How to transfer money from paypal to paypal

How to transfer money from paypal to paypal

PayPal instant transfer: Fees, limits and types

Adam Rozsa

PayPal instant transfer lets you send money from your PayPal balance to an eligible bank account in just a few minutes for an extra fee.

We’ll cover everything about PayPal instant transfers, including the PayPal instant transfer fee structure, limits and more.

Ready to get started with a PayPal instant bank transfer? Let’s dive right in.

But first, a word.

If you want to send money abroad fast for low fees, take a look at Wise. It takes just a few minutes to get a free account.

How do instant transfers work with PayPal?

A standard PayPal transfer takes about 1-3 days to reach a bank account.

However, if you have a PayPal balance, you can use instant transfers to move your money to your bank or debit card up to 30 minutes for an extra fee.

Maybe you sold something online and got paid via PayPal, or a friend sent you some money with PayPal to cover a split bill. If you need to withdraw the money to your bank account fast, an instant transfer might be the best option.¹

There are costs involved with using this withdrawal method, so make sure you read on to the fee section before you get started.

How to link your bank account or card to PayPal to do instant transfers?

To add a credit or debit card to your PayPal account, take the following steps:

To add a bank account:

It’s worth noting that this process doesn’t mean you’re withdrawing money from your account or adding money to your PayPal balance. It just means your card or account is linked so the next time you use PayPal to make a payment or transfer, the amount will be deducted from the payment method you select.

How to transfer money from PayPal to bank account instantly?

Here’s how you can use instant transfer: ¹

| Wise can be up to 6x cheaper when sending money spending abroad, compared to banks and PayPal. Plus, right now, 45% of our transfers are instant money transfers. |

|---|

PayPal instant transfer fees

Is PayPal’s instant transfer free?

No, as we mentioned above, there are some charges you need to know about if you want to use PayPal instant transfer.

Withdrawing money to your bank account

Transfers to bank accounts usually happen within minutes, or up to half an hour for a transfer to a linked card

Fees effective from 17 June 2022

Other types of transfer

If you’re using PayPal as a way to send money to friends or family from your linked bank account or card, there are different fees depending on the transfer details. Here’s an overview.

PayPal instant transfer limits

Is there a limit on PayPal instant transfers?

Yes. If you want to use the instant transfer service, there are some limits you need to know about:

| Instant withdrawal type | PayPal instant transfer limit⁴ |

|---|---|

| Instant transfer to a card | Up to $5,000 per transaction, $5,000 per day and $5,000 per week in total. Up to $15,000 per month |

| Instant transfer to a bank account | Up to $25,000 per transaction |

Frequently asked questions

PayPal has resources online, including an FAQ section and community answers to specific questions. If you need personal advice, you can also notify the PayPal support team. Here are a couple of common issues and how to resolve them.

PayPal instant transfer pending: Why and what does it mean?

If you get a notification that your transfer is pending, or if it takes longer than you expect, it could be because it’s being checked by PayPal. Transfers are subject to review to help stop fraud, which can cause a delay.⁵

Other reasons your payment may be pending can be to do with your bank or card provider’s own processes. There’s advice online, and in the PayPal community forums which may help you troubleshoot in this situation.⁶⁷

PayPal instant transfer not working?

If you’re still struggling to get instant transfer to work it could be as a result of the following issues:⁸

You could try to use an alternative linked card or account to process the payment, or use a PayPal Cash Card. You’ll also be able to order a check to get your money. There are fees for some of these services, so be sure to look at the full terms and conditions online before you make a decision.

If you need to get in touch with someone at PayPal to ask questions about your account, or file a complaint, you can use the contact form available on the PayPal website.⁹

If you use PayPal regularly, instant transfer can be an easy way to send money to your bank account or linked card quickly. However, as we have covered above, there are fees you need to consider before you use the service.

Do a bit of research before you start using instant transfer to make sure it’s the best option available for you, and to avoid paying more than you need to for your PayPal balance withdrawal.

All sources last checked on 2 May 2022

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

Send fast international money transfers

PayPal and our new Xoom service offer the flexibility, speed and security you need to send money worldwide. Choose from a variety of convenient options to transfer funds internationally – all with amazing rates.

