How the market works

How the market works

Learn How The Market Works Before You Start Investing

Just over half of Americans invest actively in the stock market. Over 20 percent of those who don’t invest, do so because they don’t understand how the stock market works. Another 16 percent don’t invest because they feel like stocks are too risky or don’t trust brokers.

The truth is, buying stocks is one of the best paths to long-term wealth generation for individual investors like you but first, you need to understand how the market works. Remember when Grandpappy bought you that stock certificate for 5 shares in Procter and Gamble when you were 7?

The stock market can be an active or passive investment, depending on how involved you want to be, but one thing is for sure: it is one of the most popular investment vehicles in America. And, it’s better than doing nothing with your money.

How the stock market works

The best thing about the stock market is that buying stocks is an easy and accessible form of investment for people of all financial means. The stock market has something for everyone, low entry points for beginners, compound interest for long-term thinkers, and Bre-X for the suckers.

Beginners may think its too complex to learn how the stock market works. Veteran investors may think if they haven’t learned by now, they won’t ever be able too. It is possible to learn, and the advantages of building this understanding can be immense for your investing future.

And, also you’ll have something to talk about at your next work party.

What is the stock market?

A stock market is a regulated exchange platform for the purchase and sale of individual stocks. A stock is a partial share in a company. Simple as that.

At its core, the stock market is an umbrella term for the collection of markets and exchanges where you can buy and sell stocks. The stock market is the backbone of our capitalist society and gives companies around the globe an opportunity to sell equity in their company for access to an ownership percentage.

And, it gives regular people like us the ability to own portions in a variety of companies.

Not all stock markets are made equal however, that is why prudent investors only trade on trusted stock exchanges.

Get our best strategies, tools, and support sent straight to your inbox.

Why do companies issue stocks?

If you own a stock in a company, you literally own a fractional piece of equity in that company. A very small one of course.

When a company goes public, they become a public entity. Just like how it’s expected politicians (HA!) and judges conduct themselves according to rules and public interest – the same applies to a public business. And there are rules they have to live by.

Generally speaking, when it’s a private business, what happens behind the scenes is private. There is no expectation of making public what that company is doing. When a company goes public, they have to provide annual reports and conduct business in the interest of stockholders. That’s now you!

Specific reporting requirements can vary depending on specific stock markets, but the practice is almost universal.

But these are more advanced topics, for another time.

What is a share?

Shares of thousands of companies are traded on these exchanges. But how can you buy a share? We’re so glad you asked!

How to buy a stock

Traders and investors continue to buy and sell the stock of the company on the exchange, although the company itself no longer receives any money from this type of trading.

How to ‘play’ the stock market

The market advantages patient traders. Someone who has the time to invest, park their money like an old bicycle outside a 7/11, and then just let it sit there for 20 years.

Despite market corrections, crashes, and outright shitstorms, over the long-term, the stock market always goes higher. The same isn’t true for individual stocks, many of which fall to zero. So the fella who invested his entire life savings into Enron in 2001…Well, that sucks dude!

The truth is, no matter how swish a pinstripe suit or high your turtleneck, it won’t mature your investment any faster.

If you want to start actively traded stocks you need to familiarize yourself with important topics such as market caps, price-to-earnings ratios, profit margins, and much more. Overwhelming? Let’s give you the basics.

Stock market basics: Indexes, dividends, and ETFs

Here are some of the most common stock market terms you’ll hear float around CNBC as you try to listen but can’t help but think Jim Cramer is about to punch you in the face.

Final thoughts on how the market works

Once you understand how the market works, you will have the capacity to buy and trade stocks more effectively. All you need to know is that a stock market is an exchange platform (now digital) where investors like you or I can buy and sell portions of publicly traded companies. That’s it. Or, as Warren Buffett likes to put it:

The stock market is a device for transfering money from the impatient to the patient.

Once you understand this simple reality, you can more easily navigate the various stock markets and even trade individual stocks when the time comes. But, make sure to educate yourself before wasting your hard-earned income.

Oh ya, and those 5 Procter and Gamble stocks your Grandpappy bought you in 1978, have seen a gain of about 4000%. Who’s lame now?

How Does the Stock Market Work?

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook.

If the thought of investing in the stock market scares you, you are not alone. Individuals with very limited financial experience are either terrified by horror stories of average investors losing 50% of their portfolio value or are beguiled by «hot tips» that bear the promise of huge rewards but seldom pay off. It is not surprising, then, that the pendulum of investment sentiment is said to swing between fear and greed.

The reality is that investing in the stock market carries risk, but when approached in a disciplined manner, it is one of the most efficient ways to build up one’s net worth. While the average individual keeps most of their net worth in their home, the affluent and very rich generally have the majority of their wealth invested in stocks. In order to understand the mechanics of the stock market, let’s begin by delving into the definition of a stock and its different types.

Key Takeaways

How The Stock Market Works

What Is a Stock?

A stock is a financial instrument that represents ownership in a company or corporation and represents a proportionate claim on its assets (what it owns) and earnings (what it generates in profits). Stocks are also called shares or equity.

Owning stock means that a shareholder owns a slice of the company equal to the number of shares held as a proportion of the company’s total outstanding shares. For instance, an individual or entity that owns 100,000 shares of a company with one million outstanding shares would have a 10% ownership stake in it. Most companies have outstanding shares that run into the millions or billions.

Stocks are also called shares or a company’s equity.

Types of Stock

There are two main types of stock: common shares and preferred shares. The term equities is synonymous with common shares, because their market value and trading volumes are many times larger than those of preferred shares.

The main distinction between the two is that common shares usually carry voting rights that enable the common shareholder to have a say in corporate meetings and elections, while preferred shares generally do not have voting rights. Preferred shares are so named because preferred shareholders have priority over common shareholders to receive dividends as well as assets in the event of a liquidation.

