How do banks make money

How do banks make money

How Do Banks Make Money?

Curious as to how banks make their money? Since commercial banks are for-profit financial institutions, their job isn’t just to hold your money, it’s to rake in some big bucks of their own. There are a few primary ways banks make money, especially from fees and interest.

Katana Dumont • November 30, 2021

In This Article

What’s a Commercial Bank?

A commercial bank is where most people go to do their everyday banking. Commercial banks give businesses and individuals a place to store their money while having access to credit and loans. Again, since one of the reasons a bank operates is to make money, most financial institutions focus on profits from the same customers they serve day to day.

Commercial Bank Definition

A commercial bank’s money essentially belongs to its customers, who can withdraw their funds at any time, even on short notice. Because of that, commercial banks offer credit for shorter lengths of time with the backing of real, concrete securities that are easy to sell.

Now that you know what a commercial bank does, the truth still stands: most of us have no idea how banks really make a profit. When you consider the fact that a bank holds onto your money — and that of other customers — how do banks actually afford to keep the lights on, remain in business and turn a profit?

Here’s a 101 primer on how banks make money and have the ability to lend that money out to their customers. Read on to learn more!

How Banks Make Money

When you open a saving s or checking account at a bank, your money doesn’t just sit there.

Every time you make a deposit, your bank “borrows” the money from you to lend it out to others. Think about all those auto and personal loans, mortgages, and even bank lines of credit. Sadly, money doesn’t grow on trees, so the bank uses your money to help fund these loans temporarily. In turn for your generosity (that most of the time you are unaware of), you get paid back in the form of interest — sort of a courtesy for trusting that financial institution with your money.

Bigger banks are also often made up of separate branches that focus on different types of customers and services. For example, commercial or retail banking branches may offer more common bank services, such as checking and savings accounts or giving out personal and business loans.

At this point you might be wondering: How can money in the bank be loaned out and available to withdraw at the same time? Don’t worry. Your money hasn’t vanished on you. Banks don’t lend out all the money they have on deposit. They’re required to keep enough money on hand to handle transactions and withdrawals. Your funds are also protected and insured by the Federal Deposit Insurance Corporation (FDIC).

Where Do Banks Get Money to Lend to Borrowers?

Now it’s time to look at the several different ways banks make a profit to lend to their customers.

