How to buy an apartment

How to buy an apartment

How to Buy an Apartment Complex

Your first purchase of a large apartment complex can be both intimidating and exciting. Here are a few easy steps to follow to make sure you stay on track.

hash-mark

Steps to Buy an Apartment Complex in 2022

hash-mark

1. Learn About Types of Apartment Complexes

The first step in buying an apartment complex is to learn about the different types of apartment buildings so that you can decide which is right for you. You’ll need to consider your goals and what you want to achieve to ensure the apartment building you buy can meet them.

The 4 Types of Apartment Complexes

Once you’ve settled on the building type, you’ll need to pick a market. Choosing a market is one of the most critical factors for success with your investment. A negatively trending market can be disastrous, whereas getting into the right market at the right time can make the apartment building one of your best investments ever.

hash-mark

2. Set Your Budget

hash-mark

3. Get Pre-Approved

Once you have a budget, a target market, and a cash flow forecast in mind, you will want to start getting pre-approved for financing. Securing financing is one of the most important aspects of buying an apartment complex, so be sure to take it seriously, and prepare all the paperwork your lender will ask for, including detailed financials.

It’s best to talk to at least 3 lenders to ensure that you are getting the best rate possible. Try to get pre-approved by at least 2 so you have options. Once you are pre-approved, you can start to search for apartment complexes that fit that budget.

hash-mark

4. Look For Properties and Make Offers

Start conducting your inspections. Apartment buildings are large investments, so be thorough with your inspection. Ask questions, and check out each unit. Pay particular attention to the roof, plumbing, HVAC, and electric system.

A potential strategy is to ask for reviews of the building or to search for them online. Although some of the problems in the reviews might be a result of poor management or other issues unrelated to the building itself, some reviews might highlight problems in individual units. You can ask if the issues were resolved or if those are problems that will come with the investment.

hash-mark

5. Select a Property Management Company

If the apartment complex is large enough, you likely won’t be managing the property yourself. You will be hiring a property management company to assist with your investment. This is equally important to invest in the right market. The management company will make or break your investment.

Make sure to conduct thorough reviews of several companies and get quotes. Find some of their reviews online and inspect some of the other properties they currently manage. Is there a common problem that comes up across all their properties? That might tip you off to a potential flaw in the company.

hash-mark

6. Finalize the Deal and Financing

Once you have found the perfect building, return to those lenders with your actual deal and finalize the financing. With multiple pre-approvals, you will be able to compare rates and other aspects of the financing more accurately. Your lender will likely require an appraisal before finishing.

Make sure there are no issues with the title, and the appraisal report comes back in good shape. If there are any problems that you were unaware of that are revealed by the report, you might reconsider your investment. Otherwise, once everything is confirmed, you can close on your deal and get ready to rent it out!

hash-mark

7. Stabilize Your Investment

Be ready to spend a few months or years stabilizing your investment and getting all the finances in order. Once you start to get tenants on auto-pilot, you might even consider expanding with a new apartment building.

hash-mark

Buying an Apartment Building: FAQs

Is Buying an Apartment Complex a Good Investment?

Buying an apartment complex can be a great investment if you do your homework and purchase in the right location and for the right price. You’ll also want to make sure your property is well-managed and that your rentals are appropriately marketed, ensuring vacancy rates are low.

The first thing to consider is whether buying a specific apartment complex is a good investment and if you have time to manage the property. Owning a few small rental properties are easier to manage, and tenants are easier to work with on a 1-to-1 basis. With an apartment complex, there are more potential vacancies and large scale problems you might face.

Generally speaking, most apartment buildings are a good investment. However, not every building is automatically a good investment. Each should be evaluated separately. You should consider things such as age, condition of the property, price per square foot (compared to the rest of the market), and the local real estate market. Knowing how to calculate price per square foot, cap rates, and how to search for comps is critical.

What makes an apartment building a safe and stable investment is the fact that when you own a building or apartment complex, you’ll have multiple individual apartments in your portfolio. So when a few are vacant, you will likely have others filled, which means you won’t lose as much cash flow. And, when you are entirely full, you will have a much larger stream of income. An apartment building allows you to expand your portfolio with just one purchase.

Another downside of an apartment building is the fact that you will be working with multiple tenants. With a rental property, you might find a tenant for 12 months and then check in every few weeks. With an apartment building, you might have 6-8 tenants you are checking in with regularly, and then you might have to advertise the opening of your other 6-8 apartments. It is a lot more work to keep the income coming in. Of course, you could hire a property manager and other staff, but all this eats away at your profits.

Apartment buildings also come with more liability risks and legal compliance issues. If you have a pool or fitness center, there are even more potential risks involved. These may be attractive and essential to the success of your investment, but they can be both expensive and time-consuming upfront.

Apartment buildings are more difficult investments to exit as well. They generally take longer to sell. So it is vital that as the investor, you have other income sources in case you run into problems and have to sell sooner than expected.

How Much Does an Apartment Building Cost?

A second factor concerns the location of the building. Apartments in smaller, rural towns tend to be cheaper than similar-sized buildings in the heart of a large or even medium-sized city. Here though, it is essential to remember that rent will also tend to be higher in these areas, so the higher price may be worth it.

