How to calculate net sales

How to calculate net sales

Net Sales Formula

Net Sales Formula in Accounting

The net sales formula in accounting is used to calculate the company’s net sales of its return, discounts, and other allowances, where the formula of net sales is gross sales revenue generated minus sales returns, discounts allowed to the customers, and allowances.

Table of contents

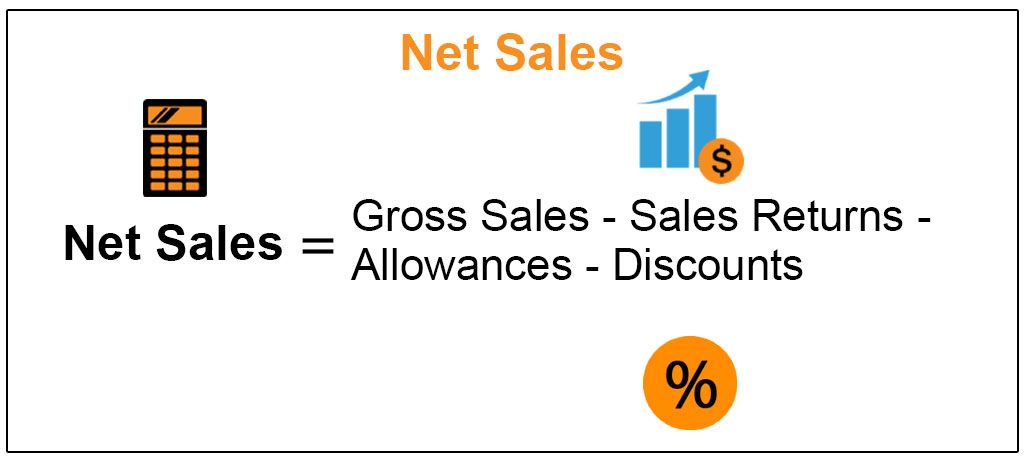

Net Sales = Gross Sales – Sales Return – Allowances – Discounts

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Net Sales Formula (wallstreetmojo.com)

Explanation

The formula of net sales in accounting calculates the Net Revenue Net Revenue Net revenue refers to a company’s sales realization acquired after deducting all the directly related selling expenses such as discount, return and other such costs from the gross sales revenue it generated. read more after accounting for any sales return, discounts, or allowances. The return would also include any damaged products or missing products.

The gross sales or gross revenue depicts the total income a company or a firm shall earn during a specified time, which could be a year or a quarter, and that shall include all the credit card, cash, trade credit Trade Credit The term «trade credit» refers to credit provided by a supplier to a buyer of goods or services. This makes it is possible to buy goods or services from a supplier on credit rather than paying cash up front. read more sales, and debit card sales performed during that time, including the discounts and allowances for sales.

Examples

Example #1

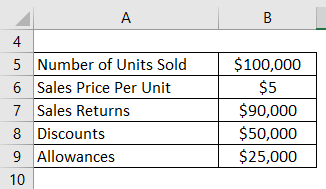

ABC limited wants to record the revenue figure in the income statement for the year ended 20XX.

It would be best to compute the net revenue figure based on the above information.

Solution

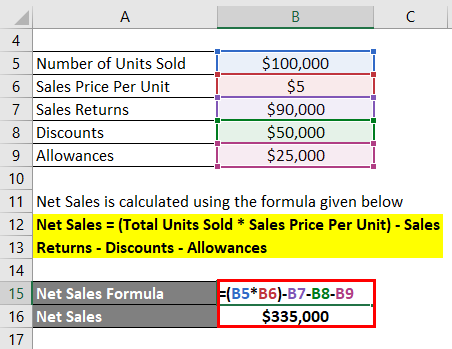

Net Sales can be calculated using the above formula as,

Therefore, the firm must record 45,00,000 as Net Revenue in its income statement.

