How much money do you spend food each month

How much money do you spend food each month

Помогите с английским языком)))

. We have never met before, ________ we?

a) have not b) have c) are d) do not

2. They have two ___________.

a) children b) child c) childs d) childrens

3. There are a lot of alligators in _______ Nile.

4. _______ too much sugar in the tea. I can’t drink it.

a) There is b) There are c) There were d) There was

5. I want those books. Please, give _______ to me.

a) they b) them c) those d) these

6. Do you know __________ here?

a) some b) any c) somebody d) anybody

7. Why _____ you absent yesterday?

a) did b) were c) was d) are

8. Our baby ______ walk in a few weeks.

a) can b) will be able to c) have to d) may

9. This way is _______ than the other.

a) safe b) safer c) more safe d) safest

10. How much money do you spend _____ food each month?

a) at b) on c) for d) to

11. He will translate the text if he _________ a dictionary.

a) has b) will have c) have d) has had

12. The TV broke down when we _________ the news.

a) watched b) was watching c) were watching d) are watching

13. They ______ each other since 1992.

a) know b) knew c) had known d) have known

14. I _______ for you for half an hour.

a) am waiting b) have been waiting c) wait d) waited

15. Ann told her friend that she_________ the competition.

a) won b) had won c) win d) has won

16. Excuse me, I ___________ for a telephone box. Is there one near here?

a) look b) looks c) looking d) am looking

17. In 1996 when I lived in Moscow I ________________ at a bank.

a) was working b) work c) working d) have worked

18. She can’t take part in this competition. She ________ her leg.

a) breaks b) broke c) has broken d) broken

19. Tom hurt his hand when he ____________ dinner.

a) cooked b) was cooking c) cooked d) has cooked

20. That bag looks heavy. I ________ you with it.

a) will help b) help c) helping d) helped

21. We_________ football with «Spartak» on Saturday last week.

a) plat b) have played c) were playing d) played

22. I usually ________ home from Lyceum at 5 o’clock.

a) coming b) am coming c) have come d) come

23. If he _________ busy I’ll invite him to the party.

a) is not b) is c) will not be d) were not

24. We found that she_________ home at 8 o’clock every morning.

a) leaves b) left c) had left d) has left

25. We _______ dinner until Jack ____________.

26. Tom asked Jane where __________ on holiday.

a) will she go b) she goes c) would she go d) she would go

27. Many children in Britain_________ wear uniform when they go to school.

a) can b) are able c) must d) had to

28. I _______ late for the first lecture yesterday.

a) am b) will be c) was d) were

29. ___________ some information about this film.

a) There’s b) There’re c) They’re d) It’s

30. If __________ ring the doorbell don’t let them in.

a) everybody b) anybody c) nobody d) everything

31. She is a very quiet person. She doesn’t speak ___________.

a) many b) little c) much d) few

32. I have got ________ money and we can go shopping.

a) many b) few c) much d) little

33. Nick has a __________ handwriting than you.

a) well b) better c) much d) good

34. After many years away he arrived back___________ England a month ago.

35. This morning I had _________ boiled eggs for ______ breakfast.

How Much Should I Spend on Food a Month – and How to Spend Less?

Sure, you may think you have to stop spending money on food, but working out how much you should spend on food a month is harder than it first seems.

After all, eating is great! So you need to hit that sweet spot between sticking to a reasonable budget without completely depriving yourself.

But deciding that you need to put yourself on a cheap monthly food budget is a great step for anyone looking to reduce their expenses. This is because food costs are one of the top three expenses in most household budgets (alongside housing and transportation).

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

Got it!

Check your inbox to grab your budget!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

And this means that working out where cuts can be made to this is perfect for having a big impact on your budget with only a few adjustments.

So keep reading to see just how much you should spend on food a month – as well as exactly what you can do to budget for food and save a ton of money.

Table of Contents

How much should I spend on food a month?

You can see more detailed information in the current USDA food budget, including individual costs for men, women and children at different ages as well as families of two. In the case of a family of four, their estimated monthly cost on food can be broken down as follows:

It’s also worth noting that this assumes that all meals and snacks are prepared at home, so how much you spend on food a month may increase if you plan to eat out at all.

How do I stop spending money on food?

When trying to stop spending money on food (or at least spending as much as you do now), there are a few tips you can implement that will make a massive difference on how much you spend on food a month.

