How to read stock charts

How to read stock charts

How to Read Stock Charts for Beginners (Ultimate Guide)

How to Read Stock Charts: Key Takeaways

Beginner traders MUST learn how to read stock charts to find success in the market. The learning process can be slow, but, to me, it’s so rewarding. Let’s dig in. Keep reading for what you need to know when it comes to reading stock charts.

Table of Contents

How to Read Stock Charts: Why Use Stock Charts?

Carpenters use hammers, surgeons use scalpels, and most stock traders use charts … These are the basic tools of the trade.

Don’t overlook stock charts. They’re basic tools, but they can be highly powerful. Traders use them to understand stock price action and help them make more intelligent, better-informed trades.

Here are some of the things a stock chart can show you:

Many traders base their trading decisions on stock charts. So it’s important for every trader to know how to read stock charts.

How to Read Stock Charts: What’s on a Stock Chart?

Here’s a quick breakdown…

Price

Price is the most basic thing you’ll find on almost every chart.

The y-axis (vertical) represents the stock price, and the x-axis (horizontal) represents time…

On a line chart, price is plotted at points where the stock traded at specific points.

On a bar or candlestick chart, the open, high, low, and close display for a specific period (such as a five-minute period).

Trading Volume

Amazon (NASDAQ: AMZN) chart with volume at the bottom (Source: StocksToTrade.com)

That tells you how much of a stock traded at a certain period and at what price. This can help you determine which price levels may excite traders to enter and exit trades.

Volume often displays in vertical bars at the bottom of the chart. For example, a horizontal volume bar below a five-minute candle will tell you how many shares traded in that five-minute period.

Technical Indicators

Once you have a chart that shows price and volume, you can add technical indicators.

There are many technical indicators. They can show you price momentum, trends, and more. Here’s a breakdown of a popular technical indicator…

The Volume-Weighted Average Price (VWAP) Indicator

Amazon (NASDAQ: AMZN) 5-minute chart with VWAP (Source: StocksToTrade.com)

Day traders like the volume-weighted average price (VWAP) indicator. VWAP is a line on a chart that looks like a moving average. But the VWAP line represents the price at which the majority of volume was traded on a stock.

This can show whether traders who recently entered positions are currently in a profit or a loss. And that can indicate whether these traders should exit their positions, which may cause the price to fluctuate.

There are many ways to use the VWAP. The general idea is that it can help you stay on the right side of market momentum.

How to Read Stock Charts for Beginners

In simple terms, a stock chart is a graph of a stock’s price and trading volume.

Charts help you see patterns. And that can be an aid in determining how the stock price might move next.

There are TONS of different stock charts, but let’s narrow our focus. Here are a few examples…

The Line Chart

Amazon (NASDAQ: AMZN) line chart (Source: StocksToTrade.com)

The line chart is the most basic view of a stock price. The price is plotted at certain points at certain times on the chart. These points connect to form a line.

Eventually, when you have enough price points, you have a basic line that zigzags and trends depending on price action. Traders don’t generally use line charts.

A lot of traders use the following two chart types — let’s check ‘em out.

The Bar Chart

Amazon (NASDAQ: AMZN) bar chart (Source: StocksToTrade.com)

Bar charts show the stock price open, high, low, and close in a specific period:

The period an individual bar represents can vary. On a five-minute chart, each bar represents five minutes. On a daily chart, each bar represents the price action of a single trading day.

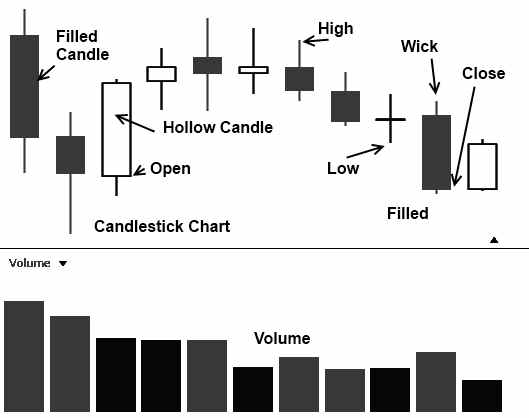

The Day Trader’s Favorite: Candlestick Charts

Amazon (NASDAQ: AMZN) candlestick chart (Source: StocksToTrade.com)

Candlestick charts are similar to bar charts but show price action differently. Lots of traders love these charts because they’re rich in information.

Why are they called candlestick charts? Well … Because their shape looks like a candlestick!

The body is the candle and represents the difference between the open and close.

And the small lines above and below the body are called wicks. The end of each wick represents the high and low prices.

Daily vs. Weekly Charts

Daily charts are important for day traders … You want to know whether a stock looks bullish or bearish for the short term. The patterns in this post can help you spot bullish and bearish trends.

Weekly charts cut out some of the weird stuff that can happen in a single day. This helps you better key in on the setup and trend.

Both offer useful information. How did the stock close yesterday? What happens the morning after a poor close and vice versa?

How to Read Stock Charts: Common Chart Patterns for Traders

There are a lot of patterns to learn while figuring out how to read stock charts. I think these six are MUSTS for beginning traders…

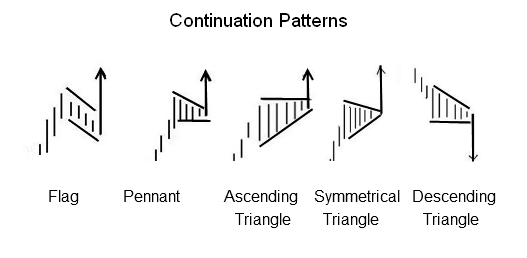

Triangles (Ascending and Descending)

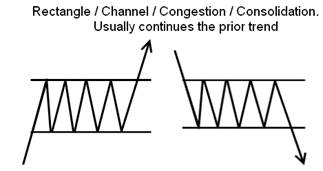

Ascending and descending triangle patterns are pretty easy to learn and very useful for trading … Just make a triangle!

A stock’s typically gearing toward a run when the top line is horizontal and the bottom line is ascending. On the flip side, the stock could tumble if the bottom line is horizontal and the top is descending.

There can also be a ‘symmetrical triangle,’ which could go in either direction. The stock typically moves BIG when it decides which direction to go…

The Walt Disney Company (NYSE: DIS) candlestick chart (Source: StocksToTrade.com)

Head and Shoulders

The head and shoulders pattern is good for determining when a trend might reverse.

The pattern works like this:

The stock forms a support level called the neckline. The support will likely fail after the second shoulder forms, sending the stock into a downtrend.

NIKE, Inc. (NYSE: NKE) head and shoulders pattern (Source: StocksToTrade.com)

There’s also the inverse head and shoulders. The two shoulders peak higher than the head. This is an uptrend pattern. The stock heads higher after the second shoulder forms.

Amazon (NASDAQ: AMZN) inverse head and shoulders pattern (Source: StocksToTrade.com)

Cup and Handle

This is a pattern for patient traders…

A stock’s rejected at resistance and falls. It slowly climbs up and meets resistance once again. This forms a U shape.

The stock will once again become rejected at resistance. Its fall is much shorter this time, forming the handle. It climbs again and finally breaks through resistance.

Intuitive Surgical, Inc. (NASDAQ: ISRG) cup and handle pattern (Source: StocksToTrade.com)

Wedge

The wedge is similar to the triangle. But the trend lines often suggest a reversal…

Volume can fizzle on the way up and lose steam, giving into sellers.

Amazon (NASDAQ: AMZN) wedge pattern (Source: StocksToTrade.com)

It happens the other way, too. The stock can become oversold and start churning upward.

You may hear me talk about a stock gapping up a lot. This is an interesting part of a chart often due to news or earnings reports.

A gap is a literal gap between two price points. This happens if the opening price is significantly higher or lower than the previous day’s close.

These trends don’t usually reverse quickly. Sometimes you have to hang around and determine whether the stock can support its higher price. Oversold stocks can also fight back if the market overreacted…

Amazon (NASDAQ: AMZN) chart gap (Source: StocksToTrade.com)

Basic Volume Patterns

Volume and price action both matter when trying to determine where the stock’s going next…

Common Technical Indicators That Can Help

Here are a few technical indicators to help you while learning how to read stock charts…

Bollinger Bands

Bollinger Bands are tied to moving averages but make it easier to see where a stock might be heading.

They can signal a move in either direction when the top and bottom bands close in.

Amazon (NASDAQ: AMZN) Bollinger Bands (Source: StocksToTrade.com)

Moving Averages

Amazon (NASDAQ: AMZN) chart with a 20-period moving average (Source: StocksToTrade.com)

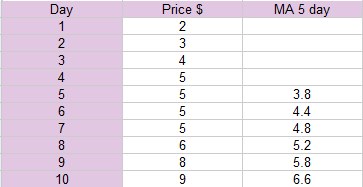

Moving averages are technical indicators.

A moving average is a line on the chart that shows the average price for a specific period.

For example, you can use a 20-period moving average on a daily bar chart. That takes the previous 20 days’ prices and averages them. This smooths out the price movements and can show you a price trend’s direction.

How you use the moving average all depends on your trading strategy…

Average Directional Index (ADX)

Average directional index is a good indicator to help determine a trend’s strength.

Like most indicators, it should be paired with analysis. Don’t rely on it alone.

Trends can reverse quickly. ADX can sometimes make it seem like a trend is stronger than it is.