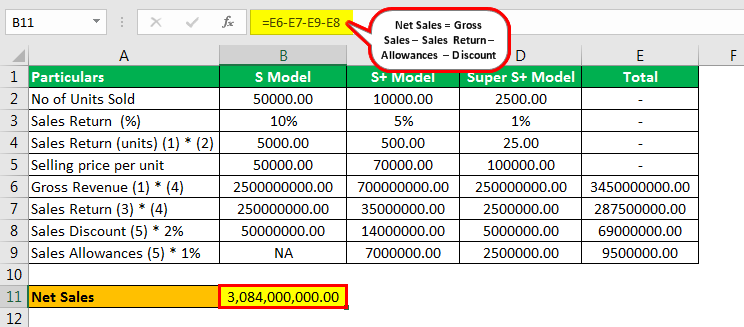

Example #2

Vijay started a new business around a year ago. He entered the business of bike sales. Last year the firm sold 50,000 units of S model bikes, 10,000 units of S+ model bikes, and 2,500 units of Super S+ model bikes. However, there were some complaints related to the bike’s performance, and as a percentage, some of the bikes that came back were: 10% of S model bikes, 5% of S+ bikes, and 1% of the Super S+ bikes.

The price range was 50,000, 70,000, and 100,000 for the S model, S+ model, and Super S+ model, respectively. These bikes are subject to service semi-annually; hence, those are treated as a firm’s expenditure: 1% of the gross amount for the S+ model and Super S+ model only. It’s the company’s policy to provide a flat 2% discount on the gross amount of bikes as a completion of one year of the firm.

Considering all of the above facts, you are required to calculate the net revenue that Vijay’s firm should record in its books of account.

Solution

Here, we are not given any of the figures directly, so we will first calculate all of those individually.

= 3,45,00,00,000.00 – 28,75,00,000.00 – 95,00,000.00 – 6,90,00,000.00

Therefore, the firm needs to record 3,08,40,00,000.00 as Net Revenue in its income statement.

Example #3

As an accountant for the firm, he was asked to help the bank provide the numbers. The bank has requested him to provide the net revenue figure.

He noted that 3,700 units of software were sold at the rate of 2,000 per piece. You are required to calculate the net revenue figure.

Solution

We shall first calculate gross revenue and arrive at the net revenue after considering all of the sales returns, allowances, and discounts.

Gross sales will be no of units * selling price per unit, which is 3,700 units * 2,000 which equals 74,00,000

We can now calculate other figures per percentage of revenue as given in the question.

Net Sales will be –

Therefore, the firm needs to record 63,04,800.00 as Net Revenue in its income statement and report it to the bank.

Relevance and Uses

Net Sales can be used for many purposes; if the difference between a company’s net and gross sales is more than the figure of the industry average, the firm may be offering lucrative discounts, or they may be realizing a greater amount of sales returns when compared with their peers. While comparing income statements, say monthly, could help them identify any potential problems and look for viable solutions.

Recommended Articles

This has been a Guide to Net Sales Formula. Here we discuss calculating net sales along with practical examples and a template. You can learn more about financial analysis from the following articles –

How to Calculate Net Sales For Your Small Business

Image source: Getty Images

Net Sales is the sales or revenue that your business has earned after all sales adjustments have been taken. Net sales is reported on your income statement, and should always be calculated for any business that sells products.

A service business needs to calculate net sales, such as when a customer discount is provided or a dissatisfied customer is refunded their payment, but these instances are much less common.

Overview: What are net sales?

Net sales is your total sales revenue left after deductions for sales returns, sale allowances, and discounts have been calculated.

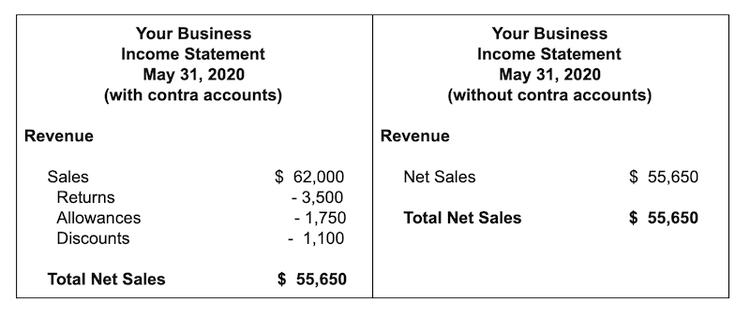

As a business owner, you have the choice to report net sales on your income statement with these deductions already included in the sales total, or report gross sales figures and list each allowance or deduction separately.

It’s important that all deductions and allowances be calculated accurately, as they directly affect your gross profit. However, your sales allowances and deductions should not include cost of goods sold, which is subtracted separately from your net sales total.

