How to transfer bank to bank

How to transfer bank to bank

How To Transfer Money From One Bank to Another

By Cynthia Measom

It’s possible to electronically move money from one bank to another using various tools. With online banking, money transfers between bank accounts have been made incredibly easy. While there are several methods you can use, each has its pros and cons. Keep reading to find out how you can transfer money between accounts efficiently.

Bank-to-Bank Transfer

This is the best option if you own both bank accounts. All you need to do is initiate the transfer in the sending bank and the receiving bank will receive the funds after two or three business days, depending on the bank’s policies. This will highly depend on the banks you’re using and whether you are transferring money to a local or international bank account.

For many banks, transfers between connected accounts are free, but this is not the case for all banks. You need to confirm the policies with the banks involved. This method is incredibly hassle-free if both accounts are in your name.

If you need to transfer the funds to someone else, you might need a third-party payment provider or a wire transfer. Your bank can provide you with information regarding the best method.

Peer-to-Peer Transfers

Nowadays, we have several P2P payment tools available online, including PayPal, Venmo, Zelle, Cash App and more. If you need to send money to someone or your bank does not allow bank-to-bank transfers, these tools can come in handy.

You’ll need to link your bank account to the payment app or service using your checking account and routing numbers to set up the accounts. When using PayPal, for instance, the funds you send are automatically deducted from your bank account.

PayPal then sends this money to the recipient’s PayPal account. From there, the recipient can choose to spend the money via PayPal or transfer it to their bank account.

Wire Transfers

This is a relatively old method that predates apps and online banking tools. Wire transfer is a quick method that allows money to be moved without needing to exchange cash. This is a safe method for both parties to transfer funds even though they may be in different geographical locations.

This transfer is usually between two banks or financial institutions. Rather than physically transferring the cash, the financial institutions involved share information about the recipient, the receiving bank account number and the amount to be transferred.

The sender is then required to pay for the transaction at their bank. The sender provides the recipient’s details, such as personal information, banking information and the reason for the transfer.

Takeaway

Today, you can send money from one bank to another securely using various methods. Understanding the different methods can be helpful when it comes to choosing a convenient way to transfer money, depending on your needs. However, be sure to understand any fees involved before initiating a transfer.

Writing Paper Checks

If technology is a little more trouble than it’s worth, you can choose to write a check. If you’ve got money somewhere in an old account, all you need to do is write a check and enter your name as the payee, then deposit the check into your new account.

Email Money Transfer

This method involves sending and receiving money using a person’s email address. The participating banks notify the individuals of the transfer via email and then the money is delivered through a secure fund transfer network. Venmo, Zelle, Apple Pay and Google Pay are some of the most commonly used services for email money transfers.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

How to Transfer Money From One Bank to Another

The Balance / Ashley DeLeon

Online banking makes transferring money between bank accounts easier than ever. You can move money from one bank to another electronically using a variety of tools. Each method has pros and cons, but they all get the job done.

Bank-to-Bank Transfer

If you’re an owner of both bank accounts, a basic bank-to-bank transfer is a good option. You can set up the transfer with the sending or receiving bank, and the funds arrive at the destination after two or three business days. The timing ultimately depends on which banks you use and whether you are moving money internationally or domestically.

Many banks allow you to make free transfers between connected accounts, but it’s a good idea to check with both banks, just to be safe.

Before you can complete a transfer, you need to link your accounts. That process can take about a week, so be sure to establish the link before you need to send money.

This method is easiest if both bank accounts are in your name. To transfer funds to somebody else, you may need to use a third-party payment provider (such as PayPal) or a wire transfer. Ask your bank what the best solution is.

External Transfer Fees

As online banking has gained in popularity, fees for sending money to external accounts have become less common. Many popular banking institutions offer the service for minimal charges or free if you meet certain criteria. Here’s a small sampling of those institutions:

This is not an exhaustive list, as many credit unions and banks also offer similar services for free. Check with local institutions for details.

