the users as a service. In most of the Fintech industry, SaaS is the common one.

For example, when you do the translation online using a digital platform, it’s considered in the Fintech. Fintech companies are the ones who have developed the entire mechanism for it.

Most of you might be using Fintech. If you think the online banking service or any financial service has made your work easier or faster, you are already agreeing with the fact that Fintech is shaping the future of banks.

Let’s see it in detail to understand how it is helping banks to shape the future.

How Fintech is Shaping the Future of Banking?

All the features provided using the digital media come under Fintech. So, even if you are checking your balance online, it is considered as the progress of Fintech.

Let’s see how it has already shaped the future and why it’s a boon to the banking industry.

Anywhere 24×7 Service

The first and best reason why it has been a boon to the banking industry is the number of hours. With technology, people don’t have to wait to make the transaction. They can make it any time they want. Whether it’s 3 in the morning or they want to make the transaction early in the morning at 7, they can easily take out their mobile phone and transfer the money to the person.

Not just limited to time, people can transfer money from any place. At first, people would have to find the banking point of an ATM from where they can withdraw the money or make the transfer. Now, they don’t need to do any of these. With Fintech, they can easily transfer the money with just a matter of clicks. Like we already mentioned, it will hardly take a few seconds for the money to reach the other person depending on the payment method they use.

Better Payment Methods

Now, the means and the mode of payments are not limited. They can use any of the methods to transfer the money. Most of the countries have developed their way to transfer money and make things easier.

In simpler words, they can transfer the money directly with their application. Not just limited to their own country, payment companies are making things easier to make the transfer. If you want to make an international transfer, you can easily make the transfer in just a fraction of seconds. This is making things easier than they used to be.

Nowadays, there are many options to make the payment. One doesn’t even need their card with them to make the transfer. They can make the transfer with digital wallets too.

Better and Valuable Service

Today, you can do all the things directly from your online banking portal. Whether you are looking to check your balance or you want to request a new credit card, you can easily do it online from the banking portal you have. Depending on the bank and the country you live in, the procedure might be a bit different. In the end, all things can be done online. Customers can avail themselves of any of the services online without needing to go to the bank.

Further, banks can also offer value-added services with the help of online portals. Banks no need to figure out and see which service the customer might want, neither they need to do any marketing of the same. They can simply show a banner of the new value-added service in their online banking portal and that’s pretty much it. If the customers want the service, they will directly buy it from that. The money will be automatically deducted from their account. This gives the banks an upper hand in all things.

The Future is Brighter

Till now, whatever we saw is available right now in almost all the banks as well as countries. The fintech industry is trying its best to provide a robust and secure platform for the customers. They can easily make the money transfer and do all the things with the help of technology.

Further, this is going to increase a lot. Fintech is progressing and there are many new methods tested regularly. Countries are doing their fintech development for their citizens. In the same way, many companies are offering international usage.

Today, you can start a business and the entire finance can be handled online whether it’s about investing in assets or you want to accept/send the payment. In the future, this is going to get much easier than how it is now. This will give you better service.

Final Words

To summarize, this was all about how the Fintech industry is shaping the future of banking. Now, all financial services can be accessed online. This is just getting started. Over time, it is going to increase more and people will get better facilities in the future.

If you are looking for any Fintech service, Finwin Technologies is here for you. Contact us today and let’s get started with your idea.

How FinTech is Shaping the Future of Banking

Fintech is booming! The world of finance will no longer be brick-mortar banks or investment firms working off spreadsheets and in-person advisement, and as FinTech start-ups and financial innovators race to meet market demands, various fledgeling businesses continue to shape the future of finance and spearhead trends in the industry. With a digital-first approach, not only has FinTech created new and innovative ways of interacting with existing and potential customers to extend banking services, such as investment advice typically reserved for the wealthy, to everyone, but also emerged as a lifestyle upgrade for most millennials today.

