How to calculate earnings per share

How to calculate earnings per share

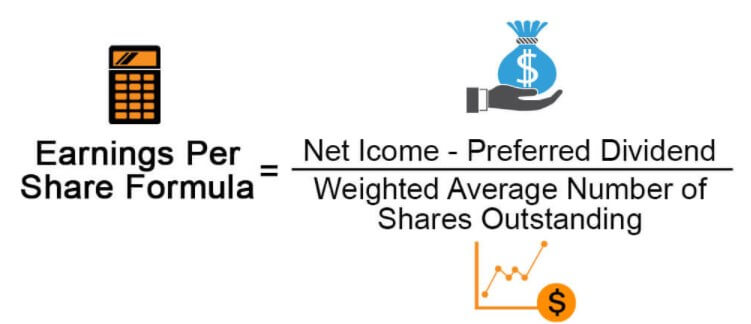

What Is the Formula for Calculating Earnings per Share (EPS)?

Earnings per share (EPS) is calculated by determining a company’s net profit and allocating that to each outstanding share of common stock

You’ll notice our example above used the average outstanding shares in the formula. Typically, an average is used, since companies may issue or buy back stock throughout the year making the true earnings per share difficult to pin down. Since the number of shares can frequently change, using an average of outstanding shares gives a more accurate picture of the earnings for the company.

Key Takeaways

Earnings Per Share Explained

The Significance of Earnings Per Share (EPS)

EPS is one measure that can serve as a proxy of a company’s financial health. If all of a company’s profits were paid out to its shareholders, EPS is the portion of a company’s net income that would be allocated to each outstanding share.

EPS is typically used by analysts and traders to gauge the financial strength of a company. It is often considered to be one of the most important variables in determining a stock’s value. Many investors still look to EPS as a gauge of a company’s profitability. In fact, it is sometimes known as the bottom line—the final statement, both literally and figuratively, of a firm’s worth.

A higher EPS means a company is profitable enough to pay out more money to its shareholders. For example, a company might increase its dividend as earnings increase over time.

Investors typically compare the EPS of two companies within the same industry to get a sense of how the company is performing relative to its peers. Investors may also pay attention to trends in EPS growth in order to get a better idea of how profitable a company has been in the past and to get a sense of its future prospects. A company with a steadily increasing EPS is considered to be a more reliable investment than one whose EPS is on the decline or varies substantially.

EPS is also an important variable in determining a stock’s value. This measurement figures into the earnings portion of the price-earnings (P/E) valuation ratio. The P/E ratio is one of the most common ratios utilized by investors in determining whether a company’s stock price is valued properly relative to its earnings.

Calculating Earnings Per Share

EPS is calculated as follows:

Companies may choose to buy back their own shares in the open market. In fact, Bank of America actually did this in 2017. In doing so, a company can improve its EPS (because there are fewer shares outstanding) without actually improving its net income. In other words, the net income gets divided up by a fewer number of shares, thus increasing the EPS.

To make the example easy, let’s say that Bank of America bought 1 billion shares back in 2017 through its share repurchase program. Its EPS would have been:

You’ll notice our example above used the average outstanding shares in the formula. Typically, an average is used, since companies may issue or buy back stock throughout the year making the true EPS difficult to pin down. Since the number of shares can frequently change, using an average of outstanding shares gives a more accurate picture of the earnings for the company.

Types of EPS

There are actually three basic types of EPS numbers, based on where the data comes from.

Trailing EPS

A company’s trailing EPS is based on the previous year’s number. It uses the previous four quarters of earnings in its calculation, and has the benefit of using actual numbers instead of projections. Most P/E ratios are calculated using the trailing EPS because it represents what actually happened, and not what might happen. Although the figure is accurate, the trailing EPS is «old news» and many investors will also look at current and forward EPS figures. We used a trailing EPS in our Bank of America example.