1. Meal plan

Meal planning is one of the best ways to stop spending money on food, as it helps you to:

The one downside of meal planning is that it can take some time to do – not to mention that it’s not the most exciting way to spend your time.

You can also sign up for a FREE 14-day trial here which you can cancel at any time.

2. Prepare your food ahead of time

Meal prepping involves making your food ahead of time, so all you have to do is simply grab the prepared meal, heat it up and it’s ready to eat.

This is a particularly good strategy for any household where most of you tend not to get home until quite late, whether it be due to work or extracurriculars. By the time you drag yourself through the door, the last thing you want to do is cook a full meal.

Unfortunately, this often means that you resort to getting take out as it’s much easier. It is, however, also much more expensive, especially when you’re trying to stop spending money on food. Instead, by having your cheaper, homemade meal ready to go, you’re far more likely to rely on that.

3. Freeze meals that you can quickly heat up

This ties into the previous option, but it’s a good idea to make meals ahead of time then store them in the freezer.

From there, you can simply pull them out of the freezer on the days you want to use them. This also works really well if you take your lunch to work (and you should!) as you can just grab it from the freezer in the morning. By the time you’re ready to eat in the middle of day, it should have defrosted.

The best way to do this properly is to focus on recipes that freeze well and meal prep in bulk. That way, with just a couple of hours in the kitchen (I do mine on Sunday afternoon), you can have up to two weeks of meals ready to go.

It can be a bit tricky at first to make sure you’re doing this as efficiently as possible, so you know you’re saving as much time and money as you can.

This is why I’d recommend this FREE freezer cooking workshop. Just by signing up for it, you’ll also get:

4. Stick to a shopping list at the supermarket

Making sure you stick to a shopping list to the supermarket is key for anyone looking to reduce how much they spend on food a month.

After all, supermarkets rely on the fact that you’ll buy that “one thing you might need” or that you’ll “grab a treat” when you see it at the check out.

Instead, by following a shopping list, you’ll only buy exactly what you need, avoiding food wastage when unused items go off as well as plain old money wastage when you buy things you don’t need.

It also makes sure you buy all the ingredients for your weekly meals in one hit, avoiding a second stop at the supermarket. If you have to go for a follow up visit, you’re greatly increasing the chances of you spending more money.

5. Take advantage of coupon apps

Gone are the days of having to spend hours cutting coupons. Instead, there are now some great apps for that.

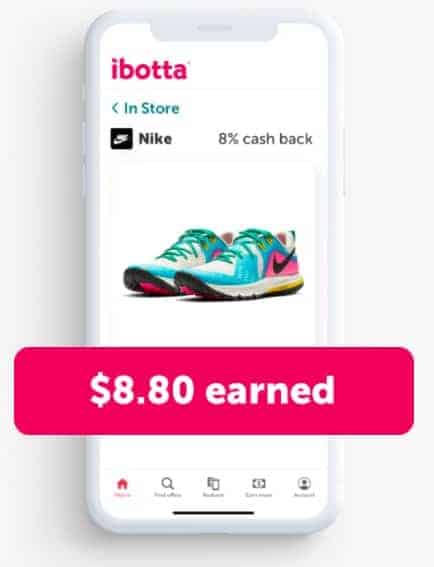

And my top pick for this is definitely Ibotta.

How it works is that you receive cash back on almost anything you buy at thousands of retailers, including groceries but also medicine, clothes and even alcohol.

Ibotta

Ibotta is a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

6. Bring your lunch to work

Bringing your lunch to work is one of those money saving strategies that are always talked about – but that’s because it works.

This is why you should definitely factor in making lunches to your meal planning or freezer cooking. The fact you’ll be able to simply grab it as you walk out the door in the morning will literally save you thousands of dollars over the course of a year.

7. Avoid take out or restaurant meals as much as possible

While there’s no question that getting take out can be more convenient, there’s also no doubt that the cost of it can really add up, especially when you’re feeding an entire family.

This means that if you’re trying to reduce how much you spend on food a month, it’s time to cut back on the take out.

Meal planning and meal prepping can really help with this, as it ensures that you always have food on hand that you can quickly turn into a meal, even if you’re tired after a long day.

Of course, your budget shouldn’t deprive you of all fun – it’s simply a matter of spending your fun money strategically. This means that you could consider budgeting for one dinner out every month or so as a treat.