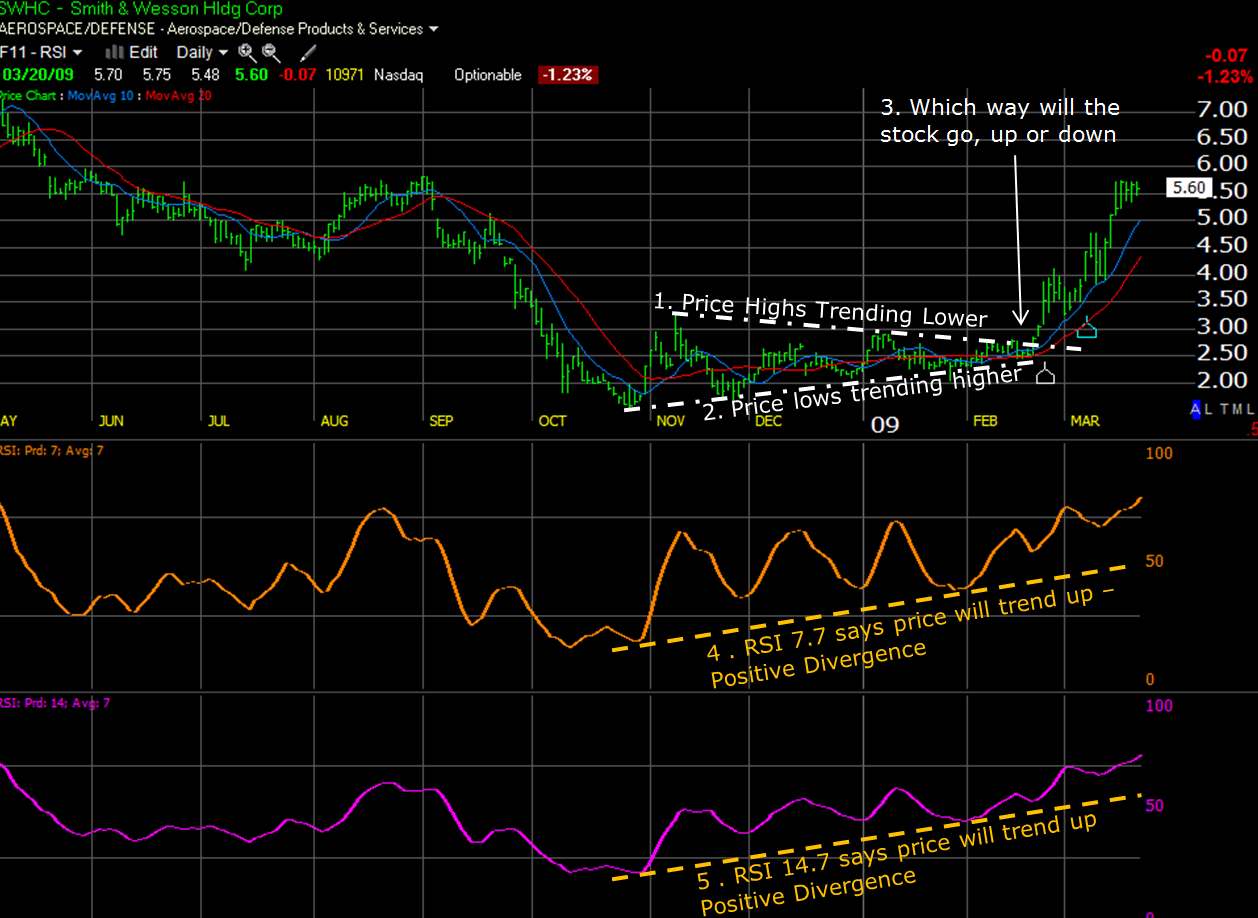

Relative Strength Index

Relative strength index can help determine a stock’s strength or weakness … Traders often use it to determine whether a stock’s overbought or oversold.

The indicator reads between 0 and 100. A stock is generally considered overbought when RSI is over 70 and oversold when it’s under 30.

A stock can go above 70 or below 30, so don’t rely on just RSI for entry/exit decisions.

Amazon (NASDAQ: AMZN) chart with RSI indicator (Source: StocksToTrade.com)

On-Balance Volume (OBV)

This measures the positive and negative flow of volume.

Financial writer Joseph Granville created this indicator in 1963. He felt that dramatic changes in volume without much price action would help predict a significant change in the price…

Some see OBV as useful for spotting upward or downward trends.

How to Identify Support and Resistance Levels

Support and resistance levels are key to understanding a stock’s future action.

A stock finds support at price levels that it doesn’t drop below. A stock has established support when it consistently hits a price point and jumps higher.

It will go lower to establish new support if the original level doesn’t hold up.

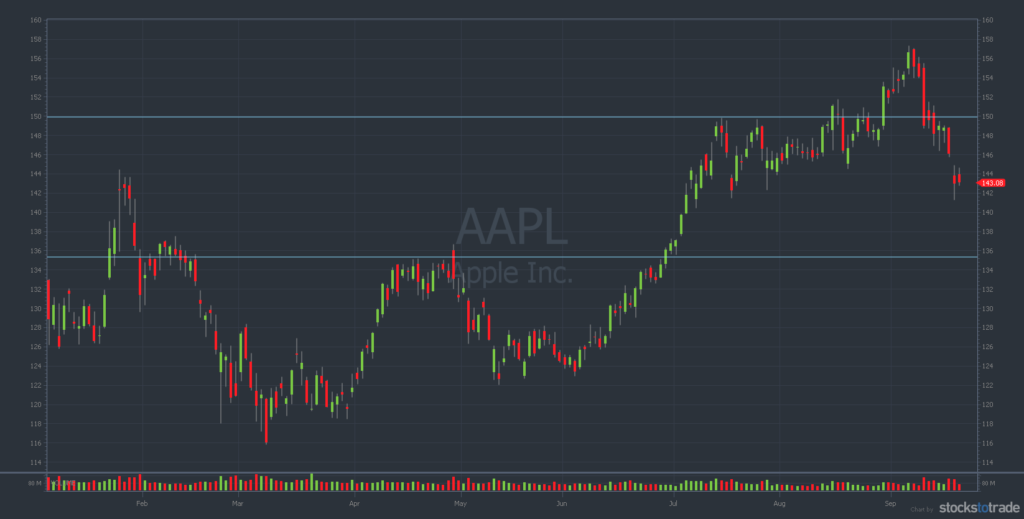

Apple (NASDAQ: AAPL) chart with lines to signify support levels (Source: StocksToTrade.com)

Support levels can also become resistance levels … This is when a stock tries to push higher but struggles to break past a certain price point.

Apple (NASDAQ: AAPL) chart with resistance levels (Source: StocksToTrade.com)

Stock Market Trends: How to Identify Trends on Charts?

The trends and indicators above can help you identify where a stock may be heading.

These trends are well-known and highly used for a reason … They’re legit! Learn them.

But remember there are no guarantees. Trends can break down or not turn out as you expect. It’s all part of the process.

Frequently Asked Questions About How to Read Stock Charts

These are common questions from learning how to read stock charts…

How Do You Pick a Stock Based on a Stock Chart?

Use reliable methods for identifying trends. You can take action or move on once you establish whether a stock’s bullish or bearish.

What Are the Best Stocks to Buy for Beginners?

There’s no one size fits all in trading. Start learning, then stick with what works for you. When you’re ready, move on to something outside of your comfort zone.

What’s the Best Stock to Buy Right Now?

I look for big percent gainers with high volume and a catalyst. That changes every day. That’s why you need to think for yourself and build solid watchlists.

What Numbers Should You Look at When Buying Stocks?

If you’re a beginner, focus on price targets. Set your entry, exit, and risk. When you’re ready, you can add in more factors.

How to Read Stock Charts: Learn More

Reading stock charts is a fundamental skill that traders develop and refine over their careers.

One effective way to learn how to read stock charts is by watching real-time price action. That’s why it’s important to have a trading platform with great charting features.

You also need to know what to look for on a chart.

StocksToTrade and Learning How to Read Stock Charts

What’s the most important thing to have if you want to learn to read charts? That’s easy — access to stock charts!

Check out StocksToTrade, an all-in-one stock trading and research platform.

We have awesome charting capabilities and countless other features that can make your trading day so much easier. We have plenty to offer traders — powerful scans, great watchlist features, live news feeds, social media activity, and more.

Don’t just take our word for it … Check it out for yourself. Start your trial of StocksToTrade today!

How to Read Stock Charts: Conclusion

I just gave you a lot to digest. But it’s all important to know.

We teach preparation here at StocksToTrade. That’s why I go live with Pre-Market Prep every trading morning at 8:30 Eastern. Knowing how a chart is shaping up can be the difference between joining the action and missing out.

Do the work. Learning how to read stock charts will help you determine your best trading plans.

What’s your go-to stock chart? How do you use indicators? I’d love to hear your process — share your comments below!

One Platform. One System. Every Tool

Interested in trying the number 1 trading platform? Get started risk free.

Learning and testing different strategies is essential to your trading education… There are plenty of ways to make.

In the current market, it’s more difficult to find great stocks to trade and execute your plan… Stocks are.

On Friday we had multiple biotech penny stock runners… I hated all of them except one. And that brings me to an.

Leave a Comment Cancel reply

Comments

thank you, short but valuable explanation of charts

Glad you liked it!

thank you so much for short but valuable explanation of charts

Option Strategies Insider

The article was short but good job, you explain it well. Thank you for sharing.

Wow really I appreciate all this information this will help me in my process to be a day trader as well to others tks. So much.

** Results not typical or guaranteed. Past performance is not indicative of future returns and financial investing isinherently risky. All content is provided subject to the qualifications and limitations set forth in ourTerms of Service and Use.

This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. No information herein is intended as securities brokerage, investment, tax,accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

StocksToTrade cannot and does not assess, verify or guarantee the adequacy, accuracy orcompleteness of any information, the suitability or profitability of any particular investment,or the potential value of any investment or informational source. The reader bears responsibility forhis/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment,and investigate and fully understand any and all risks before investing.

should seek the advice of a qualified securities professional before making any investment,and investigate and fully understand any and all risks before investing.

How to Read Stock Charts

A comprehensive guide to stock charts

How to Read Stock Charts

If you’re going to actively trade stocks as a stock market investor, then you need to know how to read stock charts. Even traders who primarily use fundamental analysis to select stocks to invest in still often use technical analysis of stock price movement to determine specific buy, or entry, and sell, or exit, points.

Stock charts are freely available on websites such as Google Finance and Yahoo Finance, and stock brokerages always make stock charts available for their clients. In short, you shouldn’t have any trouble finding stock charts to examine.

Stock Chart Construction – Lines, Bars, Candlesticks

Stock charts can vary in their construction from bar charts to candlestick charts to line charts to point and figure charts. Nearly all stock charts give you the option to switch between the various types of charts, as well as the ability to overlay various technical indicators on a chart. You can also vary the time frame shown by a chart. While daily charts are probably the most commonly used, intraday, weekly, monthly, year-to-date (YTD), 5-year, 10-year, and a complete historical lifetime of a stock are also available.

There are relative advantages and disadvantages to using different chart construction styles and to using different time frames for analysis. What style and time frame will work best for you as an individual analyst or investor is something that you can only discover through actually doing stock chart analysis. You can glean valuable indications of probable stock price movement from any stock chart. You should choose the chart style that makes it easiest for you to read and analyze the chart, and trade profitably.

