How to rinse the banks a forex guide

How to rinse the banks a forex guide

A Basic Guide To Forex Trading

Updated: Apr 21, 2022, 5:53pm

The foreign exchange market (dubbed forex or FX) is the market for exchanging foreign currencies. Forex is the largest market in the world, and the trades that happen in it affect everything from the price of clothing imported from China to the amount you pay for a margarita while vacationing in Mexico.

What Is Forex Trading?

At its simplest, forex trading is similar to the currency exchange you may do while traveling abroad: A trader buys one currency and sells another, and the exchange rate constantly fluctuates based on supply and demand.

Currencies are traded in the foreign exchange market, a global marketplace that’s open 24 hours a day Monday through Friday. All forex trading is conducted over the counter (OTC), meaning there’s no physical exchange (as there is for stocks) and a global network of banks and other financial institutions oversee the market (instead of a central exchange, like the New York Stock Exchange).

A vast majority of trade activity in the forex market occurs between institutional traders, such as people who work for banks, fund managers and multinational corporations. These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations.

A forex trader might buy U.S. dollars (and sell euros), for example, if she believes the dollar will strengthen in value and therefore be able to buy more euros in the future. Meanwhile, an American company with Indian operations could use the forex market as a hedge in the event the rupee weakens, meaning the value of their income earned there falls.

How Currencies Are Traded

All currencies are assigned a three-letter code much like a stock’s ticker symbol. While there are more than 170 currencies worldwide, the U.S. dollar is involved in a vast majority of forex trading, so it’s especially helpful to know its code: USD. The second most popular currency in the forex market is the euro, the currency accepted in 19 countries in the European Union (code: EUR).

Other major currencies, in order of popularity, are: the Japanese yen (JPY), the British pound (GBP), the Australian dollar (AUD), the Canadian dollar (CAD), the Swiss franc (CHF) and the New Zealand dollar (NZD).

All forex trading is expressed as a combination of the two currencies being exchanged. The following seven currency pairs—what are known as the majors—account for about 75% of trading in the forex market:

How Forex Trades Are Quoted

Each currency pair represents the current exchange rate for the two currencies. Here’s how to interpret that information, using EUR/USD—or the euro-to-dollar exchange rate—as an example:

A quick note: Currency pairs are usually presented with the base currency first and the quote currency second, though there’s historical convention for how some currency pairs are expressed. For example, USD to EUR conversions are listed as EUR/USD, but not USD/EUR.

Three Ways to Trade Forex

Most forex trades aren’t made for the purpose of exchanging currencies (as you might at a currency exchange while traveling) but rather to speculate about future price movements, much like you would with stock trading. Similar to stock traders, forex traders are attempting to buy currencies whose values they think will increase relative to other currencies or to get rid of currencies whose purchasing power they anticipate will decrease.

There are three different ways to trade forex, which will accommodate traders with varying goals:

The forward and futures markets are primarily used by forex traders who want to speculate or hedge against future price changes in a currency. The exchange rates in these markets are based on what’s happening in the spot market, which is the largest of the forex markets and is where a majority of forex trades are executed.

Forex Terms to Know

Each market has its own language. These are words to know before engaging in forex trading:

What Moves the Forex Market

Like any other market, currency prices are set by the supply and demand of sellers and buyers. However, there are other macro forces at play in this market. Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in question.

The forex market is open 24 hours a day, five days a week, which gives traders in this market the opportunity to react to news that might not affect the stock market until much later. Because so much of currency trading focuses on speculation or hedging, it’s important for traders to be up to speed on the dynamics that could cause sharp spikes in currencies.

Risks of Forex Trading

Because forex trading requires leverage and traders use margin, there are additional risks to forex trading than other types of assets. Currency prices are constantly fluctuating, but at very small amounts, which means traders need to execute large trades (using leverage) to make money.

This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed. In addition, if a currency falls too much in value, leverage users open themselves up to margin calls, which may force them to sell their securities purchased with borrowed funds at a loss. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade.

On top of all that, you should keep in mind that those who trade foreign currencies are little fish swimming in a pond of skilled, professional traders—and there could be potential fraud or information that may confuse new traders.

Perhaps it’s a good thing then that forex trading isn’t so common among individual investors. In fact, retail trading (a.k.a. trading by non-professionals) accounts for just 5.5% of the entire global market, figures from DailyForex show, and some of the major online brokers don’t even offer forex trading. What’s more, of the few retailer traders who engage in forex trading, most struggle to turn a profit with forex. CompareForexBrokers found that, on average, 71% of retail FX traders lost money. This makes forex trading a strategy often best left to the professionals.