Choose from a variety of ways to send money internationally Sending options will vary by country.

PayPal Transfer Send money between PayPal accounts to almost anywhere in the world. Send to PayPal Account Recipients must have or open a PayPal account.

International Bank Deposits Deposit money directly into international bank accounts. Send to Bank

Cash Pickup We work with trusted banks and retailers for your recipient to collect cash in person. Set up Cash Pickup

Mobile Reload Add minutes and data to prepaid mobile phones overseas. Reload Phones

It’s easy to start sending money with Xoom

You can easily log in with your PayPal credentials, and all of your linked PayPal payment methods will be automatically available when you send money abroad. Plus, the recipient of a Xoom transfer doesn’t need a PayPal or Xoom account to receive international funds.

Speed and simplicity

Get access to fast and easy options for moving money around the world.

Secure transfers

Send money abroad with peace of mind, knowing your transaction is protected.

Amazing rates

We’re committed to providing transparent rates for every transaction.

Total flexibility

Transfer funds to a PayPal account* or deposit directly into an international bank account with Xoom. *Recipients must have or open a PayPal Account.

Questions & Answers

Will my international money transfers be trackable?

Yes, you’ll stay current with text updates, email notifications and have online access from your computer or phone. Please note: Notifications may differ depending on money sending method.

Can I now use PayPal’s new Xoom service to send money within Canada?

Can I fund my Xoom transfer with money in my PayPal Balance?

If I send money with PayPal’s Xoom service, will my transaction appear in my PayPal account?

How to Withdraw Money From PayPal

Posted by Frank Gogol

Updated on May 17, 2022

PayPal is a payment system that has revolutionized the way we send and receive money. All you have to do is link your bank account, and you can add money, send it to someone, or withdraw it back into your account in real-time. So how exactly does the whole process of withdrawal work? Read on to find out.

Table of Contents

How to Withdraw Money From PayPal

PayPal uses simple steps to make the process of withdrawing money from your PayPal wallet to your bank account as easy as possible. The whole process is done in just eight steps!

How to Link Your Bank Account With PayPal

Knowing how to withdraw money from PayPal is great, but if you wish to link your bank account with your PayPal account, you will need the following steps:

The Process of Linking Instantly and Linking Manually

To link your account instantly, you will have to give your bank’s online login ID and password. PayPal will then verify these credentials with your bank, and upon successful verification, your account will be added.

How to Instantly Transfer Money From PayPal

Once you have added your bank account to your PayPal wallet and added some amount to your PayPal wallet, it is time to transfer your money to others instantly. The process itself is quite simple:

Then, your money will instantly be transferred to your recipient’s wallet.

PayPal Transfer Fees

While the service provided by PayPal is truly extraordinary, it is not free. PayPal charges you various fees for various transfers while also giving you certain services for free. Here is a list of some of the services PayPal provides:

Account Opening Charges

PayPal does not require you to pay a fee for opening an account. Account opening is a free service offered by PayPal.

Personal Payments

These are the money transfers you make to your friends and family. Or any account that is not registered as a seller account with PayPal.

Sending and Receiving Money

There are no fees to send or receive money through your PayPal wallet, your bank account, or a combination of both. However, if you or your sender uses your credit or debit card, you will be charged a certain fee depending on the bank you use.

Purchase Payments

If you transfer money to a seller, there is no payment to be made in the form of fees to PayPal. However, you will have to pay a certain percentage of the transaction amount as fees if you receive money.

International Transactions

All international transactions are charged at a specific rate depending on the sender’s or receiver’s country. Both the sender and the receiver are charged for international payments.

Withdrawing Money

There is no fee to withdraw money from your PayPal wallet.

Read More

Conclusion

As you can see, the steps involved in sending, receiving, and withdrawing money from your PayPal account are simple. The service is also easy to use overall.

Need a Loan? Get One in 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon you’ll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days (some lenders will be as quick as 2-3 business days). Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. (F-1, OPT, H-1B, O-1, L-1, TN visa holders) at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Send money internationally PayPal: All you need to know

Adam Rozsa

Since launching close on 20 years ago, PayPal has played a big role in transforming ecommerce. Today, you can use your PayPal account to shop online, receive payments if you’re a freelancer or entrepreneur, and send cash to family and friends.

