It is made from the buyers bank account to the sellers in accordance with the

It is made from the buyers bank account to the sellers in accordance with the

Terms of payment

In business there are many occasions on which people have to deal with money and talk about money.

Payment in foreign trade may be made in cash and on credit. There are different methods of cash payment:

1. By cheque (They are mostly used for payment in home trade).

2. By telegraphic or telex transfer or post. They are made from the Buyer’s bank account to the Seller’s in accordance with the Buyer’s letter of instruction.

3. Ву a letter of credit (L/C). In commercial practice the following types of letters of credit are usually used: irrevocable, confirmed and revolving. An irrevocable L/C cannot be modified or controlled without the agreement of all the parties. A confirmed L/C is an irrevocable L/C, payment under which is guaranteed by a first class bank. A revolving L/C is one under which its value is constantly made up to a given limit after payment for each shipment which saves the charges on multiplied letter of credit.

The letter of credit is the most frequently used method of cash payment because it is profitable and secure both to the Buyer and to the Seller though it is more expensive than payment by transfer. Payment is made against shipping documents.

4. Payment for collection is not widely used because it doesn’t give the Seller any guarantee that he will receive payment in time or at all. It is more advantageous to the Buyer because there is no need to withdraw from circulation big sums of money before actually receiving the goods. Most modern business is done on a credit basis which may be:

· by drafts. A draft is an order to pay. It is made out by an exporter and presented to the importer. It is also called a bill of exchange. There are two main types of drafts: sight draft and term draft. A sight draft is a bill which is paid immediately on presentation. A bill to be paid at a later date is called a term draft. There are 30-day, 60-, 90-and 120-day drafts;

· in advance (the Buyer credits the Seller) [For example the contract may stipulate a 10 % or 15 % advance payment, which is profitable to the Sellers]. This method is used when the Buyers are unknown to the Sellers or in case of single transaction;

Terms of payment

Payment in foreign trade may be made in cash and on credit. There are different methods of cash payment:

1.By cheque (but it is not practicable as a cheque is payable in the country of origin. That’s why cheques are mostly used for payment in home trade.)

2.By telegraphic or telex transfers or post (mail) remittance which is made from the Buyers’ bank account to the Sellers’ in accordance with the Buyers’ letter of instruction. Actually this method of cash payment may sometimes take several months, which is naturally very disadvantageous to the Sellers. The transfer is carried out at current rates of exchange.

3.By letter of credit (or just by credit) — L/C

The following types of letters of credit are usually used: irrevocable, confirmed and revolving.

• An irrevocable L/C is one which can neither be modified nor cancelled without the consent of the party in whose favor it has been opened.

• A confirmed L/C is an irrevocable L/C, payment under which is guaranteed by a first class bank in case the opener of the L/C (i.e. the Buyers) or the bank effecting payment defaults, or is unable to make payment.

• A revolving L/C is one under which its value is constantly made up to a given limit after payment for each shipment, which saves the charges on multiple letters of credit.

The Letter of Credit is the most frequently used method of cash payment because it is advantageous and secure both to the Exporter and to the Importer though it is more expensive than payment by transfer. It overcomes the gap between Delivery and payment and gives protection to the Sellers by making the money available for them on the fulfillment of the transaction and to the Buyers because they know that payment will only be made against shipping documents giving them the title for the goods. This method оf payment is often used in dealings with developing countries.

4.For collection (Payment for collection does not give any advantages to the Exporter because it does not give any guarantee that he will receive payment in time or at all. That’s why the Exporter usually requires that the Importer presents a guarantee of a first class bank that payment will be effected in due time. Also, there is a long period of time between the delivery of the goods and actual payment. But it is advantageous to the Importer because there is no need to withdraw from circulation big sums of money before actually receiving the goods).

Payment for collection against documents (with subsequent acceptance or very often telegraphic collection with subsequent acceptance) is mostly used in trade with East European countries.

The costs involved in effecting payment for collection are twice or three times lower than those by letter of credit. Most modern business is done on a credit basis which may be:

1)by drafts (by Вills of Exchange — B/E) — the Exporter credits the Importer which is advantageous to the latter.