If you choose to do this, you should check out the discounts you can get through apps like Swagbucks. It offers money back at all sorts of restaurants around the US – and is completely free to use.

8. Keep some convenience food on hand

For those days when you just didn’t have time to meal prep and you’re so exhausted that the thought of coming home to make a full meal sounds like the worst thing in the world, it’s a good idea to have some convenience food on hand.

The goal here is to do everything possible to deter you from getting take out, which is always going to be the more expensive option. So whether you choose to keep some microwave pizzas in the freezer or some other ready-made meal, keeping a few of these on standby can be a good strategy when you’re trying to limit how much you spend on food a month.

9. Don’t shop hungry

It’s been shown that going to the shops hungry can result in you spending up to 70% more than you would have if you’d eaten before going. And funnily enough, this even includes spending on non-food items!

The moral of the story is: have a snack before going to the shops, whether you’re planning to visit the supermarket or Target.

10. Buy in bulk if you can

This won’t be an option for everyone, especially if you don’t have much storage space. But if it’s a possibility, buying in bulk can really help to stop spending money on food.

The goal here is to buy things in bulk that last for a long time, meaning things like rice, beans, legumes and flour are all perfect for this.

From there, you can then structure your meals around these ingredients. By making cheap items the main item of any meal, you’ll be able to cut your costs far more effectively.

11. Shop seasonally

Buying fruit and vegetables that are in season will save you a ton of money over the course of a year. Not only will they be cheaper to buy given that they won’t be brought from the other side of the world, they also tend to last longer. This means that you won’t be wasting money when your food goes off in only a few days.

The USDA has a great Seasonal Produce Guide to help you see what’s on offer for you now.

How much do you spend on food a week in this plan?

You can do the math, but you’ll quickly see that strictly following this meal plan brings you well below the amounts suggested in the USDA food budget.

How do you budget for food?

The best way to budget for food is to follow a few simple steps:

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Average Cost of Groceries Per Month: How Much Should You Be Spending?

By Cynthia Measom

Spending money on food is non-negotiable; we have to eat. And you’ve likely gotten more used to buying groceries and eating at home since the pandemic struck.

However, if you don’t budget for groceries and instead just buy what you need — and want — at intervals throughout the month, you could be overspending. To help you sort it all out, here are the facts about the average cost of groceries each month in the U.S. and ways to determine how much you should be spending.

The Average Cost of Groceries Per Month

But that figure varies depending on the type of food each household buys, the amount consumed, the prices for groceries where you shop and whether you use one of the grocery delivery services that charge additional fees.

Higher Income Earners Spend More on Groceries

How much you make will also determine how much you spend each month on groceries.

Unsurprisingly, a higher income rolls out a smorgasbord of options. For example, people with higher income can afford to pay more for organic produce, prepared foods and gourmet items.

Low income, however, not only comes with a need to make every penny count to stretch the food budget, but it can also influence overall choices. According to a 2019 study about food shopping, lower-income households purchase fewer fruits and vegetables than households with a higher income.

Low-income households also pay more for the food they buy. A tighter budget puts money-saving bulk purchases out of reach, for example. Those households also shop online less frequently, and they have less access to large grocery stores with competitive pricing, according to Progressive Grocer.

How Much Should I Be Spending on Groceries Per Month?

These plans can help you estimate a monthly grocery budget based on the size of your household and what type of budget you’re working with.

Spending Plan for Each Family Member

Below, you’ll find the breakdown for a single person, a family of two and a family of four. The figures are based on a four-person household and adjusted according to USDA guidelines for other household sizes. Larger families generally pay less per person due to economies of scale.

If your household size isn’t listed below, you’ll need to make similar adjustments using costs for a family of four as the baseline for your chosen plan:

Here’s a look at the USDA food plan spending for a single person, a family of two and a family of four:

USDA Food Plan Spending for a Single Person

Here’s the breakdown of monthly costs for each type of food plan for a single female. Whereas the thrifty plan bases costs on the 20-50 age group, the other plans use a 19-50 age group.

Here’s the breakdown of monthly costs for each type of food plan for a single male. As with the single female, the thrifty plan for males bases costs on the 20-50 age group, but the other plans use a 19-50 age group.