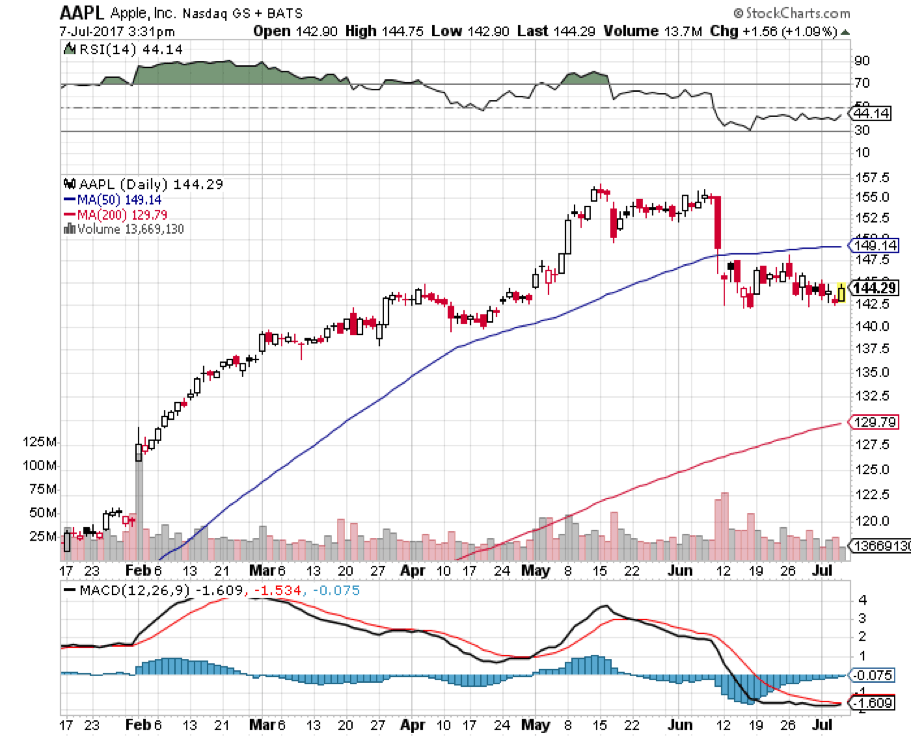

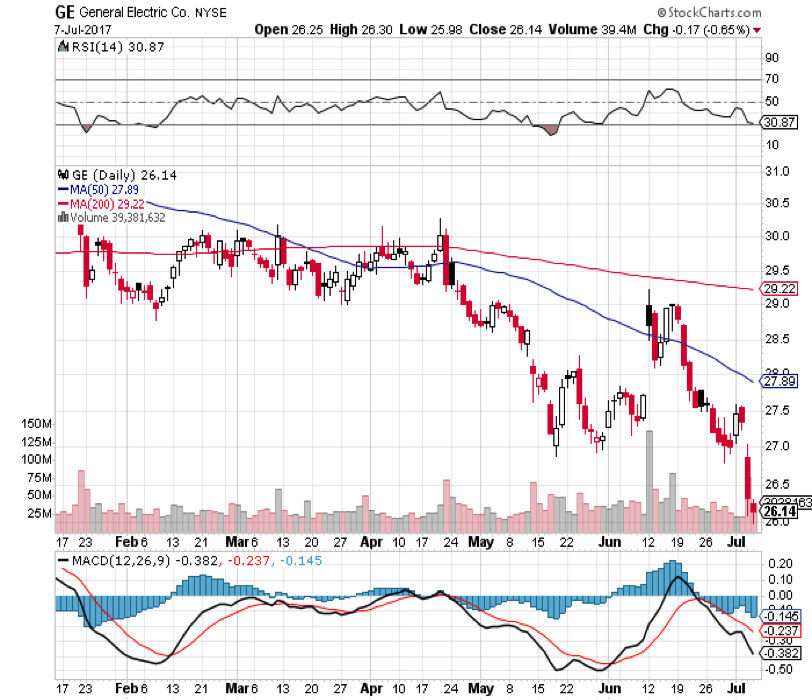

Looking at a Stock Chart

Below is a year-to-date daily chart of Apple Inc. (AAPL), courtesy of stockcharts.com. This chart is a candlestick chart, with white candles showing up days for the stock and red candles showing down days. In addition, this chart has several technical indicators added: a 50-period moving average and a 200-period moving average, appearing as blue and red lines on the chart; the relative strength indicator (RSI) which appears in a separate window above the main chart window; the moving average convergence divergence indicator (MACD) which appears in a separate window below the chart.

The Importance of Volume

Volume appears on nearly every stock chart that you’ll find. That’s because trading volume is considered a critical technical indicator by nearly every stock investor. On the chart above, in addition to showing the total level of trading volume for each day, days with greater buying volume are indicated with blue bars and days with greater selling volume are indicated with red bars.

The reason that volume is considered to be a very important technical indicator is a simple one. The vast majority of stock market buying and selling is done by large institutional traders, such as investment banks, and by fund managers, such as mutual fund or exchange-traded fund (ETF) managers. When those investors make major purchases or sales of a stock, it creates high trading volume, and it is that kind of major buying and selling by large investors that typically move a stock higher or lower.

Therefore, individual or other institutional traders watch volume figures for indications of major buying or selling activity by large institutions. This information can be used either to forecast a future price trend for the stock or to identify key price support and resistance levels.

In fact, many individual investors determine their buying and selling decisions almost solely based on following the identified actions of major institutional traders. They buy stocks when volume and price movement indicate that major institutions are buying, and sell or avoid buying stocks when there are indications of major institutional selling.

Such a strategy works best when applied to major stocks that are generally heavily traded. It will likely be less effective when applied to stocks of small companies that are not yet on the radar screens of large institutional investors and that have relatively small trading volumes even on days when the stock is more heavily traded than usual.

Basic Volume Patterns

There are four basic volume patterns that traders typically watch as indicators.

High volume trading on Up Days – This is a bullish indication that a stock’s price will continue to rise

Low volume trading on Down Days – This is also a bullish indication since it indicates that on days when the stock’s price falls back a bit, not many investors are involved in the trading. Therefore, such down days occurring in an overall bull market are commonly interpreted as temporary retracements or corrections rather than as indicators of future significant price movement.

High Volume Trading on Down Days – This is considered a bearish indicator for a stock, as it shows that major institutional traders are aggressively selling the stock.

Low Volume Trading on Up Days – This is another bearish indicator, although not as strong as high volume trading on down days. The low volume tends to peg the trading action on such days as less significant and usually evidence of just a short-term counter-trend retracement upward in an overall, long-term bearish trend.

Using Technical Indicators

In analyzing stock charts for stock market investing, investors use a variety of technical indicators to help them more precisely probable price movement, to identify trends, and to anticipate market reversals from bullish trends to bearish trends and vice-versa.

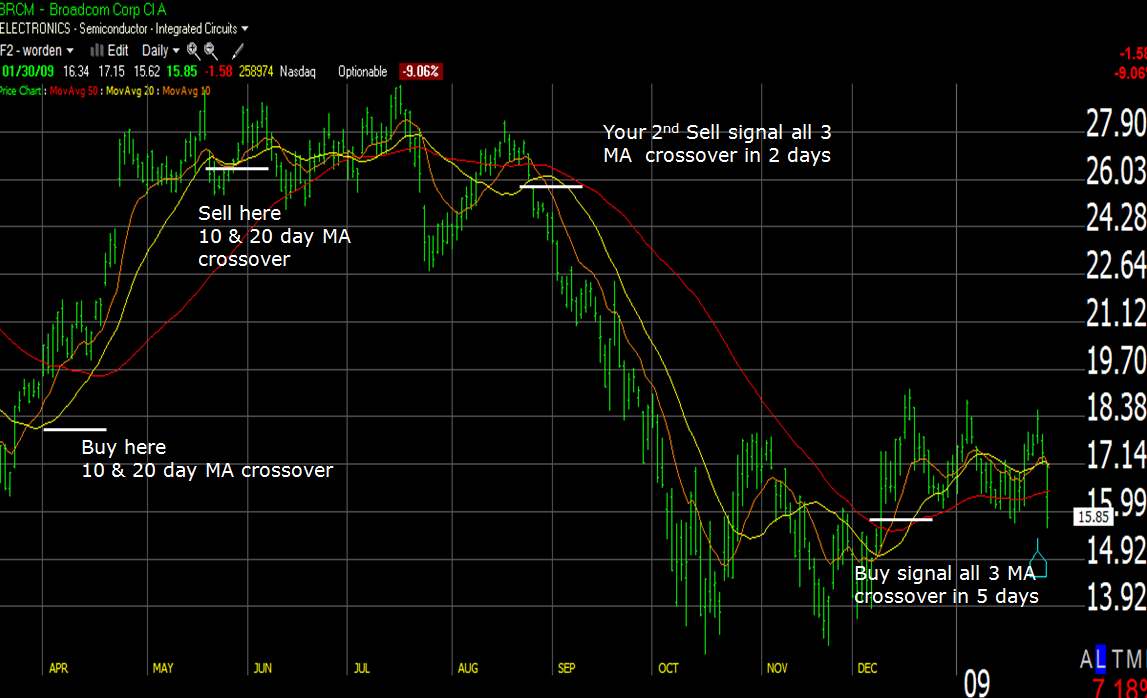

One of the most commonly used technical indicators is a moving average. The moving averages that are most frequently applied to daily stock charts are the 20-day, 50-day, and 200-day moving average. Generally speaking, as long as a shorter period moving average is above a longer period moving average, a stock is considered to be in an overall uptrend. Conversely, if shorter term moving averages are below longer term moving averages, then that indicates an overall downtrend.

The Importance of the 200-Day Moving Average

The 200-day moving average is considered by most analysts as a critical indicator on a stock chart. Traders who are bullish on a stock want to see the stock’s price remain above the 200-day moving average. Bearish traders who are selling short a stock want to see the stock price stay below the 200-day moving average. If a stock’s price crosses from below the 200-day moving average to above it, this is usually interpreted as a bullish market reversal. A downside cross of price from above the 200-day moving average is interpreted as a bearish indication for the stock.

The interplay between the 50-day and 200-day moving averages is also considered as a strong indicator for future price movement. When the 50-day moving average crosses from below to above the 200-day moving average, this event is referred to by technical analysts as a “golden cross”. A golden cross is basically an indication that the stock is “gold”, set for substantially higher prices.

On the flip side, if the 50-day moving average crosses from above to below the 200-day moving average, this is referred to by analysts as a “death cross”. You can probably figure out on your own that a “death cross” isn’t considered to bode well for a stock’s future price movement.

Trend and Momentum Indicators

There is virtually an endless list of technical indicators for traders to choose from in analyzing a chart. Experiment with various indicators to discover the ones that work best for your particular style of trading, and as applied to the specific stocks that you trade. You’ll likely find that some indicators work very well for you in forecasting price movement for some stocks but not for others.

Technical analysts often use indicators of different types in conjunction with each other. Technical indicators are classified into two basic types: trend indicators, such as moving averages, and momentum indicators, such as the MACD or the average directional index (ADX). Trend indicators are used to identify the overall direction of a stock’s price, up or down, while momentum indicators gauge the strength of price movement.