Common stock can be further classified in terms of their voting rights. While the basic premise of common shares is that they should have equal voting rights—one vote per share held—some companies have dual or multiple classes of stock with different voting rights attached to each class. In such a dual-class structure, Class A shares may have 10 votes per share, while Class B shares may only have one vote per share. Dual- or multiple-class share structures are designed to enable the founders of a company to control its fortunes, strategic direction, and ability to innovate.

Why Companies Issue Shares

Many of today’s corporate giants started as small private entities launched by a visionary founder a few decades ago. Think of Jack Ma incubating Alibaba (BABA) from his apartment in Hangzhou, China, in 1999, or Mark Zuckerberg founding the earliest version of Facebook (now Meta), from his Harvard University dorm room in 2004. Technology giants like these have become among the biggest companies in the world within a couple of decades.

However, growing at such a frenetic pace requires access to a massive amount of capital. In order to make the transition from an idea germinating in an entrepreneur’s brain to an operating company, they need to lease an office or factory, hire employees, buy equipment and raw materials, and put in place a sales and distribution network, among other things. These resources require significant amounts of capital, depending on the scale and scope of the business.

Raising Capital

A startup can raise such capital either by selling shares (equity financing) or borrowing money (debt financing). Debt financing can be a problem for a startup because it may have few assets to pledge for a loan—especially in sectors such as technology or biotechnology, where a firm has few tangible assets—plus the interest on the loan would impose a financial burden in the early days, when the company may have no revenues or earnings.

Equity financing, therefore, is the preferred route for most startups that need capital. The entrepreneur may initially source funds from personal savings, as well as friends and family, to get the business off the ground. As the business expands and its capital requirements become more substantial, the entrepreneur may turn to angel investors and venture capital firms.

Listing Shares

When a company establishes itself, it may need access to much larger amounts of capital than it can get from ongoing operations or a traditional bank loan. It can do so by selling shares to the public through an initial public offering (IPO).

This changes the status of the company from a private firm whose shares are held by a few shareholders to a publicly-traded company whose shares will be held by numerous members of the general public. The IPO also offers early investors in the company an opportunity to cash out part of their stake, often reaping very handsome rewards in the process.

Once the company’s shares are listed on a stock exchange and trading in it commences, the price of these shares fluctuates as investors and traders assess and reassess their intrinsic value. There are many different ratios and metrics that can be used to value stocks, of which the single-most popular measure is probably the price-to-earnings (PE) ratio. The stock analysis also tends to fall into one of two camps—fundamental analysis, or technical analysis.

What Is a Stock Exchange?

Stock exchanges are secondary markets where existing shareholders can transact with potential buyers. It is important to understand that the corporations listed on stock markets do not buy and sell their own shares on a regular basis. Companies may engage in stock buybacks or issue new shares but these are not day-to-day operations and often occur outside of the framework of an exchange.

So when you buy a share of stock on the stock market, you are not buying it from the company, you are buying it from some other existing shareholder. Likewise, when you sell your shares, you do not sell them back to the company—rather you sell them to some other investor.

History of Stock Exchanges

The first stock markets appeared in Europe in the 16th and 17th centuries, mainly in port cities or trading hubs such as Antwerp, Amsterdam, and London. These early stock exchanges, however, were more akin to bond exchanges as the small number of companies did not issue equity. In fact, most early corporations were considered semi-public organizations since they had to be chartered by their government in order to conduct business.

In the late 18th century, stock markets began appearing in America, notably the New York Stock Exchange (NYSE), which allowed for equity shares to trade. The honor of the first stock exchange in America goes to the Philadelphia Stock Exchange (PHLX), which still exists today. The NYSE was founded in 1792 with the signing of the Buttonwood Agreement by 24 New York City stockbrokers and merchants. Prior to this official incorporation, traders and brokers would meet unofficially under a buttonwood tree on Wall Street to buy and sell shares.

The advent of modern stock markets ushered in an age of regulation and professionalization that now ensures buyers and sellers of shares can trust that their transactions will go through at fair prices and within a reasonable period of time. Today, there are many stock exchanges in the U.S. and throughout the world, many of which are linked together electronically. This in turn means markets are more efficient and more liquid.

Over-the-Counter Exchanges

There also exists a number of loosely regulated over-the-counter (OTC) exchanges, which may also be referred to as bulletin boards (OTCBB). These shares tend to be riskier since they list companies that fail to meet the more strict listing criteria of bigger exchanges. Larger exchanges may require that a company has been in operation for a certain amount of time before being listed and that it meets certain conditions regarding company value and profitability.

In most developed countries, stock exchanges are self-regulatory organizations (SROs), non-governmental organizations that have the power to create and enforce industry regulations and standards.

The priority for stock exchanges is to protect investors through the establishment of rules that promote ethics and equality. Examples of such SRO’s in the U.S. include individual stock exchanges, as well as the National Association of Securities Dealers (NASD) and the Financial Industry Regulatory Authority (FINRA).

How Share Prices Are Set

The prices of shares on a stock market can be set in a number of ways. The most common way is through an auction process where buyers and sellers place bids and offers to buy or sell. A bid is the price at which somebody wishes to buy, and an offer (or ask) is the price at which somebody wishes to sell. When the bid and ask coincide, a trade is made.

The overall market is made up of millions of investors and traders, who may have differing ideas about the value of a specific stock and thus the price at which they are willing to buy or sell it. The thousands of transactions that occur as these investors and traders convert their intentions to actions by buying and/or selling a stock cause minute-by-minute gyrations in it over the course of a trading day.

A stock exchange provides a platform where such trading can be easily conducted by matching buyers and sellers of stocks. For the average person to get access to these exchanges, they would need a stockbroker. This stockbroker acts as the middleman between the buyer and the seller. Getting a stockbroker is most commonly accomplished by creating an account with a well-established retail broker.