Current EPS

This measurement typically includes the four quarters of the current fiscal year, some of which may have already elapsed, and some of which are yet to come. As a result, some of the data will be based on actual figures and some will be based on projections.

Forward EPS

Forward EPS is based on future numbers. This measurement includes projections for some period of time in the future (usually the coming four quarters). Forward EPS estimates can be made by analysts, or by the company itself. While this number is based on estimates and not on actual data, investors are often very interested in forward EPS because, in general, investing is predicated on estimates of a company’s future earning potential.

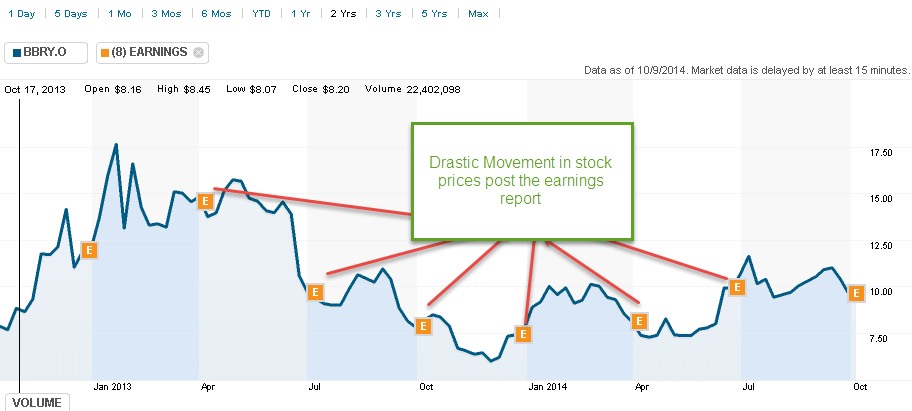

Investors often compare these different EPS calculations. For example, they may compare the forward EPS (that makes future projections) with the company’s actual EPS for the current quarter. If the actual EPS falls short of forward EPS projections, the stock price may fall. On the other hand, if the actual EPS beats its estimates, the stock may experience a rally.

The Bottom Line

EPS becomes especially meaningful when investors look at both historical and future EPS figures for the same company, or when they compare EPS for companies within the same industry. Bank of America, for example, is in the financial services sector.

As a result, investors should compare the EPS of Bank of America with other stocks in the financial services field, such as JPMorgan Chase (JPM) or Wells Fargo (WFC). Since EPS is only one number, it’s essential to use it in conjunction with other performance measures before making any investment decisions.

Earnings Per Share (EPS)

Investopedia / Alex Dos Diaz

What Is Earnings Per Share (EPS)?

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability. It is common for a company to report EPS that is adjusted for extraordinary items and potential share dilution.

The higher a company’s EPS, the more profitable it is considered to be.

Key Takeaways

Earnings Per Share Explained

Formula and Calculation for EPS

Earnings per share value is calculated as net income (also known as profits or earnings) divided by available shares. A more refined calculation adjusts the numerator and denominator for shares that could be created through options, convertible debt, or warrants. The numerator of the equation is also more relevant if it is adjusted for continuing operations.

To calculate a company’s EPS, the balance sheet and income statement are used to find the period-end number of common shares, dividends paid on preferred stock (if any), and the net income or earnings. It is more accurate to use a weighted average number of common shares over the reporting term because the number of shares can change over time.

Any stock dividends or splits that occur must be reflected in the calculation of the weighted average number of shares outstanding. Some data sources simplify the calculation by using the number of shares outstanding at the end of a period.

Example of EPS

Say that the calculation of EPS for three companies at the end of the fiscal year was as follows:

How Is EPS Used?

Earnings per share is one of the most important metrics employed when determining a firm’s profitability on an absolute basis. It is also a major component of calculating the price-to-earnings (P/E) ratio, where the E in P/E refers to EPS. By dividing a company’s share price by its earnings per share, an investor can see the value of a stock in terms of how much the market is willing to pay for each dollar of earnings.