A draft (a bill of exchange) is an order in writing from a Creditor to a Debtor to pay on demand or on a named date a certain sum of money to a company named on the Вill, or to their order. It is drawn by the Sellers on the Buyers and is sent through a bank to the Buyers for acceptance (i.e. for acknowledging the debt). The draft becomes legally binding when signed and dated by the Buyers on its face (front) and is to be met when due, i.e. 30, 60 or 90 days after presentation. The draft may be negotiable, i.e. it may be used by the Sellers to pay their own debts, but in this case the Sellers are to endorse it by signing it en its back, then they can pass it on to the new holders.

If the exporter wants immediate payment, he can discount the draft in return for a cash advance with a bank for a commission, i.e. sell it to a bank for its face value loss interest, and by supplying a document (a letter of hypothecation) giving the bank the legal right to claim the goods if necessary. Besides, he may leave it with a bank as security for a loan. All this makes the Draft a very practical method of payment in foreign trade. To sum up its advantages — it simplifies the financing of export and import foreign trade and cuts down innumerable movements of currency.

There may be two main types of drafts:

Sights Drafts, which are payable on presentation (at sight) or on acceptance and

Term Drafts, which are drawn at various periods (terms) and are payable at a future date and not immediately they are accepted. Term, drafts may pass through several hands before maturity and require endorsement by the Sellers.

2)in advance (the Importer credits the Exporter, for example, the contract may stipulate a 10 or 15 % advance payment, which is advantageous to the Sellers). This method is used when the Buyers are unknown to the Sellers or in the case of a single isolated transaction or as part of combination of methods in a large-scale (transaction) contract.

3)on an open account. Open account terms are usually granted by the Sellers to the regular Buyers’ or customers in whom the Sellers have complete confidence, but sometimes they are granted when the Sellers want to attract new Buyers then they risk their money for that purpose. Actual payment is made monthly, quarterly or annually as agreed upon. This method is disadvantageous to the Exporter, but may be good to gain new markets.

The two methods of payment (in cash and on credit) are very often combined in a contract. Drafts, for example, may be presented under a letter of credit and there may be other, sometimes very complicated combinations of various methods of payment stipulated in a contract.

The currency to be used for payment is a matter for arrangement between the counterparts.

Дата добавления: 2015-09-12 ; просмотров: 9 | Нарушение авторских прав

Terms of Payment. Ways of Payment. Forms of Payment. Bills of Exchange

Страницы работы

Фрагмент текста работы

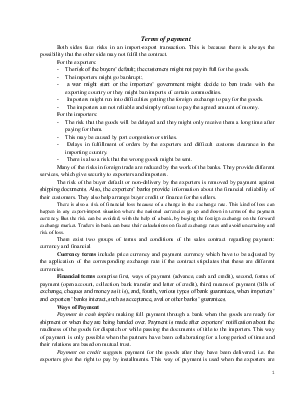

Both sides face risks in an import-export transaction. This is because there is always the possibility that the other side may not fulfil the contract.

For the exporters:

— The risk of the buyers’ default; the customers might not pay in full for the goods.

— The importers might go bankrupt;

— a war might start or the importers’ government might decide to ban trade with the exporting country or they might ban imports of certain commodities.

— Importers might run into difficulties getting the foreign exchange to pay for the goods.

— The importers are not reliable and simply refuse to pay the agreed amount of money.

For the importers:

— The risk that the goods will be delayed and they might only receive them a long time after paying for them.

— This may be caused by port congestion or strikes.

— Delays in fulfillment of orders by the exporters and difficult customs clearance in the importing country.

— There is also a risk that the wrong goods might be sent.

Many of the risks in foreign trade are reduced by the work of the banks. They provide different services, which give security to exporters and importers.

The risk of the buyer default or non-delivery by the exporters is removed by payment against shipping documents. Also, the exporters’ banks provide information about the financial reliability of their customers. They also help arrange buyer credit or finance for the sellers.