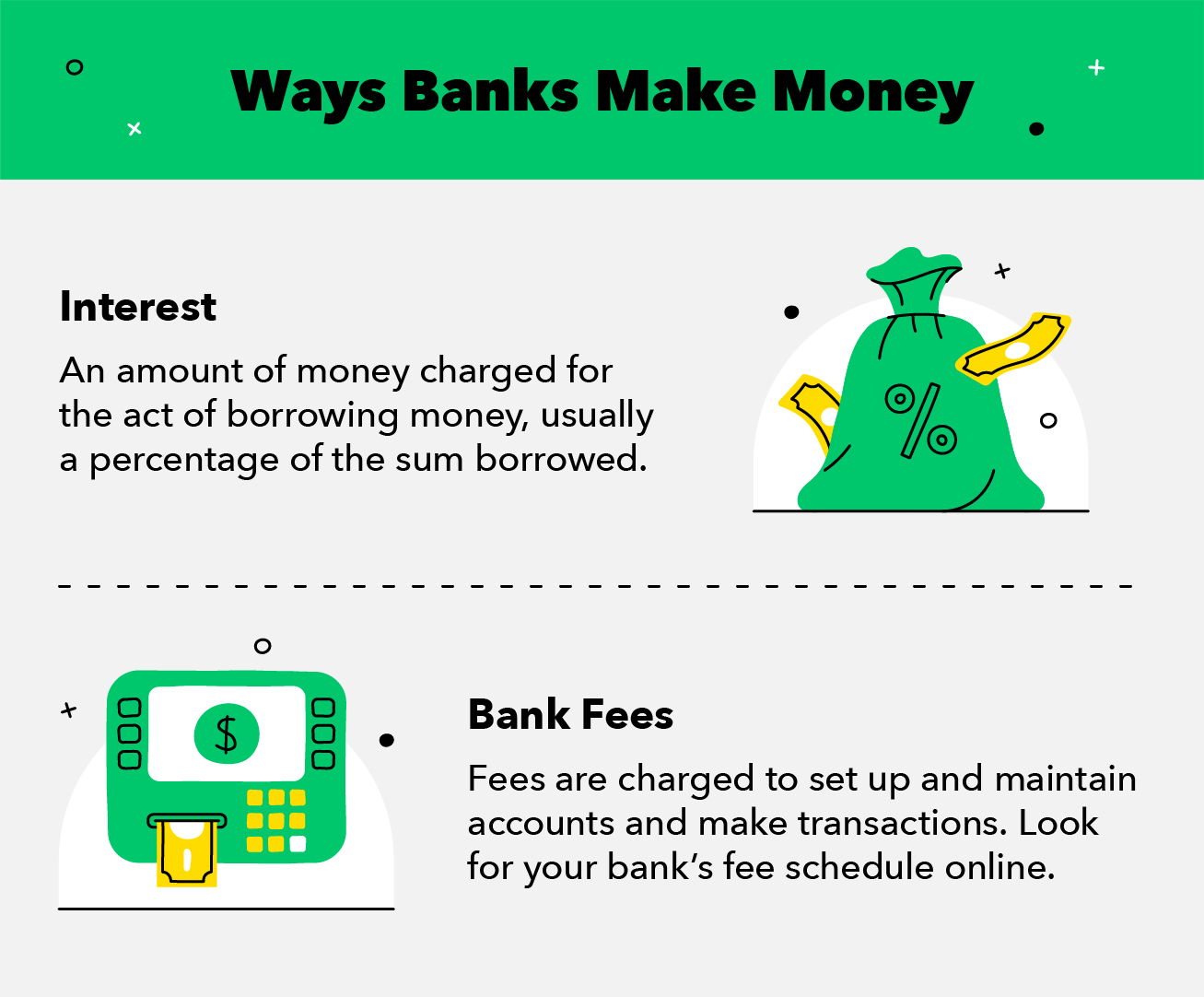

Interest

When you deposit money in your bank account, banks use that money to loan out to other people or businesses. The banks charge them interest, which they collect as their profit.

The bank pays you a certain amount of interest in exchange for keeping your deposit. However, they collect even more interest on the loans they issue to others, and this is where they make most of their money.

If you’re on the borrowing side, banks lend money to you and receive extra interest when you repay the loan. Many banks make the majority of their money from charging interest on loaned funds, such as home loans, auto loans, or personal loans that are issued to consumers. Many banks also offer loans to small and large businesses. Customers who have a credit card and revolve a balance may also pay interest on their credit card debt.

Defaulted Assets

A defaulted asset is an asset that is 30 or more days delinquent in the payment of principal, interest, fees, or other amounts payable under the agreeable terms of the item.

Banking Fees

Brick-and-mortar banks may also charge teller fees, fees to obtain bank statements, vault and safety deposit box fees, and other application and loan fees. This may seem like too many fees to handle, but remember, not all banks are fee-driven, and choosing the right place to hold your money is important to your financial success.

Interchange Fees

Interchange fees are the amounts paid between banks for the acceptance of card-based transactions.

With Chime, Fees Are Kept to a Minimum

Because there’s no monthly fees, you can skip the headache and trust your money is in the right place.

Additional Ways Banks Make Money

There are other avenues banks take to make their profit, such as:

Where Do Banks Put Their Money?

Banks typically don’t stash away your money. They actually quickly lend it out to someone who can use it when you don’t. Again, no need to worry about getting your money when you do need it.

The money the bank does keep on hand for withdrawals is usually kept in safes or vaults on site. The remainder of their funds are tied in investments, being used to pay bills or being loaned out to customers of that bank.

What’s the largest source of income for banks?

The largest source of income for most banks is the interest earned from various loans or credit cards used by borrowers. It’s always a good idea to be conscious of the interest rates on credit cards you apply for or on the loans you are taking out. High interest rates could accumulate large amounts of debt for yourself, and large amounts of money for the bank to keep in their pocket.

When do banks make money from deposits?

In the meantime, the bank lends your money out through a variety of ways, all at an interest rate over the prime rate. Even though the bank doesn’t own the money that is deposited or lent out, it makes money on, guess what? The interest payments!

Where do banks invest their money?

There are over 6,000 commercial banks that accept deposits and invest those funds within the guidelines given by federal and state agencies. Banking institutions are required to maintain reserves up to 10% of their deposits. The remainder is usually invested in real estate loans, commercial and consumer loans, and government securities.

Final Thoughts

As you’ve now learned, banks make their money in many ways. Several of these factors may cross your mind when choosing where to store your finances.