EPS is one of the many indicators you could use to pick stocks. If you have an interest in stock trading or investing, your next step is to choose a broker that works for your investment style.

Comparing EPS in absolute terms may not have much meaning to investors because ordinary shareholders do not have direct access to the earnings. Instead, investors will compare EPS with the share price of the stock to determine the value of earnings and how investors feel about future growth.

Basic EPS vs. Diluted EPS

The formula in the table above calculates the basic EPS of each of these select companies. Basic EPS does not factor in the dilutive effect of shares that could be issued by the company. When the capital structure of a company includes items such as stock options, warrants, or restricted stock units (RSU), these investments—if exercised—could increase the total number of shares outstanding in the market.

To better illustrate the effects of additional securities on per-share earnings, companies also report the diluted EPS, which assumes that all shares that could be outstanding have been issued.

Sometimes an adjustment to the numerator is required when calculating a fully diluted EPS. For example, sometimes a lender will provide a loan that allows them to convert the debt into shares under certain conditions. The shares that would be created by the convertible debt should be included in the denominator of the diluted EPS calculation, but if that happened, then the company wouldn’t have paid interest on the debt. In this case, the company or analyst will add the interest paid on convertible debt back into the numerator of the EPS calculation so the result isn’t distorted.

EPS Excluding Extraordinary Items

Earnings per share can be distorted, both intentionally and unintentionally, by several factors. Analysts use variations of the basic EPS formula to avoid the most common ways that EPS may be inflated.

Imagine a company that owns two factories that make cellphone screens. The land on which one of the factories sits has become very valuable as new developments have surrounded it over the past few years. The company’s management team decides to sell the factory and build another one on less valuable land. This transaction creates a windfall profit for the firm.

Though this land sale has created real profits for the company and its shareholders, it is considered an “extraordinary item” because there is no reason to believe the company can repeat that transaction in the future. Shareholders might be misled if the windfall is included in the numerator of the EPS equation, so it is excluded.

A similar argument could be made if a company had an unusual loss—maybe the factory burned down—which would have temporarily decreased EPS and should be excluded for the same reason. The calculation for EPS excluding extraordinary items is:

EPS From Continuing Operations

In this example, that could increase the EPS because the 100 closed stores were perhaps operating at a loss. By evaluating EPS from continuing operations, an analyst is better able to compare prior performance to current performance

EPS and Capital

An important aspect of EPS that is often ignored is the capital that is required to generate the earnings (net income) in the calculation. Two companies could generate the same EPS, but one could do so with fewer net assets; that company would be more efficient at using its capital to generate income and, all other things being equal, would be a «better» company in terms of efficiency. A metric that can be used to identify more efficient companies is the return on equity (ROE).

EPS and Dividends

Although EPS is widely used as a way to track a company’s performance, shareholders do not have direct access to those profits. A portion of the earnings may be distributed as a dividend, but all or a portion of the EPS can be retained by the company. Shareholders, through their representatives on the board of directors, would have to change the portion of EPS that is distributed through dividends to access more of those profits.

EPS and Price-to-Earnings (P/E)

Making a comparison of the P/E ratio within an industry group can be helpful, though in unexpected ways. Although it seems like a stock that costs more relative to its EPS when compared to peers might be “overvalued,” the opposite tends to be the rule. Regardless of its historical EPS, investors are willing to pay more for a stock if it is expected to grow or outperform its peers. In a bull market, it is normal for the stocks with the highest P/E ratios in a stock index to outperform the average of the other stocks in the index.

What Is a Good EPS?

What counts as a good EPS will depend on factors such as the recent performance of the company, the performance of its competitors, and the expectations of the analysts who follow the stock. Sometimes, a company might report growing EPS, but the stock might decline in price if analysts were expecting an even higher number.

Likewise, a shrinking EPS figure might nonetheless lead to a price increase if analysts were expecting an even worse result. It is important to always judge EPS in relation to the company’s share price, such as by looking at the company’s P/E or earnings yield.

