How to defi coingecko

How to defi coingecko

How To DeFi

Decentralized Finance (DeFi) is disrupting the traditional financial sector at a breakneck speed. Use this book to gain insight into the novel financial innovations enabled by DeFi. Join us in this exciting adventure of redefining finance!

Note: This is an eBook. Purchasers will receive PDF, ePub, and Mobi versions of this book for download.

«Probably the most comprehensive DeFi Manual out there, a must-read.»

Hugh Karp, Founder of Nexus Mutual

Learn more about How to DeFi (Beginner)

Learn more about How to DeFi (Advanced)

How To DeFi: Beginner

Decentralized Finance (DeFi) is fast disrupting the traditional financial sector. This updated version of How To DeFi is a must-read book for anyone looking to learn DeFi. It is packed with simple explanations and step-by-step guides to help you understand and get started in this fast-developing ecosystem.

Note: This is an eBook. Purchasers will receive PDF, ePub, and Mobi versions of this book for download.

Readers say

Chapters included in this book

Part One: Centralized & Decentralized Finance

Chapter 1: The Traditional Financial Institutions

The Banks

Decentralized Finance vs Traditional Finance

Chapter 2: What is Decentralized Finance (DeFi)?

The DeFi Ecosystem

How Decentralized is DeFi

Part Two: Getting into DeFi

Chapter 3: The Decentralized Layer: Ethereum

What is Ethereum?

What is Smart Contract?

What are Decentralized Applications?

Chapter 4: Ethereum Wallets

Custodial vs Non Custodial Wallets

Argent Wallet

Metamask Wallet

Part Three: Deep Diving into DeFi

Chapter 5: Decentralized Stablecoins

Maker

Maker’s Collateral Ratio, Stability Fee

Dai Savings Rate

Sai vs Dai

Minting and Saving Dai

Chapter 6: Decentralized Lending and Borrowing

Compound

Borrowing and Lending on Compound

Compound Governance

Aave

Borrowing and Lending on Aave

Aave Governance

Chapter 7: Decentralized Exchanges

Uniswap

Liquidity Pools

Automated Market Makers Mechanism

1inch

Dex Aggregators

Chapter 8: Decentralized Derivatives

Synthetix

Synthetic Assets

Minting Synthetic Assets

Opyn

What are Options?

How does Opyn Work?

Chapter 9: Decentralized Fund Management

TokenSets

What Kind of Sets are There?

How are Sets Helpful?

Chapter 10: Decentralized Lottery

PoolTogether

Why Bother with Decentralized Lotteries?

PoolTogether Token and Governance

Chapter 11: Decentralized Payments

Sablier

What does Streaming Payment Mean?

Why is Streaming Payment Important?

Chapter 12: Decentralized Insurance

Nexus Mutual

Buying Insurance with Nexus Mutual

Other Insurance Platforms

Chapter 13: Governance

Aragon

What is Aragon Court?

Who uses Aragon?

Snapshot

What are the Shortcomings of Using Snapshot?

How to Vote Using Snapshot?

Chapter 14: DeFi Dashboard

Zapper

What is a Dashboard?

Using Zapper Dashboard

Part Four: DeFi in Action

Chapter 15: DeFi in Action

Surviving Argentina’s High Inflation

Uniswap’s Ban

Chapter 16: DeFi is the Future, and the Future is Now

DeFi is the Future, and the Future is Now

What about DeFi User Experience?

How To DeFi: Advanced

Decentralized Finance (DeFi) has already existed since 2018, but it has recently witnessed a surge in popularity in the first half of 2021 with no ceiling in sight. Use this book to gain insight into the novel financial innovations enabled by DeFi. Join us in this exciting adventure of redefining finance.

Обзор книги – CoinGecko’s “How to DeFi”

Децентрализованные финансы (DeFi), безусловно, сейчас являются модной фразой в мире криптовалют. Но хотя мы все больше и больше слышим о потенциале этого технологического прорыва, который революционизирует мир традиционных финансов, многие до сих пор не уверены, что на самом деле включает в себя DeFi..