Net sales vs. gross sales: What’s the difference?

Gross sales are your total sales for a specific period before accounting for any deductions such as sales allowances, sales discounts, and sales returns.

Applicable mainly to businesses that sell products, service businesses rarely have to worry about gross sales and net sales, with only an occasional discount or allowance given.

If you don’t properly account for these adjustments, your gross profit will be overstated as will your total revenue number. This simple omission can cause incorrect financial statements, which leads to inaccurate financial ratios and misstated profit levels for your business.

It can also result in overpaying on your taxes.

How to calculate net sales

To calculate net sales, familiarize yourself with the three common sales deductions mentioned above:

If you’re ready to calculate your net sales, use this simple formula:

To properly track return, allowance, and discount totals, you will need to create contra accounts for your sales account. Contra accounts are income/revenue accounts that will maintain a debit balance instead of their normal credit balance. On your chart of accounts, your contra accounts would look like this:

The sales returns, sales allowances, and sales discounts accounts are all considered contra accounts of the main sales account and will have a debit balance. At the end of the accounting period, any debit balance in the contra accounts will be subtracted from the sales account balance to obtain net sales totals.

Now that your contra accounts have been created, you can record your sales journal entry for the following sales transactions.

| Date | Account | Debit | Credit |

| 5-31-2020 | Sales | $62,000 | |

| 5-31-2020 | Sales Returns | $ 3,500 | |

| 5-31-2020 | Sales Allowances | $ 1,750 | |

| 5-31-2020 | Sales Discounts | $ 1,100 | |

| 5-31-2020 | Accounts Receivable | $55,650 |

If additional customers end up taking a discount, you will need to adjust the sales discount account and the accounts receivable account in order to reflect the additional discount.

In order to record sales numbers manually, you’ll need to add your gross sales and then subtract returns, allowances, and discounts from that total. If you’re using accounting software, you can record your adjustments directly into the software application.

After all journal entries have been recorded, your income statement will reflect the adjustments. You can create an income statement listing all of the sales adjustments individually, or just use the net sales number.

If you use the income statement without the contra account amounts displayed, you will still have access to the adjusted totals in your general ledger.

This is important, since you’ll want to know how much the adjustments are costing your business. The only difference is that the totals will not be displayed on the income statement.

Tracking net sales

It’s equally important to track gross and net sales. While gross sales provides information such as how well your products are selling and how successful your business is in reaching customers, tracking net sales totals are just as important.

For instance, inadequate tracking of net sales can lead to over-inflated revenue totals, a possible overpayment on taxes, and inaccurate financial statements.

Tracking net sales also addresses the underlying reason for the sales adjustments. For instance, if your sales allowances are high, you might need to address product defects and perhaps look for a new supplier. If your product returns are high, investigate why so many customers are returning your product.

The best way to keep track of both gross and net sales is to use accounting software. If you’re thinking about making the move from manual ledgers and spreadsheets, check out The Ascent’s accounting software reviews.

How to Calculate Net Sales? Formula for Net Sales

SHARE

Urmi Sengupta | Updated on: May 6, 2022

What is net sales?

Net sales is the total number of sales that a business makes minus the discounts, sales returns, and allowances. Net sales are different from gross sales because the latter does not take sales returns, allowances, and discounts into account. Net sales are part of the income statement and they ensure that an accurate figure is provided when analyzing the financial statement. You will typically see the gross sales mentioned first in the income statement. Then you will see deductions and discounts. After these expenses, you will see net sales. Net sales can be calculated annually or they can also be calculated quarterly depending on the business.

The net sales value must be regularly analyzed by you because it is an important metric. For example, if the difference between gross sales and net sales is big then it means your business is getting product returns or giving more discounts than others. You cannot calculate net sales accurately if you do not know the gross sales, returns, allowances, and discounts. This is why a software solution like TallyPrime is crucial for MSMEs to ensure every sale is recorded so it can be used to calculate net sales and other important values that the business can use.

What is the formula for net sales?

The formula for net sales is as follows.

Net sales = Gross sales – Returns – Allowances – Discounts

Gross sales value refers to the total revenue that your business generates before discounts, returns, and allowances. The gross sales will include sales that have been made with a debit card, cash, credit card, and trade credit. Gross sales is calculated by multiplying the total units sold by the sale per unit price.