What Is the Difference Between Basic EPS and Diluted EPS?

Analysts will sometimes distinguish between basic and diluted EPS. Basic EPS consists of the company’s net income divided by its outstanding shares. It is the figure most commonly reported in the financial media and is also the simplest definition of EPS.

Diluted EPS, on the other hand, will always be equal to or lower than basic EPS because it includes a more expansive definition of the company’s shares outstanding. Specifically, it incorporates shares that are not currently outstanding but could become outstanding if stock options and other convertible securities were to be exercised.

What Is the Difference Between EPS and Adjusted EPS?

Adjusted EPS is a type of EPS calculation in which the analyst makes adjustments to the numerator. Typically, this consists of adding or removing components of net income that are deemed to be non-recurring. For instance, if the company’s net income was increased based on a one-time sale of a building, the analyst might deduct the proceeds from that sale, thereby reducing net income. In that scenario, adjusted EPS would be lower than basic EPS.

What Are Some Limitations of EPS?

When looking at EPS to make an investment or trading decision, be aware of some possible drawbacks. For instance, a company can game its EPS by buying back stock, reducing the number of shares outstanding, and inflating the EPS number given the same level of earnings. Changes to accounting policy for reporting earnings can also change EPS. EPS also does not take into account the price of the share, so it has little to say about whether a company’s stock is over or undervalued.

How Do You Calculate EPS Using Excel?

After collecting the necessary data, input the net income, preferred dividends, and number of common shares outstanding into three adjacent cells, say B3 through B5. In cell B6, input the formula «=B3-B4» to subtract preferred dividends from net income. In cell B7, input the formula «=B6/B5» to render the EPS ratio.

What Is Earnings Per Share?

Here’s how to calculate and use earnings per share.

Earnings per share (EPS) is a metric investors commonly use to value a stock or company because it indicates how profitable a company is on a per-share basis. EPS is calculated by subtracting any preferred dividends from a company’s net income and dividing that amount by the number of shares outstanding. Net income is the amount of money that remains in a reporting period after all cash and non-cash expenses are deducted, and net income minus preferred dividends is synonymous with a company’s profit for the period. Preferred dividends must be subtracted because holders of preferred stock have contractual rights to dividend payouts.

A company reports its EPS in Consolidated Statements of Operations (income statements) in both annual (10-K) and quarterly (10-Q) SEC filings. Considering a company’s earnings as its profit, the company can either distribute that money to shareholders or reinvest it in the company.

It’s useful to know how to calculate EPS yourself for a few different reasons.

How to calculate EPS

Limitations of EPS

The main limitation of using EPS to value a stock or company is that EPS is calculated using net income. Non-cash expenses such as depreciation and amortization are subtracted from net income, and the lumpy nature of capital expenditures can cause a company’s net income to vary greatly across reporting periods. Businesses can have much different non-operating expenses, such as tax and interest payments, which affect net income. A company’s net income doesn’t accurately reflect its cash flow or the health of its business.

Additionally, companies can and do manipulate their EPS numbers by changing the number of shares outstanding. Share issuances, splits, and stock buybacks all change the denominator by which net income less preferred dividends is divided.

EPS numbers are most useful when evaluated along with other metrics. The two most common are the price/earnings (P/E) ratio, which compares a company’s stock price to its EPS, and the return on equity (ROE), which indicates how much profit a company generates from its net assets.

Basic EPS vs. diluted EPS

Diluted EPS numbers, unlike the «basic» EPS metric described above, account for all potential shares outstanding. Financial instruments like convertible debt and employee stock options, which are often used to raise capital and motivate employees, must be added to the outstanding share count to calculate a company’s diluted EPS.

Valuation models use fully diluted EPS because it is more conservative. Share counts tend to increase, especially for fast-growing companies that leverage their abilities to issue more shares in order to expand.

What is the difference between EPS and adjusted EPS?