Analyzing Trends

When reviewing a stock chart, in addition to determining the stock’s overall trend, up or down, it’s also helpful to look to identify aspects of a trend such as the following:

Identifying Support and Resistance Levels

Stock charts can be particularly helpful in identifying support and resistance levels for stocks. Support levels are price levels where you usually seeing fresh buying coming in to support a stock’s price and turn it back to the upside. Conversely, resistance levels represent prices at which a stock has shown a tendency to fail in attempting to move higher, turning back to the downside.

Identifying support and resistance levels can be especially helpful in trading a stock that tends to trade within an established trading range over a long period of time. Some stock traders, having identified such a stock, will look to buy the stock at support levels and sell it at resistance levels over and over again, making more and more money as the stock traverses the same ground multiple times.

Conclusion – Using Stock Chart Analysis

Stock chart analysis is not infallible, not even in the hands of the most expert technical analyst. If it were, every stock investor would be a multi-millionaire. However, learning to read a stock chart will definitely help turn the odds of being a successful stock market investor in your favor.

Stock chart analysis is a skill, and like any other skill, one only becomes an expert at it through practice. The good news is that virtually anyone willing to work diligently at analyzing stock charts can become, if not an outright expert, at least pretty good at it – good enough to improve their overall profitability in stock market trading. Therefore, it’s in your best interest as an investor to begin or continue your education in stock chart analysis.

Additional Resources

Thank you for reading CFI’s guide on How to Read Stock Charts. To keep learning and advancing your career, the following resources will be helpful:

How to Read Stock Charts

Want to claim 6 FREE stocks? Head over to Webull to get started.

In today’s financial world, the saying “knowledge is power” applies more to investors and traders than ever before. Understanding how to read stock charts is an important part of technical analysis and has become virtually essential for any risk-taker looking to achieve long-term success in the financial markets. For example, it helps to know how to read Robinhood charts if you’ve put all your eggs in the Robinhood basket. Moreover, understanding a range of charts helps you see more aspects of the market that the average retail trader would not see.

For traders, knowing how to read stock charts and interpret their data opens up various intraday and swing trading opportunities. Investors can also quickly peruse a chart to assess how a stock has performed over a specific period of time to understand better how the stock might perform in the future. If you’re new to trading or investing, learning how to read a stock chart as part of technical analysis can provide a solid foundation for forecasting future price action even in turbulent times.

What are Stock Charts?

A stock chart is a graphic depiction of the price of a stock and how its price has changed over a certain period. It’s generally drawn on a grid and provides detail on the current price and historical price changes. At the same time, it can also include information such as volume and the company’s financial information. The chart’s horizontal or X-axis shows the dates of price observations in an order further from the present as you move your eyes left.

The chart’s vertical or Y-axis shows the price level of the stock that increases when looking upward and decreases when looking downward. A stock chart will often include technical indicators in a box below the price action as well as price action overlays like a moving average (MA) of the price taken over a certain number of days.

This example of a stock chart depicts the price of Apple Inc. (AAPL) over the past year. It includes a 20-period MA drawn in red and superimposed over the price action, as well as blue dots from the parabolic SAR indicator that gives trading signals intended to reflect short-term accumulation and distribution activity in the stock. The trading volume figures per period appear in light red and green along the bottom of the chart, with their 20-period MA shown in orange. The circled E and D letters along the bottom represent the ex-dividend and dividend payment each quarter for the stock.

Most stock charts depict the price of a stock in these basic ways:

Line charts: This straightforward type of chart shows the price, as, you guessed it, a line, at any given point during its trading day, typically the closing price, with a single point. Each price point is connected to adjacent prices with lines.

Bar charts: The more sophisticated bar chart shows the range of the stock for the period charted by drawing a vertical line or “bar” from its high to its low price. A horizontal “flag” is then drawn to the left and to the right at the opening and closing stock price levels respectively.

Candlestick charts: Invented in Japan, the candlestick chart is packed with even more information than a bar chart. The color of each candlestick indicates whether the stock’s price closed up or down for the period. White and black or green and red are the most popular color schemes, with white or green for up periods and black or red for down periods.

The candle’s “body” shows the range of the stock price from open to close, while 2 wicks extend from the top and bottom of the candle’s body showing the upper and lower levels respectively of the stock’s price range. Interpreting candlestick charts according to the traditional Japanese system evolved over centuries of market observation lies outside the scope of this introduction. However, it is worth researching to help boost your forecasting abilities.

After reviewing the different types of stock charts, one thing becomes clear. An essential component of understanding how to read stock charts is knowing which chart you prefer.

Reading Trend Lines

Reading trend lines is a way to assess whether a price trend exists for a particular stock. Price trends are directional movements that consist of a set of higher highs and higher lows in a stock’s price.

Trend lines can be drawn between those highs and lows, and they can provide technical analysts with a quick visual assessment of whether a trend exists and to what degree.

Many analysts also use trend indicators along with drawing trend lines, such as the 200-, 50- or 20-period MA.

Reading Stock Splits

Stock splits generally occur when a stock has risen significantly enough to make the stock price too high for average investors to buy in round lots of 100 shares. Thus, the stock split makes the stock available to more investors and generally fuels more demand, often causing the stock price to gain after the split.

Stock splits and reverse stock splits are generally adjusted for on a stock’s price chart on the day the split occurs. You do not have to take splits into account when reading stock charts produced by professional charting services or trading platforms.

Reading Trade Volumes

The degree of interest that the market has in stock tends to appear in the stock’s trading volume numbers. Notable shifts in trading volume can offer a helpful indication to support a directional movement in the stock.

Keep a keen eye on volume figures since changes in the stock’s activity level can confirm breakouts from the classic continuation and reversal patterns technical analysts look for in a stock’s price — they can have predictive value.

If a stock’s price increases on a large amount of volume, for example, it’s probable that the stock will continue to rally and therefore tends to confirm the upward move. The same concept tends to hold if a stock declines on a large amount of volume. When stocks fall, volume tends to increase incrementally as stops are hit, which can further fuel the decline and can even cause a crash.

Stock Chart Terminology

In addition to the price information appearing on a stock chart, a number of other important fundamental stock data is often included with the graph. This information has considerable significance to stock traders and is referred to with specific terminology. Whether you came here to learn how to read Robinhood charts or uncover a few pointers, these terms are universal:

Online Brokers With the Best Stock Charts

Top online stock brokers generally provide excellent charts to their clients. In addition, a number of nonbroker websites like TradingView provide excellent stock charts free of charge. Benzinga has compiled a table of online brokers with the best stock charts below.

How to Read Stock Charts – Comprehensive guide

How to read stock market charts is often an important question faced by stock market investors, especially beginners. Stock investing requires a fundamental analysis of the company and a technical analysis of the stock price.

So, if you want to invest in the stock of a particular company, analyzing its financials, management team, competitive landscape, etc., can help you understand if the company can withstand economic volatilities.

Also, technical analysis that primarily includes reading stock charts, can help you look at how the stock price has reacted to market changes over time and identify trends that might help you make informed decisions.

As you can see, the basic chart offers a visual view of the performance of the stock price over a selected period along with the following information and options:

This basic view offers a quick glance at the price movement based on the demand and supply of the stock. For a more detailed analysis, you can click on the ‘Advanced’ option.

Advanced Stock Chart Options

When clicking on the ‘Advanced’ option, the following screen is displayed:

Here are the options and information available through this screen:

1. Stock Price

Right at the top of the screen, you can see the name of the stock and the current stock price. If you are looking at the chart after market hours, then it would display the stock price at the close of the previous trading day.

2. Time Period

At the bottom of the screen, you can select the period for which you want to check the performance of the stock. There are preset values here:

Each of these periods can be used based on the kind of research you are conducting with respect to the stock. For example, an intraday trader can select 1D or 1W to assess the stock’s recent performance and make trading decisions. However, long-term investors would want to look at 3-5 years to assess the performance of the stock across different market cycles.

3. Time Interval

Once you have selected the time period, you also need to select the interval at which you need the chart plotted. For example, if you select the time period as one day, then you need to determine if you want the data points to be plotted every minute, five minutes, ten minutes, 15 minutes, 30 minutes, one hour, or four hours. Here is a table of time intervals available per time period:

You can choose the time intervals based on how you want to analyze the stock’s performance.

4. Price

Let’s say that you choose a time period of one day and a time interval of five minutes. The stock chart will be plotted using price details for every interval. Hence, you will have four price points for each interval like opening price, closing price, highest price, and lowest price of the stock. This can be beneficial for traders as it can offer insights into the volatility of the stock price over a given period at every interval.

For example, you can look at the stock chart for the previous day with an interval of five minutes to gauge the volatility in price throughout the day. You can analyze for several days in succession and observe trends to make smart trading decisions.

5. Volume

Right below the price section, you have a clickable option to assess the volume of transactions of the said stock. As soon as you click it, a bar chart appears at the bottom of the chart area displaying the trading volume for the selected period. The height of the bar represents the volume. So, a taller bar means more volume and vice-versa. Here is a quick look at the volume section:

You can also see that the bars are colored – green and red. A green volume bar means that the stock closed higher in that interval compared to the previous interval’s close. A red volume bar means that the stock closed lower during the current interval compared to the previous interval’s close.

So, a tall green volume bar means an interval where the stock closed higher than the previous interval with high trading volumes – a sign of optimistic investor sentiment towards the said stock. It is important to remember that sometimes, there can be a difference in the colour of the volume bar and price bar/point/line. This can happen when the stock price is higher than the previous interval but has moved lower than the opening price.

6. Stock Exchange

On the right bottom corner of the screen, there is a button to switch between the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). You can view the price movements on the exchange that you invest in.

On the top menu, you have an option to select the chart style from the range of options listed. You need to choose the chart type based on the information you are seeking. Here is a list of options available.

7. Chart Style

a. Candle

Candle or candlesticks are a great visual representation of the fluctuations in the price of a stock. Traders use this to identify trends and estimate the direction the stock price can take in the near term. These are highly popular among traders and investors as they pack a lot of information in them.