Returns or sales returns refers to the goods that have been returned by the customers in exchange for a refund for the goods. Generally, businesses are expected to make a full refund to their customers when customers make a return.

Allowances refers to the price reduction of goods that have been found to be defective or which have been damaged. For example, if a customer bought a product and found that the product isn’t in perfect condition, then the partial refund will be an allowance and will be accounted for in the net sales calculation.

Discounts are given by the business to customers if they meet a certain criterion. For example, if a customer makes the complete payment in one go then he will receive a discount of 5%. This will be the sales discount and this will be used when calculating the net sales.

Note that the sales value does not include the sales tax. This is because the seller is not earning the taxes and so it is not his revenue. Sales taxes are going to the local government and so it is their revenue and not the seller’s. Although the seller is collecting the taxes on behalf of the government, it is eventually the government that is receiving those taxes from sales. Generally, businesses will include it in the sales taxes payable. When the tax is paid to the government, you will see a reduction in the sales taxes payable.

Example to illustrate net sales

You can better understand the formula for net sales with an example.

| Gross Sales | $90,000 |

| Returns | $500 |

| Allowances | $100 |

| Discounts | $1000 |

| Net Sales | $88,400 |

What is the significance of net sales?

Net sales is important because it is more accurate in comparison to gross sales. It provides an insight into your business and how much you are earning. This gives you a glimpse of your business health as it highlights the costs that are incurred when making sales. This allows you to know if you are meeting your target sales and if you are actually making money rather than spending more on returns and discounts. It helps drive business decisions because you can make better decisions when you have computed net sales. Let us say your net sales value is lesser than expected, it shows that you need to change your marketing or make changes to the prices to make more sales to meet your target.

When business owners, investors, and others look at the gross sales of a business, they get a skewed figure of sales. This can be misleading when making key decisions and this is the reason why net sales are said to be more accurate. Imagine if a business owner gets to know that they are making several thousand in sales while in reality a lot of products are getting returned or losses are taking place due to damage and defective items. In reality, no matter how careful a business owner is, mistakes happen and so the net sales provide a realistic view of the sales.

When you know that products are being returned more than the industry standard or that products are being purchased only after discounts, it is time to rethink your strategies. In the case of discounts, you can provide them only when customers reach a specific threshold of having spent a certain amount so you have more sales. In the case of more returns, you can take a proper look at the most common reason behind returns and then rectify it so that it doesn’t happen as often anymore. You might need to speak to the manufacturing department to ensure the products are nothing short of perfect.

Use TallyPrime to stay ahead

You can only get accurate results when you have reliable financial records. TallyPrime empowers you to stay on top of your finances by recording and organizing your financial reports. It is a business management solution for MSMEs that allows you to generate all financial statements so you know the financial position of your business. It allows you to manage cash flow, inventory, and payroll. It enables you to manage more than one business and store data of different branches for easy accounting from one place. It provides advanced security and banking features so you can do complex accounting with a single software package.

Net sales are the most accurate reflection of your small business’s well-being and efficiency. All businesses use the net sales formula to calculate the number of net sales every quarter or for a period of time.

Do you run your own small business? Have you brought in enough net sales? Is your business going to be profitable?

Net sales help you understand the financial health of your small business. It is essential to understand and familiarize yourself with the formula so as to use it effectively to profit your small business.

Understanding financial metrics and resource management is the crucial while setting up any small business plan. This is required for both short-term or long-term perspective.

Business owners must never ignore their financial operations, especially net sales. The bottom line is, just a minor mistake can make a business lose a considerable amount of money. It is one of the reasons why entrepreneurs are always trying to analyze their net sales operations and profitability from the moment they start up their small business.

This article will be going through some of the terms associated with Net sales, such as Net Income (or net profit), Gross Sales, Income Statement, and Profit Margins. This will help you calculate your net sales and focus your attention on the profitability of your small business.

What Is Net Sales?

The income statement is the financial report used when calculating the company’s revenues, revenue growth, and operational expenses. The income statement is broken into three-parts, which support the analysis of capital costs, direct costs, and indirect costs. Net sales are found in the direct cost portion of the income statement.