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

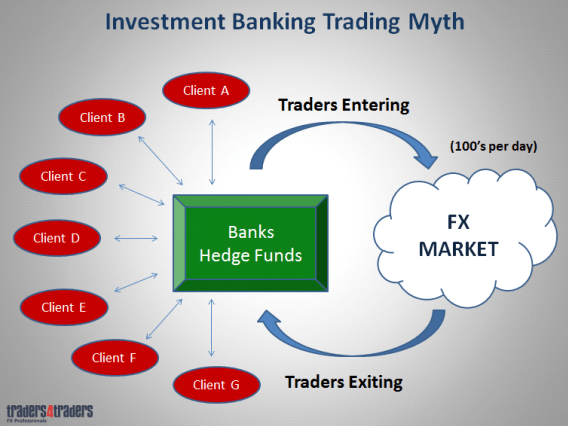

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

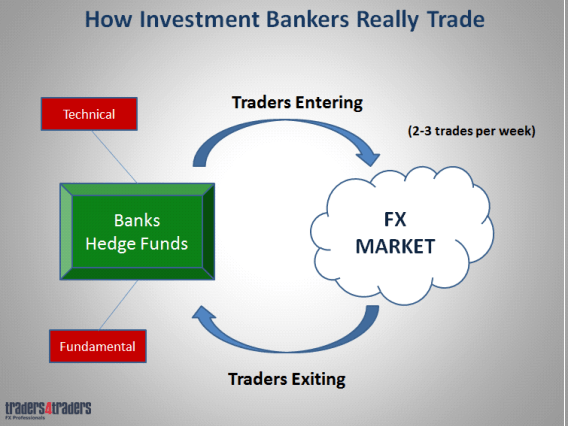

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

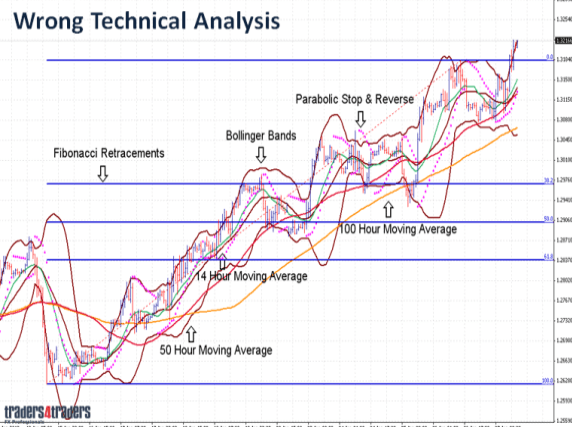

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

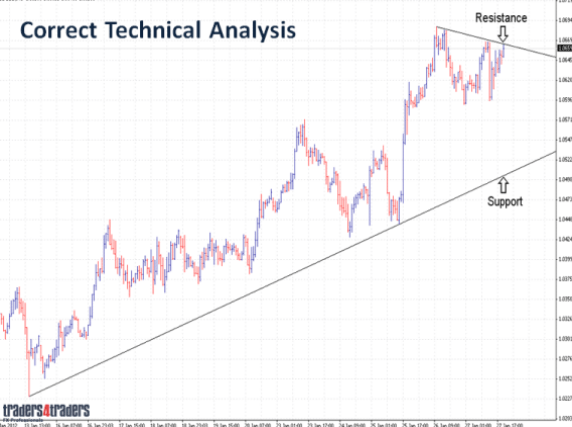

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: There are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

How you make money trading and investing in the markets is no different than how you make money buying and selling anything in life and this basic concept never changes. The only difference between Costco and JP Morgan is what they sell, not how they operate or make and lose money. Costco buys the products at wholesale prices, marks them up and sells to us at retail prices. JP Morgan gets stocks and bonds at wholesale prices, marks them up and sells to us at retail prices. It is really the exact same business model, just a different product.

The risk of loss in Forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in Forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

Bank Trading Strategy: The Basics and the 3 Key Steps

Many traders want to know how to trade in position with the banks. Why is it so important? We’re going to learn all about it in this bank trading strategy.

To get the point across, let’s break down the players in the forex market before we get into the bank strategy:

Who Trades Forex?

If you are reading this article, chance is you are a forex trader, or at least you plan to be on in the future. As a player in the forex market, it is very advisable that you know who partake in forex trading and what reasons they have to trade forex.

Commercial and Investment Banks

Commercial and investment banks are the biggest participants in terms of total currency volume traded. However, it is the big banks (such as JP Morgan, Deutsche Bank, HSBC, etc.) that control the interbank market thanks to their financial power. For the record, the interbank market is not exclusive to banks. Other participants like investment managers and hedge funds also make this category. Apart from conducting their own trades, the banks also offer forex trading services to their clients by acting as dealers. They make money from this through the bid-ask spread.

