How to calculate gdp

How to calculate gdp

How to Calculate the GDP of a Country

The gross domestic product (GDP) of a nation is an estimate of the total value of all the goods and services it produced during a specific period, usually a quarter or a year. Its greatest use is as a point of comparison: Did the nation’s economy grow or contract compared to the previous period measured?

Key Takeaways

There are two main ways to measure GDP: by measuring spending or by measuring income.

And then there’s real GDP, which is an adjustment that removes the effects of inflation so that the economy’s growth or contraction can be seen clearly.

Calculating GDP Based on Spending

One way of arriving at GDP is to count up all of the money spent by the different groups that participate in the economy. These include consumers, businesses, and the government. All pay for goods and services that contribute to the GDP total.

In addition, some of the nation’s goods and services are exported for sale overseas. And some of the products and services that are consumed are imported from abroad. The GDP calculation accounts for spending on both exports and imports.

Thus, a country’s GDP is the total of consumer spending (C) plus business investment (I) and government spending (G), plus net exports, which is total exports minus total imports (X – M).

Calculating GDP Based on Income

The flip side of spending is income. Thus, an estimate of GDP may reflect the total amount of income paid to everyone in the country.

This calculation includes all of the factors of production that make up an economy. It includes the wages paid to labor, the rent earned by land, the return on capital in the form of interest, and the entrepreneur’s profits. All of these make up the national income.

This approach is complicated by the need to make adjustments for some items that don’t always appear in the raw numbers. These include:

In this income approach, the GDP of a country is calculated as its national income plus its indirect business taxes and depreciation, plus its net foreign factor income.

Real GDP

Since GDP measures an economy’s output, it is subject to inflationary pressure. Over a period of time, prices typically go up, and this will be reflected in GDP.

A nation’s unadjusted GDP can’t tell you whether GDP went up because production and consumption increased or because prices went up.

Gross national product (GNP) is a similar measure to GDP. It starts with GDP and adds in the foreign investment income of its residents and subtracts foreign residents’ income that has been earned within the country.

How GDP Is Used

GDP is an important statistic that indicates whether an economy is growing or contracting. In the U.S., the government releases an annualized GDP estimate for every quarter and every year, followed by final figures for each of those periods.

Tracking GDP over time helps a government make decisions such as whether to stimulate the economy by pumping more cash into it or to cool it by pulling money out.

Businesses may use GDP as a factor when deciding whether to expand or contract production or whether to undertake major projects.

Investors watch GDP to get a sense of where the economy may be headed in the weeks ahead.

Criticisms of GDP

While GDP is a useful way to get a sense of the state of an economy, it is by no means a perfect approach. One criticism is that it does not account for activities that are not part of the legalized economy. The proceeds of off-the-books labor, some cash transactions, drug dealing, and more are not factored into GDP.

Another criticism is that some activities that provide value are not factored into GDP. For instance, if you hire a professional cleaner to keep your house clean, a cook to prepare your meals, and a caregiver to care for your children, you will pay these employees and the payments will factor into GDP. If you do those jobs yourself, your contribution is not counted in GDP.

So, while GDP can provide a sense of an economy’s performance over time, it doesn’t tell the whole story.

What Is the Formula for GDP?

The formula for GDP is: GDP = C + I + G + (X-M). C is consumer spending, I is business investment, G is government spending, and (X-M) is net exports.

What Are the 3 Types of GDP?

The three types of GDP are nominal, actual, and real. Nominal GDP is the value of all goods and services produced at current market prices. This includes inflation and deflation. Real GDP is the value of all goods and services at a base price value, which means the GDP is inflation-adjusted. Actual GDP is a measurement in real-time, meaning a specific interval, and shows what the state of the economy is at this very moment.

Which Country Has the Highest GDP?

The Bottom Line

Gross domestic product (GDP) is an important economic indicator of a nation that estimates the total value of all the goods and services it produced during a specific period. It is useful in showing if a nation’s economy grew or shrunk and how monetary and fiscal policy can react to that.