The term Net sales refer to the revenue that a company reports after making several calculations and deductions from the gross sale. For example, such as returns, discounts, and allowances are subtracted from the gross sales.

Net Sales is calculated by deducting any returns, discounts, and allowances from Gross Sales. It is represented on the income statement of a company. The formula for calculating Net Sales is give below:

Net Sales = Gross Sales – Sales Returns – Discounts – Allowances

Net Sales = (Total Units Sold * Sales Price Per Unit) – Sales Returns – Discounts – Allowances

Some small businesses usually do not provide any transparency in the area of net sales. Net Sales may not apply to every business or industry because of different components of its calculation.

The costs associated with net sales will affect the gross profit and gross profit margin of the business. Net sales do not include the cost of goods sold, also known as COGS, which is usually the primary driver of gross profit margins.

If a business has any returns, allowances, or discounts, then adjustments are made to identify and report net sales. Most small businesses report gross sales, then net sales and sales cost in the direct costs portion of the income statement. Sometimes, they may report net sales on the top line and then move on to the costs of goods sold.

In summary, net sales do not account for the cost of goods sold, general expenses, and administrative expenses, which are analyzed with different effects on income statement margins.

What are the Components of Net Sales?

Understanding each term in the formula and its importance for calculating the net sales number:

Allowances are usually because of transporting problems, making the business review its storage methods or shipping tactics. Often returns are managed quickly without creating issues. Small businesses offering discounts may lower or increase their discount terms to become more competitive within their industry.

What is the Difference between Gross Sales and Net Sales?

Gross sales and net sales might seem similar and are usually confused with each other. Net sales are derived from gross sales, is used while analyzing the quality and quantity of a company’s sales.

Gross sales overstate a company’s actual sales because it includes several other variables that cannot practically be classified as sales. Hence, gross sales on their own are not too accurate.

Net sales are a more accurate reflection of a company’s operations and can be used to assess the company’s true turnover. Net Sales is used for coming up with strategies for the sales and marketing teams to improve future revenues.

Gross sales are calculated as the units sold multiplied by the sales price per unit.

The gross sales amount is typically much more significant in numbers than the net sales amount. This is because it does not include returns, allowances, or discounts.

The net sales amount, which is calculated after adjusting for the above variables, is lower than the gross sales amount.

Since the irrelevant metrics are removed while calculating net sales, it is a better reflection of the company’s turnover and health. Hence, net sales are the metrics usually employed for decision-making purposes for the business.

How to Determine Net Sales, Net Income, and Profit Margins?

In most companies, net sales are depicted on a company’s income statement. However, some companies report gross and net sales both on the income statement itself.

While net sales are the amount shown by the business’s actual sales during a period or time frame. Net income is the amount of substantial income earned from net sales and other operations of the business.

What is Net Income?

Net income is defined as the income remaining after subtracting all costs, expenses (production & administration, and selling & distribution), loss on the sale of assets, interest (long-term debt), taxes, and preference dividends from net sales. Hence, the net income is dependent on the net sales.

There are two ways net income is maintained. Small businesses can either hold net income in retained earnings or distributed as dividend among the equity shareholders.

Earnings per share can also be calculated by dividing the total number of shares from the net income. It is the net increase in the equity shareholders find.

The top number is gross sales, and the different components are deducted to derive net sales. Gross profit is calculated using net sales and not the gross sales numbers.

Let’s say the discrepancy between the gross and net sales numbers is very high. It can be a red flag for the business as it may not be reporting sales correctly, or the quality of revenue for the company is not good.

Take this example below:

Gross Sales =$20,000

Net Profit Margin = ($13,000/$19,400)*100 = 67%

What are the Terms used in Net Income?

You need also have to understand the following terms to calculate net income correctly:

Why is Net Income Essential for Your Small Business?

Net Income is an indicator of how successful your small business is.

Net income indicates that a business is making money. It provides you with useful information on the health of your business. In order to track net income for your business, you should be able to track both revenues and expenses properly.

If expenses and taxes outweighed revenues, the business would experience a net loss. Net income, unlike gross income, shows you just how much money you have leftover after all of your expenses have been paid;

Net Income is also used for comparing performance over the years and serves to show the growth trend for a company.