Central Banks

Representing their respective nations, the central banks play a vital role in the forex market. They can significantly influence currency rates through open market operations and interest rate policies. Also, some of them are tasked to fix the price of their currencies in the market, so they may deliberately strengthen or weaken their currencies if necessary. All the actions that the central banks take are aimed to stabilize or improve their nations’ economies.

Investment Managers and Hedge Funds

Investment Managers and Hedge Funds are the second biggest players in the forex market after the banks and central banks. Investment managers engage in forex trading for services such as pension funds, foundations, and endowments. If they have international portfolios, they will have to buy and sell currencies. They may also make speculative forex trades. On the other hand, speculation is part of hedge funds’ investment strategies in the forex market.

Multinational Corporations

Multinational corporations whose business activities involve importing and exporting goods and services certainly contribute to forex transactions. Consider this case: an Italian tire company imports components from the US and sell their product in Japan. The profit this company earns in Yen must be converted to EUR, which is subsequently converted to USD to buy more components.

In order to minimize the risk of volatility in foreign currencies, that Italian company might buy USD in the spot market, or make a currency swap agreement to acquire USD in advance before buying the American components. This way, the Italian company reduces the exposure from foreign currency risk.

Retail Traders

A trader like you is called an individual trader, or retail trader, as you trade with your own money through a broker or other trading agents. The number of retail traders is growing exponentially in recent years. Around 90% of all traders are retail traders. However, retail traders’ contribution to the forex market is still tiny compared to the other market participants in terms of the trading volume. Retail traders may use the combination of fundamentals and technical indicators to approach the market.

Who is Smart Money?

Now that we understood each market participant in the forex market, there is another term that we need to learn: smart money. Generally, smart money traders can be defined as the largest market participants whose capital can change the market patterns. Their trading volume is so large that their positions cannot be opened or closed in a single order without apparent price spikes. Smart money includes major investment banks, hedge funds, massive global companies, insurance companies, prop firms, etc.

Based on a survey in 2019, banks dominate the market share of daily forex volumes worldwide. Out of the top 10 institutions on the list, eight of them are banks. US-based JP Morgan leads the market, followed by Swiss’ UBS and XTX Markets to make up the top 3.

XTX markets and Jump Trading are the only non-bank entities from the list above. But like the banks, these two entities are also smart money that acts as a market maker. Since smart money involves in market-making activity, they will drive the market based on supply and demand.

What is Bank Trading Strategy?

The forex bank trading strategy is a method to identify the likeliest price levels for the banks to open and close their positions based on supply and demand areas. The banks control the majority shares of forex daily volumes, so when they move, the market moves. With this piece of information in mind, we can track their trading activity as the basis of bank trading strategy.

The 3 Key Steps

When it comes to forex trading, the banks conduct their activity in three steps i.e. accumulation, manipulation, and distribution/market trend. Accumulation is the step where banks enter their positions, manipulation is the phase where a false push appears, distribution is the stage where a trend begins.

Before we discuss these three steps in detail, we should keep in mind that the law of supply and demand applies to forex trading. If you want to buy a currency in the market, there must be someone else who is willing to sell. Likewise, if you want to sell a currency, another trader must be willing to buy. The buying and selling counterpart always happens in every transaction.

So based on the law above, if the bank plans to buy a large position, they must find an equal amount of selling pressure. It would be easier for us to spot their trade if they enter the market in one large order. But obviously, this is not the case. What they do instead is to place their order over time, which is also known as the accumulation step.

1. Accumulation

Accumulation is the first step that you must identify in the bank trading strategy. The banks enter the market by accumulating either a long position that they will later sell at a higher price or a short position that they will later buy back at a lower price. If we can identify the accurate price levels where the banks are accumulating, we will also be able to identify the direction of upcoming price movements. That’s why accumulation is a very essential step in bank trading strategy.

Unlike retail traders, banks must enter positions over time due to their massive trading volumes. They do this to conceal their activity as a single large order would spike the market.

To understand what the accumulation step looks like, let’s see the USD/CHF chart below. Accumulation is characterized by a ranging market where the price moves sideways. This is the area where the banks regularly entered the market to accumulate their desired position at intervals of hours or days.

2. Manipulation

Manipulation is the next step after accumulation. This step is characterized by a false push that starts a short-term market trend. Retail traders often fall victim to market manipulation. They would enter positions when they see there is a potential breakout. But it turns out it is just a false push and the price later moves in the opposite direction.

If you’re ever in this situation, it’s not bad luck. It does not mean the forex market is being unfair to you. Most likely, though, you’re being used by the banks. How so?

Let’s say the banks are trying to enter or accumulate a long position. At the same time, they will also create selling pressures. They will try to ‘manipulate’ retail traders to enter short positions.

To track the banks, we need to identify the false push that marks the end of an accumulation phase How can we identify this false push or manipulation? Let’s take a look at the chart below.