Apps and Online Payment Tools

If your bank doesn’t offer bank-to-bank transfers or if you need to send money to somebody else, person-to-person (P2P) payment tools may provide what you need. To set up your accounts, link your bank account to the app or service using your checking account and routing numbers the same way you link accounts from separate banks. For example, if using PayPal, the funds you send come out of your bank account. PayPal then moves funds to the recipient’s PayPal account, and the recipient then can spend the money via PayPal or transfer it to a bank account.

Numerous options are available:

Writing Old-Fashioned Checks

Not in any rush to move the money? Sometimes technology is more trouble than it’s worth. Maybe you’ve got a few bucks sitting around in an old bank account, and you just want to move that cash to your new bank. It might not be worth the effort to punch in all the routing and account numbers and sign up for a new app just for that.

If you’ve got checks, writing one to yourself is a simple solution. Just enter your own name down as the payee, and deposit the check into your new account. You can take care of the whole thing without leaving the house if you deposit the check with your mobile device.

If you don’t have a check, ask your bank to print one for you. Even if you’re nowhere near a bank branch, there’s rarely any difficulty getting a check made payable to you (the account owner) and mailed to your home address on file with the bank.

You can use your bank’s online bill payment service to make a payment to yourself.

If you use a credit union that’s part of the shared branching network, you can walk into almost any participating branch in the country and request a check. Moving funds from one credit union to another might be especially easy—and something you can complete in one trip—if they’re both part of the network.

Frequently Asked Questions (FAQs)

How long does it take to transfer money from PayPal to a bank account?

Transfers from PayPal to a bank account can settle within a day or they can take up to three days. You can also pay a fee for an instant transfer that settles within 30 minutes.

How do you transfer an IRA to another bank?

IRA funds cannot be transferred from one bank to another as easily as cash from a checking account. You must open a rollover IRA account and arrange for an IRA rollover from your current account. Failure to properly transfer IRA funds could result in penalty taxes.

How to transfer money from one bank account to another

Transferring money to other bank accounts

March 16, 2022 | 5 min read

There are plenty of reasons for needing to transfer money––and plenty of ways to get the job done. From old-fashioned checks to new-fashioned apps and online bank transfers, there’s a way to transfer money that will suit your timeframe, budget and other needs.

Whether you’re looking for how to make bank-to-bank transfers between your own accounts or how to transfer money to someone else’s bank account, wire transfers can be a common method. A wire transfer is an electronic transfer of money. These bank transfers can usually be done online or you have the option to go to a branch and request the transfer in person. You also typically have the option to transfer money by writing a check and depositing the money into the other bank account. And finally, another popular way of sending money is with money transfer apps that connect to your bank account and allow you to quickly transfer money to friends and family.