Each candle has three parts – the body, lower shadow, and upper shadow. Also, each candlestick offers a visual representation of the opening price, closing price, highest price, and lowest price of the interval it represents. Here is an example:

As you can see, a single candlestick displays information about different aspects of the stock price. When viewed over a period, this can be a wealth of information for traders/investors. Here is how you can read a candlestick chart:

b. Hollow Candle

While in standard candlestick charts all candles are coloured, the hollow candlestick chart uses fill attributes and different colours to display the behaviour of stock price. This is what a hollow candlestick chart looks like:

As you can see, there are different types of candles in this chart:

| Type of Candle | Description | Image |

| SOLID | Closing price is lower than the Opening price |  |

| HOLLOW | Closing price is higher than the Opening price |  |

Color of the candle:

| Color of Candle | Description | Image |

| GREEN | The Current candle’s closing price is higher than the previous candle’s closing price |  |

| RED | The Current candle’s closing price is lower than the previous candle’s closing price |  |

| BLUE | The current candle’s closing price is the same as the previous candle’s closing price |  |

Hence, you will have different types of candles in a hollow candlestick chart:

Typically, indicates a price decline.

Typically, indicates a trend of price decline with but an increase in price in the current interval.

Typically, indicates a trend of price increase but a decline in price in the current interval.

Typically, indicates a trend of price increase.

You need to look at more intervals to identify a trend. This represents a steady price movement over two intervals.

You need to look at more intervals to identify a trend. This represents a steady price movement over two intervals.

It is important to remember that the solid candles in a traditional candlestick chart where all candles are solid behave differently than solid candles in a hollow candlestick chart. Here are some tips to help you read a hollow candlestick chart:

It is important to remember that the solid candles in a traditional candlestick chart where all candles are solid behave differently than solid candles in a hollow candlestick chart. Here are some tips to help you read a hollow candlestick chart:

As explained above, if the candle is hollow, then the stock closed higher than its opening price and vice-versa if it is filled with any colour. Hence, when you glance at a hollow candle chart, if you can see more hollow candles, then it means that the stock price has experienced intraday price increases more frequently. This can be a great tool for day traders.

More greens in a hollow candlestick chart indicate a trend of the price increase. On the other hand, if there are more red candles (hollow or not), it means that the stock price is declining. This can be a great tool for medium-to-long-term investors.

Here is a sample hollow candlestick chart for a period of six months with an interval of one day:

As you can see above, there are periods when the stock price has rallied and corrected. Based on the colours, you can see that while the months of November and December displayed a price increase trend, there were spurts of correction from January.

Further, if you look at the fill attributes, you can observe that the period where the colours are green and the candles are hollow is the time where the stock price rallied and filled candles that were red in colour were periods where major correction occurred. Similarly, you can analyze any stock based on the period and interval you want.

C. Volume Candle

By now, you should be fairly conversant with candlesticks. The height of a candlestick represents the difference between the opening and closing prices for the interval, the wick/shadow length representing the highest and lowest prices respectively.

In volume candlestick charts, one more dimension is added – the width of the candle representing the trading volume. If the candle’s body is skinny, then it represents a low-trading volume in the interval and if it is wide, then the volume is higher. Also, a red candle with a wide body indicates a price drop where many people are selling the stock and vice-versa with green candles.

Therefore, a volume candlestick chart is a step up from a standard candlestick chart since it allows you to assess the trading volume along with the price movement to assess the market sentiment and estimate the trend. Here is an example:

The large red candle at the beginning of the period represents periods where the trading volumes were high and the stock price was declining (2020). While there was some green-relief in Nov-Dec, 2020, major recovery took place between January and March 2021. This chart can give you a better idea about the price and volume of a stock at a glance.

D. Bar

A bar stock chart is similar to a candlestick chart with the difference being that the candles have a body, while bar charts have straight lines. They offer similar information like the opening price, closing price, highest price, and lowest price.

A bar chart has a vertical bar denoting the range in which the price fluctuates during the interval. There is a horizontal bar on each side (feet of the bar) that denotes the opening and closing price of the stock in the interval. The foot on the left side is the opening price and the one on the right side is the closing price. Here is what a bar looks like:

Reading a bar chart is similar to a candlestick chart too. The only difference is the presence of the feet instead of the body. Here are some tips:

You can also calculate the range of the bar by subtracting the low from the high. The taller the bar, the more the price fluctuated in the interval. Here is what a bar chart looks like:

E. Colored Bars

While a basic bar chart has bars of the same colour, many platforms offering stock charts include an option of a coloured bar chart too. The bars are coloured green or red based on the following aspects:

There are various tricks that can help you interpret bar charts:

These are unclear trends and cause uncertainty in the minds of investors/traders.

There are many other ways in which you can analyze a bar chart. Ensure that you understand it completely before making investing decisions.

F. Range Bars

Range bar charts are unique since they are based on price only, and not time or any other aspect. These are not as popular as the regular time-based charts where a fixed number of bars are plotted for a fixed interval, regardless of the volatility or price movements. Range bars are designed to help traders view volatility differently and utilize it to their benefit.

In a time-based chart, if you select the time interval as one hour, then the chart will show price activity per hour for the selected period. Even if the market goes through a lot of volatility or has high trading volumes, the number of bars plotted remains the same.

However, in range bar charts, more bars are printed if the volatility is high and less if it is low. Some primary rules of range bars are:

Here is a sample range bar chart for your reference:

As you can see, a new bar is plotted only when the preset range is fulfilled. This can help you get a clear view of how the stock’s price is moving. Further, you can identify support and resistance levels using horizontal trend lines and trending periods using up and down-trend lines. Using a range bar chart successfully requires you to spend some time observing the way it works and do some paper trading before using it for your investments.

G. Line Chart

A line chart is the most basic type of stock chart that tracks the closing price of a stock over time. Based on the period and interval chosen by you, the closing price is represented by a dot and all dots are joined together using a line. Since it only tracks the closing price, there is no information about the day’s highs and lows and/or intraday price movements. Here is what a line chart looks like:

These charts are used by beginners to gauge if the stock is increasing or decreasing in price. It also offers a quick view of the volatility in stock price.

H. Colored Line Chart

Coloured line charts offer a slightly better view of the price fluctuations by colouring the line segment red if the current interval’s closing price is lower than the previous interval and green if it is higher. This allows you to quickly assess the performance of the stock over the time period, across intervals. Here is what it looks like:

I. Heikin Ashi

Heikin Ashi is a Japanese technique used on a candlestick chart with a modified formula based on two-period averages. This creates a smoother chart, filter out unnecessary noise, and helps investors/traders identify trends and reversals with ease. In simple terms, the Heikin Ashi chart uses average price data for plotting. Hence, it is considered to be a better indicator of trends than the standard candlestick charts. Here is how it looks:

A standard candlestick chart uses the opening, closing, highest, and lowest prices which can lead to some gaps and a lot of noise in the chart. By working on averages, the Heikin Ashi chart offers a better picture of trends and reversals. This is because it averages the price data over two intervals. Hence, while a standard candlestick chart change frequently from up to down based on market volatility; in a Heikin Ashi chart, you have more consecutive coloured candles making it easier to spot trends.

The first chart above shows the Heikin Ashi technique used on the candlestick chart shown below. As you can observe, the Heikin Ashi chart is smoother than the candlestick chart and has more consecutive colours too. It is important to remember that the Heikin Ashi does not display the actual market price since it works on averages. Also, Heikin Ashi charts tend to stay red for longer during a down-trend and green during an up-trend.

Here are some tips to help identify opportunities using a Heikin Ashi chart:

J. Renko

A Renko chart is another contribution from the Japanese to stock charts. In the Japanese language, ‘ Renko ’ means bricks and has been named so since the chart looks like a chain of bricks. These bricks are placed at a 45-degree angle to each other when the stock price increases/decreases by a certain amount. If the price increases, the brick is coloured green and red if it falls. Here is how it looks:

While these charts have a time axis, a brick is not formed based on time but only when it crosses the preset threshold. Hence, in Renko charts the movements are minimal and they offer a broad-level perspective to stock volatility. These charts are created using the closing price based on the interval chosen.

The simple construction of Renko charts makes it easier for investors/traders to spot trends. However, some price information is lost in this process. They are also known to be effective in spotting support and resistance levels.

In the image above, the stock price shows a strong up-trend with a couple of dips and a subsequent dip during the end of the selected period. The two red dots in the centre can be seen as excellent buying opportunities after a short pullback.

K. Mountain

A Mountain chart is primarily a Line chart with the space below the line filled with colour giving the chart the appearance of a mountain range. It is also known as an Area chart. It offers all information like a standard line chart. Hence, apart from looking more colourful, mountain and line charts are the same. Here is what they look like:

L. Baseline Chart

A Baseline chart plots a line/mountain chart around a baseline determined by you. The area above the baseline is coloured green and below it is coloured red. On the Groww platform, you can adjust the baseline by using a slider to the right of the screen, right next to the Y-axis as shown below:

Here is what a Baseline chart looks like:

Many traders set the baseline at the opening price of the stock to assess its movement and make buy/sell decisions accordingly.

M. Line Break Chart

Another contribution by the Japanese to stock charts, a Line Break chart is another way to reduce market noise and spot trends and reversals. Many new traders can mistake a line break chart for a candlestick chart since they look similar. However, they are created differently and offer different sets of information. Here is how a line break chart looks:

In a line break chart, each of the candle-like blocks as can be seen above are called lines. If you look carefully, each consecutive red line has a closing price lower than the previous line. Also, each consecutive green line has a closing price higher than the previous line.

To plot a line break chart, the following rules are used:

Many traders use this chart to create trading strategies. We urge you to spend some time and do paper trading before making investment decisions based on this chart.

N. Point and Figure Chart

This chart is also independent of time. Points are plotted based on price movements. In a Point & Figure chart, there are two columns, one with X’s and the other with O’s. These represent filtered price movements. The X-columns represent rising prices and the O-columns represent falling prices. These charts offer some unique advantages:

Here is how a Point & Figure chart looks:

It is important to spend some time understanding these charts before using them to make investment decisions.

It is important to spend some time understanding these charts before using them to make investment decisions.

8. Indicators

On the top menu, you also have an option to select indicators that you can overlay on the chart for customized analysis.

1. RSI – Relative Strength Index

One of the fundamental aspects that traders look for is assessing the momentum of the stock price. The Relative Strength Index or RSI is one of the most commonly used momentum indicators. It measures the extent of the recent fluctuations in price and assesses if the stock has been oversold or over-purchased. You can choose the RSI indicator via the Indicator tab at the top of the screen. As soon as you click it, a line graph is displayed on the screen, below the existing chart (as selected by you). This is an oscillator graph that reads between 0 and 100. Typically, an RSI reading of less than 30 indicates a stock that is oversold or undervalued; and reading of greater than 70 indicates a stock that is overvalued or over-purchased. Here is what an RSI oscillator looks like:

This indicator offers valuable insights into the volume/price condition of the stock.