CoinGecko только что выпустила свою первую книгу под названием «Как DeFi». Эта книга призвана предоставить легкую отправную точку для тех, кто хочет узнать о предмете.

Зачем использовать DeFi

После обязательного набора цитат из отраслевых деятелей, рекомендующих книгу как идеальную отправную точку для входа в мир DeFi, мы сразу понимаем, почему это так важно..

С активами на сумму более 1 миллиарда долларов, заблокированных в экосистеме DeFi, в настоящее время это один из самых быстрорастущих секторов в сфере криптовалюты. Самым радикальным изменением, которое он обещает принести, является устранение необходимости в централизованных учреждениях для контроля над финансовой системой..

Три области, в которых DeFi в настоящее время стремится улучшить централизованные банковские структуры, – это стоимость и скорость денежных переводов, предоставление финансовых услуг без цензуры (в том числе 1,7 миллиарда человек во всем мире, не охваченных банковскими услугами) и прозрачность управления..

После объяснения того, что такое DeFi, в книге перечислены категории финансовых услуг, доступных в настоящее время через него. От стейблкоинов, кредитования и заимствования через биржи, деривативы и управление фондами до лотерей, платежей и страхования – охватывается каждый аспект текущей экосистемы DeFi..

Как DeFi

Во второй части книги объясняется работа сети Ethereum как самой популярной платформы для приложений DeFi. Объясняются смарт-контракты, эфир и газ, прежде чем смотреть на плюсы и минусы децентрализованных приложений (Dapps)..

Наконец, сравниваются разные типы кошельков с пошаговым руководством по установке и запуску как на мобильном кошельке Argent, так и на Metamask для ПК. После всего этого мы переходим к третьей части, глубокому погружению..

Каждой из вышеупомянутых категорий услуг DeFi дается полная глава, в каждом случае фокусируясь на одном или двух ключевых провайдерах. Мы узнаем о стейблкоинах на примере платформы MakerDAO, Compound используется для иллюстрации кредитов, децентрализованные биржи (DEx) объясняются с использованием Uniswap и dYdX и т. Д..

В каждой главе дается обзор доступных сервисов с диаграммами, помогающими объяснить некоторые из более сложных концепций. Затем в нем объясняется, как сервис работает на выбранной платформе, а также приводится пошаговое руководство для тех, кто чувствует необходимость сразу же приступить к делу..

Целевая аудитория книги – новички в DeFi, поэтому некоторые более тонкие детали выбранных платформ опускаются, но уровень, как правило, соответствует правильному. Например, действительно ли новичку в DeFi нужно знать тонкости схемы стимулирования Maker Protocol, или же она достаточно привязана к доллару??

Читать ли

В то время как предыдущие главы проделывают огромную работу по введению новичка в мир DeFi с обилием объяснений и диаграмм, последующие главы, похоже, предполагают наличие некоторых существующих знаний по этому предмету..

Например, главы о производных финансовых инструментах и управлении фондами будут более полезны для тех, кто уже понимает эти концепции в традиционных финансах. Хотя, возможно, было бы разумно не поощрять новичка заниматься торговлей производными финансовыми инструментами с использованием заемных средств, так что это может быть неплохо..

Последним испытанием был «тест отца»; То есть мог ли мой отец, человек лет семидесяти с очень элементарными знаниями криптовалюты, получить разумное представление о DeFi, просто прочитав эту книгу? Я получил это сообщение, когда он читал около 50 страниц в:

«… хотя я не понимаю всего, что мне понравилось читать. Он написан в очень простом стиле, и я думаю, что большинство людей, интересующихся этой темой, смогут следить за ним ».

Конечно, мой отец не совсем целевая аудитория книги, но он по-прежнему находил информацию доступной и чувствовал, что кто-то с более глубокими знаниями о криптовалюте получит от нее больше. Ему также понравились пошаговые инструкции, показывающие, как выполнять определенные функции на представленных платформах..