For bearish market, a false push can be identified when the price moves beyond the high of an accumulation period which indicates that the banks have been selling into the market. After the false push, we will most likely see a short-term downtrend.

For bullish market, a false push can be identified when the price moves beyond the low of an accumulation period which indicates that the banks have been buying into the market. After the false push, we will most likely see a short-term uptrend.

3. Distribution or Market Trend

Distribution is the step where we can make profits from the market. At this point, the banks have accumulated their position and created market manipulation. They are not trying to conceal their presence anymore. Now, banks will try to push the price toward a particular direction, meaning that this is the phase where a market trend begins.

Figuring out the market distribution can be considered to be the easiest of the three steps, but this task is highly dependent on the previous two steps. It is very imperative that we avoid the manipulation trap. If we understand how the banks manipulated the market, we will be able to identify the direction of the market trend that banks attempt to push. Our next task then is to simply ride the trend.

This is the first part of a bank strategy for retail traders. In the next part, we’re going to reveal the implementation of the strategy in trading and several key tips on how to trade like a bank.

A freelance writer who has been regularly writing for BrokerXplorer since 2020. With my articles, I wish to provide forex traders with educational topics to learn from.

Financial Expert

How to trade forex is a science, rather than an art form. This beginners guide on how to trade forex will introduce you to the forex markets and explain how retail investors gain access to this fast-moving and high stakes investment activity.

Warning: Trading forex remains a high-risk investment activity, and is not a simple alternative to buying shares or investing in property. Trading forex is considered high risk due to the leverage implicit in the stake offered by brokers. When trading with leverage, investment losses can actually exceed your original investment amount.

In general, trading forex is not recommended for beginners. FX trades should only be placed by:

It goes without saying that you should only invest with money you can afford to lose. This guide is a piece of financial journalism and does not replace advice from a financial adviser.

How to trade forex – a beginners guide

An introduction to the foreign exchange market

There are three main reasons behind the vast scale of the forex market:

The wholesale interbank market

Foreign currencies can be passed between multiple parties, including banks, dealers and clients, in connection with a single underlying transaction. If a business wishes to buy £1m of Euros, the Euros that arrive in their account may have passed through multiple hands before they appear on their statement. Indeed the vast majority of forex transactions are between banks themselves, in the perpetual back-and-forth movements of currencies between institutions to ensure each can meet their short term needs.

Central bank intervention

Leveraged speculation

Compared to the stock markets, the daily change in currency pairs is quite subtle. It is rare for a currency to gain or lose more than 1% of value in a single day.

Therefore, speculators tend to multiply the size of their bets to allow them to capture a reasonable profit from relatively small movements.

An investor with £1,000 might use it to buy shares worth £1,000. However, with the right forex broker account, a speculator could use £1,000 in capital to buy £20,000 of foreign currency. This is known as leverage, and I will cover this in more detail below.

Why do people use the forex market?

There are many different reasons for people to use the forex market in some form.

Businesses looking to hedge against forex risk from their operations.

For example, imagine a British company imports its goods from Europe and pays in Euros. The cost of these purchases will constantly fluctuate in GBP terms, each time the Euro rate moves. They could enter into an agreement with another party to fix a certain FX rate for dates in the future, which will provide them with certainty over the GBP cost of those purchases.

Tourists

Tourists travelling abroad. Travellers will exchange their domestic currency for the currency of their holiday destination at the spot rate using a retail forex bureau de change.

Large corporations borrowing in a foreign currency.

Companies do this occasionally to take advantage of lower interest rates available in overseas bond markets. Bonds issued in a different currency to the company are known as ‘Eurobonds’.

This fundraising will necessitate them to swap the proceeds for their own currency before they can actually use the money.

Forex traders wishing to profit from a movement in a currency pair

Forex traders, whether individuals or trading on account for an investment bank or hedge fund, will enter into FX deals to allow them to take advantage of a rise or fall in the value of a currency.

Which countries do the most forex trading?

The Bank for International Settlements (BIS) reported in 2019 that just five countries; the United Kingdom, the United States, Hong Kong, Singapore and Japan – initiated approximately 80% of all forex trades.

This data relates to the dealers and sales desks which work as the machinery of the forex market. The underlying clients and currency demand will have actually come from a much wider pool of countries. Ultimately, every economy needs easy access to foreign currencies to enable global trade – even North Korea.

How to begin trading forex – getting started

So how does a beginner actually trade forex? Can you use your stockbroker? Is it as simple as buying the currency you expect to appreciate?

Let’s look at these fundamental questions first before we discuss the financial instruments and trading strategies that investors use to trade.

The quick answer is that ordinary stockbrokers, fund supermarkets or share dealing accounts do not offer a full suite of forex trading tools.