However, keep in mind that banks are also in the business of making you money. Remember, the relationship between you and your bank of choice should be mutually beneficial, where it’s able to make its money without making you incapable of reaching your financial goals, especially at the bank’s expense.

Ready to make that decision? Check out the Chime Checking Account and see if it’s the right move for you and your hard-earned cash.

How Do Banks Make Money?

By Cynthia Bowman

Do you ever wonder how your bank can afford its location, overhead and staff? Or, how banks make money when they give away free checking accounts and pay interest on savings? It’s common knowledge that top-level bankers are quite well paid — but where the income comes from is less clear.

Here’s a closer look at how banks and credit unions earn money — on your money, no less.

Banks Make Money Off Deposits

Banks know how to leverage money in genius ways. When you deposit money into your savings account or certificates of deposit, your bank will pay interest as an incentive for you to park your cash there. That’s because banks need your money to make loans. Your cash isn’t really physically in your account, waiting — your bank is making lucrative deals lending it to other customers and businesses until you need it.

This might sound alarming, but don’t worry. Your money will be there when you want to withdraw it. The Federal Reserve insures your money against loss through the Federal Deposit Insurance Corporation for up to “$250,000 per depositor, per insured bank, for each account ownership category.”

So how do banks make money on savings accounts? In a nutshell, by lending out the money in your account(s) and charging more interest than it pays you.

Banks Make Money With Bank Fees

Fees are one of the more obvious ways banks make money. Imagine millions of customers paying the following banking fees on a regular basis:

And then there are credit cards. How do banks make money off of credit cards? Charging interest when consumers don’t pay their card balances in full each month is one way. But credit cards have a whole set of fees, like over-the-limit fees, late-payment charges and annual fees you pay just for having the card.

Banks charge fees to earn money and consumers try to avoid fees to save money. It’s a battle many consumers lose, and the fees add up to a tidy profit for a bank.

Banks Make Money With Interchange Fees

Retailers pay interchange fees every time a customer uses a credit or debit card in a sales transaction. Interchange fee rates are set by the credit card companies and are normally a percentage of the purchase plus a flat rate.

Banks Make Money Through Investments

Investment banks are different from commercial banks. They make their money by selling services to companies, governments and investment funds instead of earning their money from consumers. Although this doesn’t apply to consumers, it’s good to know it’s another way banks make money, thereby making it possible for you to enjoy your free checking account.

Investment banks earn fees and commissions from:

Bank Earnings Examples

How Do Banks Make Money?

How do banks make money on checking accounts and so many other products and services if they’re free? They get creative and find other ways to earn income. So next time you visit your local branch, don’t feel too guilty about taking some extra candy.

How Banks and Credit Unions Make Money

Hiya Images / Corbis / Getty Images

Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. She is the founder of Wealth Women Daily and an author.

Banks offer numerous “free” services, like savings accounts and free checking. In fact, they may even pay you for leaving money in the bank, and you can also boost your earnings by using certificates of deposit (CD) and money market accounts. Most banks and credit unions, other than those that are exclusively online, also have physical locations staffed by employees. They also run call centers with extended customer service hours.

How do they pay for all of those services? Banks earn revenue from investments (or borrowing and lending), account fees, and additional financial services. Whenever you give money to a financial institution, it’s essential to understand its business model and exactly how much they charge, but it’s not always clear how banks get paid. There are several ways for banks to earn revenue, including investing customers’ money and charging fees.

The Spread

The traditional way for banks to earn profits is by borrowing and lending. Banks take deposits from customers (essentially borrowing that money from account holders), and they lend it out to other customers. The mechanics are a bit more complicated, but that’s the general idea.

Pay Less, Earn More: Banks pay interest at low rates to depositors who keep money in savings accounts, CDs, and money market accounts. They usually pay nothing at all on balances in checking accounts. At the same time, the bank charges relatively high-interest rates to customers who take out home loans, auto loans, student loans, business loans, or personal loans.

The difference between the low rate that banks payout and the high rate that they earn is known as “the spread,” sometimes called the bank’s «margin.»

For example, a bank pays a 1% annual percentage yield (APY) on cash in savings accounts. Customers who get auto loans to buy new cars pay 6.27% APR, on average. That means the bank earns theoretically 5.27% on those funds, but potentially relatively less if you account for operating expenses. It will earn even more with credit cards. According to the Federal Reserve, the average annual percentage rates (APR) on credit cards is 16.30%, as of October 2021, the most recent data.