Stock Market Supply and Demand

The stock market also offers a fascinating example of the laws of supply and demand at work in real-time. For every stock transaction, there must be a buyer and a seller. Because of the immutable laws of supply and demand, if there are more buyers for a specific stock than there are sellers of it, the stock price will trend up. Conversely, if there are more sellers of the stock than buyers, the price will trend down.

The bid-ask or bid-offer spread (the difference between the bid price for a stock and its ask or offer price) represents the difference between the highest price that a buyer is willing to pay or bid for a stock and the lowest price at which a seller is offering the stock.

A trade transaction occurs either when a buyer accepts the ask price or a seller takes the bid price. If buyers outnumber sellers, they may be willing to raise their bids in order to acquire the stock. Sellers will, therefore, ask higher prices for it, ratcheting the price up. If sellers outnumber buyers, they may be willing to accept lower offers for the stock, while buyers will also lower their bids, effectively forcing the price down.

Matching Buyers to Sellers

Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. These are known as specialists or market makers.

A two-sided market consists of the bid and the offer, and the spread is the difference in price between the bid and the offer. The more narrow the price spread and the larger size of the bids and offers (the amount of shares on each side), the greater the liquidity of the stock. Moreover, if there are many buyers and sellers at sequentially higher and lower prices, the market is said to have good depth.

Matching buyers and sellers of stocks on an exchange was initially done manually, but it is now increasingly carried out through computerized trading systems. The manual method of trading was based on a system known as the open outcry system, where traders used verbal and hand signal communications to buy and sell large blocks of stocks in the trading pit or the exchange floor.

However, the open outcry system has been superseded by electronic trading systems at most exchanges. These systems can match buyers and sellers far more efficiently and rapidly than humans can, resulting in significant benefits such as lower trading costs and faster trade execution.

High-quality stock markets tend to have small bid-ask spreads, high liquidity, and good depth, which means that individual stocks of high quality, large companies tend to have the same characteristics.

Benefits of Stock Exchange Listing

Until recently, the ultimate goal for an entrepreneur was to get his or her company listed on a reputed stock exchange such as the NYSE or Nasdaq, because of the obvious benefits, which include:

These benefits mean that most large companies are public rather than private. Very large private companies such as food and agriculture giant Cargill, industrial conglomerate Koch Industries, and DIY furniture retailer Ikea are among the world’s most valuable private companies, and they are the exception rather than the norm.

Problems of Stock Exchange Listing

But there are some drawbacks to being listed on a stock exchange, such as:

While this delayed listing may partly be attributable to the drawbacks listed above, the main reason could be that well-managed startups with a compelling business proposition have access to unprecedented amounts of capital from sovereign wealth funds, private equity, and venture capitalists. Such access to seemingly unlimited amounts of capital would make an IPO and exchange listing much less of a pressing issue for a startup.

The number of publicly-traded companies in the U.S. is also shrinking—from more than 8,000 in 1996 to around 4,300 in 2017.

Investing in Stocks

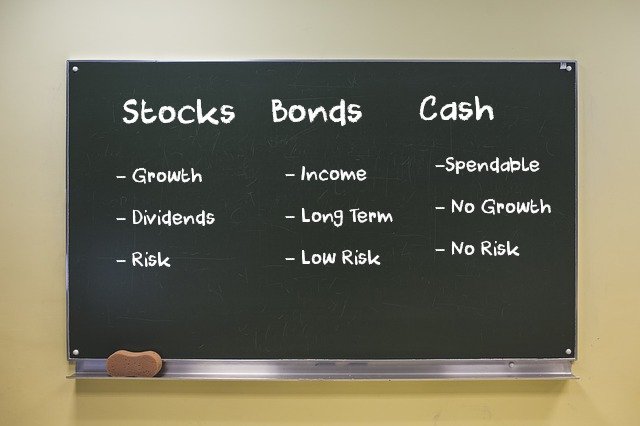

Numerous studies have shown that, over long periods of time, stocks generate investment returns that are superior to those from every other asset class. Stock returns arise from capital gains and dividends.

A capital gain occurs when you sell a stock at a higher price than the price at which you purchased it. A dividend is the share of profit that a company distributes to its shareholders. Dividends are an important component of stock returns. They have contributed nearly one-third of total equity return since 1956, while capital gains have contributed two-thirds.

While the allure of buying a stock similar to one of the fabled FAANG quintet—Meta, Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google parent Alphabet (GOOGL)—at a very early stage is one of the more tantalizing prospects of stock investing, in reality, such home runs are few and far between.

Investors who want to swing for the fences with the stocks in their portfolios should have a higher tolerance for risk. These investors will be keen to generate most of their returns from capital gains rather than dividends. On the other hand, investors who are conservative and need the income from their portfolios may opt for stocks that have a long history of paying substantial dividends.

Market Cap and Sector

While stocks can be classified in a number of ways, two of the most common are by market capitalization and by sector.

The industry standard for stock classification by sector is the Global Industry Classification Standard (GICS), which was developed by MSCI and S&P Dow Jones Indices in 1999 as an efficient tool to capture the breadth, depth, and evolution of industry sectors. GICS is a four-tiered industry classification system that consists of 11 sectors and 24 industry groups. The 11 sectors are:

This sector classification makes it easy for investors to tailor their portfolios according to their risk tolerance and investment preference. For example, conservative investors with income needs may weigh their portfolios toward sectors whose constituent stocks have better price stability and offer attractive dividends through so-called defensive sectors such as consumer staples, health care, and utilities. Aggressive investors may prefer more volatile sectors such as information technology, financials, and energy.

The year the first modern stock exchange opened in Amsterdam. There was only one stock to trade: the Dutch East India Company.