Often, these platforms cater to buy-to-hold investors who are looking for a low-cost way to manage a long term portfolio, rather than day trading or forex trading.

Trading forex with your stockbroker account

However, it is still possible to trade forex with a stockbroker account.

Full-service stockbrokers such as Interactive Investor, Barclays and HSBC allow you to execute foreign exchange transactions. This is primarily to allow UK investors to buy shares denominated in a foreign currency (such stocks traded on the New York Stock Exchange, which are priced in USD).

The facility is also useful to convert foreign dividends back into GBP to allow them to be reinvested elsewhere.

But you could also speculate on the value of a foreign currency using this forex service.

If you were correct, then at a later date, you could convert those US Dollars back into Pound Sterling, at an advantageous rate, resulting in £1,060 returning to your account. The £60 difference is your profit on the trade.

This is a simple example of utilising the spot market for forex.

In other words, you are buying and selling real currency at the live market price.

The advantages of trading in this manner are:

The drawbacks are:

Forex trading with a retail Forex broker

If you’re a UK investor, before you invest, be sure to check that any broker you are considering investing with is regulated and authorised to provide forex trading services by the Financial Conduct Authority. Their register of firms is here.

Also, check out our guide on spotting investment scams, which could help you avoid loss as forex scams are one of the most common forms of investment scams online.

As you are learning about forex trading, you will hear about the following financial instruments:

These represent different types of trades that a professional forex trader may enter into with a bank or dealer.

They differ in how they work, when they expire, and whether the trade value needs to be physically settled.

They’re interesting to learn about from an academic standpoint, but I will not cover them in this beginners guide to forex trading because they are irrelevant to a retail investor. These are only traded through professional platforms.

If you search online for “forex broker” or “forex trading”, you will be presented with brokers who offer services to retail investors.

I will now explain the two main forms that they take:

Forex trading via spread betting & CFDs

Spread betting, or contracts for difference offer an alternative way to gain exposure to short term movements in foreign currency pairs.

Investors use spread betting as a quick and convenient way to profit from rises or falls in the prices of many financial instruments. Foreign currency pairs are one of the most popular instruments traded on these platforms.

For any currency pair, a spread betting firm will quote a bid/offer spread (a buy and a sell price).

For example, GBP/USD: 1.2901 (Bid) / 1.2909 (Offer)

For your purposes, the broker is offering to buy from you at 1.2901 and sell to you for 1.2909. The difference between the two is the ‘bid-offer spread’ and will naturally lead to a profit margin for the dealer over time.

If you believe this rate will increase, you can buy at 1.2909. If you believe the rate will fall, you can sell at 1.2901.

You control the size of a spread bet by choosing how much you want to stake on each point movement – which is the smallest decimal point visible. The difference between 1.2901 and 1.2909 is 8 points or 8 pips.

Forex spread betting example

Let’s imagine that we’re bullish on the value of Pound Sterling, therefore we expect the GBP/USD rate to rise. We stake £1 per point on an increase, and ‘buy’ at 1.2909.

20 minutes later, the market rate has increased. The firm now quotes you the following:

GBP/USD: 1.2916 (Bid) / 1.2923 (Offer)

To close out our position transaction, we need to complete the opposite trade by selling. We will receive the bid price this time, which is 1.2916.

We bought at 1.2909 and sold at 1.2916 therefore we made a profit of 7 pips, or £7.

You will notice that the fact we must buy at the higher price and sell at the lower price means we lose out by the width of the bid-offer spread each time we open and close a transaction.

This is why spread betting firms compete on how ‘tight’ (or narrow) their bid-offer spreads are. In theory the tighter the spread, the lower the transaction costs for the forex trader.

Forex spread betting providers

The larger spread betting platforms which cater to UK investors include IG, CMC Markets, City Index and FXCM.

In the UK, spread betting carries the advantage of being a tax-free method of investing. Any net proceeds from spread betting are not considered as taxable income. Rather, they’re treated like winnings from a casino.

Forex spread betting risk

Spread betting investors often take very high risks when placing spread bets, due to the implicit leverage in the bets.

Leverage in action

When we staked “£1 per point” in the GBP/USD trade above. How much of our own capital did we actually put at risk?

We can work this out by calculating our loss if the price fell from 1.2909 to zero? This would have been 12,909 points lost, or £12,909. Therefore in principle, our bet represented a £12,909 trade for Pound Sterling versus the US Dollar. This is the amount we would need to physically invest for a movement of £0.0001 to result in a £1 gain or loss.

Because a single point is such a minuscule price movement, investors can be completely unaware that a small sounding bet of ‘£10 per point’ could represent a £100k+ trade.

When you enter a trade, spread betting firms only require you to hold a relatively small cash balance in your account compared to the maximum liability should your trade go against you. This fraction is often 5% but can be even lower.