Книга, безусловно, хорошо написана и тщательно исследована, со ссылками на использованные ссылки, предложениями для дальнейшего чтения и глоссарием терминов в самом конце..

Он полон актуальной и своевременной информации и доступен для бесплатная загрузка до 30 апреля. Розничная цена после 30 апреля составит 14,99 долларов США..

How To CoinGecko: A Complete Beginner’s Guide

Table of Contents

“If I can’t buy crypto directly on CoinGecko, then what can I do with it?”

There’s a ton of things you can do and achieve with CoinGecko, the leading Crypto Data Aggregator loved by the crypto community!

Goal: Learn about key features of CoinGecko & understand why millions of users use it everyday!

More ways to explore coins

Candy & Portfolio Tracker

Skill: Beginner

Effort: 10-15 minutes

ROI: able to use CoinGecko like a pro = unlimited % potentials

TL;DR Summary:

If you haven’t, create a free CoinGecko account now!

Discover coins via:

Trending Coins (through search bar, or bottom of the page)

Categories (some really hot ones like Metaverse, GameFi, DAO Governance, and chain ecosystems)

Look for useful data on the Coin page:

Fundamental information, official websites & social media

Price chart, price changes

Where to buy the coin (centralized and decentralized exchanges).

Start adding coins that interest you into the portfolio, so that you can keep track of them in a watchlist. You may create multiple portfolios for different purposes too. Then,

Add transactions to record your investment.

Or add fake transactions in a test portfolio account.

Save price alerts for coins that you think could be a good trade entry or sales position.

Last but not least, collect free Candy on a daily basis, and redeem rewards like ebook, NFTs, discounts and more!

Download our best-in-class Android and iOS app to elevate your CoinGecko experience!

1. Let’s begin with CoinGecko.com

Note: if you’re new to DeFi (Decentralized Finance) and NFT, you definitely wanna grab a copy of our best-selling ‘How To DeFi’ and ‘How To NFT’ ebooks to level up! You can get our ebook for free too, more on this later.

The homepage is our most popular page where millions of monthly users visit to view the latest price of the top 100 cryptocurrencies by market cap. If you’re wondering why the price here is different from other crypto exchanges, it is because CoinGecko tracks the price from different exchanges to provide a global average price.

Crypto exchanges show different prices and sometimes provide very inaccurate odd prices. Hence, the crypto communities love relying on CoinGecko to get the most accurate and unbiased crypto price! To learn more about our methodologies, visit our page here.

Glossary:

Market Capitalization (Mkt Cap): the total value of a cryptocurrency. Market Cap = Current Price x Circulating Supply

Crypto investors generally use the market cap to determine the valuation of a crypto coin. It is also a common practice to compare the market cap of 2 similar coins to determine the potential growth of a smaller coin.

Tips: use our Compare tool to help you compare market data for different coins. Here’s an example for comparing the Market Cap of a few Layer-1 coins under the Smart Contract Platforms category. All else being equal, one might say that a coin with a lower market cap has more room to grow when compared to another coin with a higher market cap.

24h Volume: the measure of a cryptocurrency trading volume across all tracked exchanges in the last 24 hours.

We will cover more glossaries in the next section!

Pro Tips: By default, the crypto price table is sorted based on the descending order of market cap value. Pro geckos love to sort between 1h, 24h, 7d price changes, to observe which of the top 100 coins experienced the largest gain or loss recently. Users may do the same for coins in different market cap ranges.

The tips above are also applicable to other tables on the CoinGecko site, such as Categories as a whole, or for coins within a specific category page like Metaverse.

Still unsure where to begin? The Search Bar could be your best friend to identify the most trending coins now:

Or simply scroll to the bottom, and see how the trending coins have been performing in the past week:

2. Coin pages

2.1 Upper part:

On the left, you can see the Price and market data like Market Cap, Circulating Supply, 24h trading volume.