Stock Market Indices

In addition to individual stocks, many investors are concerned with stock indices, which are also called indexes. Indices represent aggregated prices of a number of different stocks, and the movement of an index is the net effect of the movements of each individual component. When people talk about the stock market, they often allude to one of the major indices such as the Dow Jones Industrial Average (DJIA) or the S&P 500.

The DJIA is a price-weighted index of 30 large American corporations. Because of its weighting scheme and the fact that it only consists of 30 stocks (when there are many thousands to choose from), it is not really a good indicator of how the stock market is doing. The S&P 500 is a market-cap-weighted index of the 500 largest companies in the U.S. and is a much more valid indicator.

Indices can be broad such as the Dow Jones or S&P 500, or they can be specific to a certain industry or market sector. Investors can trade indices indirectly via futures markets, or via exchange-traded funds (ETFs), which act just like stocks on stock exchanges.

A market index is a popular measure of stock market performance. Most market indices are market-cap weighted, which means that the weight of each index constituent is proportional to its market capitalization. Keep in mind, though, that a few of them are price-weighted, such as the DJIA. In addition to the DJIA, other widely watched indices in the U.S. and internationally include the:

Largest Stock Exchanges

Stock exchanges have been around for more than two centuries. The venerable NYSE traces its roots back to 1792 when two dozen brokers met in Lower Manhattan and signed an agreement to trade securities on commission. In 1817, New York stockbrokers operating under the agreement made some key changes and reorganized as the New York Stock and Exchange Board.

The NYSE and Nasdaq are the two largest exchanges in the world, based on the total market capitalization of all the companies listed on the exchange. The number of U.S. stock exchanges registered with the Securities and Exchange Commission has reached nearly two dozen, though most of these are owned by either Cboe Global Markets, Nasdaq, or NYSE-owner Intercontinental Exchange. The table below displays the 20 biggest exchanges globally, ranked by the total market capitalization of their listed companies.

| List of Stock Exchanges by Market Capitalization | ||

|---|---|---|

| Exchange | Location | Market Cap.* |

| NYSE | U.S. | 26.11 |

| Nasdaq | U.S. | 22.42 |

| Shanghai Stock Exchange | China | 7.37 |

| Tokyo Stock Exchange | Japan | 6.0 |

| Shenzhen Stock Exchange | China | 5.33 |

| Hong Kong Stock Exchange | Hong Kong | 4.97 |

| London Stock Exchange | U.K. | 3.57 |

| India National Stock Exchange | India | 3.45 |

| Toronto Stock Exchange | Canada | 3.41 |

| Saudi Stock Exchange (Tadawul) | Saudi Arabia | 3.20 |

| Bombay Stock Exchange | India | 2.22 |

| Copenhagen Stock Exchange | Denmark | 2.18 |

| Frankfurt Stock Exchange | Germany | 2.17 |

| SIX Swiss Exchange | Switzerland | 2.13 |

| South Korea Stock Exchange | South Korea | 2.12 |

| Euronext Paris Exchange | France | 2.09 |

| Australia Securities Exchange | Australia | 1.99 |

| Taiwan Stock Exchange | Taiwan | 1.92 |

| Johannesburg Stock Exchange | South Africa | 1.33 |

| Tehran Stock Exchange | Iran | 1.28 |

| * as of May 2022 | ||

Source: Trading Hours.

How Does Inflation Affect the Stock Market?

Inflation refers to an increase in consumer prices, either due to an oversupply of money or a shortage of consumer goods. The effects of inflation on the stock market are unpredictable: in some cases, it can lead to higher share prices, due to more money entering the market and increased job growth. However, higher input prices can also restrict corporate earnings, causing profits to fall. Overall, value stocks tend to perform better than growth stocks in times of high inflation.

How Much Does the Stock Market Grow Every Year?

The S&P 500 has grown about 10.5% per year since it was established in the 1920s. Using this as a barometer for market growth, one can estimate that the stock market grows in value by about the same amount each year. However, there is an element of probability: in some years the stock market sees greater growth, and in some years it grows less. In addition, some stocks grow faster than others.

How Do People Lose Money in the Stock Market?

Most people who lose money in the stock market do so through reckless investments in high-risk securities. Although these can score high returns if they are successful, they are just as likely to lose money. There is also an element of psychology: an investor who sells during a crash will lock in their losses, while those who hold their stock have a chance of seeing their patience rewarded. Finally, margin trading can make the stock market even riskier, by magnifying one’s potential gains or losses.

The Bottom Line

Stock markets represent the heartbeat of the market, and experts often use stock prices as a barometer of economic health. But the importance of stock markets goes beyond mere speculation. By allowing companies to sell their shares to thousands or millions of retail investors, stock markets also represent an important source of capital for public companies.

How the market works

Meet the Dogs No question about it, investing is a dog-eat-dog world. Traders are constantly developing and revising strategies in order to make the most money in the stock market. Throughout time many strategies have come and gone, few sustaining any significant longevity. However, over the past decades, Michael O’Higgins’ strategy coined “Dogs of the Read More…

6 Short-Term Financial Goals Every 20 Year Old Should Set

It’s essential to establish a well-thought-out plan regarding your finances, no matter how young one is. The first thing you need to do is to identify your short-term goals. Though your long-term goals are just as important, the fundamental approach to achieving those hinges on your ability to hit short-term goals. Failure to define your Read More…

How To Pick Stocks

How To Pick Stocks – The Basics The most challenging aspect of starting to invest in the stock market is picking the first few stocks to add to a portfolio. Every experienced investor has his/her own techniques and strategies that they believe in. But when you are just getting started, learning how to pick stocks Read More…

Basic Investing Strategies

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more. Liquidity, Risk, and Potential Returns All investments balance liquidity (how easily it can be converted into cash for other use), risk (the Read More…

Credit – Using Borrowed Money

What Is Credit? “Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of Read More…