In our example, we might have only needed to have 5% * £12,909 = £646 in our account to take this position.

Risks of leverage

The risk of taking large positions against a small cash deposit is that it doesn’t take a large adverse price movement to wipe out our cash amount.

In our example, Pound Sterling would only need to fall by 646 points to wipe out our £646 minimum deposit. In terms of price, that would look like a fall from 1.2909 to 1.2263.

Movements of this nature over longer terms are hardly rare occurrences. This means that when trading with high leverage, it’s not a matter of ‘if’ we’ll be wiped out, but just a matter of when.

You can enjoy a whole string of lucky or skilful trading gains, but you only need to lose big once to be taken to zero if you continue to leverage your account to the max.

Not many investors listen to these sensible warnings, which is why all UK regulated spread betting & CFD firms will include a health warning on the front page of their website, explaining what percentage of their clients lose money. This percentage is typically over 70%.

It takes self-restraint and discipline to trade using low leverage (or zero leverage) on a spread betting platform, but it’ll go a long way to reducing account volatility.

The potential for unlimited losses

Spread betting could lead to potentially unlimited losses where the investor bets downward and the price of the instrument skyrockets. There is no limit on how high a price can rise, and therefore an investor on the losing side of this trade could lose significantly more than they deposited.

Protections can be put in place, such as automatic ‘stop-losses’ which close out your trade as soon as your account value hits zero. Indeed, spread betting firms in the UK have been required by the regulator to ensure that this does happen, but it would be reckless to rely completely on these regulations.

The best way to directly manage your risk is to exercise control over the size of the bet in the first place. Moreover, some investors trade currencies through a broker such as Vantage FX. Read a full review of vantage FX here, this is not an endorsement but an example.

Forex trading via binary options

Retailer investors in the UK used to be able to gain exposure to forex through binary options.

Binary options are a simple bet on the directionality of an instrument. A currency pair binary option will offer the investor two options:

At any given moment, the odds of an up or down movement are balanced – like the outcome of a coin flip. However, binary option providers would build a profit margin into the payouts offered, much like how bookmakers calculate the payouts on football matches.

This would mean that if you correctly predicted up, you might receive a payout of 1.9 x your stake, in contrast to the “fair” odds of a similar risk bet being 2.0.

Binary options are effectively gambling through a bookmaker who specialises in financial markets. As a result, the vast majority of clients lose money.

This led the FCA to ban the sale of these services to UK investors in April 2019.

The FCA warns that any firms offering such services now are probably unauthorised and might be an investment scam.

The UK authorities aren’t alone in their dislike of gambling entertainment being packaged as an ‘investment opportunity. This warning from the US Securities and Exchange Commission adds concerns that:

“Much of the binary options market operates through Internet-based trading platforms that are not necessarily complying with applicable U.s. regulatory requirements and may be engaging in illegal activity.”

The SEC encourages US investors to use the broker check tool maintained by US regulator FINRA to check the status of any broker.

What is the expected return from forex trading?

The expected return for all participants from the forex market is 0%.

By this, I mean that the combined sum of returns experienced by everyone who traded in the market each year will be precisely nil.

There are still winners, and losers, but these will be equal to each other, and I’ll explain why.

When investing in the stock market or buying property, it is possible for most participants to experience a neutral or positive return.

In a year where stock markets rise overall – anyone who bought or holds shares will enjoy a gain. Anyone who sold their shares will have received cash, which will be worth the same value.

Thus overall, there are few losers in this scenario, and all participants have either maintained or increased their buying power.

I’ll contrast this with forex trading. When a currency strengthens, it does so at the expense of the opposing currency pair. The holder of the strengthening currency sees a gain, whereas the individual on the other side of the trade will see an equal and opposite loss.

It isn’t theoretically possible for all currencies to strengthen at one, because strength is only measured relative to another currency getting weaker.

This is known as a zero sum game. This is why pension funds, and institutional investors do not generally ‘invest in the forex market’, as they would see higher expected returns from investing in wealth-producing assets such as corporate bonds.

It’s true that many hedge funds and private investors successfully trade forex and win more often than they lose, but it’s difficult for an institution to pick the winning traders in advance.

How to Trade Forex: A Step-by-step Guide to Kick-off Your Trading

Are you looking for an answer to how to trade forex? Great! You are on the right page! In this guide, you will find out how you can use technical and fundamental analysis to identify market opportunities, how to develop a trading plan, how to efficiently use and implement a money management system to protect your account, and so much more. Learn how you can enhance your skills to master this market and become a successful trader with our step-by-step guide to kick-off your trading.

Table of Contents

Choose the right forex pair: Finding a trending currency pair

The first step on how to trade forex successfully is to find a trending currency pair. No-one wants to open a position on a pair that is ranging and be stuck with an open trade that isn’t going anywhere, possibly accumulating swap fees, and slowly eating your account margin.