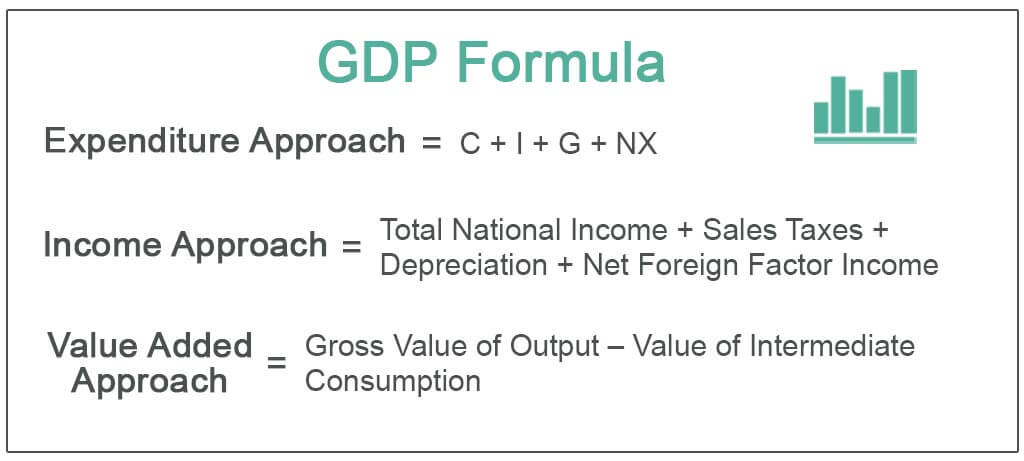

GDP Formula

How to calculate a country’s Gross Domestic Product

What is Gross Domestic Product (GDP)?

Gross Domestic Product (GDP) is the monetary value, in local currency, of all final economic goods and services produced in a country during a specific period of time. It is the broadest financial measurement of a nation’s total economic activity. The total goods and services bought by consumers encompass all private expenditures, government spending, investments, and net exports. Below are two different approaches to the GDP formula.

What is the GDP Formula?

There are two primary methods or formulas by which GDP can be determined:

1. Expenditure Approach

The expenditure approach is the most commonly used GDP formula, which is based on the money spent by various groups that participate in the economy.

GDP = C + G + I + NX

C = consumption or all private consumer spending within a country’s economy, including, durable goods (items with a lifespan greater than three years), non-durable goods (food & clothing), and services.

G = total government expenditures, including salaries of government employees, road construction/repair, public schools, and military expenditure.

I = sum of a country’s investments spent on capital equipment, inventories, and housing.

NX = net exports or a country’s total exports less total imports.

2. Income Approach

This GDP formula takes the total income generated by the goods and services produced.

GDP = Total National Income + Sales Taxes + Depreciation + Net Foreign Factor Income

Total National Income – the sum of all wages, rent, interest, and profits.

Sales Taxes – consumer taxes imposed by the government on the sales of goods and services.

Depreciation – cost allocated to a tangible asset over its useful life.

Net Foreign Factor Income – the difference between the total income that a country’s citizens and companies generate in foreign countries, versus the total income foreign citizens and companies generate in the domestic country.

What are the Types of GDP?

GPD can be measured in several different ways. The most common methods include:

Why is GDP Important to Economists and Investors?

Gross Domestic Product represents the economic production and growth of a nation and is one of the primary indicators used to determine the overall well-being of a country’s economy and standard of living. One way to determine how well a country’s economy is flourishing is by its GDP growth rate. This rate reflects the increase or decrease in the percentage of economic output in monthly, quarterly, or yearly periods.

Gross Domestic Product enables economic policymakers to assess whether the economy is weakening or progressing, if it needs improvements or restrictions, and if threats of recession or inflation are imminent. From these assessments, government agencies can determine if expansionary, monetary policies are needed to address economic issues.

Investors place importance on GDP growth rates to decide how the economy is changing so that they can make adjustments to their asset allocation. However, when there is an economic slump, businesses experience low profits, which means lower stock prices and consumers tend to cut spending. Investors are also on the lookout for potential investments, locally and abroad, basing their judgment on countries’ growth rate comparisons.

What are Some Drawbacks of GDP?

Gross Domestic Product does not reflect the black market, which may be a large part of the economy in certain countries. The black market, or the underground economy, includes illegal economic activities, such as the sale of drugs, prostitution, and some lawful transactions that don’t comply with tax obligations. In these cases, GDP is not an accurate measure of some components that play a large role in the economic state of a country.