Credit Reports

Credit Reports are basically a report that contains your credit history – both the good and bad. If you watch late-night TV, you have probably seen a few commercials offering free credit reports, so you might know that these are important. Most people, however, don’t know just how big a role a credit report can Read More…

Fractions, Percentages, Ratios and the Stock Market

Fractions What is a fraction? A “Fraction” means one piece of a whole. You can use fractions in any case where it might be useful to look at something in parts, rather than the whole thing at once. The most delicious fractions are slices of pizza. If the pizza is in 8 slices, we know Read More…

Using Excel to Track Your Stock Portfolio

In this article we will be looking at how you can use Excel with your HTMW account to keep track of your account’s performance. Using Excel To Track Your Stock Portfolio – Getting Some Data Before we can do anything with Excel, we need to get some numbers! The information you use in excel is Read More…

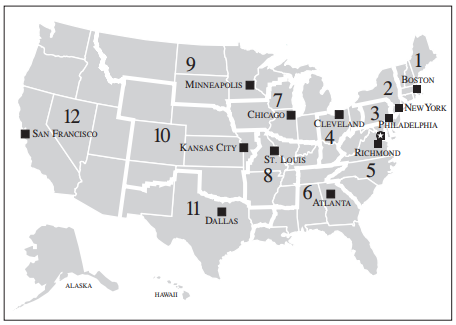

What is the Federal Reserve?

Definition The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks. Regulating Currency The Federal Reserve works to maintain the interest rates that banks use to lend money to Read More…

Finding Stocks In Specific Sectors

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between more than one sector. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our Quotes Tool has all the information you need to Read More…

Why Invest In Stocks?

Simply put, when you have money to invest for an extended period of time (like 20 years or more), the stock market historically has provided the greatest return. When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if Read More…

Intro to Stocks

The basics about stocks. What are they? What do they represent? How does Risk figure into stock ownership.

ETFs showing signs of stress with high trading!

ETFs have been one of the most popular investment vehicles in the world over the last decade or so, with investors of all types attracted to the low fees, but diverse holdings, falling somewhere between mutual funds and stocks in terms of how easy they are to manage in a portfolio. However, one of the Read More…

Forex

Live Forex trading includes negotiating of national bills which is performed on a live basis at 24 hour, around-the-clock period. Forex is derived from the words Foreign Exchange which is known as the global market that does business in money trading.

Stop and Limit Orders

Definition A Stop (or stop loss) order and limit order are orders that try to execute (meaning become a market order) when a certain price threshold is reached. Limit and stop orders are mirrors of each other; they have the same mechanics, but have opposite triggers. When creating a limit or stop order, you will select Read More…

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

Stock

Asset

Definition: An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs. There can also be intangible assets such as the value of a brand name or logo. Details: Assets generally refer Read More…

Asset Allocation

Definition “Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk. Details Whenever you pick stocks, open a bank account, get paid, buy something, or do anything with any resources, you Read More…

Investment Strategy

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. Here we will look at the larger overall strategies rather than very specific strategies. Given Read More…

How the market works

HowTheMarketWorks is an awesome free stock game, built specifically for schools. Between our easy set-up of custom contests, Assignments and lessons, and live-streaming rankings, why are so many teachers upgrading their class to PersonalFinanceLab? Reason 1: Huge Curriculum Expansion HowTheMarketWork’s Assignments tool lets teachers add in a few basic Personal Finance and Economics lessons from Read More…

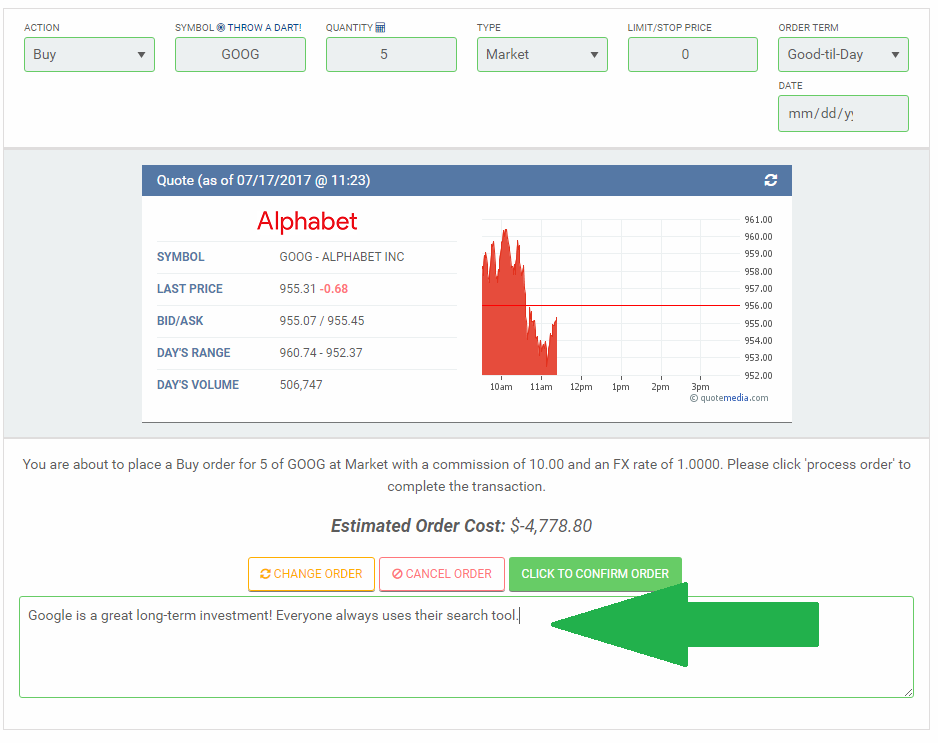

Trade Notes – Justify Your Trades

HowTheMarketWorks is all about education – we want students to learn about investing and personal finance by managing their virtual portfolio with carefully-selected trades. How It Works Every time your students place a trade, they will be prompted to enter their “Trade Notes” – a short sentence mentioning why they are placing this trade (almost Read More…

Trailing Stops Have Arrived!