Net income comparisons from year to year can provide you and your accountant with a way to track business growth and financial health over a period of time.

For instance, if your net income remains stagnant or decreases over a period of three to five years, you may need to find ways to cut expenses or increase revenue. While a steep incline shows that your business is growing in a healthy manner from year to year.

Net Income provides investors with the financial data they need

Good net income indicates that a small business is financially stable, with enough money left over to pay their bills. It also provides useful insight into whether a small business is likely to remain successful. Net income is one of the first things that investors and financial institutions will look at.

Net Sales are used finally to calculate the Profit margin, the most critical metrics for any small business to look at to know the company’s health.

What is Net Profit Margin?

Net profit margin is a percentage of net profit over net sales.

Net Profit Margin = (Net Profit/Net Sales) * 100

The ideal net profit margin varies over time. This is because it depends on your industry, your small business’s age, and stability and the goals set for the future of business.

Understanding why the margin goes up and down is essential. If the margin drops from, say, 11%to 7%, it might be because your supplier has increased the prices of the raw materials. This might either be an issue, or it could also be a sign of success. Maybe you are expanding and adding extra staff, which increases your payroll expenses.

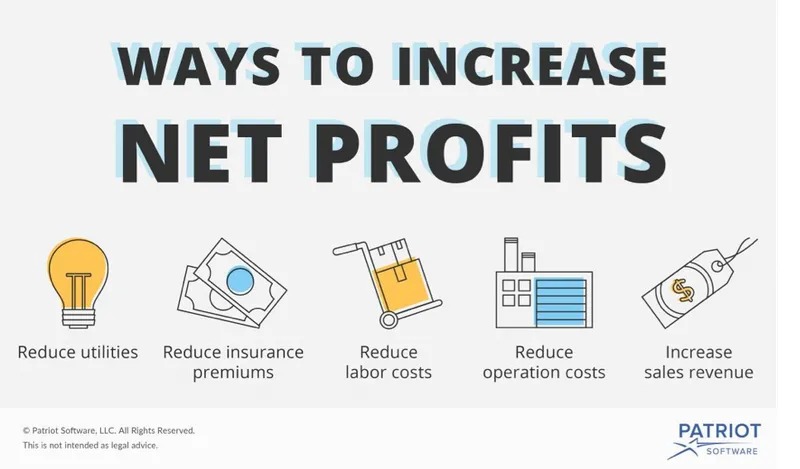

How to Increase my Net Profit Margin?

There are several things you can do to help increase net profit margin, including looking at your cost of goods sold. Are you paying too much for materials? Are there ways you can reduce labor costs, or make labor more efficient?

You may also want to look at operating costs to see if there are expenses you can cut. Finally, you can look to increase net profit revenue by adding another product or service, or increasing the selling price of your current products.

However, you’ll need to have sufficient justification to do so or your customers may take their business elsewhere.

Limitations of Using Net Sales

There are just a few limitations of net sales, even though net sales play an integral role in almost all businesses’ financial operations.

We hope understanding net sales and other financial terms helps you run your small business in a better manner. When used correctly, net sales is a useful calculation for both you and your management to measure how well the business is selling its goods and services.

While other numbers such as gross income and gross profit are also important for different reasons, net income is the bottom-line number that investors and banks want to see.

The net sale is a fundamental factor in the income statement; thus, every business needs to track and manage it with care.

The easiest way to calculate your net income is by using accounting software for invoicing and sales management.

While the number can be calculated manually, using accounting software’s such as Deskera Books helps track revenue and expenses accurately, providing you with a net income figure that you can trust.

We have finally reached the end of this article. To summarize the take away from fro above :

We hope this article gives you a better understanding of Net Sales and its terms and helps you to manage your small business sales better to bring in profitability.

Net Sales Formula

By

Net Sales Formula (Table of Contents)

What is Net Sales Formula?