An Overview of FinTech Revolution

The rise of digitization and technologies like mobile, IoT, AR, VR, Blockchain has revolutionized the global market in each segment. As per the current scenario, the FinTech sector is thriving with the rise of digital investment. This clearly is an indicator that soon it will continue to flourish in the coming years too.

Simply put, FinTech is a term for the segment at the juncture of the financial services and digital technology. This basically prompts the use of digital technology that is focused on start-ups and new market entrants pushing to innovate products and services. Nowadays customers do not go for services being provided by the traditional financial services industry. They seek services that can give them a quick and prompt response based on their query. FinTech is thus gaining significant momentum in the industry and causing disruption to the traditional value chain. FinTech usually relates to small start-up enterprise that focuses on developing innovative technological solutions such as online banking, mobile payments, big data, alternative finance, and financial management overall.

So, how has FinTech transformed the banking scenario for customers today? Let us understand.

Are our future-bankers prepared for facing Fintech revolution?

Author, teacher, and Chairman of the FinTech Association of Hong Kong, Henri Arslanian in his TEDx Talk explores how FinTech is revolutionizing the banking industry to create new user-friendly financial services. (Watch here)

His talk doesn’t just look at the ways FinTech will change how consumers access banking but also explores how it will extend to those who have access to these services. With so much change happening in the banking industry, are the new generation of bankers ready for the digital-first banking industry? That is the most crucial question to be addressed today.

While FinTech is revolutionizing the banking industry and giving millions of people access to financial services for the first time, new banking models are emerging with FinTech start-ups and tech firms potentially disrupting the status quo. But business schools and universities are not preparing future bankers for these changes, says FinTech thought leader Henri Arslanian.

The need of the hour is to not only educate students in finance but also in how to leverage the power of technology in finance. We need to start building the necessary skills at a young age. This will grow the next generation of financial professionals who are well versed in technology and its potential and who will help propel the industry into the future. To prepare for the future of finance, governments and businesses should invest in domestic talent by partnering with educational institutions to develop FinTech skills. Therefore, incorporating the right education is imperative to ready students for the financial world they’ll eventually tread into.

However, the only good news is that the millennial generation has already managed to sail through this shift gracefully because most of them have grown up with handling smart devices, connected homes and online learning. But in order to train the forthcoming generation with the best of the tech skillsets, schools must also adopt a tech-driven pattern of curriculum, especially in finance, to bring them up as the next cutting-edge innovators in finance.

The Bottom Line

Finance rules the world, but soon technology will rule finance. If you’re not aware of how technology is already transforming finance, then you’re probably lagging behind. Moreover, if you’re not preparing the next generation of leaders to embrace innovation, you’re never going to catch up. As FinTech moves from an upstart movement into the mainstream, readying students for the future of finance is vital. Like Henri Arslanian says, the future generation of bankers may not simply be known as bankers. They need to possess dynamic skills of knowledge and implementation to make a difference in the banking industry. The utmost need of the hour, thus, is to shape their financial careers into being designers, programmers and creative thinkers. A first-hand theoretical approach on finance might just not be enough!

Views expressed in this article are the personal opinion of Sachin Mittal, Founder, Loanwalle.com.

The Banking & Finance Post is an initiative of Elets Technomedia Pvt Ltd, existing since 2003.

Now, Elets’ YouTube channel, a treasure of premier innovation-oriented knowledge-conferences and awards, is also active. To Subscribe Free, Click Here.

Get a chance to meet the Who’s who of the NBFCs and Insurance industry. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook, connect with us on LinkedIn and follow us on Twitter, Instagram & Pinterest.

How China and Asia are Shaping the Wealth Management Industry

Without a doubt, China is the global leader in B2C FinTech. But Chinese innovators also stands to overturn the traditional asset and wealth management sectors, shaping the future of the industry.