If you have ever wanted to protect your portfolio on HowTheMarketWorks from losses, you have definitely used Stop Orders. The biggest downside of stop orders is, of course, the fact that you have to constantly update them as your investments grow to “lock in” your gains… What are Trailing Stop Orders? Trailing Stop orders work Read More…

Finding Stocks In Specific Sectors

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between more than one sector. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our Quotes Tool has all the information you need to Read More…

Creating Assignments On HowTheMarketWorks

Creating Assignments On HowTheMarketWorks

Have you ever wanted to make sure your students are following the class, but don’t have the class time to walk them through every step? HowTheMarketWorks has your back! Our Assignments feature makes it easier than ever to keep your personal finance, investing, economics, or social studies class engaged, and keep track of your whole class all in one place!

HowTheMarketWorks Videos

Registration And Site Overview New to HowTheMarketWorks? These videos will give you a great picture of how to get around the site, and how to use some of the most popular features Registration And Site Overview My Portfolio, Open Positions, And Rankings Pages Trading Stocks Trading Mutual Funds Teacher Tools And Research Creating your own Read More…

The Official HTMW User Guide

Hello! This is an A to Z guide on the basics of using How The Market Works. We’ll cover everything you need to know about using our site and all the tools you have at your disposal. Let’s Begin! Registration Whether you’re a student, teacher or just someone looking to learn and practice, everyone starts Read More…

Contest Creation and Administration

Hi! This tutorial will be showing you how to create and customize your own contests, as well as what you’re able to do once you’ve made one. Creating Your Contest Once you’ve registered your account and logged in, the first step is to get to the contest creation page. Find the “Contests!” tab on the Read More…

New HowTheMarketWorks Videos!

Walkthough Videos! Welcome to our Videos section, where you can see all the great features of our new site, all in one place! If you think something is missing here that you would love to see, send a ticket to our Support Desk, and we will get it made and posted as soon as possible! Read More…

MGH_InvestmentTrader_Business

McGraw-Hill and Stock-Trak, the leader in educational portfolio simulations, have joined together to offer students that purchase a McGraw-Hill college finance textbook a FREE account at Stock-Trak’s new real-time, streaming stock simulation at HowTheMarketWorks.com, used by over 200,000 students and beginning investors each year! Buying and selling stocks is a fantastic educational experience for students Read More…

Stock Contests

Contest Help

Our FREE Stock Market Game allows to you create or join up to 4 stock contests and also create 3 personal portfolios!

Expiration Types

Expirations determine when your order gets placed on the market.

Fun Mode vs Realistic Mode

Our site offers two modes for Virtual Trading: Fun Mode and Realistic Mode.

Create a Contest

Create a virtual stock market game or a stock market contest on How The Market Works.

Free Real Time Stock Quotes

Our site now offers free real-time stock quotes for more than 2,000 of the most popular stocks in the USA! These quotes are also used in our trading games.

Order

An investor’s instructions to a broker or brokerage firm to purchase or sell a security. Orders are typically placed over the phone or online. Orders fall into different available types which allow investors to place restrictions on their orders affecting the price and time at which the order can be executed.

Get Started in the Stock Market Game with these 10 Easy Steps

The stock market can seem overwhelming to beginners, so we have compiled a short list of how to get started in our market game.

Trade – Commonly asked Trading Questions About our Stock Market Game

How well do you know the stock market? Test your stock market IQ for free today with our practice stock trading questions.

Trade with the HTMW Virtual Stock Exchange

Our Virtual Stock Exchange allows you to practice buying and selling real stocks using our trading game online for the purpose of gaining experience with stock trading. This is also known as paper trading or fantasy trading.

The Official HTMW User Guide

This is an A to Z guide on the basics of using How The Market Works. We’ll cover everything you need to know about using our site and all the tools you have at your disposal. Let’s Begin!

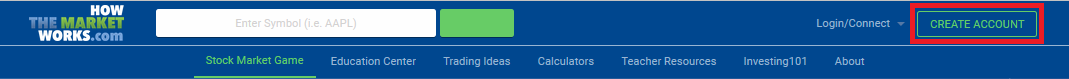

Registration

Whether you’re a student, teacher or just someone looking to learn and practice, everyone starts by registering a new account. If someone has sent you an invitation link to join their contest, the link will take you straight to the registration page. If not, then all you have to do is click “CREATE ACCOUNT” from the main menu on our homepage.

Now just scroll down and fill in all the necessary information to create your HTMW account. If you found your way here be using a contest invitation, then you’ll automatically be registered into the contest as soon as you finish creating your account. You’ll receive a confirmation email with your account details so hold onto that in case you forget anything.

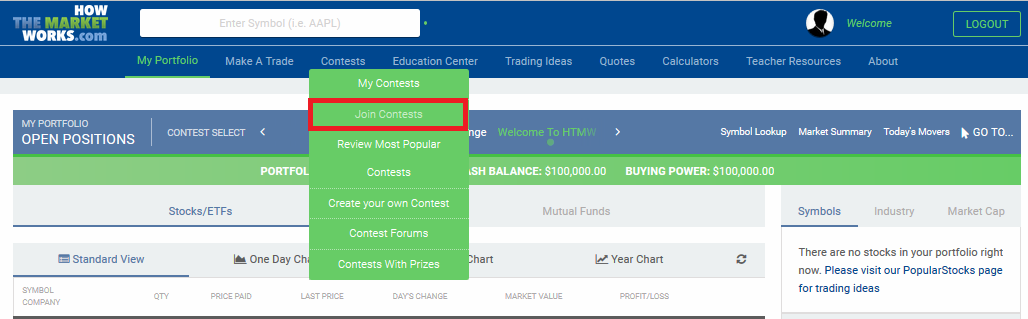

Contests

Most users are joining a contest for their class or club, which is great! There are two ways to get into the contest you’re looking for:

From here, just search for the contest you’re looking for, or even join one of the public contests!