There is also a risk of financial loss because of a change in the exchange rate. This kind of loss can happen in any export-import situation where the national currencies go up and down in terms of the payment currency. But the risk can be avoided, with the help of a bank, by buying the foreign exchange on the forward exchange market. Traders in bank can base their calculations on fixed exchange rates and avoid uncertainty and risk of loss.

There exist two groups of terms and conditions of the sales contract regarding payment: currency and financial

Currency terms include price currency and payment currency which have to be adjusted by the application of the corresponding exchange rate if the contract stipulates that these are different currencies.

Financial terms comprise first, ways of payment (advance, cash and credit), second, forms of payment (open account, collection, bank transfer and letter of credit), third, means of payment (bills of exchange, cheques and money as it is), and, fourth, various types of bank guarantees, when importers’ and exporters’ banks interact, such as acceptance, aval or other banks’ guarantees.

Ways of Payment

Payment in cash implies making full payment through a bank when the goods are ready for shipment or when they are being handed over. Payment is made after exporters’ notification about the readiness of the goods for dispatch or while passing the documents of title to the importers. This way of payment is only possible when the partners have been collaborating for a long period of time and their relations are based on mutual trust.

Payment on credit suggests payment for the goods after they have been delivered, i.e. the exporters give the right to pay by installments. This way of payment is used when the exporters are particularly interested in selling their goods. However, in this situation the exporters may increase the price for the goods and require the importers’ bank guarantee.

Payment in advance means partial (10-30%) or complete (100%) payment beforehand for the goods before their dispatch. The importers credit the exporters, for example, the contract may stipulate a 10 or 15 per cent advance payment, which is advantageous for the sellers. This way of payment is used when the buyers are unknown to the sellers or in the case of a single isolated transaction or as part of combination of different ways, forms and methods of payment in a large-scale contract.

Forms of Payment

A form of payment is a mode and procedure of transferring goods and payment documents through a bank. A bank transfer denotes the movement of money by the importers’ bank on the basis of its payment order to the exporters’ account. It is made from the buyers’ bank account to the sellers’ in accordance with the buyers’ letter of instruction. Actually this form of payment may sometimes take several months, which is naturally very disadvantageous to the sellers. The transfer is carried out at current rates of exchange. The bank transfer is used where there is complete trust between sellers and buyers. The buyers don’t need to open any account but they are to notify the sellers about the code of the transfer.

An open account stipulates periodical payments by the importers onto the open account of the exporters after the goods have been sent with due regard for the current backlog. The open account agreement is usually granted by the sellers to the regular buyers in whom the sellers have complete confidence, but sometimes it is granted when the sellers want to attract new buyers, then they risk their money for that end. Actual payment is made monthly, quarterly or annually as agreed upon. This form is disadvantageous to the exporters, but may be good to gain new markets.

Платеж как важнейшее звено внешнеторговой операции

Покупатель при совершении сделки преследует, как правило, следующие цели:

1. Получить в указанные в контракте сроки товары или услуги в нужном количестве и соответствующего качества.

2.Обеспечить финансирование и оплатить контракт, будучи уверенным, что продавец полностью выполнил свои обязательства.

Продавца интересует скорейшее получение платежа. При этом ему нужна:

а) уверенность, что в случае выполнения своих обязательств контракт будет оплачен в согласованные сроки и в полном объеме;

б) уверенность, что никакие внешние обстоятельства не помешают выполнению обязательств, прямо влияющих на сроки получения платежа.

Поэтому условия платежа, учитывая противоположную направленность интересов сторон, всегда являются предметом сложных переговоров и поиска компромиссов.

В современной международной торговле можно выделить следующие виды расчетов:

1. Платеж по открытому счету (чистый платеж— clean payment).

3. Документарное инкассо (documentary collection).

4. Документарный аккредитив (Letter of Credit = L/C).

Суть первого способа заключается в оплате покупателем, как правило, банковским переводом или чеком, счета продавца за товары или услуги.

При расчетах векселями условно можно выделить «импортный» и «экспортный» векселя (import or export draft) в зависимости от того, выдан он в стране покупателя или продавца.