Transfer money from one bank account to another

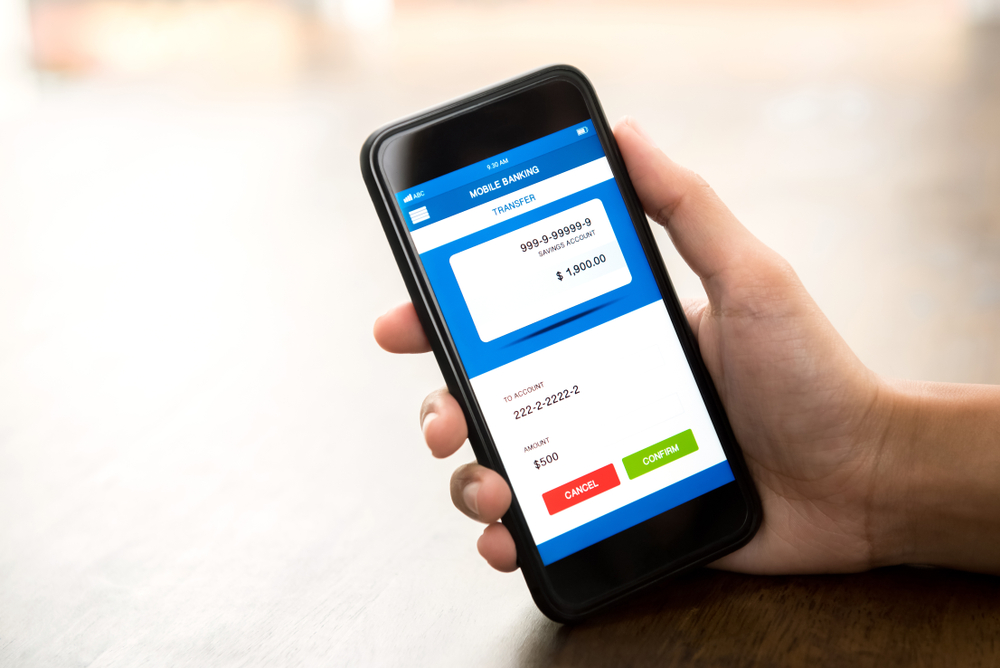

If you need to transfer money between two of your own accounts at different banks, the process is typically free, and you can do it with your online banking account. But first you’ll need to “link” the accounts, which can take about a week. Every bank varies a bit, but these are generally the steps you’ll need to go through:

Transferring money from a checking account to a prepaid card online is also usually free. The steps are similar to those above. In this case, you’d be asked to provide the bank name, account number and routing number of your prepaid card to create an external account.

Instead of sending one-off transfers, you can also set up recurring bank transfers to help make saving a no-brainer. You choose the amount and the frequency, and automatic transfers can do the rest for you. Some banks allow you to set up bill pay, too. You can save yourself some work by paying your bills with an online transfer or even set up automatic bill pay.

Online bank transfer apps

There’s an ever-growing list of money-transfer apps, including Zelle and many others. They all tout unique features, so visiting their websites may help you pick one that best meets your needs.

Apps can be a good idea if you’re looking for low (or no) fees, convenience or an alternative to carrying cash. Essentially, they give you a fairly quick and easy way to send money.

With Zelle, for example, you’d download the app to your device, follow enrollment instructions and enter information such as the email address or mobile number of the person you’re paying and the amount you’d like to send.

According to Zelle, if you and the recipient are both enrolled, sending or receiving money should take just minutes. 1

When using apps to transfer money online to a bank account, always be sure that you’re paying the person you intended, as transactions can’t usually be reversed. On the flip side, only accept payments from people you know and trust. While problems are rare, hackers and scammers are always on the prowl for weak spots. So anytime you’re sending money online, slow down, double check your digits and keep your apps up-to-date.

Down to the wire: bank-to-bank wire transfers

Wire transfers have been helping people move money around for quite some time. Some wire transfer services have been around since the 1800s. These companies allow customers to transfer funds quickly by dropping off or picking up cash at any of its locations worldwide.

Like all things, wire transfers come with pros and cons. On the upside, they can be fast and don’t require you to jump through too many technical hoops. On the downside, they typically involve fees, which vary depending on whether you’re transferring money to someone’s bank account or setting them up to receive cash.

You can also usually wire transfer money between banks. To do so, you’ll need to have some information on hand, including the recipient’s account number along with their bank’s name and routing number. But there are often fees for these types of wires too. 2

If there’s a word of caution about wire transfers, it’s this: Once the recipient collects the cash or it’s deposited into another account, the money is essentially «gone,» so be sure you know exactly who you’re sending money to and that all of the information you provide is accurate.

Transfer money by check

Sometimes, a slightly slower, no-tech method of payment is all you need. If you’re paying yourself, you can simply write your own name next to “Pay to the Order of” on your check and deposit it in your account. You may even be able to skip a trip to the bank by using the mobile deposit feature on your bank’s app or visiting a nearby ATM.

To pay others by check, put their full name or company name on the payee line. If you’re not sure about the payee, you can make a check payable to «Cash.» Just remember that anyone will be able to cash it, so keep it safe until you’re ready to hand it over.