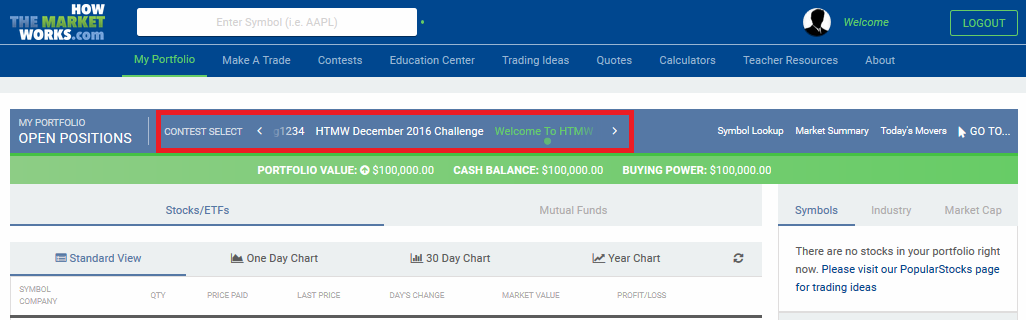

Active Contests

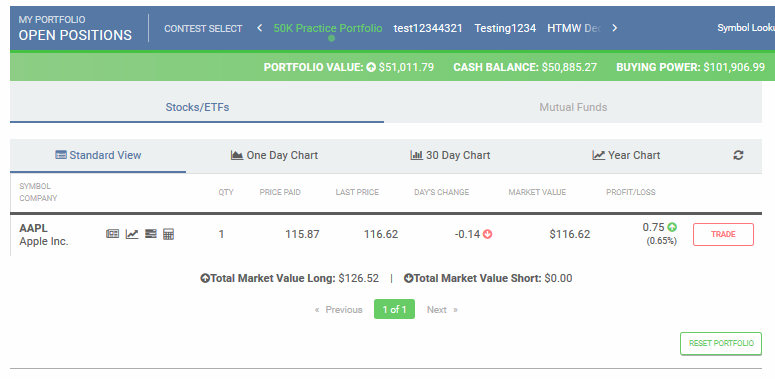

The most important thing to remember before trading or doing anything else, is setting your active contest to the right one. In almost every page is a “Contest Select” menu where you can select which contest of yours you want to view or places trades in. Here’s an example from the open positions page:

The initial default contest is your practice portfolio, however the system will save whatever contest you last set to active and make it your default the next time you log in. As long as you keep accessing the site from the same device you won’t have to worry about changing it more than once if you only have 1 contest.

From now on, you can assume that the first step in anything mentioned in this guide is to always make sure you have the right contest selected!

With that out of the way it’s time to move onto something more interesting!

How to Trade

Trading is the heart and soul of HTMW and it’s probably why you came here in the first place.

Let’s start by learning how to trade stocks.

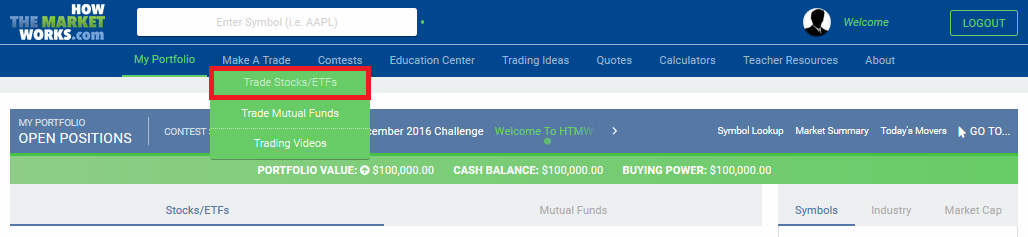

Trading Stocks

To begin, go to “Make a Trade” on the menu bar and then select “Trade Stocks/ETFs” from the sub menu, as seen below:

This will take you to the stock trading page where you can begin trading. We’re going to go cover what each part of the trading tool does so that you know exactly what you’re doing when making trades.

1. Action – This is where you set what kind of order you’re going to make. You can buy, sell, cover or short a stock. The default is always buy, so if you want to get rid of one of your stocks, don’t forget to change the order type of you’ll end up with even more of it! Most of your orders will probably be buying and selling, unless your a bit more advanced user.

2. Symbol – This is where you enter the symbol of the stock or ETF you wish to trade. In the above example I entered AAPL, which is the stock symbol for Apple. As you can see, once you enter the stock symbol, a quote appears telling you all the important information about the stock as well as a chart that show the stock’s movement during the current trading day.

3. Quantity – Here is where you enter how many shares you want. If you accidentally ask for more than you can afford, don’t worry! The system will stop you from accidentally going bankrupt or breaking any rules.

4. Type – This is where you set the order type. The default is always a Market order and this is what most people will use the vast majority of the time. Market orders will fill you as soon as possible at whatever the current trading price is. Limit and Stop orders allow you to set a specific price that will determine when your order fills. You can go here for more information on how the different order types work.

5. Limit/Stop Price – If you’re using a market order, as in the example above, this box will be greyed out since you don’t set a price for market orders. If you’re not using a market order, this is where you enter what you want your limit or stop order price to be.

6. Order Term – The order term is where you decide when you want open orders to expire. Market orders are always set to expire at the end of the current trading day. If you place an order while the markets are closed then your order will be come active at the start of the next trading day. If you’re using limit/stop orders then you have the option to choose “good-til-cancel” as your order term. This will keep your orders open until either your limit/stop price is hit, or you manually cancel the order.