Income generated in a country by an overseas company that is transferred back to foreign investors is not taken into account. This overstates a country’s economic output.

Sources of GDP Information

For US GDP information, the Bureau of Economic Analysis in the U.S. Department of Commerce is the best direct source. You can view the bureau’s latest releases here: https://www.bea.gov/gdpnewsrelease.htm

Additional Resources

Thank you for reading CFI’s guide on How to Calculate GDP. To keep learning about important economic concepts, see the additional free resources below:

GDP Formula

Formula to Calculate GDP

#1 – Expenditure Approach –

There are three main groups of expenditure household, business, and the government. By adding all-expense, we get the below equation.

We can also write this as:-

GDP = Consumption + Investment + Government Spending + Net Export

The Expenditure Approach is a commonly used method for calculating GDP.

#2 – Income Approach –

The Income Approach is a way to calculate GDP by total income generated by goods and services.

#3 – Production or Value-Added Approach –

From the name, it is clear that value is added at the time of production. It is also known as the reverse of the expenditure approach. Estimating the gross value-added total cost of economic output is reduced by the cost of intermediate goods used to produce final goods.

Gross Value Added = Gross Value of Output – Value of Intermediate Consumption

Table of contents

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: GDP Formula (wallstreetmojo.com)

GDP Calculation

Let us see how to use these formulas to calculate GDP.

The industries are as follows:

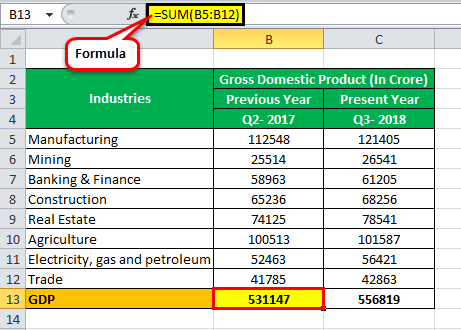

Examples of GDP Formula (with Excel Template)

Example #1

Let us take an example where one wants to compare multiple industries’ GDP with the previous year’s GDP.

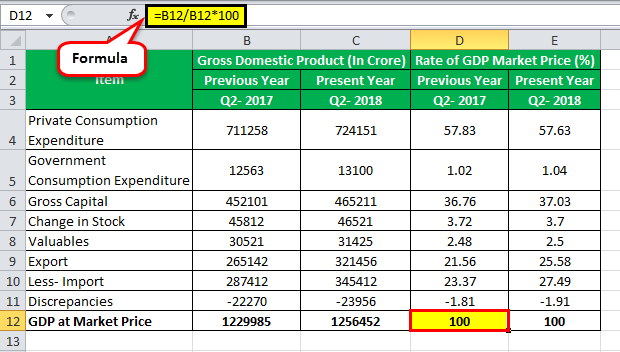

In the below-given figure, we have shown the calculation of total GDP for Quarter 2 of 2017.

Similarly, we have done the calculation of GDP for Quarter 2 of 2018.

And then, changes between two quarters are calculated in percentage, i.e., GDP of industry upon a sum of total GDP multiple by 100.

At the bottom, it provides an overall change in GDP between two quarters. Again, this is an economic activity-based method.

It helps the government and investors decide on investment and allows the government for policy formation and implementation.

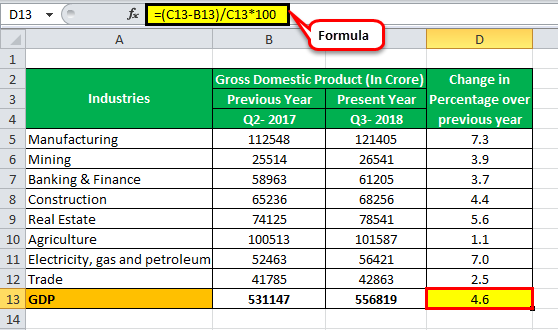

Example #2

Now, let’s see an example of an expenditure method that considers expenditure from different means. It is inclusive of expenditure and investment.

Below are the different expenditures, gross capital, export, import, etc. These will help calculate GDP.

Similarly, we have calculated GDP for Quarter 2 of 2018.

Here, first, the sum of expenditure is taken along with gross capital, change in stocks, valuables, and discrepancies which are an export minus import.