Главную роль в аккредитивной операции играет банк, выставляющий аккредитив, или банк-эмитент. Открытие аккредитива происходит по указанию приказодателя (импортера), определяющего его основные условия. Передача аккредитива бенефициару (экспортеру) происходит, как правило, через банк-посредник, называемый авизующим банком. Роль последнего заключается в проверке подлинности документа. В случае, если авизующий банк берет на себя дополнительные обязательства, связанные с оплатой аккредитива, он переходит в категорию подтверждающего банка.

Из всех перечисленных способов оплаты аккредитив наиболее нейтрален и сбалансирован с точки зрения интересов экспортера и импортера. Существует много видов аккредитива. Чащ на практике встречаются: безотзывный аккредитив (irrevocable L/C), который может быть отклонен только с согласия человека, ожидающего оплату за товар или услугу; подтвержденный аккредитив (confirmed L/C), к которому выплачивающий банк прилагает гарантию того, что оплата будет произведена после представления определенных документов.

Terms of Payment

Payment in foreign trade may be made in cash (наличными) and on credit (в кредит). There are different methods of cash payment (наличный расчет):

— by cheque(чек).But it is not practicable as a cheque is payable in the country of origin. That’s why cheques are mostly used for payment in home trade.

— by telegraphic or telex transfers(телеграфный перевод)or post(mail) remittance(почтовый перевод).It is made from the Buyers’ bank account to the Sellers’ in accordance with the Buyers’ letter of instruction. Actually this method of cash payment may sometimes take several months, which is naturally very disadvantageous to the Sellers. The transfer is carried out at current rates of exchange.

An irrevocable L/C (аккредитив безотзывный) is one which can neither be modified nor cancelled (аннулировать, отменять, расторгать) without the consent of the party in whose favour it has been opened.

A confirmed L/C (аккредитив подтвержденный) is an irrevocable L/C, payment under which is guaranteed by a first class bank in case the opener of the L/C (i.e. the Buyers) or the bank effecting payment defaults (неуплата), or is unable to make payment.

A revolving L/C (аккредитив револьверный, автоматически возобновляемый) is one under which its value (стоимость) is constantly made up to a given limit after payment for each shipment, which saves the charges (расходы, издержки) on multiple letters of credit.

The Letter of Credit is the most frequently used method of cash payment because it is advantageous and secure both to the Exporter and to the Importer though it is more expensive than payment by transfer. It overcomes the gap between Delivery and payment and gives protection to the Sellers by making the money available for them on the fulfillment of the transaction and to the Buyers because they know that payment will only be made against shipping documents giving them the title for the goods. This method of payment is often used in dealings with developing countries.

— payment for collection.But it does not give any advantages to the Exporter because it does not give any guarantee that he will receive payment in time or at all. That’s why the Exporter usually requires that the Importer presents a guarantee of a first class bank that payment will be effected in due time. Also, there is a long period of time between the delivery of the goods and actual payment. But it is advantageous to the Importer because there is no need to withdraw from circulation big sums of money before actually receiving the goods).

Payment for collection against documents (with subsequent acceptance (акцепт, согласие на оплату денежных и товарных документов) or very often telegraphic collection with subsequent acceptance) is mostly used in trade with East European countries.

The costs involved in effecting payment for collection are twice or three times lower than those by letter of credit.

Most modern business is done on a credit basis which may be:

by drafts (by Bills of Exchange — B/E). The Exporter credits the Importer which is advantageous to the latter.

A draft / a bill of exchange (вексель, тратта) is an order in writing from a Creditor to a Debtor to pay on demand or on a named date a certain sum of money to a company named on the Bill, or to their order. It is drawn by the Sellers on the Buyers and is sent through a bank to the Buyers for acceptance (i.e. for acknowledging the debt). The draft becomes legally binding when signed and dated by the Buyers on its face (front) and is to be met when due, i.e. 30, 60 or 90 days after presentation. The draft may be negotiable, i.e. it may be used by the Sellers to pay their own debts, but in this case the Sellers are to endorse (индоссировать, делать передаточную надпись) it by signing it on its back, then they can pass it on to the new holders.