How Much Money Can I Make From an Apartment Building?

What Types of Loans Are Available for Apartment Buildings?

For buildings with 4 or fewer units, residential loans are available to the buyers. If the apartment complex has more than 4 units, there are three commercial options:

How do I Properly Value an Apartment Complex?

The most common way to value an apartment complex is through the income approach. This approach divides the net operating income (or NOI) by the cap rate.

Can I Buy an Apartment Complex With Zero Money Down?

Occasionally, sellers will offer seller financing that covers either the full amount of the purchase or just the down payment. You may ask your seller to see if he or she is willing to make that offer, but do not expect this to be the case in your situation.

How Much Time Does it Take to Manage an Apartment Complex?

An apartment complex with multiple individual units is too large for one person to manage by himself or herself. You will need to hire a property management company to take over the day-to-day operations. You can work with the property management company so that you are involved with certain decisions and any significant issues that arise.

However, the property management company can essentially stand in for you. In other words, you can be as involved as you would like to be. This makes hiring the right company all the more important to the success of your project.

How to buy an apartment

There are a huge number of things to consider when buying a home, particularly if it’s in a foreign country, or it’s a first-time purchase. In this article, we try to break down some of the things to consider.

Financials

When it comes to the financial aspects of buying an apartment, there are two main areas to consider: budget and ongoing costs. Before you even begin looking at apartments, you will need to work out what your budget is, how much money you can afford to spend on a property. Sounds relatively straightforward? Well, it is not as simple as looking at the purchase price; there are a number of other expenses which go toward the final acquisition costs. Things such as the sales commission, legal fees, and various taxes can all make your final acquisition costs substantially more than the initial purchase price. Take a look at our purchase process guide for more detail.

Market insights

Once you have settled on a budget, make sure to research the market, to see what kind of value you can get for your money. Check recent comparable sales in the area, and look at how prices have changed in recent years. The other financial consideration to keep in mind, is that there will still be ongoing costs once you have bought the apartment. The upkeep and operation of the building is generally handled by the homeowners’ association, and you will have to pay them a regular fee known in Germany as Hausgeld. This will cover things like general maintenance, garbage disposal, and management fees. Make sure you are aware of how much these costs are likely to be.

Mortgage options

In Germany, there are no restrictions on foreigners (non-Germans or non-EU citizens) from owning property or obtaining a mortgage from a German bank. It is really no more difficult to obtain a mortgage in Germany than in any other European country, and it functions in essentially the exact same way as in other countries: you borrow money from a lender and agree monthly repayments at a certain rate. In general there are four main categories of loan types in Germany:

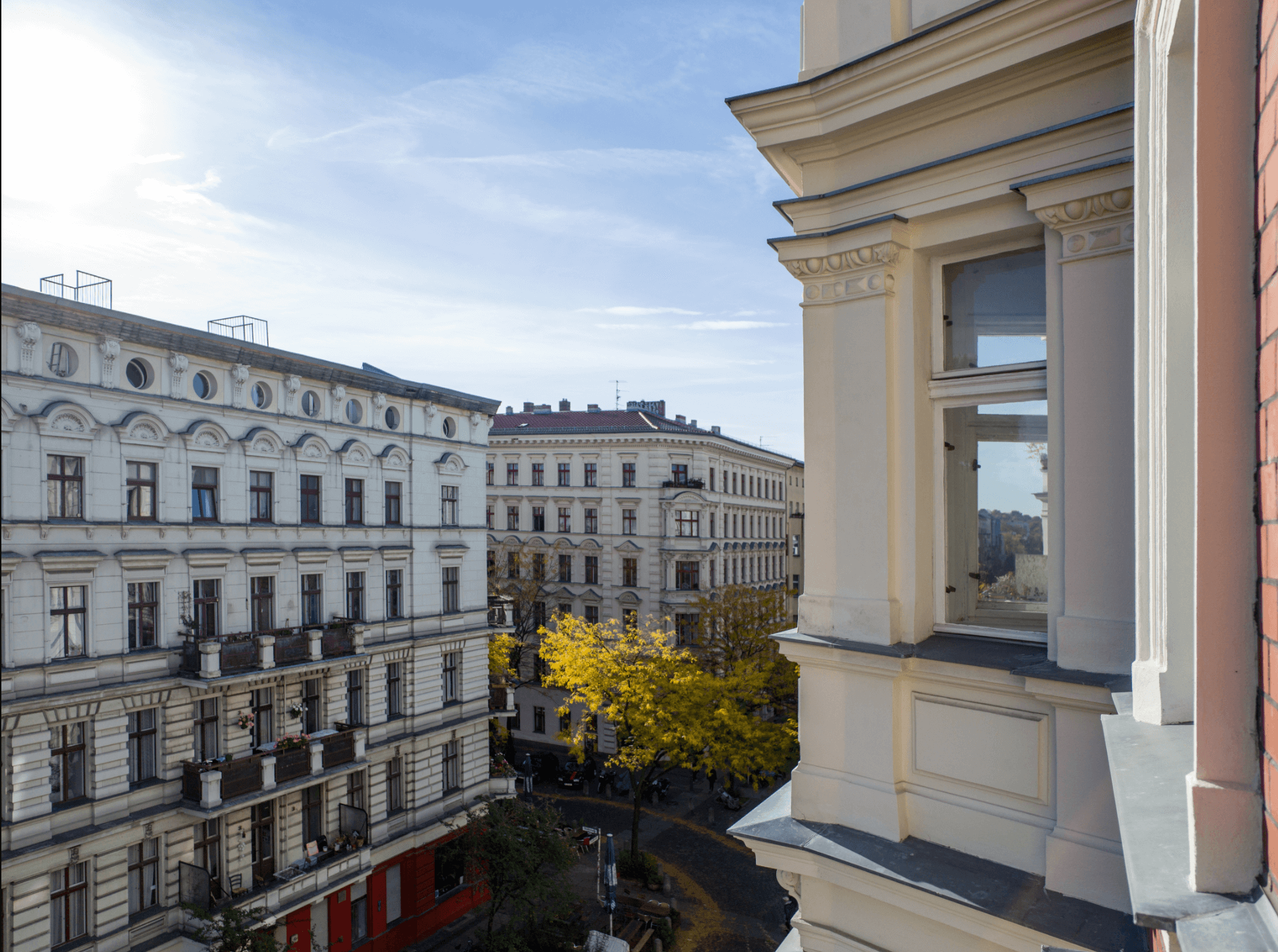

Location

It’s a familiar refrain, when discussing property; location, location, location. Residential area can have a huge impact on the value of your property. It can also be broken down into two parts: a macro-level and a micro-level.

On the macro-level, this is really deciding in which neighbourhood you would like to live. If you are already familiar with Berlin, then you probably already have an idea of where you would like to live (and if not, take a look at our pages detailing everything you need to know about Berlin’s top neighbourhoods).

Choose your scene

Each area has its own distinct characteristics, and its important you feel completely at home in your own neighbourhood. Do some research into the demographics of the different areas, find out what kind of people live there, and what the local culture and lifestyles are like. Berlin is blessed with a lot of green spaces, and lots of water, so look for your closest parks. It is also useful to know how far you are likely to have to commute, so make sure your journey to work isn’t too difficult.

Then once you have decided on an area, and are looking at possible options within that, you can examine the location on a micro-level. What are the immediate surroundings like? Are you close to shops, cafés, transport links? Do you have a host of bars and restaurants just outside your front door, or does your building back on to a large park? Do you value living in the countryside, or do you prefer innercity? It is also good to note if there are any other planned developments nearby, as these may affect both your day-to-day life and the local property prices.

How to Buy an Apartment

You can fulfill the American dream of homeownership by owning an apartment just as you can with a traditional single-tenant home. Owning instead of renting can also be good for your finances, as you’re building equity in a property you can later sell instead of throwing money away to a landlord. So if you’re interested in purchasing an apartment for yourself and your family, here’s what you need to know.

Do you have questions about how an apartment purchase can affect your long-term financial plan? Speak with a financial advisor today.

The “Rent vs. Buy” Decision

Perhaps the biggest factor in deciding whether to rent or buy is the length of time you expect to stay in your new apartment. Generally speaking, if you don’t anticipate living there for at least five years, renting is likely to be a financially wiser move.

If you plan to live there for five or more years, compare how much you are paying to rent with how much you could be paying to own. A mortgage payment will generally be less than rent, assuming the place you want to buy is similar to the place you’re renting. That’s because your landlord is paying the same as you would for principal, interest, taxes, homeowners association fees, and repairs, plus a little extra for profit.

Still, there’s more to owning than the payment. To buy something, you’ll have to put up more cash than you would need to sign a lease. The biggest outlay will be for the down payment. The amount required for this depends on the type of mortgage you get and potentially even where the home is located.

Calculating What You Can Afford

Now it’s time to see how much you can afford to pay. Start by figuring out your debt-to-income ratio. To do this, add up all your monthly debt payments, such as credit cards, car loans, student loans, child support payments, alimony, and your estimated mortgage payment.

Lenders use this debt-to-income ratio to determine how much payment you can afford to make on a monthly basis. They will usually look for a debt-to-income ratio of no more than 43%. If you find yourself above that mark, it may be tough to qualify for a mortgage. You can improve your debt-to-income ratio by planning for a lower mortgage payment. That usually means buying a lower-priced apartment.

SmartAsset’s mortgage calculator can help you simulate the entire process above. All you need is the full price of the home, the size of your down payment, the type and length of the mortgage you’re getting and the interest rate you expect to receive. Don’t neglect other costs, though. These include property taxes, homeowners insurance and possibly homeowners association fees. All of these costs combined can add several hundred dollars a month to your payments.

Buying Into Condos 0r Co-ops

An alternative to buying an apartment might be buying into a set of condominiums or a co-op, which physically is set up similarly but can be quite different to manage. When you purchase a condominium, you are buying a unit in a building. That means you will share the costs of running the building with other condo owners. Purchasing a co-op means buying part ownership of the corporation that owns the building. Rather than a specific unit, you’ll own shares in the corporation.