2. MACD – Moving Average Convergence Divergence

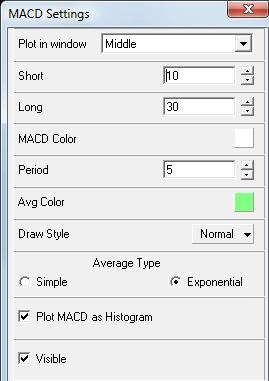

For traders who understand statistics, MACD is a common function used to assess if the bullish or bearish trends in the price of a stock are getting weaker or stronger. MACD is a momentum indicator that plots the relationship between two moving averages (MAs) of the price of a security. To calculate MACD, the 26-period exponential moving average or EMA is subtracted from the 12-period EMA.

Further, a nine-day exponential moving average of the MACD called the Signal line, which offers triggers for buy and sells transactions, is also displayed on the chart. On Groww, MACD is displayed along with a histogram that highlights the distance between the MACD line and the Signal line. MACD, along with the RSI indicator can offer a clearer perspective about the price momentum of a stock. Here is how a MACD graph looks:

Lastly, you can right-click on the MACD area and customize the settings to choose values as needed by you for your analysis.

3. VWAP – Volume Weighted Average Price

The Volume Weighted Average Price or VWAP is an excellent indicator of the relative strength of a stock. It is the average trading price of a stock in a day based on the stock price and trading volume. It is used primarily by short-term stock traders to get a more accurate estimate of the price action. There are various ways in which this indicator can be used to make profitable trading decisions quickly including:

It is preferred by traders since it allows them to:

As a trader, using a VWAP indicator will require a lot of practice of reading it and correlating it with trading opportunities. Here is what it looks like:

You also have the option of plotting the standard deviation bands above and below the VWAP line. There are three options available as shown below:

Observing how the stock price performs within these standard deviation bands can offer interesting buying and selling areas to traders.

4. Moving Average

As a trader, one of the most difficult things to do is predict trends in the stock markets. To avoid complete speculation, chart analysis and using the right indicators is crucial.

A moving average indicator is widely used by traders to identify an up-trend, down-trend, upward momentum, and downward momentum. It is also used to identify support and resistance levels. This is what a moving average looks like on a candlestick chart:

On the Groww platform, if you right-click on the moving average line, you can choose the period for which you want to view the moving average. Usually, traders opt for a 50 or 200-day moving average. It is important to remember that since this is a moving average, a shorter period would make it highly sensitive to price movements and a longer period will make it less sensitive. Depending on your needs, you can choose the period and view the moving average for the stock.

Here is some information provided by a Moving Average (MA) indicator:

When you right-click on the MA line, you can choose from the following options:

5. Bollinger Bands

Bollinger Bands define a price range plotted at one (or more) standard deviation levels above and below the simple moving average of the price of the stock. Hence, they are excellent indicators of high or low prices on a relative basis. This is what a Bollinger band plot looks like:

Here are some tips to help you understand Bollinger bands and use them to make trading decisions:

On Groww, when you right-click on the Bollinger bands, you get the following options for customization:

6. Pivot Points

Pivot Points are indicators used by traders to determine the trends of the market over different time periods. A pivot point is calculated by taking a simple average of the highest, lowest, and closing price of the stock from the previous trading day. When you use this point on the next day, any trade above the pivot point is considered to be bullish and below the point is considered to be bearish. This is what it looks like:

As you can see (more clearly in the Continuous Pivot Points chart), there are three levels of support and resistance displayed. These can help traders make buy/sell decisions by creating cut-off points.

On Groww, when you right-click on the Pivot Points, you get the following options for customization:

7. Volume Underlay

This is the same as the clickable volume option on the top left part of the chart.

8. Standard Deviation

Standard Deviation is a mathematical way of calculating the volatility of the stock market. It measures the dispersion of the stock price from its average price. In other words, it is a measure of how high or low a stock price can go based on historical data. This is how it looks:

Here is how you can use the Standard Deviation indicator to make trading decisions:

On Groww, when you right-click on the Standard Deviation line, you get the following options for customization:

Other Indicators

There are many other indicators that can help you analyze the stock performance better and spot profit-making opportunities with ease. Here is a quick look:

Anchored VWAP

A modified VWAP overlay where you can determine the starting point. This is what it looks like:

On Groww, when you right-click on the Anchored VWAP area, you get the following options for customization:

Price Rate of Change

This is an unbounded momentum indicator that has a zero midpoint. This is how it looks:

On Groww, when you right-click on the Price Rate of Change line, you get the following options for customization:

Momentum Indicator

This indicator offers information about the rate at which the price of the stock changes. They only offer information about the speed of the change and NOT the direction. This is how it looks:

On Groww, when you right-click on the Momentum Indicator line, you get the following options for customization:

True Range

This indicator measures the daily price range plus/minus any gap from the closing price of the previous day. In other words, the closing price of the preceding period is substituted for the current low, if lower, of the current high, if higher. This is what it looks like:

On Groww, when you right-click on the True Range line, you get the following options for customization:

Key Takeaways

However, with the right tools, charts can be easy to read, informative, and may even help predict future stock prices.

How to Read Stock Charts Like a Boss: Beginners Guide +pdf

How To Read Stock Charts for Beginners: 9 Step Ultimate Guide By A Certified Analyst. Stock Charts, Indicators, Patterns, Trendlines + Videos

To read stock charts, you need to use stock charting software, select your chart type, configure your timeframe, determine price direction using trendlines, and use indicators to estimate future prices.

That may sound complicated, but as a technical analyst with the IFTA, I am certified in how to read stock charts, and I am here to help you learn. So I hope you enjoy this in-depth definitive guide to reading and understanding stock charts, patterns, and indicators.

What is a Stock Chart?

A stock chart visually represents the current and historical stock prices displayed on an X & Y axis graph. Stock charts allow you to see the past and recent price performance of a company’s shares. Volume and price indicators are significant to stock charts and the ability to see historical price patterns and trends to predict future price movement.

To understand stock charts, you need to know how supply and demand work in a marketplace. The volume indicator and the stock price movement are the critical elements in effectively interpreting stock charts. For example, when the price rises on increased trading volume, you can expect the price to continue higher.

All of this will be covered in the volume, supply, and demand section.

Table of Contents

How to Read a Stock Chart: 7 Step Process

Here is a quick and simple process for reading a stock chart:

1. Open a Stock Chart

You can read stock charts using stock charting software that performs the data collection and calculations for you. You need to understand stock prices, timeframes, supply and demand, chart patterns, volumes, and how stock chart indicators are calculated. We cover the eight stock chart types, indicators & patterns in this guide.

To quickly open a stock chart for free and without registration, try TradingView.

This section is all about understanding a basic stock chart. Known as Technical Analysis or stock chart analysis, chart reading enables us to visualize a stock not through numbers but through patterns. It allows us to see the stock, see its history, learn its personality and make a value judgment on its future. Before you get started learning to read charts, you might want to select charting software that is perfect for beginners.

We will start with a basic price chart, move on to technical indicators, and assess their importance and meaning in future sessions.

Liberated Stock Trader Pro Investing Course

★ 16 Hours of Video Lessons + eBook ★

★ Complete Fundamental Stock Analysis Lessons ★

★ 2 Powerful Value Investing Strategies ★

★ 4 Dividend/Income Investing Strategies ★

★ Professional Grade Stock Chart Technical Analysis Lessons ★

2. Select a Chart Type

Stock charts come in many shapes and sizes, from the differences in the bars to the different concepts applied to the chart itself. Here you will find a quick reference guide to the many types of charts available with an overview of their potential uses. Click here for an in-depth guide to stock chart types.

1. Line Stock Chart

This is one of the most basic charts, probably giving the least amount of information. The line in the top pane is drawn using the close price for each unit of time. So if this is a daily line chart, the close price for the day is used. If this is a 5-minute chart, then the close price for every 5 minutes of trading is used.

The Positives of Line Stock Charts

A clear view of the price movement. Good to use when comparing the performance of many stocks on the same chart.

The Negatives of Line Stock Charts

It does not show the Price Open / High / Low for the trading period. The day’s trading range is important in price-based decision-making, indicating bullish or bearish momentum.

Stock Charting Software With Line Charts

2. High Low Close Bar Stock Chart (HLC)

Using bars is a step up from the line chart as it allows us to plot additional useful data on the chart. Here we have each bar representing a trading period with the price High, Low, and Close represented. Refer to the diagram.

The Positives of High Low Close Bar Charts

More information is available, showing the days trading range, meaning did the stock price close near its high (bullish) or near its low (bearish).

The Negatives of High Low Close Bar Charts

No opening price is reflected in this chart. The opening price is important as it allows us to immediately see if the price gapped up or down on the open and where the closing price is related to the opening price.

Stock Charting Software With HLC Charts

Video: Stock Chart Types Walkthrough

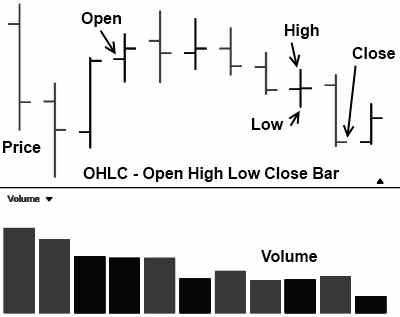

3. Open High Low Close Bar Stock Chart (OHLC)

The complete bar chart. The chart of choice for those who like to use bar charts. Here we see the day’s trading range, including the open and close prices.

The Positives of Open High Low Close Bar Charts

We can see instantly if the trading period closed higher or lower than the open. We can also see the bar’s length, which shows us the trend’s volatility or strength.

The Negatives of Open High Low Close Bar Charts

There are a few downsides to this chart type, and many investors and traders use it. Most chart packages also allow you to color the up days green and the down days red. The following charts can also be used for those who prefer even more information in the price chart.

Stock Charting Services With OHLC Charts

4. Japanese Candlestick Charts (Recommended)

Used widely in Japan and gaining a strong foothold in the rest of the world, the Japanese Candlestick chart gives an excellent insight into current and future price movements.

The Positives of Japanese Candlestick Charts

Candlestick charts give an excellent view of the asset price open, high, low, and close. Candlestick charts are visually illuminating and make market supply and demand easier to spot. Candlestick chart patterns allow us to judge the future short-term direction of price. Candlestick charts connect investor psychology with the price pattern.

The Negatives of Japanese Candlestick Charts

Although Candlesticks have many advantages, they can seem like information overload to the beginner. There are also many Candlestick patterns to learn.

Automated Candlestick Chart Recognition

Before you jump into a headlong three months of studying and analyzing Japanese Candlesticks manually, I highly recommend you use the power of modern stock charting algorithm software to recognize patterns for you.