Investments: When banks lend your money to other customers, the bank essentially “invests” those funds. But banks don’t just invest by disbursing loans to their customer base. Some banks invest extensively in different types of assets. Some of those investments are simple and secure, but others are complicated and risky.

Regulations limit how much banks can gamble with your money, especially if your account is FDIC insured. However, those regulations tend to change over time. Banks can still boost their income by taking more risks with your money.

Accountholder Fees

As a consumer, you’re probably familiar with bank fees that hit your checking, savings, and other accounts. Those charges are getting easier to dodge, but fees still make a significant contribution to a bank’s earnings.

Service Fees

In addition to earning revenue from borrowing and lending, banks offer optional services.

You might not pay for any of these, but plenty of bank customers (individuals, businesses, and other organizations) do.

Things are different at every bank, but some of the most common services include:

Credit Cards: You already know that banks charge interest on your loan balances, and banks may charge annual fees to card users. They also earn interchange revenue or «swipe fees» every time you use your card to make a purchase. By contrast, debit card transactions bring in much less revenue than credit cards. That issue is why merchants would prefer you pay with cash or a debit card, and some stores even pass those fees on to customers in the form of credit card surcharges.

Wealth Management: In addition to standard bank accounts, some institutions offer products and services through financial advisors. Commissions and fees, including assets-under-management fees, from those activities supplement bank profits.

Payment Processing: Banks often handle payments for large and small businesses that want to accept credit cards and ACH payments from customers. Monthly and per-transaction fees are common.

Positive Pay: If you worry about thieves printing fake checks with your business account information, you can have the bank monitor all outgoing payments before they’re authorized, but, of course, there’s a fee for that.

Loan Fees: Depending on your bank and the type of loan, you might pay an application fee, an origination fee of 1% or so, discount points, or other fees to get a mortgage. Those fees are in addition to the interest you pay on your loan balance.

Some credit unions pay interest and charge fees similar to what you’d find at a typical bank, so the different structure is just a technicality.

How Credit Unions Work

Credit unions are customer-owned institutions that function more or less like banks. They offer similar products and services, they typically have the same types of fees, and they invest deposits by lending or investing in the financial markets.

Because credit unions are tax-exempt organizations, and customers own them, credit unions can sometimes pursue less profit than traditional banks. They might pay more interest, charge less interest on loans, and invest more conservatively.

Frequently Asked Questions (FAQs)

What do credit unions do with any profits they make?

Credit unions return profits back to members, who are also owners, in the form of higher savings rates, lower loan rates, and reduced fees.

How much money do banks make?

How Do Banks Make Money?

Share this:

The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is «as is» and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. After 20 days, comments are closed on posts. Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted. Click here to read full Terms of Service.

Save more, spend smarter, and make your money go further

Banks make money on the services they provide. They earn money by charging customers interest on various loans and through bank fees.

As hubs for money and financial services, banks deal with lending money and keeping it secured for their customers, but how do banks make money? Much like any other profit-driven business, banks charge money for the services and financial products they provide. The two main offerings banks profit from are interest on loans and fees associated with their services.

Read on for a breakdown of these main services and find out exactly how banks make money from them. Along the way, learn about good money management practices that will prevent banks from making money off of you.

Interest

Interest is what is charged to borrow money. Banks offer customers a service by lending money, and interest is how they profit off of that service. Typically, interest is charged as a percentage of the amount borrowed.

Banks charge interest on a variety of products and services like credit cards, loans, and mortgages. Interest rates vary for different offerings, so take a look at the table below for examples. They also fluctuate over time and based on the economy. For the better part of 2020, 30-year fixed-rate mortgage rates fell to historic lows, hovering around or below 3 percent.

Services Banks Charge Interest On

30-Year Fixed Rate Mortgage

15-Year Fixed Rate Mortgage

Sources: Freddie Mac 1 2 | Federal Reserve | U.S. News 1 2 |

Bank Fees

Banks make a significant amount of their money by charging customers fees to use their financial products and services. Fees take many forms, but they’re often charged to create and maintain a bank account or to execute a transaction. They can be recurring or one-time charges. All banks should be upfront about all of their fees and disclose them somewhere accessible to their customers. Look for a fee schedule online or in the fine print your financial documents.