Large Chinese technology firms and FinTech players have already transformed the practices of asset and wealth management. Chinese consumers now have access to hundreds of different products, many of them highly tailored, and seamlessly integrated onto smartphones. The key to their success has been a solid focus on user experience design, matched with the utilization of big data for smarter services. They understand their users far better and can use that data to comply with KYC regulations, conduct credit checks, and manage suitability and pricing. They are truly shaping the wealth management industry of the future.

The same is likely to happen outside of China as well. Large tech firms like Facebook or Amazon may provide the wealth management interfaces of tomorrow. These platforms not only have direct and daily touchpoints with their customers but also hold their trust and confidence. Few of us would disagree that Facebook knows more about us (and our families, activities and interests) than the best intentioned traditional private banker.

Author: Henri Arslanian

Follow: @HenriArslanian

The Impact of Fintech on the Future of Banks and Financial Services

In this article, we take a closer look at the impact of fintech on banks, the banking industry, and financial services. And also you can find how fintech affects the global economy.

In this post:

The development of technologies served as an engine for the transformation of macroeconomics. The key segment in the development of financial markets has become the introduction of new financial technologies that appear as a result of conservative financial management when using digital technologies. Over the past few years, the financial technology industry has developed at a significant pace, but despite the rapid development of this phenomenon, the exact definition of fintech has not yet been derived. Fintech (financial technologies) is a business direction that uses new technologies and innovations in the financial services market, which involves such advanced areas as digital, mobile payments and transfers, e-wallets, online lending, P2P platforms, crowdfunding, online funds, online insurance, etc.

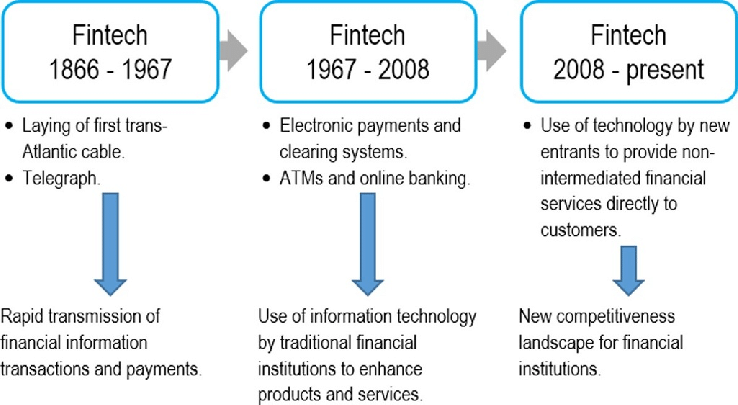

Having decided on an understanding of the essence of fintech, it is advisable to study the history of its development for a deeper analysis of this phenomenon. The evolution of fintech development can be conditionally divided into 3 stages, which are clearly shown in the image below.

Thus, we can say that fintech has evolved from the initial stage of introducing technologies exclusively into traditional sectors of the economy, to the point at which it is a unique mechanism capable of determining user expectations. In turn, fintech service providers are not viewed solely from a start-up perspective but are professionally managed companies with broad operational capabilities, a comprehensive product portfolio, and an international presence.

Fintech is changing the way the traditional financial market operates and is one of the fastest-growing segments at the intersection of financial services and innovative technologies. In this segment, technology startups and new market participants are applying innovative approaches to products and services, shaping preconditions for the effective development of fintech.

In this article, we will look at how fintech affects banks, how will fintech affect the financial system, main effects of fintech on banking industry and fintech impact on financial services.

How fintech affects the financial system.

The global financial crisis has exposed serious problems and weaknesses in financial regulation and supervision. As a result, the Financial Stability Board is undertaking a comprehensive and ongoing review of the global financial regulatory architecture to set standards. One of the weaknesses identified by the crisis was poor risk data collection and reporting in banks. This led to the Basel Committee on Banking Supervision publishing its Principles for Risk Aggregation and Risk Reporting in 2013. This was a key development as the principles set minimum standards for data collection and management, which may require additional investment in technology and organization restructuring. The increasing complexity of the global regulatory framework, growing regulatory reporting requirements and the risk of costly penalties as a result of tightening post-crisis standards have contributed to higher compliance costs in financial institutions. This has become especially important for international banks faced with formidable and sometimes conflicting regulations.