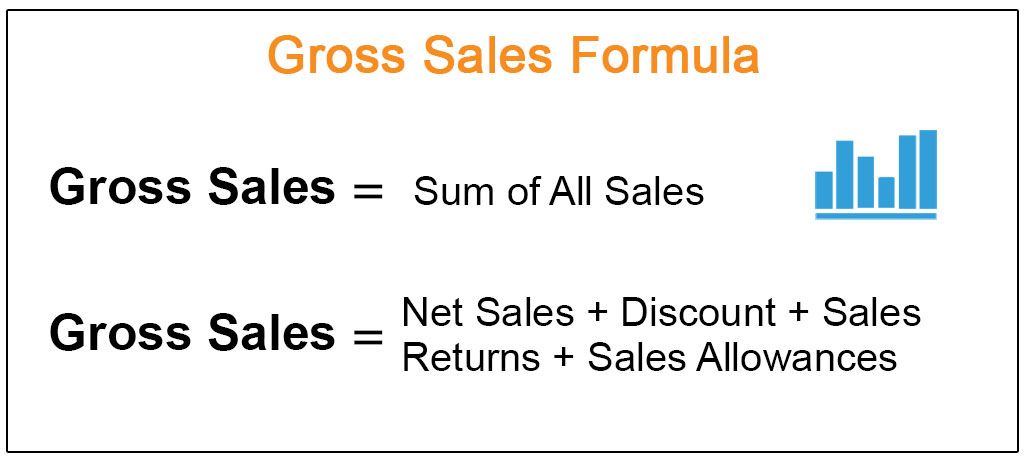

The term “net sales” refers to the revenue that a company books after making several deductions such as returns, discounts, and allowances from the gross sales. Gross sales are the total sales before any deductions are done. The formula for net sales can be derived by deducting sales returns, discounts, and allowances from the product of total units sold and sales price per unit. Mathematically, it is represented as,

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

or

Examples of Net Sales Formula (With Excel Template)

Let’s take an example to understand the calculation of Net Sales in a better manner.

Net Sales Formula – Example #1

Solution:

Net Sales is calculated using the formula given below

Net Sales = (Total Units Sold * Sales Price Per Unit) – Sales Returns – Discounts – Allowances

Net Sales Formula – Example #2

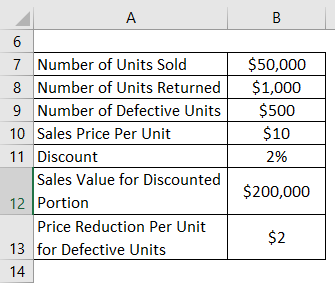

Based on the given information, Calculate the net sales of the company during the year.

Solution:

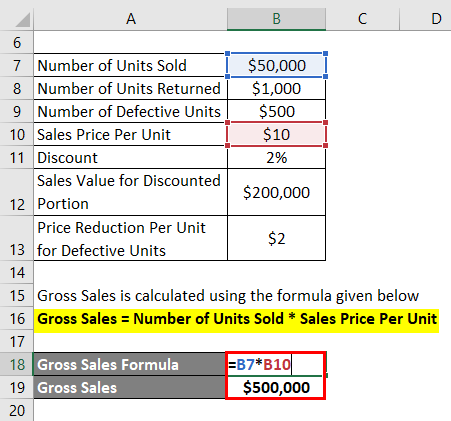

Gross Sales is calculated using the formula given below

Gross Sales = Number of Units Sold * Sales Price Per Unit

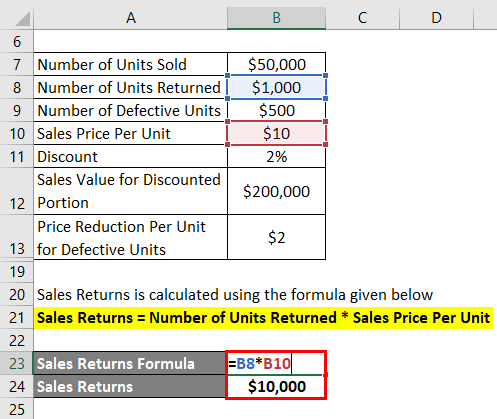

Sales Returns is calculated using the formula given below

Sales Returns = Number of Units Returned * Sales Price Per Unit

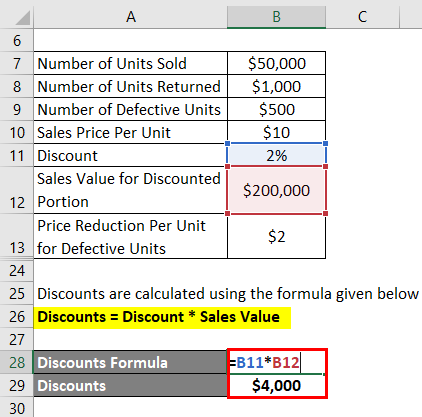

Discounts = Discount * Sales Value

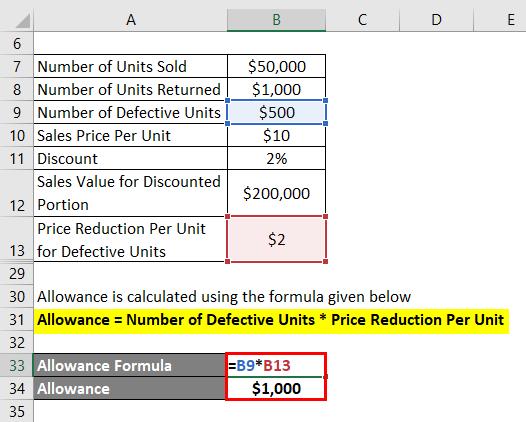

Allowance is calculated using the formula given below

Allowance = Number of Defective Units * Price Reduction Per Unit

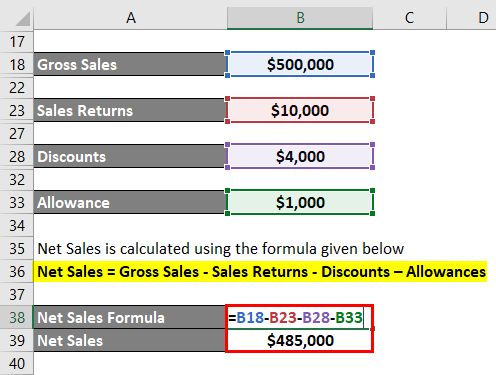

Net Sales is calculated using the formula given below

Net Sales = Gross Sales – Sales Returns – Discounts – Allowances

Explanation

The formula for net sales can be derived by using the following steps:

Step 1: Firstly, determine the total number of units sold of the product under consideration during a certain period of time, which can be daily, monthly, quarterly or annually.

Step 2: Next, determine the sales price per unit of the product.

Step 3: Next, calculate the gross sales by multiplying the number of units sold (step 1) and the sales price per unit (step 2) as shown below.

Gross Sales = Total Units Sold * Sales Price Per Unit

Step 4: Next, determine the sales return which includes the value of the products returned by the customers for various reasons like business return policy, product quality, etc. The customers receive a refund for the returned product.

Step 5: Next, determine the value of discounts which includes the deduction offered to the customers on their invoices due to early or timely payments. These discounts intended for lower account receivables and faster recovery.

Step 6: Next, determine the value of allowances which refers to the price reductions offered to the customers in case of some defect or damage in the product.

Step 7: Finally, the formula for net sales can be derived by deducting sales returns (step 4), discounts (step 5) and allowances (step 6) from the gross sales (step 3) as shown below.

Net Sales = Gross Sales – Sales Returns – Discounts – Allowances

Net Sales = (Total Units Sold * Sales Price Per Unit) – Sales Returns – Discounts – Allowances

Relevance and Uses of Net Sales Formula

The concept of net sales is a very important one as it is, if not the first line item, one of the first few the income statement that sets the tone of the statement. In fact, in case an income statement has a single line item that is labeled simply as “sales,” then it is safe to assume that the line item refers to the net sales. In most cases, the amount of total revenues booked by a company in its income statement is usually the net sales figure, which is the value arrived at after the deductions of all forms of sales. It is advisable to report gross sales as a separate line item itself, followed by all the deduction and then the net sales. Apparently, non-reporting of the deductions can prevent the readers of the financial statements or other stakeholders from drawing meaningful insights about the sales transactions.

Net Sales Formula Calculator

You can use the following Net Sales Formula Calculator

| Total Units Sold |

| Sales Price Per Unit |

| Sales Returns |

| Discounts |

| Allowances |

| Net Sales |

Recommended Articles

This is a guide to Net Sales Formula. Here we discuss how to calculate Net Sales along with practical examples. We also provide a Net Sales calculator with a downloadable excel template. You may also look at the following articles to learn more –

All in One Financial Analyst Bundle (250+ Courses, 40+ Projects)