If you don’t have checks, your bank can usually print a cashier’s check or counter check for you on-demand. Cashier’s checks are guaranteed funds with payee information printed on them. Counter checks work like regular checks, drawing money from your checking account when they clear. Keep in mind, a bank might charge a fee for a cashier’s or counter check.

Knowing how to transfer money from one bank to another is a handy skill to have, especially when you have lots of options. Whether you need to send money to a bank account instantly or enjoy the simplicity of writing a check, you have choices.

So next time the whole crew shows up for taco Tuesday, you’ll have ways to safely transfer the money you need.

This site is for educational purposes. The material provided on this site is not intended to provide legal, investment, or financial advice or to indicate the availability or suitability of any Capital One product or service to your unique circumstances. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

How to Transfer Money Between Accounts at Different Banks

Share this:

The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is «as is» and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. After 20 days, comments are closed on posts. Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted. Click here to read full Terms of Service.

Save more, spend smarter, and make your money go further

As a personal finance writer, I’m often answering questions from friends and family about basic financial principles. When someone is setting up a savings account for the first time, they’ll often ask, “How do I actually move the money from my checking to my savings?” Which is why I’ve created this guide on how to transfer money from one bank to another bank.

It seems like such a simple concept, but transferring large amounts of money almost always involves jumping through some hoops. You can’t just call up your bank and ask them to move the funds, and actively withdrawing and then depositing the money is an unnecessary hassle. So what do you do?

If you want to transfer money between bank accounts, whether they’re your own, or you’re sending money to someone else, here are the best ways to do so.

How Do Banks Transfer Money?

Every major bank uses the Automated Clearing House (ACH) system to transfer money. When your employer sends your paycheck via direct deposit, they’re using the ACH.

The ACH was created in the 1970s as a faster alternative to checks and a cheaper solution than wire transfers. It’s an electronic system that transfers money in large batches overnight. In addition to being faster than many other traditional transfer options, the ACH is often more secure than wire transfers and other types of electronic payment because it is backed by the self-regulating NACHA.

How to Transfer Money from One Bank to Another

Transferring money between different bank accounts is a common need for most people. I myself have three different banks I use for my personal and business needs, and I initiate transfers between them at least once a week. In other cases, I might be sending money to someone else, which also requires a bank to bank transfer.

Setting up external transfers can be confusing, so let’s use a hypothetical example to explain how it works using your online bank’s website. Bank A is the bank you’re transferring money out of, and Bank B is where you want to send those funds. Below, you’ll find six steps on how to transfer money from bank to bank:

1. Go to your bank’s website to link accounts.

Log in to Bank A and click on the “Transfer Funds” section, then “External Transfers” or “External Accounts,” and finally, “Add an external account.”

2. Proof of account ownership.

To add an external account, you have to verify your Bank B account with Bank A. Bank A will need proof that you are the owner of the account at Bank B.

3. Provide the necessary information.

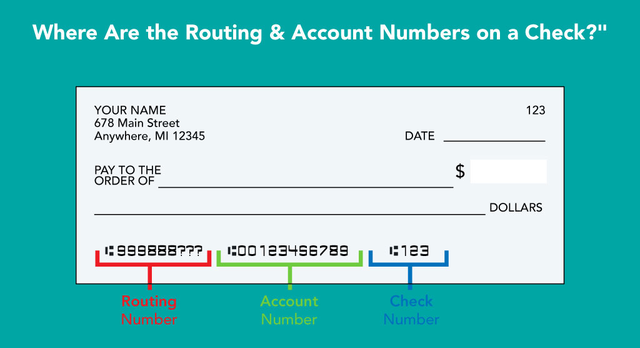

Bank A will ask for the account and routing number for Bank B (I’ll show you exactly how to find your account or routing number later in this post), and whether it’s a checking or savings account.

4. Very the account.

Bank A will then ask you to verify your account with Bank B in one of two ways:

5. Verify the deposits.

Log into Bank A and go to the “External Accounts” section. There should be a part that says, “Verify Your Deposits,” where you will enter the amounts that were transferred to Bank B. This process usually takes at least 1-2 business days.