A rate of GDP at Market Price:

Similarly, we can calculate the rate of GDP for Quarter 2 of 2018.

GDP at market price is a sum of all expenditures. The GDP market price percentage rate is calculated when expenditure is divided by total GDP at market price multiplied by 100.

Through this, one can compare and get a market situation. For example, in a country like India, the global slowdown does not have any major impact only affected factor is export. But on the other hand, if a country has high export, it will get affected by the global recession.

Recommended Articles

This article has been a guide to GDP Formula. We discuss the calculation of GDP using 3 types of formulas (Expenditure, Income & Production Approach) with examples and a downloadable Excel template. You can learn more about Economics from the following articles: –

What is GDP and How to Calculate Gross Domestic Product

When you hear about the word GDP, what comes into mind? World economics, right? Well GDP is one of the major indicators of how sophisticated and economically vibrant country is. More developed countries have very large GDPs compared to third world countries. The population of a country can fairly determine how large its GDP will be.

What is GDP?

GDP stands for Gross Domestic Production. It refers to the value of money in your local currency of all goods and services in your country in a certain period of time. This is very important in the running of development projects and the organization of a country’s economy. In many countries, gross domestic product is calculated quarterly and then for the whole year.

Economically developed countries such as Germany, the United States of America, China, and many others are usually concerned about their GDP in order to know if it is suitable to pump money into the economy or not to supply excess money into the economy. Normally, an increase in GDP is an indicator of increased development in a country. That is why knowing how to calculate GDP is very crucial for any person who is interested in economics.

In addition, GDP is not an aspect that works for countries alone. GDP also matters largely to a business owner. Growth in GDP in the country your business is located in means that you can pump more money/capital into the business.

Types of GDP

GDP is measured in different ways depending on the variables used. There are basically four types of GDP figures that economists calculate. They defer according to the prices of goods that are used to calculate GDP;

How to Determine Gross Domestic Product

Calculating GDP is not an impossible task. Although the extent and size of information that you need to collect before calculating the GDP is the real task. Data collection in small countries such as Luxembourg can take you a long while and that is why many analysts depend on government-provided data to calculate. In order for you to determine the gross domestic product, there are three relevant ways that you can use. They include:

The above-mentioned methods are used by economists worldwide to calculate the GDP of their countries. GDP in most countries is calculated on a quarterly basis and the figures are used to calculate annual GDP.

GDP is very crucial because it’s the real-time measure of whether economic activities have increased or reduced. This way, if a government notices a slump in economic activities, it can pump money to revitalize it.

Expenditure Method

The expenditure method is the most widely used method by economists to calculate GDP. In this method, you calculate GDP by the goods and services offered to people in terms of how they are purchased. In other instances, some goods or services are produced but not sold. This means that the goods or services are produced but not sold meaning that the producers have kind of bought the goods and services from themselves. These methods therefore include;

How to Calculate GDP Using Expenditure Method

For you to get the gross domestic product you need to know the components that will help you to get GDP. They include:

GDP = C + I + G + NX

Income Method

This method includes the value of goods produced and services provided to calculate the GDP of a country. This method is a bit exhaustive compared by the expenditure methods since the provision of services is a major part of the economy and it needs to be included when calculating GDP.

How to Calculate GDP Using the Income Method

When using the income method to calculate GDP, there are various variables that should be collected;

When you want to calculate GDP using the income method, the following formula is applied;

GDP = Total National Income + Sales Tax + Depreciation + Net + Foreign Income Factor

Production Method

The production method is rarely used because of its lack of exhaustiveness. This is because it takes only a small aspect of production in its calculation. The production method uses the sum of value added to a product during the production process. It, therefore, used value addition as its base for GDP.

This method is highly critiqued since it leaves out a large section of the economy such as the services sector, imports, and exports, government spending, etc.

Drawbacks of GDP Calculation Methods

The methods that have been explained above are not completely exhaustive since they do not include the black-market which is a very major source of income for a significant part of a population. The black market is very large and untaxed in many countries and therefore it is impossible to include it in the calculation of GDP.

Another drawback of GDP calculation is that it does not gauge whether poverty levels have increased or reduced. Therefore, GDP can indicate the increase in economic activity in a country without indicating whether the country’s Human Development Index is really improving.