7. Share Slider – If you’re not sure exactly how many shares you want, you can use the share slider to adjust the quantity anywhere from 1 share to the maximum you can afford. As you move the slider the system will calculate the total cost which allows you to quickly see how much you’d be spending for different quantities, instead of having to manually enter a new number for every estimate.

8. Order Preview – Once you’ve entered in all the necessary information, the order preview will give you the estimated cost of your transaction. If you like what you see, hit the “Preview Order” button and you’ll get a final confirmation request. The “Preview Order” button will change to “Confirm Order”. Now if everything looks good, hit the confirmation button and that’s it! You’ve placed your first stock order!

Now lets move on to trading Mutual Funds.

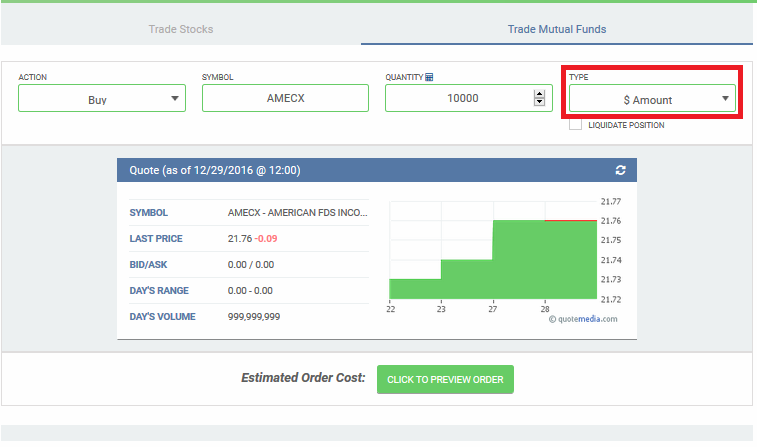

Trading Mutual Funds

This time go to “Make a Trade” on the menu bar and then select “Trade Mutual Funds” from the sub menu, as seen below:

This will take you to the mutual fund trading page. You’ll notice it looks fairly similar to the stock trading tool, but there are a couple of key differences to note which we’ll talk about below the example image.

As you can see, for mutual fund orders there is only an action, symbol and quantity that need to be set. Mutual fund orders are always market orders and they are always good-til-day so there is no need for the other options.

Since the price of mutual funds is only settled at the end of the trading day, mutual fund orders only fill after the markets close. So don’t worry if your ordering is sitting open all day long, they will usually fill sometimes after 6pm Est.

Managing Your Portfolio

Now that you have bought a few stocks and mutual funds, its always a good idea to keep track of what you have! You already have a lot of information on your portfolio right at your fingertips.

Open Positions

Now that you’ve started trading, you’ll no doubt want to keep track of everything you’ve bought. The easiest way to do this is to the “Open Positions” page found under the “My Portfolio” tab.

Your open positions page gives you a quick view of all the stocks you own, displaying important information such as the price you paid, what they’re worth now and how much you’ve gained or lost for each one. The “Mutual Funds” tab shows you the same information for your mutual funds if you have any.

You also have the option of seeing each position as mini one-day, 30-day or 1-year charts. The default tab is “Standard View” (found right above your list of open positions) and you can toggle between the different charts by selecting the appropriate tab.

Account Balances

Next to the “Open Positions” tab shown above, you’ll find the “Account Balances” tab. This is where you’ll go to get more detailed data on your current portfolio. You have 2 different options here :

Transaction History

A bit farther down the menu you can find your Transaction History

This is where you can see all your orders that have executed, plus all the dividends that have been paid to your stocks. We pay out dividends on the ex-dividend date, and the whole process is automatic, so you never need to worry about missing one. We also handle all splits, and you can see those here as well.

You can change the dates that you want to look at, in case you only want this week, or several months.

Order History

Under your Transaction History is your Order History page:

Here you can see all your orders, whether or not they have executed. For example, in the screenshot here, I have an order that has not yet executed, so I have the option to cancel it.

All orders placed after 4pm will be “pending” until the next market open, so you can always cancel them overnight. Mutual fund orders will be open until 6pm on the day you bought them, when they execute. If you placed a good-till-cancel limit order, and you want to cancel it, this is the only place to do so.

Graph My Portfolio

If you want to see your portfolio value over time, and compare it with an index like the S&P 500, or Gold, you can do so at Graph My Porfolio. You can switch between a 1 month and 3 month view.

Rankings

One of the most popular places on HowTheMarketWorks is the rankings page. There are no rankings for the official practice portfolio, but if you join a contest you can see your performance against everyone else in that contest.

Rankings are divided by Overall, Weekly, and Monthly

Trading Ideas

Not sure where to start? Don’t worry! We have tons of resources to get you started.

We have several different options under our “Trading Ideas” tab, check them all out if you’re feeling “stock” and aren’t sure what to look for. We even have an option to “Throw Darts” for completely fresh ideas (these are chosen from a list of popular stocks, and show the price and if the stock is up or down).

Quotes and Research

Doing stock research is a huge topic in and of itself, but if you want to do research, look up company info, check out the day’s market summary, and much, much more, check out the Quotes tool!

Creating A Contest

If you want to create a contest, check out our Contest FAQ section here:

You can find a lot of information, including tutorial videos and a step-by-step guide to getting your contest going!

:max_bytes(150000):strip_icc()/adam_hayes-5bfc262a46e0fb005118b414.jpg)

:max_bytes(150000):strip_icc()/mansaPicture_08T-Copy-JuliusMansa-127908fd255745b5886a16fced0cdb7b.jpg)

:max_bytes(150000):strip_icc()/KSchmitt2019Color-67b7647ab8114851ab0fd161242d5f89.jpg)