It’s important to educate yourself on the types of fees that banks impose so that you can be an involved advocate for your own financial wellbeing. Knowing what certain fees are and why they’re charged is a great way to manage the money you keep in the bank and prevent mistakes or errors from eating into your budget. Learn about common bank fees below.

Non-sufficient Funds (NSF) Fees

Non-sufficient funds fees are charged when a customer makes a transaction but doesn’t have enough money to pay for it. The transaction “returns” or “bounces,” and the bank charges the customer an NSF fee.

Overdraft Fees

An overdraft occurs when your bank balance falls below zero. An overdraft fee is charged, and interest can even accrue on the overdrawn amount because the bank may consider that money borrowed as a short-term loan.

ATM Fees

Fees are charged for a few reasons when it comes to ATMs. If you use an ATM that isn’t associated with your bank’s network, you’ll most likely be charged a fee for that transaction. Another fee can be charged if you make too many withdrawals from your account through ATMs.

Late Payment Fees

Fees are charged on credit card or bank statements if a customer misses a payment or pays their bill late. Statements have due dates listed on them whether they’re on paper or online, so make sure you’re aware of these dates in order to not miss a payment.

Minimum Balance Fees

Certain bank accounts have a minimum balance that’s required to remain in the account. If you fall below this minimum balance at any point, you’ll be charged a fee at the end of the month. If you don’t maintain the minimum balance required for your account, your bank may even close your account.

Withdrawal Fees

Depending on your account, you may have a specific number of withdrawals you’re allowed to make per month. Checking accounts are intended for transactional purposes and may allow a certain number of withdrawals before charging a fee. Savings accounts, on the other hand, often put a stricter limit on withdrawals, with the federal limit at six withdrawals. If you make more than the number of allowed withdrawals, you’ll pay a fee each time.

Wire Transfer Fees

A wire transfer fee is incurred when you transfer funds electronically. They’re typically used to transfer money safely and securely across large geographic distances.