About Sonia Kukreja

I am a mother of a lovely kid, and an avid fan technology, computing and management related topics. I hold a degree in MBA from well known management college in India. After completing my post graduation I thought to start a website where I can share management related concepts with rest of the people.

Gross Domestic Product (GDP)

Investopedia / Zoe Hansen

What Is Gross Domestic Product (GDP)?

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

Though GDP is typically calculated on an annual basis, it is sometimes calculated on a quarterly basis as well. In the U.S., for example, the government releases an annualized GDP estimate for each fiscal quarter and also for the calendar year. The individual data sets included in this report are given in real terms, so the data is adjusted for price changes and is, therefore, net of inflation.

Key Takeaways

What Is GDP?

Understanding Gross Domestic Product (GDP)

The calculation of a country’s GDP encompasses all private and public consumption, government outlays, investments, additions to private inventories, paid-in construction costs, and the foreign balance of trade. (Exports are added to the value and imports are subtracted).

Of all the components that make up a country’s GDP, the foreign balance of trade is especially important. The GDP of a country tends to increase when the total value of goods and services that domestic producers sell to foreign countries exceeds the total value of foreign goods and services that domestic consumers buy. When this situation occurs, a country is said to have a trade surplus.

If the opposite situation occurs—if the amount that domestic consumers spend on foreign products is greater than the total sum of what domestic producers are able to sell to foreign consumers—it is called a trade deficit. In this situation, the GDP of a country tends to decrease.

GDP can be computed on a nominal basis or a real basis, the latter accounting for inflation. Overall, real GDP is a better method for expressing long-term national economic performance since it uses constant dollars.

The annual rate of decrease for U.S. GDP in the second quarter of 2022. In the fourth quarter of 2021, the real GDP increased by 6.9%.

Types of Gross Domestic Product

GDP can be reported in several ways, each of which provides slightly different information.

Nominal GDP

Nominal GDP is an assessment of economic production in an economy that includes current prices in its calculation. In other words, it doesn’t strip out inflation or the pace of rising prices, which can inflate the growth figure.

All goods and services counted in nominal GDP are valued at the prices that those goods and services are actually sold for in that year. Nominal GDP is evaluated in either the local currency or U.S. dollars at currency market exchange rates to compare countries’ GDPs in purely financial terms.

Nominal GDP is used when comparing different quarters of output within the same year. When comparing the GDP of two or more years, real GDP is used. This is because, in effect, the removal of the influence of inflation allows the comparison of the different years to focus solely on volume.

Real GDP

Real GDP is an inflation-adjusted measure that reflects the number of goods and services produced by an economy in a given year, with prices held constant from year to year to separate out the impact of inflation or deflation from the trend in output over time. Since GDP is based on the monetary value of goods and services, it is subject to inflation.

Rising prices tend to increase a country’s GDP, but this does not necessarily reflect any change in the quantity or quality of goods and services produced. Thus, by looking just at an economy’s nominal GDP, it can be difficult to tell whether the figure has risen because of a real expansion in production or simply because prices rose.

Economists use a process that adjusts for inflation to arrive at an economy’s real GDP. By adjusting the output in any given year for the price levels that prevailed in a reference year, called the base year, economists can adjust for inflation’s impact. This way, it is possible to compare a country’s GDP from one year to another and see if there is any real growth.

Real GDP is calculated using a GDP price deflator, which is the difference in prices between the current year and the base year. For example, if prices rose by 5% since the base year, then the deflator would be 1.05. Nominal GDP is divided by this deflator, yielding real GDP. Nominal GDP is usually higher than real GDP because inflation is typically a positive number.

Real GDP accounts for changes in market value and thus narrows the difference between output figures from year to year. If there is a large discrepancy between a nation’s real GDP and nominal GDP, this may be an indicator of significant inflation or deflation in its economy.

GDP Per Capita

GDP per capita is a measurement of the GDP per person in a country’s population. It indicates that the amount of output or income per person in an economy can indicate average productivity or average living standards. GDP per capita can be stated in nominal, real (inflation-adjusted), or PPP (purchasing power parity) terms.