Mortgage lenders have different requirements for condo and co-op loans. For instance, they may want to see that a condo association has enough money in the bank as financial reserves to cover any needed repairs or maintenance. Some lenders are reluctant to make co-op loans because they can’t repossess the unit if you have trouble making payments. So if you’re looking for a loan then you may find an apartment or an affordable single-family dwelling to be a better option.

Getting More Help

Would-be apartment buyers can get help navigating this home buying journey from a licensed real estate agent. An agent can help with questions about pricing, taxes, fees and communities. At the same time, he or she can provide valuable insight into how to negotiate with sellers.

You can even integrate a financial advisor into your homebuying experience. These individuals will often work together with real estate agents to ensure that the decisions you’re making are aligned with your overall financial goals. Plus, they can answer your questions about what you can afford and how much of a loan you can target.

Bottom Line

Overall, buying an apartment can be similar to buying a single-family house. The loan application and closing procedures are very similar. The important part is determining how much home you can afford and then determining whether you should buy or rent. Once you’re able to figure that out then you can set up your finances in preparation for your decision.

How to Buy an Apartment Building: Apartment Syndication 101

If you want to learn how to buy an apartment building, apartment syndication is worth checking out. Apartment syndication passive investors pool their money to purchase apartment communities. These real estate assets generate revenue. The syndicator and investors each take their cut.

This complex investment strategy, however, has a high entry barrier. You’ll need years of real estate experience and a highly-skilled team. Dealing with other people’s money, after all, requires both experience and expertise.

If you have both and want to learn how to launch a business in apartment syndication, then stick around. We’re breaking down what you need to know about apartment syndication and how you could buy an apartment building with no money down from your pocket.

Apartment Syndication 101

Step 1: Build Your Real Estate Investing Experience

Apartment syndication, as we mentioned before, is not for real estate beginners. It is a long-term investment strategy with extensive upfront work.

As the apartment syndicator (also called the general partner), your responsibilities include:

If you don’t have experience with the above tasks, you’ll struggle with apartment syndication. Focus first on getting hands-on experience. Intern for a real estate firm. Work with professionals. Attend real estate seminars and join communities.

If you don’t have real estate experience, a business background will also work. Project management skills, especially, are excellent in real estate syndication. We still recommend that you hire a real estate advisor. Their insight will be helpful as you slowly build your own experience.

Even if you’re starting late as an investor, you can make fast progress, like Tom Burns, a surgeon who’s done really well with his real estate investments. Ryan and Tom shared some wine and talked investing.

Step 2: Set Your Apartment Syndication Goals

Since apartment syndication can be tricky, know your goals before diving in.

If you want to syndicate full-time, set a figure for how much you want to make. Reverse engineer that figure to understand how much you need to charge and how much work you’ll need to put in.

We’ll be covering the various fees you can charge in a later section.

Step 3: Select a Target Market for Investing

In real estate, you’ve probably heard of the phrase, location, location, location. Your target market as an apartment syndicator will be the geographic location you’ll want to focus on.

When choosing a target market, you’ll want the area to be just the right size. Too large and there will be too many fluctuating variables — rent prices, school districts, crime rates. Too small and you’ll limit the opportunities available to you.

If you’re unsure of where to start, try evaluating the city you live in.

Population:

Has the population risen or decreased over the years? If it has decreased that suggests apartment vacancies and there might be some property assets you can syndicate. However, population declines could also indicate that the area is not a good area to live in, which may turn away tenants.

Increasing population, also, can be ideal. It shows that this area is desirable and if you secure an apartment complex, then tenants will occupy your apartment building.

Unemployment:

A community with high unemployment rates signals a bad market. You’ll want to search for target markets that are low or showing a downward trend. This shift indicates that businesses are improving and jobs are available.

Job Diversity:

While low unemployment is ideal, you’ll want to research job diversity within your target market. If one company employs too large a percentage of a population, then that area is at risk, should that company ever go belly-up.

Using these criteria, evaluate the viability of each target market on your list. You might learn that some markets show bad data, which you can eliminate from your list of markets to pursue.

Step 4: Build Your Real Estate Team

In apartment syndication, avoid doing everything yourself. This can waste valuable time and trigger unnecessary stress. Delegation is more efficient and can highlight each member’s strengths and background. The core members of your apartment syndication team will include:

Below is a summary of each professional’s role and expectations.

General Partners

The general partners are responsible for executing the syndication process from start to finish. You’ll be involved in overseeing the execution of your business plan. General partners are also referred to as sponsors or syndicators. In this article, you are a general partner.

As a general partner, you are responsible for:

General partners can be an individual or multiple individuals. With multiple general partners, the responsibilities are usually distributed by skills and background.

For example, one partner can oversee apartment operations. Another partner with a high net worth will sign their name on the loan. Another partner with an extensive network will find potential passive investors.

Limited Partners

The passive investors who pool their money to buy the apartment building are known as limited partners. The term “limited” comes from their liability being limited to their share of the ownership. The passive investor’s main responsibility, as you’ve probably guessed, is to fund all or a portion of the initial equity investment.

Although they are funding the purchase of the apartment building, they are not involved in the business plan’s execution. Except for tax management, the passive investor is completely passive.