Name

Explanation

Market Cap

Market Cap = Current Price x Circulating Supply

Refers to the total market value of a cryptocurrency’s circulating supply. It is similar to the stock market’s measurement of multiplying the price per share by shares readily available in the market (not held & locked by insiders, or governments)

24 Hour Trading Vol

A measure of a cryptocurrency trading volume across all tracked platforms in the last 24 hours. This is tracked on a rolling 24-hour basis with no open/closing times.

Fully Diluted Valuation

FDV = Current Price x Max Supply

The market capitalization (valuation) if the max supply of a coin is in circulation. Note that it can take 3, 5, 10 or more years before the FDV can be reached, depending on how the emission schedule is designed.

Total Value Locked (TVL)

Capital deposited into the platform in the form of loan collateral or liquidity trading pool.

Data provided by Defi Llama

Fully Diluted Valuation / TVL Ratio

The ratio of fully diluted valuation (FDV) to the total value locked (TVL) of this asset. A ratio of more than 1.0 means that the FDV is greater than its TVL.

FDV/TVL is used to approximate a protocol’s fully diluted market value vs. the amount in assets it has staked/locked.

Market Cap / TVL Ratio

The ratio of market capitalization to the total value locked of this asset. A ratio of more than 1.0 refers to its market cap being greater than its total value locked.

MC/TVL is used to approximate a protocol’s market value vs. the amount in assets it has staked/locked.

Circulating Supply

The amount of coins that are circulating in the market and are tradeable by the public. It is comparable to looking at shares readily available in the market (not held & locked by insiders, governments).

Total Supply

The amount of coins that have already been created, minus any coins that have been burned (removed from circulation). It is comparable to outstanding shares in the stock market.

Max Supply

The maximum number of coins coded to exist in the lifetime of the cryptocurrency. It is comparable to the maximum number of issuable shares in the stock market.

Max Supply = Theoretical maximum as coded

Note: the information above is also available via tooltip on the Coin page.

Pro Tips: pro geckos sometimes compare the ratios listed above between 2 or more coins, to determine which coin is relatively under- or over-valued

How can I use the supply information?

Why is certain data not available on a Coin page?

You may not be able to view certain information like Total Value Locked (TVL), because these are only applicable to DeFi protocols like DEX (decentralized exchanges), yield farming, and lending protocols.

If you’re wondering why some coins do not have market capitalization data, this is because such information is left blank by default, and will only be approved for display once our team has conducted certain due diligence.

If you have more questions about the data, feel free to take a look at our Methodologies, FAQ, and Help Center page.

The right side contains useful links for the coin project:

Blockchain explorer*

Category tags – this is where you can easily find other similar coins that fall under the same category.

*But Sir? If you don’t know what a MetaMask contract is, and are not familiar with DeFi, fret not! Our team authored the first & best-selling ‘How To DeFi’ books for beginners like you! https://landing.coingecko.com/how-to-defi/ ← you can get this eBook by signing up for an account and claiming it through Candy Rewards! More on this below.

Some key actions that you can do here:

(A) Use the currency converter to convert to your local currency.

(B) Save Price Alert for a coin to notify you with a web browser or mobile app notifications. Pro geckos use this to alert them for key metrics such as liquidation thresholds.

(C) Add a coin into Portfolio by clicking the Star button, so that you can keep track of all the coins in one place. Tips: you may create multiple portfolios for different purposes, such as general watchlist, long-term hodl investment, memecoin, or ROI simulation (with fake transactions).

2.2 Lower Part:

Here are some tabs that you find above the chart.

Name

What it does

Markets

Full list of exchanges that trade the coin

Chart

View the Price chart in expanded view

Historical Data

View and export historical price data

Social

Metrics on social media users & followers

Security

Security audit, review, bugs bounty, and insurance coverage

Developer

Widgets

Some handy price widgets to embed on your site

Here you will notice a price chart, which you may switch between different dates to view the price movements.

Beneath the chart is a very handy table to let you know how the coin price performed in the past 1 hour, 24 hours, and up to 1 year. ← another Gecko’s screenshot favourite!

Why show BTC and ETH on the price chart?