Companies often report EPS values using net income numbers that are adjusted for one-time profits and expenses, like sales of business units or losses from natural disasters. While a company’s adjusted EPS can be a more accurate indicator of the company’s performance, some companies aggressively «adjust» their net incomes in misleading or even fraudulent ways to boost their adjusted EPS numbers.

Related investing topics

Stock Market Basics for Beginners

If you’re just getting started investing, these basics can help guide you.

Best Long-Term ETFs

These exchange-traded funds are great to buy and hold.

Portfolio Diversification

Spreading your money across industries and companies is a smart way to ensure returns.

Corporate Bonds

If the issuing company remains solvent, these can be a good, stable investment.

What is a good EPS?

What makes a good EPS is determined less by the absolute value of the EPS and more by its year-over-year change. The absolute value of a company’s EPS should increase annually, but the rate of increase of EPS should also accelerate.

A company’s EPS can vary based on fluctuations in earnings, total number of shares outstanding, or both. A company can boost its EPS by increasing its earnings or reducing its share count through share buybacks, but a company that increases its outstanding share count faster than its earnings will cause its EPS to drop.

Stock investors can further evaluate a company’s EPS by considering it in conjunction with its P/E ratio and determining how the company’s share price is fluctuating relative to its earnings.

Earnings Per Share (EPS)

What is Earnings Per Share (EPS)?

Earnings Per Share (EPS) is a financial metric calculated by dividing the Net income by the total number of outstanding common shares. Investors use EPS to assess a company’s performance and profitability before investing. Higher EPS means the company is more profitable.

Table of contents

Earnings Per share Formula

You can calculate EPS using the formula given below –

Earnings Per Share Formula = (Net Income – Preferred Dividends)/Weighted Average Number of Shares Outstanding

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Earnings Per Share (EPS) (wallstreetmojo.com)

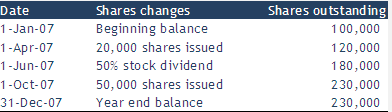

Since the number of common shares outstanding may change over the year, the weighted average calculates EPS. The weighted average number of common shares is the number of shares outstanding during the year weighted by the year they were outstanding. Therefore, analysts need to find the equivalent number of whole shares outstanding for the year.

Three steps to calculate the weighted average number of common shares outstanding:

Identify the beginning balance of common shares and changes in the common shares during the year.

For each change in the common shares:

Earnings Per Share Calculation Examples

Let’s take a practical example to illustrate the earnings per share formula.

Example #1

Hit Technology Inc. has the following information –

Find out the earnings per share of Hit Technology Inc.

In the example, we know the net income and the preferred dividends. That means we know all the information needed for the numerator. However, we don’t know the weighted average of common shares outstanding; because we need to calculate that from the data given.

Let’s calculate the weighted average number of common shares outstanding first.

Here’s the calculation –

Now, we will find out the EPS formula –

Example #2

source – Colgate 10K filings

Example #3

What will be the numerator of basic EPS for Albatross Inc?

The numerator of EPS = Net Income – Preferred Dividends

The weighted average number of shares calculation

The weighted average number of shares is calculated as per below –

Effect of Stock Dividends & Stock Splits on EPS

In calculating the weighted average number of shares, stock dividends and stock splits are only changed in the units of measurement, not changes in the ownership of earnings. A stock dividend or split shareholders).

Specifically, before starting the three steps of computing the weighted average, the following numbers are restated to reflect the effects of the stock dividend/split:

The beginning balance of shares outstanding;