Like general partners, limited partners can be an individual or multiple individuals. If there is only one limited partner, that individual will fund the entire equity investment. If there are multiple limited partners, each will contribute a portion of the equity investment. With apartment syndications, it’s more often the latter.

Property Management Company

As an apartment syndicator, you already have your plate full. You’re finding private investors, researching target markets, and closing property sales. If you try adding property management, something is bound to slip through the cracks. Even the most organized real estate professionals get overwhelmed. That’s where your property management company comes in.

They will save you time and stress by taking over the following responsibilities:

If there are multiple general partners, one partner might want to take over the property management. This can be a viable decision, especially if that partner has previous experience. In most cases, though, the property management company is a third-party provider not listed as a general partner.

If you decide to go with a third-party, it will benefit you to use an experienced and competent company. Now, if you syndicate multiple properties within an area, you can use the same company to manage all of those properties. If you grow your real estate syndication into a large-scale real estate firm, you can even hire an in-house property management company.

Commercial Real Estate Broker

Your commercial real estate broker will focus on scoping out the available deals within a target market. When they find a deal that may catch your eye, they’ll create a marketing package and send it to you for consideration.

Having a quality real estate broker is key to your success. They will be your nose when sniffing out multifamily apartment buildings for sale within your target market.

Real Estate and Securities Attorney

A trusted real estate attorney and securities attorney is invaluable. They explain and help you write the necessary legal documents. Your attorneys also ensure that your contracts outline each party’s responsibilities and expectations.

In the apartment syndication process, here are some legal documents you’ll encounter:

Purchase Sale Agreement:

This contract involves the buyer and seller of the apartment community. The seller’s attorney will draft the contract and send it for your review. Review the language with your attorney before signing and returning it.

Operating Agreement:

One operating agreement is created among the general partners. It will outline each member’s responsibilities and their ownership percentage. As a general partner, carefully comb through the legal language. Understand everything before agreeing to anything.

A second operating agreement is created between the general partners and limited partners. This document outlines the limited partners’ ownership percentage for each real estate asset.

Private Placement Memorandum:

This document discloses the risks involved when entering this contract. You should work with your securities attorney to prepare this document. Sometimes, this document includes points in the operating agreement. For example, you might see the minimum investment amounts and payment terms.

Step 5: Find Qualified Real Estate Investors

When figuring out how to get a loan for an apartment building, you’ll need to seek accredited or sophisticated investors.

If an investor does not meet either of these standards, they cannot source your capital requirements.

Finding qualified investors, however, is often easier than convincing them to invest in you. The secret to inspiring them to work with you is to earn their trust. Do this by building your experience, highlighting your expertise, and expanding your network.

Passive investors, naturally, want to work with people who have a track record of success within the real estate industry. Apartment syndication will be difficult for beginners to break into. It requires extensive knowledge of real estate, property management, and communication.

Building connections will have a significant impact on how many passive investors you can secure. Carefully organize all of your contacts. You’ll never know when that person you met at your child’s PTA fundraiser has a friend who’s seeking to invest. Passive investors are more welcoming when you share a contact. Getting that mutual contact to vouch for you can quickly establish your credibility.

Step 6: Choose Your Investment Strategy

In apartment syndication, how you write your business plan depends on the type of property you purchase. Different strategies will apply to different markets. Make sure that you have a clear plan when recruiting passive investors.

Here are two common strategies in apartment syndication:

Use What’s Already Working

As the name suggests, this strategy is to buy an apartment community that is already faring well. The occupancy level is usually high. The property should be well-maintained. Also, the unit fixtures and appliances are up-to-date. If you add even more value, like installing a fitness center, you can possibly increase the rent or use it as another marketing point.

You’re stepping into a system that’s already profitable and then taking over the cash flow.

Passive investors tend to favor this apartment syndication strategy. The risk tends to be less because the property is already profitable. But some strategies need more work than this one. Take the next strategy, for example.

The Property Flip

This follows the same strategy as house flipping : buy, fix it up, and then flip it for a profit.

Run-down apartments with declining occupancy rates are favorable. The strategy here is straightforward. You’ll buy the complex, fix it up, and then sell it for a profit.

When fixing up the community, aesthetic fixes make a huge difference. Splash on some new paint. Bring in your landscaping team. Update your branding. A combination of these and more can boost your asset’s value.

After you increase tenant occupancy and stabilize it, you can then sell it for a massive profit.

The «Use What’s Already Working» focuses more on monthly cash flow. This strategy, though, relies on the lump-sum sale after flipping the property.

Step 7: Find and Make an Offer on Apartment Deals

If you’ve reached this point, you’ve accomplished quite a lot:

Keep in mind that these steps can take several weeks to months depending on how aggressive you are.

Creating the right team and writing your business plan are steps that you do not want to rush. These factors will determine the number and quality of your passive investors. Also, it will prepare you for success in executing your business plan.

Finally, it’s time to find an actual apartment community to syndicate.

This is where having a real estate broker is helpful. A talented real estate broker will sniff out profitable opportunities for you.