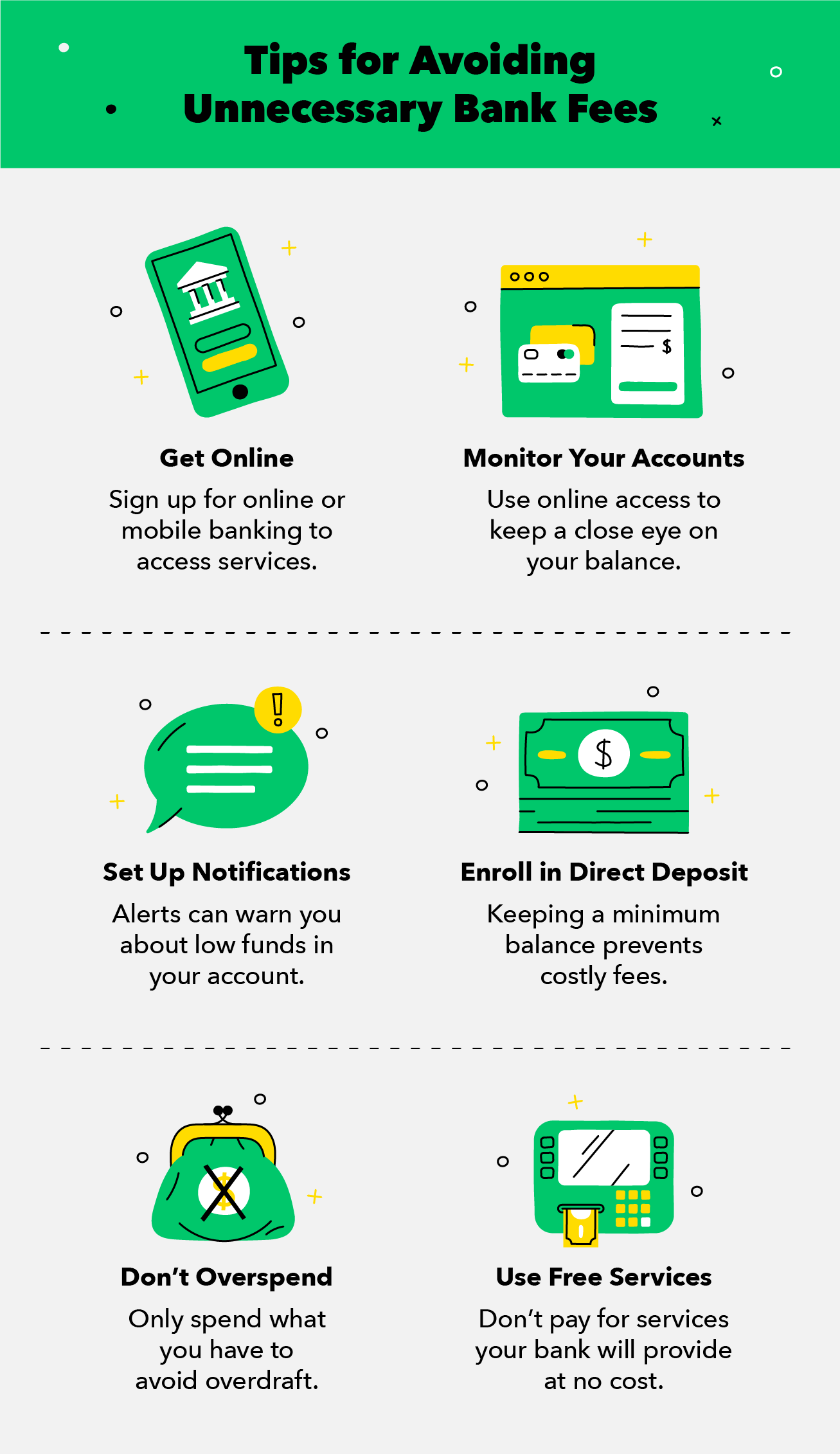

How To Avoid Bank Fees

Banks profit off of charging their customers fees, but there are steps you can take to avoid them. While not all bank fees are avoidable, use these tips to prevent losing money over unnecessary charges.

Tip #1: Take Advantage of Online Services

Most banks have online banking services that allow you to access your accounts remotely. Take advantage of these services by signing up for an online account or logging into your bank’s mobile app. Be careful to not share your login details with others and set up appropriate security measures, like using a strong password or enabling security questions.

Tip #2: Monitor Your Account Balances

Once you have access to an online banking platform or app, use it to keep a close eye on your accounts. Check your account balance so that you don’t overdraw funds and get charged a non-sufficient funds or overdraft fee. Also, use this easy online access to monitor your account for any transaction errors or fraudulent activity. If something does look suspicious, notify your bank immediately.

Tip #3: Set up Automatic Notifications and Payments

Human error can result in costly bank fees. You can use your app or online bank platform to automate loan payments, get notified when a direct deposit is made to your account, and set alerts for when your balance dips below a specific amount or falls into overdraft. Let these processes do the work for you and never spend another cent on bank fees again.

Tip #4: Enroll in Direct Deposit

Direct deposit is another simple automated process that helps you avoid unnecessary fees or consequences. Some bank accounts have a minimum balance in order for them to stay open, and the bank may charge a fee if your account falls below this amount. Set up direct deposit to make sure that your hard earned money gets into your account and keeps it open with no fees.

Tip #5: Don’t Overspend

A good way to never get charged overdraft or NSF fees is to not overspend. Try to live within your means and don’t spend more money than you actually have. Build up an emergency fund so that you won’t need to overdraw your account or take out a loan if the unexpected happens. Balanced money management and preparation are the key to preserving your financial wellbeing.

Tip #6: Try to Use Free Services

Many banks offer free services such as free checking and savings accounts, money transfers, and certain free ATMs. Make yourself aware of these services and their restrictions in order to make the most of them. Try to use ATMs from your bank to avoid ATM fees and pick out a free checking and savings account that fits your needs.

Banks make money off of the interest and fees they charge their customers. Keep your money in your pockets and not the banks’ by following good money management practices. Try to pay off your credit card in full every month to minimize interest payments and monitor your account balances closely so you don’t get charged extra fees. When you practice good money habits, you’ll actively safeguard your financial wellbeing.

Sources: Consumer Financial Protection Bureau 1 2 |

Save more, spend smarter, and make your money go further

How Do Banks Make Money

A bank is a financial institution that accepts public deposits and develops demand deposits while also issuing loans. The bank might execute lending activities directly or indirectly through capital markets.

Furthermore, Banks are heavily regulated in most jurisdictions because they play a critical role in financial stability and its economy.

Additionally, most countries have adopted a fractional reserve banking system, in which banks keep liquid assets equivalent to only a portion of their current liabilities. The question of how banks make money stems from the fact that they don’t make or sell anything. Instead, they make money by making money. The idea of making money with cash may be familiar to investors, but it is not to everyone else.