At a basic interpretation, per-capita GDP shows how much economic production value can be attributed to each individual citizen. This also translates to a measure of overall national wealth since GDP market value per person also readily serves as a prosperity measure.

Per-capita GDP is often analyzed alongside more traditional measures of GDP. Economists use this metric for insight into their own country’s domestic productivity and the productivity of other countries. Per-capita GDP considers both a country’s GDP and its population. Therefore, it can be important to understand how each factor contributes to the overall result and is affecting per-capita GDP growth.

If a country’s per-capita GDP is growing with a stable population level, for example, it could be the result of technological progressions that are producing more with the same population level. Some countries may have a high per-capita GDP but a small population, which usually means they have built up a self-sufficient economy based on an abundance of special resources.

GDP Growth Rate

The GDP growth rate compares the year-over-year (or quarterly) change in a country’s economic output to measure how fast an economy is growing. Usually expressed as a percentage rate, this measure is popular for economic policymakers because GDP growth is thought to be closely connected to key policy targets such as inflation and unemployment rates.

If GDP growth rates accelerate, it may be a signal that the economy is overheating and the central bank may seek to raise interest rates. Conversely, central banks see a shrinking (or negative) GDP growth rate (i.e., a recession) as a signal that rates should be lowered and that stimulus may be necessary.

GDP Purchasing Power Parity (PPP)

While not directly a measure of GDP, economists look at purchasing power parity (PPP) to see how one country’s GDP measures up in international dollars using a method that adjusts for differences in local prices and costs of living to make cross-country comparisons of real output, real income, and living standards.

GDP Formula

GDP can be determined via three primary methods. All three methods should yield the same figure when correctly calculated. These three approaches are often termed the expenditure approach, the output (or production) approach, and the income approach.

The Expenditure Approach

The expenditure approach, also known as the spending approach, calculates spending by the different groups that participate in the economy. The U.S. GDP is primarily measured based on the expenditure approach. This approach can be calculated using the following formula:

All of these activities contribute to the GDP of a country. Consumption refers to private consumption expenditures or consumer spending. Consumers spend money to acquire goods and services, such as groceries and haircuts. Consumer spending is the biggest component of GDP, accounting for more than two-thirds of the U.S. GDP.

Consumer confidence, therefore, has a very significant bearing on economic growth. A high confidence level indicates that consumers are willing to spend, while a low confidence level reflects uncertainty about the future and an unwillingness to spend.

Government spending represents government consumption expenditure and gross investment. Governments spend money on equipment, infrastructure, and payroll. Government spending may become more important relative to other components of a country’s GDP when consumer spending and business investment both decline sharply. (This may occur in the wake of a recession, for example.)

Investment refers to private domestic investment or capital expenditures. Businesses spend money to invest in their business activities. For example, a business may buy machinery. Business investment is a critical component of GDP since it increases the productive capacity of an economy and boosts employment levels.

The Production (Output) Approach

The production approach is essentially the reverse of the expenditure approach. Instead of measuring the input costs that contribute to economic activity, the production approach estimates the total value of economic output and deducts the cost of intermediate goods that are consumed in the process (like those of materials and services). Whereas the expenditure approach projects forward from costs, the production approach looks backward from the vantage point of a state of completed economic activity.

The Income Approach

The income approach represents a kind of middle ground between the two other approaches to calculating GDP. The income approach calculates the income earned by all the factors of production in an economy, including the wages paid to labor, the rent earned by land, the return on capital in the form of interest, and corporate profits.

The income approach factors in some adjustments for those items that are not considered payments made to factors of production. For one, there are some taxes—such as sales taxes and property taxes—that are classified as indirect business taxes. In addition, depreciation—a reserve that businesses set aside to account for the replacement of equipment that tends to wear down with use—is also added to the national income. All of this together constitutes a nation’s income.

GDP vs. GNP vs. GNI

Although GDP is a widely used metric, there are other ways of measuring the economic growth of a country. While GDP measures the economic activity within the physical borders of a country (whether the producers are native to that country or foreign-owned entities), gross national product (GNP) is a measurement of the overall production of people or corporations native to a country, including those based abroad. GNP excludes domestic production by foreigners.