The concept of «financial innovation» is much broader than Fintech, and, accordingly, not all financial innovations are financial technologies (for example, the creation of a new derivative, etc.). At the same time, the concept of financial innovation can be partially included in the concept of «digital economy» (Fintech completely, since its functioning without digital technologies is almost impossible).

Fintech today is often viewed as a unique segment of financial services and information technology. However, the relationship between finance and technology has a long-standing relationship, often complementing and reinforcing each other. As we wrote above, the global financial crisis of 2008 was a turning point and the reason why Fintech is turning into a new paradigm. This evolution creates challenges for regulators and market participants, especially in balancing the potential benefits of innovation with the potential risks.

Currently, Fintech includes numerous technology startups, as well as large organizations trying to improve and optimize financial services provided. At the end of 2014, investments in this segment reached 157 billion dollars. After that, the term began to refer to a large and rapidly growing industry.

Most of the development of financial technology is modernizing traditional financial services and products in several areas:

The new wave of Fintech over the past 10 years tends to develop from the bottom up, i.e. it is born mainly in agile startups that seek to break traditional rules, do business, compete or are acquired by existing financial institutions. This new startup trend has a lot of advantages and coupled with post-crisis regulatory reforms that have spurred structural change in the industry, is pushing incumbent financial institutions to increasingly focus on technology to compete against the threat posed by new Fintech startups.

Fintech can influence the financial market in several main areas:

1. By increasing competition, empowering consumers, democratizing access to financial services, especially in developing countries and, as a consequence, stimulating further innovation. Innovation creates new product / service opportunities, new strategies and commercialization channels;

2. By improving efficiency through innovation in:

3. By creating new investment opportunities for existing financial institutions. Banks and insurance companies are increasingly investing and buying out fintech companies as part of their (broader) investment portfolio, and some are also sponsoring fintech incubators to create investment opportunities;

4. By improving financial supervision;

5. By improving and optimizing the risk management process.

When assessing the impact of new technologies on the financial market, 2 factors have recently acquired particular importance:

1. the level of acceptance of basic technologies by society;

2. degree and prevalence of technological know-how among the general population.

Effects of fintech on the banking industry.

Fintech and banking industry sector includes the following technological trends:

Reasons and prerequisites for the development of financial technologies in the banking sector.

The development of financial technologies, especially noticeable in the last five years, was caused by the following circumstances:

1. Loss of customer confidence in the traditional banking sector during the 2008 global financial crisis and stricter regulation. Trust is an absolutely necessary category for the successful functioning of the financial system, and its loss has accelerated the process of development of financial technologies inevitable in any case. Against this background, there is a demand for services provided by Fintech startups, as well as for the optimization of services caused by a decrease in their profitability due to stricter regulation.

2. Raising the level of expectations for the services provided, including financial. The consumer becomes more and more focused on constant updating and acceleration of processes, greater availability of technologies and greater convenience of services in the conditions of obsolescence and limitations of traditional financial services both in form and in essence. The development of information processing technologies has determined the development of such fintech segments as blockchain, P2P lending, online scoring, algorithmic trading, etc.

3. The spread of the mobile Internet, leading to the fact that the focus of the bank’s customer acquisition strategy is shifting from opening another branch to creating online services and supporting the mobile version of the site.

4. The desire for innovation, increased requirements for ease of use of services, quality and speed of obtaining information, characteristic of the largest generation of millennials in world history (born in the period from 1980 to the early 2000s), is a powerful catalyst for changes in the financial sector.

5. Banking legislation, for which consumer rights are always a priority, but their protection does not impede the implementation of innovations and flexibly adapts the rules to the requirements of the financial sector (in the UK, Singapore, Australia). On the contrary, in other countries, the financial sector is highly regulated, which hinders the development of the financial services industry.