In addition, Banks are subject to minimum capital requirements based on an international set of capital rules known as the Basel Accords, in addition to other restrictions designed to ensure liquidity. Bank gives advances and loans to cooperation, individuals and companies. The interest received on these loans is their primary source of income. Another major source of income for banks is they invest in government and rate securities. They are earning payments and dividends from them.

Your money will be safe in your bank account, as it will be safeguarded from theft and fires. Furthermore, your funds will be federally insured, ensuring that you will receive your funds if your bank fails. It’s a simple method to save money: many banks will pay you interest if you deposit your money in a savings account.

Banks make money by using your money.

The interest you paid on the loan sum accumulated as a valuable source of revenue for the bank, which they reimbursed in part to those depositors. One may be wondering, How do banks make money? Similarly, your savings, certificates of deposit, money market accounts, and other assurances. In other words, banks do not take your money and then loan it to you at a higher interest rate. However, they use the money you deposit to balance their books and fulfill the required cash reserves that allow them to make those loans.

Ways Banks Make Money

Banks earn money in a variety of ways, but they are primarily lenders. Banks make money by borrowing money from depositors and paying them a specific interest rate in return. Banks will lend the funds to borrowers at a higher interest rate, earning from the interest rate spread. Alternatively, Banks also diversify their business portfolios and create a revenue through various financial services such as investment banking and wealth management. The money-generating business of banks, on the other hand, can be divided into the following categories.

1. Interest Income:

Most commercial banks make their money primarily through interest income. Interest income is one of the answers to the question, how do banks make money. It is completed, as previously said, by obtaining funds from depositors who do not want their funds at this time. Depositors are compensated with a set interest rate and the security of their funds in exchange for putting their money in the bank.

Additionally, the bank can then lend out the funds that have been deposited to borrowers that require cash right away. Lenders must pay a greater interest rate on borrowed cash than depositors. The interest rate spread, or the difference between paid and received, allows the bank to profit. The interest rate is vital to a bank as a critical source of how banks make money.

The interest rate is a proportion of the principal amount owed (the amount borrowed or deposited). Central banks establish the interest rate in the near term, which manages interest rates to support a healthy economy and keep inflation under control.

2. Capital Market-Related Income:

Banks frequently provide capital markets services to firms and investors. Additionally, the capital markets are essentially a marketplace that connects firms. Capital market-related income is one of the answers to the question, how do banks make money.

Capital market-related income is one of the answers to the question, how do banks make money looking for funding to fund expansion or projects with investors looking for a return on their investment. In addition, Banks promote capital market activity by providing a variety of services, including.

Services in sales and trading Services for underwriting And Advice on mergers and acquisitions. With their in-house brokerage services, banks will assist in the execution of trades. Banks will also hire specialized investment banking teams to help with debt and equity underwriting across sectors.

Additionally, It essentially aids firms and other entities in raising financing and equity. The investment banking teams will also assist with corporate mergers and acquisitions (M&A).

Client fees are collected in exchange for the services. Furthermore, Banks’ capital market income is a very variable source of revenue. They are entirely reliant on the activity of the capital markets at any particular time, which can fluctuate dramatically.

During moments of economic recession, exercise tends to slow down, whereas it tends to pick up during periods of economic expansion.

3. Fee-Based Income:

Banks also charge non-interest fees for their services. For example, if a depositor creates a bank account, the bank may charge monthly account fees to keep the account open.

Fee-based income is one of the answers to the question, how do banks make money. Fee-Based income is one of the answers to the question, how do banks make money. Banks also charge payments for a variety of different services and goods.

Here are a few examples: fees charged by credit cards, Accounts to be checked, Accounts of savings, Revenue from mutual funds, Fees for investment management, And Fees charged by the custodian.

Additionally, Banks benefit from fees for services supplied, as well as prices for some investment products. Such as mutual funds, because they frequently provide wealth management services to their customers.

Banks may offer in-house mutual fund services to which their customers’ money is directed. Furthermore, Fee-based revenue is appealing to banks since it is consistent and does not fluctuate over time.

It is advantageous, particularly during economic downturns when interest rates are artificially low, and capital market activity slows.

4. Interbank Lending:

Banks profit from lending money to customers. And from lending money to other banks and financial institutions. The question is, how do banks make money from interbank lending.

Interbank lending is one of the answers to the question, how do banks make money. The loans are frequently for a short period, such as a few months or even overnight. Banks charge an interest rate on a specific loan amount. The interest rate is frequently applied to a maintenance and service account.