Gross national income (GNI) is another measure of economic growth. It is the sum of all income earned by citizens or nationals of a country (regardless of whether the underlying economic activity takes place domestically or abroad). The relationship between GNP and GNI is similar to the relationship between the production (output) approach and the income approach used to calculate GDP.

GNP uses the production approach, while GNI uses the income approach. With GNI, the income of a country is calculated as its domestic income, plus its indirect business taxes and depreciation (as well as its net foreign factor income). The figure for net foreign factor income is calculated by subtracting all payments made to foreign companies and individuals from all payments made to domestic businesses.

In an increasingly global economy, GNI has been put forward as a potentially better metric for overall economic health than GDP. Because certain countries have most of their income withdrawn abroad by foreign corporations and individuals, their GDP figure is much higher than the figure that represents their GNI.

Adjustments to GDP

A number of adjustments can be made to a country’s GDP to improve the usefulness of this figure. For economists, a country’s GDP reveals the size of the economy but provides little information about the standard of living in that country. Part of the reason for this is that population size and cost of living are not consistent around the world.

For example, comparing the nominal GDP of China to the nominal GDP of Ireland would not provide much meaningful information about the realities of living in those countries because China has approximately 300 times the population of Ireland.

To help solve this problem, statisticians sometimes compare GDP per capita between countries. GDP per capita is calculated by dividing a country’s total GDP by its population, and this figure is frequently cited to assess the nation’s standard of living. Even so, the measure is still imperfect.

PPP attempts to solve this problem by comparing how many goods and services an exchange-rate-adjusted unit of money can purchase in different countries—comparing the price of an item, or basket of items, in two countries after adjusting for the exchange rate between the two, in effect.

How to Use GDP Data

Most nations release GDP data every month and quarter. In the U.S., the Bureau of Economic Analysis (BEA) publishes an advance release of quarterly GDP four weeks after the quarter ends, and a final release three months after the quarter ends. The BEA releases are exhaustive and contain a wealth of detail, enabling economists and investors to obtain information and insights on various aspects of the economy.

GDP’s market impact is generally limited, since it is backward-looking, and a substantial amount of time has already elapsed between the quarter-end and GDP data release. However, GDP data can have an impact on markets if the actual numbers differ considerably from expectations.

Because GDP provides a direct indication of the health and growth of the economy, businesses can use GDP as a guide to their business strategy. Government entities, such as the Fed in the U.S., use the growth rate and other GDP stats as part of their decision process in determining what type of monetary policies to implement.

If the growth rate is slowing, they might implement an expansionary monetary policy to try to boost the economy. If the growth rate is robust, they might use monetary policy to slow things down to try to ward off inflation.

Real GDP is the indicator that says the most about the health of the economy. It is widely followed and discussed by economists, analysts, investors, and policymakers. The advance release of the latest data will almost always move markets, although that impact can be limited, as noted above.

GDP and Investing

Investors watch GDP since it provides a framework for decision-making. The corporate profits and inventory data in the GDP report are a great resource for equity investors, as both categories show total growth during the period; corporate profits data also displays pre-tax profits, operating cash flows, and breakdowns for all major sectors of the economy.

Comparing the GDP growth rates of different countries can play a part in asset allocation, aiding decisions about whether to invest in fast-growing economies abroad—and if so, which ones.

One interesting metric that investors can use to get some sense of the valuation of an equity market is the ratio of total market capitalization to GDP, expressed as a percentage. The closest equivalent to this in terms of stock valuation is a company’s market cap to total sales (or revenues), which in per-share terms is the well-known price-to-sales ratio.

Just as stocks in different sectors trade at widely divergent price-to-sales ratios, different nations trade at market-cap-to-GDP ratios that are literally all over the map. For example, according to the World Bank, the U.S. had a market-cap-to-GDP ratio of 195% for 2020, while China had a ratio of just over 83% and Hong Kong had a ratio of 1,769%.

However, the utility of this ratio lies in comparing it to historical norms for a particular nation. As an example, the U.S. had a market-cap-to-GDP ratio of 142% at the end of 2006, which dropped to 79% by the end of 2008. In retrospect, these represented zones of substantial overvaluation and undervaluation, respectively, for U.S. equities.

The biggest downside of this data is its lack of timeliness; investors only get one update per quarter, and revisions can be large enough to significantly alter the percentage change in GDP.