USDA Food Plan Spending for a Family of Two

For a family of two, with one male and one female age 19-50 — 20-50 for the thrifty plan — here’s the breakdown of monthly costs for each type of food plan:

USDA Food Plan Spending for a Family of Four

Work Out a Budget for Groceries

Not having a budget for groceries is dangerous and leaves you open to temptation when you visit or order from the grocery store. Without knowing how much you should be spending each month, you run the risk of overspending, spending too much on the wrong items and even wasting foods due to throwing out perishable items, such as meat, dairy, baked goods and produce, that you buy and don’t use.

Budgeting Tip: 50/30/20

One budget that may appeal to you is the 50/30/20 budget. Within this budget, you spend 50% of your monthly net income on needs, which is where your grocery budget would fall, along with other necessities like mortgage or rent, insurance and car payments. Things you want — but don’t have to have — comprise 30% of this budget and 20% goes to savings and debts.

To create a budget for your groceries, subtract 50% from your net income and then subtract needs other than groceries from that number to see what you have left to spend on groceries. If it’s not enough, adjust your spending in the wants category to compensate.

How To Stretch Your Grocery Budget

Print off a custom grocery list to shop for ingredients, or send the list to Walmart, Kroger or other participating stores to pick up your ingredients and avoid impulse shopping. Menus are designed for your eating style, with plan options ranging from kid-friendly to Paleo. As a free alternative, the What’s for Dinner website lets you browse recipes and create your own custom shopping list.

Jodi Thornton-O’Connell and Daria Uhlig contributed to the reporting for this article.

This article has been updated with additional reporting since its original publication.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Here’s How Much Financial Experts Say You Should Spend On Each Of Your Monthly Necessities

Getting your financial life in check can sometimes feel like the hardest puzzle in the book — between keeping track of your coffee spending, making sure that rent is paid on time, commuting back and forth from work, all while hanging onto some semblance of a balanced diet. It’s just hard.

In an age where Instagram pages make everyone else’s lives seem so much more luxurious and put together than yours, sticking to a budget often feels like a big sacrifice. Still, it’s one of the easiest traps to fall into to think that you can’ keep to a budget.

Here is how much the experts recommend you spend on each of your most important monthly expenses. Consider this your budget starting point.

How Much Should I Spend On Food A Month?

Spending on food is probably one of the most basic and important expenses you incur every month. It’s simply unavoidable.

To stick to a budget inside the grocery store, US News recommends shopping for in-season produce, sticking with store-brand products, and making use of coupons and loyalty programs. Shoppers should avoid premade foods, in-store impulse traps (usually the flashy stuff at the ends of aisles), and—this last one might bite—meat.

But smarter spending begins even before you head into the store. It can help to take a snapshot, figuratively or literally, of your pantry at home to know exactly what you need; and when you go, adopt a “get in, get out” mentality to avoid making any unplanned purchases. Other tips include shopping at night to avoid distractions, shopping on a full stomach to avoid impulse buys, or befriending sales associates for good price advice.

How Much Should I Spend On Rent A Month?

While some people operate on the outdated advice of putting 30 percent of your income towards rent, figuring out what exactly to pay is much more complicated. Lendkey advocates for paying a fixed amount for rent each month. For students with high college debt, a 43 percent rule may be a better fit. Earnest.com suggests going with a “50/30/20” rule where 50% of your pay goes to housing, utilities, groceries, and transportation, 30% goes to non-essentials like clothing and dining out, and 20% goes to savings and paying off debt.

Cutting back on other housing expenses like furniture and room size and making sure the place you go with is near public transportation is also something to consider (all things that could save you money). It’s also helpful to consider homes where utilities are factored into the costs, giving you the ease of mind of having fewer monthly expenses to keep track of. And it always help to befriend (or in the least, maintain a polite acquaintance with) the landlord for those times when your up for a rent increase.

How Much Should I Spend On My Car A Month?

For those of us who live in the city and use public transit every day, paying for a car might not be a relevant expense. But for residents in states like Texas and California, where driving is the main method of getting around, paying for a car—which often means paying for a whole host of things other than the car—can be a major headache. Saving money on your car means finding ways to get around for less, hopefully decreasing the cost of driving for you and for the earth.

Much like paying rent, the best way to figure out how much to pay for a car requires a complex understanding of your financial situation each month. Spending on a car should be decided based on how much you make and how much of your income you’re willing to spend.