6. Start transferring money from one bank to another.

You are now able to transfer money from Bank A to Bank B with no problems. You can set up recurring or one-time transfers, depending on your needs.

Typically, transferring money between two accounts is free, but sometimes there’s a limit on how much you can transfer at one time. This depends on your bank’s policies. For instance, when comparing credit unions vs. banks, credit unions usually have lower fees. When transferring money in and out of your accounts, keep in mind that there are usually savings and checking account minimums you must maintain to avoid additional fees or account closures.

What Info Do You Need to Transfer Money?

When it comes to trying to figure out how to transfer money from one bank to another, it can be confusing to set up if you don’t know what you need. In order to transfer money between banks, you’ll need the following information:

How Do You Find the Routing and Account Number?

There are several ways to find the routing and account number for a particular bank account:

Alternatives to Bank Transfers

If you want to send money from your bank account to someone else’s, you’ll typically have to find an alternative to bank to bank transfers. That’s because you need to be the account holder at both banks in order to send or receive money. Here are some other popular bank transfer solutions:

Fortunately, doing so has become easier than ever with plenty of apps and sites offering transfer services. Whether you’re splitting the dinner bill, paying your portion of the hotel reservation for an upcoming bachelorette party, or getting some last-minute rent money from Mom and Dad—you’ll be thankful you know about these easy options when you need to quickly transfer money between banks.

Once your bank account is linked in the app, you can quickly type in a dollar amount, select the recipient, and hit send—they’ll get the funds nearly instantly.

Not only are they usually more convenient when you need to do a bank to bank transfer with someone who uses a different one than you, but they often allow the recipient to get the money the same day—usually for a small fee, of course.

Additionally, you can also keep a balance in these apps, which can act as a short-term savings account. For instance, if you have someone transferring you rent money, it’s easier not to accidentally spend it if it’s not sitting in your bank account. If you choose to do this, just make sure you’re not using this balance to make payments to others, or you might find yourself stressed when the 1st of the month rolls around.

Writing a Check

While it might seem outdated, writing a check is a feasible alternative to transfer funds to another one of your accounts or to someone else. If you don’t have a checkbook, many banks may provide a few checks per year, free of charge, or for a small fee. So, how do you transfer money using a check? It’s easy:

Wire Transfers

Another option when you need to transfer money between banks quickly is a wire transfer, which allows you to send money electronically. Wire transfers are a feasible alternative if you need to figure out how to transfer money without going through your bank since there are nonbank providers such as Western Union.

Wire transfers are a popular solution for sending money abroad or making fast transfers. For a wire transfer, you’ll typically need:

*Note: Dates and amounts may vary depending on your bank and type of transfer. Policies may change.

Which Transfer Method Should You Use?

There are several factors to consider when trying to decide how to transfer money between banks, including:

Key Takeaways for How to Transfer Money from One Bank to Another

Find the best savings account offers.

Start growing your savings by opening an account with one of our partners today.

This article has been updated since it was originally published on Oct 1, 2013.

Save more, spend smarter, and make your money go further

How to transfer money from one bank to another: 4 ways

Advertiser Disclosure

How We Make Money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Share this page

Share

Why you can trust Bankrate

Why you can trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial Integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Insurance Disclosure

Coverage.com, LLC is a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed. Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

Open page navigation

ON THIS PAGE

Close page navigation

The ability to transfer funds between accounts at different banks is a useful way to help you get money where it needs to be — whether it’s into your own account or someone else’s.

Transfer costs and speed are important considerations when choosing the best transfer method, and the two are often linked. Getting money where it needs to be in the quickest way can also be the most expensive method.

What are bank-to-bank transfers?

A bank-to-bank transfer, also known as an external transfer, is the process of getting funds from an account at Bank A to another at Bank B. External transfers that are electronic or utilize the internet can expedite getting money to someone else by eliminating the need to physically move cash between banks.