There may be two main types of drafts:

Sights Drafts (тратта «на предъявителя»),which are payable on presentation (at sight) or on acceptance and

Term Drafts (тратта с оплатой в конце обусловленного периода),which are drawn at various periods (terms) and are payable at a future date and not immediately they are accepted.

Term drafts may pass through several hands before maturity (срок долгового обязательства) and require endorsement (индоссамент, передаточная надпись на векселе, подтверждающая переход прав по этому документу к другому лиц) by the Sellers

in advance (the Importer credits the Exporter, for example, the contract may stipulate a 10 or 15 % advance payment, which is advantageous to the Sellers). This method is used when the Buyers are unknown to the Sellers or in the case of a single isolated transaction or as part of combination of methods in a large-scale (transaction) contract.

on an open account. Open account terms are usually granted by the Sellers to the regular Buyers’ or customers in whom the Sellers have complete confidence, but sometimes they are granted when the Sellers want to attract new Buyers then they risk their money for that purpose. Actual payment is made monthly, quarterly or annually as agreed upon. This method is disadvantageous to the Exporter, but may be good to gain new markets.

The two methods of payment (in cash and on credit) are very often combined in a contract. Drafts, for example, may be presented under a letter of credit and there may be other, sometimes very complicated combinations of various methods of payment stipulated in a contract. The currency to be used for payment is a matter for arrangement between the counterparts.

TERMS OF PAYMENT

Payment in foreign trade may be made in cash and on credit. There are different methods of cash payment:

1. By cheque (but it is not practicable as a cheque is payable in the country of origin and its use is time-wasting to say the least. That’s why cheques are mostly used for payment in home trade).

2. By telegraphic transfers or post (mail) remittance which is made from the Buyers’ bank account to the Sellers’ in accordance with the Buyers’ letter of instruction. Actually this method of cash payment may sometimes take several months, which is naturally very disadvantageous to the Sellers. The transfer is carried out at current rates of exchange.

3. By letter of credit (or just by credit) — L/C. In our commercial practice the following types of letters of credit are usually used: irrevocable, confirmed and revolving. An irrevocable L/C is one which can neither be modified nor cancelled without the consent of the party in whose favour it has been opened. A confirmed L/C is an irrevocable L/C, payment under which is guaranteed by a first class bank in case the opener of the L/C (i.e. the Buyers) or the bank effecting payment defaults, or is unable to make payment. A revolving L/C is one under which its value is constantly made up to a given limit after payment for each shipment, which saves the charges on multiple letters of credit.

The Letter of Credit is the most frequently used method of cash payment because it is advantageous and secure both to the Exporter and to the Importer though it is more expensive than payment by transfer. It overcomes the gap between delivery and payment and gives protection to the Sellers by making the money available for them on the fulfilment of the transaction and to the Buyers because they know that payment will only be made against shipping documents giving them the title for the goods. This method of payment is often used in dealings with developing countries.

4. For collection (Payment for collection does not give any advantages to the Exporter because it does not give any guarantee that he will receive payment in time or at all. That’s why the Exporter usually requires that the Importer presents a guarantee of a first class bank that payment will be effected in due time. Also, there is a long period of time between the delivery of the goods and actual payment. But it is advantageous to the Importer because there is no need to withdraw from circulation big sums of money before actually receiving the goods).

Payment for collection against documents (with subsequent acceptance or very often telegraphic collection with subsequent acceptance) is mostly used in trade, with East European countries. The costs involved in effecting payment for collection are twice or three times lower than those by letter of credit. Most modern business is done on a credit basis which may be:

1) by drafts (by Bills of Exchange — B/E) — the Exporter credits the Importer which is advantageous to the latter. A draft (a bill of exchange) is an order in writing from a Creditor to a Debtor to pay on demand or on a named date a certain sum of money to a company named on the Bill, or to their order. It is drawn by the Sellers on the Buyers and is sent through a bank to the Buyers for acceptance (i.e. for acknowledging the debt). The draft becomes legally binding when signed and dated by the Buyers on its face (front) and is to be met when due, i.e. 30, 60 or 90 days after presentation. The draft, may be negotiable, i.e. it may be used by the Sellers to pay their own debts, but in this case the Sellers are to endorse it by signing it on its back, then they can pass it on to the new holders. If the exporter wants immediate payment, he can discount the draft in return for a cash advance with a bank for a commission, i.e. sell it to a bank for its face value less interest, and by supplying a document (a letter of hypothecation) giving the bank the legal right to claim the goods if necessary. Besides, he may leave it with a bank as security for a loan. All this makes the Draft a very practical method of payment in foreign trade. To sum up its advantages one should say that it simplifies the financing of export and import foreign trade and cuts down innumerable movements of currency. There may be two main types of drafts:

Sights Drafts, which are payable on presentation (at sight) or on acceptance and Term Drafts, which are drawn at various periods (terms) and are payable at a future date and not immediately they are accepted. Term drafts may pass through several hands before maturity and require endorsement by the Sellers.

2) in advance (the Importer credits the Exporter, for example, the contract may stipulate a 10 or 15 % advance payment, which is advantageous to the Sellers). This method is used when the Buyers are unknown to the Sellers or in the case of a single isolated transaction or as part of combination of methods in a large-scale (transaction) contract.

3) on an open account. Open account terms are usually granted by the Sellers to the regular Buyers or customers in whom the Sellers have complete confidence, but sometimes they are granted when the Sellers want to attract new Buyers then they risk their money for that end. Actual payment is made monthly, quarterly or annually as agreed upon. This method is disadvantageous to the Exporter, but may be good to gain new markets.

The two methods of payment (in cash and on credit) are very often combined in a contract. Drafts, for example, may be presented under a latter of credit and there may be other, sometimes very complicated combinations of various methods of payment stipulated in a contract.

The form of payment to be used, i.e. in dollars, pounds sterling or other currency, is a matter for arrangement between the counterparts.

1. What methods of cash payment do you know?

2. Why is payment by cheque very infrequent in foreign trade?

3. Is payment by transfer (remittance) used in foreign trade frequently? Why?

4. What is the most frequently used method of cash payment? And why?

5. What types of letter of credit are used in our commercial practice? Describe them.

6. When are payment for collection terms used?

7. Can you sum up advantages and disadvantages of each method of cash payment?

8. In dealings with what countries are they preferably used? Why?

9. What are the methods of payment on credit?

10. What is a draft?

11. What does endorsement of the draft mean? When is it used?

12. What does discounting of the draft mean? When is it used?

13. What makes the draft a very practical method of payment in foreign trade?

14. What types of drafts do you know? Describe them.

15. In what cases is advance payment used?

16. When is payment on an open account practical?

17. Are open account terms considered to be a long term or a short term credit?

18. Why is payment on an open account disadvantageous to the Exporter?

Ex. 1. Find in the text the English equivalents for the following:

1. не может быть ни изменен, ни аннулирован без согласия стороны, в чью пользу он был открыт, 2. в случае, если банк осуществляющий платеж, не выполнит обязательств, 3. он преодолевает разрыв между поставкой и платежом, 4. давая им право на товар, 5. производить платеж почтовым переводом в соответствии с инструкциями покупателя, 6. производить расчеты в соответствии с текущим обменным курсом валюты, 7. быть выгодным, безопасным, но дорогим методом платежа, 8. своевременно осуществлять платеж, 9. предусмотреть инкассовую форму платежа с последующим акцептом, 10. предъявлять тратту к оплате, когда наступит срок платежа, 11. срочные тратты подлежат оплате в будущем, 12. индоссировать тратту, подписав ее на обратной стороне, 13. дающий банку законное право потребовать товар, 14. перед наступлением срока оплаты, 15. чтобы сократить многочисленное движение валюты, 16. т.е. для подтверждения долга, 17. могут передать ее новым владельцам.

Ex. 2. Look through the dialogue between Mr James Craft, Manager of the Import Department, and Mr Sergey Batov, Sales Manager. Find out the main reason for their talks and tell, what the partners have agreed on.

C.: –Shall we start with coffee or get down to business straight away?