Creditdonkey.com has a useful chart for what to spend on monthly car payments based on your income level, but essentially, they advise that you not spend more than 20% of your income on a car. Of course, this rule changes when accounting for how you live. Some alternative rules to follow include frugally spending 10% of your salary on a car, spending just a total of 36% of your salary on all your loan payments (that includes mortgage, car loans, student debt, etc.), or following a “20/4/10” rule where you put down 20% of the total payment on a car, pay off the car over four years with 10% of your salary.

A great tip for figuring out how much you’re willing shell out each month for a car is to set a trial period where you “pay” yourself each month however much you’d pay for a car payment. This will help you become accustomed with partitioning your monthly salary for auto expenses and will give you a clearer picture of where to start when looking for a car.

How Much Should I Spend On Entertainment A Month?

It’s important to take a step back and enjoy life no matter who you are and what your financial situation is. Still, it’s important to take the right steps to make sure you aren’t blindsided by overly costly “fun” bills, but also that you have enough wiggle room to keep a spark of spontaneity in your life.

How Much Should I Spend On Clothes A Month?

When it comes to clothes, the external pressures of fashion and practicality can pull you in diverging directions, making shopping for what to wear a high-stress activity. Sometimes when the anxiety gets to you while out, poor purchasing choices can wreck even the most well-laid plans to “get what you need and go.” Regretful purchases pile up, and, even more regrettably, a closet becomes trapped in a cycle of “I have nothing to wear” and the subsequent “I need to go shopping.” Sticking to what you need, and making sure any clothing purchase checks off the boxes for practicality, versatility, and tastefulness will make sure that you don’t end up with bulging closets, empty wallets, and nothing to wear.

That being said, if you are dealing with debt or other financial issues, clothing is an expense that should take the backseat.

How Much Do You Spend on Food?

Ah food. We need it to live, yet most of us consume way more than we actually need to survive. It eats up a significant portion of our take home pay and our spare time.

There are so many choices when it comes to how a household eats, one of which, is how much to spend on groceries.

Now, I’m of the opinion that having a refrigerator full of healthy, filling food is a great way to avoid costly dinners out with friends, so I tend to want to spend a little more than the average person on groceries. Does that mean my grocery bill breaks the bank?

So, how much should you spend on groceries?

Focus on the food

In order to determine what your grocery budget truly should be each month, it’s important to take a look at what you’re actually spending on food.

Most grocery stores have become one stop shops for tons of other stuff like pet food and cleaning supplies. The next time you make a trip to the store, take a look at your receipt, how much did you really spend on actual food? It’s probably less than you thought.

Focus on the REAL food

In the same vain, a grocery budget should be reserved for stuff that is actually, truly, food.

Indulgences like pop, chips, and other unhealthy treats aren’t really food. They don’t provide nutritional value and are typically consumed as snacks, not as part of a diet (or at least they shouldn’t be!), as such, it might be helpful to put those types of food into a second, “snacks” category.

Reduce food waste

I used to spend a lot more on groceries than I do today, and a significant portion of that was because I wasn’t organized well enough to not let food spoil. You can easily reduce your grocery bill and get a better sense of what you truly spend on groceries by simply making sure less food is wasted.

So what should you be spending every month on groceries?

Try out a few of these tips to get a sense of exactly what your food budget should really be.

Related Posts

Comments

Reducing food waste is so important. For the UK, I have found the two following stats:

1) Weekly family food bill tops £77 a week as food prices in Britain soar to twice the EU average (September 2012)

2) 17.5% of all purchased food in the UK is thrown away

This means that the average person in the UK is taking £700 in cash, and just throwing it directly in the trash!!

I shop at Costco to save money but always end up buying too much food. The worst is the multi pack of meats I buy that expire before I eat it. Costco does have the best snacks, which is another of my budget leaks.

The Norwegian Girl says

Love this post!! I’m so curious to see what other people spend on groceries. Do you think where you live effects the cost of your groceries? I feel like NYC and surrounding boroughs can be more expensive than other areas.

I can usually get under this budget if I meal plan for the week. On weeks I don’t meal plan we end up wasting a lot more food.

Nicole @ Treasure Tromp says

Reducing food waste is key. I HATE throwing away food (and so does my wife) so you really have to manage what you have on hand so that you don’t let your fruits and veggies go bad. The good news is that if you are motivated to reduce food waste you usually are motivated to eat all your fruits and veggies, which in turn obviously makes your diet just a little bit healthier.