Additionally, Interbank lending insurance provides banks with a steady stream of revenue. Banks must demonstrate that they are liquid at all times, so they frequently borrow money from other banks when they have payouts that would cause their minimum balance requirements to be breached.

Banks lend to one another because the interest rates they charge each other are lower than those offered by other lenders. Banks save money by borrowing from one another, and these loans also help them make money. It’s a win-win situation for both banks involved in the deal.

Furthermore, It is not only large sums of money that are lent between banks. Banks invest in the interbank market as well. Non-performing assets that turn into liabilities are the most common. They become instant revenue generators at a low service cost when they sell them on the interbank market.

5. Brokers Fee:

You may be asking how banks make money from brokers’ fees. If your bank provides investing services, you can bet that it earns a lot of money from those services. How do banks make money from Brokers Fee? A broker fee is one of the answers to the question, how do banks make money.

Additionally, when an investment banker is involved in a transaction for a customer, banks impose brokerage fees. Customers may not be charged directly; instead, they may profit from interest or the funds they fill.

6. Mortgage fees:

The application process for a mortgage is not free. The application process costs a lot of money at banks. Furthermore, Closing fees, appraisal costs, and inspection costs are all required when purchasing a home with a mortgage.

An attorney fee, assumption fee, and prepayment interest may be required when purchasing a new home.

Additionally, The home buyer must pay the mortgage each month after taking possession of the property. The borrower usually has a payment that comprises both the principal and the interest. Because interest rates are typically about 5%, banks can generate a consistent income from each mortgage account they keep.

Bank costs are generally included in the loan. Thus, the 0.05 percent you paid for the loan was effectively rolled into the loan. However, Customers can compare prices to find the best deal. To compete with banks, some mortgage providers charge a flat cost for all loans.

Conclusion

Customers save more money in the bank because banks offer appealing interest rates. Similarly, banks provide loan and credit card offers to encourage people to borrow more.

This is their product and service cycle. I’m confident you now have a firm grasp on how banks make money and are more confident that your money is safe with the various banks.

When cardholders use their credit/debit card, the card issued (usually a bank) earns money. It is one of the frequently asked questions about banks.

However, retailers are charged between 1.99 and 3.5 percent every transaction when you pay for any goods or services in most cases. Furthermore, the payer is frequently unaware of this charge. This money is deducted from the payment to the merchant’s account when it is settled, and then the remaining is occupied.

When cardholders use their credit/debit card, the card issuer (usually a bank) earns money. It is one of the frequently asked questions about banks. However, retailers are charged between 1.99 and 3.5 percent every transaction when you pay for any goods or services in most cases. Furthermore, The payer is frequently unaware of this charge. This money is deducted from the payment to the merchant’s account when it is settled, and then the remaining is occupied.

It depends on the reason for the withdrawal. Bounced checks, a loan you didn’t pay back, monies from someone else placed in your account in error, all of these things are real. It is one of the frequently asked questions about banks. If he took it, report it to the cops, FBI, and his bosses. The bank will not wait until you get around to paying it if you cash a bad check or pay your loans late. So, the answer to your query isn’t clear on whether the withdrawal was lawful or not.

Is there any way for the bank to penalize me if I leave it at that? Your account will become inactive if you don’t use it for a year. It is one of the frequently asked questions about banks. Furthermore, the bank will determine the timeline for this. Additionally, you may use your debit card to activate it at any moment by swiping it anywhere.

They certainly have the ability. It is one of the frequently asked questions about banks. And if you carefully read the fine print in the documents you signed when opening the account, it would have stated that they can do that to recover money owed to them for fees, 2. to comply with a court order to withhold money from your account, and some other reasons.

It is one of the frequently asked questions about banks. Yes, in general, though not directly. On each transaction, the networks levy an interchange fee. The merchant who swipes your card is responsible for that interchange fee. To offset the interchange cost, the merchant may charge a convenience fee to the customer. Additionally, a percentage of the interchange fee is paid to the bank that issued your card.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/client-and-bank-employee-talking-by-counter-173289628-5bdb9719c9e77c002601bf08.jpg)

:max_bytes(150000):strip_icc()/PritchardJustinJacketSized-5b7485a846e0fb0050436534.jpg)

:max_bytes(150000):strip_icc()/CharleneRhinehartHeadshot-CharleneRhinehart-95d680d01e524f3e97ea85984fbbcac5.jpg)