Three of our recommended stock charting software have automated Candlestick pattern recognition that identifies and analyzes candlesticks better than humans.

| CandleStick Software | TrendSpider | TradingView | MetaStock |

| Rating | ★★★★★ | ★★★★ | ★★★★ |

| Candlestick Patterns Recognized | 123 | 27 | 52 |

| Pricing | Included | Included | $349 add-on |

| Full Review | Read the Review | Read the Review | Read the Review |

| Get the Software | Visit TrendSpider | Visit TradingView | Visit MetaStock |

Further Reading on Japanese Candlesticks.

Stock Charting Services With Candlesticks Charts

Stock Charts Using Volume

The use of volume in technical analysis is important as volume allows us an insight into the supply and demand situation. The following charts incorporate volume into the price window to provide additional information.

5. Volume at Price (VAP) Stock Chart

The price at volume chart is an exciting new development, as instead of showing volume for a certain time period, it shows us the volume of trades at a specific price level.

This lets us see at what price level most market participants believe the stock is fairly priced.

The Positives of the Volume at Price Chart

Innovative and intuitive, this charting method, combined with standard volume bars, can enable you to see market psychology both in time and price. It is also easy to see volume increasing as price rises; this is a very bullish sign.

The Negatives of the Volume at Price Chart

Not all stock charting packages offer this type of indicator.

Stock Charting Services With Volume at Price Charts

6. Point and Figure (P&F) Charts

There are a few other types of charts that you probably have never heard of before. However, they are quite useful, and you would be required to learn them if you wanted to become a Certified Technical Analyst.

Point & Figure Charts are very unusual as they feature no timeline along the bottom horizontal axis. The Chart is made up only of price swings. The vertical price bar is arithmetic and shows only units of price.

A “0” is plotted if the price moves down a whole price unit (for example, 50 cents). When the price changes direction and starts to move upwards, an “X” is marked in each box. This filters out smaller price moves and enables us to focus on trend quality.

Trendlines are always plotted either horizontally or at 45-degree angles.

The Positives of Point & Figure Stock Charts

An excellent tool for doing price target calculations. Simple to learn and interpret, few price patterns to learn.

The Negatives of Point & Figure Stock Charts

Learning this type of charting can be easiest when performing the charting by hand. That means you are marking the “X” and “O” on a piece of paper. This can also be very time-consuming. Few services offer Point and Figure Charts. However, StockCharts.com offers a free Point and Figure Charting Service that is well worth investigating.

Stock Charting Services With Line Charts

8. Market Profile Stock Charts

Developed in the 1980s by Chicago Board Of Trade Pitt Trader J. Peter Stiedlmayer. The letters on the chart show time units. “A” represents the first 30 minutes of trading, and “B” represents the second 30 minutes of trading.

The point of control is the area (price range) where most trades occur during the day.

The value areas are the price range at which 70% of the action happens. When the price is above and below the value areas, this represents a possible ideal buying or selling point.

The Positives of Market Profile Stock Charts

People who use market profile charts become evangelists for the cause. They believe it offers unique insights into buy and sell opportunities. It can be a good option if you are a quick-fire day trader.

The Negatives of Market Profile Stock Charts

It can require an effort to learn how to use them, and very few stock chart services offer this type of charting.

3. Choose a Chart Timeframe

Core Elements of a Stock Chart

This is a historical price chart of Intel Corp. (Ticker: INTC). Once you understand what each of these arrows means, you are ready to step forward into the technical indicators section.

Understanding a Stock Price Chart – Open, High, Low, Close, TimeFrame, Ticker & Scaling

This chart is in the format of a Daily “Open High Low Close” OLHC bar chart, mapped to the Logarithmic Scale.

Ticker & Company Name

The ticker (INTC) is the unique abbreviated stock reference code; all stocks have a unique Ticker to be easily found and referenced.

Chart Type

There are many different types of charts available; this one is an OLHC Chart, which means “Open, High, Low, Close.” OHLC refers to the bar itself. The opening price is the left-sided dash, High is the top of the vertical line, Low is the bottom of the line, and Close is the right-sided horizontal dash. Read more about stock prices.

Time Frames

Timeframes are always plotted along the chart’s bottom and can be anything from 1 minute per bar (intraday) to 1 year per bar. This chart shows a Daily chart, which means each bar equals 1 day.

Chart Scaling

Chart Scaling is critical; most professional chart readers use the “Logarithmic Scale,” meaning each unit along the right-sided Y-Axis is the same percentage apart; this makes it very easy for you to see on the price chart what percentage a stock moves on any given day in history.

If the bottom right-hand side of the chart shows a 2.20%, this is the % between the horizontal Plotlines.

Arithmetic Scale.

4. Assess Price Direction Using Trendlines

To read a stock chart, you need to draw a trendline on the price pattern; this helps you assess the direction of the stock price.

What is a Stock Price Trend?

If someone asked you today, “Is the stock market in an uptrend, downtrend, or a lateral consolidation,” what would you answer? Knowing the answer to this key question is important for the stock market or even an individual stock. Why?

If you buy a stock (go long) in an uptrend, you are more likely to make money on it. There is a simple way to see if the market is heading upwards or downwards.

First, let’s examine what types of trends exist:

3 Types of stock price trends:

There are also timeframes to consider in evaluating a trend; for this, we will refer to Charles Dow’s classification in Dow Theory.

Types of Stock Trend Time-Frames:

By combining the above terms, you could be specific about the market trend. For example, you could say the market is in a short-term up-trend but a long-term down-trend. But isn’t that contradictory, the market being in both an uptrend and a downtrend simultaneously?

Not really it makes perfect sense.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

The Following Examples are an excerpt from the Liberated Stock Trader Academy Book and Training Course. Chapter 7, Section 2.

How to Draw Trendlines on the Stock Price

Drawing trendlines is one of the most important skills of technical analysts; trendlines represent important areas of support and resistance. Once you have this skill, charts come to life and start to signal their message to you.

Video: How To Draw Trendlines

3 Steps to Drawing your First Trend-lines

1. Drawing Uptrends

Quick Tip: The more bounces off a trendline the stronger the trend.

Based on the trendlines shown here, buying and selling would have bagged you a 49% win. Life is never that easy, and showing this in retrospect does mean we benefit from hindsight.

2. Drawing Support & Resistance Trendlines

You must practice drawing trendlines as much as possible; after a while, you will get used to it, and it will become second nature.

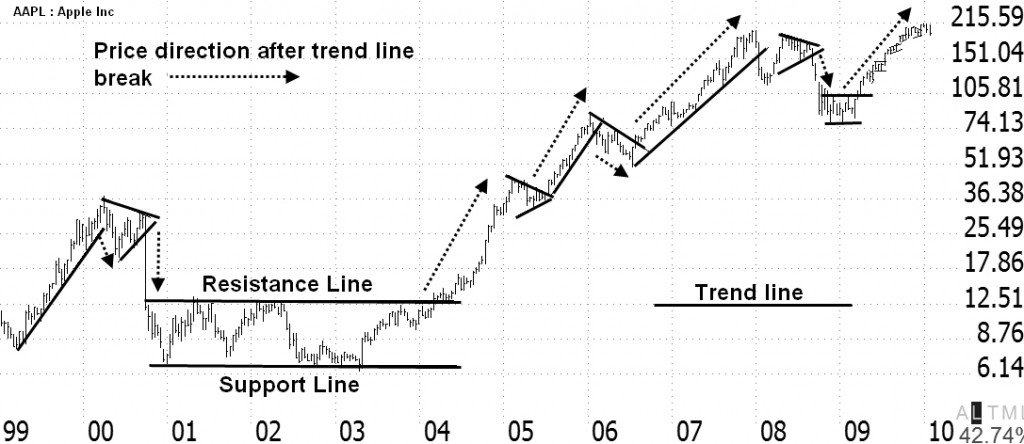

Here is another example of how to draw trendlines. This is a chart of Ticker: AAPL Apple Inc. it shows how to draw trendlines in a downward price move and an upward price move.

Notice that the trendline above the price is called resistance, and the trendline below the price is called support. When the price breaks up through resistance, it moves higher; this could potentially be a buy signal. When the price breaks down through the support trendline, it moves lower; this could potentially be a sell signal.

Quick Tip: The longer the trendline is in place or acts as support or resistance, the stronger the trend and the bigger the move when the trendline is broken.

Look again at the chart of Apple Inc. See how Apple was in a sideways consolidation from 2001 through to 2004. When it eventually broke out of that channel upwards through resistance, the stock took off, making over 1600% gain.

Chapter 7 of the PRO Training delves deeper into the technical analysis to enable you to make Buy and Sell decisions using trendlines, spot the most important patterns and trends, and discusses the importance of Price Gaps, Triangles, and Wedges.

5. Use Trendlines to Determine Price Patterns

Drawing Trendlines to Recognise Stock Chart Patterns

If you cannot draw a Trend-line you should not invest in the stock market!

This example will examine how to look at price movement and use it to evaluate the stock.

Price is the most important indicator, so it should be when it boils down to it; the most important thing is the price.

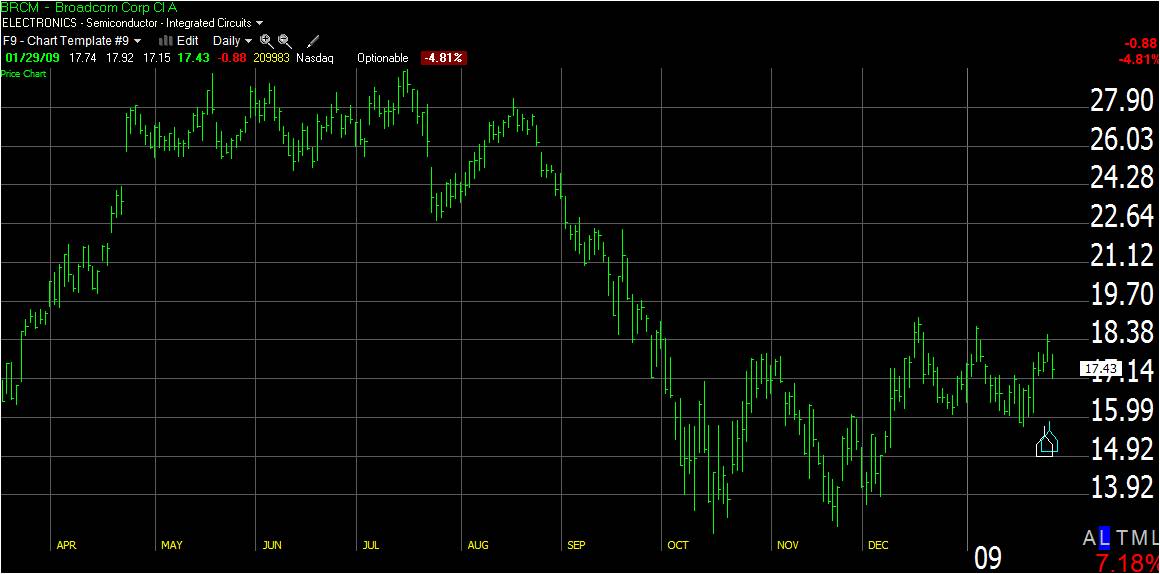

Here we can see a Broadcom (BRCM) chart, one of the darlings of the tech bubble in 2000.