We have been monitoring our grocery spending closely. I am trying like heck to keep it under 600.00 which sounds like a lot. It was higher…. and that is embarrassing in itself.

Alicia @ Financial Diffraction says

Our biggest thing is we used to be huge food wasters – I am pretty ashamed of it honestly, especially with me being raised that nothing gets thrown out, and my fiance being raised in a very low-income family… food wasn’t something to waste. But we did it because we thought the epitome of having enough food for a week or two was a fridge stuffed to the brim. It resulted in A LOT of waste. Now our fridge looks a little emptier, but we are never hungry, and we might waste 5% tops due to veggie spoiling – so much better!

kelly @stayingonbudget says

YEs I agree, food is a big budget buster. I see all the time a family of two having a food budget of 800 dollars plus, that is just crazy.

That is just for me – and I never eat processed food, always meal plan and cook for myself. I was surprised at how high it was for a while, and when I think about having a partner to cook for too – who eats twice as much as I do – what on earth is our grocery budget going to be?! It kind of scares me 😉

I read a lot on PF blogs about people trying to drastically cut the amount they spend on groceries. I get it – it’s one area that you do have control over and can make a dent in your budget. But, for me, good, healthy whole food is a priority, so I am willing to pay for it. I love eating what I cook and I think in the long run you get some savings by hopefully not having to deal with health problems that can come later, in part because of an unhealthy diet.

I HATE when I fail to plan properly and food goes to waste. It makes me angry with myself!

You won’t believe this, but I budget 1200/month for our family of 4 (plus dog and cat).

This amount accounts for items like cleaners and animal food and eating out.

I had thought we were only spending about 800-900 but after doing some analysis I discovered it is closer to the 1200 – 1400 dollar mark…

I think I will start breaking things down a bit more granularly and see what I actually spend on food and what I spend on other stuff I currently include in my grocery category… Seperating the eating out and animal food is much easier to do.

Andy | Income by Example says

I don’t spend much on food but between me and my two preschool aged kids we don’t eat a lot either. We have been eating pretty healthy lately though due to all of the fresh garden veggies. We are definitely far from completely healthy eaters but it’s something I’ve been working on.

What someone should be spending each month depends on many factors. It depends firstly on their budget, their health needs and what food really means to them. I think some people put too much emphasis on the fact that some people can spend less and eat very healthy and think that it’s not possible when it is, we are proof of that. Cutting out the crap is the easiest way and eating clean helps keep us all healthy. Most times we don’t need half the amount of food we put in our bodies. Do we eat too much? Most likely and that also contributes to a higher grocery budget which I wrote about earlier this year. There are so many variables when it comes to the grocery budget that it really depends on the person. Cheers!

Lisa E. @ Lisa Vs. The Loans says

Thankfully, since I still live at home, my mom takes care of the grocery bill. I’m lucky, I know!

Food waste is a big pet peeve of mine. I hate seeing perfectly good fruits and veggies go to waste, especially when we work with a pretty lean budget! I try to freeze things to use later, if I can’t use them up right away and I also like make soups and baking, which is a great way to use up ripe produce.

We’re averaging about the same as you guys, and trying to focus more on real food. Have you read Michael Pollan’s In Defense of Food? Highly recommend it!

Julien @cashsnail says

400$ for groceries is very nice… We are spending between 500€ & 600€ (700-800$) for 2 and a baby. But it include cleaning and laundry product and a little healthcare costs

But we don’t buy snacks and we eat out once per month (it’s usually too annoying to find a babysitter :))

I haven’t done a formal food budget in quite a while (it was probably scare me if I did). I know we’re spending too much on takeout and going out to eat and it’s something I’m trying to get back in check. We both love to eat and our waistlines recently show that.

Jennifer H. says

When I go to the store, pet supplies (food and litter) are the 2 main things that eat up my budget. I account for them in my planning, but since I get paid semi-monthly, each trip to the store is for restock as well. Even after I’ve put everythign away I feel like I didn’t buy any real food.

James Maxwell says

Food is an area in which we can make massive savings. My wife and I recently changed the way we shop.

The one thing that has made a big difference to us is scrapping the convenience of buying from one store. We shop from 3-4 different stores for the foods we know we can buy cheapest from each.

I estimate we have cut our food bills by 1/3.