6. The success of tech companies in other sectors of the economy (retail, entertainment, etc.). The emergence of successful companies that have significantly changed their markets and offered more competitive products and services has sparked the interest of entrepreneurs, including in the financial sector.

How fintech affects banks? Consulting experts from McKinsey & Co predict that over the next ten years, commercial banks may lose up to 60% of profits in favor of new financial companies. Among the areas of banking activities that can primarily be replaced by fintech startups are consumer finance, microloans, and payment services.

Why fintech and banks should work together:

The way people use financial services and banking has evolved. Technological changes of recent times provoked changes in people’s banking behavior and now we already see the changes, which indicate the significant fintech’s impact on the banking industry. Let’s list several of them:

Impact of fintech on banks.

According to a Marketforce LIVE experts, UK banks see fintech startups as a major threat to the business models of traditional financial companies and institutions. To find out the attitude of banks to fintechs, about 600 representatives of the financial sector were interviewed.

What does fintech mean for banks? In general, the industry has seen various forms of collaboration between classic banks and Fintech. If some time ago Fintech was viewed as a potential threat to banks and the banking industry in general, now they talk about cooperation and mutual benefit. Fintech companies can support banks by providing specific services, solutions, such as risk analysis services. Baltic International Bank also uses Fintech companies as service providers. The Bank is currently in a process of change, successfully implementing a new business model, so many new ideas and methods need to be adapted. Here is one example of how a classic bank can partner with Fintech. Baltic International Bank is a client of the American rating agency Sigma Ratings, which uses an advanced technological approach to assess the management efficiency and risk of financial crimes at the organizational level. In early 2020, the company also carried out an independent assessment of Baltic International Bank, assessing the risks of organizations related to the prevention of financial crimes, governance, sanctions, corruption and reputation. All of this was done online by the company using a methodology based on industry best practices.

How does fintech affect banks? Fintech perfectly complements classical banking, helping, for example, to use the available data more intelligently and offer data analysis services, since data is more valuable than gold and oil today. An increasingly popular term is the Insight Driven Organization (IDO), or knowledge-based organization that uses analytics, data and the input it makes to all decision-making processes.

Fintech impact on financial services.

New technologies are changing the way people use fintech banking and financial services. Unlike previous historical episodes of heightened competition in the banking market, alternatives are now evolving too quickly.

The banking industry has existed for centuries, and during this time it was predicted an imminent end more than once. For example, in the middle of the XX century. in the United States, the threat to traditional banking came from alternative credit institutions in the 1970s. mutual funds offered an alternative to deposits, and in the early 2000s. banks faced competition from large trading and industrial companies, which began to obtain banking licenses and offer services in addition to their core business.

But what is happening now differs from the periods of aggravation of competition in past years in scale, speed and global nature. The scale of innovations is unprecedented, they are introduced at an unprecedented rate and spread with ease around the world, ignoring boundaries. This changes not only banking business models, but also the principles of financial services.

Regulatory implications

Impact of technology on financial services is testing not only the existing banking business model, but also the traditional scheme of financial regulation. Regulators need to balance many forces to ensure financial stability, a competitive and efficient environment, and proper data handling.

For example, it is not yet clear to what extent financial stability is sensitive to technology as such. The “ungrouping” of services traditionally united by one bank, inherent in the current technological breakthrough, can lead to the formation of a new type of risk. For example, some activities will fall outside the perimeter of prudential regulation and supervision. In addition, fintech projects using wholesale funding may be vulnerable to liquidity shocks.

It is also unclear how artificial intelligence and algorithmic provision of financial services based on new types of data will behave in a disrupting time of crisis. At the same time, the growing dependence on digital processes and systems increases operational and cyber risks. Now they are perceived and regulated as specific, but the digitalization of financial services turns them into systemic ones, which may lead to the need to revise the regulatory approach.

Our Experience.

The Geniusee team has extensive experience in developing financial applications. Below we will provide some examples of our work.