Where will you draw the trendlines?

Take a moment to think about where you would draw the trendlines before scrolling down to the chart where I have drawn them.

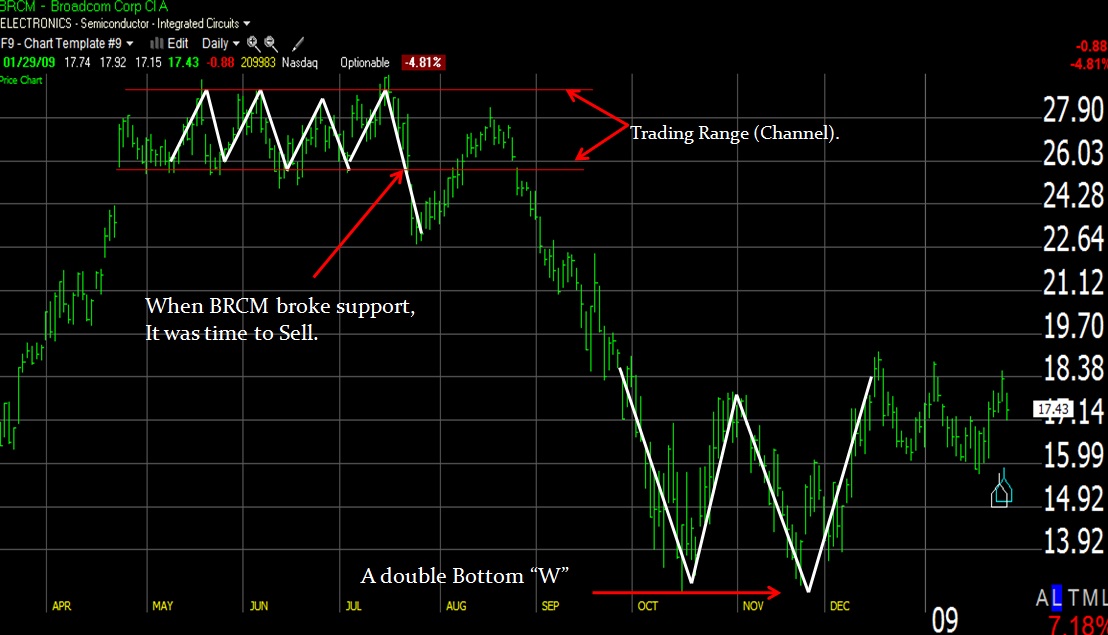

Support & Resistance and a Double Bottom Pattern Trendlines

A chart can come alive when we add trendlines. The graphic below shows BRCM, with trendlines superimposed.

Follow This Process to Draw the Trendlines

Learn To Recognize These Price Patterns

The first example in this module will show you the head and shoulders pattern. We will then discuss the other patterns that exist.

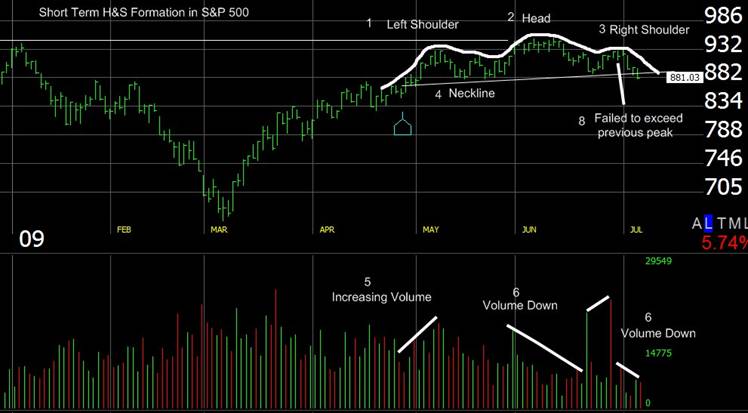

Head and Shoulders Pattern

What does a Head and Shoulder Pattern look like? The importance of the head and shoulders pattern should not be underestimated; it is one of the most reliable patterns in technical analysis yet one of the most misunderstood.

Here we discuss the famous head and shoulders price pattern. Understood to be one of the most predictive patterns, the Head and Shoulders pattern has unique characteristics.

However, you do need to know what you are looking for.

A Head & Shoulders Pattern has the following traits.

So what lessons can we learn from the chart?

All of the above conditions of the Head & Shoulders pattern are consistent with textbook descriptions.

The Head and Shoulders pattern is said to be confirmed on a break of the neckline; this is about to occur/has occurred in the final price bar in July.

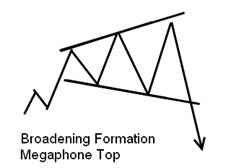

Megaphone Chart Pattern

Here we have a Megaphone Top. This is a rare pattern that usually occurs at major tops. You can see that the swings get larger at each bounce, suggesting uncertainty and volatility until, finally, the price breaks out downward on increased volume.

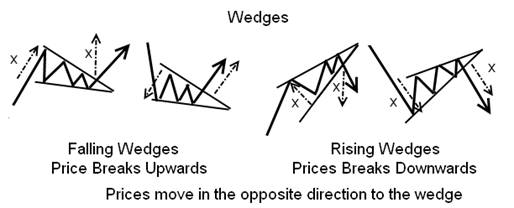

Wedge Chart Pattern

Wedges are very different from triangles because they point in the exact opposite direction to the breakout. Both of the edges of the wedge point in the same direction, either upward or downwards. In the image below, we can see that the falling wedges signify an upward breakout.

The rising wedge signals a downward breakout.

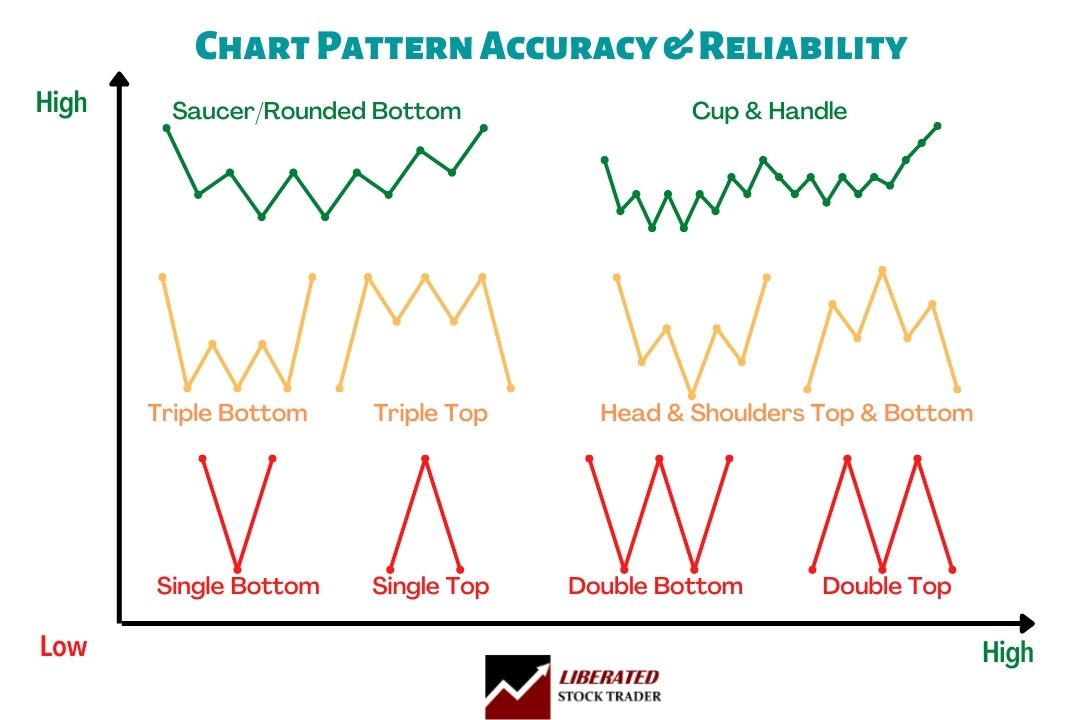

Stock Chart Pattern Accuracy

The following diagram shows us the most common reversal patterns and their relative probability of accuracy.

Price patterns and trendlines share the same characteristics. The longer they are, the more important they are. The more a price pattern touches a trendline and reverses, the more important that line is. This diagram shows that a Triple Top’s accuracy is more than that of a Single Top. Why? Because the price touches the resistance level more times.

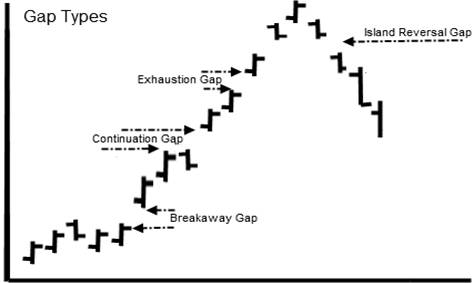

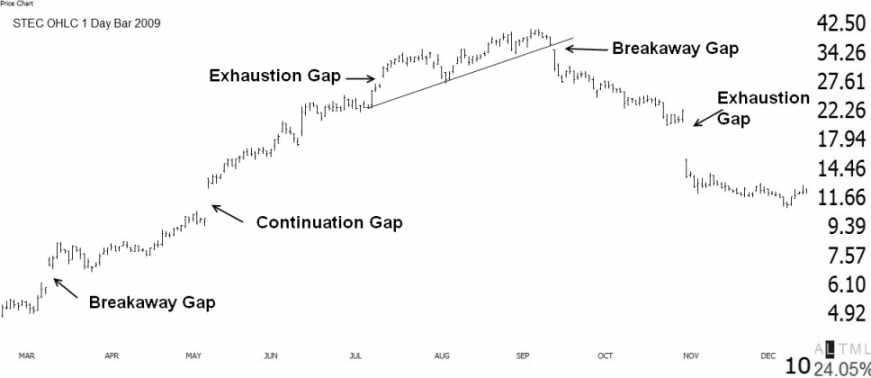

Gaps in Stock Chart Patterns