Some pro geckos love to compare a coin’s price movement against BTC and ETH, with many experienced traders moving their holdings between BTC, ETH, and altcoins to adjust their trading strategy across different market cycles.

Example below: by plotting ETH (red line) on the chart, it helps users to understand whether UNI coin performed better or worse than ETH in the past 1 year. The red line (UNI price, denominated in ETH) was going upward from January to March 2021, indicating that UNI had greater price growth performance than ETH during this period, and started losing out to ETH in April 2021.

Below you will be able to find out: which exchange allows you to trade the coin, at what price point, and which market pair (e.g. UNI/USDT = buy UNI with USDT) is available.

Pro Tips: pro geckos sometimes use this section to check whether a coin is listed on major exchanges like Binance. If not, the coin may have a high growth potential to be adopted by more traders later. On the flip side, it is also common for a coin to experience high sales pressure (and the price goes down) after being listed on a famous exchange.

At the bottom, you will find the description of the coin, and also relevant news and guides.

3. Looking for ways to explore more coins? Here’s what you can do:

3.1 Categories

Find out the full list of coins under certain hot categories like metaverse, NFT, GameFi, and more! You may save your favourite category with our Custom Tab feature too.

3.2 Large Movers

View the largest price gainers and losers in recent, or up to 1 year ago!

Quiz & Answer: do you know how much Shiba Inu’s price has gone up in the past 365 days? It’s 59180218.7% (on 27 Dec 2021)

3.3 Recently Added

The latest coins listed on CoinGecko! Hidden low cap gem?

3.4 Discover more coins under our Discover page.

If you’re interested to know which Coins are currently trending in certain countries like the United States and the Philippines, you may get the answers on this page too.

3.5 Exchanges

If you’re already using a (centralized or decentralized) crypto exchange or are considering using a new exchange, you can find out which coins are available for trading there, its liquidity and trust score.

Pro Tips: If a user is undecided between 2 exchanges to trade a coin, pro geckos would go with the one with higher liquidity or trust score.

While anyone can access all the price and market data on our website, here are some benefits that geckos love by signing a FREE account with us.

4.1 Claim free Candy for rewards

Sign up for your free account now before missing out on more free candies & rewards like ebooks, NFTs, discounts, and more!

4.2 Track P/L or coin research with Portfolio

Other than using it to record your actual investment across centralized exchanges and DeFi, you may also use the portfolio as your Watchlist. That being said, you don’t have to put in real money to start your crypto investment learning & research journey! Some users add ‘virtual’ transactions to simulate potential Profit and Loss on certain coins.

Tips: you can create multiple portfolios for different purposes! And don’t forget to sync your portfolio and price alert across the web and mobile app.

5. Wanna improve your crypto knowledge?

Here’s what you can do:

Subscribe to our daily newsletter, and join over 100,000s Geckos!

Learn from our crypto guides and analysis on CoinGecko Learn.

Read our quarterly report to learn about recent trends.

Read the latest news on our site. may do so with our Mobile App too!

Join our Premium plan to be in the same group chat with our in-house analysts.

Gain insights from industry leaders through CoinGecko Podcast.

We wanna learn from you too, if you have any feedback to improve CoinGecko products, just shoot us an email: hello+product@coingecko.com

Congratulations on finishing this guide, WAGMI!

Need a quick summary and can’t wait to try these out? We’ve got you covered, please refer to the TL,DR checklist at the top of this article.

Is this the best 10 minutes you spent to kickstart your crypto journey? RT @coingecko on Twitter to let us know!

When one shares, everyone wins. Share with those who need a read of this too!

Till then, see you on the moon, I mean.. cryptoverse..

If you find this article helpful, do check out our video guide on how to use CoinGecko App like a pro!

CoinGecko

Did you know the gecko also does some writing here? Hope you enjoy his writing. Follow the author on Twitter @coingecko

CoinGecko Debuts World-First DeFi Book with Launch of “Earn” Section

It is with great pleasure and excitement that we announce the release of a new section on CoinGecko called CoinGecko Earn and the publication of the world-first Decentralized Finance (DeFi) book titled How to DeFi.