Calculate the weighted average number of shares for the following –

The weighted average number of shares is calculated as per below –

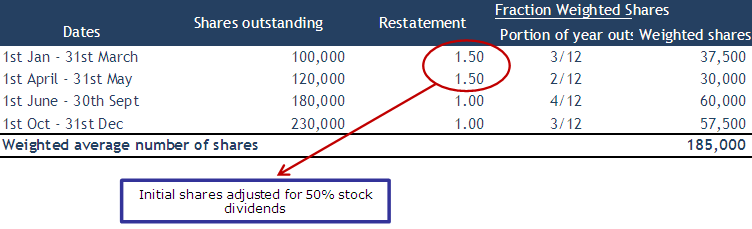

Colgate’s Stock Dividends and Earnings Per Share

As a result of 2013, Stock Split Stock Split Stock splits refer to the process whereby a company increases its number of shares, reducing the per-share price of the stocks. read more all historical per share data and numbers of shares outstanding were retroactively adjusted. In 2012, the shares outstanding were 476.1 million, and they almost doubled up to 930.8 million due to the two-for-one stock split.

source – Colgate 10K filings

Simple vs. Complex Capital Structure

A complex capital structure has securities that could have a dilutive effect on earnings per common share.

Let us look at the Colgate earnings per share. We note that there are two variations – Basic and Diluted EPS in Colgate. Also, note that stock options and restricted stock units affect the total number of shares outstanding.

source – Colgate 10K filings

How Earnings Per Share Affects Stock Valuation?

Earnings per Share (EPS) Video

Recommended Articles

This article has guided what Earnings Per Share (EPS) and its meaning is. Here we discuss how to calculate earnings per share along with weighted average shares, share splits, stock dividends, and practical examples. You may also learn more from the following articles on Shares

What Next?

If you learned something new or enjoyed the post, please leave a comment below. Let me know what you think. Many thanks, and take care. Happy Learning!

Comments

Firstly, I appreciate the blog you have created. This is one of the tremendous work you have done. I have a little bit query with regards to ‘Calculate the effect of Stock Splits & Stock Dividends’where your answer is 185000 as weighted average common share outstanding, and my answer is 162500. Can you please recalculate the Stock Splits & Stock Dividends on weighted average comm. share outstanding….?

Thanks & Regards,

Shalin

thanks for the question. I guess you missed the restatement that needs to be done due to 50% stock dividend. The calculation becomes (100,000 x 1.5 x 3/12) + (120,000 x 1.5 x 2/12) + ……

Thanks so much for a clear picture for the EPS evolution.

Alex

thank you so much, it is so helpful to me

dalam menghitung %perubahan eps, eps mana yang digunakan??

eps dilusian atau eps dasar??

I am preparing for a certification exam and your article provided much know leg area beyond what I needed. Thank you.

Thanks Joan. I am glad you linked the article.

its very interesting and helpful to me. i learned something extra what i knew earlier.

thanking you to share such files.

i hope i can learn many more new things by following you…

Helpful. Simple. Easy to understand. Thanks for sharing your knowledge.

Thank you for this elaborate article on EPS. Your style of writing is simple, yet comprehensive.

Thank you Dennis.

You articles relating to valuations are very helpful and easy to go thru. And very excellent stuff to learn and horn our valuation skills.

Many thanks. I am glad you like these resources 🙂

Earnings Per Share (EPS)

Each common share’s profit allocation out of the company’s total profit

What is Earnings per Share (EPS)?

Earnings per share (EPS) is a key metric used to determine the common shareholder’s portion of the company’s profit. EPS measures each common share’s profit allocation in relation to the company’s total profit. IFRS uses the term “ordinary shares” to refer to common shares.

The EPS figure is important because it is used by investors and analysts to assess company performance, to predict future earnings, and to estimate the value of the company’s shares. The higher the EPS, the more profitable the company is considered to be and the more profits are available for distribution to its shareholders.

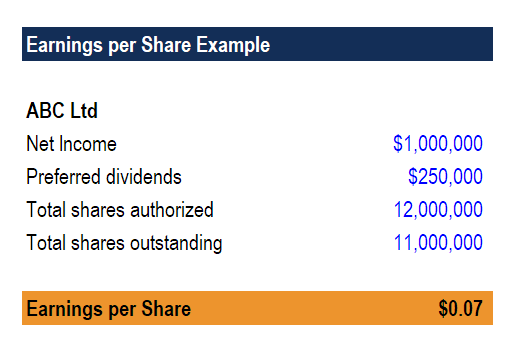

Earnings Per Share Example

Capital Structures

Capital structures that do not include potentially dilutive securities are called simple capital structures. On the other hand, complex capital structures include such securities.