В.: –Perhaps we’ll start the talks and have coffee a bit later. We’ve just had our lunch, you know.

C.: –As you like. (It’s up to you.) Your wish is a must — you’re our guest. What shall we start with?

B.: –You’ve seen our tractors in operation, haven’t you?

C.: –Yes, we have. And we are more or less satisfied with their performance.

В.: –I’m glad to hear that. Perhaps we’ll start with the price and the terms of delivery? Would you like us to quote а сif or a fob price?

C.: –As a matter of fact we’ve got your price-list here. Is it the latest?

В.: –Let me have a look. Yes, it’s our latest price-list. You seem to be well equipped for the talks, and what’s your opinion?

C.: –I tried to do my homework as well as I could. As to my opinion since you’ve got a liner from Saint Petersburg to Montreal, I suppose you’d prefer сif prices.

B.: –Yes, you’ve quite right there. And it’s our usual practice to say the least.

C.: –Is your price subject to a discount?

В.: –If you mean a trade discount, we don’t have it in our practice, but if you order a great number of tractors or pay in cash, then you’re granted a discount.

C.: –Oh I see. And what do you consider “a great number”?

B.: –Over 75 tractors, let’s say.

C.: –What discount will it be then?

B.: –Well, Mr Craft, perhaps we’ll come down from theoretical discussion to the ground. I wish you would name the exact number of tractors you require and we’ll go on from there.

C.: –All right, Mr Batov, we’re going to order, say, 100 tractors if the price’s reasonable.

В.: –In that case we’ll give you a 25 % discount.

C.: –Could it be 35 %, Mr Batov?

В.: –That’s a bit too much. We’ll meet you half-way, though, and make it 30 %, Mr Craft, but that’s final.

В.: –Shall we consider the price problem settled?

В.: –You’re quite right. Well begun is half done, as they say. Shall we call it a day then? Let’s meet tomorrow morning at 10.Goodbye!

C.: –Fine. See you tomorrow morning at 10 then. Goodbye!

Ex. 3. Match the documents in the left hand column with their definitions in the right hand column. Make sure you know their Russian equivalents.

Ex. 4. Fill in the gaps with the correct words. The first letters are given to you.

Selling your goods 1) o______ is never as simple as selling them at home. But the exporter has plenty of professional help to call on. The business of transporting the goods is usually entrusted to a firm of freight 2) f______. They will arrange for the goods to be 3) s______ by sea or by air and for all freight 4) c______ to be paid. They handle all the necessary documentation and arrange for the shipment to be 5) i______ against all risks.

Banks also offer many services which make life easier and more secure for exporters and importers. Among these are 6) d______ credits, which facilitate payment. Suppose your overseas customer says that he wishes to 7) p______ an order with you. You calculate the total 8) c______ of the goods, add on the insurance 9) p______ (fixed by the insurance company) and freight charges (fixed by the freight forwarder), and send him a 10) p______ invoice. He instructs his bank to open a 11) c______ in your favour for the amount of the invoice and to inform your bank, who in turn will advise you of the details. The 12) l______ of 13) c______ is normally 14) i______: that is the customer cannot recall or cancel it.

Ex. 5. Complete the following passages on documentary credits with the correct words from the boxes.

A

| bills, certificate, chamber, expiry, freight, full, insurance, invoice, lading, origin, payment, ship |

Your customer has opened an irrevocable credit on his account and in your favor.

You can now go ahead and 1) ______ the goods. You must not delay too long; the credit is only valid until its 2) ______date. As soon as the goods are on board ship, the bill of 3) ______ is signed and sent to your freight forwarder. You can now send it to your bank with the other documents which will enable 4) ______to be made. The first is the 5) ______, showing the total cost c.i.f. — cost of goods, plus 6) ______, plus 7) ______. This must be accompanied by the insurance 8) ______, and often by the certificate of 9) ______, to show where the goods, and the raw materials in them, originated. This often has to be authenticated by your local 10) ______ of commerce. If the goods are going by sea, you must also enclose the 11) ______ set of clean 12) ______ of lading.