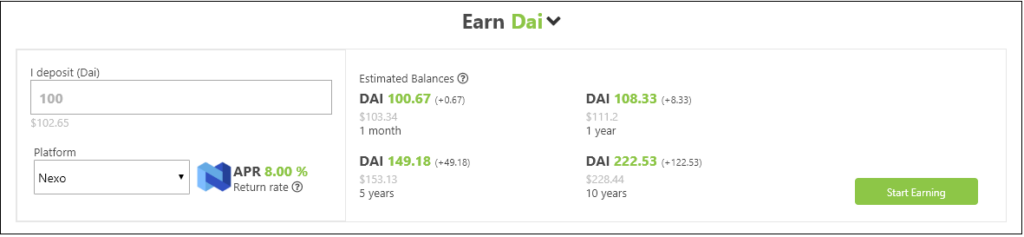

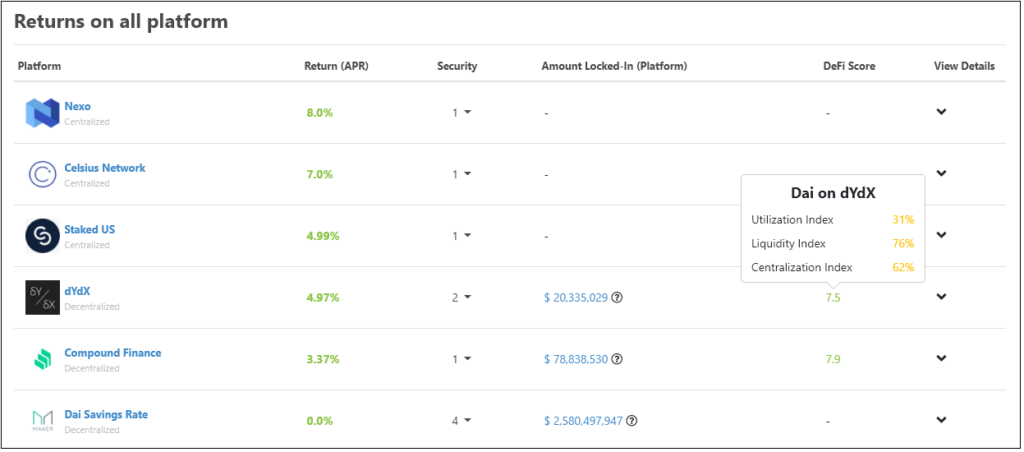

CoinGecko Earn

CoinGecko Earn, as the name suggests, will provide you with an overview on the returns on various cryptocurrency lending/staking platforms. In addition to returns, CoinGecko Earn will also provide you with additional data (where available for both centralized and decentralized platforms) to also display security audit records, DeFi risk scores and more.

Here’s a brief overview on two of the key features of CoinGecko Earn:

(i) Annual Percentage Return (APR) Calculator – This calculator helps you to visualize how much you can potentially earn if you use this lending platform after 1 month, 1 year, 5 years, and 10 years.

(ii) Overview – This section covers the following data:

With return rates on over 50 cryptocurrencies and platform details on both centralized and decentralized cryptocurrency lending platforms, CoinGecko Earn is the most comprehensive cryptocurrency interest rate site. We believe that the crypto space is filled with opportunities, and it would be a pleasure for us to unlock that value for you through data.

How to DeFi Book

Together with the launch of CoinGecko Earn, we are also releasing “How to DeFi”, the first-ever book published covering the DeFi ecosystem. Packed with concise and comprehensive step-by-step guides on getting started with the various DeFi applications, this book will both serve as a great introductory material to newcomers to the space, as well as reference material for the seasoned veterans.

You can download our book on CoinGecko and also on Amazon. Do leave us a 5-star rating on Amazon after reading our book.