Things to consider before transferring money

When choosing a method to send money to another person:

After deciding on speed, cost and what sending options you have, you’re ready to make a money transfer.

Here are four ways to transfer money from your bank to another institution.

1. Wire transfers

A wire transfer is one of the fastest ways to transfer money electronically from one person to another through a bank or a nonbank provider such as Wise, formerly TransferWise.

For a domestic wire transfer, you’ll need the routing number, account number, the name of the recipient and possibly the recipient’s address. A domestic wire transfer can be set up online or at a branch or office.

Keep in mind your bank might have a weekday deadline for wire transfers, and they can’t be sent on weekends or bank holidays.

2. Mobile apps

Banks aren’t the only option for sending money. PayPal, MoneyGram, Western Union and other third-party companies are also considerations. PayPal customers don’t incur a fee when moving money from PayPal to their bank accounts.

Fees for international transactions typically are higher, and an exchange-rate fee may apply on transfers made in a foreign currency.

3. Email money transfers

Your bank’s app might offer a service, such as Zelle or Popmoney, that allows you to send money electronically to someone else using their email address or cellphone number. Transfers can take seconds or a few days, depending on the method selected. A fee or additional charge may apply for instant transfers. Apple Pay, Google Pay, Samsung Pay Cash and Venmo are other ways to send money to others using an app.

4. Write a check

A traditional way of transferring money between banks is by writing a check and depositing it either at a bank branch, online, through a mobile app or by mail. A money order can be used instead, though some bank’s websites and/or apps lack the capability to deposit a money order. Funds can also be transferred using an official check, also known as a cashier’s check, and deposited the same way a standard check is. A fee may apply for the purchase of an official check or money order.

What are the benefits of external bank transfers?

External bank transfers allow you to transfer funds between banks or send funds to another person without having to visit a branch or ATM.

An external transfer can be useful for moving funds, for example, from a high-yield savings account held at an online-only institution to a checking account at a brick-and-mortar bank. Having a checking account at a brick-and-mortar bank provides access to a branch — an important consideration for some consumers, while the online bank allows them to earn higher yields on savings that a traditional bank may not offer.

Money can also be transferred from a checking account to a bank or credit union that offers multiple savings accounts, or buckets, allowing consumers to set distinct savings goals.

Transferring your money to yourself at a different bank

Many consumers have accounts at more than one bank and sometimes need to transfer money from one account to one at a different bank.

Some options are setting up an external transfer or using a service such as Zelle. Some lower-tech options are writing a check to yourself or withdrawing cash from one bank and depositing it into another.

Be aware of savings withdrawal limits

The Federal Reserve deleted a rule in April 2020 that restricted the number of transfers and withdrawals from savings deposit accounts, which include savings accounts and money market accounts.

Even though this requirement no longer applies, your bank may restrict the number of transactions in these accounts, and exceeding your bank’s withdrawal limits could result in a fee.

Bottom line

An external transfer is a quick and easy way to funds from one account to another. It’s important to research transfer options to know how much they cost and how long it can take for the funds to get where they need to me. If you frequently need to move money between accounts urgently, setting up a practice transfer can help familiarize yourself with the process and help alleviate the stress you may experience when needing to transfer funds quickly.

Источники информации:

- http://www.thebalance.com/best-ways-to-transfer-money-between-bank-accounts-315466

- http://www.capitalone.com/bank/money-management/banking-basics/how-to-transfer-money/

- http://mint.intuit.com/blog/how-to/how-to-transfer-money-between-accounts-at-different-banks-1013/

- http://www.bankrate.com/banking/how-to-transfer-money-from-one-bank-to-another/

:max_bytes(150000):strip_icc()/PritchardJustinJacketSized-5b7485a846e0fb0050436534.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

:strip_icc()/best-ways-to-transfer-money-between-bank-accounts-315466-4a4f19f450f646ee9dda1d56887db93b-e909be5663a64f7aa3d8faf73c7eaecd.jpg)