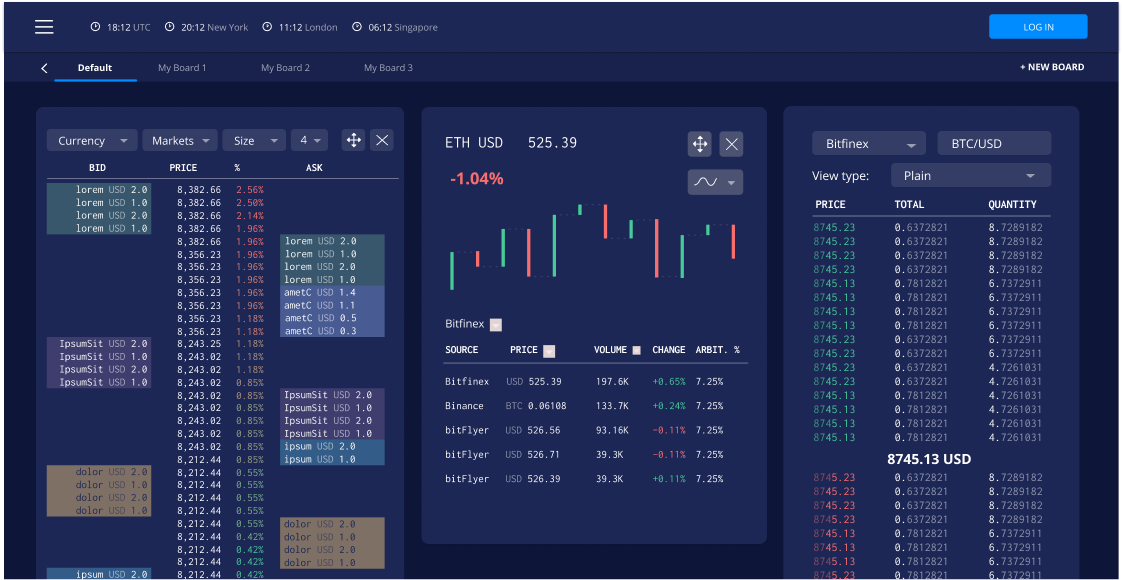

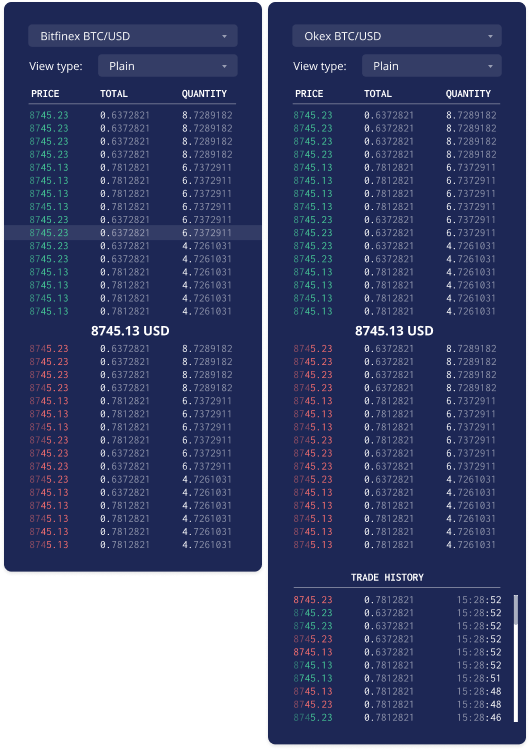

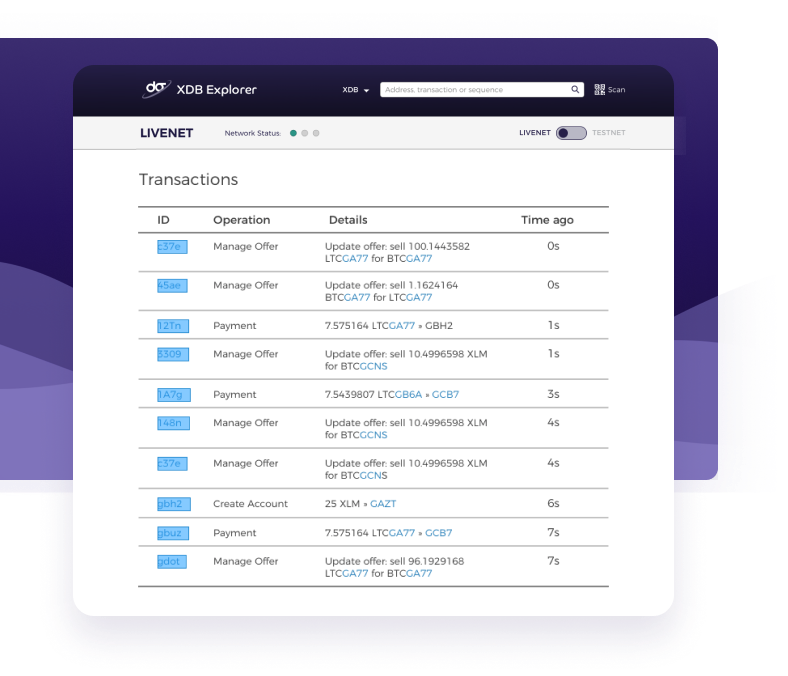

1. Crypto analytics.

Due to the high volatility of the cryptocurrency market, a trading company faced with an issue that traders need to quickly analyze cryptocurrency market information.

We were faced with the following tasks:

Result:

2. Digital Bits Wallet.

DigitalBits™ is an open-source project supporting the adoption of blockchain technology by enterprises. The technology enables enterprises to tokenize assets on the decentralized DigitalBits blockchain; transfer & trade those tokenized assets on-chain; and enables fast payments & remittances.

We were faced with the following tasks:

Result:

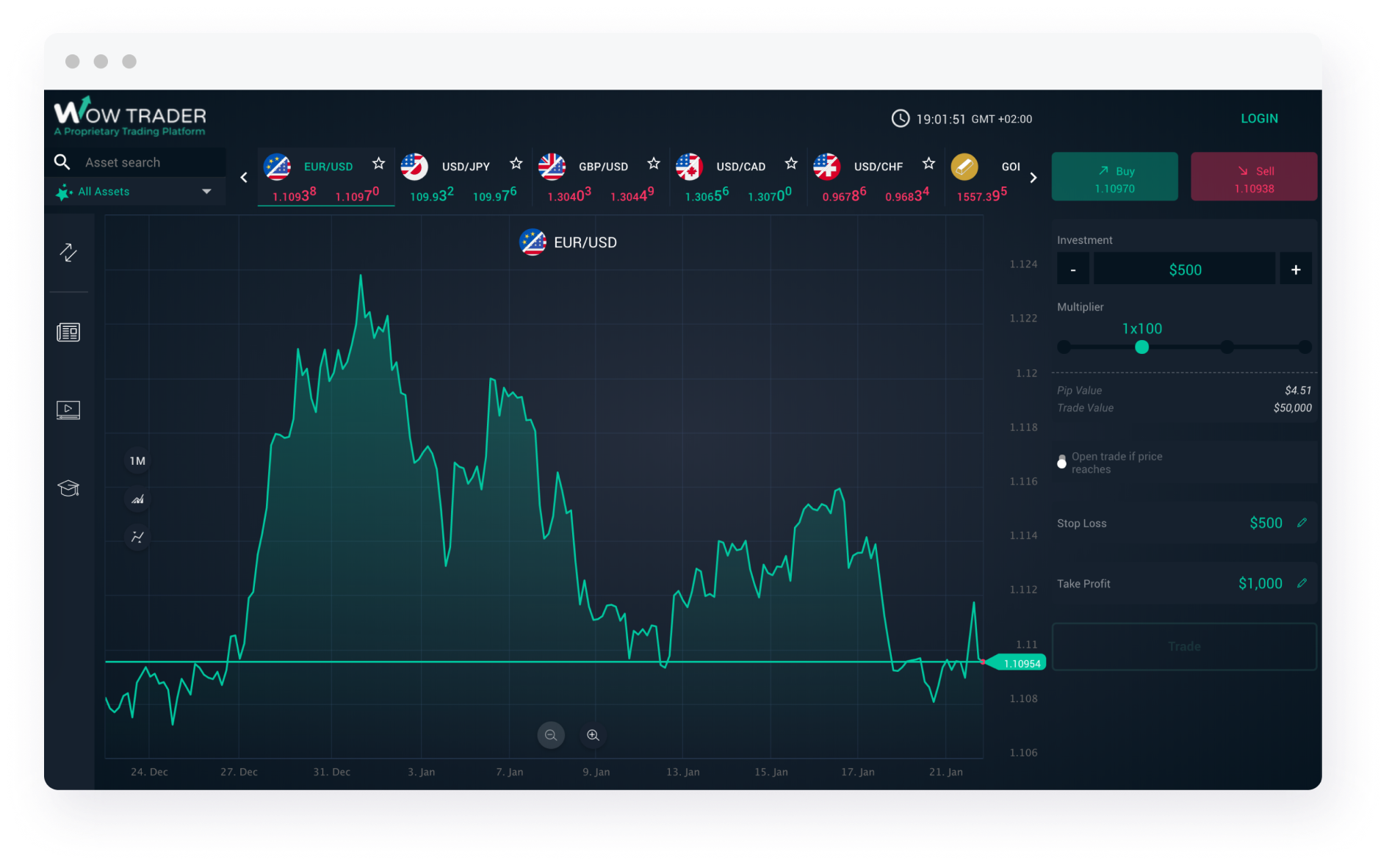

3. TradeSmarter.

Tradesmarter is leading in providing white label trading solutions offering a web responsive trading platform that enables top financial companies to unleash a new era of competition, revolution and user experience.

We were faced with the following tasks:

Result:

Conclusion

Fintech is a complex system that unites the sectors of new technologies and financial services, start-ups and the corresponding infrastructure. The financial services sector is increasingly using new technologies and tools to perform its functions and implement fundamentally new solutions that consumers are interested in. Today, new financial technologies are penetrating the manufacturing sector (including retail, telecommunications, pharmaceuticals, agriculture); exert their influence on the segment of insurance, lending, accounting services, mass appraisal of real estate, asset management, investment, tax administration, etc. Government and regulatory organizations are showing increasing interest in them, their close partnership is determined by operational solution of emerging legal issues, the speed and breadth of the promotion of fintech products, comprehensive solutions to security issues, increasing the financial literacy of the population and the availability of financial services.

The impact of fintech on banking and impact of fintech on financial services gives the banking sector an impetus for development.. The existence of an internet site, a mobile version of a site, a user’s personal account has already become a standard for a modern bank — and the user, by default, waits for such services as, for example, an SMS message about the movement of funds or the ability to manage his account online. Already nobody will be surprised by the possibility of online payment of bills, including utility bills and fines. Fintech is already developing what banks are only planning to experiment with. Most likely, some innovations will take root, others will not: this is facilitated by the competition between new financial enterprises. To compete with fintech projects, banks in a new market must either quickly rebuild themselves or look for areas collaborating with financial technology. However, despite the differences and difficulties, fintech companies and banks can mutually benefit from cooperation. Over the long years of their existence, banks have gained tremendous experience of interaction with clients and created the functionality of the financial sector.

Источники информации:

- http://medium.com/finwintech/how-fintech-is-shaping-the-future-of-banking-d40535e66b1b

- http://bfsi.eletsonline.com/how-fintech-is-shaping-the-future-of-banking/

- http://fintechcircle.com/insights/china-asia-shaping-wealth-management-industry/

- http://geniusee.com/single-blog/fintechs-impact-on-the-future-of-banking-and-financial-services