If you’re considering sending money abroad using your PayPal account, there are a few things you need to know about how to set up your international money transfer.

Sending money abroad? Wise could save you. A lot.

Banks and money transfer providers often give you a bad exchange rate to make extra profits.

Wise is different. Its smart new technology skips hefty international transfer fees by connecting local bank accounts all around the world. Which means you can save up to 6x by using Wise vs your bank when you send your money abroad.

Oh, and while you’re at it, check out Wise’s borderless multi-currency account. Where you can manage and send dozens of currencies, all from the same account.

Does PayPal work internationally?

Let’s say you want to send money abroad – and you’ve been wondering: is PayPal international?

Yes, PayPal can be a useful tool for sending money internationally. And if you’re going to send money abroad with PayPal, then it pays to know a little about the fees and charges you’ll encounter along the way.

PayPal international transfer fees

When you arrange an international transfer with PayPal, from a PayPal account based in the USA, you need to understand both the fee structure, and the currency conversion rate applied.

The international transfer fee is on top of the domestic transfer fee, which in case of card transfers is 2.90%+ a fixed fee based on the received currency.¹

See the PayPal most important international transfer fees on this table:

| If you need to make a business transfer, the Wise Business account is even up to 19x cheaper than PayPal for business use. |

|---|

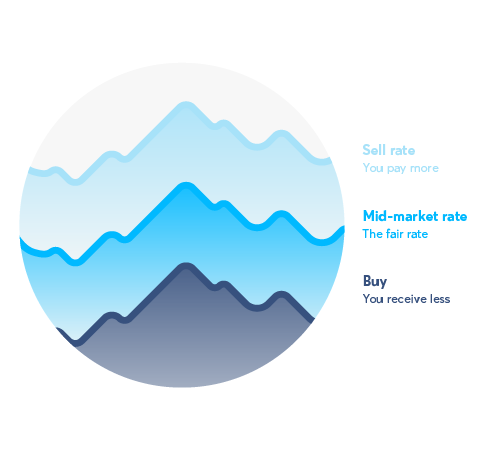

PayPal conversion rate vs bank exchange rates

PayPal charges international transfer fees, but that’s not all you need to know about. If you’re sending money internationally, you’ll also find that you pay a currency conversion spread of 4.00%¹, which is added onto the wholesale exchange rate.

What that means, is that PayPal takes the exchange rate they get from a third party, and adds their conversion spread. You can see this if you compare the PayPal exchange rate with the mid-market rate, sometimes called wholesale, spot, or interbank rate.

It’s the same rate you can find if you google USD (US dollars) along with the other currency involved in your international transfer. Exchange rates change all the time, but you can see the exchange rate that PayPal is offering you for your transfer, by logging into your PayPal account.

Between this and the international transaction charges described above, you can find that the costs of making an international money transfer with PayPal mount up pretty quickly.

Here are some of the most common PayPal currency conversion fees:

| PayPal fees | |

|---|---|

| Currency conversion fees when sending money to a friend or family² | 4.00% or such other amount, which may be revealed during the transaction¹ |

| Currency conversion fees when sending paying for goods and services² | 4.00% or such other amount, which may be revealed during the transaction¹ |

| 💡 Want to learn more about PayPal’s currency conversion rates? Read our article here. |

|---|

Sending money abroad: Alternatives to PayPal

If you decide against sending money abroad with PayPal, you have a couple of other options.

Try a different money transfer service

Looking for different money transfer services other than PayPal? Wise can actually save you a lot of money when sending money abroad – up to 6x. Let’s see a real-life example of sending 1000 dollars with PayPal and Wise from the US to Canada:

The true cost of sending USD to CAD

If you frequently make cross-border payments, you also may consider signing up for the Wise borderless multi-currency account. You can also get the Wise multi-currency debit card, which you can use to pay for goods and services all over the world.

Make an international bank wire transfer

The fees related to making a wire transfer online, or on the phone via your normal bank, are usually a little lower. That’s if your bank even offers the service online. Check out the terms and conditions for your particular account before you commit.