When we say a trending pair, we mean a forex pair trending on higher time-frames. Not on M5 time-frame! To find a trending forex pair, you should always look at higher TFs. Anything below the D1 time-frame, not only will be a risk to trade, but you would not be able to see if there’s a trend or not.

Some traders prefer to trade on monthly charts, some the weekly, but on this guide, we recommend, at least, using the daily time-frame. And by doing so, you will have more chances to be trading the trend where smart money, like banks and funds, are also trading.

To start finding a trending pair you should first “listen” to the fundamentals. Is the country represented by that currency in a stable economic or political position? Check the economic, political and social factors that can affect the demand and supply of a currency.

The purpose for this fundamental analysis is to try to predict if the current, or future, economic outlook of a country’s is good, and if so, their currency should strengthen versus the quote currency, or vice-versa.

As the financial say goes “sell the rumour, buy the news”. So, if the country’s economic outlook is rumoured to be negative, you should think about positioning yourself short. If the outlook is positive then you should consider long positions.

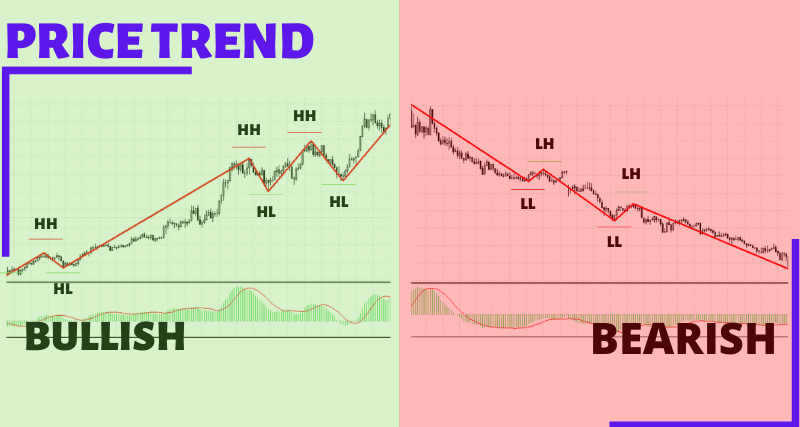

Now it’s time to find a trend within the price action. If the currency pair you choose to trade has the right balance of fundamental factors, open a daily chart (on your trading platform), and let’s try to identify the trend.

How to identify a trend in a forex pair?

Well, it’s quite simple actually. The assumption behind a trending forex pair is that on an uptrend the price is making higher highs, followed by higher lows, called retracements.

If the quote is in a downtrend, then the price will be making lower lows, followed by lower highs, also retracements. No trend ever goes up or down in a vertical line. Trends are made of longer direction impulses and retracements, in a zig-zag shape, which translates on entry opportunities within the trend.

Identify a market opportunity: Using technical analysis to find entry levels

The second step on our guide is to identify a market opportunity that allows you to enter the predominant currency pair trend. Just because you found a trending pair and the fundamentals are good you are not opening a position at whatever market price.

The key to trend trading is to buy low and close high on an uptrend and to sell high and close low on a downtrend. Therefore, to identify an entry opportunity, you will need to identify the trend retracements. These pullbacks are small corrections within the main trend and the entry levels to open your trade. You can use your favourite technical analysis indicators to identify the trend, like Par Sar or MACD.

We recommend the use of MACD to visually identify the main trend. MACD is the abbreviation for Moving Average Convergence Divergence, a trend-following indicator that shows changes in the strength, the direction, the momentum, and the duration of a trend. It is also a reliable technical analysis indicator widely used by all types of traders including professional traders. Now, with the main trend identified, you will need to find a good entry-level. This is the second part of the technical analysis.

How to find an entry-level in a trending forex pair?

To find an entry-level you should try to draw the trendlines on your price chart. Trendlines are fundamental tools used in technical analysis to identify the support and resistance levels of a trading asset. The support levels on an uptrend and the resistance levels on a downtrend should be your entry levels.

These levels are a follow up on that we saw previously; higher highs (resistance breakout) and higher lows (support level) on an uptrend and lower lows (support breakout) and lower highs (resistance level) on a downtrend. So, to find an entry-level all you have to do is to find and mark these levels within the trend. If you would like to learn more about trading with trendlines, then check out our article on how to plot trendlines.