If you find an apartment community that resonates with you, submit your letter of intent. This document acts as a formal submission of your intent to buy the property. If accepted, you will get in touch with the apartment owner. Arrange a time and place to sign the purchase-and-sale agreement. Upon signing, the property is under contract to purchase.

If you’ve purchased a home, you’re likely familiar with due diligence. In apartment syndication, you usually have up to 60 days to do this.

Here are some things you should check off your list:

If you find anything amiss, such as serious structural issues, you can withdraw from the contract.

Step 8: Meet With Your Passive Investors

You’ve taken care of the legwork of finding the apartment community. Before you can buy the property, you’ll need approval from your limited partners.

Before scheduling a meeting with the partners, compile and organize your research. It should list the asset highlights, including property value and cash flow. Also, have your attorneys prepare the necessary legal documents. This includes the operating agreement, subscription agreement, and private placement memorandum.

Be sure to answer any questions your partners have. If all goes well, it’s time to sign the legal documents. After obtaining their signatures, you can close the sale on the apartment community.

Step 9: Execute Your Business Plan

The limited partners funded the purchase and you’ve closed the sale. This concludes their role. It’s your responsibility, now, to execute what was outlined in your business plan.

For example, if you plan to improve the saleability of your apartment building before flipping it, now is the time to lay the groundwork. You can hire local contractors to get the necessary work completed.

Also, you will work with your property management company. Get them set up to oversee the day-to-day operations of the apartment building. Not having to deal directly with your apartment tenants will free up your time and resources for other projects.

Step 10: Sell The Property

Even if you’re not looking to flip the apartment complex within a short time frame, many syndications have an exit strategy. Some will hold the property for several years before selling it. Others may sell it after a few years. It depends on what was outlined in your business plan, contracts, and market conditions.

Similar to the property purchase, the general partners will manage the sales process. Again, the limited partners will not be involved in these steps. After the sale, the limited partners’ remaining equity is repaid. Also, any additional profits will be distributed among the limited and general partners. The percentage distribution will depend on what all parties agreed in the contract.

Making Money as a General Partner

There are a couple of ways that general partners make money. Many of them are through one-time fees and ongoing fees. Here is a breakdown of each:

Acquisition Fee

The acquisition fee is a one-time fee paid to the general partner at the closing of the apartment building. This fee is often likened to a consulting fee. The general partner is paid for executing the legwork of finding the apartment building, inspecting it, and then closing the sale.

Asset Management Fee

Unlike the one-time acquisition fee, the asset management fee is an ongoing fee. It is paid to the general partners for overseeing the partnership and asset. Remember: the limited partners do not execute the business plan. It is the general partner’s responsibility. This fee can be charged to ensure that the asset is maintained and performing as expected.

That means, however, that the general partners cannot sit and relax after the apartment building is secured and there is cash flow. The general partner must still check in with their property manager. Even if property management is outsourced, the general partner must confirm the asset is maintained. Also, it’s recommended to update the limited partners on how their asset is performing.

There are typically two ways to pay out the asset management fee.

However, it’s important to note that the asset management fee is paid after the preferred return. The preferred return is the amount paid to the limited partners. That means that if an asset doesn’t generate enough for preferred return, then the asset management fee isn’t paid out. This is to ensure that the passive investor is receiving some return on their investment. Also, this structure incentivizes the general partners to maximize the asset’s value.

You now might be wondering which fee is superior: percentage-based or per unit-based?

Each fee structure has its pros and cons. The first will scale depending on how much revenue the asset generates, which incentivizes you to market and improve the property. The second structure guarantees a predictable cash flow but is unaffected by how poor or well the property performs. The answer to this debate will depend on what you and your general partners are most comfortable with.

Profit Split

Your contract should cover how to distribute profits beyond the preferred return. How will you agree to split the profits? What will the general partners take home and what will the limited investors take home?

The amount will depend on the percentages outlined in the contract — often it will be a 70/30 distribution with limited partners receiving 70% of the remaining profit.

For example, if the preferred rate is 10% and cash flow generates 15%, 10% is paid out to the limited partners. The remaining 5% is split between the general partners and limited partners. Within that 5%, limited partners receive 70%. The general partners receive the remaining 30%.

Making Money as a Limited Partner

Since a partnership involves at least two people, it’s important to know about your partners. You should, especially, learn how it is that limited partners get paid. What’s in it for them?

The main payment method to a limited partner is through preferred returns. The preferred return specifies how much the limited partner is paid — usually 8% of their current capital account.

It’s important to note that payment to the limited partners is often before the general partners receive payment.

For example, let’s say that cash flow is 8% and the preferred amount is 8%. That means the limited partners take the full 8%.

If cash flow is only 5%, then the limited partners will still receive that 5%. The unpaid amount may or may not accrue. It’s important to outline this detail in your private placement memorandum.

If cash flow, instead, is 10%, then 8% is paid to the limited partners and the remaining 2% is split between the limited partners and general partners.

Apartment Syndication: Pros

If you’re wondering whether this is a worthwhile business venture for you, consider reviewing a pros and cons list of real estate syndication.

Here are some benefits of syndicating apartments:

Attractive to Passive Investors

Investors, or limited partners, generate ongoing passive income through preferred returns. Investors, however, are not involved in day-to-day operations. This type of investor relationship may make it easier to find investors to fund your syndication project.