Watch out for extra fees thanks to the SWIFT network

Unfortunately, if you choose to send your money via a traditional bank, they often won’t be able to tell you exactly what your transfer will cost you if your transfer is processed using the SWIFT network.

The SWIFT network is how international transfers are passed from one bank to another, using a system of international protocols to make sure the money stays safe, and finds its way to the correct account in the end.

How to make an international money transfer with PayPal: Step-by-step

These are the steps you need to follow if you want to make an international transfer with PayPal:

Other payment routes you may want to use

So, the guide above is what you need to follow when you want to send money quickly to friends and family. However, if you do decide to make an international money transfer with PayPal, you’ll have a couple different options³ as well:

Some of these services are delivered through Xoom³, which is a PayPal subsidiary specialising in certain types of payments and transfers. If you send cash to your recipient’s PayPal wallet, then they’ll need to have a PayPal account themselves to be able to access it. However, for the other options you can transfer cash via PayPal, even if the recipient doesn’t have a PayPal account themselves.

| 💡 Note: Not all transfer options are available in all countries and currencies. |

|---|

Need more information? Check out these PayPal articles:

Sources

All sources checked as of 12 November 2021

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

How to withdraw money from PayPal

Zorica Lončar

If you’ve got money in your PayPal account, you’ll need to know how to withdraw the balance. The good news is that it should be relatively quick and easy, provided your PayPal account is all set up.

In this guide, we’ll walk you through everything you need to know on how to withdraw money from PayPal. This includes how to use Wise to avoid expensive exchange rate mark-ups when withdrawing balances in different currencies.

How do I withdraw money from PayPal?

How to transfer money from PayPal to a bank account¹

Ready to send money from your PayPal balance to your bank account? Here are the steps you need to follow to do it online:

Withdrawing money using the PayPal app is even easier, as all you need to do is tap your PayPal balance and then select ‘withdraw money’.

How to link your bank account with PayPal²

Before you can withdraw your PayPal balance as above, you’ll need to first link your bank account to PayPal. Follow these steps:

You may also need to complete a few security checks, especially if you want to use your bank account as a funding source for PayPal transactions. This usually involves a verification process, where PayPal will deposit 1p in your account along with a 4-digit code. You’ll use this code to confirm that you are the owner of the account.

PayPal exchange rate

Have a PayPal balance in a different currency to your bank account? For example, if you’ve been paid by an overseas client in US dollars, your PayPal balance will be in US dollars.

If you want to withdraw it to your UK sterling bank account, you’ll need to know about PayPal’s exchange rates for currency conversion.

How to get a PayPal balance for a better rate

Exchange rate matters when you need to send and receive money in other currencies, so how do you ensure you get a fair rate? One option is to use Wise to avoid PayPal’s exchange rate mark-up.

Open a Wise multi-currency account and you can get your own local account details for multiple currencies, including USD, EUR, AUD and many more. You can use these international account details to withdraw your PayPal balance.

PayPal fees: How much does PayPal charge?

Here’s a roundup of the most common withdrawal costs you need to know about, to get you started.

PayPal withdrawal limit in the UK⁴

With PayPal, you can withdraw any amount to your confirmed bank account provided you have enough money in your PayPal balance. However, there may be delays and restrictions imposed for security reasons, such as to comply with anti-fraud processes. And new users may have limitations on their PayPal activity until they are able to verify their bank account⁵.

PayPal debit card

If you want to convert PayPal to cash, then you’ll need a PayPal debit MasterCard to spend the money held on your account. In order to get a PayPal debit card, you’ll need to have a PayPal Business account⁶. At the time of writing, PayPal doesn’t offer a linked debit card for personal customers in the UK. If you have a PayPal Business account, then you will be able to spend your PayPal balance conveniently, online or in stores.

Contact PayPal

If you’re having any issues relating to PayPal withdrawals, here’s how to get help⁷:

After reading this, you should have all the info you need on how to withdraw money from PayPal, including the steps to follow, fees and how to get help if you need it.

Sources used for this article:

Sources checked on 27-September-2021.

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.