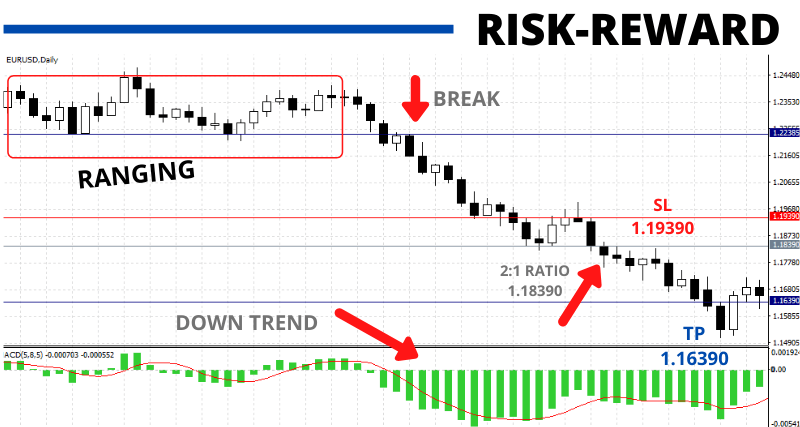

Decide to enter the market: Defining a precise trading plan

Our third step on how to trade forex will cover the need to define a trading plan. You can’t just enter the market without one. A trading plan is a set of guidelines, elaborated according to a trader’s circumstances, that takes into consideration several variables including the trade time length, the trade risk-reward, the trade goals and more.

A trading plan outlines how a trader will define the trade conditions, how large should the position be, managing the trade and adding more positions or partially close the trade, calculating the risk-reward ratio to check if the trade it’s worth the risk or not.

How to build a sustainable trading plan?

A good trading plan should, at least, include these three main variables:

With these guidelines in mind, let’s look in more detail at each one of them. You should start by including on your trading plan the time-frame that you which to trade (we recommend at least the D1 time-frame) and then set your goals. Scrap the idea of doubling your account balance with one trade, that’s pure fiction (more likely you can blow-up your account with one trade).

Next, on your trading plan, you should include the calculation of the risk-reward ratio for the trade. The risk-reward ratio measures the distance between a trade’s entry price to a stop-loss level and a take-profit level. Before pushing the buy or sell button, you have to decide for yourself what’s your acceptable risk-reward ratio.

This means you are willing to risk a loss of 100 pips to earn a profit of 200 pips. But this ratio can be adjusted to your preference or the market conditions, just to clarify, 2:1 is the minimum acceptable by most traders.

You can use our handy Position size and risk calculator to find your ideal risk-reward ratio and to complement your money management system for the trade we also recommend the use of our Pip value calculator.

Open your trade: Using money management to protect your account

On our next step in this guide, we will look at the importance of solid money management to protect your trade. You should use an effective money management policy to protect your trade and your account equity in the event of a violent market change against your position, something that can quite naturally happen with forex trading.

What to consider for an efficient money management plan?

To create a robust money management plan to keep you trading for longer in the forex market you should include:

Monitor your trade: Partially closing your position in profit

Due to some last-minute, not so positive political event in the Eurozone, the EUR/USD quote is currently finding some unexpected resistance @ 1.1035. You are afraid that the recent news might bring a trend reversal and that the trade might turn into a loss.

But on the other hand, market analysts are saying that this event was already priced into the quote and the price should carry on with the main long trend. So, what to do? Well, you can partially close your trade (let’s say 50% = 0.10 lot, half of your 0.20 lot original position), secure some profits (0.10 lot with 110 pips profit) and let the remaining 0.10 lot run until price reaches your TP @ 1.1125 (or get you stopped out).

How to partially close a position with MT4 and MT5.

That’s it, done. You can now let the remaining half run until the market goes to your TP or SL level. Let’s not forget that even if your remaining 0.10 lot gets stopped out with 100 pips stop loss, overall, it will not be a losing trade as the 0.10 lot that you partially closed got you a 110 pips profit!

Close your trade: Post-trade analysis

The final step on our how to trade forex guide is the post-trade analysis. What happened? Was the trade executed following your trading plan rules? Was it a successful one, or a loss? After your trade closed, by reaching the TP level or by being stopped out, it is time to understand the trade dynamics and write down some notes.

A post-trade analysis is a way of keeping a track record of what worked and what you should change (hopefully nothing, if you have followed these steps) so that you can trade better in the future. On your post-trade analysis consider the following questions:

These questions should help you understand the reasons and factors behind the trade outcome. If all went well just keep repeating what you did. But if your trade was a loss, the reasons behind failure could be many. Let’s have a look at the main factors in case of loss:

If your trade didn’t turn out as expected, you should stop trading and analyse what went wrong. Close your trading platform and try to find an answer by asking yourself the above questions. Try to find the logic behind the trade execution and write down what you did.

Take this exercise with a professional attitude, especially, if you are a new trader. It will give you a clear perspective regarding your trading ability to be a successful trader. Don’t be shy, to master this market you will need two things; discipline and practice. And hopefully with our step-by-step guide to kick-off your trading you will be a better trader.