Profit Splitting

Any profit generated beyond the preferred return is split among the limited and general partners. This incentivizes you to work harder. The more revenue your assets generate, then the more money you take home.

Make Money With Other People’s Money

As an apartment syndicator, you’re investing other people’s money. Even though you do not have liquid capital, you can still profit from this opportunity. Instead of capital, you’re offering your experience, expertise, and the actual execution of the business plan.

Apartment Syndication: Cons

Despite its attractive features, apartment syndication also has its disadvantages. Here are a few cons of real estate syndicating:

Lack of Control

In apartment syndication, your team members usually split the responsibilities. General partners will fulfill different tasks. Real estate agents will advise. Property managers will maintain the physical asset. Lawyers will draft and review contracts.

While you may perform your roles perfectly, other members may fall short. That’s why building an experienced and competent team is necessary for succeeding in apartment syndication.

High Entry Barriers

As we mentioned before, apartment syndication isn’t for the real estate beginner. To break into this field, you’ll need years of experience and strong connections. Without this, you’ll struggle with securing enough capital from passive investors. And without capital, you can’t purchase an apartment complex.

Intensive Management

Managing an apartment community can be more complex than managing a single-family unit. There’s significantly more stress if you decide to manage the property and forego hiring a property management team. You will need to respond to repair orders, answer tenant inquiries, and ensure proper maintenance of property.

Common Apartment Syndication Mistakes

There are countless moving parts within apartment syndication. If you want to save time, energy, and headaches then be mindful about avoiding these mistakes:

Liability Issues

The law is an entire professional field that you have neither the time (or interest) to learn. That’s why it’s worth working with a security lawyer. Outsource this responsibility to a legal professional. Their legal expertise will navigate you through the apartment syndication process. Also, be sure to review all legal documents with them before signing and distributing them among your team.

Poor Marketing

Years of experience alone isn’t enough to achieve your goals, especially when it comes to apartment syndication. You will need to learn how to properly market yourself so that investors trust you with their money.

Market yourself as a real estate syndication expert by increasing your online presence. You can publish blog articles, post videos, or start a podcast talking about real estate syndication. Seeing your content pop up on Google search results and a large following will boost your credibility.

Poor Communication

You receive an asset management fee and that includes communicating regularly with the limited partners. Your investors will appreciate progress reports on how their assets are performing.

Frequently Asked Questions:

How much money do you need to buy an apartment building?

There is no exact figure to list when it comes to answering how much it costs to buy an apartment building. The price will fluctuate wildly depending on a variety of factors:

These prices, however, do not factor in repairs and renovations you’ll want to do after purchasing the apartment building. If you’re planning to purchase an apartment community for a quick flip, there’s more number-crunching involved. Be sure to get an estimated value of the renovations and add it to the building’s purchase price.

Is owning apartments profitable?

Yes, buying and owning apartments via real estate syndication can be a profitable business venture. The amount of money that an apartment syndicator makes varies. It will depend on what fees you charge and how many properties you syndicate.

How do I buy my first apartment complex?

The process would largely follow many of the steps outlined earlier. You’ll want to work with a real estate broker to find apartments for sale within your target market. When you locate a property that interests you, you can submit an offer and letter of intent to purchase. You must still complete your due diligence. If everything clears, move forward with closing the sale.

Again, we recommend that you hire an attorney and property manager. Maintaining the properties and doing legal research is a poor use of your time. Outsource those responsibilities. It will save you time, headaches, and confusion.

Is investing in an apartment building a good investment?

If you’re wondering whether buying an apartment complex is a good investment, the short answer is yes. Recent residential trends show apartments increasing in popularity. That shows that purchasing apartment buildings is a good investment choice.

If you’re wondering why, it’s because homeownership is becoming increasingly expensive. With more Americans unable to afford a house, they turn to apartment renting. This has caused apartment occupancy to increase, along with rent rates.

Do apartments increase in value?

Like many homes, apartments can appreciate in value over time. Current trends also suggest that apartments will be a good long-term investment:

If you have the experience and have been curious about syndicating, now is the time to start. Real estate trends are presenting a golden opportunity for you.

What is the average salary for an apartment property manager?

Apartment Syndication: The Bottom Line

If you’ve made it to the end of this guide, you’ve learned how complex apartment syndication can be.

If you have the experience and drive, then apartment syndication can be a worthwhile investment. Depending on your efforts, it can supplement or replace your income. If you have a love for real estate, project management, and networking, then definitely give real estate syndicating a try.

If you’re an entrepreneur who’s ready to learn how to invest the profits from your business into real estate holdings, you don’t have to learn the hard way. You sure don’t have to do it alone. We recommend joining The One Percent community, where entrepreneurs create wealth and passive income. Check it out and join us.

How to buy an apartment

Most people are not familiar with the process of apartment sale. As a first time home buyers, they don’t know what to expect. In this article, I will try to explain the process of buying and selling apartments and to give you heads up about all the essential details. Given that this is a significant decision that impacts the quality of living and your finances, you must understand every step of the way. Even if you are buying an apartment as an investment, it’s important to analyze this entire process to secure a satisfying profit.