Dilutive securities refer to any financial instrument that can be converted or can increase the number of common shares outstanding for the company. Dilutive securities can be convertible bonds, convertible preferred shares, or stock options or warrants.

Basic and Diluted EPS

There are two different types of earnings per share: basic and diluted. Reporting basic EPS is required because it increases the comparability of earnings between different companies. Diluted EPS is required to reduce moral hazard issues.

Without diluted EPS, it would be easier for the management to mislead shareholders regarding the profitability of the company. It is done by issuing convertible securities such as bonds, preferred shares, and stock options that do not require issuing common shares immediately but can lead to issuance in the future.

| Basic EPS | Diluted EPS |

|---|---|

| Shows how much of the company’s earnings are attributable to each common share | Amount of the company’s earnings attributable to each common shareholder in a hypothetical scenario in which all dilutive securities are converted to common shares |

| EPS = (Net income available to shareholders) / (Weighted average number of shares outstanding) | Amount of the company’s earnings attributable to each common shareholder in a hypothetical scenario in which all dilutive securities are converted to common shares |

| Basic EPS is always larger than diluted EPS | Diluted EPS is always smaller than basic EPS |

Basic EPS Formula

Net income available to shareholders for EPS purposes refers to net income less dividends on preferred shares. Dividends payable to preferred shareholders are not available to common shareholders and must be deducted to calculate EPS.

There are two kinds of preferred shares that we need to know about: cumulative and non-cumulative. For cumulative preferred shares, the preferred shareholder’s entitlement must always be deducted regardless of whether they are declared or paid.

Only the current period’s dividends should be considered, not any dividend in arrears. For non-cumulative preferred shares, the dividends should only be deducted if the dividend’s been declared.

To determine the total number of common shares, we calculate the weighted average number of ordinary shares outstanding. A weighted average number is used instead of a year-end number because the number of common shares frequently changes throughout the year.

Consider the following example:

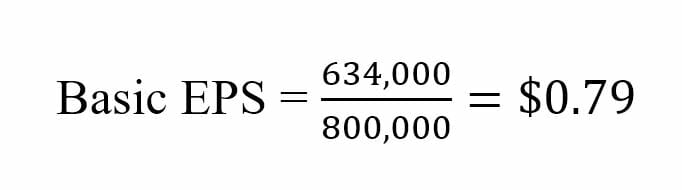

Assume that on January 1, 2017, XYZ Company reported the following:

Common shares: 5,000,000 authorized, 800,000 issued and outstanding, no par value, and no fixed dividend.

Step 1: Calculate net income available to common shareholders

| Net income | $2,234,000 |

| Less: Cumulative preferred dividends | ($1,600,000) |

| Net income available to common shareholders | $634,000 |

Step 2: Weighted Average Number of Shares Outstanding

In our example, there are no instances of common share issuance or repurchase. Therefore, the weighted average is equal to the number of shares outstanding: 800,000

Step 3: Apply the Basic EPS formula

Download the Free Template

Enter your name and email in the form below and download the free template now!

:max_bytes(150000):strip_icc()/jean_folger-5bfc2ab246e0fb0083c05476.gif)

:max_bytes(150000):strip_icc()/JamesHeadshot-PeggyJames-9f712f1197374a9b824289fe0d5ec842.jpg)

:max_bytes(150000):strip_icc()/ArielCourage-50e270c152b046738d83fb7355117d67.jpg)

:max_bytes(150000):strip_icc()/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

:max_bytes(150000):strip_icc()/PortraitHeadshot-DavidKindness-DavidKindness-2318e84654364a0584b715e44c99f13a.jpg)