History of GDP

The concept of GDP was first proposed in 1937 in a report to the U.S. Congress in response to the Great Depression, conceived of and presented by an economist at the National Bureau of Economic Research (NBER), Simon Kuznets.

At the time, the preeminent system of measurement was GNP. After the Bretton Woods conference in 1944, GDP was widely adopted as the standard means for measuring national economies; however, the U.S. continued to use GNP as its official measure of economic welfare until 1991, after which it switched to GDP.

Beginning in the 1950s, however, some economists and policymakers began to question GDP. Some observed, for example, a tendency to accept GDP as an absolute indicator of a nation’s failure or success, despite its failure to account for health, happiness, (in)equality, and other constituent factors of public welfare. In other words, these critics drew attention to a distinction between economic progress and social progress.

However, most authorities, like Arthur Okun, an economist for President John F. Kennedy’s Council of Economic Advisers, held firm to the belief that GDP is an absolute indicator of economic success, claiming that for every increase in GDP, there would be a corresponding drop in unemployment.

Criticisms of GDP

There are, of course, drawbacks to using GDP as an indicator. In addition to the lack of timeliness, some criticisms of GDP as a measure are:

Global Sources for Country GDP Data

The World Bank hosts one of the most reliable web-based databases. It has one of the best and most comprehensive lists of countries for which it tracks GDP data. The International Money Fund (IMF) also provides GDP data through its multiple databases, such as World Economic Outlook and International Financial Statistics.

Another highly reliable source of GDP data is the Organization for Economic Cooperation and Development (OECD). The OECD not only provides historical data but also forecasts GDP growth. The disadvantage of using the OECD database is that it tracks only OECD member countries and a few nonmember countries.

In the U.S., the Fed collects data from multiple sources, including a country’s statistical agencies and The World Bank. The only drawback to using a Fed database is a lack of updating in GDP data and an absence of data for certain countries.

The BEA is a division of the U.S. Department of Commerce. It issues its own analysis document with each GDP release, which is a great investor tool for analyzing figures and trends and reading highlights of the very lengthy full release.

What Is a Simple Definition of GDP?

Gross domestic product is a measurement that seeks to capture a country’s economic output. Countries with larger GDPs will have a greater amount of goods and services generated within them, and will generally have a higher standard of living. For this reason, many citizens and political leaders see GDP growth as an important measure of national success, often referring to GDP growth and economic growth interchangeably. Due to various limitations, however, many economists have argued that GDP should not be used as a proxy for overall economic success, much less the success of a society.

Which Country Has the Highest GDP?

Is a High GDP Good?

Most people perceive a higher GDP to be a good thing because it is associated with greater economic opportunities and an improved standard of material well-being. It is possible, however, for a country to have a high GDP and still be an unattractive place to live, so it is important to also consider other measurements. For example, a country could have a high GDP and a low per-capita GDP, suggesting that significant wealth exists but is concentrated in the hands of very few people. One way to address this is to look at GDP alongside another measure of economic development, such as the Human Development Index (HDI).

The Bottom Line

In their seminal textbook Economics, Paul Samuelson and William Nordhaus neatly sum up the importance of the national accounts and GDP. They liken the ability of GDP to give an overall picture of the state of the economy to that of a satellite in space that can survey the weather across an entire continent.

GDP enables policymakers and central banks to judge whether the economy is contracting or expanding, whether it needs a boost or restraint, and if a threat such as a recession or inflation looms on the horizon. Like any measure, GDP has its imperfections. In recent decades, governments have created various nuanced modifications in attempts to increase GDP accuracy and specificity. Means of calculating GDP have also evolved continually since its conception to keep up with evolving measurements of industry activity and the generation and consumption of new, emerging forms of intangible assets.

:max_bytes(150000):strip_icc()/picture-53712-1421087725-5bfc2a93c9e77c0026b4cc1f.jpg)

:max_bytes(150000):strip_icc()/image0-MichaelBoyle-d90f2cc61d274246a2be03cdd144f699.jpeg)

:max_bytes(150000):strip_icc()/JaspersonHeadShot1-b5b480f2351248de8fd3e673f7ce6d0d.jpeg)

:max_bytes(150000):strip_icc()/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

:max_bytes(150000):strip_icc()/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)