We can split the entire sales process into the following steps:

How to get a mortgage loan

The first thing you need to do is to is check your credit scoring. It will help you to determine your budget. The main thing you need to take into account is your salary and total monthly income. Depending on the bank you chose, you may have an option to take a joint mortgage loan (with your married partner).

How and where to find an ideal apartment?

Once you checked your credit scoring and defined your budget, it’s time to find an apartment.

You’ve chosen the right real estate agency, found an apartment and now what?

The next usual step is to start the negotiation process. Usually, it’s the plain old bargaining, and some people have the natural talent to lower the price. However, most people rely on the expertise of their real estate agent.

Real estate agents can not only help you to lower the price, but they can also help you with documentation and paperwork. They have been through this same old process many times, and they know exactly how they can help you. What’s important is that they know how to negotiate with the property owners, and get you the best possible deal.

Once they reach an agreement about the price, and once both sides are satisfied with the term of sale, it’s time to start chasing paperwork. This phase is something that causes most stress, and it’s an absolute nightmare, even to us, who have been through this process many many times before. That’s why I must state out how important it is to have help here, and how much City Expert can do for you in terms of dealing with administration.

This is the step where you’ll fully realize how important it is to choose the right real estate agency. City Expert will save you time and money and eliminate the stress of dealing with documentation all alone. Before listing an apartment or a house on the website, City Expert team checks the following documentation:

I would also like to point out that we only work with registered properties. This is the first and most important condition one property must fulfill to be eligible for our brokerage services.

If you’re buying an apartment with cash, the entire process will go much faster. But getting a housing loan is not that much more complicated, especially if you are familiar with with the procedure.

Buying property with cash

You’ve found an apartment, you successfully negotiated the price, sorted out the documentation, and now it’s time to prepare preliminary and main contracts of sale.

Preliminary and main contracts of sale are signed in our office and certified at a public notary.

The statistics show that the majority of apartments are bought by getting a housing loan, so I’m going to break out the entire process of buying an apartment by getting a mortgage.

Buying a property by getting a housing loan

Choosing a bank

The first thing you need to do, once you decide to buy a property, is to choose a bank. This is a very important choice as you will be paying off your mortgage for the next 20 or 30 years. City Expert real estate agents can help you with the decision and introduce you to authorized personnel, who have become our acquaintances during the past few years of doing business.

Calculating your credit score

It’s best to check out your credit score before you start the sales process so that you can plan your budget. You can use the credit calculator on our website and to the preliminary calculations by yourself.

Interest rates

Interest rates are very low at the moment, and that’s why 2018 and 2019 were and are the best years to take a mortgage loan. Please be careful here, and take into account that you will be paying off your mortgage for the next decade or so. Interest rates can increase over time, and it’s important to be aware that your monthly rates will probably go up or even double in the future.

Currency

If you’re getting paid in Serbian dinars, then you should choose Serbian dinars as your currency. Mortgage loans in Serbian dinars are generally a safer option. However, they only come with a fixed rate, which is usually higher than the floating rate.

How long do I have to wait for the mortgage approval?

There are two ways to get your mortgage approval. The first one is to get it approved by your bank, and that way is much faster. The other, slower way, is to get your mortgage approved by national corporations for credit insurance. The second type of mortgage is more secure and can help you get a better interest rate, but their service costs much more.

Preliminary contract of sale

Once you’ve chosen a bank, you will forward the necessary information to your real estate agent and your lawyer. With City Expert, there is no need to hire both, as you have our legal team at your service. The documents you need to deliver are, for property owners:

Once the draft of the preliminary contract is outlined, both sides need to double check it and to suggest changes. The preliminary contract must have notes about:

Property evaluator

The bank gives the list of property evaluators to the buyer. The buyer chooses one, and then the evaluator visits the property and estimates its worth. The report is then forwarded to the bank and/or insurance company who will then approve the loan.

Lien statement

Assuming that the loan is approved, the bank notifies the buyer, prepares a loan agreement and a lien statement. A lien statement is a document compiled by the owner (in this case, the bank’s lawyers make a lien statement on behalf of the owner), by which the owner unilaterally undertakes that if the debt is not paid, the bank has the right to sell the property, in the manner prescribed by law.

Sale contract

The buyer signs a loan agreement and after that awaits the verification of the contract of sale. Shortly before the contract is validated, the seller signs the pledge statement, followed by the certification and signing of the contract.

Public notary sends the request for signing the mortgage in the cadastre of immovable property. Within eight days, the cadastre is obliged to issue a decision on placing a mortgage and to inform everyone, including the bank, about that decision. Then the bank needs to notify the client that they will forward the money. Just before the release of the loan, the buyer pays the remaining part of the price. After receiving the money, the seller is required to issue a certified statement to the buyer that he has received the total amount of the real estate price. This statement is important as the buyer needs it for registration as the new owner of the property.

If you buy or sell a property for the first time, initially this entire process will seem complicated. That’s partly true, as you need to be sure that you double checked all information and all documentation. To avoid any problems, I always tell future buyers that they need the right team that will help them overcome the obstacles and make this entire process as easy as possible.