B

| against, cash, credit, discount, exchange, negotiable, released, shipping, sight, signing, warehouse |

Once the shipment is safely on its way, the 1) ______ documents are sent to your customer’s bank, while your own bank notifies you that everything has been done in accordance with your instructions. The documents will only be 2) ______ to the customer 3) ______ payment. The customer, however, doesn’t want to hand over the money yet, because it will be several days or weeks before the goods are delivered to his 4) ______. You, the supplier, therefore send him a bill of 5) ______ and ask him to accept it by 6) ______ it. Some bills are payable as soon as the bank sees them — these are called 7) ______ bills. Most are payable at 30, 60, 90 days; this gives the customer time to receive and use or resell the goods before the money is transferred from his letter of 8) ______. But an accepted bill is a guarantee of payment, and it is therefore 9) ______: it can be bought and sold. In fact, it is almost as good as 10) ______, except for the delay in payment. As the supplier, you will probably sell it to a bank, which will 11) ______ it — that is, deduct interest from the total amount.

Ex. 6. Translate these word combinations into English using your active vocabulary (in writing). Mind the difference in translating the words in italics in part B.

A.

1. из расчета 100 долларов за штуку, 2. осуществить отгрузку товара за счет покупателя, 3. производить платеж подтвержденным безотзывным аккредитивом, 4. предусмотреть, что аккредитив открывается покупателем до начала изготовления товара, 5. повлечь за собой большие издержки производства и обращения, 6. вызвать задержку в поставке, 7. быть уверенным в сокращении стоимости провоза, 8. осуществлять платеж по открытому счету (на открытый счет), 9. согласовать условия платежа по открытому счету, 10. если иначе не согласовано, 11. обоснованные претензии, 12. к полному удовлетворению и выгоде обеих сторон, 13. предложить переводной аккредитив, 14. по какой фрахтовой ставке, 15. в размере 550 рублей за штуку, 16. выслать сопроводительное письмо с приложением нужных документов, 17. согласиться с расторжением контракта, 18. никаких изменений без согласия покупателя, 19. путем осуществления платежа подтвержденным безотзывным аккредитивом, 20. отнести все складские расходы на счет покупателя, 21. обеспечить право и собственность на товар, 22. причитающаяся фирме сумма, 23. … когда наступит срок платежа тратты, 24. путем открытия переводного аккредитива в пользу заказчика, 25. предоставить бесплатно послепродажное обслуживание в течение 6 месяцев, 26. предоставить чистый, переводной коносамент, 27. предложить индоссировать тратту, 28. без предоставления аванса, 29. повлечь за собой дополнительные расходы, 30. по предъявлении отгрузочных документов, 31. произведя учет тратты, 32. по истечении гарантийного срока, 33. в пределах оговоренного периода, 34. быть уверенным в получении подтоварного кредита, 35. путем упрощения финансовых операций, 36. путем сокращения всех расходов на складирование, 37. индоссировать коносамент, 38. предоставить заем с пятью процентами годовых, 39. оригинал коносамента, выписанного на имя Покупателя, с указанием конечного порта назначения, 40. заключить рейсовый или тайм-чартер, 41. переводить оставшуюся сумму по почте, 42. товар, предназначенный для немедленной поставки, 43. платить за товар ежемесячными взносами.

B.

1. а) Вы все согласны с этим планом? б) Почему Вы не согласны с его мнением?

2. а) Какое количество потребительских товаров вам требуется? б) Какую сумму они требуют у вас?

3. а) Сертификат качества подтверждает, что ваш товар высокого качества. б) Вы уже послали телекс с подтверждением нашего телефонного разговора? в) Просим вас подтвердить получение нашего счета.

4. а) Плата за хранение товара возросла. б) Наши расходы за хранение товара в этом месяце возросли.

5. а) Какие еще фирмы предлагают нам такое оборудование? б) Какие еще изменения вы предлагаете?

6. а) Их предложение изменить конструкцию машины нас не устраивает. б) Их предложение послепродажных услуг нас очень устраивает.

7. а) Попозиционная стоимость этого изделия не постоянна. б) Они являются постоянными покупателями нашего товара.