Closing Remarks

In our mission to democratize access to crypto data, we consider the release of our CoinGecko Earn section and How to DeFi book a huge step forward in making DeFi accessible to a more mainstream audience. Both of these products will be invaluable to users looking to make returns from their assets, or simply to learn their way around in this new, decentralized financial system.

This release is a reflection of our continued dedication to the DeFi sector, as we have done previously by collaborating with decentralized data oracles, ChainLink and Band Protocol by providing our cryptocurrency market data that powers their oracles.

As always, we remain committed to delivering data in actionable formats to help you make informed decisions. Thank you once more for your time, and we hope you’ve enjoyed reading about this release as much as we have creating them!

CoinGecko Earn and How to DeFi book can be accessed at the following links:

For beginners wanting to learn more about decentralized finance, CoinGecko’s ‘How to Defi’ provides an accessible entry point.

Decentralized Finance (DeFi) is certainly the buzz-phrase in the cryptocurrency world right now. But although we are hearing more and more about the potential of this technological breakthrough to revolutionize the world of traditional finance, many are still unsure of what DeFi actually involves.

CoinGecko has just released its very first book, called ‘How to DeFi’. This book aims to provide an easy entry point for those wanting to learn about the subject.

Why to DeFi

After an obligatory slew of quotes from industry figures, recommending the book as the ideal starting point from which to enter the world of DeFi, we get straight into why it matters.

The three areas in which DeFi currently aims to improve on centralized banking structures are cost and speed of remittance payments, providing financial services without censorship (including to the 1.7 billion global unbanked), and transparency of governance.

After explaining what DeFi is, the book lists the categories of financial service currently available through it. From stablecoins, lending and borrowing, through exchanges, derivatives and fund management, to lotteries, payments and insurance, every aspect of the current DeFi ecosystem is covered.

How to DeFi

Part Two of the book explains the workings of the Ethereum network, as the most popular platform for DeFi applications. Smart contracts, Ether, and Gas are explained, before looking at the pros and cons of decentralized apps (Dapps).

Finally, different wallet types are compared, with a step-by-step walkthrough of getting up and running on both mobile wallet Argent, and Metamask for desktop. All that done, we move on to Part Three, the deep dive.

Each of the aforementioned categories of DeFi service are given a full chapter, focussing on one or two key providers in each case. We learn about stablecoins through the example of the MakerDAO platform, Compound is used to illustrate loans, decentralized exchanges (DEx) are explained using Uniswap and dYdX, and so on.

Each chapter gives an overview of the services available, with diagrams helping to explain some of the trickier concepts. It then explains how the service works on the chosen example platform, along with a step-by-step guide for those who feel compelled to jump straight in.

The target audience of the book is DeFi beginners, so some of the finer details of the chosen platforms are left out, but the level is generally pitched about right. Does a DeFi novice, for example, really need to know the intricacies of the Maker Protocol’s incentive scheme, or is the fact that it is soft-pegged to the dollar knowledge enough?

Whether to read

While the earlier chapters do a great job of leading a beginner into the world of DeFi, with a wealth of explanations and diagrams, later chapters seem to assume some existing knowledge of the subject.

For example, the chapters on derivatives and fund management will be more useful to those who already understand these concepts in traditional finance. Although, it is perhaps wise not to encourage a beginner to let loose with leveraged derivatives trading, so that may not be a bad thing.

The final challenge was the ‘Dad test’; i.e. could my father, a man in his seventies with only a very basic knowledge of cryptocurrency, gain a reasonable understanding of DeFi, simply through reading this book? I received this message when he was around 50 pages in:

“. although I don’t understand everything I have enjoyed reading it. It is written in a very easy style that I think most people who are interested in the subject would be able to follow.”

Of course, my dad isn’t exactly the book’s target audience, but he still found the information accessible, and felt that someone with a greater background knowledge of cryptocurrency would get more from it. He also liked the step-by-step walkthroughs showing how to perform certain functions on the platforms featured.

The book is certainly well written and thoroughly researched, with links to references used, suggested further reading, and a glossary of terms at the very end.